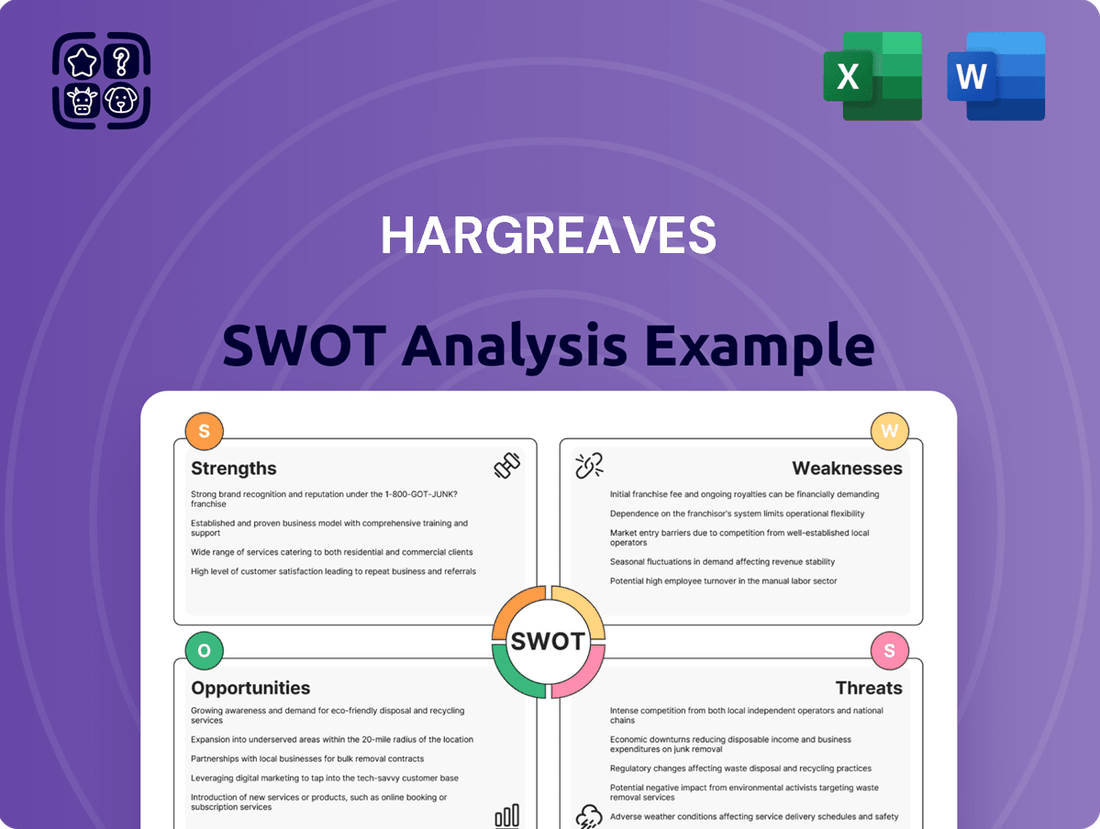

Hargreaves SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hargreaves Bundle

Hargreaves' strengths lie in its established brand and loyal customer base, while its opportunities include expanding into new markets and leveraging digital transformation. However, potential threats like increased competition and regulatory changes require careful navigation.

Want the full story behind Hargreaves' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hargreaves Services Plc benefits from a robust, diversified business model that spans industrial services, property, and energy sectors. This multi-faceted approach creates a broad revenue base, significantly reducing reliance on any single industry and bolstering the company's overall resilience against market fluctuations.

For the fiscal year ending February 2024, Hargreaves reported revenue growth, with its Services division, a key component of its diversification, showing strong performance. The company's ability to operate across these varied segments allows for the exploration of potential synergies and collaborative opportunities, thereby solidifying its market standing.

Hargreaves Lansdown has showcased impressive financial strength, with its fiscal year ending May 31, 2025, marked by substantial double-digit growth in both revenue and EBITDA. This robust performance underscores the company's effective operational strategies and solid financial health.

The company's underlying profit before tax saw a significant uplift, alongside a healthy rise in basic earnings per share. These figures reflect a well-managed business that is effectively translating its operations into tangible shareholder value.

