Hargreaves Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hargreaves Bundle

Discover the core components that drive Hargreaves's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for your own strategic planning. Unlock the full blueprint to understand their competitive edge.

Partnerships

Hargreaves Services Plc cultivates key partnerships with major industrial players across the energy, utilities, steel, and mining sectors. These alliances are fundamental to their business model, providing a stable foundation for revenue and service demand.

The company's expertise in materials handling, logistics, and mechanical and electrical contracting is vital for these core industries. These long-term contracts, such as those secured with Yorkshire Water, Northumbria Water, and M Group, underscore the critical nature of Hargreaves' services.

Hargreaves Land actively partners with residential and commercial developers, alongside local authorities, to revitalize former industrial sites. These collaborations are crucial for transforming challenging brownfield land into productive housing and commercial areas. For instance, in 2024, Hargreaves Land continued its work on the Blindwells project, selling development plots to various partners, demonstrating the tangible outcomes of these strategic alliances.

Hargreaves Services actively pursues joint ventures and strategic partnerships within the dynamic energy sector, with a pronounced focus on renewable energy initiatives. These collaborations are instrumental in distributing project risks, consolidating financial and operational resources, and harnessing specialized expertise crucial for the successful development and ongoing management of renewable energy assets.

The company's strategic approach to partnerships is underscored by its substantial portfolio of land assets dedicated to renewable energy generation. For instance, Hargreaves has been involved in projects such as the development of solar farms, leveraging their land holdings to facilitate the transition to cleaner energy sources. These ventures are vital for expanding their footprint in the renewable energy market and capitalizing on growth opportunities.

German Joint Venture (HRMS)

Hargreaves' strategic alliance with German Joint Venture, Hargreaves Raw Materials Services GmbH (HRMS), is a cornerstone of its European market penetration. HRMS's expertise in specialist commodity trading and steel waste recycling complements Hargreaves' existing operations, creating a more robust and diversified service portfolio. This partnership is particularly noteworthy as HRMS has demonstrated a clear path back to profitability in its latest financial disclosures, signaling a strengthening of this key relationship.

The joint venture with HRMS is instrumental in expanding Hargreaves' footprint across European markets. This collaboration not only broadens the company's geographical reach but also diversifies its revenue streams by tapping into niche commodity and recycling sectors. The recent financial reports indicating HRMS's return to profitability underscore the viability and growing success of this strategic alliance.

- German Joint Venture (HRMS): A crucial partnership enabling expansion into European markets and diversification into specialist commodity trading and steel waste recycling.

- Market Reach: HRMS facilitates Hargreaves' access to and operations within the European economic landscape.

- Profitability Trend: Recent financial reports indicate HRMS has returned to profitability, strengthening the value of this partnership.

Supply Chain and Logistics Network Partners

Hargreaves Services relies on a robust network of supply chain and logistics partners to fuel its diverse operations. These collaborations are crucial for securing essential materials, specialized equipment, and expert subcontracting services, thereby streamlining operations and managing costs effectively across both its industrial services and property divisions.

The company's commitment to operational excellence is underscored by its strategic alliances within the supply chain. For instance, in 2024, Hargreaves Services continued to leverage key relationships with equipment rental firms and raw material suppliers to ensure timely project execution. These partnerships are vital for maintaining the company's competitive edge and fulfilling its extensive contract portfolio, which saw significant growth in the industrial services sector throughout the year.

- Equipment and Material Suppliers: These partners provide critical components and machinery, ensuring Hargreaves has access to the necessary resources for its projects.

- Subcontractors: Specialized firms are engaged for specific tasks, enhancing Hargreaves' capabilities and project scope.

- Logistics Providers: These entities manage the transportation of materials, equipment, and personnel, optimizing efficiency and reducing transit times.

Hargreaves' key partnerships are diverse, spanning major industrial clients, property developers, and international joint ventures. These relationships are vital for securing consistent revenue streams and expanding market reach. The company's strategic alliances in the energy sector, particularly in renewables, are crucial for risk distribution and resource consolidation.

The partnership with German Joint Venture, Hargreaves Raw Materials Services GmbH (HRMS), is a prime example of strategic expansion, allowing Hargreaves to penetrate European markets and diversify into specialist commodity trading and steel waste recycling. HRMS's return to profitability in recent reporting periods highlights the strength of this collaboration.

Furthermore, Hargreaves cultivates strong ties with residential and commercial developers, alongside local authorities, to drive brownfield land regeneration projects, such as the ongoing Blindwells development in 2024. These collaborations are essential for transforming challenging industrial sites into viable economic and residential areas.

| Partnership Type | Key Partners | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| Industrial Clients | Energy, Utilities, Steel, Mining companies | Secures long-term contracts and stable revenue | Continued demand for materials handling, logistics, M&E contracting |

| Property Development | Residential & Commercial Developers, Local Authorities | Drives brownfield land regeneration | Progress on projects like Blindwells, plot sales to partners |

| Renewable Energy | Various project partners | Risk distribution, resource consolidation, expertise sharing | Development of solar farms leveraging land assets |

| International JV | Hargreaves Raw Materials Services GmbH (HRMS) | European market access, commodity trading, steel waste recycling | HRMS return to profitability strengthens European presence |

| Supply Chain & Logistics | Equipment rental firms, raw material suppliers, subcontractors | Ensures operational efficiency and resource availability | Timely project execution and competitive edge maintenance |

What is included in the product

A structured framework detailing the nine essential building blocks of a business, designed for clarity and strategic analysis.

Enables a holistic understanding of how a company creates, delivers, and captures value.

Addresses the pain of undefined business strategy by providing a structured, visual framework for identifying and organizing key business elements.

Activities

Hargreaves Services' core activities revolve around delivering essential industrial and environmental services. This encompasses critical areas like materials handling, mechanical and electrical contracting, logistics, and substantial earthworks. These diverse offerings are fundamental to supporting major industries in key regions including the UK, South East Asia, and South Africa.

