Helios Underwriting Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helios Underwriting Bundle

Helios Underwriting operates within a competitive insurance landscape, and a Porter's Five Forces analysis reveals critical insights into its market position. Understanding the threat of new entrants and the bargaining power of buyers are key to navigating this sector.

The analysis also scrutinizes the intensity of rivalry among existing insurers and the potential impact of substitute products or services. Furthermore, it illuminates the leverage held by suppliers, from reinsurers to technology providers.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Helios Underwriting’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Helios Underwriting's primary suppliers are the Lloyd's syndicates providing underwriting capacity. These syndicates, with their specialized knowledge and access to distinct risks, wield considerable power. This is amplified by the limited availability of sought-after capacity within the highly regulated Lloyd's market.

The crucial reliance of Helios's business model on high-quality, profitable syndicate capacity places these suppliers in a strong negotiating position. For instance, in 2024, Lloyd's continued to focus on profitable underwriting, meaning syndicates with proven track records and access to specific profitable lines of business would command premium capacity costs.

Helios Underwriting benefits from syndicates staffed by underwriters possessing deep, specialized knowledge in specific risk classes. This niche expertise is a significant barrier to entry for competitors, granting these underwriting teams considerable influence over terms and pricing. In 2024, the Lloyd's market, where many such syndicates operate, saw continued demand for specialized underwriting skills, particularly in areas like cyber and complex property risks, underscoring the value Helios places on these relationships.

Operating within the Lloyd's market demands adherence to rigorous regulatory standards and substantial capital investments. This environment naturally limits the number of eligible and financially robust syndicates available for participation.

Syndicates that consistently meet these demanding capital and compliance benchmarks gain leverage, as their stability and financial soundness are crucial for entities like Helios Underwriting seeking to secure participations.

Helios's capacity to secure and effectively manage its participations is therefore intrinsically linked to the regulatory compliance and financial stability of these few powerful syndicates.

Limited Number of High-Performing Syndicates

The insurance syndicates operating within Lloyd's, while numerous, present a concentrated pool of high-performers that align with Helios Underwriting's strategic investment criteria. This scarcity of top-tier syndicates means that Helios, along with other capital providers, faces competition for access to their profitable underwriting capacity.

The demand for efficiently managed and consistently profitable syndicates often outstrips the available supply of this sought-after capacity. This imbalance directly enhances the bargaining power of these leading syndicates, allowing them to negotiate more favorable terms with capital providers like Helios.

- Limited High-Performing Syndicates: While the Lloyd's market is extensive, the number of syndicates consistently delivering strong financial results and meeting specific investment profiles is comparatively small.

- Competition for Capacity: Helios Underwriting competes with other capital allocators for access to the most attractive and well-performing syndicates, increasing the leverage of these syndicates.

- Demand Exceeds Supply: The market often sees a greater demand for well-managed underwriting capacity than is readily available, strengthening the position of syndicate management.

Alternative Capital for Syndicates

Lloyd's syndicates benefit from a diverse range of capital providers, including direct corporate members, publicly traded investment vehicles, and private equity funds. This access to alternative capital streams significantly reduces their dependence on any single capital source, including entities like Helios Underwriting.

This capital diversification empowers syndicates, as they can readily switch or negotiate with different capital providers based on who offers the most advantageous terms or the best strategic fit. For instance, in 2023, the Lloyd's market saw continued growth in third-party capital, with approximately 35% of the market's stamp capacity provided by non-corporate capital, highlighting the increasing availability of alternatives.

- Diversified Capital Sources: Syndicates can tap into corporate members, listed vehicles, and private capital.

- Reduced Reliance: This lessens dependence on any single capital provider.

- Negotiating Power: Syndicates can secure more favorable terms by having multiple options.

- Strategic Alignment: The ability to choose capital partners based on strategic goals is enhanced.

