Horstman SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horstman Bundle

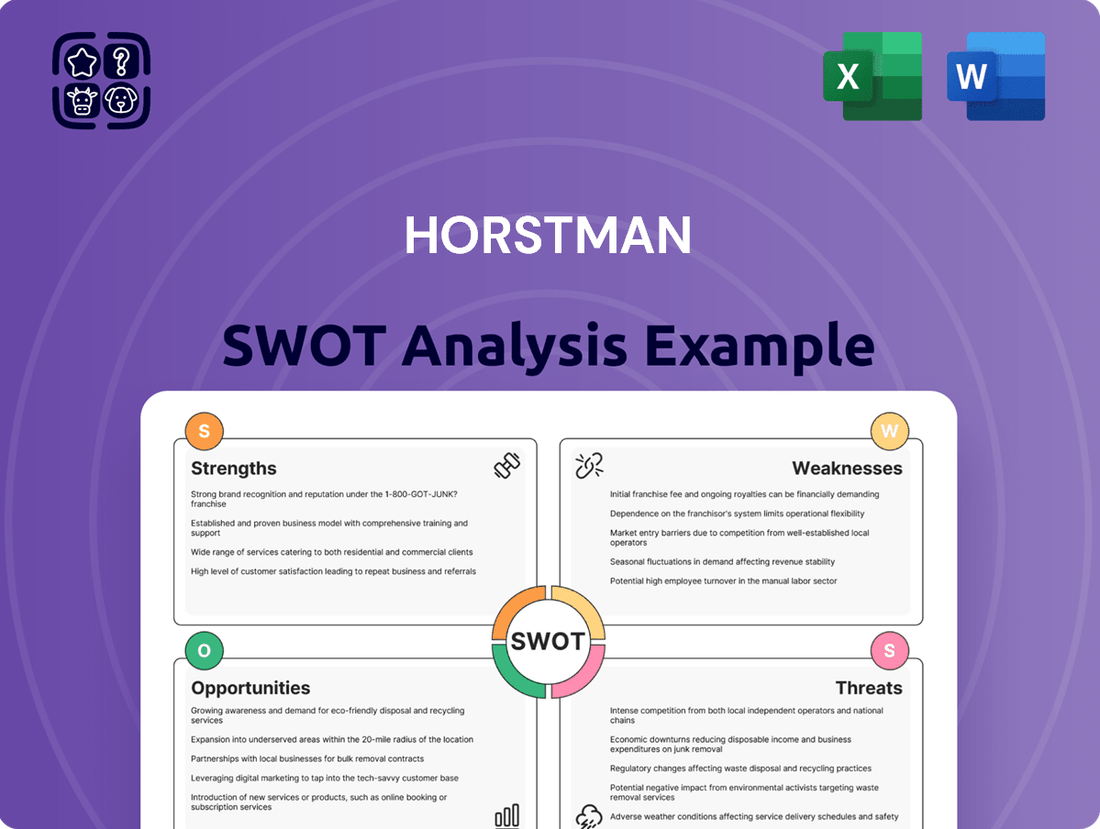

Horstman's strategic position is illuminated by its unique strengths and potential opportunities. Understanding these internal capabilities and external market dynamics is crucial for informed decision-making.

However, to truly grasp Horstman's competitive edge and navigate potential challenges, a deeper dive is essential. Our comprehensive SWOT analysis provides this critical context.

Want the full story behind Horstman's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Horstman stands as a global leader in advanced suspension systems, specifically for military vehicles, a highly specialized field. This dedicated focus enables deep expertise in hydro-pneumatic and rotary damper technologies, fostering a strong reputation for innovation. As a pre-eminent provider, Horstman leverages a significant competitive advantage within this market, characterized by high barriers to entry. This leadership is rooted in over a century of engineering integrity, with its legacy dating back to 1913.

Horstman possesses advanced technological capabilities, standing at the forefront of suspension innovation with products like the InArm® and HydroCore® systems. Continuous investment in research and development ensures cutting-edge solutions that significantly enhance vehicle mobility, performance, and crew survivability. This technological leadership is a core differentiator, securing their selection for major defense initiatives such as the U.S. Army's Mobile Protected Firepower (MPF) program, a contract valued at over $1.1 billion by late 2023.

Horstman, as a vital part of the RENK Group since 2019, benefits significantly from this strong parent company backing. This relationship provides robust financial stability, highlighted by RENK's successful IPO in February 2024, which bolstered capital for the entire group. Horstman leverages RENK's extensive global sales network and strategic resources, enhancing its market reach and credibility. This allows Horstman to operate as an independent specialist while gaining from synergistic opportunities and access to investment for expansion, all within a larger, financially secure corporation with 2023 revenues exceeding €1 billion.