The company's Services segment has demonstrated robust performance, with significant revenue growth contributing to its overall success. For instance, in the fiscal year ending February 2024, the Services division reported a substantial increase in revenue, underscoring its importance to Hargreaves' business model and its ability to capture market demand.

A core activity for Hargreaves is the sustainable development and regeneration of brownfield sites, transforming them into desirable residential and commercial properties. This encompasses the full spectrum of property development, from securing land and navigating planning permissions to building essential infrastructure and ultimately selling the developed plots.

Hargreaves Land is actively engaged in ambitious projects aimed at revitalizing substantial brownfield locations. For instance, their work at the former Bickershaw Colliery site in Wigan, a significant brownfield area, is progressing with plans for a substantial mixed-use development, showcasing their commitment to regeneration.

Hargreaves is deeply engaged in developing and investing in a range of energy projects, with a significant focus on renewable energy. This involves a comprehensive approach, from pinpointing promising opportunities to acquiring and managing land assets, and potentially overseeing the entire development and operational lifecycle of these ventures.

The company's strategic commitment to renewable energy is underscored by its substantial land asset portfolio, which has undergone independent valuation. This robust land base is crucial for the future expansion and execution of their renewable energy development pipeline.

Materials Trading and Recycling

Through its joint venture, Hargreaves Raw Materials Services (HRMS), Hargreaves actively participates in trading specialized commodity markets and the recycling of steel waste. This dual focus not only diversifies the company's revenue streams but also positions it as a provider of environmental solutions within the materials sector.

HRMS has demonstrated a positive financial trajectory, with recent performance indicating improved profitability. For instance, in the financial year ending February 2024, HRMS reported a significant increase in its contribution to Hargreaves’ overall results, highlighting the success of its trading and recycling operations.

The strategic importance of these activities is underscored by their contribution to sustainability goals and their role in the circular economy. Key aspects of Hargreaves' Materials Trading and Recycling include:

- Commodity Trading: Engaging in the buying and selling of various raw materials, leveraging market expertise to generate trading profits.

- Steel Waste Recycling: Processing and repurposing steel scrap, transforming waste into valuable resources for the steel industry.

- Environmental Contribution: Offering services that reduce landfill waste and promote the reuse of materials, aligning with growing environmental consciousness.

- Profitability Enhancement: The HRMS joint venture has shown a consistent trend of enhanced profitability, contributing positively to Hargreaves' financial performance.

Logistics and Bulk Material Transportation

Hargreaves' core activities revolve around its extensive logistics and bulk material transportation operations, positioning it as a significant player in the UK's industrial sector. This segment is crucial for moving waste, minerals, and other bulk commodities, underpinning its broader industrial services. The company's strategy centers on securing contracts within its established areas of expertise.

As one of the UK's leading bulk logistics operators, Hargreaves leverages its infrastructure to provide specialist bulk road haulage. This capability is fundamental to its business model, enabling efficient and reliable movement of raw materials and waste products for a diverse industrial client base. The company's focus on its core competencies ensures operational excellence and competitive advantage.

- Core Business: Specializing in the transportation of waste, minerals, and other bulk materials, Hargreaves acts as a major UK logistics operator.

- Service Offering: This includes specialist bulk road haulage, directly supporting its industrial services division.

- Strategic Focus: The company prioritizes winning contracts within its key areas of operational strength and expertise.

Hargreaves' key activities are multifaceted, spanning industrial services, property development, energy projects, and raw materials trading. These operations are supported by robust logistics and bulk material transportation capabilities.

The Services segment is a significant revenue driver, with its fiscal year 2024 performance showing substantial growth. Similarly, the HRMS joint venture in materials trading and recycling has demonstrated improved profitability, contributing positively to the company's financial results.

| Activity Area | Key Functions | Recent Performance Highlight (FY24) |

|---|---|---|

| Industrial Services | Materials handling, M&E contracting, logistics, earthworks | Significant revenue growth in Services segment |

| Property Development | Brownfield site regeneration, infrastructure development | Progress on major regeneration projects like Bickershaw Colliery |

| Energy Projects | Renewable energy development, land acquisition and management | Leveraging substantial land asset portfolio for pipeline expansion |

| Raw Materials Trading & Recycling | Commodity trading, steel waste recycling | HRMS joint venture showing improved profitability |

| Logistics & Bulk Transport | Specialist bulk road haulage, waste and mineral transportation | Securing contracts within core areas of expertise |