The bargaining power of Helios Underwriting's suppliers, primarily Lloyd's syndicates, is significant due to the limited availability of high-quality underwriting capacity. Syndicates with proven profitability and specialized expertise in sought-after risk classes, such as cyber and complex property, command higher terms. This is further amplified by the stringent regulatory and capital requirements within the Lloyd's market, which restrict the number of eligible syndicates.

In 2024, the Lloyd's market continued its focus on profitable underwriting, meaning syndicates demonstrating strong performance and access to profitable lines of business were able to dictate more favorable terms for their capacity. This demand-driven environment, coupled with the syndicates' ability to access diverse capital streams, including approximately 35% from third-party capital in 2023, enhances their negotiating leverage against capital providers like Helios.

| Supplier Characteristic | Impact on Bargaining Power | 2024 Market Context |

|---|---|---|

| Specialized Knowledge & Expertise | High | Demand for cyber and complex property underwriting skills remained strong. |

| Proven Profitability & Track Record | High | Lloyd's focus on profitable underwriting favored syndicates with consistent performance. |

| Limited Availability of Sought-After Capacity | High | Competition among capital providers for top-tier syndicates increased. |

| Regulatory & Capital Requirements | High | Strict standards limited the pool of eligible and financially robust syndicates. |

| Access to Diverse Capital Sources | Moderate (reduces dependence on Helios) | Third-party capital provided ~35% of Lloyd's stamp capacity in 2023. |

What is included in the product

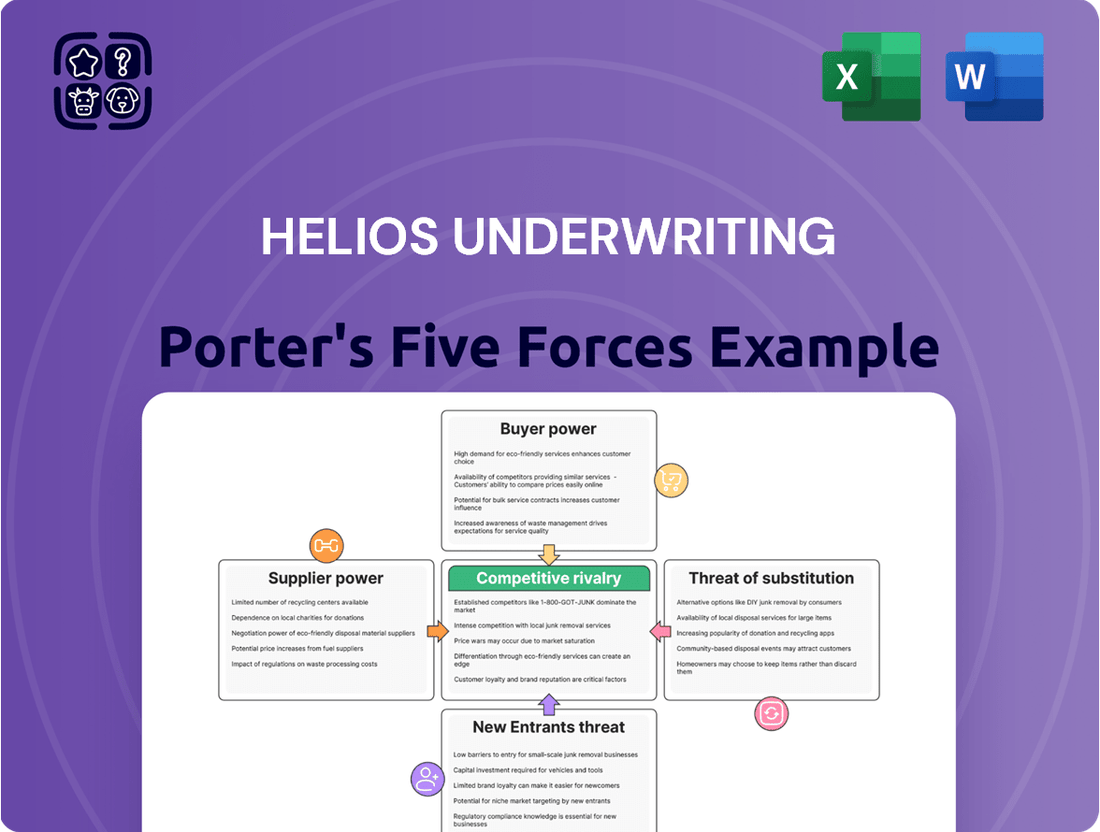

Tailored exclusively for Helios Underwriting, analyzing its position within its competitive landscape by examining the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces chart, highlighting key pressure points for strategic action.