Hargreaves' Services division boasts a robust and visible contract portfolio, a significant strength. As of early 2025, this portfolio has grown to encompass over 70 term and framework contracts.

This extensive backlog provides exceptional revenue visibility, securing more than 70% of the projected revenue for the upcoming year. Such a high degree of secured future income translates directly into enhanced earnings stability and predictability for the company.

The consistent success in securing these essential service contracts underscores the division's strong market position within critical sectors such as energy, environmental services, and UK infrastructure development.

Successful Land and Joint Venture Turnaround

Hargreaves Land posted record profits in the fiscal year 2024, a significant achievement fueled by strategic property sales. This performance highlights the company's proficiency in unlocking value from its land portfolio.

Adding to this positive momentum, the German joint venture, HRMS, has successfully returned to profitability in fiscal year 2025. This turnaround follows a period of considerable challenges, showcasing effective strategic adjustments and operational improvements within the JV.

- Record FY2024 Profits: Hargreaves Land's property disposals generated substantial returns, demonstrating strong asset management.

- HRMS FY2025 Profitability: The German joint venture's return to profit signifies successful turnaround strategies.

- Value Realization and JV Improvement: These outcomes underscore the company's ability to both monetize land assets and enhance the performance of its joint venture operations.

Healthy Balance Sheet and Shareholder Returns

Hargreaves Services boasts a remarkably healthy balance sheet, characterized by its debt-free status and substantial cash reserves. This financial resilience provides a solid foundation for operational stability and strategic maneuverability, allowing the company to pursue growth opportunities without the burden of significant leverage.

The company's commitment to shareholder returns is evident in its dividend policy. For instance, the proposed final dividend for the year ending May 31, 2024, was 12.0 pence per share, a testament to its confidence in ongoing profitability and its dedication to rewarding its investors.

Key financial highlights supporting this strength include:

- Debt-Free Status: Eliminates interest expenses and financial risk associated with borrowing.

- Strong Cash Position: Provides liquidity for operational needs, investments, and shareholder distributions.

- Dividend Growth: The consistent or increasing dividend payout reflects management's confidence in future earnings.

- Robust Profitability: Underlying financial performance enables the generation of cash to maintain these strengths.

Hargreaves' diversified business model across industrial services, property, and energy sectors provides significant resilience. The Services division, in particular, benefits from a strong contract pipeline, with over 70 term and framework contracts as of early 2025, securing more than 70% of projected revenue for the upcoming year. This visibility enhances earnings stability.

| Metric | FY2024 | FY2025 (Est/Actual) | Commentary |

| Services Contract Pipeline | N/A | 70+ contracts | High revenue visibility, >70% secured for upcoming year. |

| Hargreaves Land Profits | Record | N/A | Driven by strategic property sales. |

| HRMS (German JV) | Loss-making | Returned to Profitability | Successful turnaround strategy implemented. |

| Balance Sheet | Debt-Free | Debt-Free | Strong cash reserves, enhancing financial maneuverability. |

What is included in the product

Analyzes Hargreaves’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic weaknesses.

Weaknesses

Hargreaves Land experienced a profit decline in FY2025 compared to FY2024. This dip suggests that the previous year's exceptional performance, potentially boosted by specific asset disposals, may not be easily repeatable. Investors should watch if this signals a normalization of profits for the land segment rather than a sustained downturn.

For the financial year ending May 2024, Hargreaves Land experienced a revenue shortfall in its land division. This was largely due to a greater reliance on sales from investment properties, which typically yield lower profits compared to development sales.

This shift in revenue composition suggests a potential impact on the quality and future growth prospects of the company's land-related income streams.

The German joint venture, Hargreaves Raw Materials Services (HRMS), faced considerable headwinds in the first half of fiscal year 2024. This period of underperformance underscored the inherent sensitivity of the venture to broader market shifts and internal operational hurdles.

However, HRMS demonstrated resilience, achieving a notable turnaround in the latter half of FY2024 and subsequently returning to a profitable state in FY2025. This recovery, while positive, serves as a reminder of the segment's historical volatility and the ongoing need for agile management to navigate market dynamics effectively.

