HP Hood SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HP Hood Bundle

HP Hood, a dairy industry stalwart, leverages its strong brand recognition and extensive distribution network as significant strengths. However, the company faces challenges from shifting consumer preferences towards plant-based alternatives and increasing competition in the dairy market.

Discover the complete picture behind HP Hood’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Want the full story behind HP Hood’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HP Hood maintains a robust and diverse brand portfolio, encompassing well-established owned and licensed names like Lactaid, Blue Diamond Almond Breeze, Hood, and Heluva Good!. This strategic diversification caters to a broad spectrum of consumer preferences, reducing reliance on single product categories and enhancing revenue stability. For example, the non-dairy milk market, where Blue Diamond Almond Breeze is a key player, saw continued growth, projected to reach over $5.5 billion in the U.S. by 2025. Combining owned brands with licensed ones enables HP Hood to leverage existing brand loyalty and effectively penetrate various market segments, bolstering its competitive position in the dairy and plant-based beverage sectors.

HP Hood boasts an extensive and efficient manufacturing and distribution network spanning the United States. The company operates multiple advanced manufacturing plants, including specialized facilities for extended-shelf-life and aseptic products. This widespread infrastructure ensures prompt product delivery and helps mitigate localized supply chain disruptions. Such a robust network supports HP Hood's ability to serve a diverse customer base, from large retail chains to various foodservice operations, maintaining strong market penetration.

HP Hood's strategic partnerships are a significant strength, allowing them to license well-known brands like Lactaid and Blue Diamond Almond Breeze. This approach grants immediate access to established consumer bases and specialized markets, bypassing high initial product development costs. Such collaborations are vital for expanding their portfolio, particularly in high-growth segments like lactose-free dairy and plant-based alternatives, which saw significant market expansion in 2024, with plant-based milk sales continuing robust growth. Leveraging partner brand recognition, HP Hood enhances its market penetration and diversifies revenue streams without proprietary innovation.

Commitment to Innovation and R&D

HP Hood demonstrates a strong commitment to innovation through its dedicated research and development operations. This focus allows the company to adapt to evolving consumer tastes, evidenced by the rising demand for healthier and functional dairy options. Their ability to develop new products, including value-added dairy and plant-based alternatives, is crucial for staying competitive in a market projected to see significant growth in dairy-free segments, reaching over $30 billion globally by 2025. This proactive approach ensures market relevance and consumer engagement.

- HP Hood's R&D drives new product development, including lactose-free and protein-fortified dairy.

- Innovation helps HP Hood compete with the expanding plant-based beverage market, which saw significant growth in 2024.

- Focus on functional foods aligns with 2025 consumer trends for health and wellness.

Strong Financial Performance and Investment

HP Hood demonstrates robust financial health, with annual sales reaching approximately $3.5 billion as of November 2024. This strong financial position is bolstered by significant, ongoing capital investments aimed at expanding and modernizing its facilities. For example, a substantial $83.5 million investment was announced in 2024 to enhance its Virginia facility, complementing other ongoing expansion projects in New York. These strategic investments significantly boost production capacity and integrate advanced technological capabilities, reinforcing the company's market standing.

- Annual sales reached approximately $3.5 billion by November 2024.

- Over $83.5 million invested in Virginia facility expansion in 2024.

- Ongoing expansion projects are also underway in New York.

- Investments enhance production capacity and technological capabilities.

HP Hood’s strengths include a diverse brand portfolio like Lactaid and Blue Diamond Almond Breeze, leveraging a non-dairy market projected at over $5.5 billion by 2025. Its extensive manufacturing network ensures efficient distribution across the U.S. Strategic partnerships and R&D drive innovation in high-growth segments, with dairy-free reaching over $30 billion globally by 2025. Robust financial health, with sales near $3.5 billion by November 2024, supports significant capital investments.

| Strength Area | Key Metric (2024/2025) | Impact | ||

|---|---|---|---|---|

| Brand Portfolio | Non-dairy market >$5.5B (US 2025) | Diversified revenue stability | ||

| Financial Health | Sales ~$3.5B (Nov 2024) | Supports expansion & tech | ||

| Innovation | Dairy-free >$30B (Global 2025) | Market relevance & growth |

What is included in the product

Analyzes HP Hood’s competitive position through key internal and external factors, detailing its strengths in brand recognition and distribution, weaknesses in product diversification, opportunities in emerging markets and plant-based alternatives, and threats from intense competition and changing consumer preferences.

Offers a clear, actionable understanding of HP Hood's competitive landscape, allowing for targeted strategies to overcome market challenges and capitalize on opportunities.

