JM Huber SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JM Huber Bundle

JM Huber's diverse portfolio presents significant strengths, but understanding its unique market challenges and strategic opportunities is crucial for informed decision-making.

Want the full story behind Huber's competitive advantages, potential threats, and avenues for innovation? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and competitive analysis.

Strengths

J.M. Huber Corporation's strength lies in its remarkably diversified global portfolio. This includes Huber Engineered Materials, Huber Engineered Woods, and its former CP Kelco business, which collectively cater to a wide array of industries such as construction, personal care, food and beverage, and various industrial applications.

This broad product and service offering significantly reduces the company's exposure to any single market downturn, acting as a natural hedge against economic volatility. For instance, the construction sector, a key market for Huber Engineered Woods, might face cyclical challenges, but demand in personal care or food and beverage from Huber Engineered Materials can remain more stable.

Furthermore, Huber's extensive global footprint, with operations and sales spanning numerous countries, enhances its market resilience. This international presence allows the company to tap into growth opportunities across different economic cycles and geographic regions, solidifying its competitive advantage and market reach.

Huber's strong commitment to sustainability is a significant strength, evident in its 2024 Impact Report. This report details their ambitious 'Vision 150' initiative, aimed at achieving nature-friendly solutions and a carbon- and waste-free future by their 150th anniversary in 2033.

This dedication to environmental responsibility is not just aspirational; it's recognized externally. For the sixth consecutive year, Huber was named a 2025 Gold Standard Best Managed Company by Deloitte, underscoring their consistent operational excellence and forward-thinking approach to business, which includes a robust sustainability framework.

JM Huber demonstrates a strong strategic capability through its consistent pursuit of acquisitions to fuel growth. The company's recent acquisitions of Active Minerals International in June 2024 and Natrium Products Business in April 2024 are prime examples of this approach. These strategic moves significantly enhance its Huber Engineered Materials segment, particularly within the specialty minerals sector, thereby strengthening its overall market standing.

Innovation and Technology Leadership

Huber's commitment to innovation is a significant strength, leveraging its deep expertise in inorganic chemistry and engineered wood composites. This focus allows them to create advanced solutions that demonstrably improve customer product performance.

Key areas of advancement include the development of halogen-free fire retardants, a critical component for safety and environmental compliance in many industries. Their work in sustainable forestry management also positions them as a leader in responsible resource utilization.

These technological advancements not only drive market innovation but also foster strong brand loyalty among customers who value performance and sustainability. For instance, their engineered wood products continue to see demand growth, with the global engineered wood market projected to reach over $200 billion by 2028, highlighting the market's appreciation for such innovations.

- Focus on inorganic chemistry and engineered wood composites

- Development of advanced solutions like halogen-free fire retardants

- Leadership in sustainable forestry management practices

- Driving market innovation and building customer brand loyalty

Long-Standing Family-Owned Legacy

J.M. Huber's enduring family ownership, spanning over 140 years, provides a distinct advantage in its long-term strategic outlook and operational stability. This deep-rooted legacy cultivates robust customer loyalty, upholds rigorous ethical principles, and instills a culture of unwavering reliability. This generational commitment underpins the company's resilience and consistent performance.

Huber's diversified business model, encompassing engineered materials and engineered woods, provides significant resilience against market fluctuations. This broad market reach, serving sectors from construction to personal care, insulates the company from single-industry downturns.

The company's strategic acquisitions, such as Active Minerals International in June 2024 and Natrium Products Business in April 2024, bolster its specialty minerals segment. These moves underscore a proactive growth strategy, enhancing its competitive position in key markets.

Huber's commitment to innovation, particularly in inorganic chemistry and engineered wood composites, drives the development of high-performance products. Their advancements, like halogen-free fire retardants, address critical industry needs for safety and environmental compliance.