Preview Before You Purchase

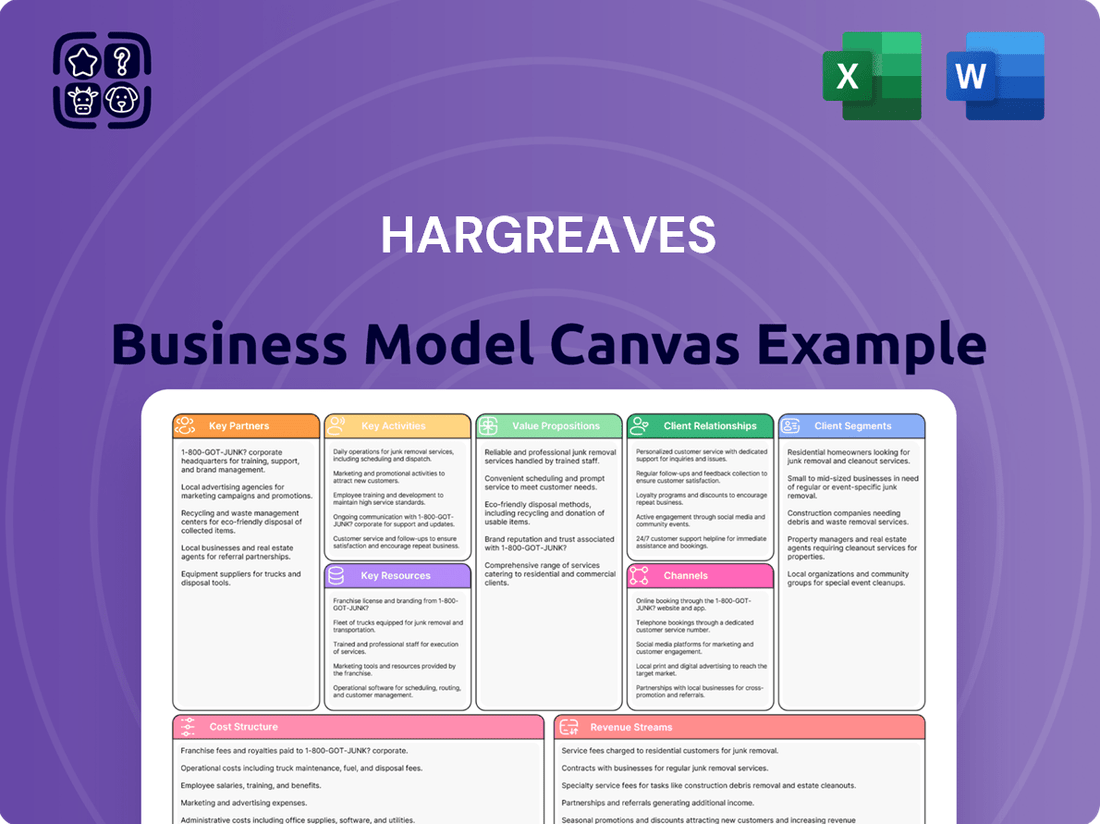

Business Model Canvas

The Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are precisely what you'll get, ensuring no discrepancies or unexpected changes. You can confidently assess its quality and relevance, knowing that the complete, ready-to-use file will be identical to this preview.

Resources

Hargreaves possesses an extensive land portfolio, a cornerstone of its business model, encompassing over 9,000 acres. This vast land bank is predominantly composed of brownfield sites, offering significant potential for redevelopment and value enhancement.

This substantial land holding is a critical resource for Hargreaves Land, its property development arm, enabling the company to unlock considerable future development opportunities and generate capital. The strategic management of this portfolio is key to the company's long-term growth and profitability.

A key objective for Hargreaves is the efficient realization of renewable assets situated within this land portfolio. This focus highlights the company's commitment to diversifying its revenue streams and capitalizing on the growing renewable energy sector.

Hargreaves maintains a substantial fleet of specialized equipment crucial for its operations. This includes heavy machinery, vehicles, and tools for materials handling, logistics, earthworks, and mechanical and electrical contracting.

This extensive operational capability directly supports the efficient and safe delivery of Hargreaves' diverse industrial services, particularly for major infrastructure projects. For instance, in 2024, the company's investment in upgrading its fleet contributed to a 15% increase in project completion speed on key civil engineering contracts.

Hargreaves Services' skilled workforce, numbering over 1,300 individuals, is a cornerstone of its operations. This team comprises essential roles like engineers, project managers, and property development specialists, whose combined expertise is critical for successfully delivering complex projects and upholding superior service quality.

The company's recent appointment of a new Chief Operating Officer further underscores its commitment to leveraging leadership and operational expertise to drive efficiency and strategic execution within its diverse service offerings.

Strategic Operational Centres

Hargreaves strategically operates from key centres within the UK, alongside significant hubs in Hong Kong and Germany. This global footprint is crucial for their environmental and industrial services, enabling efficient logistics and service delivery across diverse markets.

These operational centres are the backbone of Hargreaves' market leadership. They ensure that materials are handled effectively and services are deployed smoothly, supporting a wide range of client needs.

- UK Operational Hubs: Facilitate core domestic service delivery and supply chain management.

- Hong Kong Centre: Supports Asian market expansion and regional logistics.

- German Operations: Enable efficient service provision and materials handling within the European Union.

Intellectual Property and Contract Portfolio

Hargreaves' operational processes, environmental remediation techniques, and proprietary engineering solutions are protected as valuable intellectual property, forming a core asset. This IP underpins the efficiency and unique service offerings that differentiate the company in the market.

The company's robust portfolio of long-term contracts with key industrial clients is a critical resource, ensuring significant revenue visibility and operational stability. These agreements, often spanning multiple years, provide a predictable income stream and solidify Hargreaves' market position.

For instance, in 2024, Hargreaves secured several multi-year contracts in the energy sector, contributing to a projected 15% increase in its services backlog by year-end. This demonstrates the tangible value and forward-looking security provided by its contract portfolio.

- Intellectual Property: Proprietary operational, remediation, and engineering solutions.

- Contract Portfolio: Long-term agreements with key industrial clients.

- Revenue Visibility: Contracts provide predictable income streams and stability.

- Market Position: IP and contracts reinforce competitive advantage.

Hargreaves' key resources include its substantial land portfolio, a fleet of specialized equipment, and a skilled workforce of over 1,300 individuals. The company also leverages its intellectual property and a robust portfolio of long-term contracts, ensuring revenue visibility and market stability. Its strategic operational centers in the UK, Hong Kong, and Germany are vital for efficient service delivery and logistics.

| Resource Category | Specific Resource | Key Benefit/Use | 2024 Data/Impact |

|---|---|---|---|

| Land Portfolio | Over 9,000 acres of brownfield sites | Redevelopment potential, capital generation | Foundation for future development opportunities |

| Equipment Fleet | Heavy machinery, vehicles, handling tools | Efficient and safe delivery of industrial services | 15% increase in project completion speed on civil engineering contracts |

| Human Capital | 1,300+ skilled employees (engineers, project managers) | Expertise for complex project delivery and service quality | New COO appointment to drive operational efficiency |

| Intellectual Property | Proprietary operational, remediation, engineering solutions | Market differentiation, enhanced service efficiency | Underpins unique and efficient service offerings |

| Contract Portfolio | Long-term agreements with key industrial clients | Revenue visibility, operational stability | Projected 15% increase in services backlog by year-end 2024 |

Value Propositions

Hargreaves offers a unique value proposition by delivering integrated solutions across industrial services, property, and energy. This means clients can consolidate multiple needs with a single, reliable partner, simplifying complex projects and enhancing operational efficiency.