Weaknesses

HP Hood's revenue stream is heavily reliant on the traditional U.S. dairy market, making it vulnerable to significant market volatility. Fluctuations in raw milk prices, such as the Class I base price averaging around $20 per hundredweight in early 2024, directly impact the company's profitability and cost of goods sold. While diversification efforts are ongoing, its core business remains susceptible to shifts in domestic consumer preferences and the overall health of the dairy sector. This dependence poses a continuous challenge to margin stability and growth.

HP Hood's significant reliance on traditional dairy products exposes it to risks from evolving consumer preferences. The demand for conventional dairy is declining, with the plant-based milk market projected to reach over $40 billion globally by 2028, reflecting a clear shift. While HP Hood has expanded into non-dairy alternatives, a substantial portion of its portfolio remains in traditional dairy, leaving it vulnerable to this trend. This could impact sales volumes and market share as consumers increasingly favor healthier and plant-derived beverage options in 2024 and 2025.

HP Hood currently lacks public disclosure of its carbon emissions data, including Scope 1, 2, and 3, and has no documented reduction targets. This absence of transparency is a notable weakness, particularly as consumer and investor focus on environmental sustainability intensifies through 2024 and 2025. The company's sustainability score is notably lower than 72% of its industry peers, which can negatively impact its brand reputation and relationships with environmentally conscious stakeholders. This data gap poses a strategic challenge for HP Hood in the evolving market landscape.

Operational Challenges in Expansion

While investing in expansion signals growth, operational challenges can significantly impede HP Hood's strategic plans. A notable example is the cancellation of a major $120 million expansion project in Batavia, New York, in September 2024. This setback stemmed from critical issues with wastewater permits, highlighting the company's vulnerability to regulatory and infrastructural hurdles. Such obstacles can delay or even derail efforts to scale operations, directly impacting HP Hood's ability to meet escalating market demand.

- The $120 million Batavia expansion was cancelled in September 2024.

- Wastewater permit issues were the primary cause for the project's termination.

- Regulatory hurdles significantly impact HP Hood's growth capacity.

- Infrastructural challenges can delay market demand fulfillment.

Competition from Private Label Brands

HP Hood faces intense competition from private label dairy brands, which frequently offer similar products at significantly lower price points. The escalating quality and growing consumer acceptance of store brands, which captured over 20% of the US dairy market in early 2024, pressure HP Hood's pricing strategies and profit margins. This trend threatens to erode market share, particularly among price-sensitive consumers seeking value amidst economic pressures. Private label growth, projected to continue into 2025, necessitates strategic responses to maintain market position.

- Private label dairy sales increased by approximately 8.5% in 2024, outpacing branded growth.

- Private label market share in dairy reached 21.5% by Q1 2024.

- Price differences between branded and private label dairy can exceed 15-20% for comparable products.

HP Hood's heavy reliance on traditional dairy exposes it to volatile raw milk prices and declining demand as consumers shift towards plant-based alternatives, a market projected to reach over $40 billion by 2028. Operational challenges, like the cancelled $120 million Batavia expansion in September 2024 due to permit issues, impede growth. Intense competition from private label brands, which captured over 20% of the US dairy market in early 2024, pressures margins. Additionally, a lack of public carbon emissions data impacts its sustainability standing.

| Weakness Area | Key Data Point (2024/2025) | Impact |

|---|---|---|

| Dairy Market Volatility | Class I milk price ~$20/cwt (early 2024) | Directly impacts profitability and COGS. |

| Consumer Preference Shift | Plant-based milk market >$40B by 2028 | Threatens sales volumes and market share. |

| Operational Hurdles | $120M Batavia expansion cancelled (Sept 2024) | Delays growth and market demand fulfillment. |

| Private Label Competition | Private label >20% US dairy market (early 2024) | Pressures pricing strategies and profit margins. |