The company's long-standing family ownership, exceeding 140 years, fosters a stable, long-term strategic vision and cultivates strong customer loyalty. This legacy supports operational consistency and a commitment to ethical business practices.

| Business Segment | Key Markets Served | Recent Strategic Move |

|---|---|---|

| Huber Engineered Materials | Personal Care, Food & Beverage, Industrial | Acquisition of Active Minerals International (June 2024) |

| Huber Engineered Woods | Construction, Residential Building | Continued investment in sustainable forestry |

| Global Operations | Multiple Industries Worldwide | Recognition as a 2025 Gold Standard Best Managed Company by Deloitte |

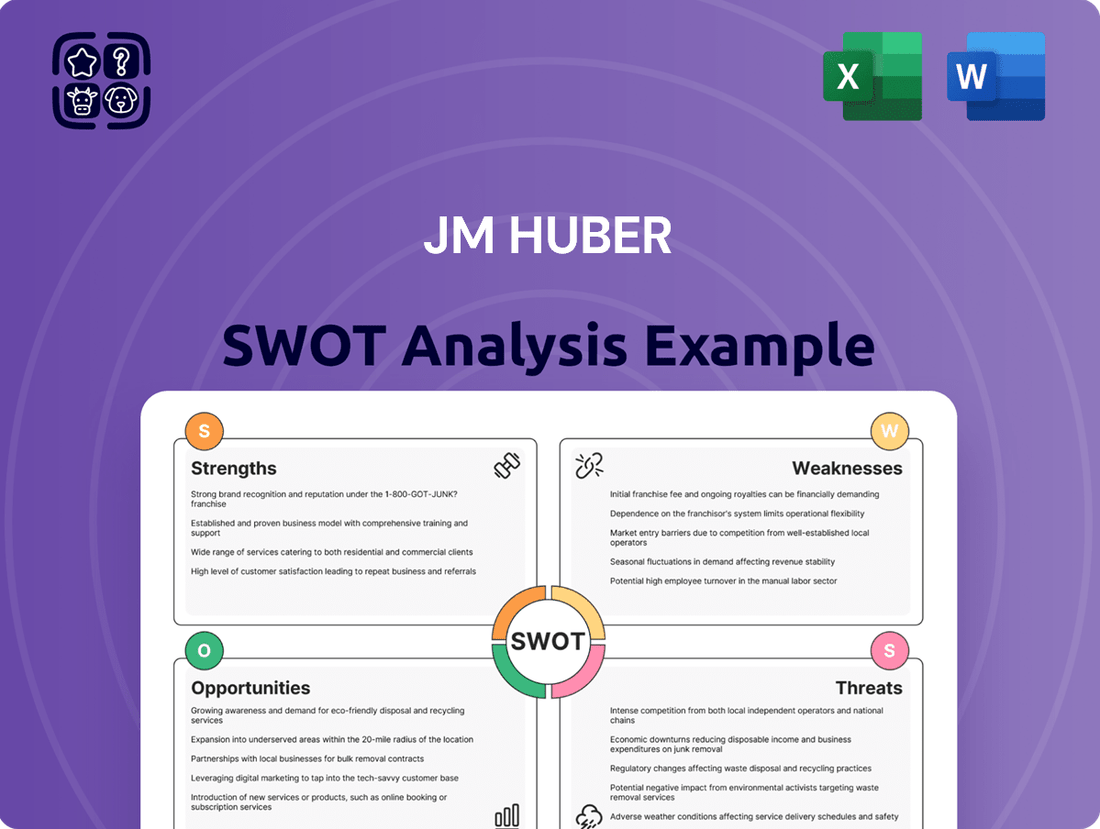

What is included in the product

Delivers a strategic overview of JM Huber’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Identifies critical internal weaknesses and external threats to proactively mitigate risks.

Weaknesses

JM Huber's diverse business units, including Huber Advanced Materials, have felt the pinch of rising raw material and freight costs. This means that expenses for things like feedstocks and shipping have gone up, forcing Huber to increase prices on its products to keep up.

This vulnerability to inflation in its supply chain directly impacts Huber's profitability. For example, in the first half of 2024, many industrial materials companies saw their cost of goods sold increase by 5-10% due to these pressures, a trend Huber likely navigated as well.

The divestiture of CP Kelco in November 2024, while unlocking strategic capital, means J.M. Huber no longer directly participates in the growth and market opportunities within the specialty food ingredients sector. This strategic move significantly reshapes Huber's portfolio and revenue diversification.

A key vulnerability for JM Huber lies in its substantial exposure to cyclical industries, most notably the construction sector through its Huber Engineered Woods division. This reliance means that demand for its products is highly susceptible to economic downturns, shifts in interest rates, and the overall health of the housing market. For instance, a significant slowdown in new home construction, a common occurrence during periods of economic uncertainty, directly translates to reduced sales volumes for Huber's engineered wood products.

Potential for Supply Chain Disruptions

As a global manufacturer, J.M. Huber is susceptible to disruptions in its extensive supply chain. Geopolitical events, such as the ongoing conflicts impacting shipping routes and trade agreements, can create significant bottlenecks. For instance, the Red Sea crisis in early 2024 led to rerouting of vessels, increasing transit times and costs for many global businesses.

