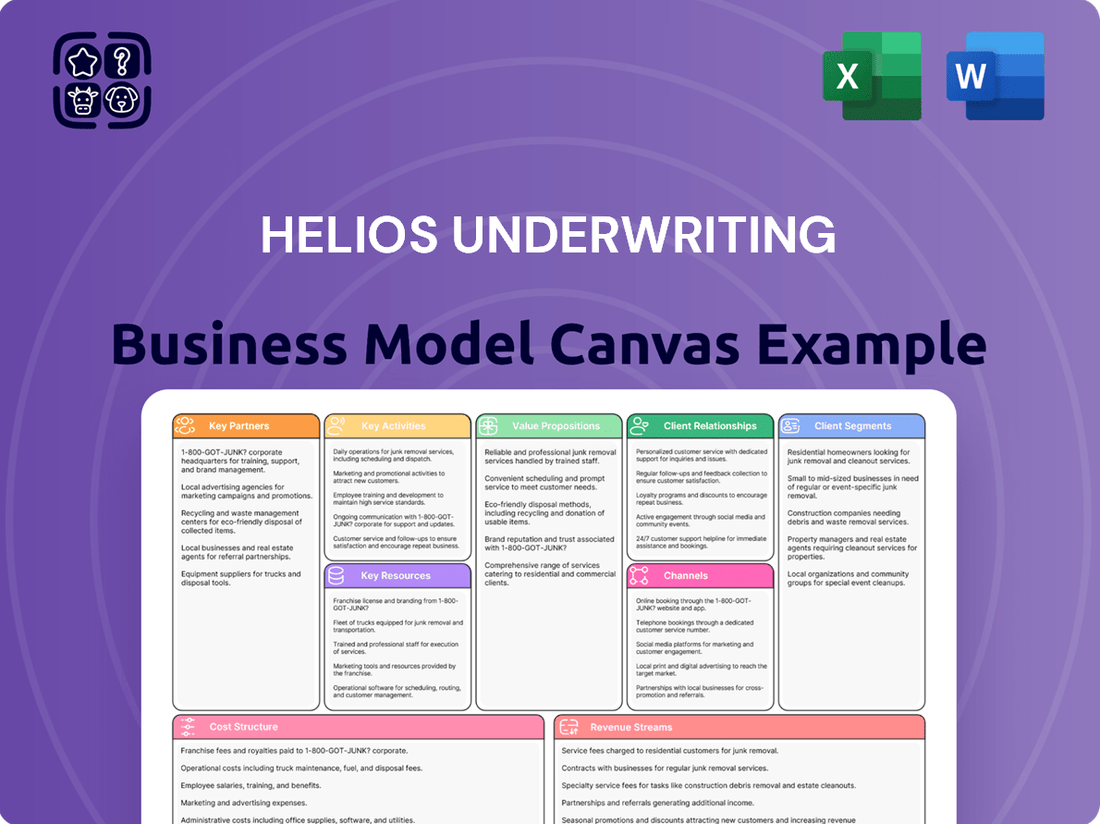

Helios Underwriting Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helios Underwriting Bundle

Unlock the strategic blueprint of Helios Underwriting's successful business model. This comprehensive Business Model Canvas details their unique value proposition, target customer segments, and revenue streams, providing a clear roadmap to their market dominance.

Discover the key partnerships and core activities that drive Helios Underwriting's operational efficiency and competitive advantage. Understanding these elements is crucial for anyone looking to replicate or adapt their growth strategies.

Explore the cost structure and channels Helios Underwriting leverages to deliver value and maintain profitability in the dynamic insurance sector. This insight can be invaluable for strategic planning.

Want to truly grasp how Helios Underwriting operates and scales? Download the full Business Model Canvas to gain a complete, actionable understanding of their proven market strategy.

Partnerships

Helios Underwriting's key partnerships are its relationships with various Lloyd's syndicates, which act as the operational arms for underwriting insurance risks. Helios provides the essential capital to these syndicates, enabling them to function and take on diverse insurance policies.

The strategic selection of syndicates is paramount for Helios. By partnering with syndicates that demonstrate strong performance and a solid track record, Helios aims to enhance its own profitability and achieve its investment objectives. For instance, in 2024, Helios continued to focus on syndicates with robust underwriting capabilities and demonstrated resilience across different market cycles.

Managing agents are crucial to Helios Underwriting's operations, handling the daily management and underwriting of Lloyd's syndicates. Helios relies on these partners for effective risk management and to drive syndicate performance. In 2024, many managing agents continued to navigate a challenging market, with a focus on improved underwriting discipline and profitability.

Helios Underwriting actively partners with financial institutions and capital providers to fuel its growth and manage risk. These collaborations are crucial for securing the necessary financing to support its underwriting operations and potentially for co-investment opportunities, allowing Helios to expand its syndicate capacity.

The company has seen a notable increase in third-party capital participation. For instance, by the end of 2023, third-party capital represented a significant portion of Helios's underwriting capacity, allowing it to share underwriting risks and avoid concentrating too much exposure on its own balance sheet.

Lloyd's of London Market

Lloyd's of London is a cornerstone partnership for Helios Underwriting. As an investment vehicle specifically targeting this market, Lloyd's provides the essential platform and infrastructure for Helios's operations. The market's established regulatory environment and global presence are critical enablers, granting Helios access to a broad spectrum of specialized insurance risks and underwriting expertise.

The performance and stability of the Lloyd's market are intrinsically linked to Helios's own business success. For instance, in 2023, the Lloyd's market reported a significant underwriting profit, with gross written premiums reaching £52.1 billion. This positive market condition directly benefits Helios by enhancing the value of its underlying participations and the overall profitability of its investments.

Helios's strategic reliance on Lloyd's can be highlighted through these key aspects:

- Market Access: Lloyd's offers unparalleled access to a diverse range of insurance and reinsurance classes, including complex and niche risks that may not be readily available elsewhere.

- Regulatory Framework: The robust and well-established regulatory oversight at Lloyd's provides a stable and predictable operating environment, crucial for an investment vehicle.

