Hutchison Telecommunications Hong Kong Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hutchison Telecommunications Hong Kong Holdings Bundle

Explore the strategic positioning of Hutchison Telecommunications Hong Kong Holdings with our BCG Matrix analysis. Understand which of their services are driving growth and which require careful consideration to optimize their portfolio.

This initial glimpse into Hutchison Telecommunications Hong Kong Holdings' BCG Matrix highlights key areas of their business. Purchase the full report to unlock detailed quadrant placements, actionable strategies, and a clear path to maximizing their market potential.

Gain a competitive edge by understanding the full scope of Hutchison Telecommunications Hong Kong Holdings' product portfolio through our comprehensive BCG Matrix. This report provides the insights needed to make informed investment and resource allocation decisions.

Stars

5G Mobile Services represent a significant growth area for Hutchison Telecommunications Hong Kong Holdings (HTHKH). The company has established a robust position within Hong Kong's rapidly expanding 5G sector. By early 2025, HTHKH achieved an impressive 5G penetration rate of 54%, demonstrating strong uptake among its customer base.

The broader Hong Kong telecommunications landscape is witnessing a swift acceleration in 5G adoption. This surge is fueled by proactive network deployments and a growing consumer desire for enhanced, high-speed data services. HTHKH's strategic focus on 5G positions it well to capitalize on these market trends.

Mobile data services are a significant driver for Hutchison Telecommunications Hong Kong Holdings (HTHKH). The increasing adoption of smartphones and data-hungry applications in Hong Kong fuels this growth. HTHKH's strategic emphasis on data-centric services, particularly its push towards 5G, positions it to leverage this expanding market.

The mobile data service sector in Hong Kong is projected to see a compound annual growth rate of 3% from 2024 to 2029. This indicates a steady and sustained demand for mobile data, benefiting HTHKH's revenue streams.

Roaming Services within Hutchison Telecommunications Hong Kong Holdings (HTHKH) are a clear Star. The company saw a significant 30% surge in roaming service revenue during 2024. This impressive growth is fueled by robust outbound tourism and HTHKH's extensive international network, suggesting a dominant position in an expanding market sector.

Prepaid Mobile Services (SoSIM)

SoSIM, a key player in Hutchison Telecommunications Hong Kong Holdings' (HTHKH) portfolio, represents a strong contender in the prepaid mobile services market. The company has solidified its position as the leading prepaid provider in Hong Kong, a testament to its effective strategy and customer appeal.

The prepaid segment, which includes SoSIM, has experienced remarkable growth. In the first half of 2024, HTHKH saw a substantial 46% year-over-year increase in its prepaid subscribers. This surge highlights the segment's dynamism and SoSIM's contribution to this upward trend.

- Market Dominance: HTHKH leads the Hong Kong prepaid market.

- Subscriber Growth: Prepaid subscribers, including SoSIM, grew by 46% year-over-year in H1 2024.

- SoSIM's Role: SoSIM is a significant contributor to this growth and market leadership.

Enterprise 5G Solutions

Enterprise 5G solutions represent a significant growth area for Hutchison Telecommunications Hong Kong Holdings (HTHKH) as Hong Kong pushes forward with its smart city initiatives. The demand for private 5G networks, coupled with solutions integrating AI and IoT, is rapidly increasing.

While HTHKH's precise market share in this segment isn't publicly segmented, the overall market trajectory is highly positive. For instance, the global private 5G market was valued at approximately USD 3.2 billion in 2023 and is projected to reach USD 11.7 billion by 2028, growing at a CAGR of 29.8%. This strong market growth provides a fertile ground for HTHKH to emerge as a star player if it can capture a meaningful portion of this expanding market.

- Growing demand for private 5G networks in Hong Kong's smart city development.

- Integration of 5G with AI and IoT for enterprise solutions.

- Global private 5G market projected to reach USD 11.7 billion by 2028.

- HTHKH has the potential to be a star by securing substantial market share in this burgeoning sector.