Raw material shortages, exacerbated by climate events or unexpected demand surges, also pose a threat. The 2024 agricultural season, for example, saw reduced yields for certain key commodities due to adverse weather, potentially impacting the availability and price of raw materials used in Huber's diverse product lines. These external factors can directly translate to production delays and challenges in ensuring consistent product availability for customers.

- Geopolitical Instability: Events like the Red Sea crisis in early 2024 disrupted global shipping, increasing lead times and costs.

- Raw Material Volatility: Adverse weather in 2024 impacted agricultural yields, potentially affecting the supply and price of key inputs.

- Transportation Bottlenecks: Port congestion and labor shortages can lead to delays, impacting J.M. Huber's ability to meet customer demand promptly.

- Increased Operational Costs: Supply chain disruptions often result in higher transportation, sourcing, and inventory holding expenses.

Challenges in Workforce Attraction and Retention

JM Huber, like many in the broader manufacturing sector, grapples with significant hurdles in attracting and retaining a skilled workforce. This persistent issue contributes to widening skills gaps across its operations, impacting efficiency and potentially increasing labor costs. For instance, in 2024, the U.S. manufacturing sector reported an average of 850,000 job openings per month, highlighting the intense competition for talent, a challenge Huber undoubtedly navigates.

These difficulties in securing and keeping qualified employees can directly translate into operational inefficiencies and hinder the company's ability to maintain peak productivity. The ongoing need to upskill existing staff or recruit extensively to fill these roles places a strain on resources and can slow down innovation and expansion efforts.

- Skilled Labor Shortage: The manufacturing industry, including JM Huber, faces ongoing challenges in finding and keeping workers with the necessary technical skills.

- Increased Labor Costs: Competition for talent drives up wages and benefits, impacting Huber's operational expenses.

- Productivity Impact: Gaps in the workforce can lead to slower production cycles and potential quality control issues.

- Skills Gap Persistence: The need for continuous training and development to bridge evolving skill requirements remains a significant hurdle.

JM Huber's reliance on cyclical industries, particularly construction through its Engineered Woods division, makes it vulnerable to economic downturns. Reduced demand in these sectors directly impacts sales volumes, as seen when housing market slowdowns occur. Furthermore, the divestiture of CP Kelco in late 2024 removes Huber from the specialty food ingredients market, limiting portfolio diversification and growth opportunities in that specific sector.

| Weakness | Impact | Example/Data Point |

|---|---|---|

| Cyclical Industry Dependence | Vulnerability to economic downturns and housing market fluctuations. | Reduced sales volumes during periods of economic uncertainty impacting construction demand. |

| Portfolio Reshaping (CP Kelco Divestiture) | Loss of direct participation in specialty food ingredients market growth. | November 2024 divestiture means no longer benefiting from market opportunities in this sector. |

| Supply Chain Disruptions | Increased costs and potential production delays due to geopolitical events or raw material shortages. | Red Sea crisis in early 2024 led to rerouting, increasing transit times and costs for global businesses. |

| Skilled Labor Shortage | Operational inefficiencies and increased labor costs due to difficulties in attracting and retaining talent. | U.S. manufacturing sector averaged 850,000 job openings per month in 2024, indicating intense competition for skilled workers. |

Full Version Awaits

JM Huber SWOT Analysis

The file shown below is not a sample—it’s the real JM Huber SWOT analysis you'll download post-purchase, in full detail. This preview accurately represents the professional quality and structure of the complete report. Purchase now to unlock the entire, comprehensive document.

Opportunities

The global market for sustainable and high-performance materials is experiencing robust growth, driven by consumer preferences and increasing regulatory pressure for environmentally friendly solutions. Industries ranging from personal care and food to construction are actively seeking natural and engineered materials that offer both superior functionality and reduced environmental impact. For instance, the global green chemistry market was valued at approximately $4.7 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a significant expansion.

Huber's strategic focus on engineered materials, particularly those derived from natural sources and designed for enhanced performance, directly aligns with these burgeoning market trends. This positions the company favorably to capture market share as businesses increasingly prioritize sustainability and seek advanced material solutions to meet evolving consumer demands and comply with stricter environmental standards.

Emerging markets, particularly in the Asia-Pacific region, are showing robust growth, driven by significant infrastructural investments. Huber's engineered woods and specialty minerals are well-positioned to capitalize on this, supporting construction and development projects.

