Hooker Furniture Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hooker Furniture Bundle

Unlock the strategic blueprint behind Hooker Furniture's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they effectively serve diverse customer segments, leverage key partnerships, and create compelling value propositions in the competitive furniture market.

Dive deeper into Hooker Furniture’s operational engine—from their core activities and resources to their revenue streams and cost structure. This downloadable canvas offers a clear, professionally written snapshot of what makes this company thrive and where its future opportunities lie.

Want to see exactly how Hooker Furniture operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations. Get the full picture today!

Partnerships

Hooker Furniture depends on a worldwide web of providers for wood, metal, leather, fabric, and other essential parts for their furniture. Strong ties with these suppliers are key to ensuring consistent quality, favorable pricing, and a dependable supply chain, vital for producing their wide array of items.

In 2024, Hooker Furniture continued to leverage strategic sourcing from diverse regions like Vietnam, Mexico, Malaysia, and India. This geographical diversification is a critical risk management strategy, helping to buffer against potential disruptions in any single sourcing location.

Hooker Furniture heavily relies on independent furniture retailers and large furniture chains as a primary distribution channel. These partnerships are crucial for exposing Hooker's wide array of products, from dining sets to living room pieces, to a diverse customer base. The company's sales figures are intrinsically linked to how well these retail partners perform.

Hooker Furniture actively collaborates with interior designers and hospitality firms, such as Samuel Lawrence Hospitality and H Contract, to serve the contract and hospitality sectors. These partnerships are crucial for delivering tailored furniture solutions for diverse commercial projects including hotels and senior living communities.

Through these strategic alliances, Hooker Furniture leverages its extensive design expertise and sourcing networks. This allows them to effectively meet the specific demands of the hospitality market, which often requires durable, stylish, and functional furniture. For instance, in 2024, the hospitality furniture market saw continued growth, with demand for customized and sustainable options increasing significantly.

E-commerce Platforms

Hooker Furniture's engagement with major e-commerce platforms is a critical component of its strategy to reach a wider customer base. These partnerships enable direct-to-consumer sales, augmenting their traditional wholesale and retail channels. For instance, in 2023, online retail sales continued to show robust growth, with furniture being a significant category, indicating the importance of these digital storefronts for brands like Hooker.

These collaborations allow Hooker Furniture to tap into the vast digital marketplaces, providing access to consumers who prefer online shopping. This expands their market presence beyond physical showrooms and independent retailers, directly addressing the evolving consumer purchasing habits. The furniture industry, in general, has seen a substantial shift towards online channels, with many consumers now comfortable purchasing larger items sight unseen, relying on detailed product descriptions and reviews.

- Expanded Reach: E-commerce platforms provide access to millions of potential customers who might not visit physical stores.

- Direct-to-Consumer (DTC) Sales: Facilitates direct transactions, potentially improving margins and customer data collection.

- Market Trend Alignment: Caters to the growing consumer preference for online furniture purchases, a trend that has accelerated in recent years.

- Sales Channel Diversification: Reduces reliance on traditional retail, creating a more resilient business model.

Logistics and Distribution Partners

Hooker Furniture relies on a robust network of logistics and distribution partners to manage its global supply chain effectively. These partnerships are fundamental to ensuring products reach customers efficiently, especially given the company's international presence.

The company leverages specialized logistics providers for warehousing and transportation services. This includes managing distribution centers strategically located to optimize delivery times. As of recent reporting, key distribution hubs are situated in Virginia and Georgia within the United States, and importantly, in Vietnam, reflecting Hooker Furniture's significant international manufacturing and distribution footprint.

These partnerships are crucial for maintaining timely delivery to a wide range of retailers and end consumers. The efficiency of these logistics operations directly impacts customer satisfaction and the overall cost-effectiveness of the business model.

- Strategic Distribution Centers: Operations are supported by distribution centers in Virginia, Georgia, and Vietnam.

- Logistics Service Providers: Partnerships with external companies for warehousing and transportation are essential.

- Timely Delivery: The network ensures efficient product movement to retailers and direct customers.

