Hutchison Telecommunications Hong Kong Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hutchison Telecommunications Hong Kong Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hutchison Telecommunications Hong Kong Holdings's trajectory. Our comprehensive PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for strategic decision-making. Don't get left behind; download the full version now to gain a significant competitive advantage.

Political factors

Government policies and the regulatory landscape significantly shape the telecommunications sector in Hong Kong and Macau. Hutchison Telecommunications Hong Kong Holdings (HTHKH) navigates this environment, guided by entities like Hong Kong's Office of the Communications Authority (OFCA) and Macau's Postal and Telecommunications Services Bureau (CTT). These regulators oversee crucial aspects such as licensing, spectrum allocation, and service quality, directly influencing HTHKH's operational reach and strategic investment decisions.

The National Security Law (NSL) enacted in Hong Kong presents significant considerations for Hutchison Telecommunications Hong Kong Holdings (HTHKH) regarding data governance. This legislation may impact how data is stored, accessed, and transferred, potentially creating compliance challenges for telecommunications operators.

HTHKH must carefully manage its data handling practices to align with the NSL and the existing Personal Data (Privacy) Ordinance (PDPO). Balancing these regulatory demands with the need to maintain customer confidence in data protection is a key strategic imperative.

The political landscape between Hong Kong, Macau, and mainland China directly shapes cross-border telecommunications. Hutchison Telecommunications Hong Kong Holdings (HTHKH) relies on these relationships for its substantial roaming revenue, especially from mainland Chinese visitors. In 2023, tourism from mainland China saw a significant rebound, with millions of visitors entering Hong Kong, directly benefiting HTHKH's roaming services.

Spectrum Allocation and 5G Development

Government decisions regarding spectrum allocation are paramount for mobile network operators such as Hutchison Telecommunications Hong Kong Holdings (HTHKH). These decisions directly influence the pace and scope of 5G and emerging 5.5G service rollouts, impacting HTHKH's capacity to meet growing data demands and introduce innovative offerings. For instance, the Office of the Communications Authority (OFCA) plays a crucial role through its spectrum auctions and allocation policies.

OFCA's approach to spectrum management significantly shapes HTHKH's strategic investments and competitive positioning. The availability and cost of spectrum directly affect the operator's ability to expand network capacity, improve service quality, and develop advanced services. In 2023, OFCA continued its efforts to ensure efficient spectrum utilization, with ongoing discussions around the allocation of mid-band and high-band spectrum, crucial for delivering the full potential of 5G.

- Spectrum Availability: HTHKH's 5G strategy is heavily reliant on securing sufficient and contiguous spectrum blocks, particularly in the 3.5 GHz and 26 GHz bands, which offer a balance of coverage and capacity.

- Auction Dynamics: The outcomes of spectrum auctions, including pricing and spectrum caps, directly impact HTHKH's capital expenditure and its ability to invest in network upgrades and new service development.

- Regulatory Framework: OFCA's policies on spectrum sharing, licensing terms, and renewal processes are critical for HTHKH's long-term network planning and operational efficiency.

Smart City Initiatives and Digital Transformation

Hong Kong's commitment to smart city development, as highlighted by the government's ongoing investments and policy support, directly fuels the demand for robust telecommunications infrastructure. Hutchison Telecommunications Hong Kong Holdings Limited (HTHKH) is well-positioned to capitalize on this trend by aligning its service offerings with these urban modernization efforts.

HTHKH can strategically position itself as a key enabler of Hong Kong's digital transformation by providing advanced connectivity solutions and enterprise-level digital services. This proactive approach allows the company to not only meet but anticipate the evolving needs of businesses and public services within the smart city framework.

- Government Investment: Hong Kong's Smart City Blueprint 2.0, launched in 2020, outlines significant investment in digital infrastructure, including 5G and IoT.

- Market Opportunity: The smart city market in Asia Pacific is projected to grow substantially, with Hong Kong being a key hub. For instance, the region's smart city market was estimated to reach over USD 30 billion by 2024.

- HTHKH's Role: HTHKH can offer specialized solutions for areas like smart transportation, smart utilities, and public safety, directly supporting the smart city agenda and creating new revenue streams.

Political stability and government policies are crucial for Hutchison Telecommunications Hong Kong Holdings (HTHKH). The regulatory environment, managed by bodies like OFCA, dictates licensing and spectrum allocation, directly impacting HTHKH's operational scope and investment in technologies like 5G. The National Security Law also introduces complexities in data governance, requiring careful compliance. Furthermore, the political relationship with mainland China is vital for HTHKH's significant roaming revenue, boosted by millions of mainland visitors in 2023.