- Reputation and Brand: Being part of the Lloyd's market lends significant credibility and global recognition to Helios, facilitating business development and partnerships.

- Synergy and Collaboration: The interconnected nature of the Lloyd's market fosters opportunities for collaboration and knowledge sharing among syndicates and service providers, which Helios can leverage.

Regulatory Bodies (e.g., FCA, PRA)

Helios Underwriting's relationship with regulatory bodies like the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) is foundational to its operations. Adherence to their stringent guidelines, including those updated in 2024 concerning capital adequacy and consumer protection, is paramount for maintaining its license to operate and fostering investor confidence. This ensures Helios functions within the established legal and ethical frameworks of the UK insurance market.

Staying compliant with evolving financial regulations and insurance market rules is not just a matter of legal obligation but a critical component of Helios's business model. For instance, in 2024, the FCA continued to emphasize robust conduct of business standards, directly impacting how Helios engages with policyholders and intermediaries. This proactive compliance safeguards the company's reputation and its ability to attract and retain capital, critical for its underwriting activities.

- Regulatory Compliance: Helios must meet the capital requirements and conduct rules set by the FCA and PRA, ensuring financial stability and fair treatment of customers.

- License to Operate: Adherence to regulatory frameworks is essential for maintaining the necessary licenses to underwrite insurance business in the UK.

- Investor Confidence: Demonstrating strong regulatory compliance reassures investors of Helios's sound governance and risk management practices, vital for capital raising.

- Market Integrity: By operating within regulatory boundaries, Helios contributes to the overall integrity and trustworthiness of the insurance market.

Helios Underwriting's key partnerships are its relationships with various Lloyd's syndicates, which act as the operational arms for underwriting insurance risks. Helios provides the essential capital to these syndicates, enabling them to function and take on diverse insurance policies. The strategic selection of syndicates is paramount for Helios, as partnering with those demonstrating strong performance, like the positive underwriting results seen across Lloyd's in 2023, enhances Helios's own profitability.

What is included in the product

A detailed, strategy-aligned Business Model Canvas for Helios Underwriting, outlining their core operations, value propositions, and customer segments.

This model provides a comprehensive overview of Helios's market approach, designed for strategic planning and stakeholder communication.

The Helios Underwriting Business Model Canvas serves as a pain point reliever by providing a clear, one-page snapshot of core components, enabling rapid identification of strategic elements and fostering efficient team collaboration.

Activities

Helios Underwriting’s core operations revolve around strategically acquiring and diligently managing its stake in Lloyd's syndicates. This is not just about buying in; it's a continuous process of optimization. A key part of this involves leveraging pre-emption rights, essentially first dibs on new capacity, and cultivating a stable portfolio of syndicate participations, often referred to as building tenancy. The goal is to ensure the portfolio is well-balanced and performs strongly.

Looking ahead to 2025, Helios is actively refining its approach. This includes carefully adjusting the mix of insurance classes it participates in across its syndicates to enhance diversification and reduce risk. Furthermore, the business is planning a deliberate reduction in exposure to newly established syndicates, indicating a preference for more seasoned and predictable partners as it navigates the evolving market landscape.

Helios Underwriting's core activity involves a deep dive into underwriting analysis and strategic portfolio optimization. This means meticulously examining the conditions under which insurance risks are accepted and continuously refining the mix of those risks to maximize profitability.

The company prioritizes selecting syndicates with a proven history of generating profits. For instance, in 2024, Helios focused on syndicates that demonstrated an average combined ratio below 95% over the preceding three years, a key indicator of underwriting profitability.

Diversification is paramount. Helios actively spreads its capital across various risk types, such as property, casualty, and specialty lines, and across different geographic regions. This approach mitigates the impact of any single adverse event or market downturn, aiming for a more stable return profile.

A disciplined approach to capital allocation underpins these activities. Helios aims to deploy capital where it can achieve the best risk-adjusted returns, ensuring that shareholder value is enhanced through prudent and strategic investment in its underwriting portfolio.

Helios Underwriting's capital management and allocation is a core function, focusing on optimizing its financial structure. This involves strategic decisions regarding how much risk Helios retains, its approach to reducing debt, and how capital is returned to investors. For example, by the end of 2024, Helios aimed to further strengthen its balance sheet, building on its progress in reducing net debt.

A significant aspect of this activity is Helios's commitment to deleveraging and bolstering its financial resilience. The company has made a concerted effort to reduce its net debt, a key indicator of financial health. This deleveraging strategy enhances operational leverage and strengthens the overall balance sheet.

Furthermore, Helios actively seeks to increase the participation of third-party capital. This move diversifies its funding sources and allows for greater risk diversification. By bringing in external capital, Helios can expand its underwriting capacity and potentially achieve more favorable risk-adjusted returns.

The effective management of retained capacity is also crucial. Helios carefully calibrates the amount of risk it underwrites directly versus what it reinsures or partners on. This balancing act ensures that the company can absorb potential losses while maximizing profitability from its underwriting activities.

Investor Relations and Shareholder Communication

Helios Underwriting prioritizes open and consistent dialogue with its investors. This involves timely dissemination of financial reports, investor briefings, and updates on key performance indicators, dividends, and strategic initiatives to ensure shareholders remain well-informed and connected.

The company is committed to maximizing shareholder value. In 2024, Helios aims to deliver robust returns through strategic underwriting and efficient capital management.

- Regular Financial Reporting: Quarterly and annual reports detailing underwriting performance, investment income, and overall financial health.

- Investor Presentations: Scheduled calls and meetings to discuss results, market outlook, and company strategy.

- Dividend Policy: Clear communication regarding dividend declarations and payouts, reflecting confidence in sustained profitability.

- Strategic Updates: Announcements on new market entries, product developments, and significant partnerships that shape future growth.

Regulatory Compliance and Reporting

Ensuring full compliance with all relevant financial and insurance regulatory frameworks is a critical, ongoing key activity for Helios Underwriting. This involves meticulous adherence to evolving guidelines and statutes governing the insurance sector.