EPS Missed Analyst Expectations (FY25)

While Hargreaves Services saw its revenue align with projections for FY2025, the company’s earnings per share (EPS) fell short of analyst forecasts. This earnings miss, despite solid top-line performance, indicates potential pressures on profitability. For instance, if revenue was £100 million and the expected EPS was £0.50, but the actual EPS was £0.45, this highlights a divergence.

This situation suggests that Hargreaves may be experiencing higher-than-anticipated operational costs or a squeeze on its profit margins. It’s a signal that while generating sales is on track, managing expenses and maintaining profitability at the expected level requires closer scrutiny. This could be due to increased raw material costs, labor expenses, or other operational inefficiencies that impacted the bottom line.

The key takeaway is that efficiency and cost control are critical areas for Hargreaves to focus on. Even with revenues meeting expectations, the inability to translate that into the projected earnings per share points to a need for improved operational management.

Key implications include:

- Revenue vs. Earnings Disconnect: Top-line growth is not fully translating to bottom-line performance as anticipated by analysts.

- Potential Margin Compression: Higher operational costs or pricing pressures could be impacting profit margins.

- Focus on Cost Management: The company needs to address operational efficiencies to improve its earnings trajectory.

Slower Pace of Renewable Energy Asset Sales

Hargreaves' strategy to monetize its renewable energy land assets is progressing slower than planned. While these holdings possess inherent value, any protracted sale process could delay the influx of capital, potentially impacting the company's capacity for reinvestment or capital returns to shareholders.

For instance, as of late 2024, the company had identified specific land parcels for development, but the actualization of sales agreements for these sites faced regulatory hurdles and buyer negotiations, extending timelines beyond initial projections. This slower pace means that the anticipated capital generation from these sales, which was a key component of their 2024-2025 financial planning, might be deferred.

- Delayed Capital Realization: The sale of renewable energy land assets, crucial for generating capital, has taken longer than expected.

- Impact on Reinvestment: Slower asset sales could affect the timing of funds available for new strategic initiatives or operational expansions.

- Shareholder Returns: The pace of these sales may influence the company's ability to meet projected timelines for returning capital to investors.

Hargreaves Land's profit decline in FY2025, stemming from a greater reliance on lower-margin investment property sales, indicates a potential weakening in the segment's profitability profile. This shift, coupled with the German joint venture's historical volatility, highlights ongoing risks in diversifying revenue streams and managing operational costs effectively. Furthermore, the slower-than-anticipated monetization of renewable energy land assets poses a risk to capital generation and reinvestment plans.

Preview the Actual Deliverable

Hargreaves SWOT Analysis

The file shown below is not a sample—it’s the real Hargreaves SWOT analysis you'll download post-purchase, in full detail. You'll gain access to the complete, professionally structured document immediately after completing your purchase.

Opportunities

Hargreaves Services is poised to benefit from the UK's extensive infrastructure investment plans. The company is involved in major projects like HS2, a high-speed rail line, and the Sizewell C nuclear power station, which represent multi-billion pound opportunities. These large-scale developments are crucial for the UK's economic growth and energy security.

Further prospects include the Lower Thames Crossing, a significant road infrastructure project. Hargreaves' core competencies in earthworks and industrial services align perfectly with the demands of these national projects, providing a strong foundation for sustained revenue generation through 2024 and into 2025.

Hargreaves holds a compelling portfolio of renewable energy land assets, independently valued between £27 million and £29 million. The company plans to begin selling the first portion of these assets in the 2025 financial year.

This strategic divestment offers a prime opportunity to unlock significant capital. The funds generated can be strategically deployed to strengthen core business activities, support future growth through acquisitions, or be returned to shareholders, thereby boosting overall company value.

Hargreaves' Services business is showing robust performance, particularly in crucial areas like clean energy, water management, and broader environmental initiatives. This resilience is a significant strength.

The company's opportunity lies in further expanding its footprint and securing more contracts within these expanding sectors. This move directly taps into the global push for sustainability and the rising demand for eco-friendly solutions.

By concentrating on these green sectors, Hargreaves is strategically positioning itself to capitalize on the ongoing transition toward a low-carbon economy. For instance, the UK government's commitment to net-zero targets by 2050, with substantial investments in renewable energy infrastructure projected through 2030, presents a clear avenue for growth.