SoSIM, a key component of HTHKH's prepaid offerings, stands out as a Star. The company's leadership in the Hong Kong prepaid market, bolstered by a substantial 46% year-over-year increase in prepaid subscribers during the first half of 2024, underscores SoSIM's strong performance and market appeal.

| Category | Hutchison Telecommunications HK Holdings (HTHKH) | Market Position | Growth Potential |

|---|---|---|---|

| SoSIM (Prepaid Services) | Leading prepaid provider in Hong Kong | High Market Share | Strong subscriber growth (46% YoY in H1 2024) |

What is included in the product

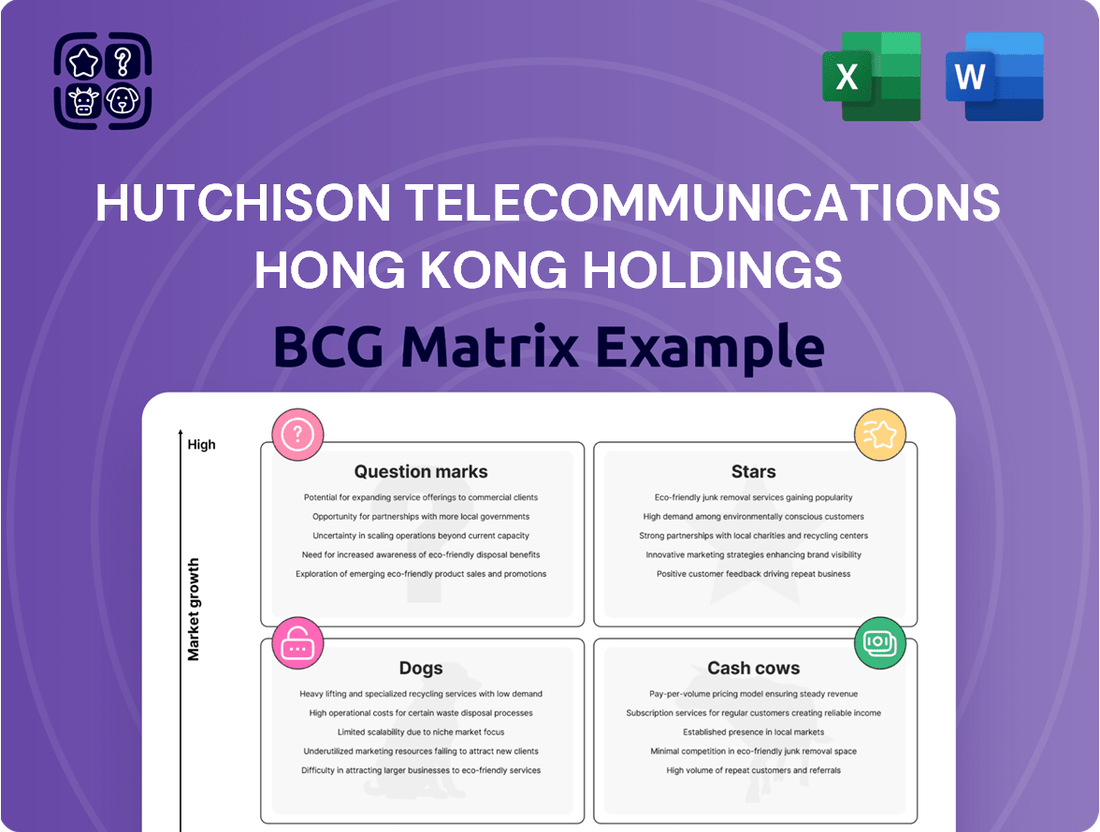

The Hutchison Telecommunications Hong Kong Holdings BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The Hutchison Telecommunications Hong Kong Holdings BCG Matrix simplifies complex portfolio analysis, acting as a pain point reliever by clearly visualizing business unit performance.

This optimized layout provides a digestible overview, easing the burden of strategic decision-making for leadership.

Cash Cows

Hutchison Telecommunications Hong Kong Holdings' (HTHKH) traditional fixed-line broadband services function as a Cash Cow within its BCG Matrix. Despite a mature and intensely competitive Hong Kong market, these services benefit from a high penetration rate and persistent demand for dependable internet connectivity, ensuring steady cash generation.