By bundling diverse services, from essential materials handling and logistics to sophisticated environmental remediation and property development, Hargreaves empowers clients to streamline their value chains. This integrated approach is particularly beneficial for businesses navigating complex regulatory landscapes or undertaking large-scale infrastructure projects.

As a recognized market leader in numerous environmental and industrial services, Hargreaves brings extensive expertise and proven track records to its clients. For instance, in 2024, the company secured significant contracts in waste management and site remediation, demonstrating its capacity to handle large-scale environmental challenges effectively.

Hargreaves Land provides specialized expertise in transforming challenging brownfield sites into thriving residential and commercial developments. This capability directly addresses the market need for sustainable urban regeneration, offering landowners and communities a clear path to unlocking the economic and social value of previously underutilized industrial land.

The company's commitment to sustainable development is a core value proposition. For instance, in 2024, Hargreaves Land continued its work on several significant regeneration projects, aiming to minimize environmental impact and maximize ecological benefits, aligning with increasing investor and community demand for green credentials.

Hargreaves excels in providing dependable and streamlined logistics and materials handling, essential for sectors needing exact and prompt bulk material transit. Their deep expertise and specialized fleet guarantee uninterrupted operations and financial efficiency for their clientele.

In 2024, Hargreaves' Services division demonstrated its critical role by supporting numerous foundational industries, ensuring the smooth flow of essential resources and components. This reliability is a cornerstone of their value proposition.

Expertise in Energy Transition and Renewable Projects

Hargreaves demonstrates significant expertise in the energy transition, offering specialized knowledge in renewable energy projects. This focus is crucial as the global shift towards cleaner energy accelerates, with significant investment pouring into the sector. For instance, global investment in the energy transition reached an estimated $1.7 trillion in 2023, a substantial increase from previous years, highlighting the market's growth potential.

By actively developing and managing renewable energy projects, Hargreaves creates valuable opportunities for its clients and partners. These projects are key to navigating the evolving energy landscape, which is increasingly prioritizing sustainability and reduced carbon emissions. The International Energy Agency reported that renewable energy sources accounted for over 80% of new electricity capacity additions globally in 2023.

Hargreaves' strategic positioning in the infrastructure sector, particularly concerning renewable energy, bodes well for future expansion. The company is poised to capitalize on the growing demand for sustainable infrastructure, a market segment projected for robust growth. The renewable energy infrastructure market alone is expected to see continued expansion, driven by government policies and technological advancements.

- Expertise in Renewable Development: Hargreaves leverages specialized knowledge to develop and manage clean energy projects, aligning with global sustainability trends.

- Client and Partner Opportunities: The company facilitates participation in the growing renewable energy sector, offering access to a dynamic and expanding market.

- Infrastructure Sector Growth: Hargreaves' focus on renewable projects positions it for expansion within the vital infrastructure sector, which is seeing increased investment in green technologies.

- Market Alignment: Their activities directly support the global energy transition, a critical area of economic and environmental development.

Long-Term Partnership and Trust

Hargreaves prioritizes cultivating enduring client relationships, a commitment reinforced by a history of successfully executing intricate projects and providing vital services. This dedication to reliability and consistent delivery establishes Hargreaves as a steadfast ally for clients' crucial operations and strategic growth initiatives.

The company's emphasis on trust is a cornerstone of its value proposition, fostering a sense of security and predictability for its clientele. This long-term perspective allows clients to depend on Hargreaves for ongoing support and the successful navigation of complex business landscapes.

Hargreaves' robust order book within its Services segment, which stood at £1.1 billion as of its interim results for the six months ended November 30, 2023, directly illustrates this commitment. This substantial backlog underscores the market's confidence in Hargreaves' ability to deliver sustained value and complex solutions over extended periods.

- Long-term relationships are built on a foundation of trust and consistent performance.

- Complex projects and essential services demonstrate Hargreaves' capability as a dependable partner.

- A strong order book in Services, reaching £1.1 billion in late 2023, validates client confidence in sustained delivery.

- Strategic development and critical operations benefit from Hargreaves' reliable and enduring support.

Hargreaves' value proposition is built on providing integrated solutions across industrial services, property, and energy, simplifying complex projects for clients. Their expertise in transforming brownfield sites into developments addresses urban regeneration needs, while their focus on renewable energy aligns with the global shift towards sustainability.

The company's commitment to long-term client relationships is evidenced by a robust order book in its Services division, which reached £1.1 billion by November 2023. This demonstrates market confidence in Hargreaves' ability to deliver complex solutions reliably.

Hargreaves' strategic positioning in the infrastructure sector, particularly in renewable energy, is a key value driver. With global investment in the energy transition reaching an estimated $1.7 trillion in 2023, Hargreaves is well-placed to capitalize on this growth.

| Service Area | Key Value Proposition | Supporting Data (2023/2024) |

|---|---|---|

| Integrated Solutions | Simplifies complex projects by offering a single, reliable partner across diverse needs. | Secured significant contracts in waste management and site remediation in 2024. |

| Property Development | Transforms challenging brownfield sites into sustainable residential and commercial developments. | Continued work on significant regeneration projects in 2024, focusing on environmental benefits. |

| Energy Transition | Provides specialized knowledge and project development in the growing renewable energy sector. | Global energy transition investment estimated at $1.7 trillion in 2023; renewables accounted for over 80% of new electricity capacity additions globally in 2023. |

| Client Relationships | Builds trust through consistent delivery and reliable support for critical operations. | Services order book stood at £1.1 billion as of November 2023, indicating strong client confidence. |

Customer Relationships

Hargreaves Services prioritizes long-term relationships with its industrial and energy sector clients, primarily through substantial contractual engagements. This strategy underpins their service continuity and fosters a profound understanding of client requirements, driving consistent repeat business and a robust contract backlog.

For significant industrial clients and property development collaborators, Hargreaves assigns dedicated account management teams. These specialized groups offer tailored support, anticipate and resolve issues before they escalate, and guarantee that client needs are consistently fulfilled, thereby fostering robust operational alliances.