Established Global Presence and Customer Base

Horstman boasts a robust global footprint, operating business units across the UK, USA, and Canada, while extending export sales to 28 countries. This extensive international reach, coupled with collaborations with over 18 blue-chip prime contractors and government research centers, solidifies a broad and trusted network as of 2024. This diverse geographic and customer base significantly mitigates reliance on any single market, laying a strong foundation for sustained global expansion into 2025.

- Global operations in UK, USA, Canada.

- Export sales active in 28 countries.

- Partnerships with over 18 blue-chip prime contractors.

Proven Performance and Long-Term Contracts

Horstman boasts a long-standing reputation for delivering reliable, high-performance products essential for defense, leading to robust, long-term contracts. Their selection for significant multi-year programs, such as the British Army's Boxer vehicle and the U.S. Army's Mobile Protected Firepower (MPF) programs, ensures a stable revenue stream well into 2025 and beyond. This proven track record is critical for defense clients who prioritize unwavering reliability and mission success in their operational procurement.

- Secured multi-year contracts like the British Army's Boxer program, valued in billions, extending through the late 2020s.

- Key supplier for the U.S. Army's MPF program, with production expected to ramp up significantly in 2024-2025.

- High product reliability reinforces customer loyalty and market leadership in defense suspension systems.

Horstman maintains global leadership in advanced military suspension systems, leveraging over a century of specialized engineering and continuous R&D investment in cutting-edge solutions like InArm® and HydroCore® technologies. The firm benefits from RENK Group's robust financial backing, enhanced by RENK's February 2024 IPO, and a broad global footprint spanning 28 export countries. This market position, supported by multi-year defense contracts such as the U.S. Army's MPF program, ensures stable revenue streams well into 2025.

| Key Strength | Metric | 2023/2024 Data |

|---|---|---|

| Technological Leadership | U.S. Army MPF Contract Value | >$1.1 Billion (late 2023) |

| Parent Company Support | RENK Group 2023 Revenue | >€1 Billion |

| Global Reach | Export Countries | 28 Countries (as of 2024) |

What is included in the product

Delivers a strategic overview of Horstman’s internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address strategic challenges, simplifying complex business environments.

Weaknesses

Horstman's revenue stream is heavily dependent on government defense budgets, making it susceptible to political shifts and procurement changes. For instance, a significant 73% of its parent RENK Group’s 2023 revenue, totaling €678 million, originated from the Automotive & Defense segment, underscoring this reliance. This concentration makes the business vulnerable to potential downturns in global defense spending or the cancellation of major vehicle programs, directly impacting its financial stability.

Horstman's strong specialization in high-end military vehicle suspension systems, while a competitive advantage, inherently creates significant market concentration risk. This niche limits their addressable market size, which is far smaller than the broader automotive or industrial sectors, impacting potential revenue diversification. For instance, the global military armored vehicle market, valued at approximately $18 billion in 2024, is a finite segment. A major technological shift, like the increased adoption of electric drive systems or new composite materials in vehicle design, could significantly reduce demand for their traditional hydraulic and hydro-pneumatic solutions, directly threatening their core business and market share.

Horstman, like many defense manufacturers, faces significant supply chain vulnerabilities. Delays in acquiring specialized materials or components from a concentrated pool of qualified suppliers directly impact production schedules and contract fulfillment. Global events, such as ongoing geopolitical tensions in 2024, continue to strain defense supply chains, with lead times for some critical electronic components exceeding 50 weeks. This reliance on a limited number of highly specialized providers heightens the risk of disruption for Horstman's operations.

Long Sales and Procurement Cycles

Operating in the defense sector, Horstman faces incredibly long and complex procurement cycles, where sales can span multiple years from initial bid to final contract. This prolonged process, often exceeding 3-5 years for major defense programs as seen in recent U.S. DoD and UK MoD acquisitions, leads to highly lumpy revenue recognition. Substantial upfront investment in business development is required, with no guarantee of securing a contract, impacting cash flow predictability. For instance, the average lead time for new vehicle programs can extend beyond five years, requiring significant sustained expenditure.

- Defense contract awards often materialize years after initial engagement.

- Revenue recognition becomes unpredictable due to extended cycles.

- Significant upfront investment in bidding incurs high costs without assured returns.

- Major defense platform procurements, like armored vehicles, average 5-7 year lifecycles from concept to deployment.

Integration and Restructuring Challenges

Following its acquisition by RENK and subsequent mergers, such as General Kinetics forming Horstman Canada, the company faces ongoing integration challenges. This complexity is underscored by a reported -1% change in employee count, potentially reflecting efficiency measures or disruption. Ensuring seamless integration of diverse corporate cultures, operational systems, and technologies is critical to realizing the full strategic benefits of these significant mergers. Effective post-merger management is essential for long-term stability and growth.