- Global Supply Chain Management: These partners are integral to managing the complexities of international furniture distribution.

Hooker Furniture's key partnerships extend to technology providers and software developers who support their e-commerce platforms and internal operations. These collaborations are vital for maintaining a competitive edge in the digital marketplace and streamlining business processes. For example, in 2024, investments in advanced CRM systems and data analytics tools were prioritized to better understand customer behavior and personalize marketing efforts.

The company also engages with financial institutions and investment partners to secure capital for growth and operational needs. These relationships are fundamental for funding expansion, acquisitions, and research and development initiatives. In the first half of 2024, Hooker Furniture reported securing new credit facilities to support its ongoing strategic investments.

Furthermore, Hooker Furniture collaborates with industry associations and research organizations to stay abreast of market trends, regulatory changes, and best practices. These affiliations foster innovation and provide valuable insights into the evolving furniture landscape.

What is included in the product

This Business Model Canvas for Hooker Furniture outlines their strategy for reaching diverse customer segments through various channels, delivering value via a wide product range and strong brand. It details key resources and activities, focusing on manufacturing efficiency and design innovation to maintain competitive advantages.

Saves hours of formatting and structuring your own business model by providing a clear, visual representation of Hooker Furniture's strategy.

Condenses Hooker Furniture's company strategy into a digestible format for quick review, simplifying complex business operations.

Activities

Hooker Furniture's key activity is the continuous design and development of new furniture lines, including casegoods, upholstery, and accent pieces. This process is fueled by extensive market research and trend analysis to ensure their offerings are both innovative and stylish, catering to diverse consumer preferences.

In 2023, Hooker Furniture reported net sales of $834.1 million, reflecting their ability to bring appealing new products to market. Their design teams focus on translating current consumer tastes and emerging interior design trends into tangible furniture collections.

Hooker Furniture's key activities revolve around a dual strategy of domestic manufacturing and global sourcing. They produce high-quality, custom leather and fabric-upholstered furniture within the United States, ensuring meticulous craftsmanship for their premium offerings.

Complementing this, the company actively sources and imports a diverse array of residential and hospitality furniture from international markets. This global reach allows them to offer a broad product selection and manage costs effectively, as seen in their extensive import operations.

In 2023, Hooker Furniture reported net sales of $1.03 billion, with their diverse sourcing and manufacturing capabilities contributing to this robust performance. This balance between in-house production and international partnerships is crucial to their business model.

Hooker Furniture's brand management and marketing are crucial. They oversee distinct brands like Hooker Casegoods, Bradington-Young, Pulaski, and Sunset West, each tailored for specific customer groups and sales avenues. This involves carefully nurturing each brand's identity and market standing.

A core activity is ensuring each brand's unique value is clearly communicated. This strategic marketing effort aims to resonate with their respective target audiences, reinforcing brand loyalty and driving sales across their diverse product lines.

Sales and Distribution Network Management

Hooker Furniture's sales and distribution network management is a core activity, focusing on nurturing relationships with a diverse range of partners. This involves working closely with furniture retailers, interior designers, and online marketplaces to ensure their products reach consumers effectively.

The company actively optimizes its showroom presence and distribution infrastructure. This strategic approach guarantees a smooth and efficient flow of goods from production facilities right to the customer's doorstep, a critical element in maintaining customer satisfaction and operational excellence.

- Retailer Relationships: Maintaining strong ties with approximately 10,000 furniture retailers globally.

- E-commerce Integration: Expanding presence on major online platforms, contributing to a significant portion of sales growth.

- Distribution Efficiency: Operating a network of distribution centers designed for rapid order fulfillment, with a focus on reducing lead times.

- International Reach: Managing distribution channels to serve customers across North America and select international markets.

Supply Chain Optimization and Cost Reduction

Hooker Furniture's supply chain optimization is a crucial ongoing activity. This involves meticulously managing inventory to meet demand without excess carrying costs and streamlining logistics for efficient product movement. For instance, in fiscal year 2024, the company focused on improving lead times and reducing transportation expenses to bolster its bottom line.