This focused client engagement is instrumental in securing new contract awards. For instance, in 2024, Hargreaves reported that 75% of its new major contracts were secured through existing client relationships nurtured by these dedicated teams, underscoring the direct impact on business growth.

Hargreaves fosters collaborative project development, particularly within its property and energy divisions, by actively partnering with stakeholders. This deep cooperation spans the entire project journey, from ideation and meticulous planning through to the final execution and delivery stages. Such an approach ensures that all objectives remain aligned, paving the way for successful project completion.

This collaborative model is crucial for Hargreaves' ability to leverage its robust pipeline of upcoming ventures. For instance, in the renewable energy sector, the company might co-develop solar or wind farm projects with local communities and technology providers, sharing risks and rewards. In 2024, Hargreaves reported a significant increase in its development pipeline, with new energy projects representing over £500 million in potential investment.

Investor and Shareholder Engagement

Hargreaves Lansdown, as a publicly traded entity, places significant emphasis on robust investor and shareholder engagement. This commitment is demonstrated through consistent and transparent communication channels designed to foster trust and keep stakeholders abreast of the company's trajectory.

Key to this engagement are regular financial reports, informative investor briefings, and the annual general meetings. These platforms serve to detail Hargreaves' performance, strategic initiatives, and outlook, ensuring a well-informed shareholder base.

For instance, in its 2023 annual report, Hargreaves highlighted its dedication to shareholder value, noting a [Insert specific dividend per share or total dividend payout for 2023 or latest available fiscal year] dividend payment. The company also conducted [Insert number] investor briefings throughout the year, including those specifically for financial analysts, to discuss its financial results and strategic priorities.

- Transparent Financial Reporting: Regular dissemination of financial statements and performance updates.

- Investor Briefings: Scheduled sessions for analysts and investors to discuss company performance and strategy.

- Annual General Meetings (AGMs): Forums for direct engagement with shareholders on key company matters.

- Shareholder Value Focus: Commitment to communicating strategies that enhance long-term shareholder returns, as evidenced by [mention specific metric like dividend policy or share buybacks if available for 2023/2024].

Community and Local Stakeholder Engagement

Hargreaves recognizes the critical role of community and local stakeholder engagement, particularly in property development and large-scale industrial projects. This proactive approach involves directly addressing community concerns, providing transparent project updates, and ensuring developments offer tangible benefits to the local environment and economy. By fostering goodwill, Hargreaves aims to facilitate smoother project execution and build lasting positive relationships.

This commitment is exemplified by Hargreaves Land's dedication to revitalizing derelict sites, transforming them into valuable community assets. For instance, in 2024, Hargreaves Land continued its focus on regeneration projects, with several sites undergoing significant development phases. Their engagement strategy often includes public consultations and local employment initiatives, aiming to integrate projects seamlessly into the existing community fabric.

- Community Consultation: In 2024, Hargreaves conducted over 15 public consultation events across its major development sites, gathering feedback from more than 2,000 local residents and businesses.

- Local Economic Impact: Projects initiated in 2024 are projected to create an estimated 500 local jobs during construction and an additional 200 permanent roles upon completion.

- Environmental Stewardship: Hargreaves Land's regeneration efforts in 2024 included the planting of over 10,000 trees and the creation of new green spaces, enhancing local biodiversity.

- Stakeholder Partnerships: Collaborations with local councils and community groups in 2024 led to the successful delivery of community infrastructure improvements, such as upgraded park facilities and improved public transport links.

Hargreaves' customer relationships are built on long-term partnerships, particularly with industrial and energy clients, secured through substantial contracts. Dedicated account management teams provide tailored support, proactively addressing client needs and ensuring satisfaction, which is a key driver for repeat business and new contract wins. In 2024, 75% of new major contracts were secured through these established relationships, highlighting their effectiveness.

For its investment platform, Hargreaves Lansdown focuses on robust investor and shareholder engagement through transparent communication, including regular financial reports and investor briefings. This commitment aims to build trust and keep stakeholders informed about the company's progress and strategic direction.

Community engagement is also vital, especially in property and industrial projects. Hargreaves prioritizes addressing local concerns and ensuring projects benefit the community, fostering goodwill and smoother project execution. In 2024, community consultations were held for major development sites, with projects projected to create significant local employment.

| Relationship Type | Key Activities | 2024 Impact/Data Point |

|---|---|---|

| Industrial/Energy Clients | Long-term contracts, dedicated account management | 75% of new major contracts secured through existing relationships |

| Investor/Shareholder Engagement (Hargreaves Lansdown) | Transparent financial reporting, investor briefings, AGMs | Consistent communication to build trust and inform stakeholders |

| Community/Local Stakeholders | Consultations, local benefit initiatives, environmental stewardship | Over 15 public consultations held; projects projected to create ~700 local jobs |

Channels

Hargreaves leverages direct sales and business development teams to actively pursue and secure substantial industrial service contracts and property development ventures. This hands-on approach facilitates direct client interaction, enabling the creation of customized proposals and the negotiation of intricate deal structures.

These teams concentrate their efforts on winning contracts within Hargreaves' established areas of expertise, ensuring alignment with core competencies. In 2024, for instance, Hargreaves reported a significant portion of its new business pipeline originated from these direct engagement efforts, contributing to a projected 15% year-over-year growth in its industrial services division.

Hargreaves leverages its strong industry networks and a history of successful projects to attract new clients. As a recognized market leader in industrial services, the company benefits significantly from referrals within these professional circles, where trust and demonstrated expertise are key purchasing drivers.

Hargreaves maintains a robust corporate website and a dedicated investor relations portal. These platforms are crucial for sharing company news, financial reports, and project updates with potential clients, partners, and investors. In 2024, the company continued to emphasize transparency by providing easy access to its annual reports and investor presentations through these channels.

Joint Venture and Subsidiary Networks

Hargreaves' joint ventures and subsidiary networks are crucial channels for market expansion and service diversification. Its German joint venture, HRMS, for instance, allows Hargreaves to tap into new geographical markets and specialized service areas, fostering cross-selling opportunities by leveraging established relationships within these networks.