- RENK's acquisition of Horstman necessitates complex post-merger integration.

- The -1% employee count shift indicates potential restructuring or efficiency drives.

- Merging diverse company cultures and operational systems is a significant hurdle.

- Successful integration is crucial for maximizing strategic benefits and operational synergy.

Horstman’s heavy reliance on government defense budgets, representing 73% of RENK Group’s €678 million 2023 Automotive & Defense revenue, creates significant vulnerability to political shifts. Its niche market in military vehicle suspension systems, a global $18 billion market in 2024, limits diversification and exposes the company to technological disruption. Furthermore, complex post-merger integration challenges, evidenced by a -1% employee count change, impact operational stability and synergy realization. Long procurement cycles, often exceeding 3-5 years for major programs, lead to unpredictable revenue and high upfront investment costs.

| Weakness Area | Key Metric | 2023/2024 Data |

|---|---|---|

| Revenue Concentration | RENK Automotive & Defense Revenue Share | 73% of €678M (2023) |

| Market Size Limitation | Global Military Armored Vehicle Market | ~$18 Billion (2024) |

| Procurement Cycle Length | Major Defense Program Lead Time | 3-5+ Years |

What You See Is What You Get

Horstman SWOT Analysis

You're previewing the actual Horstman SWOT analysis document. The full, detailed report becomes available immediately after purchase.

This preview reflects the real document you'll receive—professional, structured, and ready to use. No surprises, just high-quality analysis.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights.

The file shown below is not a sample—it’s the real Horstman SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Global geopolitical tensions are significantly boosting defense budgets, particularly across Europe and Asia, creating a substantial opportunity. NATO members are projected to collectively spend 2% of their GDP on defense by 2024, a major increase from previous years, driving demand for advanced military hardware. This trend, expected to accelerate into 2025, directly fuels vehicle modernization and new procurement programs worldwide. As nations upgrade armored vehicle fleets, the need for Horstman's advanced suspension systems is set to rise, with the global military vehicle market projected to reach over $28 billion by 2025.

The global defense sector shows a strong trend towards modernizing existing armored vehicle fleets to enhance both performance and survivability. As these vehicles undergo significant up-armoring, the increased weight necessitates more robust suspension systems. Horstman's core competency in advanced suspension technology directly addresses this critical requirement. Projections indicate the armored vehicle upgrade market alone could reach $14 billion by 2025, presenting a substantial aftermarket and upgrade opportunity for Horstman beyond new vehicle builds.

The market for unmanned ground vehicles (UGVs) is expanding rapidly, with global military UGV spending projected to reach over $3.5 billion by 2025. These next-generation autonomous platforms demand sophisticated, reliable, and specialized suspension systems to ensure stability for critical sensors and weapon systems. Horstman's proven expertise in advanced mobility solutions, including its Hydrostrut and InMotion systems, positions it strongly to capture a significant share of this emerging and high-value market segment. This growth provides a substantial opportunity for Horstman to diversify its offerings and leverage its engineering prowess in cutting-edge defense applications.

Expansion into Adjacent Markets and Diversification

Horstman possesses significant opportunities to leverage its core competencies in precision machining and high-integrity engineering for expansion beyond defense. The company has already successfully diversified into adjacent services, evidenced by its 2024 revenue streams including environmental control units. Further strategic moves into sectors like the specialized commercial vehicle market, projected to grow by 5.5% annually through 2025, or specific aerospace components, could substantially reduce its reliance on a single market. This diversification strengthens resilience and broadens the company's revenue base.

- Specialized commercial vehicle market growth: 5.5% CAGR (2024-2025 est.).

- Potential for aerospace component contracts beyond defense.

- Utilize precision machining for non-defense industrial applications.

Technological Advancements and New Product Development

The continuous evolution of vehicle technology presents substantial opportunities for innovation, particularly in advanced suspension systems. Developing next-generation smart or active suspension systems that integrate with vehicle electronics, AI, and advanced sensors can create compelling new value propositions. Innovations like Horstman’s HydroCore scalable architecture already allow for modular solutions adaptable to a wider range of vehicles, including the burgeoning electric vehicle market. The global smart suspension market is projected to reach approximately $13.5 billion by 2025, highlighting significant growth potential.

- Integration of AI and advanced sensors into future suspension systems.

- Expansion of HydroCore architecture across diverse vehicle platforms.

- Targeting the global smart suspension market, estimated at $13.5 billion by 2025.