In 2024, the Hong Kong broadband market remained a battleground, with multiple providers vying for subscribers. HTHKH's established infrastructure and customer base allow it to leverage these mature services for consistent, albeit potentially slow-growing, cash flow, supporting investments in newer ventures.

Legacy mobile voice services for Hutchison Telecommunications Hong Kong Holdings (HTHKH) are firmly positioned as cash cows. While the overall Hong Kong mobile voice market is experiencing a decline, reflecting its maturity and limited growth prospects, these services continue to generate substantial cash flow. This is primarily due to HTHKH’s established and sizable subscriber base, which provides a consistent revenue stream with minimal need for further capital investment.

Basic International Connectivity Services represent a significant Cash Cow for Hutchison Telecommunications Hong Kong Holdings (HTHKH). These services, though not experiencing the explosive growth of newer digital offerings, provide a consistent and reliable revenue stream. They are foundational to HTHKH's portfolio, serving a broad base of corporate and individual customers who depend on these essential communication links.

In 2024, the demand for international connectivity remained robust, underpinning HTHKH's stable revenue generation. These services are often bundled with other offerings, enhancing their value proposition and customer stickiness. The predictable nature of this revenue allows HTHKH to fund investments in more innovative and high-growth areas of its business.

Existing Data Center Services

Hutchison Telecommunications Hong Kong Holdings' (HTHKH) existing data center services, especially those serving long-term, established clients, are likely positioned as cash cows. These operations typically exhibit low growth potential but command a significant market share, generating consistent and predictable cash flows for the company.

While the overall IT market in Hong Kong is experiencing growth, mature data center facilities within HTHKH’s portfolio would align with the characteristics of a cash cow. This implies they require minimal investment to maintain their market position and continue to be reliable sources of revenue.

For instance, in 2023, the Hong Kong data center market saw continued demand driven by cloud adoption and digital transformation initiatives. HTHKH’s established infrastructure, built over years, benefits from this demand without needing substantial new capital expenditure to expand capacity significantly, thus contributing to its cash cow status.

- Low Growth, High Share: Existing data center services cater to a stable, long-term client base, indicating low revenue growth but a strong market position.

- Steady Cash Flow Generation: These mature operations provide a predictable and consistent stream of income, essential for funding other business ventures.

- Market Context: Despite overall IT market growth in Hong Kong, HTHKH's established data centers fit the cash cow profile due to their maturity.

- Investment Efficiency: Mature data centers typically require less capital investment for maintenance and operational upkeep compared to newer, expanding facilities.

Standard Consumer Mobile Plans (Non-5G)

Standard Consumer Mobile Plans (Non-5G) are Hutchison Telecommunications Hong Kong Holdings' (HTHKH) cash cows. This segment caters to consumers who have not yet transitioned to 5G technology, representing a mature market for the company.

These plans benefit from a substantial and stable subscriber base, which translates into predictable and consistent revenue streams. HTHKH can maintain these revenue streams with comparatively minimal investment in promotions and market placement when contrasted with newer, high-growth offerings.

- Stable Subscriber Base: HTHKH's 4G mobile plans serve a large, established customer group.

- Consistent Revenue Generation: These mature plans are a reliable source of income for the company.

- Lower Investment Needs: Compared to 5G services, 4G plans require less capital for marketing and customer acquisition.

Hutchison Telecommunications Hong Kong Holdings' (HTHKH) traditional fixed-line broadband services operate as cash cows. Despite a mature Hong Kong market, these services maintain consistent demand, generating steady cash flow. In 2024, the broadband sector remained competitive, but HTHKH's established infrastructure and customer base ensure reliable, albeit slow-growing, revenue that supports new ventures.

Legacy mobile voice services are also firmly positioned as cash cows for HTHKH. While the overall Hong Kong mobile voice market is declining, these services continue to provide substantial cash flow due to HTHKH’s large, established subscriber base, requiring minimal further capital investment.

