Hooker Furniture Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hooker Furniture Bundle

Hooker Furniture navigates a competitive landscape shaped by powerful buyer bargaining, intense rivalry, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp their market position.

The complete report reveals the real forces shaping Hooker Furniture’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hooker Furnishings' supplier bargaining power is significantly shaped by the concentration of its raw material sources. When the market for key components like specific hardwoods, metal alloys, or high-quality upholstery fabrics is dominated by a small number of providers, these suppliers gain considerable influence. For instance, if only two or three companies supply a critical type of kiln-dried lumber essential for furniture frames, they can dictate higher prices or stricter payment terms, directly impacting Hooker's costs. This limited supplier pool grants them leverage, as Hooker has fewer viable alternatives.

The availability of substitute materials for furniture production directly influences the bargaining power of suppliers. If Hooker Furniture can easily switch between different wood types, fabrics, or metal components, or source them from multiple vendors, the leverage of any single supplier diminishes considerably. For instance, a surge in the price of a specific hardwood might be mitigated if Hooker can readily adopt a more affordable but comparable alternative, thereby limiting the supplier's ability to dictate terms.

The bargaining power of suppliers for Hooker Furniture is significantly influenced by how critical their inputs are to the final quality and uniqueness of Hooker's products. If a supplier offers a specialized component or a proprietary finish that is essential to Hooker's brand image for high quality, that supplier holds considerable leverage. For instance, access to unique wood grains or patented upholstery materials can make a supplier indispensable, increasing their ability to negotiate terms.

Switching Costs for Hooker Furnishings

The bargaining power of suppliers for Hooker Furnishings is influenced by the costs and complexities involved in switching to an alternative provider. If Hooker Furnishings incurs significant expenses or operational disruptions when changing suppliers, such as the need for new equipment, product redesigns, or the establishment of entirely new distribution networks, then current suppliers gain leverage.

Hooker Furnishings has been strategically addressing supply chain challenges, including efforts to mitigate U.S. port congestion and shorten delivery times. These initiatives, such as expanding operations in Vietnam, could potentially alter the switching costs associated with their suppliers.

- Supplier Dependence: The extent to which Hooker Furnishings relies on a limited number of suppliers for critical components or materials directly affects supplier power.

- Switching Costs: High costs for Hooker Furnishings to change suppliers, including investment in new machinery or product re-engineering, strengthen suppliers' positions.

- Supplier Concentration: If the supply market is concentrated with few dominant players, these suppliers can exert greater influence.

- Input Differentiation: When the inputs provided by suppliers are highly specialized or unique, making them difficult to substitute, suppliers' bargaining power increases.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into furniture manufacturing presents a significant risk to companies like Hooker Furnishings. If a key supplier, for instance, a major wood panel producer or a specialized hardware manufacturer, were to establish its own furniture production lines, it could disrupt the existing supply chain and create a direct competitive challenge. This move would inherently boost the supplier's bargaining power, as they would then control both the input materials and the finished product, potentially dictating terms to their former customers.

Consider the implications for a company reliant on a single, high-quality upholstery fabric supplier. If that supplier decided to launch its own line of upholstered furniture, it could simultaneously withdraw its crucial materials from the open market or significantly increase prices for competitors. This scenario would leave furniture manufacturers scrambling for alternatives, potentially with inferior quality or higher costs. In 2024, the global furniture market saw continued supply chain volatility, making such forward integration a more plausible strategic consideration for suppliers seeking to capture greater value.

- Supplier Forward Integration Risk: Suppliers entering furniture manufacturing directly challenges existing players.

- Leverage Gain: This integration grants suppliers significant control over both raw materials and finished goods.

- Market Impact: Furniture companies could face material shortages or price hikes from former suppliers.

- 2024 Context: Supply chain disruptions in 2024 heightened the strategic viability of supplier forward integration.

