JM Huber Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JM Huber Bundle

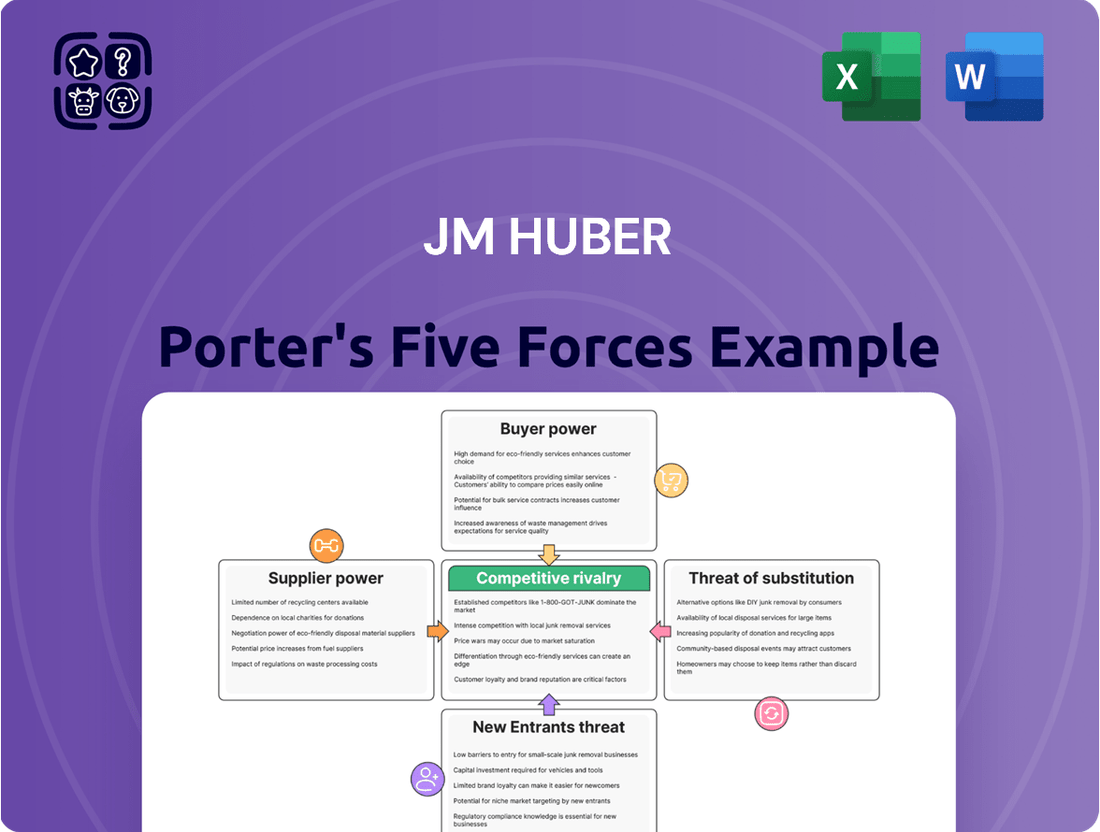

JM Huber operates in diverse markets, facing unique competitive pressures. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for strategic advantage.

The complete report reveals the real forces shaping JM Huber’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a major factor in how much power suppliers have. When only a few companies provide essential materials, like the specialized minerals JM Huber relies on for some of its engineered materials, those suppliers can often charge more. For instance, in 2024, the global market for rare earth elements, critical for certain advanced materials, saw significant price volatility due to a limited number of major producers, highlighting this dynamic.

Conversely, if Huber sources from a wide array of suppliers, it gains more negotiating strength. The company's diverse business portfolio means this concentration varies greatly. For example, while the market for certain wood products might be more fragmented, the supply chain for specific chemical additives used in Huber's specialty chemicals segment could be much more concentrated, impacting bargaining power differently across its operations.

The cost and complexity for J.M. Huber to switch suppliers for critical inputs can significantly enhance supplier power. If changing suppliers involves substantial retooling of manufacturing processes, rigorous re-certification of materials, or poses risks to product quality and consistency, Huber may find itself locked into existing supplier relationships. This situation grants suppliers more leverage in price and contract negotiations, especially when dealing with highly specialized engineered materials or proprietary ingredients that are not readily available from multiple sources.