Basic International Connectivity Services are a significant cash cow for HTHKH, offering a consistent and reliable revenue stream. These foundational services serve a broad customer base, and in 2024, robust demand underpinned HTHKH's stable revenue generation, allowing for investment in growth areas.

| Service Segment | BCG Category | Key Characteristics | 2024 Market Context |

| Fixed-line Broadband | Cash Cow | Mature, stable demand, established infrastructure | Intense competition, steady revenue |

| Legacy Mobile Voice | Cash Cow | Declining market, large subscriber base, low investment | Consistent cash flow despite market maturity |

| Basic International Connectivity | Cash Cow | Foundational, broad customer base, predictable revenue | Robust demand, supports growth investments |

Full Transparency, Always

Hutchison Telecommunications Hong Kong Holdings BCG Matrix

The preview you are seeing is the complete and final Hutchison Telecommunications Hong Kong Holdings BCG Matrix report that you will receive upon purchase. This means the analysis, charts, and strategic insights presented here are precisely what will be delivered, offering an uncompromised view of the company's business units. You can trust that the document you preview is the exact, fully formatted, and ready-to-use strategic tool that will be yours to leverage immediately. This ensures transparency and confidence in the quality and completeness of the information you are acquiring for your business planning and decision-making processes.

Dogs

Hutchison Telecommunications Hong Kong Holdings (HTHKH) saw a significant downturn in its hardware segment, with revenue dropping 44% in the first half of 2024. This decline is attributed to cautious consumer spending and longer periods between mobile phone upgrades.

This performance places HTHKH's hardware sales firmly in the 'Dogs' category of the BCG Matrix. It represents a low-growth market with a low market share, indicating a segment that consumes cash without generating substantial returns, potentially acting as a cash trap for the company.

Hutchison Telecommunications Hong Kong Holdings' legacy value-added services, such as basic ringtone downloads or older mobile content portals, are likely positioned as Dogs in the BCG matrix. These offerings have seen declining subscriber interest and minimal revenue generation, reflecting a failure to keep pace with evolving consumer preferences for streaming services and interactive digital content.

Hutchison Telecommunications Hong Kong Holdings' (HTHKH) traditional fixed-line voice services are likely facing a decline, mirroring the trend seen in mobile voice. This is driven by the increasing adoption of internet-based communication platforms like WhatsApp and Zoom, which offer more features and often lower costs.

If a substantial portion of HTHKH's fixed-line revenue still originates from pure voice services, this segment would be classified as a 'Dog' in the BCG matrix. For instance, in 2024, the global decline in traditional voice revenue for telecom operators continued, with many reporting single-digit or even double-digit percentage drops year-over-year for this specific service line.

Underutilized or Obsolete Infrastructure

Hutchison Telecommunications Hong Kong Holdings (HTHK) may identify underutilized or obsolete infrastructure as a significant 'dog' in its BCG Matrix. This includes older network components or legacy systems that are no longer cost-effective to maintain or cannot support the demands of newer, high-growth services like 5G or advanced data analytics.

These underperforming assets represent a drain on capital, tying up resources that could be reinvested in more promising areas. For instance, the ongoing operational expenses for maintaining outdated 3G or even early 4G infrastructure, which offer lower data speeds and capacity, could be substantial. In 2024, the trend towards network modernization means that any infrastructure not aligned with future-proof technologies will increasingly fall into this category, yielding diminishing returns.

- High Maintenance Costs: Legacy equipment often incurs higher repair and operational expenses compared to modern, efficient systems.

- Low Revenue Generation: Obsolete infrastructure typically supports services with lower demand and profitability.

- Hindrance to Innovation: These assets can prevent the deployment of new, high-margin services, limiting growth opportunities.

- Capital Tie-up: Significant capital is locked in assets that do not generate adequate returns, impacting overall financial flexibility.

Low-Engagement Digital Content Platforms

Low-engagement digital content platforms within Hutchison Telecommunications Hong Kong Holdings (HTHKH) would likely be categorized as Dogs in the BCG Matrix. These are ventures that have seen minimal investment and consequently, very low market share and growth. For instance, if HTHKH had previously invested in niche e-book platforms or older mobile social networking apps that failed to attract a substantial user base, these would fit the description.