The bargaining power of Hooker Furnishings' suppliers is a critical factor in its operational costs and profitability. When suppliers are few and concentrated, or when their products are highly differentiated and difficult to substitute, they can command higher prices. For example, in 2024, the global furniture industry continued to grapple with the availability and cost of specialized lumber and high-performance fabrics, giving dominant suppliers significant leverage. This power is amplified if Hooker faces substantial costs or operational disruptions when switching to alternative suppliers, making supplier relationships a key strategic consideration.

| Factor | Impact on Hooker Furnishings | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier leverage. | Continued consolidation in key material markets. |

| Switching Costs | High switching costs empower existing suppliers. | Investment in specialized machinery for new materials can be prohibitive. |

| Input Differentiation | Unique inputs grant suppliers pricing power. | Proprietary finishes or specific wood grains remain in demand. |

| Supplier Forward Integration | Suppliers entering manufacturing pose a competitive threat. | Heightened volatility in 2024 made this a more attractive strategy for some suppliers. |

What is included in the product

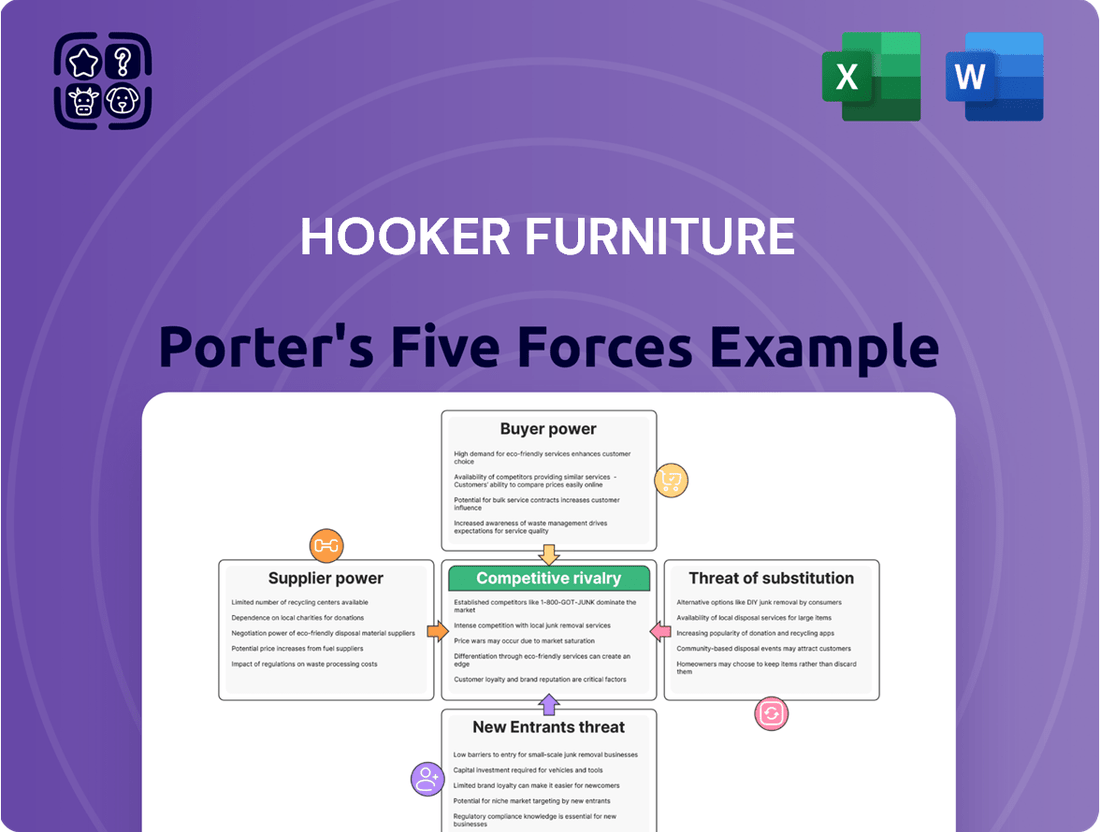

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Hooker Furniture, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of buyer power, supplier power, new entrants, substitutes, and existing rivalry.