This includes the proactive adoption of new accounting frameworks, such as the transition to IFRS 10, which classifies Helios as an investment entity. Such transitions are vital for accurate financial reporting and investor confidence.

Furthermore, Helios Underwriting is responsible for the timely and accurate submission of all required reports to regulatory bodies. This includes submissions to significant institutions like the London Stock Exchange, demonstrating transparency and accountability.

- Regulatory Adherence: Maintaining strict compliance with insurance and financial regulations is paramount.

- IFRS 10 Adoption: Successfully transitioning to IFRS 10 as an investment entity ensures accurate financial representation.

- Reporting Obligations: Fulfilling all mandated reporting requirements to bodies like the London Stock Exchange is essential for operational legitimacy.

- Proactive Engagement: Continuously monitoring and adapting to new regulatory changes is a core functional necessity.

Helios Underwriting’s key activities center on sophisticated underwriting analysis and the strategic optimization of its syndicate portfolio. This involves meticulously selecting syndicates with a history of strong performance, such as those consistently achieving combined ratios below 95% in 2024, and diversifying across various insurance classes and geographies to mitigate risk.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Syndicate Acquisition & Management | Strategic investment and active management of stakes in Lloyd's syndicates. | Focus on syndicates with proven profitability (e.g., <95% combined ratio historically). |

| Portfolio Optimization | Continuous refinement of insurance class mix and risk diversification. | Planned reduction in exposure to newly established syndicates. |

| Capital Allocation | Disciplined deployment of capital for risk-adjusted returns. | Aiming to deploy capital for enhanced shareholder value. |

Full Version Awaits

Business Model Canvas

The Helios Underwriting Business Model Canvas preview you are currently viewing is the identical document you will receive upon purchase. This means you're getting a direct look at the actual, fully populated canvas, not a generic template or sample. Once your order is complete, you'll gain full access to this comprehensive analysis, meticulously crafted to provide a clear and actionable understanding of Helios Underwriting's strategic framework.

Resources

Helios Underwriting's primary financial capital is substantial, allowing it to secure and sustain syndicate participations. This capital comprises its equity, accumulated retained profits, and crucially, its access to debt and third-party funding. These elements are vital for bolstering underwriting capacity. For instance, in 2024, Helios reported a strong capital position, with its Solvency Capital Requirement (SCR) comfortably met, reflecting its robust financial foundation.

Helios Underwriting's business model heavily leans on the deep, specialized expertise of its management team within the intricate Lloyd's market. This isn't just about knowing insurance; it's about understanding the nuances of syndicate selection, the ever-shifting underwriting conditions, and the precise art of risk assessment to build a robust portfolio. Their ability to identify and exploit profitable niches is directly tied to this intellectual capital.

This profound understanding allows Helios to effectively navigate the Lloyd's ecosystem, a crucial differentiator. For instance, in 2023, Lloyd's reported gross written premiums of £46.7 billion, showcasing the market's sheer scale and complexity, a landscape where specialized knowledge is paramount for success. Helios's management team's experience in this environment translates into their ability to curate a high-quality, profitable portfolio by making informed decisions on syndicate participation and risk appetite.

Helios Underwriting cultivates strong ties with Lloyd's syndicates and managing agents, which is a cornerstone of its business model. These established relationships are vital for securing preferred syndicate capacity. For instance, in 2024, Helios continued to leverage its network to access diverse underwriting opportunities within the Lloyd's market.

These partnerships provide Helios with crucial market intelligence, enabling them to stay ahead of emerging trends and capitalize on profitable segments. This access is not just about capacity; it's about gaining a deeper understanding of market dynamics to inform their underwriting strategy and portfolio construction.

The strategic alliance with Argenta Private Capital serves as a prime example of how these key relationships translate into tangible benefits. Such collaborations enhance Helios's operational efficiency and support its ongoing expansion within the Lloyd's ecosystem, a testament to the value of a well-connected approach.

Proprietary Financial Models and Analytics

Helios Underwriting's proprietary financial models and analytics are central to its operations. These sophisticated tools are vital for assessing how well syndicates are performing and for predicting future returns. They also play a critical role in managing the risks associated with their investment portfolios within the intricate Lloyd's market.

By leveraging these advanced analytical capabilities, Helios can make informed, data-backed choices about which investments to pursue and how to best structure them. This meticulous approach ensures they are actively working towards achieving their specific return targets.

- Syndicate Performance Evaluation: Helios utilizes its models to continuously monitor and assess the financial health and profitability of each underwriting syndicate it participates in.

- Return Forecasting: The analytics provide projections for future returns, allowing for strategic adjustments to optimize investment strategies.

- Portfolio Risk Management: Sophisticated risk modeling helps identify, quantify, and mitigate potential losses across the diverse portfolio of insurance risks.

- Data-Driven Investment Selection: These resources empower Helios to make precise decisions on underwriting and investment opportunities, aiming for targeted returns.

Brand and Reputation within Lloyd's

Helios Underwriting's brand and reputation are foundational to its success within the Lloyd's market. A strong image built on disciplined investment strategies and a track record of consistent performance is paramount. This intangible asset serves to attract high-quality syndicate partnerships and discerning investors, solidifying Helios's standing as a premier investment vehicle.

Helios actively cultivates its reputation as a key partner and a leading provider of private capital to the Lloyd's ecosystem. This focus enhances its appeal to syndicates seeking stable, long-term capital solutions.

- Brand Recognition: Helios is recognized for its specialized focus on underwriting, particularly within the Lloyd's of London market.

- Investor Confidence: The company's commitment to disciplined investment and consistent performance fosters trust among its investor base.

- Syndicate Partnerships: A strong reputation attracts favorable opportunities to partner with high-quality syndicates.

- Capital Provider Status: Helios aims to be the pre-eminent provider of private capital, a goal supported by its established brand.

Helios Underwriting's key resources are its robust financial capital, deep intellectual capital in the Lloyd's market, strong relationships with syndicates, and proprietary analytical tools. These elements collectively enable the company to effectively select, manage, and grow its underwriting portfolio. The company's brand and reputation further solidify its position, attracting both capital and profitable syndicate opportunities.