Suppliers gain leverage when they offer raw materials that are one-of-a-kind, highly specialized, or protected by patents, especially if these are critical for JM Huber's product innovation and lack viable alternatives. This distinctiveness enables suppliers to set terms and prices, as Huber's market differentiation hinges on these specific inputs.

For example, CP Kelco's reliance on particular mineral grades or bio-based feedstocks could exemplify such unique inputs. In 2024, the global specialty chemicals market, where CP Kelco operates, saw continued demand for high-performance ingredients, with some niche materials experiencing price increases due to constrained supply chains and specialized production requirements.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into JM Huber's markets significantly amplifies their bargaining power. If a supplier can credibly transition from providing raw materials to producing finished or semi-finished goods that Huber currently sells, they gain substantial leverage in pricing and supply negotiations. This risk is particularly pronounced in industries where the initial processing stages are less technologically demanding.

For instance, consider the specialty chemicals sector where Huber operates. If a supplier of a key chemical intermediate, which requires relatively straightforward processing, were to invest in the facilities to create a more refined product that competes directly with Huber's offerings, they could dictate terms more aggressively. This forward integration essentially turns a supplier into a potential rival, forcing Huber to consider the supplier's competitive threat in addition to its role as a material provider.

- Supplier Capability: Suppliers with the financial resources and technical know-how to undertake further processing gain a stronger position.

- Market Attractiveness: If Huber's downstream markets offer attractive profit margins, this incentivizes suppliers to consider forward integration.

- Industry Complexity: Less complex processing stages for suppliers make forward integration a more feasible and immediate threat.

Importance of Huber to Suppliers

The degree to which a supplier relies on J.M. Huber for its revenue significantly impacts its bargaining power. If Huber constitutes a substantial percentage of a supplier's total sales, that supplier is likely to be more accommodating with pricing and terms to secure continued business. For instance, if a key chemical supplier, which saw its global revenue reach approximately $5 billion in 2024, derives 20% of its income from Huber, it has a strong incentive to maintain that relationship through favorable negotiations.

Conversely, if J.M. Huber represents a minor customer for a supplier, the supplier's flexibility diminishes. In such scenarios, the supplier may prioritize larger accounts or operate on standard, less negotiable terms, knowing that losing Huber's business would have a minimal impact on its overall financial performance. This dynamic is crucial for Huber in managing its supply chain costs and ensuring competitive input prices.

- Supplier Revenue Dependence: The percentage of a supplier's revenue generated from J.M. Huber.

- Negotiating Leverage: Higher dependence on Huber grants suppliers less leverage.

- Strategic Importance: Huber's status as a major or minor customer influences supplier flexibility.

The bargaining power of suppliers for JM Huber is influenced by several key factors, including supplier concentration and the uniqueness of their offerings. When few suppliers provide essential materials, like specialized minerals for engineered products, they can command higher prices. For example, in 2024, the rare earth elements market experienced price volatility due to a limited number of producers.

The cost and complexity for Huber to switch suppliers also empower suppliers. If changing suppliers requires significant retooling or risks product quality, Huber may be locked into existing relationships, giving suppliers more leverage. This is especially true for highly specialized or proprietary ingredients that lack readily available alternatives.

Suppliers gain leverage when their products are unique, patented, or critical for Huber's innovation, with no viable substitutes. This distinctiveness allows them to dictate terms and prices, as Huber's competitive edge relies on these specific inputs. For instance, in 2024, niche materials in the specialty chemicals market saw price increases due to supply chain constraints.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Supplier Concentration | Increases power if few suppliers exist | Rare earth elements market volatility due to limited producers |

| Switching Costs | Increases power if switching is costly/complex | Re-certification of specialized materials |

| Product Uniqueness/Patents | Increases power if inputs are critical and unique | Niche specialty chemicals with constrained supply |

What is included in the product

This analysis delves into the competitive landscape for JM Huber, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products on JM Huber's strategic positioning.