Cost reduction initiatives are deeply intertwined with supply chain efforts. These actions aim to enhance profitability and ensure financial resilience, especially when facing economic uncertainties. Hooker Furniture consistently seeks opportunities to negotiate better terms with suppliers and improve operational efficiencies across its network.

- Inventory Management: Maintaining optimal stock levels to balance availability with carrying costs.

- Logistics Efficiency: Streamlining transportation and warehousing to reduce transit times and expenses.

- Supplier Negotiations: Continuously working to secure favorable pricing and terms with material and component providers.

- Operational Improvements: Implementing process enhancements within manufacturing and distribution to lower overall costs.

Hooker Furniture's core activities encompass the entire product lifecycle, from initial design and development to efficient sales and distribution. They are deeply involved in sourcing materials and manufacturing furniture, both domestically and internationally, to offer a wide product range. Crucially, they manage a portfolio of distinct brands, each with targeted marketing efforts to connect with specific customer segments.

The company's operational efficiency is further bolstered by robust supply chain management and ongoing cost reduction initiatives. These activities are designed to ensure product availability, minimize expenses, and ultimately enhance profitability. For example, in fiscal year 2024, Hooker Furniture reported a net sales increase to $1.08 billion, demonstrating the effectiveness of these integrated activities.

| Key Activity | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Design & Development | Creating new furniture lines based on market trends. | Drove product innovation and market appeal. |

| Manufacturing & Sourcing | Domestic production and global import of furniture. | Supported diverse product offerings and cost management. |

| Brand Management | Nurturing distinct brands like Hooker Casegoods and Pulaski. | Enhanced market positioning and customer connection. |

| Sales & Distribution | Managing relationships with retailers and e-commerce platforms. | Ensured broad product accessibility and efficient delivery. |

| Supply Chain & Cost Reduction | Optimizing inventory, logistics, and supplier terms. | Improved lead times, reduced expenses, and boosted profitability. |