Customers Bargaining Power

Hooker Furnishings' customers' sensitivity to price directly influences their bargaining power. When the furniture market is crowded with numerous alternatives, consumers are more inclined to switch to lower-priced brands, thereby increasing their leverage.

The furniture sector has experienced a period of subdued demand and heightened promotional activity, indicating that price sensitivity is indeed a significant consideration for customers. For instance, in the first quarter of 2024, the U.S. furniture and home furnishings stores saw a 3.1% decrease in sales compared to the previous year, reflecting a cautious consumer spending environment where price often plays a crucial role in purchasing decisions.

The availability of numerous substitute products significantly bolsters customer bargaining power in the furniture industry. Hooker Furnishings faces this reality as consumers can readily find alternatives from a vast array of competitors, offering diverse styles, price points, and purchasing avenues, including online retailers.

In 2024, the furniture market continues to be characterized by intense competition, with many brands vying for consumer attention. This abundance of choice means customers can easily switch suppliers if they perceive better value or are dissatisfied with Hooker Furnishings' offerings, thereby increasing their leverage.

Customers wield significant influence when they possess ample information regarding product pricing, quality benchmarks, and the competitive landscape. This transparency allows them to scrutinize offerings and demand better value, directly impacting a company's pricing strategies and profit margins.

The furniture industry has seen a dramatic surge in customer power, largely driven by the proliferation of e-commerce and online review platforms. In 2024, consumers can effortlessly compare prices, read detailed product reviews, and view competitor offerings, making informed purchasing decisions more accessible than ever before. This heightened transparency means Hooker Furniture must remain competitive not only on product but also on price and customer experience to retain its market share.

Volume of Purchases by Individual Customers

The volume of furniture purchased by individual customers, especially large retailers or hospitality businesses, significantly impacts their bargaining power with manufacturers like Hooker Furniture. These high-volume buyers can negotiate more favorable pricing, payment terms, and even request customized product features due to the substantial revenue they represent.

Hooker Furnishings operates through various sales channels, including furniture retailers, interior designers, and e-commerce. Large furniture chains and mass merchants are particularly important, as their considerable purchasing volumes give them substantial leverage in negotiations.

- High-volume buyers, such as major furniture retailers, can command better pricing due to the sheer quantity of goods they procure.

- Negotiating power extends to terms and conditions, allowing large customers to secure more favorable payment schedules or delivery arrangements.

- The ability to request customization options is often tied to purchase volume, enabling significant clients to influence product design and specifications.

- Hooker Furnishings' reliance on large retail partners means these customers are key players in shaping the company's pricing and product strategies.

Switching Costs for Customers

Hooker Furniture's customers face relatively low switching costs, which amplifies their bargaining power. The effort to find alternative furniture suppliers is generally minimal, and there are few significant impacts on complementary purchases when a customer decides to switch brands. This ease of transition means customers can readily shift their business if they perceive better value or service elsewhere.

For instance, in the broader furniture market, a customer looking for a new sofa can easily compare prices and styles from multiple retailers and manufacturers online and in-store. The financial commitment, while present, doesn't typically lock them into a long-term relationship with a single brand. This lack of a strong lock-in effect empowers customers to demand more favorable terms from Hooker Furniture.

- Low Switching Effort: Customers can easily research and purchase furniture from competing brands.

- Minimal Complementary Impact: Switching furniture brands rarely disrupts other purchases or services.

- Price Sensitivity: Lower switching costs make customers more sensitive to price differences between brands.

Hooker Furnishings faces considerable customer bargaining power due to low switching costs and the availability of numerous substitutes. In 2024, consumers can easily compare prices and styles online, making it simple to shift to competitors. This environment necessitates competitive pricing and strong customer service to retain business.