Effortlessly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Customers Bargaining Power

The bargaining power of J.M. Huber's customers is heavily influenced by how concentrated and how large their purchasing volume is. When a few major customers account for a significant portion of Huber's sales, they gain considerable leverage. These large buyers, particularly in sectors such as food processing or major construction projects, can negotiate for reduced prices, more favorable contract terms, or even specialized product development because of their substantial order sizes and their capacity to switch suppliers if their demands aren't met.

For instance, in the industrial chemicals sector, where J.M. Huber has a presence, major players often consolidate their purchasing. In 2023, the global industrial chemicals market saw significant consolidation, with large corporations seeking to optimize their supply chains and reduce costs. This trend directly translates to increased bargaining power for these consolidated entities when dealing with suppliers like Huber, as their collective volume represents a substantial portion of a supplier's revenue.

However, J.M. Huber's strategy of serving a wide array of industries, from food ingredients to engineered materials, helps to diffuse this risk. By not being overly reliant on any single customer or industry segment, Huber can mitigate the impact of any one large customer demanding concessions. This diversification means that even if a few major clients exert pressure, the overall business remains more stable.

The ease with which JM Huber's customers can switch to other suppliers significantly impacts their bargaining power. If it's simple and inexpensive to change, customers gain leverage, especially if competitors offer more attractive pricing or terms. For instance, in commodity chemical markets, where products are largely interchangeable, switching costs are typically low, empowering buyers.

However, for specialized engineered materials or unique food ingredients where performance, consistency, and technical support are paramount, the cost and effort associated with switching suppliers can be substantial. This can involve retooling, extensive testing, and potential disruption to production lines. For example, a food manufacturer relying on a specific Huber ingredient for a proprietary product formulation would face considerable switching costs, thereby diminishing their bargaining power.

The availability of substitutes significantly bolsters customer bargaining power. When customers can easily switch to alternative products or services that meet their needs, they gain leverage to demand better pricing and quality from JM Huber. For instance, in the specialty chemicals sector, if customers can readily source similar materials from competitors, Huber faces increased pressure to remain competitive.

In 2024, the global chemical industry, a key market for Huber, continued to see a proliferation of new entrants and the development of alternative materials, particularly in areas like bio-based plastics and advanced composites. This trend directly amplifies customer options, making it harder for any single supplier to command premium pricing without demonstrable differentiation.

Huber's strategic emphasis on innovation and sustainability is a direct response to this dynamic. By developing unique, high-performance, and environmentally conscious solutions, Huber aims to reduce the perceived substitutability of its offerings. This differentiation allows them to command stronger pricing and foster customer loyalty, mitigating the impact of readily available alternatives.

Customer Price Sensitivity

Customer price sensitivity directly impacts their bargaining power. When customers are highly sensitive to price, they actively seek out the most cost-effective options, which can lead to downward pressure on JM Huber's profit margins.

This sensitivity tends to be more pronounced for products that are essentially commodities, where there's little to distinguish one offering from another. In contrast, specialized or high-performance materials, which have a clearer value proposition, typically experience lower price sensitivity from customers.

Industries that operate with already thin profit margins are generally more susceptible to customer price sensitivity. For instance, in 2024, the global industrial chemicals market, a sector where Huber operates, faced ongoing price pressures due to overcapacity in certain segments and fluctuating raw material costs.

- Price Sensitivity Drivers: Customer demand for lower prices increases when alternatives are readily available and switching costs are low.

- Commodity vs. Specialty: Huber's specialty chemicals, like those used in food or personal care, generally command higher prices and face less intense price sensitivity than its more commoditized offerings.

- Industry Margin Impact: In 2024, sectors with average net profit margins below 5%, such as certain segments of paper and packaging where Huber has interests, exhibit higher customer price sensitivity.

Threat of Backward Integration by Customers

The threat of customers integrating backward into manufacturing products that JM Huber supplies significantly increases their bargaining power. If a substantial customer has the technical expertise and financial resources to produce their own engineered materials or specialty ingredients, they can leverage this capability during price negotiations. For instance, in 2024, the automotive sector, a key customer for many industrial material suppliers, continued to explore in-house production of certain components to gain cost control and supply chain resilience.