Customers Bargaining Power

Helios Underwriting's customers are primarily investors looking for access to the Lloyd's insurance market's potential underwriting profits. This investor base is diverse, encompassing both large institutional players and individual investors.

These investors possess significant bargaining power due to the vast array of alternative investment options available to them worldwide. They can easily allocate capital to other financial instruments, real estate, commodities, or even different insurance-linked securities markets, diminishing their dependence on Helios.

For instance, as of early 2024, global alternative investment assets under management were estimated to be over $17 trillion, showcasing the sheer scale of choices available to investors. This broad market access means investors can readily switch their capital if Helios's offerings are not competitive or attractive enough.

The presence of numerous alternative investment vehicles effectively lowers the switching costs for these customers. If Helios Underwriting's terms or projected returns are less appealing than other opportunities, these investors can swiftly reallocate their funds, thereby strengthening their negotiating position with Helios.

The Lloyd's market, where Helios Underwriting operates, provides significant transparency through published syndicate reports and market data. This allows customers, particularly those seeking investment opportunities in the insurance sector, to readily compare Helios's performance and returns against a broad spectrum of other syndicates and investment vehicles. For instance, by examining publicly available Lloyd's syndicate results, investors can scrutinize metrics like combined ratios and return on equity for various participants.

Investors in the capital markets often face low costs when shifting their funds between different investment opportunities. This ease of movement significantly amplifies the bargaining power of these capital providers.

Should Helios Underwriting not meet investor expectations regarding returns or stability, these capital providers can readily redirect their investments to competing listed vehicles or even directly into the Lloyd's market. For instance, in 2024, the global investment management industry saw substantial flows, with many investors prioritizing liquidity and demonstrable performance, underscoring the impact of low switching costs.

Price Sensitivity to Returns

Customers of Helios Underwriting are acutely focused on the returns their capital generates, making them highly sensitive to performance. Their core aim is capital appreciation and underwriting profits, meaning any hint of underperformance or excessive fees compared to market alternatives could easily drive them to seek out other investment opportunities.

This strong emphasis on return on investment inherently grants customers substantial bargaining power. They can effectively leverage Helios’s pricing and the specifics of its offerings to their advantage. For instance, if Helios's expense ratios are higher than industry averages, or if their underwriting profits lag behind comparable syndicates, clients have a clear basis to negotiate better terms or simply move their capital elsewhere.

- Price Sensitivity: Investors in the insurance sector, particularly those allocating capital to syndicates like Helios, closely monitor expense ratios and profit margins. For example, a syndicate with an expense ratio of 20% might be perceived less favorably than one with 15%, assuming similar risk profiles and return potential.

- Demand Elasticity: The demand for underwriting capacity from Helios is likely elastic. If alternative investment vehicles, such as other insurance-linked securities or even traditional asset classes, offer comparable or superior risk-adjusted returns with lower fees, customers will readily switch.

- Information Asymmetry: While Helios possesses detailed underwriting and operational data, sophisticated investors can access market benchmarks and competitor performance data, reducing information asymmetry and strengthening their negotiating position.

Availability of Direct Lloyd's Exposure

Sophisticated investors, including institutional players and high-net-worth individuals, possess the capability to directly participate as 'Names' or corporate members within the Lloyd's market. This direct engagement offers an alternative to investing through structures like Helios Underwriting, thereby enhancing their bargaining leverage.