High-volume buyers, such as large furniture retailers, possess significant leverage, enabling them to negotiate better pricing and terms. For example, major chains can secure more favorable payment schedules or delivery arrangements, directly influencing Hooker Furnishings' operational strategies and profit margins.

Customer price sensitivity remains a key factor, amplified by a cautious spending climate observed in early 2024. With U.S. furniture and home furnishings stores experiencing a sales decrease in Q1 2024, customers are more inclined to seek value, increasing their power to demand better deals.

| Factor | Impact on Hooker Furnishings | 2024 Relevance |

| Low Switching Costs | Amplifies customer power; easy to switch brands. | Minimal effort to find alternatives online. |

| Availability of Substitutes | Increases customer choice and leverage. | Vast online and brick-and-mortar competition. |

| Price Sensitivity | Customers demand better value due to economic conditions. | Q1 2024 sales decline indicates cautious spending. |

| High-Volume Buyers | Negotiate favorable pricing and terms. | Large retailers hold significant influence. |

Preview Before You Purchase

Hooker Furniture Porter's Five Forces Analysis

This preview shows the exact, comprehensive Hooker Furniture Porter's Five Forces Analysis you'll receive immediately after purchase. It details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the furniture industry. You'll gain actionable insights into the strategic positioning and potential challenges faced by Hooker Furniture.

Rivalry Among Competitors

The furniture industry is quite crowded, with many companies competing for customers. You have big names like Bassett Furniture, Ethan Allen, and La-Z-Boy, but also many smaller, specialized companies and a growing number of online sellers. This means there's a lot of competition for market share.

A slower industry growth rate naturally intensifies competitive rivalry. When the overall market isn't expanding quickly, companies must battle more aggressively for market share, often leading to price wars or increased promotional activity. This dynamic directly impacts profitability.

The home furnishings retail sector, for instance, has seen sluggish demand in recent periods. Factors such as elevated interest rates and a general slowdown in housing market activity have contributed to this trend. Consequently, businesses within this industry are compelled to compete more fiercely for the available consumer spending, putting pressure on Hooker Furniture.

Hooker Furnishings' ability to make its products stand out from rivals is a key factor in how intense the competition is. When furniture is very similar across different companies, the battle often comes down to who offers the lowest price, which naturally heats up rivalry. For instance, in 2023, the U.S. furniture and bedding stores industry saw a revenue of approximately $124.5 billion, indicating a large and competitive market where differentiation is crucial.

Hooker Furnishings actively works to differentiate itself by offering a wide range of furniture styles and operating under several distinct brands. This strategy allows them to appeal to various customer preferences and market segments, from value-conscious buyers to those seeking higher-end, specialized pieces. This multi-brand approach helps them carve out unique market positions rather than competing solely on price.

Exit Barriers

Hooker Furniture likely faces moderate exit barriers. The company's investments in manufacturing facilities and distribution networks represent significant fixed costs. These specialized assets, while valuable, might not easily be redeployed to other industries, making a complete exit costly.

The presence of these exit barriers can indeed prolong the presence of struggling companies within the furniture market. This means even less profitable competitors might persist, leading to sustained price competition and pressure on overall industry profitability. For instance, in 2023, the U.S. furniture industry experienced a slight contraction in sales, a scenario where companies with high exit barriers might be less inclined to cease operations.

- Specialized Assets: Hooker Furniture's manufacturing plants and equipment are tailored for furniture production, limiting their resale value in other sectors.

- High Fixed Costs: Maintaining factories, warehouses, and a distribution fleet incurs substantial ongoing expenses, making it difficult to cease operations without significant write-offs.

- Market Persistence: Companies with these barriers may continue to operate even at low profitability, intensifying rivalry and potentially impacting Hooker Furniture's market share and pricing power.