This threat is particularly potent for less complex, standardized products or those with high sales volumes. When customers can easily replicate a product or process, their ability to demand lower prices or better terms intensifies. A notable trend in 2024 saw several large consumer goods companies investing in pilot plants for ingredient production, signaling a potential shift in their supplier relationships for certain chemical inputs.

- Customer Leverage: The potential for customers to manufacture Huber's products themselves grants them considerable negotiation leverage, especially for commoditized offerings.

- Technical & Financial Capacity: Customers with strong R&D capabilities and capital can realistically consider backward integration, directly impacting Huber's pricing power.

- Product Complexity: The risk of backward integration is higher for less specialized or high-volume products where the barriers to entry for the customer are lower.

The bargaining power of J.M. Huber's customers is shaped by the concentration of buyers, the ease of switching suppliers, the availability of substitutes, price sensitivity, and the threat of backward integration.

In 2024, the industrial chemicals sector, a key market for Huber, experienced continued consolidation, with large buyers leveraging their volume to negotiate favorable terms. For example, major automotive manufacturers explored in-house production of certain components, increasing their leverage over material suppliers.

| Factor | Impact on Huber's Customer Bargaining Power | 2024 Trend Example |

|---|---|---|

| Buyer Concentration | High concentration increases power. | Consolidation in industrial chemicals. |

| Switching Costs | Low costs empower customers. | Low for commodity chemicals, high for specialty ingredients. |

| Availability of Substitutes | More substitutes mean higher power. | Proliferation of bio-based materials in chemicals. |

| Price Sensitivity | High sensitivity pressures margins. | Pronounced in sectors with thin profit margins, like paper. |

| Backward Integration Threat | Potential for in-house production increases leverage. | Consumer goods companies exploring pilot plants for ingredient production. |

Full Version Awaits

JM Huber Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of JM Huber. It details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within JM Huber's industries. You'll gain actionable insights into the strategic positioning and competitive dynamics affecting this diversified global company.

Rivalry Among Competitors

The industry growth rate is a major factor in how fiercely companies compete. In markets that aren't growing much, or are already mature, businesses often fight harder for every customer, which can lead to price wars and more advertising spending. For instance, in 2024, the global specialty chemicals market, a sector where JM Huber has interests, was projected to grow at a compound annual growth rate (CAGR) of around 5.5%, indicating a moderately growing environment.

Conversely, when industries are expanding rapidly, there's usually enough room for new companies to enter and existing ones to grow without directly battling each other for market share. JM Huber's involvement in areas like engineered materials, which cater to sectors experiencing robust demand, benefits from this dynamic. The construction materials sector, another area for Huber, saw global construction output increase by an estimated 2.5% in 2024, showing a steady, albeit not explosive, growth that can temper intense rivalry.

The competitive landscape for JM Huber is characterized by a diverse array of players, ranging from massive global conglomerates to specialized niche firms. This broad spectrum of competitors, varying in size and strategic approach, directly influences the intensity of rivalry across Huber's core business segments.

In the engineered materials sector, for instance, Huber competes with giants like BASF and Dow, alongside numerous smaller, specialized chemical manufacturers. Similarly, its engineered woods division faces competition from large lumber producers such as Weyerhaeuser and Boise Cascade, as well as regional sawmills. The CP Kelco business unit, focused on hydrocolloids, contends with established players like DuPont (now IFF) and Cargill, alongside emerging biopolymer companies.

The sheer number and varied sizes of these competitors mean that rivalry can be fierce and multifaceted. In fragmented markets with many similarly sized players, price wars and aggressive market share grabs are common. Conversely, in segments dominated by a few large entities, competition often shifts towards innovation, strategic partnerships, and long-term customer relationships. For example, in 2024, the specialty chemicals market, where Huber operates, saw significant consolidation, with companies like Evonik and Ashland making strategic acquisitions to bolster their portfolios and market presence, thereby intensifying competition for established players.

The intensity of competition for JM Huber is significantly shaped by how distinct its products are and how difficult it is for customers to switch to a competitor. When Huber's offerings are clearly different and customers find it costly or inconvenient to change suppliers, the pressure from rivals is generally lower. This allows Huber to maintain stronger pricing power.