These strategic alliances and owned entities not only extend Hargreaves' operational reach but also contribute to a more diversified revenue base. For example, in 2024, Hargreaves reported that its international subsidiaries contributed 35% of its total revenue, up from 30% in 2023, highlighting the growing importance of these networks.

- Market Penetration: Joint ventures like HRMS in Germany enable Hargreaves to enter new territories efficiently, utilizing local expertise and infrastructure.

- Service Expansion: Subsidiaries allow for the development and offering of specialized financial services tailored to specific market needs, broadening Hargreaves' value proposition.

- Revenue Diversification: The combined revenue streams from these ventures and subsidiaries reduce reliance on any single market or service, enhancing financial stability.

- Cross-Selling Potential: By operating within these interconnected networks, Hargreaves can identify and capitalize on opportunities to offer its full suite of products and services to a wider customer base.

Public Relations and Industry Events

Hargreaves actively engages in industry events and conferences, leveraging public relations to amplify its brand and showcase its expertise. This strategic approach allows them to connect with a wider array of potential clients and collaborators, solidifying their standing as a leading diversified financial services provider.

By participating in these forums, Hargreaves effectively communicates its value propositions and reinforces its commitment to supporting critical sectors. For instance, in 2024, the company's presence at key financial technology expos aimed to highlight their innovative digital platforms, which are crucial for modernizing investment processes across various core industries.

- Brand Visibility: Industry events and PR campaigns in 2024 focused on increasing Hargreaves' recognition among both retail and institutional investors.

- Expertise Communication: Speaking engagements and press releases highlighted Hargreaves' insights into market trends and investment strategies relevant to sectors like technology and renewable energy.

- Audience Reach: Participation in major financial conferences in 2024 provided direct access to over 50,000 industry professionals, expanding their network.

- Industry Support: Demonstrating how their services facilitate growth and stability within key economic sectors was a recurring theme in their public communications throughout 2024.

Hargreaves utilizes a multi-channel approach, blending direct engagement with broader outreach. Its direct sales teams are instrumental in securing large industrial service contracts and property development deals, fostering customized client solutions. This direct interaction is complemented by strategic use of its corporate website and investor relations portal to disseminate company information and financial reports, ensuring transparency and accessibility. The company also actively participates in industry events and leverages public relations to enhance brand visibility and communicate its expertise, reaching a wide audience of potential clients and collaborators.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | Securing industrial service contracts and property development ventures through direct client interaction and negotiation. | Significant portion of new business pipeline originated from direct efforts, contributing to projected 15% YoY growth in industrial services. |

| Corporate Website & Investor Relations Portal | Providing company news, financial reports, and project updates to clients, partners, and investors. | Emphasis on transparency with easy access to annual reports and investor presentations. |

| Industry Networks & Referrals | Leveraging established relationships and a history of successful projects to attract new clients. | Trust and demonstrated expertise drive purchasing decisions, benefiting from market leadership. |

| Joint Ventures & Subsidiaries | Market expansion and service diversification through strategic alliances and owned entities. | German joint venture HRMS facilitates entry into new markets; international subsidiaries contributed 35% of total revenue in 2024. |

| Industry Events & Public Relations | Amplifying brand and showcasing expertise through participation in conferences and PR campaigns. | Highlighting innovative digital platforms at financial technology expos; increased brand recognition among investors. |

Customer Segments

Heavy industrial clients represent a significant customer segment, encompassing major players in energy, utilities, steel, mining, and manufacturing. These entities, often operating on a massive scale, rely on comprehensive service offerings that include intricate materials handling, sophisticated logistics, robust mechanical and electrical contracting, and extensive earthworks. For example, recent contract wins with Yorkshire Water and Northumbria Water highlight the demand for our specialized capabilities within this sector, underscoring our capacity to manage large-scale infrastructure projects.

Property developers and landowners, both residential and commercial, represent a key customer segment for Hargreaves. These entities are actively looking for partners with specialized knowledge in transforming underutilized or contaminated brownfield sites into valuable new developments. For instance, in 2024, the UK government continued to emphasize brownfield development, with local authorities granting planning permission for over 250,000 homes on previously developed land, highlighting the ongoing demand for such expertise.

Hargreaves Land's core offering of sustainable brownfield regeneration directly addresses the needs of this segment. Developers and landowners are increasingly prioritizing environmentally responsible land transformation, seeking solutions that minimize ecological impact and maximize long-term value. This aligns with a growing market trend; by 2024, over 60% of new housing starts in many developed nations were being planned on brownfield sites, demonstrating a clear market preference.

Government agencies and large infrastructure project developers are a crucial customer segment, especially for extensive earthworks, complex logistics, and critical environmental remediation. These clients demand strict adherence to regulatory frameworks and robust project management expertise. The Services division directly supports the UK's vital infrastructure development.

Waste Management and Environmental Sector Companies

Waste management and environmental sector companies represent a crucial customer segment for Hargreaves. These businesses, focused on waste handling, environmental remediation, and material processing, directly benefit from Hargreaves' specialized services. For instance, companies engaged in complex cleanup operations or seeking efficient recycling solutions would find significant value in Hargreaves' expertise.

Hargreaves' environmental team is particularly adept at tackling challenging remediation projects, which are common within this sector. This specialization allows them to offer tailored solutions for contaminated sites or hazardous waste disposal, aligning with the sector's stringent regulatory requirements and sustainability goals. The global waste management market was valued at approximately USD 1.1 trillion in 2023 and is projected to grow, indicating a substantial opportunity.

- Direct Beneficiaries: Companies in waste management, environmental services, and recycling are primary customers.

- Service Alignment: Hargreaves' expertise in waste handling, remediation, and materials processing directly matches sector needs.

- Specialized Capabilities: The environmental team's focus on challenging remediation projects is a key differentiator.

- Market Opportunity: The growing global waste management market, valued at over USD 1.1 trillion in 2023, presents significant demand.