This geographical expansion offers a valuable opportunity for Huber to diversify its revenue streams, reducing reliance on any single market and enhancing overall business resilience. For instance, the Asia-Pacific construction market alone was projected to reach over $4.5 trillion by 2024, offering substantial demand for Huber's materials.

Huber's commitment to R&D fuels product innovation, evidenced by advancements in halogen-free flame retardants and thermal management. This focus, a key driver of their strategy, allows them to enter new markets and enhance their competitive standing.

Leveraging Digital Transformation and Automation

JM Huber can significantly boost its manufacturing operations by adopting advanced technologies like AI, IoT, and automation. This digital transformation offers a prime opportunity to streamline processes, leading to enhanced efficiency and cost reductions. For instance, by 2025, the global industrial automation market is projected to reach over $300 billion, highlighting the substantial potential for companies like Huber to gain a competitive edge through technology adoption.

Embracing these digital tools allows for better supply chain management and more informed decision-making. Predictive maintenance powered by IoT sensors, for example, can minimize downtime and optimize resource allocation. This strategic move is expected to drive increased productivity and substantial cost savings across Huber's diverse business units.

- Enhanced Operational Efficiency

- Optimized Supply Chain Management

- Improved Data-Driven Decision Making

- Increased Productivity and Cost Savings

Strategic Collaborations for Sustainability and Growth

JM Huber can significantly enhance its sustainability efforts and market reach by forming strategic collaborations. Partnering with organizations such as the World Business Council for Sustainable Development offers a valuable avenue to share best practices and co-develop innovative solutions for environmental challenges. These alliances can foster a collective approach to industry-wide sustainability, driving meaningful progress.

These partnerships are not just about environmental stewardship; they also unlock tangible business benefits. By joining forces with other industry leaders and sustainability-focused groups, Huber can gain access to new markets and distribution channels. Furthermore, the exchange of knowledge and expertise within these collaborative frameworks can accelerate innovation and lead to more efficient operational strategies, ultimately contributing to long-term growth.

- Enhanced Sustainability Initiatives: Collaborating with groups like the World Business Council for Sustainable Development allows for shared learning and joint projects on critical environmental issues, aligning with global sustainability goals.

- Market Expansion Opportunities: Strategic partnerships can open doors to new geographical regions and customer segments, leveraging the combined networks of collaborators.

- Knowledge Sharing and Innovation: Engaging in alliances facilitates the exchange of technical expertise and market insights, fostering a more innovative and adaptive business environment.

- Industry Influence: Collective action through partnerships can position Huber as a leader in driving sustainable practices across its sectors, influencing broader industry standards and policies.

JM Huber is well-positioned to capitalize on the growing demand for sustainable and high-performance materials, with the global green chemistry market projected to exceed $10 billion by 2030. The company's focus on engineered materials, particularly those derived from natural sources, aligns with increasing consumer and regulatory preferences for eco-friendly solutions.

Expansion into emerging markets, such as the Asia-Pacific region with its projected construction market value exceeding $4.5 trillion by 2024, presents a significant opportunity for Huber to diversify revenue and leverage its engineered woods and specialty minerals.

Investing in advanced manufacturing technologies like AI and IoT offers a pathway to enhanced operational efficiency and cost reduction, as the global industrial automation market is expected to surpass $300 billion by 2025.

Strategic collaborations, such as with the World Business Council for Sustainable Development, can bolster Huber's sustainability initiatives, unlock new market access, and accelerate innovation through shared expertise.

Threats

Global economic uncertainties, particularly persistent inflation and elevated interest rates throughout 2024 and into early 2025, present a significant threat to JM Huber. These conditions can curb consumer and business spending, directly impacting demand for Huber's diverse product portfolio across construction, industrial, and consumer goods sectors. For instance, a slowdown in construction due to higher borrowing costs could reduce sales of Huber Engineered Materials' specialty ingredients.

JM Huber faces significant competitive headwinds in both its engineered materials and wood products segments. In engineered materials, the company competes with global giants and specialized firms, leading to constant pressure on pricing and the need for substantial investment in research and development to maintain a competitive edge. For instance, the global engineered wood market alone was valued at approximately $75 billion in 2023 and is projected to grow, but this growth attracts numerous players, intensifying rivalry.