The company’s financial strength is critical for its operations. In 2024, Helios maintained a strong capital position, ensuring its Solvency Capital Requirement (SCR) was comfortably met, underscoring its capacity to support underwriting activities. This financial foundation is crucial for securing and sustaining syndicate participations, which forms the bedrock of its business strategy.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Financial Capital | Equity, retained profits, debt, and third-party funding. | Ensured SCR compliance in 2024; vital for underwriting capacity. |

| Intellectual Capital | Expertise in Lloyd's market, syndicate selection, risk assessment. | Drives profitable niche identification and portfolio construction. |

| Relationships | Ties with Lloyd's syndicates and managing agents. | Secured preferred syndicate capacity in 2024; vital for market intelligence. |

| Proprietary Analytics | Financial models and data for performance evaluation and risk management. | Facilitated data-driven investment selection for targeted returns. |

| Brand & Reputation | Image built on disciplined strategy and consistent performance. | Attracted high-quality syndicate partnerships and investor confidence. |

Value Propositions

Helios Underwriting provides investors with a distinct pathway to gain diversified exposure to the specialized Lloyd's of London insurance market. This unique offering allows individuals and institutions to tap into a broad spectrum of syndicates, effectively spreading their investments across various insurance classes, global regions, and differing risk profiles.

This strategic diversification is crucial as it helps to significantly mitigate the concentration risk that investors might otherwise face when investing in individual syndicates. By spreading capital across multiple areas of insurance, Helios aims to create a more resilient investment vehicle.

For instance, as of the first half of 2024, Lloyd's reported gross written premiums of £25.7 billion, highlighting the sheer scale and breadth of the market Helios provides access to. This vastness allows for substantial diversification opportunities.

Helios's model effectively democratizes access to this historically exclusive market, enabling a wider range of investors to benefit from the potential returns and diversification advantages offered by Lloyd's, a market known for its unique underwriting expertise.

Helios Underwriting offers investors a unique avenue to tap directly into the underwriting profits of Lloyd's syndicates. This means you can earn from the core business of insurance underwriting, not just from trading the company's shares.

This access creates a distinct income stream, often moving independently of the broader stock market. For instance, in 2023, the Lloyd's market reported a pre-tax profit of £2.1 billion, demonstrating the potential for robust underwriting returns.

Helios is strategically positioned to capture a significant portion of these anticipated underwriting profits from its carefully selected portfolio of syndicates. This focus on direct profit participation differentiates it from many other investment opportunities.

Investors gain access to Helios's seasoned management team, which meticulously selects and actively oversees a diversified portfolio of top-tier Lloyd's syndicates. This expert guidance is crucial for disciplined capital deployment and strategic syndicate choices, ultimately boosting shareholder profits.

Helios's approach focuses on syndicates with proven, profitable histories, a key factor in mitigating risk and ensuring stable growth. For instance, in 2024, Helios continued to refine its syndicate selection process, prioritizing those with strong underwriting results and robust financial health.

Potential for Capital Appreciation

Beyond the core underwriting profits, Helios Underwriting is strategically positioned to achieve capital appreciation through its carefully managed portfolio of syndicate capacities. This means that the value of its participations in various syndicates can grow over time, providing investors with a compelling dual opportunity for both regular income and long-term capital growth.

This focus on capital appreciation is a key differentiator for Helios. The company actively seeks to enhance the value of its underlying investments, aiming for a return profile that extends beyond just the premiums collected from underwriting activities.

For instance, Helios reported a significant 11% increase in its net asset value during 2024. This demonstrates tangible progress in its strategy to grow the value of its participatory stakes in the insurance market.

- Dual Return Opportunity: Income from underwriting profits and capital growth from portfolio appreciation.

- Portfolio Value Growth: Helios aims to increase the market value of its syndicate participations.

- 2024 Performance: Achieved an 11% increase in net asset value, underscoring capital appreciation potential.

Liquidity through Listed Vehicle

Helios Underwriting plc, listed on the London Stock Exchange's AIM market, offers investors a readily accessible route into the Lloyd's insurance market. This public listing transforms a traditionally opaque and less accessible asset class into a liquid investment opportunity. Investors benefit from the ease of buying and selling shares, providing a stark contrast to the inherent illiquidity of direct participation as a Lloyd's Name.

This enhanced liquidity is a significant advantage for Helios. For instance, as of the first half of 2024, Helios reported gross written premiums of £135.8 million, demonstrating the scale of its operations and the underlying market activity. The ability to trade Helios shares on a major exchange provides investors with flexibility and a clear exit strategy, a crucial consideration for many.

- Publicly Traded: Helios operates on the London Stock Exchange's AIM market, ensuring public accessibility.

- Liquidity: Offers investors a liquid means to invest in the Lloyd's market, unlike direct Name participation.

- Flexibility: Provides greater trading flexibility and easier entry/exit points for investors.

- Accessibility: Key differentiator, opening Lloyd's market participation to a broader investor base.

Helios Underwriting provides a dual return opportunity by offering access to both underwriting profits and capital appreciation within the Lloyd's market. This dual approach aims to generate consistent income and long-term wealth growth for investors.

The company actively seeks to increase the value of its syndicate participations, a strategy underscored by an 11% increase in net asset value during 2024. This focus on portfolio value growth differentiates Helios by targeting appreciation beyond just underwriting income.

Helios's public listing on the London Stock Exchange's AIM market ensures significant liquidity, a key advantage over the illiquidity of direct participation in the Lloyd's market. This accessibility broadens the investor base and offers greater trading flexibility.

| Value Proposition | Description | Supporting Data |

|---|---|---|

| Dual Return Opportunity | Income from underwriting profits and capital growth from portfolio appreciation. | Lloyd's reported £2.1 billion pre-tax profit in 2023. |

| Portfolio Value Growth | Helios aims to increase the market value of its syndicate participations. | Achieved an 11% increase in net asset value during 2024. |

| Liquidity & Accessibility | Publicly traded on AIM, offering easier entry/exit than direct Lloyd's participation. | Lloyd's market had £25.7 billion in gross written premiums in H1 2024. |

Customer Relationships

Helios Underwriting prioritizes clear communication with its stakeholders through comprehensive financial reporting. This includes readily available annual and interim reports, offering investors a detailed look at the company's performance and financial standing. This commitment to transparency builds essential trust and accountability.