This direct access, while demanding substantial capital outlay and direct risk assumption, presents a potent alternative for investors. It diminishes their reliance on intermediary investment vehicles such as Helios. In 2024, the Lloyd's market continued to attract significant capital, with total syndicates' gross written premiums reaching an estimated £45 billion, underscoring the scale of direct participation opportunities available to sophisticated investors.

- Direct Lloyd's Membership: Sophisticated investors can bypass intermediaries like Helios and become direct members.

- Higher Capital Commitment: Direct participation typically requires a larger capital investment compared to investing in a vehicle like Helios.

- Increased Bargaining Power: The availability of direct access strengthens the bargaining position of these investors against Helios.

- Reduced Dependency: This direct route lowers investors' reliance on investment management firms or syndicates.

Helios Underwriting's customers, primarily investors, wield considerable bargaining power due to the vast array of alternative investment options available. As of early 2024, global alternative investment assets exceeded $17 trillion, highlighting the ease with which investors can reallocate capital if Helios's offerings are not competitive.

The transparency of the Lloyd's market allows investors to easily compare Helios's performance against numerous other syndicates and investment vehicles, strengthening their negotiating position. This information access, coupled with low switching costs for capital markets investors, means Helios must remain attractive to retain its client base.

Investors are highly sensitive to returns and fees, readily switching to alternatives if Helios underperforms or charges higher expense ratios than industry averages. For instance, a 20% expense ratio versus a 15% ratio for a comparable syndicate can significantly influence investor decisions.

Sophisticated investors can even bypass intermediaries like Helios by becoming direct members of the Lloyd's market, a move that provides significant bargaining leverage. In 2024, Lloyd's syndicates generated an estimated £45 billion in gross written premiums, underscoring the substantial opportunities for direct participation.

| Factor | Impact on Helios | Supporting Data (2024 Estimates) |

|---|---|---|

| Availability of Substitutes | High bargaining power for customers | Global alternative investment AUM > $17 trillion |

| Switching Costs | High bargaining power for customers | Low costs for capital markets investors to reallocate funds |

| Information Availability | High bargaining power for customers | Publicly available Lloyd's syndicate performance data |

| Direct Participation Option | High bargaining power for sophisticated customers | Lloyd's GWP ~ £45 billion |

What You See Is What You Get

Helios Underwriting Porter's Five Forces Analysis

This preview shows the exact Helios Underwriting Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape Helios operates within, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This meticulously researched document provides actionable insights to inform strategic decision-making.

Rivalry Among Competitors

The Lloyd's market hosts a variety of listed and private investment vehicles, alongside companies that buy and manage syndicate capacities. This robust presence fuels fierce rivalry for investor funds and desirable syndicate stakes.

In 2024, the competitive landscape is characterized by these diverse entities, each vying for investor attention. For instance, companies like Canopius Group and Apollo Global Management's insurance ventures actively participate in acquiring and managing syndicate capacity at Lloyd's.

Each investment vehicle actively seeks to stand out by highlighting its unique portfolio composition, the depth of its management team's expertise, and its approach to shareholder returns through dividend policies.

This intense competition for capital and syndicate participation directly impacts the profitability and strategic options available to players within the Lloyd's ecosystem.

Helios Underwriting faces significant competition for crucial syndicate capacity at Lloyd's. It vies with numerous other capital providers, ranging from fellow publicly traded entities and private equity funds to individual investors, often referred to as Names. This intense competition directly impacts Helios's ability to secure the most attractive underwriting opportunities.

The demand for capacity from top-tier Lloyd's syndicates is consistently high. This scarcity means that Helios must actively compete to gain access to these profitable lines of business. The best syndicates are highly sought after, making it a challenge for any single capital provider to secure the optimal mix of risk and reward.

This rivalry can escalate the cost of acquiring necessary underwriting capacity. As more capital chases limited opportunities, premiums for capacity can rise, directly impacting Helios's profitability. Alternatively, the sheer demand might simply restrict availability, forcing Helios to consider less desirable or more capital-intensive syndicates.