Conversely, if Huber's products are seen as interchangeable, like basic commodities, and switching is easy and inexpensive, then competition often devolves into price wars. This is a common scenario in many industrial markets. For instance, in the engineered materials sector, where Huber operates, even minor price differences can drive customer decisions if product performance is perceived as similar.

Huber's strategic emphasis on innovation is a direct effort to counter this commoditization. By developing unique formulations and performance characteristics, Huber aims to create products that customers value and are less willing to abandon for cheaper alternatives. This differentiation strategy is crucial for reducing the impact of competitive rivalry.

Exit Barriers

High exit barriers can certainly make competition tougher. When it's difficult or expensive for companies to leave a market, they might stick around even when they aren't making much money. This can lead to too much supply and drive prices down as everyone tries to survive.

For JM Huber, some of its manufacturing operations, particularly those that are capital-intensive, could mean higher exit barriers. Think about specialized machinery or plants that are hard to sell or repurpose. If a company has invested heavily in these kinds of assets, leaving the business becomes a much more costly decision.

Consider the specialty chemicals sector, where Huber has a presence. In 2024, many chemical companies reported significant investments in advanced manufacturing facilities. For instance, some companies were investing billions in new plants for sustainable chemical production, creating assets that are highly specific to their operations. This kind of investment makes exiting a particular product line or market segment a substantial financial challenge.

- High Capital Investment: Specialized, often proprietary, manufacturing equipment and facilities represent a significant sunk cost for companies like Huber.

- Limited Alternative Uses: Assets designed for specific chemical processes or material production may have few viable alternative uses, increasing the cost of divestment.

- Employee and Community Ties: Long-standing operations often involve a dedicated workforce and community relationships, adding an emotional and social dimension to exit decisions.

- Contractual Obligations: Long-term supply agreements or customer contracts can also create obligations that make immediate exit impractical or financially detrimental.

Diversity of Competitors

The competitive landscape for JM Huber is characterized by a wide array of players, each with unique strategic approaches, origins, and objectives. This diversity intensifies rivalry as competitors may focus on different market segments or compete on varying factors like cost, innovation, or service. For instance, Huber contends with both large, publicly traded corporations and smaller, privately held or family-owned enterprises, each possessing distinct capital structures and risk appetites.

The varied national origins of competitors also contribute to a dynamic and often unpredictable market. Companies from different economic and regulatory environments may operate with different cost structures or pursue growth strategies that diverge significantly from domestic players. This can lead to aggressive competition on price or product features, as firms leverage their unique advantages. In 2024, the global specialty chemicals market, a key sector for Huber, saw continued growth driven by demand in automotive and construction, but also faced pressure from emerging market players offering lower-cost alternatives.

- Diverse Competitor Set: Huber competes against a broad spectrum of companies, including global conglomerates, regional specialists, and niche private firms.

- Strategic Goal Variation: Competitors range from those focused on market share expansion to others prioritizing profitability or specific technological advancements, creating multifaceted competitive pressures.

- Origin-Based Advantages: Companies from different countries may benefit from varying labor costs, raw material access, or government incentives, impacting their competitive positioning.

- Impact on Rivalry: This heterogeneity means competition can occur across multiple dimensions, from pricing and R&D to supply chain efficiency and customer relationships, making the market highly dynamic.

JM Huber faces intense competitive rivalry due to a fragmented market with numerous players, from large global entities to specialized niche firms, each employing varied strategies. This diversity means competition spans pricing, innovation, and customer service across Huber's diverse business units, including engineered materials and specialty chemicals.

The intensity is further amplified by product differentiation levels and switching costs. Where products are perceived as similar and switching is easy, price competition escalates, as seen in some engineered materials segments. Huber counters this by focusing on product innovation to create unique value and reduce customer willingness to switch based solely on price.

High exit barriers, such as significant capital investment in specialized manufacturing, can trap companies in markets, leading to sustained oversupply and price pressure. For example, substantial investments in advanced chemical production facilities by competitors in 2024 create assets with limited alternative uses, making market exits costly and prolonging competitive battles.