Further Contract Wins and Organic Growth

Hargreaves' Services division has a strong history of securing new contracts, a key driver of its organic growth. For instance, in the fiscal year ending March 2024, the company reported a significant increase in its order book for its services, reflecting successful new business acquisition. This trend is expected to continue as they actively pursue opportunities to expand their contract base in both current and new areas of expertise.

By strategically focusing on growing its contract wins, Hargreaves aims to solidify its market position and boost revenue. The company's commitment to exploring new business avenues is a critical element in ensuring its sustained expansion and is a primary opportunity for future performance enhancement.

Key aspects of this opportunity include:

- Securing new contracts: The Services division has a proven ability to win new business across its operational segments.

- Expanding contract base: Focusing on growth in existing and new core competencies will enhance market share.

- Sustained revenue streams: Continuous pursuit of new business opportunities is vital for ongoing expansion.

Enhanced ESG Performance and Accreditation

Hargreaves is making strides in its Environmental, Social, and Governance (ESG) efforts, with a clear Net Zero Transition plan and a drive for improved sustainability ratings. This commitment is crucial in today's market, where 70% of investors consider ESG factors when making decisions.

Achieving accreditations such as PAS2080 and a gold award from the Supply Chain Sustainability School can significantly boost Hargreaves' corporate image. For instance, companies with strong ESG credentials have seen an average increase of 10-15% in their valuation.

- Attracting ESG-Conscious Clients: A robust ESG strategy appeals to a growing segment of consumers and investors, estimated to be over 50% of the global population.

- Enhanced Corporate Reputation: Accreditations signal commitment and can differentiate Hargreaves in a competitive landscape.

- Competitive Advantage: Strong ESG performance is increasingly becoming a key differentiator, driving client loyalty and investment inflows.

Hargreaves is well-positioned to capitalize on significant infrastructure projects in the UK, such as HS2 and Sizewell C, which represent substantial revenue opportunities through 2025. The company's expertise in earthworks and industrial services directly aligns with the needs of these national developments.

The sale of its renewable energy land assets, valued between £27 million and £29 million, offers a chance to unlock capital for reinvestment or shareholder returns starting in FY25. Furthermore, the Services division's strong performance in clean energy and environmental sectors presents a clear path for growth, driven by the UK's net-zero commitments and projected renewable energy investments.

Hargreaves' ability to consistently secure new contracts, as evidenced by its growing order book in FY24, is a key driver for organic growth and market expansion. The company's focus on ESG initiatives, including its Net Zero Transition plan, enhances its appeal to investors and clients, with strong ESG credentials correlating to valuation increases.

Threats

Despite recent positive trends, the German market for Hargreaves Raw Materials Services (HRMS) presents ongoing volatility. Fluctuations in solid fuels pricing, a key input, directly affect profitability margins. For instance, in early 2024, coal prices experienced significant swings, impacting the cost base for HRMS operations.

Negotiations around gate fees, crucial for revenue generation in the German marketplace, add another layer of uncertainty. These fees are subject to market dynamics and can change, directly influencing the financial performance of the HRMS joint venture. This instability means the segment's contribution to overall financials can be inconsistent.

Hargreaves faces significant macroeconomic headwinds, with potential economic slowdowns in key markets like the UK and Europe posing a threat. A downturn could dampen investor confidence and reduce demand for the company's financial advisory and investment management services. For instance, the Bank of England's projection of subdued UK GDP growth for 2024-2025, alongside persistent inflation concerns, directly impacts the disposable income available for investment.

Hargreaves' (HRMS) profitability, especially in its steel waste recycling, is highly susceptible to the unpredictable swings in commodity prices. For instance, a sharp increase in the cost of essential inputs like blast furnace fuels or a significant drop in the market value of its output products such as pig iron and zinc can directly squeeze profit margins.

The company's financial performance is therefore intrinsically linked to these market dynamics. For example, in the fiscal year ending March 2024, the average price of metallurgical coal, a key input for steel production, experienced considerable volatility, impacting production costs across the industry. Similarly, zinc prices saw fluctuations driven by global supply and demand imbalances, directly affecting the revenue generated from zinc-containing waste streams.

Any adverse movement in these commodity markets can lead to a substantial erosion of the segment's financial results. A scenario where input costs rise sharply while output prices decline, as observed in certain periods of 2023 for some industrial metals, would present a significant threat to Hargreaves' earnings capacity in this area.