The Hong Kong government's push for smart city development, outlined in initiatives like the Smart City Blueprint 2.0, creates substantial opportunities for HTHKH. By providing advanced connectivity and digital services, HTHKH can support smart transportation and public safety, aligning with the projected growth in the Asia Pacific smart city market, which was estimated to exceed USD 30 billion by 2024.

| Factor | Impact on HTHKH | 2023/2024 Data/Trend |

|---|---|---|

| Regulatory Oversight (OFCA) | Shapes spectrum access, licensing, and service quality. | Continued focus on efficient spectrum utilization, including mid-band and high-band for 5G. |

| National Security Law | Affects data governance and compliance. | Ongoing need for HTHKH to balance data protection with legal requirements. |

| Cross-border Relations (Mainland China) | Drives roaming revenue. | Significant rebound in mainland tourist arrivals in 2023, boosting roaming services. |

| Smart City Initiatives | Drives demand for advanced telecom infrastructure. | Hong Kong's Smart City Blueprint 2.0 supports HTHKH's enterprise solutions. |

What is included in the product

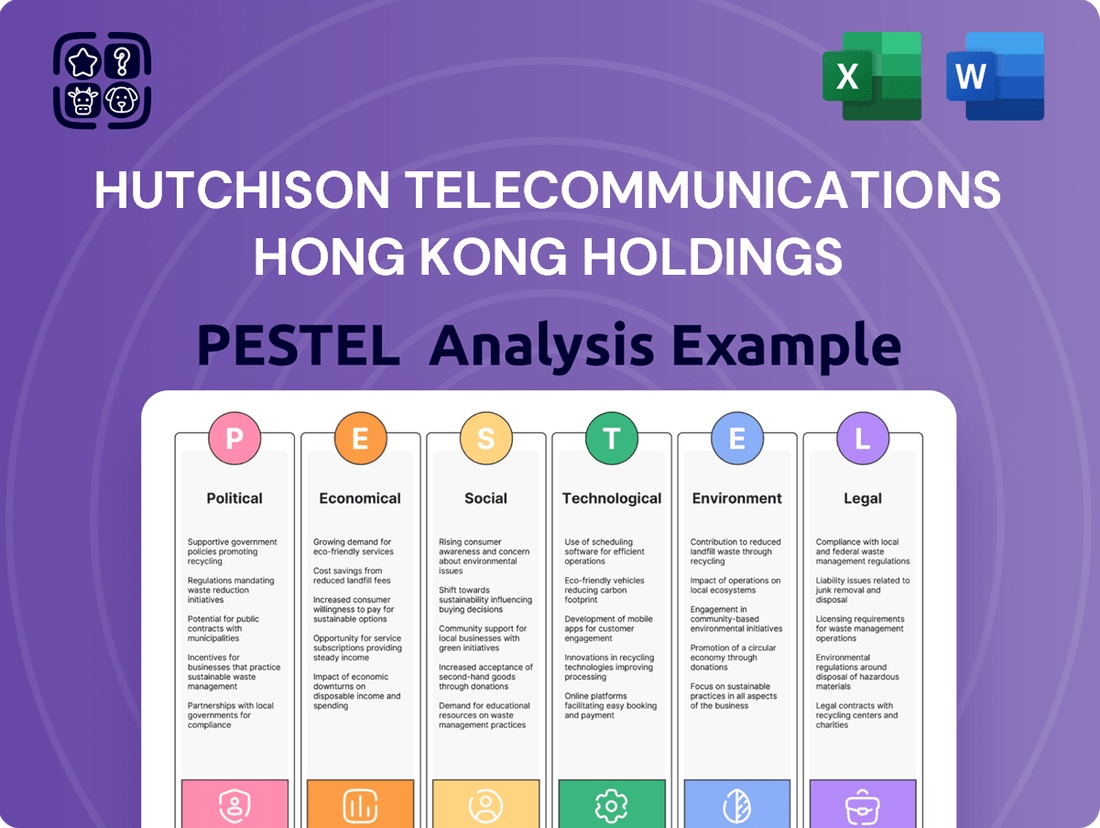

This PESTLE analysis examines the external macro-environmental factors influencing Hutchison Telecommunications Hong Kong Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a comprehensive understanding of how these global and regional trends present both challenges and strategic opportunities for the company.

A PESTLE analysis for Hutchison Telecommunications Hong Kong Holdings acts as a pain point reliever by providing a structured framework to proactively identify and address external challenges, thereby reducing uncertainty and supporting informed strategic decision-making.

Economic factors

The Hong Kong and Macau telecom arenas are packed with competition, featuring major players like SmarTone, China Mobile Hong Kong, and CSL. This crowded landscape means Hutchison Telecommunications Hong Kong Holdings (HTHKH) faces constant pressure on its pricing strategies, directly affecting its profitability and average revenue per user (ARPU).