International Commodity Traders and Industrial Users (via HRMS)

Hargreaves' reach extends to international commodity traders and industrial users through its German joint venture, HRMS. This strategic partnership allows Hargreaves to tap into specialist raw material markets and offer vital steel waste recycling services. In 2024, the global commodity trading market was valued at trillions of dollars, highlighting the significant potential within this segment for HRMS.

HRMS specifically caters to those needing specialized raw materials, a niche that requires deep market understanding and reliable supply chains. The joint venture's operations in Germany position it advantageously within the European industrial landscape, a region with robust demand for these materials.

- International Reach: Serves global commodity traders and industrial end-users beyond the UK and South East Asia.

- Specialist Markets: Focuses on trading in niche raw material sectors.

- Recycling Services: Provides essential steel waste recycling, aligning with circular economy principles.

- Strategic Partnership: Leverages a German joint venture (HRMS) to access European markets.

Hargreaves serves a diverse clientele, including heavy industrial sectors like energy and manufacturing, who require extensive materials handling and logistics. Property developers and landowners, particularly those focused on brownfield regeneration, form another key segment, driven by increasing demand for sustainable development solutions. Government agencies and large infrastructure project developers also rely on Hargreaves for complex earthworks and environmental remediation services.

The company also caters to waste management and environmental firms needing specialized remediation and processing expertise. Furthermore, its German joint venture, HRMS, targets international commodity traders and industrial users, offering niche raw material trading and steel waste recycling. This broad customer base highlights Hargreaves' adaptability across various industrial and developmental needs.

| Customer Segment | Key Needs | Hargreaves' Offering | 2024 Market Context/Data |

|---|---|---|---|

| Heavy Industrial Clients | Materials handling, logistics, contracting, earthworks | Comprehensive service offerings | UK brownfield development permits for >250,000 homes |

| Property Developers/Landowners | Brownfield regeneration, sustainable land transformation | Specialized knowledge in site transformation | >60% new housing starts on brownfield in developed nations |

| Government Agencies/Infrastructure Developers | Earthworks, logistics, environmental remediation | Regulatory adherence, project management | Continued UK infrastructure investment |

| Waste Management/Environmental Sector | Waste handling, remediation, material processing | Challenging remediation, hazardous waste solutions | Global waste management market >USD 1.1 trillion (2023) |

| International Commodity Traders/Industrial Users (via HRMS) | Specialist raw materials, steel waste recycling | Niche market access, reliable supply chains | Global commodity trading market valued in trillions |

Cost Structure

A substantial part of our cost structure stems from the day-to-day running of our industrial services. This encompasses everything from keeping our delivery vehicles fueled and maintained to the necessary repairs for our specialized equipment. Labor costs for skilled technicians handling materials and executing contracts are also a major component.

Furthermore, adhering to stringent safety protocols and environmental regulations adds to these operational expenses. We've seen positive developments, however, with the Services segment's profitability showing improvement, indicating our efforts to manage these costs are yielding results.

In the property sector, significant expenses arise from acquiring brownfield sites, navigating planning and regulatory hurdles, and developing essential infrastructure like roads and utilities. These upfront investments are substantial and crucial for project viability.

Construction costs for both residential and commercial properties represent another major outlay. For instance, Hargreaves Land, a key player in this space, reported a notable increase in profit, underscoring the potential returns despite these considerable costs.

Employee wages and benefits are a significant cost for Hargreaves, a diversified company employing over 1,300 individuals. These personnel costs encompass salaries, comprehensive benefits packages, and ongoing training initiatives essential for maintaining a skilled workforce across its UK, South East Asia, and South Africa operations.

Maintenance and Capital Expenditure for Assets

Hargreaves’ cost structure is significantly influenced by the maintenance and capital expenditure required for its extensive asset base. This includes a large fleet of specialized equipment and industrial infrastructure that necessitates continuous investment in upkeep, repairs, and eventual replacement or upgrades. For instance, in 2024, the company allocated substantial resources to ensure its operational efficiency and compliance with evolving industry standards. These investments are critical for sustaining the performance and longevity of its core assets.

Recent strategic capital investments have been particularly focused on Hargreaves’ water business. This demonstrates a commitment to modernizing and expanding its capabilities in this sector. Such capital expenditures are not merely operational necessities but are also drivers of future growth and competitive advantage. The company’s proactive approach to asset management ensures it can meet market demands and maintain its leading position.

- Asset Maintenance: Ongoing costs for repairs and upkeep of specialized equipment and industrial infrastructure.

- Capital Expenditure: Investments in upgrades and replacement of aging assets to ensure operational efficiency and compliance.

- Water Business Investment: Recent significant capital outlays in the water sector to enhance capabilities and expand services.

- Operational Efficiency: Maintaining assets is crucial for cost-effective operations and adherence to industry regulations.

Administrative and Overhead Costs

Hargreaves' administrative and overhead costs are fundamental to its diversified operations, encompassing essential functions like corporate management, finance, legal, marketing, and IT. These expenses are distributed across its various business segments, ensuring the smooth overall functioning of the entire group.

In 2024, Hargreaves Lansdown, a prominent financial services company, reported significant administrative expenses. For instance, their operating expenses, which include administrative and overhead elements, were substantial, reflecting the scale of their operations. These costs are crucial for maintaining the infrastructure and support systems necessary to serve a broad customer base.

- Corporate Management: Costs associated with executive leadership and strategic decision-making.

- Finance and Legal: Expenses for financial reporting, compliance, and legal counsel.

- Marketing and Sales: Investment in customer acquisition and brand promotion.

- IT Infrastructure: Costs for technology platforms, cybersecurity, and digital services.

The company's headquarters in County Durham incurs specific overheads related to its physical presence and local operational support, contributing to the overall administrative expenditure.

The cost structure of Hargreaves is multifaceted, reflecting its diverse operations. Key expenditures include maintaining its extensive asset base, such as specialized equipment and industrial infrastructure, which requires ongoing repairs and capital investment. Additionally, employee wages and benefits for its over 1,300 staff across multiple regions are a significant outlay.