Horstman can significantly grow by capitalizing on increased global defense spending, with the military vehicle market projected at $28 billion by 2025, and the $14 billion armored vehicle upgrade market. Expanding into the specialized commercial vehicle sector, growing at 5.5% annually through 2025, and the $13.5 billion smart suspension market by 2025 offers substantial diversification. The rapidly expanding $3.5 billion UGV market by 2025 also presents a key opportunity for advanced suspension systems.

| Market Segment | Projected Value (2025) | Growth Driver |

|---|---|---|

| Global Military Vehicles | $28 Billion | Increased Defense Budgets |

| Armored Vehicle Upgrades | $14 Billion | Fleet Modernization |

| Unmanned Ground Vehicles (UGVs) | $3.5 Billion | Next-Generation Platforms |

| Smart Suspension Systems | $13.5 Billion | Technology Integration |

| Specialized Commercial Vehicles | 5.5% CAGR | Diversification beyond Defense |

Threats

Horstman faces intense market competition from both large, diversified defense contractors and specialized component manufacturers. Global players like Curtiss-Wright, with projected 2024 revenues exceeding $2.8 billion in defense segments, and Hyundai WIA, a significant player in defense systems, pose constant challenges. Smaller, specialized firms also vie for contracts, making it crucial for Horstman to maintain a technological and cost-competitive edge. The global defense market, estimated to reach over $2.5 trillion by 2025, demands continuous innovation and efficiency to secure new programs and sustain growth.

A fundamental shift in military doctrine or technology could significantly reduce the emphasis on traditional heavy armored vehicles, directly impacting Horstman's core market. The rise of drone warfare, cyber warfare, and long-range precision munitions is already altering procurement priorities, with projections for 2025 showing increased investment in these areas. For instance, the US Department of Defense's FY2025 budget request highlights a continued pivot towards advanced capabilities and lighter, more expendable platforms, potentially diverting funds from heavy vehicle modernization. While currently a growth area for Horstman, future defense spending could increasingly favor autonomous systems and networked capabilities over conventional armored vehicle platforms.

Geopolitical instability, while potentially increasing defense budgets, creates significant market access challenges for Horstman. Tariffs, such as the persistent 25% US steel tariff or 10% aluminum tariff in 2024, directly elevate production costs for critical components. Continued conflict and regional instability, like that seen in Eastern Europe or the Middle East through 2025, threaten to disrupt Horstman's supply chains and operational continuity in key sourcing regions. This directly impacts profitability and timely delivery of defense systems.

Cybersecurity

As Horstman’s suspension systems increasingly integrate with vehicle electronics and control networks, they become potential targets for sophisticated cyber-attacks. A cybersecurity breach could severely compromise vehicle performance, safety, and mission-critical functionality, posing a significant threat to Horstman’s reputation and client security. Ensuring robust cybersecurity for their advanced products and internal systems is a critical and growing challenge, especially with projected cybercrime costs reaching over $10.5 trillion annually by 2025. This necessitates continuous investment in defensive measures and incident response.

- Automotive cyber incidents surged over 70% in 2024, impacting vehicle systems and data.

- The average cost of a data breach is projected to exceed $5 million by 2025.

Pressure on Defense Budgets and Program Cancellations

Despite current trends showing global defense spending reaching record highs, such as the estimated $2.4 trillion in 2024, national budgets always face pressure from competing priorities like healthcare and education. Future economic downturns or shifts in political focus could lead to sudden budget cuts, impacting defense procurement. This represents a significant threat to Horstman's long-term revenue stability, potentially leading to the cancellation of major vehicle programs for which it is a key supplier.

- Global defense spending, while high in 2024, remains susceptible to future fiscal austerity measures.

- Potential shifts in government priorities post-2025 could redirect funds away from military hardware.

- Economic forecasts for 2025-2026 suggest potential for budget tightening in key markets.

Horstman faces intense competition and risks from evolving military doctrines shifting away from heavy vehicles. Geopolitical instability and tariffs, like the 25% US steel tariff, disrupt supply chains and increase costs. Cybersecurity threats are growing, with automotive cyber incidents surging 70% in 2024. Future defense budget cuts, despite 2024's $2.4 trillion spending, also pose a significant risk.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Competition | Market share erosion | Global defense market >$2.5T by 2025 |

| Technological Shifts | Reduced demand for core products | US DoD FY2025 budget pivot to advanced capabilities |

| Cybersecurity | Reputational damage, operational compromise | Automotive cyber incidents surged 70% in 2024 |

| Budgetary Pressures | Program cancellations, revenue instability | Global defense spending $2.4T in 2024, susceptible to cuts |

| Geopolitical Instability | Supply chain disruptions, increased costs | 25% US steel tariff (2024) |

SWOT Analysis Data Sources

This Horstman SWOT analysis is built upon a robust foundation of verified financial reports, in-depth market research, and expert industry insights. These sources provide the reliable, data-driven information necessary for a comprehensive and accurate strategic assessment.