For instance, in the first half of 2024, HTHKH reported a slight dip in ARPU, a trend often exacerbated by aggressive pricing from rivals seeking to capture market share. To counter this, HTHKH is focusing on service differentiation and exploring new revenue streams beyond traditional mobile plans.

Consumer spending patterns, particularly the increasing demand for mobile data services, are significant economic drivers for Hutchison Telecommunications Hong Kong Holdings (HTHKH). The widespread adoption of smartphones and the growing popularity of data-heavy applications directly translate into a greater need for robust, high-speed connectivity. This trend fuels the expansion of mobile data revenue streams for companies like HTHKH.

HTHKH's success is closely tied to its capacity to provide appealing data plans and innovative services. By offering competitive and attractive packages, the company can effectively grow its subscriber base and, consequently, its overall revenue. For instance, in 2024, the average monthly mobile data consumption in Hong Kong continued its upward trajectory, with many users exceeding 10GB per month, underscoring the market's appetite for data-intensive services.

Hong Kong's economic performance and the vitality of its tourism sector are crucial for Hutchison Telecommunications Hong Kong Holdings Limited (HTHKH). A strong economy generally translates to higher consumer spending on telecommunications services, including data and voice plans. For instance, Hong Kong's GDP grew by an estimated 3.2% in 2023, indicating a healthy economic environment.

Tourism plays a particularly significant role for HTHKH, especially concerning its roaming service revenue. Inbound tourists, particularly those from mainland China, are heavy users of mobile data and international roaming services. During the first half of 2024, Hong Kong saw a notable increase in visitor arrivals, with figures reaching over 14 million, a substantial rise from the previous year, directly benefiting HTHKH's revenue streams.

Infrastructure Investment and Capital Expenditure

Hutchison Telecommunications Hong Kong Holdings (HTHKH) bases its financial health on substantial infrastructure outlays, especially for 5G and upcoming 5.5G network upgrades. These capital expenditures are vital for network superiority, broader reach, and embracing new technological advancements.

The company's capacity to generate revenue from these significant infrastructure investments directly impacts its long-term profitability. For instance, HTHKH reported capital expenditures of HK$1,320 million in 2023, a significant portion dedicated to network enhancement and expansion.

- Network Upgrades: HTHKH's ongoing investment in 5G and 5.5G infrastructure is a primary driver of its operational capacity and future revenue streams.

- Capital Expenditure: In 2023, the company's capital expenditure reached HK$1,320 million, underscoring the commitment to network development.

- Monetization Strategy: The success of HTHKH's infrastructure investments hinges on its ability to effectively monetize these advancements through new services and enhanced customer offerings.

- Competitive Landscape: Continued capital expenditure is necessary to maintain a competitive edge in the rapidly evolving telecommunications market in Hong Kong.

Interest Rates and Financial Performance

Fluctuations in interest rates directly impact Hutchison Telecommunications Hong Kong Holdings (HTHKH) by influencing its net interest income and overall profitability. Higher rates can increase borrowing costs, while lower rates might reduce income from its cash reserves. For instance, in the first half of 2024, the Hong Kong Monetary Authority maintained its base rate in line with the US Federal Reserve's policy rate, which remained elevated for much of the period, potentially pressuring HTHKH's financing expenses.

HTHKH's financial health is closely tied to its debt management strategies and its capacity to leverage interest income. The company's balance sheet and its sensitivity to interest rate changes are critical considerations for investors. As of the end of 2023, HTHKH reported total debt, and its effective management of this debt in a dynamic interest rate environment is key to sustaining strong financial performance.

- Interest Rate Sensitivity: HTHKH's profitability can be significantly affected by changes in the prevailing interest rates in Hong Kong and globally.

- Net Interest Income: Rising interest rates can increase the cost of servicing HTHKH's debt, potentially reducing its net interest income.

- Leverage Management: The company's ability to effectively manage its debt levels and optimize its capital structure is crucial for mitigating interest rate risk.

- 2024 Outlook: With interest rates anticipated to remain a key economic factor throughout 2024, HTHKH's financial strategy must account for potential shifts in borrowing costs and investment yields.

The economic landscape in Hong Kong significantly influences Hutchison Telecommunications Hong Kong Holdings (HTHKH). Consumer spending power, driven by economic growth, directly impacts demand for telecom services. For instance, Hong Kong's GDP growth of an estimated 3.2% in 2023 signals a supportive economic climate for HTHKH.