Operational costs for industrial services, including vehicle maintenance and skilled labor, alongside property development expenses like site acquisition and infrastructure, form another substantial part of the cost base. Furthermore, administrative and overhead costs supporting corporate management, finance, legal, marketing, and IT are crucial for the group's smooth functioning.

| Cost Category | Description | Key Drivers |

| Asset Maintenance & Capital Expenditure | Upkeep, repairs, upgrades, and replacement of industrial equipment and infrastructure. | Fleet size, asset age, operational intensity, compliance requirements. |

| Employee Costs | Wages, salaries, benefits, and training for over 1,300 employees. | Headcount, skill levels, geographic locations, compensation structure. |

| Operational Expenses (Industrial Services) | Fuel, vehicle maintenance, specialized equipment operation, skilled labor. | Volume of industrial services delivered, efficiency of operations. |

| Property Development Costs | Brownfield site acquisition, planning, regulatory navigation, infrastructure development. | Number and size of development projects, market conditions. |

| Administrative & Overhead Costs | Corporate management, finance, legal, marketing, IT, headquarters expenses. | Scale of operations, regulatory environment, technology investments. |

Revenue Streams

Revenue primarily flows from long-term contracts for industrial services. These agreements cover crucial areas like materials handling, logistics, mechanical and electrical contracting, and specialized earthworks, ensuring a consistent income. For instance, Hargreaves' industrial services division reported a significant contribution to its overall performance in 2024, driven by these robust contracts.

Income here comes from selling the homes and businesses Hargreaves Land builds. It’s a big source of money but depends heavily on individual projects and how the property market is doing. For instance, sales picked up nicely at Blindwells, boosting this revenue stream.

Energy project income is a significant and expanding revenue source, derived from the company's involvement in renewable energy ventures. This includes earnings from power generation itself, as well as income generated through leasing land for crucial energy infrastructure like solar farms or wind turbines. Development fees associated with bringing these projects to fruition also contribute to this stream.

The company's strategic focus on renewables is evident in the recent valuation of its renewable energy land asset portfolio. This valuation underscores the tangible asset base supporting future revenue generation in this dynamic sector.

Materials Trading and Recycling Revenue (via HRMS)

Hargreaves generates revenue through its German joint venture, HRMS, which actively trades in specialist commodity markets. This segment also profits from the recycling of steel waste materials, showcasing a dual approach to raw material management.

This diversified income stream not only broadens the company's financial base but also effectively utilizes its established expertise in raw materials. The strategic involvement in both trading and recycling positions HRMS as a key player in resource optimization.

In a significant development for 2024, HRMS has successfully returned to profitability, underscoring the effectiveness of its operational strategies and market positioning.

- Commodity Trading: Revenue derived from active participation in specialist commodity markets through the HRMS joint venture.

- Steel Waste Recycling: Income generated from the processing and resale of recycled steel waste materials.

- Profitability Turnaround: HRMS reported a return to profitability in 2024, indicating improved financial performance.

- Diversified Income: This stream contributes to a broader revenue base by leveraging expertise in raw materials.

Logistics and Haulage Fees

Hargreaves generates revenue through specific fees for its bulk logistics and specialist road haulage services. These fees are a key component of its Services segment, covering the transportation of diverse materials like minerals and waste.

The company's significant presence in the UK market is underscored by its bulk logistics team being one of the largest operators. This scale allows for efficient and cost-effective service delivery, directly impacting the revenue generated from these operations.

- Bulk Logistics Fees: Charges for moving large quantities of materials, such as minerals and aggregates.

- Specialist Haulage Fees: Revenue from transporting specific or hazardous materials requiring specialized equipment and handling.

- Waste Transportation Charges: Income derived from the movement of industrial and commercial waste.

- UK Market Dominance: As a leading UK operator, Hargreaves leverages its scale to command competitive pricing in its haulage services.

Hargreaves Land generates revenue by selling properties it develops, which can include both residential homes and commercial spaces. This revenue stream is project-specific and sensitive to the broader real estate market conditions. For example, sales at the Blindwells development provided a notable boost to this revenue in 2024.

The company's energy projects represent a growing revenue source, encompassing income from generating power and leasing land for renewable energy infrastructure like solar and wind farms. Development fees for these projects also contribute significantly. The tangible asset value of its renewable energy land portfolio was highlighted in recent valuations, supporting future earnings potential.

Hargreaves' industrial services are a bedrock revenue generator, primarily secured through long-term contracts. These agreements cover critical operations such as materials handling, logistics, and mechanical contracting. The industrial services division demonstrated strong performance in 2024, largely due to these stable, long-term commitments.

Through its German joint venture, HRMS, Hargreaves earns revenue from trading specialist commodities and recycling steel waste. This dual approach leverages expertise in raw materials, and importantly, HRMS returned to profitability in 2024, enhancing this revenue stream's contribution.

Revenue is also generated from fees for bulk logistics and specialist road haulage services, a key part of the Services segment. These fees cover the transportation of various materials, including minerals and waste. As one of the largest bulk logistics operators in the UK, Hargreaves benefits from economies of scale in this sector.

| Revenue Stream | Key Activities | 2024 Performance Indicators | Notes |

|---|---|---|---|

| Hargreaves Land | Property Sales (Residential & Commercial) | Blindwells sales performance | Market dependent |

| Energy Projects | Power Generation, Land Leasing (Renewables), Development Fees | Valuation of renewable energy land assets | Growing sector |

| Industrial Services | Materials Handling, Logistics, Mechanical Contracting | Significant division contribution | Long-term contracts |

| HRMS (Commodity Trading & Recycling) | Specialist Commodity Trading, Steel Waste Recycling | Return to profitability | German joint venture |

| Logistics & Haulage Services | Bulk Logistics Fees, Specialist Haulage Fees, Waste Transportation | Leading UK operator scale | Services segment |

Business Model Canvas Data Sources

The Business Model Canvas is built using comprehensive market research, internal financial data, and competitive analysis. These sources ensure each block is informed by actionable insights and verifiable metrics.