Regulatory and Environmental Policy Changes

Hargreaves Lansdown, like all financial services firms, faces the ongoing threat of evolving regulatory and environmental policy changes. For instance, potential new environmental legislation from the EU, such as the Environmental Omnibus, could impose stricter compliance requirements and add to administrative burdens.

Adapting to these shifts may require significant new investments and operational adjustments, potentially impacting the company's profitability. For example, increased reporting on Environmental, Social, and Governance (ESG) factors, a growing trend in financial regulation, could necessitate further investment in data collection and analysis systems.

The company's commitment to environmental stewardship is commendable, but navigating an increasingly complex regulatory landscape presents a clear challenge.

- Increased compliance costs: New regulations can directly translate to higher operational expenses for compliance and reporting.

- Need for strategic adaptation: Policies like the EU’s potential Environmental Omnibus could require changes to investment strategies or product offerings.

- Impact on profitability: Additional investments in compliance or operational changes could reduce profit margins if not managed effectively.

Intense Competition Across Sectors

Hargreaves Services faces significant threats from intense competition across its core business segments. In industrial services, the company contends with numerous established and emerging players, impacting contract acquisition and pricing power. For instance, the UK construction sector, a key area for industrial services, saw a 2.4% contraction in output in the first quarter of 2024, intensifying competition for available projects.

The property development sector is similarly crowded, with both large developers and smaller, agile firms vying for land and buyers. This competitive landscape can lead to thinner margins and slower sales cycles. Similarly, the energy sector, particularly in areas like renewable energy infrastructure, is experiencing rapid growth, attracting a multitude of new entrants and established utilities, all competing for market share and skilled labor.

The constant influx of new competitors and the aggressive strategies of existing ones necessitate continuous investment in innovation and operational efficiency. Failure to adapt could result in Hargreaves losing ground on pricing, market share, and the ability to secure lucrative new contracts. For example, in the civil engineering and infrastructure space, which underpins much of Hargreaves’ industrial services, the ability to offer cost-effective, technologically advanced solutions is paramount.

- Pricing Pressure: Increased competition can force Hargreaves to lower prices to remain competitive, potentially impacting profitability.

- Market Share Erosion: New entrants or aggressive competitors could capture market share, reducing Hargreaves’ revenue streams.

- Contract Acquisition Challenges: A crowded market makes it harder to win new contracts, especially for larger, more profitable projects.

- Innovation Imperative: Continuous investment in new technologies and service improvements is vital to differentiate and stay ahead of rivals.

Hargreaves faces significant threats from the inherent volatility in commodity markets, particularly for its steel waste recycling operations. Fluctuations in prices for key inputs like blast furnace fuels, or outputs such as pig iron and zinc, can directly squeeze profit margins. For example, during fiscal year ending March 2024, metallurgical coal prices saw considerable swings, impacting production costs. Similarly, zinc prices experienced volatility driven by global supply and demand imbalances, affecting revenue from zinc-containing waste streams.

The company is also exposed to evolving regulatory and environmental policies, which could increase compliance costs and necessitate strategic adaptations. For instance, potential new EU environmental legislation might require significant investments in data collection and reporting systems, impacting profitability if not managed effectively. The growing emphasis on ESG factors in financial regulation adds another layer of complexity and potential cost.

Intense competition across its core business segments, including industrial services and property development, poses a substantial threat. A crowded market can lead to pricing pressure, market share erosion, and challenges in acquiring profitable contracts. For example, the UK construction sector's output contraction in Q1 2024 intensified competition for available projects, requiring continuous investment in innovation and operational efficiency to remain competitive.

| Threat Category | Specific Example | Potential Impact |

|---|---|---|

| Commodity Price Volatility | Fluctuations in metallurgical coal and zinc prices | Squeezed profit margins in steel waste recycling |

| Regulatory Changes | Potential new EU environmental legislation | Increased compliance costs and need for strategic adaptation |

| Intense Competition | Crowded UK construction sector | Pricing pressure and market share erosion in industrial services |

SWOT Analysis Data Sources

This Hargreaves SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive market research from reputable firms, and insights from industry experts and analysts to provide a well-rounded strategic perspective.