Competitive rivalry in the insurance sector, including for Helios Underwriting, is heavily influenced by a company's performance track record and the confidence it instills in investors. In 2024, insurers are keenly aware that a history of consistent underwriting profits and successful capital appreciation directly translates into a stronger ability to attract and retain capital. This focus on demonstrable financial success makes the past performance of management teams a crucial differentiator. For instance, insurers with a proven ability to navigate market volatility and deliver positive returns are better positioned to secure the investment needed for growth and innovation.

Management Expertise and Market Insight

Management expertise and market insight are crucial for success in the Lloyd's insurance market. Identifying, acquiring, and effectively managing participations in profitable syndicates hinges on a deep understanding of market dynamics and experienced leadership. This intense competition for top talent with specialized Lloyd's knowledge directly impacts a firm's ability to secure advantageous placements.

Superior expertise in portfolio management and astute risk selection are key differentiators. For instance, during 2024, syndicates demonstrating exceptional underwriting discipline and a forward-looking view on emerging risks, such as cyber threats and climate-related events, often outperformed their peers. This translates directly into better returns for investors and a stronger market position.

- Talent Acquisition: Lloyd's syndicates actively compete for underwriters and portfolio managers with proven track records, driving up compensation and retention efforts.

- Market Insight: Understanding the nuances of capacity deployment and the impact of regulatory changes in 2024 provided significant advantages to well-informed management teams.

- Risk Selection: The ability to accurately price and manage complex risks, a hallmark of experienced management, directly influences syndicate profitability.

Capital Raising and Deployment Efficiency

Competitive rivalry within the insurance sector, including Lloyd's, is significantly shaped by how efficiently entities can secure and then utilize capital. Those underwriters, like Helios Underwriting, that can quickly access funds and deploy them into profitable ventures possess a distinct advantage.

This efficiency in capital management is paramount. It involves not only raising money but also minimizing operational costs and maximizing the return for investors. For instance, in 2024, successful syndicates often demonstrated lower expense ratios, allowing more premium to be retained for underwriting profit.

The ability to attract capital is a direct reflection of a firm's perceived underwriting strength and financial stability. In 2023, many Lloyd's syndicates saw strong capital inflows, particularly those with a track record of consistent profitability and a clear strategy for navigating market cycles.

- Capital Raising Prowess: Syndicates capable of attracting diverse capital sources, including institutional investors and pension funds, can scale their operations more effectively.

- Deployment Speed: Rapid deployment of capital into high-demand or underpriced insurance lines provides a critical first-mover advantage.

- Expense Management: Lower operational and acquisition costs translate directly into higher underwriting margins, enhancing competitive standing.

- Shareholder Returns: Demonstrating a consistent ability to deliver strong shareholder returns is key to maintaining investor confidence and facilitating future capital raises.

Helios Underwriting faces intense competition for syndicate capacity at Lloyd's from a diverse range of capital providers. This rivalry escalates the cost of acquiring capacity and limits access to the most profitable underwriting opportunities.

Companies like Canopius Group and various private equity funds actively compete for stakes in lucrative syndicates, driving up demand. In 2024, the market saw a surge in capital seeking deployment, intensifying this competition.

The ability to attract and retain capital is directly tied to a firm's performance track record and management expertise. Syndicates demonstrating superior risk selection and consistent profitability in 2023, such as those focusing on specialty lines, had a distinct advantage in securing investor backing.

| Competitor Type | 2024 Capital Focus | Impact on Helios |

|---|---|---|

| Listed Investment Vehicles | Seeking high-yield syndicates | Increased cost of capacity |

| Private Equity Funds | Acquiring majority syndicate stakes | Reduced availability of desirable capacity |

| Individual Investors (Names) | Diversifying portfolios | Heightened competition for limited slots |

SSubstitutes Threaten

Sophisticated investors, especially high-net-worth individuals and institutions, have the option to directly invest in Lloyd's syndicates as corporate members. This direct route bypasses intermediaries like Helios Underwriting, offering them greater control and direct exposure to underwriting results.