Strategic Stakes

The furniture market's inherent importance to competing firms significantly fuels competitive rivalry. Companies heavily invested in manufacturing, distribution, and brand development in this sector will fiercely battle for market share. Hooker Furnishings, for instance, has undertaken strategic restructuring, indicating the high stakes involved in maintaining its competitive standing.

This intense competition is evident in the industry's dynamics. For example, in 2023, the U.S. furniture and bedding market generated approximately $125 billion in revenue, highlighting the substantial financial incentives driving competition among players like Hooker Furnishings.

- High Investment: Significant capital is tied up in factories, supply chains, and marketing, making it difficult for companies to exit and encouraging them to fight for every sale.

- Brand Loyalty: Established furniture brands cultivate customer loyalty, forcing newer entrants or smaller players to invest heavily in marketing to gain traction.

- Product Differentiation: While some competition is price-based, many firms differentiate through design, quality, and customization, leading to a complex competitive landscape.

- Market Saturation: In certain segments, the market can become saturated, intensifying the struggle for consumer attention and purchase.

Competitive rivalry within the furniture industry is significant, driven by a crowded marketplace and a mature growth rate. Hooker Furnishings, like its peers, faces intense pressure from numerous competitors, ranging from large established brands to smaller niche players and online retailers.

The U.S. furniture and bedding market generated approximately $125 billion in revenue in 2023, underscoring the substantial financial incentives for companies to aggressively compete for market share. This high level of competition often translates into price sensitivity among consumers and a need for continuous innovation and marketing efforts from companies like Hooker Furnishings.

| Key Factor | Impact on Hooker Furnishings | Supporting Data (2023) |

|---|---|---|

| Market Crowding | Intensifies competition for customers and market share. | U.S. Furniture & Bedding Revenue: ~$125 billion |

| Industry Growth Rate | Slower growth necessitates more aggressive competition for existing demand. | General slowdown in housing market activity impacting demand. |

| Product Differentiation | Crucial for avoiding price-based competition; Hooker uses multi-brand strategy. | Industry revenue indicates significant consumer spending, but differentiation is key. |

| Exit Barriers | Can keep less profitable competitors in the market, sustaining rivalry. | Specialized assets and high fixed costs limit easy exits for industry players. |

SSubstitutes Threaten

The threat of substitutes for Hooker Furniture extends beyond direct competitors within the furniture sector. Consider the growing trend towards multi-functional spaces and integrated home solutions. For instance, custom built-in cabinetry can replace the need for separate bookshelves or entertainment units, directly impacting demand for traditional furniture pieces. In 2024, the home renovation market saw significant growth, with many homeowners opting for space-saving, built-in solutions as a primary design choice.

The attractiveness of substitutes for traditional wood furniture hinges on their price-performance trade-off. Materials like metal and plastic, often significantly cheaper, present a viable alternative for consumers prioritizing cost savings, even if they don't perfectly match the look or durability of wood.

For instance, in 2024, the average price of a metal dining chair could be 30-50% lower than a comparable solid wood chair, making it a compelling option for budget-conscious buyers or those furnishing high-traffic areas where durability is key. This price advantage can draw consumers away from traditional furniture manufacturers like Hooker Furniture.

Customers' willingness to switch to alternative solutions is a significant factor for Hooker Furniture. While the basic need for furniture persists, shifts in consumer behavior, such as a growing preference for rented or pre-owned furniture driven by budget considerations or environmental awareness, could elevate the likelihood of substitution for new furniture purchases.

Technological Advancements in Substitutes

Technological advancements are continuously reshaping industries, and the threat of substitutes in the furniture sector is no exception. Emerging technologies could introduce novel alternatives that challenge traditional furniture offerings. For instance, smart home integration might offer solutions that reduce the reliance on conventional furniture pieces. Advanced material science could also lead to innovative materials that provide functionality currently fulfilled by furniture, potentially altering consumer preferences.