Same Document Delivered

HP Hood SWOT Analysis

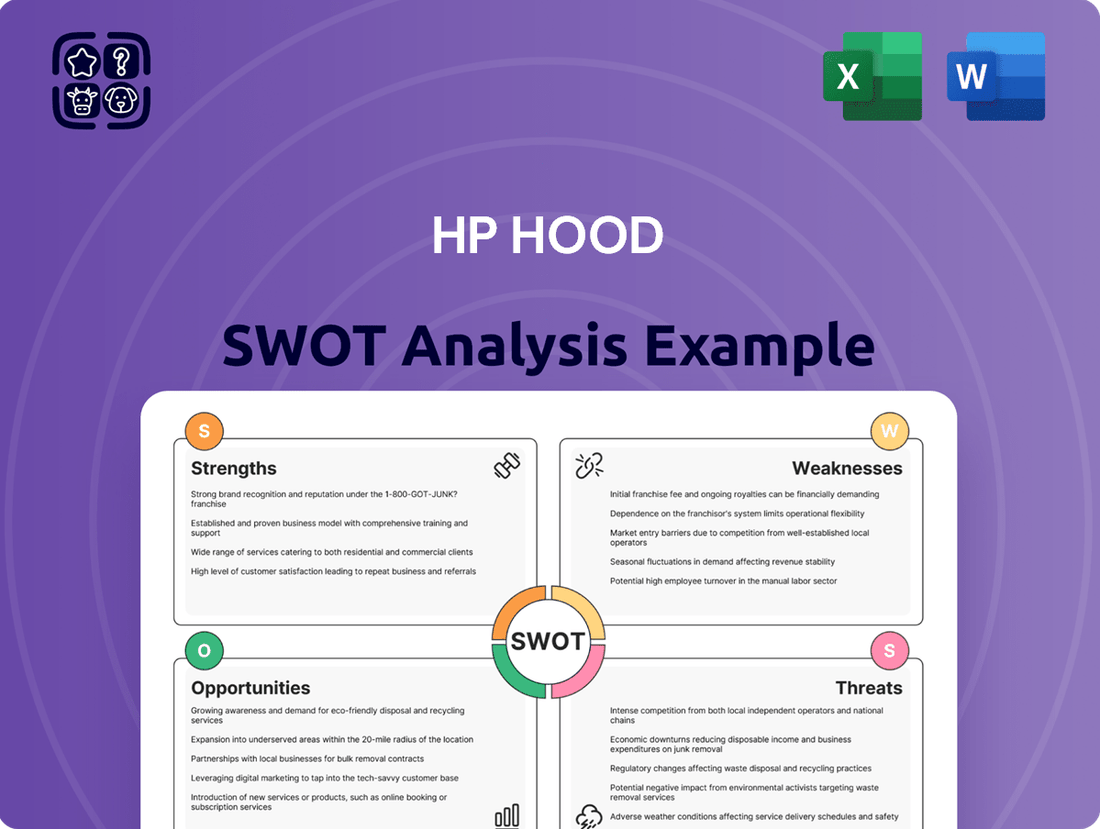

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of HP Hood's Strengths, Weaknesses, Opportunities, and Threats. You'll gain insights into their competitive landscape and strategic positioning. The preview is a direct representation of the complete, actionable report you will receive.

Opportunities

The rapidly expanding market for plant-based and dairy-alternative products presents a significant growth opportunity for HP Hood. The plant-based market was valued at over $8 billion in 2024, with milk alternatives alone reaching $3.1 billion. HP Hood can capitalize on this trend by continuing to expand its non-dairy beverage portfolio. Leveraging brands like Planet Oat and strategic partnerships positions the company well within this growing consumer segment.

Consumer demand for dairy products with added health benefits, such as high-protein yogurts and probiotic drinks, continues to rise. This trend presents a significant opportunity for HP Hood to innovate and market functional dairy products. The global functional dairy market is projected to reach approximately $60 billion by 2025, driven by health-conscious consumers seeking value-added options. By focusing on these categories, HP Hood can capture a larger share of this expanding market segment and cater to evolving consumer preferences.

Investing in and expanding Extended-Shelf-Life (ESL) and aseptic processing capabilities presents a significant growth opportunity for HP Hood. ESL products, which can have shelf lives exceeding 90 days, facilitate broader distribution, reaching new geographic markets and channels such as convenience stores and foodservice, a segment projected to grow by over 5% annually through 2025. Continued investment in facilities supporting ESL technology enhances operational efficiency, reducing waste and meeting the rising consumer demand for convenient, long-lasting dairy and non-dairy beverages. This strategic focus can capture a larger share of the evolving dairy market where UHT milk sales continue to see strong year-over-year growth.

Strategic Acquisitions and New Partnerships

Pursuing strategic acquisitions of smaller, innovative brands or forming new partnerships can significantly accelerate HP Hood's growth trajectory. This approach allows rapid entry into high-growth market segments, such as the surging plant-based dairy alternatives market, which is projected to reach over 35 billion USD globally by 2025. Acquiring a brand specializing in niche health and wellness categories, like functional beverages, could quickly expand their brand portfolio and capture new consumer bases.

- The global food and beverage M&A market saw continued activity into 2024, reflecting a strong appetite for strategic consolidation.

- Consumer demand for health-conscious and sustainable products remains a key driver for potential acquisition targets.

- Partnerships with emerging food technology firms could provide access to new processing methods or ingredients.

- Focusing on brands with strong regional presence could also enhance distribution networks.

Increasing Snacking and Convenience Trends

The growing demand for convenient, on-the-go snacking presents a significant opportunity for HP Hood. Consumers increasingly seek quick, nutritious options, driving growth in categories like drinkable yogurts, cheese sticks, and single-serving milk beverages. This trend is robust, with the global convenient food market projected to reach approximately $1.2 trillion by 2025. By innovating and marketing products specifically for these busy lifestyles, HP Hood can capture a larger share of the evolving dairy market.