Tourism is another vital economic factor, especially for roaming revenues. With over 14 million visitor arrivals in the first half of 2024, a substantial increase from the previous year, HTHKH benefits directly from increased mobile usage by tourists.

The competitive pricing environment, marked by aggressive strategies from rivals like SmarTone and China Mobile Hong Kong, continues to pressure HTHKH's average revenue per user (ARPU). In the first half of 2024, HTHKH experienced a slight dip in ARPU, necessitating a focus on service differentiation.

| Economic Factor | Impact on HTHKH | Supporting Data (2023-2024) |

|---|---|---|

| Economic Growth (GDP) | Higher consumer spending on telecom services | Hong Kong GDP grew by an estimated 3.2% in 2023 |

| Tourism | Increased roaming revenue and data usage | Over 14 million visitor arrivals in H1 2024 |

| Competition & Pricing | Pressure on ARPU and profitability | H1 2024 ARPU saw a slight dip |

| Interest Rates | Impact on borrowing costs and net interest income | HKMA base rate aligned with elevated US Fed rates in H1 2024 |

Same Document Delivered

Hutchison Telecommunications Hong Kong Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hutchison Telecommunications Hong Kong Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Hong Kong's mobile penetration rate is remarkably high, exceeding 250% as of late 2023, meaning many individuals have multiple SIM cards. This deeply ingrained mobile culture, coupled with a population that quickly embraces new digital trends, presents a substantial opportunity for Hutchison Telecommunications Hong Kong Holdings (HTHKH).

This tech-savvy demographic is a fertile ground for HTHKH's services, but it also demands constant evolution. For instance, the increasing demand for 5G services and advanced data packages means HTHKH must continually invest in network upgrades and innovative offerings to stay ahead of consumer expectations and competitive pressures in the dynamic Hong Kong market.

Hong Kong's consumers are increasingly embracing digital lifestyles, with mobile devices becoming central to daily activities. This trend directly impacts Hutchison Telecommunications Hong Kong Holdings (HTHKH) as demand for data-intensive services rises. For instance, in 2024, mobile data consumption in Hong Kong continued its upward trajectory, driven by video streaming and social media use.

The burgeoning popularity of Over-The-Top (OTT) services, such as Netflix and Disney+, further fuels this shift, necessitating that HTHKH adapt its service offerings. To remain competitive, the company must prioritize data-centric solutions and flexible bundles that cater to these evolving entertainment and communication preferences, ensuring they meet the growing appetite for seamless digital experiences.

There's a significant and growing appetite for faster internet, with both fiber-optic broadband and 5G services seeing increased demand. This surge is fueled by the rise of data-heavy applications and the ongoing digital transformation across industries.

For Hutchison Telecommunications Hong Kong Holdings (HTHKH), meeting this demand for reliable, high-speed connectivity is paramount. Successfully encouraging 5G adoption will be a key determinant of its future performance in this evolving landscape.

Urbanization and Northern Metropolis Development

The ongoing urbanization, particularly the ambitious development of Hong Kong's Northern Metropolis, creates a significant demand for robust telecommunications infrastructure. Hutchison Telecommunications Hong Kong Holdings Limited (HTHKH) must strategically invest in expanding its network capabilities to cater to the projected influx of residents and businesses in these burgeoning areas. This development is expected to house a substantial portion of Hong Kong's future population, necessitating advanced connectivity solutions.

HTHKH's network expansion in the Northern Metropolis is crucial for capturing new market share and maintaining its competitive edge. The government's plan to develop the Northern Metropolis into a key economic and residential hub by 2030, with an estimated population of 2.5 million, underscores the urgency for enhanced service provision. This expansion will involve deploying 5G and fiber optic networks to support smart city initiatives and increased data consumption.

- Northern Metropolis Development: Aiming to house approximately 2.5 million residents by 2030.

- Increased Demand: Urbanization drives higher mobile data usage and the need for ubiquitous connectivity.

- Infrastructure Investment: HTHKH must upgrade and expand its network to meet future population and commuter needs.

- Smart City Integration: The development will likely incorporate smart city technologies requiring advanced telecommunications.

Work-from-Home and Hybrid Work Trends

The ongoing shift towards work-from-home and hybrid arrangements significantly impacts the demand for reliable connectivity. HTHKH's fixed-line and broadband services are crucial for both individuals setting up home offices and businesses needing to support remote employees. For instance, in early 2024, a significant portion of Hong Kong’s workforce continued to engage in flexible work, underscoring the sustained need for high-quality internet infrastructure.

This sociological trend directly translates into increased reliance on HTHKH's core offerings. As more people spend extended periods at home, the need for stable, high-speed broadband for video conferencing, cloud access, and general productivity becomes paramount. This sustained demand validates the strategic importance of HTHKH's network investments.