While not an immediate direct threat to the core purpose of furniture – providing comfort and utility – these technological shifts warrant attention. The furniture industry itself is not static; it's actively embracing new technologies. Companies like Hooker Furniture are incorporating augmented reality (AR) into their customer experience, allowing shoppers to visualize furniture in their own homes. This integration of technology within the industry can, in turn, mitigate the threat from external technological substitutes by enhancing the value proposition of traditional furniture.

Consider the potential impact of 3D printing on furniture customization and on-demand production, which could offer alternatives to mass-produced items. Furthermore, advancements in sustainable and biodegradable materials might present substitutes that appeal to environmentally conscious consumers. The pace of these changes means that monitoring technological trends remains crucial for understanding the evolving competitive landscape.

Switching Costs for Customers to Substitutes

The threat of substitutes for Hooker Furniture is generally moderate, largely due to the switching costs involved for consumers. When customers consider moving from Hooker Furniture to an alternative, the effort, expense, or disruption required plays a significant role. For instance, replacing a substantial piece of furniture like a sofa or dining set often involves more than just a simple transaction; it can require delivery coordination, assembly, and disposal of the old item, all of which contribute to higher switching costs.

The nature of furniture as a durable good and a significant household investment also inherently raises the barrier to switching. Consumers typically don't replace furniture frequently, and when they do, it's often a considered purchase. This long-term perspective means that switching to a substitute product that doesn't meet expectations in terms of quality, style, or durability can be a costly mistake, both financially and aesthetically. For example, a customer investing in a solid wood dining table from Hooker Furniture may face considerable inconvenience and expense if they later decide to switch to a lower-quality, mass-produced alternative that doesn't hold up over time.

Here's a breakdown of switching costs impacting the threat of substitutes:

- High Initial Investment: Furniture purchases represent a significant outlay for consumers, making them hesitant to switch without strong justification.

- Logistical Hurdles: Delivery, assembly, and potential disposal of old furniture add complexity and cost to switching.

- Brand Loyalty and Style Consistency: Consumers often build loyalty to brands like Hooker Furniture that align with their aesthetic preferences, making it harder to switch to unfamiliar styles or quality levels.

- Durability and Longevity Concerns: The expectation of long-term use means customers are wary of switching to substitutes that might offer lower quality or shorter lifespans, leading to repeated replacement costs.

The threat of substitutes for Hooker Furniture is moderate, primarily due to significant switching costs for consumers. These costs include the initial investment in durable goods, logistical complexities like delivery and assembly, and the desire for style consistency. For example, consumers often invest in solid wood pieces, making a shift to lower-quality alternatives a costly mistake in the long run.

While custom built-ins and space-saving solutions offer alternatives, their appeal is often tied to specific design trends rather than a complete replacement of furniture's core function. In 2024, the home renovation market's growth indicated a continued demand for integrated solutions, but these often complement rather than entirely substitute traditional furniture pieces.

The price-performance ratio of substitutes like metal or plastic furniture also plays a role. In 2024, metal dining chairs were often 30-50% cheaper than comparable wood chairs, presenting a budget-friendly alternative. However, the durability and aesthetic appeal of Hooker Furniture's offerings often outweigh these cost savings for many consumers.

Emerging technologies like 3D printing and advanced materials could introduce new substitutes, but their widespread adoption as direct replacements for core furniture functions remains limited. Hooker Furniture's own integration of AR technology aims to enhance the value of traditional furniture, potentially mitigating these future threats.

Entrants Threaten

The furniture industry, including companies like Hooker Furniture, demands considerable upfront capital. Establishing design studios, manufacturing plants, and robust distribution networks requires millions in investment. For instance, setting up a modern furniture factory with advanced machinery and automation can easily cost tens of millions of dollars, creating a substantial hurdle for potential new competitors.

Hooker Furniture, like many established players in the furniture industry, benefits significantly from economies of scale. This means their large-scale production allows them to spread fixed costs over a greater number of units, leading to lower per-unit manufacturing costs. For instance, in 2023, Hooker reported net sales of $1.02 billion, indicating a substantial operational volume that underpins their cost advantages.