This alternative requires substantial capital commitment and subjects investors to direct liability, but it appeals to those prioritizing autonomy. For instance, a significant portion of Lloyd's capital comes from these direct members, demonstrating the appeal of this substitute investment strategy.

Investors looking for exposure to the insurance industry beyond Helios's specific niche have readily available alternatives. They can invest in shares of large, publicly traded traditional insurance or reinsurance companies. These giants offer a much broader range of insurance products and operate on a global scale, providing a diversified approach to the sector.

For instance, major players like Berkshire Hathaway, with its extensive insurance operations, or global reinsurers such as Munich Re and Swiss Re, represent significant substitutes. These companies, unlike Helios's focus on Lloyd's syndicates, provide direct investment in established insurance entities with substantial market share and capital. Their sheer size and scope mean they absorb a significant portion of investor capital seeking insurance sector exposure.

While the investment structure differs – direct equity in a large insurer versus exposure to Lloyd's syndicates through Helios – the underlying goal for many investors is the same: gaining participation in the insurance market. The availability of these large, liquid, and well-established insurance companies presents a constant threat of substitution for investors considering Helios.

Insurance-Linked Securities (ILS) and Funds present a significant threat of substitutes for Helios Underwriting. The broader ILS market, encompassing catastrophe bonds, collateralized reinsurance, and various ILS funds, offers investors alternative avenues to gain exposure to insurance-related risks. These instruments provide a spectrum of risk-return profiles and liquidity, acting as substitutes for those looking to diversify beyond traditional Lloyd's syndicate investments.

The ILS market has seen substantial growth, with total market capacity reaching approximately $100 billion by the end of 2023, according to industry reports. This expansion indicates a deepening pool of capital seeking to participate in insurance risk transfer, directly competing for investor attention that might otherwise be directed towards traditional reinsurance or underwriting capacity, such as that offered by Helios.

For investors, ILS products offer diversification benefits and can provide uncorrelated returns to traditional asset classes. The increasing sophistication and accessibility of ILS platforms mean that capital can flow more readily into these alternative risk transfer mechanisms, potentially siphoning off investment capital that could be deployed into Lloyd's syndicates.

General Financial Market Investments

Investors have a vast universe of general financial market investments to consider, acting as direct substitutes for capital that could be deployed into Helios Underwriting. These include traditional asset classes like equities and bonds, as well as alternatives such as real estate and private equity, all offering different risk-return profiles. For instance, in 2024, global equity markets saw significant inflows, with the MSCI World Index returning approximately 15% year-to-date by mid-year, directly competing for investor attention.

Helios must therefore constantly benchmark its potential returns and inherent risks against a broad spectrum of market alternatives. The availability of liquid and diverse investment options means that if Helios's projected returns are not sufficiently attractive or its risk management is perceived as weak, investors can easily reallocate capital elsewhere. Consider the bond market in 2024, where rising interest rates in many developed economies offered yields that were increasingly competitive with equity market expectations, especially for more risk-averse investors.

The threat of substitutes is amplified by the accessibility and transparency of these general market investments.

- Equities: Offering potential for high growth, global equity markets continue to attract substantial investment, with total market capitalization reaching over $100 trillion in early 2024.

- Bonds: Providing income and relative stability, the global bond market, valued in the hundreds of trillions, offers diverse options from government to corporate debt.

- Real Estate: A tangible asset class, global real estate investment trusts (REITs) alone represent trillions in market value, providing diversification and income potential.

- Private Equity: While less liquid, private equity funds raised over $1 trillion globally in 2023, signaling strong investor appetite for alternative growth opportunities.

Private Equity and Debt in Insurance Sector

Private equity and debt providers represent a significant threat of substitutes for investors in the traditional Lloyd's syndicate model. These financial players offer alternative routes for capital allocation within the insurance industry, bypassing the specific structure of Lloyd's.