- Increased Demand for Broadband: Flexible work models necessitate robust home internet to support multiple users and bandwidth-intensive applications.

- Enterprise Support: Businesses require reliable connectivity solutions to enable their hybrid workforces, boosting demand for HTHKH's enterprise broadband.

- Service Evolution: HTHKH may need to adapt its service packages to cater to the specific needs of remote workers, such as enhanced upload speeds and dedicated business lines.

Hong Kong's high mobile penetration, exceeding 250% by late 2023, indicates a strong consumer reliance on multiple devices and services. This tech-savvy population readily adopts new digital trends, creating a fertile ground for Hutchison Telecommunications Hong Kong Holdings (HTHKH) to offer advanced 5G and data-intensive packages. The increasing adoption of Over-The-Top (OTT) services further fuels demand for robust mobile data solutions.

The ongoing trend of urbanization, particularly the development of the Northern Metropolis aiming for 2.5 million residents by 2030, necessitates significant network expansion for HTHKH. Similarly, the sustained adoption of work-from-home and hybrid models by a substantial portion of the workforce in early 2024 drives increased demand for reliable broadband and fixed-line services. These sociological shifts highlight the critical need for HTHKH to invest in and upgrade its infrastructure to meet evolving consumer and business connectivity needs.

Technological factors

Hutchison Telecommunications Hong Kong Holdings (HTHKH) is aggressively rolling out and upgrading its 5G infrastructure, with a strategic shift towards 5.5G. This next-generation technology promises significant improvements in speed, network capacity, and reduced latency, which are vital for delivering advanced services.

The transition to 5.5G is expected to unlock new revenue streams through enhanced mobile broadband and the Internet of Things (IoT). As of early 2024, HTHKH has been actively expanding its 5G coverage across Hong Kong, aiming to capture a larger market share by offering superior connectivity.

This technological advancement is not just about faster downloads; it's about enabling new applications like real-time augmented reality, advanced cloud gaming, and more responsive industrial automation. By investing in these upgrades, HTHKH positions itself to maintain a strong competitive advantage in the dynamic telecommunications landscape.

Hutchison Telecommunications Hong Kong Holdings (HTHKH) is actively integrating Artificial Intelligence (AI) into its network operations. This technological shift is crucial for optimizing service delivery and operational efficiency. The company is leveraging AI to proactively monitor user experience in real-time, ensuring smooth connectivity even during peak demand.

AI-powered systems are instrumental in HTHKH's strategy to enhance network performance, particularly in densely populated areas. By analyzing vast amounts of data, AI helps predict and manage traffic flow, thereby minimizing congestion. Furthermore, AI is being deployed for energy-saving initiatives, contributing to sustainability and cost reduction.

The increasing adoption and expansion of Fixed Wireless Access (FWA) are fundamentally reshaping broadband connectivity, offering an alternative to traditional wired infrastructure.

HTHKH is actively promoting FWA, enabling broadband deployment in diverse locations without the constraints of fixed lines, thereby ensuring seamless connectivity for a growing ecosystem of smart devices.

This strategic push into FWA not only enhances service reach but also creates new avenues for revenue generation, as evidenced by the global FWA market projected to reach $100 billion by 2027, according to recent industry forecasts.

Internet of Things (IoT) and Cloud Computing Growth

The increasing proliferation of Internet of Things (IoT) devices and the robust expansion of cloud computing are significantly boosting the need for sophisticated telecommunications services. This surge directly translates into opportunities for companies like Hutchison Telecommunications Hong Kong Holdings (HTHKH).

HTHKH is well-positioned to leverage these technological advancements. By providing comprehensive solutions that facilitate business digital transformation and accommodate the ever-growing ecosystem of connected devices, the company can secure a competitive edge.

- IoT Market Expansion: The global IoT market is projected to reach $1.5 trillion by 2025, indicating substantial demand for connectivity and data management services.

- Cloud Adoption: In 2024, over 90% of enterprises were using cloud services, with a significant portion expanding their cloud infrastructure, requiring robust network capabilities.

- 5G Integration: The ongoing rollout of 5G networks is crucial for supporting the high bandwidth and low latency demands of IoT applications, a key area for HTHKH to focus on.

Cybersecurity and Data Security Technologies

As technology marches forward and the volume of data handled by Hutchison Telecommunications Hong Kong Holdings (HTHKH) escalates, the importance of strong cybersecurity and data security technologies cannot be overstated. HTHKH faces the continuous challenge of safeguarding customer information and its critical network infrastructure against an ever-evolving landscape of cyber threats and potential data breaches.