This cost advantage is a formidable barrier for new entrants. A newcomer would need to invest heavily to achieve comparable production volumes and secure favorable pricing from suppliers for raw materials and components. Without this scale, new companies would struggle to match Hooker's pricing, making it challenging to gain market share and compete effectively on cost.

Hooker Furniture benefits from strong brand recognition and customer loyalty, built over decades. This established reputation acts as a significant barrier for new entrants, who would struggle to quickly replicate the trust and preference consumers have for existing players like Hooker. The company's diverse brand portfolio further solidifies this advantage.

Access to Distribution Channels

New companies entering the furniture market face significant challenges in securing access to established distribution channels. Retailers, interior designers, and major e-commerce platforms often have existing relationships with suppliers like Hooker Furniture, making it difficult for newcomers to gain shelf space, both physical and digital.

These established relationships mean new entrants must invest heavily to build their own distribution networks or pay premiums for limited access. For instance, in 2024, the furniture retail sector saw continued consolidation, with larger chains and online marketplaces commanding significant bargaining power, further complicating market entry for smaller or newer brands.

- Limited Retail Shelf Space: Securing prime placement in brick-and-mortar stores is a major barrier, as existing brands have long-standing agreements.

- E-commerce Dominance: Penetrating top-tier online furniture marketplaces requires substantial marketing budgets and often favorable terms that are hard for new players to meet.

- Interior Designer Partnerships: Building trust and securing recommendations from influential interior designers is crucial but takes time and consistent effort.

- Logistics and Supply Chain: New entrants must also establish efficient logistics to support their distribution, a costly undertaking compared to established players with optimized supply chains.

Government Policy and Regulations

Government policies and trade regulations significantly influence the threat of new entrants in the furniture market. For instance, evolving trade policies and tariffs can introduce substantial costs and complexities for new companies aiming to establish import-reliant supply chains. The furniture industry, particularly in 2024, has navigated ongoing discussions around trade agreements and potential import duties, directly impacting the financial feasibility for emerging players.

These regulatory shifts can act as a barrier, increasing the capital required and the operational uncertainty for newcomers. Companies like Hooker Furniture must constantly adapt to these changing trade landscapes, which can deter smaller, less capitalized entrants. The potential for tariffs to fluctuate means new businesses face unpredictable cost structures, making market entry more challenging.

- Tariff Uncertainty: Recent trade disputes have led to fluctuating tariffs on furniture imports, increasing costs and supply chain risks for new entrants.

- Regulatory Compliance: New businesses must navigate complex import regulations, safety standards, and environmental policies, adding to initial setup costs.

- Trade Agreements: Changes in international trade agreements can alter the competitive landscape, potentially favoring established players with existing global networks.

The threat of new entrants for Hooker Furniture is generally moderate due to significant capital requirements for manufacturing and distribution, coupled with established brand loyalty. However, evolving e-commerce platforms and niche market opportunities can present avenues for new, agile competitors. In 2024, the furniture industry continues to see innovation in direct-to-consumer models, which can lower initial barriers.

| Barrier to Entry | Impact on New Entrants | Hooker Furniture's Advantage |

|---|---|---|

| Capital Investment (Manufacturing & Distribution) | High | Significant economies of scale and established networks |

| Brand Recognition & Customer Loyalty | High | Decades of building trust and diverse brand portfolio |

| Distribution Channel Access | High | Long-standing relationships with retailers and designers |

| Regulatory & Trade Policies | Moderate to High | Ability to absorb fluctuating tariffs and compliance costs |

| E-commerce & DTC Models | Moderate | Requires agile digital strategy to counter |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hooker Furniture leverages data from industry-specific market research reports, financial statements, and publicly available company filings to assess competitive intensity.

We gather insights from trade associations, economic databases, and competitor financial disclosures to understand the bargaining power of buyers and suppliers impacting Hooker Furniture.