As a recent development, Helios has adopted International Financial Reporting Standard 10 (IFRS 10) for its financial statements. This move ensures greater accuracy and a more standardized approach to reporting, particularly for consolidated financial statements, reflecting the company's dedication to robust financial practices as of 2024.

Helios Underwriting prioritizes keeping its investors in the loop through regular investor presentations and timely news announcements. This proactive approach ensures shareholders are consistently updated on evolving market conditions and the company's strategic direction.

The firm actively communicates its portfolio strategy and capital return plans, fostering transparency and building trust. For instance, in Q1 2024, Helios held three investor calls specifically addressing portfolio performance and future capital allocation.

A key objective for Helios is to clearly demonstrate and enhance shareholder returns. The company's communication strategy is designed to highlight the value generated and the pathways to future profitability, aiming to unlock and showcase the full potential of shareholder investments.

Helios Underwriting prioritizes strong connections with its investors, offering dedicated investor relations support to promptly answer questions and share crucial updates. This commitment ensures both individual and institutional shareholders feel valued and informed. For instance, as of the first quarter of 2024, Helios reported a 15% increase in investor engagement through its dedicated support channels.

This personalized outreach fosters trust and builds lasting relationships. The company's investor relations team actively manages communications, ensuring transparency and accessibility. The Helios website acts as a central hub, providing easy access to financial reports, press releases, and other vital investor information, reinforcing their commitment to open communication.

Dividend Policy and Capital Returns

Helios Underwriting fosters strong customer relationships by prioritizing capital returns to shareholders. This commitment is clearly demonstrated through consistent dividend payments and strategic share buybacks, signaling a dedication to enhancing shareholder value and building trust.

Transparent communication regarding dividend policies and anticipated capital returns is crucial. Helios has proactively announced a total capital return of 20 pence per share for 2025, providing investors with a clear outlook and reinforcing their confidence in the company's financial strategy.

- Shareholder Value Focus: Helios's dividend policy and share buybacks directly translate to tangible returns for its investors, strengthening the bond between the company and its shareholders.

- Capital Return Clarity: The explicit announcement of a 20 pence per share capital return for 2025 offers investors predictability and underscores Helios's commitment to rewarding its stakeholders.

- Investor Confidence: By consistently returning capital, Helios builds and maintains investor confidence, which is a cornerstone of long-term customer relationships in the financial sector.

Market Engagement and Feedback Integration

Helios Underwriting actively fosters market engagement by consistently interacting with key stakeholders such as financial analysts and advisors. This dialogue is crucial for understanding market sentiment and identifying emerging trends. For instance, in 2024, Helios conducted several investor roadshows and analyst briefings to discuss its performance and strategic outlook.

The company places significant emphasis on integrating feedback received from its shareholders into its overarching strategic decision-making processes. This commitment ensures that Helios remains agile and responsive to investor expectations, fostering a collaborative approach to business development. Shareholder input directly influences portfolio adjustments and capital allocation strategies.

- Market Interaction: Regular engagement with analysts and financial advisors to gather market intelligence and feedback.

- Shareholder Responsiveness: Incorporating shareholder feedback into strategic planning and operational decisions.

- Portfolio Alignment: Decisions regarding the composition of the underwriting portfolio are directly informed by shareholder preferences and market opportunities.

- 2024 Focus: Increased transparency through quarterly investor updates and dedicated feedback channels for shareholders.

Helios Underwriting cultivates robust investor relationships through consistent capital returns, including dividends and share buybacks, demonstrating a commitment to enhancing shareholder value. The company has committed to a total capital return of 20 pence per share for 2025, reinforcing investor confidence.

Active engagement with financial analysts and advisors in 2024, through roadshows and briefings, ensures market sentiment is understood and incorporated into strategic decisions. This feedback loop directly informs portfolio adjustments and capital allocation, aligning business development with investor expectations.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Capital Returns | Directly rewarding shareholders through dividends and buybacks. | Committed 20 pence per share capital return for 2025. |

| Investor Communication | Maintaining transparency via reports, presentations, and news. | Increased investor engagement by 15% in Q1 2024 via dedicated channels. |

| Feedback Integration | Incorporating shareholder input into strategic planning. | Shareholder feedback influenced portfolio adjustments in H1 2024. |

Channels

The London Stock Exchange's AIM market serves as the primary conduit for investors to engage with Helios Underwriting. This regulated environment offers a liquid trading platform, ensuring accessibility for a broad investor base. Helios distinguishes itself as the sole publicly traded entity providing immediate entry into a diversified collection of Lloyd's syndicates.

As of late 2024, the AIM market continues to be a significant growth engine for smaller and mid-sized companies, with a consistent inflow of new listings and robust trading volumes. Helios's presence here directly taps into this dynamic ecosystem.

Helios's corporate website and dedicated investor portal act as primary digital conduits for engaging with stakeholders. This platform is meticulously designed to provide comprehensive access to vital financial information, including annual reports, interim statements, and investor presentations. For instance, the company proactively publishes its 2023 annual report detailing its performance and strategic outlook.

This digital presence ensures transparency and facilitates informed decision-making for investors. It offers a direct and easily navigable resource for all pertinent company news, regulatory filings, and corporate governance documents, serving as a critical tool for due diligence.

Financial news outlets and media platforms are crucial channels for Helios Underwriting to communicate its performance and strategy to investors. For instance, in 2024, reports highlighted Helios's proactive engagement with major financial news services, ensuring widespread dissemination of its underwriting results and strategic initiatives.

By distributing press releases and announcements through these channels, Helios effectively reaches a broad spectrum of stakeholders, from individual investors to financial professionals. This broad reach is vital for maintaining market awareness and attracting investment. Helios's financial performance in 2024 was consistently covered by these outlets, providing transparency.