To address these risks, HTHKH must maintain a proactive stance by consistently investing in and deploying cutting-edge security solutions. This commitment is essential for building and preserving customer trust and ensuring operational resilience.

- Increased Investment in AI-Powered Threat Detection: In 2024, cybersecurity spending globally is projected to reach over $200 billion, with a significant portion allocated to AI-driven solutions for identifying and neutralizing threats in real-time.

- Focus on Data Encryption and Access Controls: Implementing robust encryption protocols for data both in transit and at rest, alongside stringent access management policies, is crucial for preventing unauthorized data exposure.

- Regular Security Audits and Vulnerability Assessments: HTHKH will likely conduct frequent penetration testing and security audits to identify and remediate potential weaknesses in its systems, ensuring compliance with evolving data protection regulations.

- Adoption of Zero Trust Architecture: Moving towards a zero-trust security model, which verifies every access request regardless of origin, is becoming a standard practice to minimize the attack surface.

HTHKH's technological strategy is heavily focused on advancing its 5G network, with a significant push towards 5.5G capabilities to enhance speed, capacity, and latency. This upgrade is critical for supporting new services like IoT and augmented reality, aiming to capture a larger market share by offering superior connectivity in Hong Kong.

The company is also integrating Artificial Intelligence (AI) to optimize network operations and user experience, using AI for traffic management and energy efficiency. Furthermore, HTHKH is expanding Fixed Wireless Access (FWA) to provide broadband in new areas, tapping into a global FWA market projected to reach $100 billion by 2027.

The increasing adoption of IoT and cloud computing drives demand for advanced telecom services, positioning HTHKH to facilitate digital transformation for businesses. To manage the escalating data volumes and evolving cyber threats, HTHKH is prioritizing cybersecurity investments, including AI-powered threat detection and zero-trust architecture, with global cybersecurity spending expected to exceed $200 billion in 2024.

| Technology Focus | Key Development | Market Impact/Projection |

|---|---|---|

| 5G/5.5G Rollout | Aggressive infrastructure upgrades and expansion. | Enhanced mobile broadband, IoT enablement, competitive advantage. |

| Artificial Intelligence (AI) | Integration into network operations for optimization. | Improved user experience, traffic management, energy efficiency. |

| Fixed Wireless Access (FWA) | Expansion of broadband services beyond fixed lines. | Increased service reach, new revenue streams; global FWA market ~$100B by 2027. |

| IoT & Cloud Computing | Leveraging increased demand for connectivity. | Facilitating business digital transformation; global IoT market ~$1.5T by 2025. |

| Cybersecurity | Investment in advanced security solutions. | Safeguarding data, ensuring operational resilience; global cybersecurity spend >$200B in 2024. |

Legal factors

Hutchison Telecommunications Hong Kong Holdings (HTHKH) operates within Hong Kong's regulatory framework, primarily governed by the Telecommunications Ordinance (Cap 106). This ordinance dictates crucial aspects of its business, including licensing requirements, spectrum allocation, and the provision of telecommunications services. Compliance with these stipulations is non-negotiable for HTHKH's continued operations and market participation.

The Communications Authority (CA) and the Office of the Communications Authority (OFCA) are the principal regulatory bodies overseeing the telecommunications sector in Hong Kong. These bodies are responsible for enforcing the Telecommunications Ordinance and ensuring fair competition and consumer protection. For instance, OFCA manages spectrum auctions; in the 2023 3.5 GHz spectrum auction, several operators secured new licenses, highlighting the ongoing regulatory activity that impacts market dynamics.

The Personal Data (Privacy) Ordinance (PDPO) is a cornerstone of legal compliance for Hutchison Telecommunications Hong Kong Holdings (HTHKH). This ordinance, enacted as Chapter 486, dictates how personal data is gathered, stored, processed, and utilized within Hong Kong.

HTHKH must navigate evolving data privacy landscapes, including potential amendments to the PDPO. These proposed changes, which may include mandatory data breach notifications and more stringent consent protocols, will directly impact HTHKH's operational procedures and customer data management strategies.

The Competition Ordinance (Cap 619) in Hong Kong is a significant legal factor for Hutchison Telecommunications Hong Kong Holdings (HTHKH). This ordinance strictly prohibits agreements that restrict competition, the abuse of dominant market positions, and mergers that could substantially lessen competition in the market. HTHKH, being a prominent telecommunications provider in Hong Kong, must meticulously adhere to these regulations to steer clear of substantial fines and uphold ethical business operations.

Ensuring compliance with the Competition Ordinance is crucial for HTHKH's sustained market presence. Failure to comply can result in hefty penalties, potentially impacting financial performance and brand reputation. For instance, the Competition Commission actively investigates and prosecutes anti-competitive behavior. In 2023, the Commission continued its enforcement actions across various sectors, underscoring the importance of proactive compliance for all major market participants like HTHKH.