The varied origins of JM Huber's competitors also shape rivalry, with companies from different economic environments leveraging distinct cost structures or government incentives. This heterogeneity means competition occurs across multiple fronts, including price, R&D, and supply chain efficiency, making the market highly dynamic.

| Competitor Type | Example Companies | Competitive Factor Focus | Impact on Rivalry |

|---|---|---|---|

| Global Conglomerates | BASF, Dow, DuPont (IFF) | Scale, R&D, broad product portfolios | High pressure on innovation and market share |

| Specialized Firms | CP Kelco competitors, Niche chemical producers | Specific product expertise, agility | Can challenge established players in targeted segments |

| Emerging Market Players | Various in specialty chemicals | Cost advantages, growing domestic demand | Pressure on pricing, especially in commoditized segments |

SSubstitutes Threaten

The price-performance trade-off of substitute products significantly impacts JM Huber's competitive landscape. If alternatives provide similar or better performance at a lower price point, Huber faces pressure to reduce its own prices or improve its product offerings to maintain market share. For instance, in the construction materials sector, readily available, lower-cost alternatives could erode Huber's pricing power.

Conversely, if substitute products are demonstrably inferior in performance or carry a higher price tag, the threat to Huber is considerably reduced. This dynamic holds true across Huber's diverse business units, whether it involves comparing engineered materials to traditional options or evaluating alternative ingredients in the food sector. Understanding this balance is key to strategic pricing and product development.

Customer willingness to switch to alternatives is a key driver of the threat of substitutes. This is shaped by how loyal customers are to existing brands, how risky they perceive switching to be, and how easy it is to adopt new options. For example, in the food industry, customers might stick with established ingredients due to the complexities of regulatory approval or the need to reformulate recipes.

JM Huber actively works to lower this propensity to substitute by fostering strong customer relationships and offering robust technical support. This engagement helps to lock in customers and make them less likely to explore alternatives. For instance, by providing extensive application support for their engineered materials, Huber can reduce the perceived risk and complexity associated with switching for their industrial clients.

The ease with which customers can discover and learn about alternative products significantly influences the threat of substitutes. If these alternatives are readily available, effectively promoted, and easily obtainable, the threat intensifies. For instance, the building materials sector, where Huber has interests, saw a 5% increase in the adoption of recycled composite materials in construction projects in 2024, directly impacting traditional wood product demand.

Technological Advancements Enabling Substitutes

Rapid technological advancements are a significant driver of substitute threats, constantly reshaping the competitive landscape. Innovations in areas like advanced materials or digital solutions can quickly render existing products or services less attractive by offering superior performance or lower costs. For instance, the burgeoning field of biodegradable polymers, with global market growth projections reaching over $10 billion by 2028, directly challenges traditional plastics used across various industries.

Huber's strategic response involves continuous investment in its own research and development, aiming to innovate faster than potential substitutes emerge. This proactive approach is essential for maintaining market share and relevance. For example, Huber's focus on specialty engineered materials aims to create differentiated value that is harder for substitutes to replicate.

The threat is amplified when technological breakthroughs lower the switching costs for customers. Consider the shift towards cloud-based software solutions, which have drastically reduced the cost and complexity of adopting new systems compared to on-premise installations. This ease of transition makes customers more receptive to exploring alternatives to established offerings.

Key areas where technological advancements are creating substitutes for traditional materials include:

- Sustainable Alternatives: Development of bio-based or recycled materials offering comparable or enhanced properties to conventional ones.

- Digital Transformation: Software and digital platforms replacing physical products or processes, as seen in the shift from physical media to streaming services.

- Advanced Manufacturing: Technologies like 3D printing enabling on-demand production of customized parts, potentially disrupting traditional supply chains and mass-produced components.

- Nanotechnology: Innovations in nanoscale materials offering novel functionalities and performance improvements, creating substitutes for existing high-performance materials.

Switching Costs for Customers to Substitutes

The threat of substitutes for JM Huber is significantly shaped by the costs customers face when switching. High switching costs, whether financial, operational, or related to retraining, deter customers from moving to alternative products. For instance, if a customer has deeply integrated Huber's specialty chemicals into their manufacturing processes, the expense and time required to re-engineer those processes for a competitor's offering can be substantial.