These platforms typically exhibit low demand and consequently, low returns on investment. In 2024, the digital content market is highly competitive, with established players dominating. Any HTHKH initiative in this space that hasn't achieved significant user adoption or revenue generation would be a prime candidate for the Dog quadrant. The cost to maintain such platforms often outweighs the minimal revenue they generate, leading to a negative cash flow situation.

- Low Market Share: Platforms with a user base significantly smaller than competitors, indicating a failure to capture market interest.

- Low Market Growth: Digital content areas where user engagement and demand are stagnant or declining.

- Minimal Revenue Generation: Ventures that contribute negligibly to HTHKH's overall revenue, failing to justify their operational costs.

- Limited Strategic Value: Content platforms that do not offer synergies with HTHKH's core telecommunications business or future growth strategies.

HTHKH's legacy hardware segment, experiencing a 44% revenue drop in H1 2024 due to cautious spending and longer upgrade cycles, is a clear 'Dog'. Similarly, older value-added services like basic ringtones, failing to compete with modern digital content, also fall into this category. Traditional fixed-line voice services, increasingly supplanted by internet-based communication, are another 'Dog' due to declining demand, a trend observed globally with many operators reporting significant year-over-year drops in this revenue stream in 2024.

Underutilized or obsolete infrastructure, such as outdated 3G or early 4G components, represents a significant 'Dog'. These assets incur high maintenance costs and low revenue, hindering the deployment of newer technologies like 5G. Low-engagement digital content platforms, with minimal investment, low market share, and stagnant growth, also fit the 'Dog' profile, often having maintenance costs exceeding their negligible revenue generation.

| Segment | BCG Category | Rationale | 2024 Data/Trend |

| Hardware Sales | Dog | Low growth, low market share, declining revenue | H1 2024 revenue down 44% |

| Legacy Value-Added Services (e.g., Ringtones) | Dog | Declining subscriber interest, minimal revenue | Failure to keep pace with digital content trends |

| Traditional Fixed-Line Voice Services | Dog | Low demand due to internet-based alternatives | Global decline in traditional voice revenue continues |

| Obsolete Network Infrastructure | Dog | High maintenance, low revenue, hinders innovation | Ongoing costs for outdated 3G/early 4G components |

| Low-Engagement Digital Content Platforms | Dog | Low market share, low growth, minimal revenue | Minimal user adoption, high competition in 2024 |

Question Marks

The Internet of Things (IoT) is a rapidly growing field, and telecom companies like Hutchison Telecommunications Hong Kong Holdings (HTHKH) are actively developing solutions. HTHKH's expansion into new IoT applications taps into a market with significant growth potential. For example, the global IoT market was projected to reach over $1.1 trillion by 2024, highlighting the immense opportunity.

However, these emerging IoT ventures likely represent a smaller market share for HTHKH currently. This means substantial investment is needed to build scale and capture a larger portion of this burgeoning market. The company's strategic focus on these areas positions it for future growth, but requires a commitment to innovation and infrastructure development.

Businesses are increasingly turning to advanced telecom services to fuel their digital transformation journeys. Hutchison Telecommunications Hong Kong Holdings (HTHKH) is actively positioning itself to meet this demand by offering specialized, advanced enterprise solutions. These solutions often integrate cutting-edge technologies like artificial intelligence (AI) and cloud services, tapping into a rapidly expanding market.

HTHKH's focus on these advanced enterprise digital transformation services places them in a high-growth sector. However, like many players entering such dynamic markets, their current market share might be relatively low. This scenario necessitates significant investment to build capabilities, establish a strong market presence, and effectively compete against established leaders.

The global private 5G network market is experiencing robust growth, with projections indicating a high compound annual growth rate. This expansion is fueled by the increasing demand for advanced connectivity in enterprise settings and the development of smart city initiatives. For instance, by 2024, the private wireless market, including private 5G, was estimated to reach tens of billions of dollars globally.