Consumer Protection Regulations

Consumer protection regulations are a significant legal factor for Hutchison Telecommunications Hong Kong Holdings (HTHKH). These regulations, like the Industry Code of Practice for Telecommunications Service Contracts, mandate transparency and fairness in service agreements. HTHKH must ensure its practices align with these consumer safeguards. In 2023, the Communications Authority (CA) in Hong Kong handled numerous consumer complaints, highlighting the importance of robust compliance.

These legal frameworks directly influence how HTHKH structures its offerings and communicates with its customer base. Adherence ensures the company avoids penalties and maintains customer trust. For instance, the CA's proactive enforcement in 2024 focused on clear billing and service termination policies, areas where telecom providers must demonstrate strict compliance.

- Industry Code of Practice for Telecommunications Service Contracts: Mandates clear terms and conditions for consumers.

- Communications Authority (CA) Oversight: Actively monitors and enforces consumer protection measures in the sector.

- Focus on Transparency: Regulations require clear disclosure of pricing, service limitations, and termination clauses.

- Complaint Handling: HTHKH must have effective processes to address consumer grievances as per regulatory guidelines.

Macau Telecommunications Regulations and License Expiry

Macau's telecommunications landscape is governed by specific regulations that directly affect Hutchison Telecommunications Hong Kong Holdings (HTHKH). These rules include the terms and expiry dates of operating licenses, a critical factor for service continuity and future planning.

A significant upcoming event is the expiry of 3G licenses in Macau in June 2025. This regulatory milestone requires operators like HTHKH to facilitate a seamless transition for their customers and infrastructure towards more advanced technologies, primarily 4G and 5G networks. This shift will undoubtedly influence HTHKH's service portfolio and strategic investments within the Macau market.

- License Expiry: Macau's 3G licenses are set to expire in June 2025.

- Technological Transition: Operators must migrate users and services to 4G and 5G.

- Regulatory Impact: HTHKH's service offerings and operational strategies in Macau are directly shaped by these upcoming regulatory changes and technological shifts.

Legal factors significantly shape Hutchison Telecommunications Hong Kong Holdings (HTHKH) operations, particularly regarding licensing, data privacy, and competition. The Telecommunications Ordinance (Cap 106) and oversight by the Communications Authority (CA) and OFCA are paramount, influencing spectrum allocation and service provision. Compliance with the Personal Data (Privacy) Ordinance (PDPO) is essential for data handling, with potential amendments in 2024 and 2025 requiring adaptation in data breach notifications and consent protocols.

The Competition Ordinance (Cap 619) prohibits anti-competitive practices, demanding careful adherence from HTHKH to avoid penalties. Consumer protection regulations, such as the Industry Code of Practice for Telecommunications Service Contracts, necessitate transparency in service agreements, with the CA actively addressing consumer complaints. In Macau, the upcoming expiry of 3G licenses in June 2025 mandates a transition to 4G and 5G, directly impacting HTHKH's strategic planning and service offerings in that market.

Environmental factors

Hutchison Telecommunications Hong Kong Holdings (HTHKH) operates vast mobile and fixed-line networks, including data centers, which inherently demand substantial energy. This significant energy usage directly contributes to the company's carbon footprint.

HTHKH is under increasing pressure from regulators and stakeholders to curb its environmental impact. This includes a push to adopt more energy-efficient technologies and operational practices across its infrastructure.

In 2023, the telecommunications industry globally saw a rising focus on sustainability, with companies exploring solutions like AI-driven energy management for data centers and renewable energy sourcing to mitigate their carbon emissions. For instance, some industry leaders are targeting significant reductions in their Scope 1 and Scope 2 emissions by 2030.

The lifecycle of telecommunications equipment, from mobile devices to network infrastructure, generates significant electronic waste. Hutchison Telecommunications Hong Kong Holdings (HTHKH) must address this by implementing robust e-waste management strategies. For instance, in 2023, global e-waste generation reached an estimated 62 million tonnes, highlighting the scale of the challenge.

HTHKH needs to consider sustainable practices for the disposal and recycling of electronic waste, aligning with environmental regulations and corporate social responsibility. This includes exploring take-back programs for old devices and partnering with certified e-waste recyclers to ensure responsible processing. Hong Kong's Environmental Protection Department has been actively promoting waste reduction initiatives, and HTHKH's compliance is crucial.