Huber actively manages this threat by building high switching costs into its customer relationships. This involves not only the technical compatibility of its products but also the provision of extensive technical support and ongoing R&D collaboration. By making its solutions an indispensable part of a customer's value chain, Huber makes the prospect of switching to a substitute less appealing. For example, in the engineered materials sector, the deep customization and performance validation required for many applications can represent significant barriers to entry for substitutes, effectively locking in existing customers.

- High Integration Costs: Customers often invest heavily in integrating Huber's products into their existing systems, making a switch prohibitively expensive.

- Operational Disruption: Switching to a substitute can lead to costly downtime and production inefficiencies during the transition period.

- Retraining and Learning Curves: New products may require significant employee training, adding to the overall cost and time burden of switching.

- Huber's Proactive Strategy: By offering tailored solutions and robust technical support, Huber increases the perceived value and integration of its offerings, thereby raising switching costs.

The threat of substitutes for JM Huber is influenced by the availability and attractiveness of alternatives across its diverse markets. For example, in the construction materials sector, the increasing use of sustainable and recycled materials, which saw a 5% rise in adoption in 2024, presents a direct substitute to traditional offerings.

Technological advancements are a key driver, with innovations like biodegradable polymers, projected to reach over $10 billion in market value by 2028, posing a significant challenge to conventional plastics used by Huber. This necessitates continuous R&D investment to maintain a competitive edge.

Huber mitigates this threat by fostering strong customer relationships and offering extensive technical support, thereby increasing switching costs. This strategy is evident in the engineered materials sector, where deep product customization and performance validation create substantial barriers for potential substitutes.

| Industry Sector | Potential Substitute | 2024 Data/Projection | Impact on Huber | Huber's Mitigation Strategy |

|---|---|---|---|---|

| Construction Materials | Recycled Composite Materials | 5% adoption increase in 2024 | Erodes demand for traditional materials | Focus on specialty engineered materials |

| Plastics/Packaging | Biodegradable Polymers | Projected market value >$10 billion by 2028 | Challenges traditional plastic demand | Investment in advanced materials R&D |

| Food Ingredients | Alternative Natural Sweeteners | Growing consumer preference for natural products | Potential shift from synthetic ingredients | Product portfolio diversification |

Entrants Threaten

The substantial capital required to establish operations in sectors like engineered materials and wood products presents a significant hurdle for potential newcomers. Huber's investments in advanced manufacturing, ongoing research and development, and extensive distribution channels demand considerable upfront funding. For instance, setting up a new specialty chemicals plant can easily run into hundreds of millions of dollars, a figure that intimidates many aspiring entrepreneurs.

Established players like JM Huber benefit from significant economies of scale in production, purchasing, and distribution. For instance, in the engineered materials sector, companies with larger production volumes can negotiate better raw material prices, spreading fixed costs over more units, which new entrants struggle to replicate.

The experience curve also plays a crucial role; as companies like Huber accumulate production experience, their costs tend to decrease due to improved efficiency and learning. New entrants face higher initial costs as they navigate this learning curve, making it difficult to compete on price with incumbents who have decades of operational refinement.

JM Huber's strong product differentiation and established brand loyalty significantly deter new entrants. When Huber's offerings are viewed as unique or superior, and customers exhibit loyalty, new competitors face substantial hurdles. They must invest heavily in marketing and innovation to even begin capturing market share.

Even within B2B sectors, Huber's reputation for quality, reliability, and innovation cultivates a form of customer allegiance. This established trust means new players must work diligently to demonstrate comparable value and build their own credibility to challenge Huber's position.

Access to Distribution Channels

Newcomers face a significant hurdle in securing access to established distribution channels, a critical factor for reaching customers. JM Huber, operating across diverse industries, has likely cultivated strong, long-standing relationships with key distributors, retailers, and end-users. For instance, in the engineered materials sector, securing shelf space or supplier agreements with major manufacturers can take years of demonstrated reliability and volume.