Hutchison Telecommunications Hong Kong Holdings (HTHKH) could view private 5G deployments as a question mark within its BCG matrix. While this segment offers significant future potential, it demands substantial capital investment to build out infrastructure and establish a competitive edge. HTHKH's strategic decision to allocate resources here will be crucial in determining its future market standing.

New Fintech Offerings

Hutchison Telecommunications Hong Kong Holdings (HTHKH) is exploring new Fintech offerings, a sector poised for significant expansion driven by Hong Kong's robust e-payment adoption. For instance, the value of mobile payment transactions in Hong Kong saw a substantial increase, reaching approximately HKD 1.8 trillion in 2023, indicating a strong market appetite for digital financial services.

Despite this promising growth, HTHKH's current footprint in the Fintech arena is likely modest when compared to established players. This positions its new Fintech ventures as question marks within the BCG matrix, necessitating careful consideration of resource allocation. The highly competitive nature of Fintech means that achieving significant market share will require substantial investment in technology, marketing, and potentially strategic alliances.

- High Growth Potential: The Fintech sector in Hong Kong benefits from increasing consumer reliance on digital payment solutions, which saw a 15% year-on-year growth in transaction volume in 2023.

- Competitive Landscape: HTHKH faces competition from numerous local and international Fintech companies, many with established user bases and advanced technological infrastructure.

- Strategic Investment Needed: To convert these new offerings into stars, HTHKH must commit significant capital and resources to differentiate its services and capture market share.

- Partnership Opportunities: Collaborating with existing Fintech providers or financial institutions could accelerate market penetration and mitigate some of the risks associated with building a new Fintech business from scratch.

Potential 6G Development Initiatives

Hutchison Telecommunications Hong Kong Holdings (HTHKH) might consider potential 6G development initiatives as a significant question mark in its BCG matrix. While 6G is still in its nascent stages, Hong Kong is actively exploring its future. Any early-stage investments or dedicated research by HTHKH into these nascent 6G technologies would represent a bet on a future high-growth market, where the company currently has no established market share. This necessitates substantial research and development (R&D) expenditure.

The global 6G market is projected to reach hundreds of billions of dollars by the early 2030s, with early movers poised to capture significant market share. For HTHKH, investing in 6G R&D now, even with uncertain returns, could position it as a leader in a transformative technology. This strategic move aligns with the question mark quadrant's characteristic of requiring significant investment to potentially achieve future market leadership.

- Early 6G Research: HTHKH could initiate or expand collaborations with universities and research institutions in Hong Kong focusing on foundational 6G technologies.

- Spectrum Exploration: Engaging with regulatory bodies to understand and potentially influence future 6G spectrum allocation is crucial.

- Technology Scouting: Actively monitoring and assessing emerging 6G enablers like AI-driven network management and terahertz communication is vital.

- Pilot Projects: Considering small-scale, experimental 6G deployments to test core functionalities and identify practical challenges.

HTHKH's Fintech ventures represent question marks due to their high growth potential but currently low market share. The Hong Kong Fintech market, driven by robust e-payment adoption, saw mobile payment transactions reach approximately HKD 1.8 trillion in 2023. Significant investment is needed to compete against established players and achieve market leadership in this dynamic sector.

New IoT applications for HTHKH are also classified as question marks. The global IoT market's projected growth to over $1.1 trillion by 2024 underscores the opportunity, but HTHKH's current market share in these emerging areas is likely small. Substantial investment is required to build scale and capture a larger portion of this expanding market.

Private 5G deployments are another question mark for HTHKH. While the private wireless market, including private 5G, was estimated in the tens of billions of dollars globally by 2024, this segment demands significant capital for infrastructure and competitive positioning. HTHKH's resource allocation here is critical for future market standing.

Early-stage 6G development initiatives are also question marks. Although the global 6G market is expected to reach hundreds of billions by the early 2030s, HTHKH's investments in nascent 6G technologies represent bets on future high-growth markets where it currently holds no market share, necessitating substantial R&D expenditure.

BCG Matrix Data Sources

Our Hutchison Telecommunications Hong Kong Holdings BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.