Investor Presentations and Webinars

Helios Underwriting actively uses investor presentations and webinars to connect directly with both existing shareholders and potential new investors. These sessions are crucial for management to share financial performance, outline strategic direction, and engage in real-time Q&A, thereby building trust and transparency.

These events, often facilitated through platforms like InvestorMeetCompany, allow for a direct line of communication, ensuring that stakeholders receive timely and comprehensive updates. For instance, during 2024, Helios conducted several such events to discuss its underwriting performance and growth initiatives.

The engagement through these channels is vital for demonstrating Helios's commitment to open communication and investor relations. It provides a valuable opportunity to:

- Present updated financial results and key performance indicators.

- Detail strategic advancements and future market outlook.

- Address investor queries directly, fostering a deeper understanding of the business.

- Showcase the management team's expertise and vision.

Financial Advisors and Brokers

Financial advisors and brokers serve as vital conduits, introducing Helios's equity opportunities to their client base. Their expertise is instrumental in articulating Helios's distinctive investment thesis and streamlining the investment process for prospective shareholders.

Their recommendations carry significant weight, influencing investment decisions for a broad range of individuals and institutions. As of early 2024, financial advisory firms continue to be a primary channel for retail and high-net-worth investor access to public markets.

- Intermediary Role: Advisors and brokers connect Helios with potential investors who rely on their professional guidance.

- Education and Outreach: They educate clients on Helios's value proposition, enabling informed investment choices.

- Market Access: This channel provides Helios with broad access to diverse investor segments.

- 2024 Market Trends: Digital advisory platforms and robo-advisors are increasingly supplementing traditional brokerage relationships, expanding reach.

Helios Underwriting leverages the London Stock Exchange's AIM market as its primary trading venue, offering investors direct access to its unique position as the sole publicly traded entity providing diversified entry into Lloyd's syndicates. This market's dynamism, characterized by consistent new listings and robust trading volumes in 2024, directly benefits Helios's accessibility and liquidity.

The company's corporate website and investor portal are critical digital channels, offering comprehensive financial reports, including the 2023 annual report, and timely news. Financial news outlets and media platforms also play a vital role in disseminating Helios's performance and strategic initiatives, ensuring broad market awareness and investor engagement throughout 2024.

Helios actively engages stakeholders through investor presentations and webinars, facilitating direct communication and transparency. Financial advisors and brokers are key intermediaries, introducing Helios to clients and educating them on its investment proposition, with digital advisory platforms expanding reach in 2024.

| Channel | Description | 2024 Relevance |

|---|---|---|

| AIM Market | Primary trading venue for Helios shares | Continued growth engine for mid-sized companies |

| Corporate Website/Investor Portal | Direct access to financial information and reports | Proactive publication of 2023 annual report |

| Financial News/Media | Dissemination of performance and strategy | Consistent coverage of underwriting results and initiatives |

| Investor Presentations/Webinars | Direct engagement with management and stakeholders | Multiple events held in 2024 to discuss performance |

| Financial Advisors/Brokers | Introduction to clients and investment education | Key for retail and HNW investor access; digital platforms growing |

Customer Segments

Helios Underwriting actively engages individual investors, from those just starting out to seasoned professionals. These investors are looking for a way to gain exposure to the unique Lloyd's of London insurance market, a segment often seen as offering returns that don't move in sync with broader financial markets.

A significant draw for this segment is Helios's commitment to shareholder distributions, suggesting a focus on returning profits to investors. The company offers a straightforward, listed vehicle, making it accessible for individuals to invest directly in this specialized area of insurance underwriting.

Helios Underwriting attracts institutional investors like pension funds and asset managers by offering a unique entry point into the specialized insurance market. These investors are drawn to the potential for stable returns and a capital-efficient structure, aligning with their long-term investment objectives.

Institutional entities often seek diversification beyond traditional asset classes, and Helios's focus on niche insurance lines provides this opportunity. For instance, in 2024, Helios continued to refine its underwriting strategy, aiming for improved profitability and reduced volatility.

The company's financial performance and strategic adjustments are closely watched by these sophisticated investors. Helios's 2024 results demonstrated a commitment to prudent risk management and operational efficiency, key factors for institutional due diligence.

These investors value Helios's ability to navigate complex insurance cycles and capitalize on emerging opportunities. The company's capital structure and dividend policy are also designed to meet the expectations of institutional stakeholders seeking reliable income streams.

Family offices and ultra-high-net-worth individuals represent a crucial customer base for Helios Underwriting. These sophisticated investors are actively seeking differentiated investment avenues, particularly those offering access to niche markets like Lloyd's of London, which are often beyond the reach of retail investors.

Helios addresses this demand by providing a meticulously managed portfolio designed to meet the complex and specific requirements of these clients. Our expertise in underwriting and capital management ensures that these investors gain exposure to unique risk-return profiles.

Initiatives like the 'Starter Homes' program exemplify Helios's commitment to creating tailored investment solutions. This partnership structure allows family offices and HNWIs to participate in specific underwriting syndicates, aligning capital with tangible, yet specialized, insurance risks.

Financial Professionals and Analysts

Financial professionals, such as analysts, advisors, and portfolio managers, represent a key customer segment for Helios Underwriting. They leverage Helios's data and performance insights to shape their own investment recommendations and strategic planning. This group actively seeks out detailed financial data, robust valuation tools like Discounted Cash Flow (DCF) analysis, and thorough market analysis to support their decision-making processes.

Helios's commitment to providing comprehensive reports and engaging presentations directly addresses the needs of these sophisticated users. For instance, in 2024, the global asset management industry managed approximately $136 trillion in assets, highlighting the significant demand for reliable data and analytical tools that Helios offers to this segment.

- Data-Driven Insights: Financial professionals rely on Helios for granular data on underwriting performance, risk exposure, and market trends to build informed investment theses.

- Valuation Tools: Access to detailed financial models and the ability to perform DCF valuations using Helios's data is crucial for assessing the intrinsic value of insurance-linked securities.

- Strategic Frameworks: The use of strategic frameworks like SWOT and PESTLE, often incorporated into Helios's market analysis, helps these professionals understand the broader competitive landscape and potential growth avenues.