Private equity firms are actively acquiring insurance businesses, undertaking mergers and acquisitions, and providing private debt financing. This allows investors to gain exposure to the insurance sector's underlying economics through different channels. For instance, in 2024, private equity continued its robust activity in financial services, with deal volumes remaining substantial, offering investors direct stakes in insurance entities.

These substitute avenues provide a distinct risk and return profile compared to investing in a Lloyd's syndicate. Investors can tailor their exposure based on their risk appetite, potentially seeking higher returns or different liquidity characteristics than typically found in the Lloyd's market.

- Private Equity Activity: Continued strong deal-making in financial services throughout 2024, with numerous insurance companies being targets for PE buyouts.

- Debt Financing Options: Increased availability of private debt for insurance firms, providing an alternative to equity investment for capital raising.

- Direct Investment: Investors can now more easily invest directly into insurance carriers or specialty lines, offering a more conventional investment pathway.

- Risk/Return Differentiation: These substitutes offer varied risk-return profiles, potentially appealing to investors seeking alternatives to the unique structure of Lloyd's syndicates.

The threat of substitutes for Helios Underwriting is substantial, stemming from direct investment in Lloyd's syndicates, publicly traded insurers, and Insurance-Linked Securities (ILS). Sophisticated investors can bypass intermediaries for direct Lloyd's membership, while large, global insurers like Berkshire Hathaway offer broader diversification. The ILS market, valued at around $100 billion by the end of 2023, provides alternative risk transfer mechanisms, further intensifying competition for investor capital.

| Substitute Category | Description | Key Characteristics | Example/Data Point (2023-2024) |

|---|---|---|---|

| Direct Lloyd's Membership | Investors joining Lloyd's as corporate members. | Higher capital commitment, direct liability, greater control. | Significant portion of Lloyd's capital sourced from direct members. |

| Publicly Traded Insurers | Investing in shares of large, established insurance companies. | Broader product range, global scale, diversified operations. | Companies like Munich Re, Swiss Re, Berkshire Hathaway. |

| Insurance-Linked Securities (ILS) | Catastrophe bonds, collateralized reinsurance, ILS funds. | Exposure to insurance risks, diverse risk-return profiles, liquidity. | ILS market capacity ~ $100 billion (end of 2023). |

| General Financial Market Investments | Equities, bonds, real estate, private equity. | Varying risk-return profiles, liquidity, broad market access. | Global equity markets capitalization > $100 trillion (early 2024); Private equity raised > $1 trillion (2023). |

Entrants Threaten

Entering the Lloyd's insurance market, either directly or through an investment structure like Helios Underwriting, presents significant hurdles due to a demanding regulatory environment. The Prudential Regulation Authority (PRA) and Lloyd's itself impose rigorous capital adequacy ratios and operational standards that new participants must meet. These requirements are designed to ensure market stability and policyholder protection, but they act as a substantial deterrent to potential new entrants.

The sheer complexity and cost associated with complying with these regulations make establishing a presence in Lloyd's a lengthy and expensive undertaking. For instance, in 2023, the average capital requirement for a new syndicate seeking to enter Lloyd's could run into hundreds of millions of pounds, a figure that inherently limits the pool of potential investors and operators.

Establishing an investment vehicle focused on Lloyd's syndicate capacity demands considerable capital. New entrants must possess substantial financial resources to acquire meaningful participations in syndicates and to satisfy ongoing capital requirements. For instance, in 2024, the average capital required to participate meaningfully in a Lloyd's syndicate can range from tens of millions to hundreds of millions of dollars, depending on the scale of participation and the specific syndicate's business. This sheer scale of capital needed acts as a significant barrier, effectively limiting the pool of potential new players. It's fundamentally a capital-intensive business.