- Global convenient food market expected to exceed $1.2 trillion by 2025.

- Single-serve dairy formats align with consumer preference for portability.

- Drinkable yogurts saw continued growth in 2024, driven by health and convenience.

- Targeting busy lifestyles maximizes product relevance and market penetration.

HP Hood can significantly expand by capitalizing on the surging plant-based and functional dairy markets, which are projected for robust growth through 2025. Investing in ESL technology and convenient, on-the-go products further enhances market reach and consumer appeal. Strategic acquisitions or partnerships offer accelerated entry into high-growth segments, diversifying the portfolio.

| Opportunity | Market Size (2024/2025 Est.) | Growth Driver |

|---|---|---|

| Plant-Based Market | $8B+ (2024) | Consumer health/sustainability |

| Functional Dairy | ~$60B (2025) | Health-conscious consumers |

| Convenient Food | ~$1.2T (2025) | On-the-go lifestyles |

Threats

The dairy industry is highly competitive, facing pressure from large national brands and a surge in private label options. Plant-based alternatives, which saw US sales reach approximately $2.8 billion in 2023, pose a significant threat, with companies like Oatly and Califia Farms expanding rapidly. This intense competition can lead to aggressive price wars, impacting HP Hood's profit margins and potentially reducing its market share in 2024 and 2025. Maintaining competitive pricing and product innovation is crucial amidst these dynamics.

The dairy market faces substantial volatility, impacting HP Hood's profitability. Fluctuating feed costs, with corn prices around $4.50/bushel in early 2024, directly increase production expenses. Energy prices, like crude oil trading near $80/barrel in mid-2024, drive up transportation and processing costs. Policy uncertainties, such as potential changes in trade agreements or labor regulations, further create an unstable operating environment for the dairy supply chain.

The evolving regulatory environment presents a significant threat to HP Hood, as shifts in food safety, labeling, and environmental standards necessitate costly operational adjustments. Potential reforms to the Federal Milk Marketing Order (FMMO) are anticipated to decrease the all-milk price, directly impacting raw material costs and overall profitability for dairy processors. Adapting to these new regulations, such as enhanced traceability requirements expected by early 2025, demands substantial investment in technology and compliance training. These changes could elevate operational expenses and reduce market competitiveness across various product lines.

Labor Shortages and Policy Changes

The dairy industry is grappling with persistent labor shortages, a challenge potentially worsened by evolving immigration policies in 2024 and 2025. This reduced availability of workers directly drives up operational costs, with agricultural wages projected to increase by 4-6% annually. Such a constrained labor pool also introduces significant risks to the reliability of the milk supply chain, impacting large-scale processors like HP Hood.

- Dairy labor shortages are a critical issue, affecting over 50% of U.S. dairy farms in recent surveys.

- Potential shifts in immigration policies could further tighten the labor market for agricultural sectors.

- Increased labor costs, estimated at 4-6% annual growth, directly impact processing margins.

- Supply chain reliability faces threats from reduced staffing for milk collection and processing.

Animal Disease Outbreaks

Animal disease outbreaks, such as highly pathogenic avian influenza impacting dairy herds in 2024, significantly threaten the dairy industry. Such events can reduce milk production, leading to supply shortages and price volatility, as seen with some national output shifts. This creates significant uncertainty and disrupts the raw milk supply chain, directly affecting availability and operational costs for companies like HP Hood.

- By May 2024, HPAI had been detected in dairy herds across at least nine U.S. states.

- The USDA confirmed a 3% decline in U.S. milk production for April 2024 compared to the previous year, partly due to HPAI impacts.

- Futures prices for Class III milk saw increased volatility in Q2 2024 following outbreak news.

HP Hood faces significant threats from intense competition, especially from plant-based alternatives, and volatile market conditions impacting raw material costs like corn at $4.50/bushel in early 2024. Evolving regulations, including FMMO reforms, necessitate costly compliance and could reduce profitability. Persistent labor shortages, with agricultural wages rising 4-6% annually, and animal disease outbreaks like HPAI affecting milk supply, further challenge operations.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Competition | Market Share Erosion | Plant-based sales $2.8B (2023) |

| Market Volatility | Increased Production Costs | Corn $4.50/bushel (early 2024) |

| Labor Shortages | Rising Operational Expenses | Ag wages up 4-6% annually |

| Disease Outbreaks | Supply Chain Disruption | US milk production down 3% (April 2024) |

SWOT Analysis Data Sources

This HP Hood SWOT analysis is built upon a foundation of credible data, including the company's financial statements, comprehensive market research reports, and expert industry analysis to ensure an accurate and actionable assessment.