Huber faces increasing pressure from evolving environmental regulations and sustainability mandates globally. For instance, the European Union's Green Deal initiatives, implemented progressively through 2024 and into 2025, are tightening emissions standards and waste management requirements, directly impacting manufacturing processes and potentially increasing operational costs.

Adapting to these dynamic regulatory frameworks across diverse operating regions, including new trade policies and chemical safety regulations, necessitates ongoing investment in compliance technologies and expert personnel. This continuous need for vigilance and adaptation can add significant overhead, affecting profitability and strategic flexibility for companies like Huber.

Supply Chain Risks and Geopolitical Instability

Ongoing geopolitical tensions, trade disputes, and other global events pose a significant threat to Huber's intricate supply chains. These disruptions can manifest as shortages of essential raw materials, escalating transportation expenses, and potential setbacks in manufacturing and product delivery. For instance, the ongoing conflict in Eastern Europe, which began in early 2022, has continued to impact global commodity markets, including those relevant to Huber's operations, leading to price volatility and availability concerns throughout 2024 and into early 2025.

The interconnected nature of global trade means that even localized conflicts or policy shifts can have ripple effects. Huber's reliance on a diverse range of suppliers across different regions exposes it to these risks. For example, in 2024, several major shipping routes experienced significant delays due to regional instability, directly affecting lead times and increasing logistics costs for many industrial manufacturers, including those in Huber's sectors.

- Supply Chain Vulnerability: Huber's global operations are susceptible to disruptions from geopolitical events, impacting raw material availability and cost.

- Increased Operational Costs: Trade disputes and transportation challenges can lead to higher expenses for sourcing materials and delivering finished goods.

- Production Delays: Geopolitical instability can cause unforeseen interruptions, resulting in slower production cycles and delayed customer fulfillment.

- Market Volatility: Global events contribute to price fluctuations in commodities and shipping, creating uncertainty in financial planning and forecasting.

Fluctuations in Raw Material and Energy Prices

JM Huber, like many industrial companies, faces significant threats from the volatility of raw material and energy prices. Fluctuations in the cost of essential inputs such as chemicals, minerals, and wood directly affect Huber's manufacturing expenses. For instance, the global chemical industry experienced price surges in early 2024 due to supply chain disruptions and increased demand, impacting companies reliant on these materials. Similarly, energy prices, a critical component of production and transportation costs, remain susceptible to geopolitical events and market dynamics.

These price swings can compress profit margins if Huber cannot fully pass on increased costs to its customers. For example, if the cost of a key mineral used in its engineered materials segment rises by 15% and the company can only pass on 10% to its clients, its profitability will be directly affected. This necessitates robust cost management strategies and efficient supply chain operations to mitigate the impact of such market instability.

- Raw Material Volatility: Chemicals, minerals, and wood are key inputs, with prices subject to global supply and demand shifts.

- Energy Price Sensitivity: Fluctuations in oil, natural gas, and electricity costs directly impact production and logistics expenses.

- Margin Compression Risk: Inability to fully pass on rising input costs to customers can significantly reduce profit margins.

- 2024 Impact: The chemical sector saw price increases in early 2024, highlighting the ongoing threat of input cost inflation.

JM Huber faces significant threats from the ongoing volatility in raw material and energy prices. For example, the global chemical industry experienced price surges in early 2024, directly impacting manufacturing expenses for companies like Huber. Energy costs, crucial for production and logistics, also remain susceptible to geopolitical events and market dynamics throughout 2024 and into early 2025.

These price fluctuations can squeeze profit margins if Huber cannot fully pass on increased costs to its customers. For instance, a 15% rise in a key mineral cost, with only a 10% cost pass-through, directly reduces profitability. This underscores the need for robust cost management and efficient supply chains to navigate market instability.

| Threat Category | Specific Impact on Huber | 2024/2025 Data/Trend |

| Raw Material Price Volatility | Increased manufacturing costs for chemicals, minerals, and wood. | Chemical sector prices surged in early 2024; energy prices remain volatile. |

| Energy Price Sensitivity | Higher production and logistics expenses. | Energy costs influenced by geopolitical events and market dynamics. |

| Margin Compression | Reduced profitability if cost increases cannot be fully passed to customers. | Example: 15% mineral cost increase with only 10% pass-through impacts margins. |

SWOT Analysis Data Sources

This SWOT analysis draws from a robust foundation of JM Huber's audited financial statements, comprehensive market intelligence reports, and expert industry analyses. These sources provide a data-driven perspective on the company's internal capabilities and external market dynamics.