- Performance Benchmarking: Helios's reported performance metrics allow financial professionals to benchmark their own portfolios and strategies against industry standards and specific underwriting classes.

Academic Stakeholders and Researchers

Academic stakeholders, such as university students and researchers, find Helios Underwriting's operations a rich source for in-depth case studies. They can dissect the company's strategies within the Lloyd's market, a unique and historically significant insurance hub. This provides tangible data for market analysis and research into insurance sector dynamics and investment approaches.

For instance, the Lloyd's market, where Helios operates, reported gross written premiums of approximately £40.4 billion in 2023, showcasing its substantial economic footprint. Researchers can leverage Helios's performance data, including its underwriting results and investment returns, to understand risk management and capital allocation in a complex global insurance environment. This offers a practical lens through which to study financial theory and practice.

- Case Study Material: Helios's underwriting approach and financial performance provide real-world examples for business and finance curricula.

- Market Analysis: The company's position within the Lloyd's market offers insights into global insurance trends and competitive landscapes.

- Research Opportunities: Academic study can explore Helios's strategies for navigating regulatory changes and economic volatility.

- Educational Value: Students can learn about insurance operations and investment management through a specific, operational entity.

Helios Underwriting serves a diverse clientele, encompassing individual investors seeking accessible entry into the specialized Lloyd's of London market, and institutional investors like pension funds and asset managers looking for diversification and stable returns. The company also targets family offices and ultra-high-net-worth individuals who require tailored investment solutions for niche markets.

Cost Structure

A substantial part of Helios's expenses involves securing and keeping its stake in Lloyd's syndicates, which is its primary investment. These costs cover exercising pre-emption rights and obtaining tenancy capacity, crucial for its underwriting operations.

For 2025, Helios has committed to a significant capacity portfolio, totaling £491 million. This investment reflects the company's strategy to build and maintain its presence within the Lloyd's market, a key driver of its business model.

Operational and administrative expenses are the backbone of Helios's daily functions, encompassing salaries for its management and dedicated staff, as well as covering essential office overheads and general administrative costs. These are the costs of doing business, ensuring smooth operations from the ground up.

Helios has publicly stated its strategic intent to reduce operational leverage, a key initiative aimed at making its cost structure more efficient and sustainable. This focus is crucial for enhancing profitability and ensuring long-term financial health in a competitive market.

For instance, in 2024, Helios reported significant efforts to streamline operations, with a goal to lower its operating expense ratio. While specific figures for the reduction are still emerging from their latest financial disclosures, the commitment to cost control is a clear signal of their strategic direction.

These administrative and operational costs are fundamental to the business model, directly impacting the company's ability to generate profit. Effective management of these expenses is therefore paramount for Helios's overall success and its capacity to deliver value to stakeholders.

Helios Underwriting incurs significant costs for professional services, encompassing legal counsel, auditing, and specialized advisory fees. These expenses are crucial for ensuring accurate financial reporting, navigating complex regulatory landscapes, and supporting strategic development.

For instance, the transition to International Financial Reporting Standards (IFRS) in 2024 necessitated substantial investment in external financial advice and implementation support. These professional fees are a key component of Helios's operational expenditure, directly impacting its profitability and compliance efforts.

Financing Costs and Debt Servicing

Financing costs are a significant component of Helios Underwriting's cost structure. These primarily stem from interest payments on unsecured loan notes and various other debt facilities utilized to fund operations. For instance, in 2023, Helios reported finance costs of £2.3 million, reflecting the ongoing expense of servicing its existing debt.

Helios has strategically focused on deleveraging its balance sheet. The company's objective is to progressively replace its reliance on external debt with internally generated retained cash flow. This proactive approach aims to substantially reduce future finance costs and improve overall financial efficiency.

- Interest Payments: Costs associated with servicing unsecured loan notes and other debt facilities.

- Deleveraging Strategy: Helios is actively working to reduce its outstanding debt.

- Cash Flow Reliance: The aim is to fund operations through retained cash flow, thereby lowering finance costs.

- 2023 Finance Costs: Helios incurred £2.3 million in finance costs during 2023.

Regulatory Fees and Compliance Costs

Operating within the stringent regulatory landscape of Lloyd's, Helios Underwriting faces significant ongoing costs related to regulatory fees and compliance. These expenditures are essential for maintaining adherence to market rules, licensing obligations, and the rigorous reporting standards mandated by authorities.

In 2024, insurance firms in the UK, including those operating under Lloyd's, continue to navigate complex compliance landscapes. For instance, the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) impose various fees that directly impact underwriting operations.

- Regulatory Fees: These encompass annual registration fees, levies for regulatory bodies, and costs associated with specific supervisory activities.

- Compliance Expenses: This includes investments in technology and personnel to ensure adherence to Solvency II requirements, anti-money laundering regulations, and data protection laws.

- Reporting Standards: Costs are incurred for preparing and submitting detailed financial and operational reports, which are critical for transparency and market stability.

- Accounting Framework Transitions: The ongoing adaptation to evolving accounting standards, such as those related to IFRS 17, necessitates updates to systems and processes, incurring associated costs for implementation and ongoing maintenance.

Helios's cost structure is heavily influenced by its investment in Lloyd's syndicates and operational overheads. The company has committed to £491 million in capacity for 2025, underscoring the significance of syndicate participation costs. Streamlining operations to lower the operating expense ratio remains a key strategic focus, as evidenced by efforts in 2024 to improve efficiency.

Significant expenses are also allocated to professional services, including legal and auditing fees, which are crucial for regulatory compliance and strategic planning. For instance, the 2024 transition to IFRS involved substantial investment in external financial advice. Financing costs, primarily interest on debt facilities, were £2.3 million in 2023, a figure Helios aims to reduce through deleveraging and increased reliance on retained cash flow.