Establishing alternative distribution networks is a costly and time-intensive endeavor for new entrants. Alternatively, convincing existing channel partners to prioritize new products over those from established players like Huber, who often offer proven performance and consistent supply, presents a substantial challenge. Consider the food ingredients market where prominent brands already have entrenched distribution agreements with major food manufacturers, making it difficult for a new ingredient supplier to gain traction without significant incentives or unique product differentiation.

The threat of new entrants is therefore moderated by the difficulty in accessing these vital sales and delivery pathways.

- Established Relationships: Huber's existing distribution networks are a significant moat, making it hard for new players to replicate.

- Channel Partner Loyalty: Distributors often favor established suppliers due to volume, reliability, and existing partnerships.

- Cost of New Channels: Building new distribution infrastructure or gaining access to existing ones requires substantial investment and time.

Government Policy and Regulation

Government policies and regulations are significant barriers for new entrants in industries where JM Huber operates. Environmental standards, safety regulations, and industry-specific licenses demand substantial compliance efforts and approvals, increasing the cost and complexity for potential competitors. For example, the specialty chemicals sector, a key area for Huber, often faces stringent regulations regarding chemical production, handling, and disposal, which can deter new market participants.

These regulatory hurdles directly impact the threat of new entrants by raising the capital investment and operational expertise required. Industries like food ingredients and construction materials, also part of Huber's portfolio, are subject to rigorous quality control, labeling, and safety standards. Navigating these complex requirements can be a major deterrent for smaller or less experienced companies seeking to enter these markets.

The burden of compliance can translate into higher upfront costs and longer lead times for new businesses. For instance, obtaining necessary permits and certifications in the construction materials sector can take months, if not years, and involve significant legal and consulting fees. This creates a substantial advantage for established players like JM Huber, who have already invested in and understand these regulatory frameworks.

- Environmental Regulations: Compliance with EPA standards, for example, can require significant investment in pollution control technology, impacting new entrants' cost structures.

- Safety Standards: Adherence to OSHA or similar international safety regulations for manufacturing processes adds operational complexity and potential cost.

- Industry-Specific Licenses: Obtaining licenses for food additives or specialty chemicals often involves lengthy approval processes and demonstrated technical capabilities.

- Global Harmonization Challenges: For companies operating internationally, navigating differing regulatory landscapes across various countries further increases the barrier to entry.

The threat of new entrants for JM Huber is generally moderate due to high capital requirements, established brand loyalty, and the difficulty in accessing distribution channels. For example, setting up a new specialty chemicals plant can cost hundreds of millions of dollars, a significant deterrent. Furthermore, Huber's strong reputation and existing customer relationships make it challenging for newcomers to gain market traction and build comparable trust.

The extensive experience curve and economies of scale enjoyed by JM Huber also act as significant barriers. As Huber has refined its production processes over decades, its costs have decreased, making it difficult for new entrants to compete on price. For instance, in the engineered materials sector, larger production volumes allow for better raw material negotiation, a benefit not easily replicated by new, smaller operations.

Regulatory hurdles, particularly in sectors like specialty chemicals and food ingredients, further limit the threat of new entrants. Compliance with stringent environmental, safety, and quality standards requires substantial investment and expertise, which can be prohibitive for new businesses. For example, obtaining necessary certifications in the food ingredients market can be a lengthy and costly process, favoring established players like Huber.

| Factor | Impact on New Entrants | Example for JM Huber |

|---|---|---|

| Capital Requirements | High Barrier | Establishing a new specialty chemicals plant can cost upwards of $100 million. |

| Economies of Scale | Significant Advantage for Huber | Lower per-unit production costs due to larger manufacturing volumes. |

| Brand Loyalty & Differentiation | High Barrier | Huber's established reputation for quality in engineered materials. |

| Distribution Channels | Difficult Access | Securing shelf space or supplier agreements with major manufacturers takes years. |

| Regulatory Compliance | High Barrier | Meeting EPA standards for chemical production requires significant investment in control technology. |

Porter's Five Forces Analysis Data Sources

Our JM Huber Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research from leading firms like IHS Markit and Wood Mackenzie to capture the competitive landscape.