Hutchison Telecommunications Hong Kong Holdings (HTHKH) faces significant environmental considerations with its infrastructure expansion. The rollout of new base stations and fiber optic networks necessitates thorough environmental impact assessments (EIAs) and strict compliance with Hong Kong's environmental protection regulations. These requirements are particularly stringent in densely populated urban centers and ecologically sensitive areas, potentially impacting project timelines and costs.

Climate Change and Network Resilience

Climate change presents a growing challenge for Hutchison Telecommunications Hong Kong Holdings (HTHKH). Extreme weather events, such as typhoons and prolonged heatwaves, can disrupt network operations and damage critical infrastructure. For instance, Hong Kong experienced 33 tropical cyclones in the 2023 season, with several causing significant disruptions to public services.

To mitigate these risks, HTHKH must invest in building resilient networks. This includes strengthening physical infrastructure, such as cell towers and data centers, to withstand severe weather conditions. Ensuring continuous service delivery during environmental emergencies is paramount for maintaining customer trust and operational continuity.

- Infrastructure Hardening: Upgrading equipment and physical sites to withstand higher wind speeds and flooding.

- Redundancy Planning: Implementing backup power systems and diverse network routes to ensure failover capabilities.

- Early Warning Systems: Developing and utilizing advanced weather forecasting to proactively manage potential disruptions.

- Climate Risk Assessment: Continuously evaluating the impact of climate change on network vulnerabilities and operational costs.

Sustainability Reporting and ESG Initiatives

Hutchison Telecommunications Hong Kong Holdings (HTHKH) faces increasing pressure from investors and stakeholders to integrate robust Environmental, Social, and Governance (ESG) factors into its operations and reporting. This growing demand necessitates comprehensive sustainability disclosures to demonstrate commitment to responsible business practices.

HTHKH's proactive engagement in environmental initiatives, such as reducing its carbon footprint and promoting energy efficiency in its network infrastructure, can significantly bolster its corporate reputation. For instance, in its 2023 sustainability report, the company highlighted a reduction in greenhouse gas emissions intensity by 15% compared to 2020. This transparency not only appeals to environmentally conscious consumers but also attracts responsible investors looking for long-term value creation.

- Investor Demand: A growing proportion of global assets under management are now ESG-focused, with many institutional investors prioritizing companies with strong sustainability credentials.

- Reputational Enhancement: Transparent and impactful ESG reporting can differentiate HTHKH from competitors and foster trust among customers, employees, and the wider community.

- Risk Mitigation: Addressing environmental risks, such as climate change impacts on infrastructure, and social risks, like data privacy, through robust ESG frameworks can prevent future operational disruptions and regulatory penalties.

- Attracting Responsible Investment: Companies demonstrating clear ESG commitments, like HTHKH's efforts in renewable energy sourcing for its data centers, are better positioned to secure capital from a widening pool of ESG-aligned funds.

Hutchison Telecommunications Hong Kong Holdings (HTHKH) must navigate increasing environmental regulations and stakeholder expectations regarding its significant energy consumption and carbon footprint. The company is pressured to adopt energy-efficient technologies and sustainable operational practices across its extensive network infrastructure, including data centers.

The telecommunications sector globally is prioritizing sustainability, with companies aiming for substantial emission reductions by 2030 and exploring solutions like AI for energy management. HTHKH faces the challenge of managing electronic waste, with global generation reaching 62 million tonnes in 2023, necessitating robust recycling programs and compliance with Hong Kong's waste reduction initiatives.

Climate change poses operational risks, with extreme weather events like typhoons potentially disrupting services; Hong Kong experienced 33 tropical cyclones in the 2023 season. HTHKH is also under pressure to integrate ESG factors, with a 15% reduction in greenhouse gas emissions intensity reported in 2023, appealing to the growing pool of ESG-focused investors.

| Environmental Factor | Impact on HTHKH | Industry Trend/Data (2023/2024) |

| Energy Consumption & Carbon Footprint | High energy demand from network infrastructure and data centers. | Global focus on AI-driven energy management for data centers; targets for Scope 1 & 2 emission reductions by 2030. |

| Electronic Waste (E-waste) | Generation of e-waste from equipment lifecycle. | Global e-waste reached 62 million tonnes in 2023; increasing emphasis on responsible disposal and recycling. |

| Climate Change & Extreme Weather | Risk of network disruption and infrastructure damage from events like typhoons. | Hong Kong experienced 33 tropical cyclones in the 2023 season, impacting services. |

| Regulatory Compliance & ESG | Need for environmental impact assessments and adherence to regulations. | Growing investor demand for ESG integration; HTHKH reported a 15% reduction in GHG emissions intensity (vs. 2020) in its 2023 report. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hutchison Telecommunications Hong Kong Holdings is built on a robust foundation of data from official government publications, financial reports from regulatory bodies, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.