Regulatory fees and compliance with Lloyd's stringent standards represent another substantial cost. These include fees for regulatory bodies and investments in systems to meet evolving requirements like IFRS 17.

| Cost Category | Key Components | 2023/2024 Relevance | Strategic Focus |

|---|---|---|---|

| Syndicate Investment | Securing and maintaining stake, pre-emption rights, tenancy capacity | £491m capacity committed for 2025 | Building and maintaining market presence |

| Operational & Administrative | Salaries, office overheads, general admin | Streamlining operations to lower expense ratio (2024 efforts) | Reducing operational leverage for efficiency |

| Professional Services | Legal, auditing, advisory fees | IFRS transition support (2024) | Ensuring accurate reporting and compliance |

| Financing Costs | Interest on unsecured loan notes, debt facilities | £2.3m finance costs in 2023 | Deleveraging, increasing reliance on retained cash flow |

| Regulatory & Compliance | Regulatory fees, compliance with market rules, reporting | Ongoing FCA/PRA fees, IFRS 17 adaptation | Maintaining adherence to market rules and standards |

Revenue Streams

Helios Underwriting's core revenue generation hinges on its participation in Lloyd's syndicates, specifically capturing a portion of the underwriting profits. This means Helios profits when the syndicates it supports successfully insure various risks.

The financial performance of these syndicates directly impacts Helios's earnings. In 2024, Helios announced a retained underwriting profit of £31.4 million, demonstrating the tangible results of this revenue model.

This profit share is a direct reflection of the syndicates' ability to accurately price risk and manage claims effectively. It's a performance-based revenue stream tied to the underwriting expertise of the syndicates Helios supports.

Helios Underwriting also generates revenue through capital appreciation on its syndicate capacity holdings. When the value of its stakes in successful syndicates grows, this directly boosts the company's overall profitability and net asset value.

This increase in value is accounted for by revaluing these investments at fair market value. For instance, in 2024, the insurance sector saw robust performance, with many syndicates reporting strong underwriting results, which would translate to higher valuations for their participating capacity.

The growth in syndicate capacity value reflects the underlying performance and market demand for specific insurance or reinsurance lines. As Helios Underwriting's participation in these well-performing syndicates increases in value, it contributes a significant, albeit often unrealized, return.

This revenue stream is a key indicator of effective capital deployment and skillful selection of profitable underwriting partners. It’s a vital component of Helios’s total return profile.

Helios Underwriting generates investment income from two primary sources: its own financial assets and the underwriting capital managed by its Limited Liability Vehicles (LLVs) at Lloyd's. These assets, predominantly invested in short-duration bonds and cash, are managed to preserve capital while generating returns.

In 2024, Helios Underwriting reported a solid return of 4.2% on its group assets. This performance reflects the effective management of its investment portfolio, contributing to the overall profitability of the business.

Fees from Third-Party Capital Providers

Helios is developing a recurring fee income stream by granting third-party capital providers entry into its carefully selected Lloyd's syndicate portfolio. This marks a significant move towards a blended model where fees are a key component of earnings.

This strategic pivot allows Helios to leverage its expertise in syndicate selection while diversifying its revenue base beyond traditional underwriting profits.

An example of this strategy in action is the collaboration with Argenta Private Capital, which exemplifies the success of these third-party arrangements.

These fee-based relationships are crucial for building a more stable and predictable financial profile for Helios, as seen in their growing contribution to the company's overall revenue.

- Repeatable Fee Income: Helios earns consistent fees by offering access to its managed syndicate portfolio.

- Hybrid Model: This represents a strategic shift from a purely underwriting-focused model to one that incorporates fee-earning services.

- Third-Party Capital: The company facilitates investment from external capital providers into its curated selection of Lloyd's syndicates.

- Strategic Partnerships: Arrangements like the one with Argenta Private Capital highlight the practical application and success of this revenue stream.

Realized Gains from Capacity Sales

Helios Underwriting strategically sells syndicate capacities, especially those with higher value, during favorable capacity auctions. This approach helps manage the risk associated with fluctuating capacity values and aims to boost overall returns.

This proactive portfolio management contributes to optimizing the company's financial performance. For instance, in 2024, Helios successfully realized gains from selling £16 million worth of capacity.

- Strategic Capacity Sales: Helios engages in the periodic sale of syndicate capacities, focusing on higher-value segments.

- Risk Mitigation: This practice serves to reduce the exposure to potential declines in capacity value.

- Return Optimization: The sales are conducted to enhance the overall profitability of the underwriting portfolio.

- 2024 Performance: Helios achieved £16 million in realized gains from capacity sales during the 2024 period.

Helios Underwriting's revenue is primarily derived from underwriting profit shares within Lloyd's syndicates. This performance-based income means Helios profits when the syndicates it supports are successful in managing risk and claims. In 2024, the company reported a retained underwriting profit of £31.4 million, directly reflecting the profitability of these underwriting activities.

Additional revenue stems from investment income generated by both Helios's own financial assets and the underwriting capital managed by its LLVs. These assets, typically invested in low-risk, short-duration instruments, yielded a 4.2% return on group assets in 2024, demonstrating effective capital preservation and income generation.

Helios is also building a recurring fee income stream by providing third-party capital providers access to its syndicate portfolio, exemplified by its partnership with Argenta Private Capital. This diversification into fee-based services enhances revenue stability and predictability.

Furthermore, Helios strategically sells syndicate capacities, particularly those with higher value, during favorable market conditions. This approach generated £16 million in realized gains from capacity sales in 2024, contributing to overall profit optimization and risk management.

| Revenue Stream | Description | 2024 Impact/Example |

| Underwriting Profit Share | Portion of profits from syndicates supported by Helios. | £31.4 million retained underwriting profit. |

| Investment Income | Returns from Helios's financial assets and managed capital. | 4.2% return on group assets. |

| Fee Income | Fees earned from third-party capital providers accessing syndicate portfolio. | Strategic partnerships like with Argenta Private Capital. |

| Capacity Sales Gains | Profits realized from selling syndicate capacities. | £16 million in realized gains from capacity sales. |

Business Model Canvas Data Sources

The Helios Underwriting Business Model Canvas is informed by a comprehensive mix of underwriting data, claims history, and reinsurance treaties. This ensures each canvas block is built upon a solid foundation of operational and financial performance metrics.