Entering the Lloyd's insurance market, where Helios Underwriting operates, demands a significant investment in specialized expertise and cultivated relationships. Newcomers face a steep climb to acquire the intricate knowledge of diverse insurance lines and the established connections with brokers, coverholders, and reinsurers that seasoned players like Helios possess. Building this intellectual capital and robust network is a multi-year endeavor, creating a formidable barrier.

For instance, in 2024, the Lloyd's market continued to emphasize sophisticated risk assessment, requiring underwriters to possess deep technical skills in areas like cyber risk or complex property catastrophe. New entrants would need to demonstrate this proficiency, which is often developed through years of hands-on experience and continuous learning, a significant hurdle compared to Helios's established expertise.

Furthermore, trust and reputation are cornerstones of the Lloyd's ecosystem. Incumbents like Helios have spent decades building credibility and a track record of reliable performance, fostering strong relationships with capital providers and distribution partners. A new entrant would struggle to replicate this established trust quickly, making it difficult to attract business and capital on par with established entities.

Difficulties in Gaining Access to Quality Syndicates

Even with ample capital, new entrants to the Lloyd's market encounter significant hurdles in securing participation within the most sought-after and profitable syndicates. Established players benefit from long-standing relationships and a demonstrated history of successful underwriting, which grants them preferential access to desirable capacity. This inherent advantage means newcomers may find themselves allocated to less attractive underwriting opportunities, thereby hindering their ability to achieve competitive returns.

This syndicate access challenge directly impacts a new entrant's profitability and market penetration. For instance, in 2023, the average gross written premium for the top 10 Lloyd's syndicates significantly outpaced that of smaller or newer entrants, reflecting their greater access to capital and market share. Newcomers often face a steeper climb to build the trust and performance metrics required to attract capacity from influential managing agents.

- Established Relationships: Incumbent syndicates leverage existing ties with brokers and capital providers for privileged access to prime underwriting opportunities.

- Track Record Imperative: A proven history of strong performance is crucial for attracting capacity, a hurdle new entrants must overcome.

- Capacity Allocation: Less desirable syndicates, often with lower historical returns, are frequently the only options available to new market participants.

- Competitive Disadvantage: Limited access to high-quality business makes it more difficult for new entrants to compete effectively on profitability and growth.

Brand Reputation and Track Record

Building a credible brand reputation and a strong track record of generating consistent returns takes considerable time and effort in the investment community, especially in specialized sectors like underwriting.

New entrants often struggle to attract investor capital because they lack this established trust and proven performance. For instance, as of early 2024, many established Lloyd's syndicates, which have decades of history, continue to attract significant capital, while newer, unproven entities face a steeper climb.

Investors in this space tend to favor established vehicles with a history of success, making it a significant barrier for newcomers to gain traction and funding, thereby lowering the threat of new entrants.

- Brand Trust: Established firms benefit from years of demonstrating reliability and expertise.

- Performance History: A proven track record of underwriting profitability is crucial for attracting capital.

- Investor Preference: Capital allocation often gravitates towards entities with a demonstrable history of success.

The threat of new entrants into the Lloyd's insurance market, where Helios Underwriting operates, is significantly mitigated by substantial capital requirements. In 2024, the capital needed to meaningfully participate in a Lloyd's syndicate can range from tens of millions to hundreds of millions of dollars, a substantial barrier for most potential competitors.

Moreover, the intricate regulatory landscape, overseen by bodies like the Prudential Regulation Authority (PRA) and Lloyd's itself, demands rigorous compliance, including high capital adequacy ratios. This complexity and cost, exemplified by potential capital requirements in the hundreds of millions of pounds for new syndicates in 2023, deter many from entering.

The need for specialized expertise and established relationships further solidifies this barrier. Newcomers must acquire deep technical underwriting skills and cultivate relationships with brokers and reinsurers, a process that takes years and is a considerable hurdle compared to established entities like Helios.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Helios Underwriting is built upon a foundation of verified data, including Helios's annual reports and investor presentations, alongside industry-specific research from reputable sources and regulatory filings.