Preview Before You Purchase

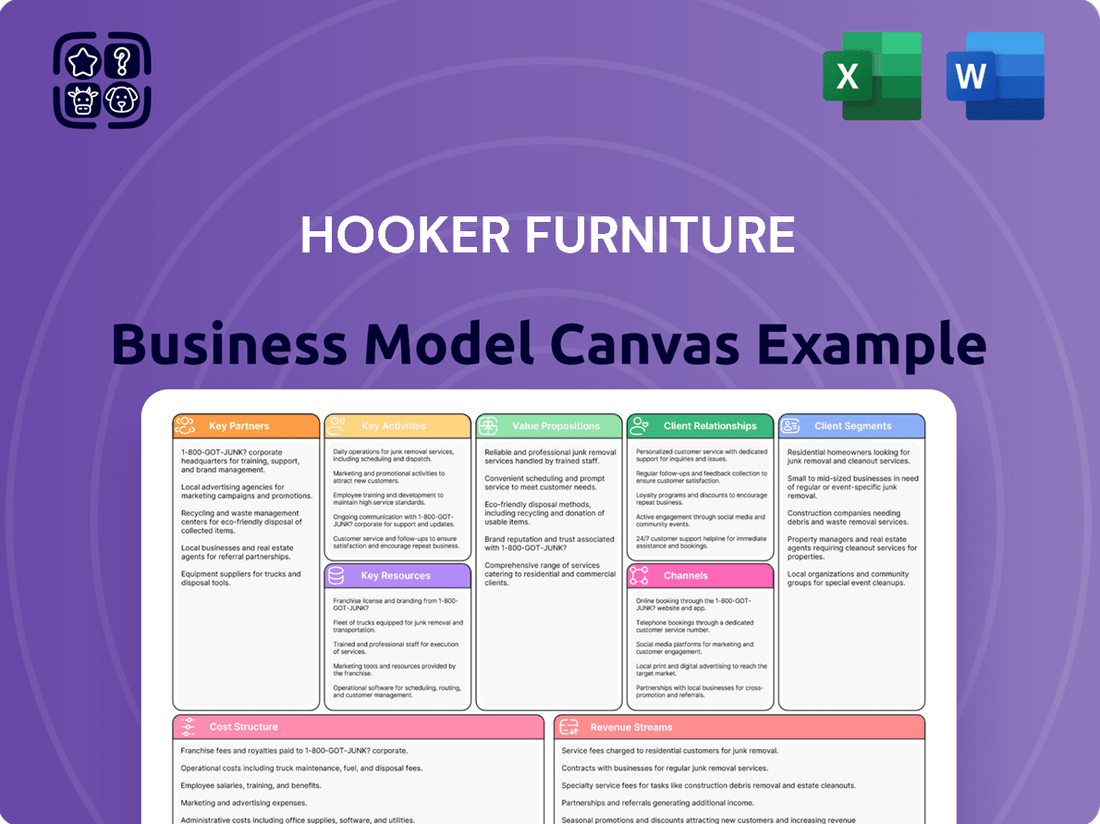

Business Model Canvas

The Hooker Furniture Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're getting a direct look at the comprehensive analysis of Hooker Furniture's strategic elements, including customer segments, value propositions, channels, and revenue streams. Once your order is complete, you'll have full access to this same, professionally structured document, ready for your review and application.

Resources

Hooker Furniture's diverse brand portfolio, including names like Hooker Casegoods, Bradington-Young, HF Custom, Pulaski, Samuel Lawrence Furniture, and Sunset West, represents a significant key resource. This collection of brands allows the company to effectively reach a broad spectrum of consumers across various price points and style preferences in both residential and hospitality markets.

Hooker Furniture's design and merchandising team, led by a Chief Creative Officer, is a core intellectual asset. This group’s ability to spot emerging trends and craft appealing product assortments is crucial for staying ahead in the furniture market.

In 2024, the company continued to leverage this expertise to curate collections that resonate with consumer preferences, aiming to drive sales and brand loyalty through aesthetically pleasing and functional offerings.

Hooker Furniture strategically utilizes a blend of domestic and international manufacturing, including upholstery plants in Virginia, North Carolina, and California. This domestic presence allows for agility and responsiveness in production.

The company's global sourcing network, with significant operations in Vietnam, Mexico, Malaysia, and India, is crucial for cost-effectiveness and accessing diverse manufacturing expertise. This dual approach underpins their ability to offer a broad product range.

In 2023, Hooker Furniture reported that approximately 70% of its products were sourced internationally, highlighting the significant role of its global manufacturing capabilities in its overall supply chain and cost structure.

Distribution and Showroom Infrastructure

Hooker Furniture relies on a robust network of distribution centers and showrooms as key physical resources. These include facilities strategically located in Virginia and Georgia within the United States, as well as in Vietnam, supporting efficient warehousing and global logistics. This infrastructure is crucial for managing inventory and ensuring timely delivery to customers.

The company's presence in major industry hubs through showrooms in High Point, Las Vegas, and Atlanta is equally vital. These spaces serve as critical touchpoints for showcasing product lines to a diverse clientele, including retailers, interior designers, and end consumers. This direct engagement facilitates sales by allowing potential buyers to experience the quality and design of Hooker Furniture's offerings firsthand, thereby strengthening market presence and brand perception.

- Distribution Centers: Virginia, Georgia, Vietnam.

- Showroom Locations: High Point, Las Vegas, Atlanta.

- Function: Efficient storage, logistics, product showcasing to retailers and designers.

- Impact: Facilitates sales, enhances market presence, and supports customer engagement.

Financial Capital and Strong Balance Sheet

Hooker Furniture's financial capital and strong balance sheet are foundational resources. A healthy cash balance and prudent capital management enable strategic growth, share buybacks, and reliable dividend payouts, even when the market is tough. This financial resilience is key to their long-term stability and ability to pursue opportunities.

- Financial Strength: As of the first quarter of fiscal year 2024, Hooker Furniture reported cash and cash equivalents of $125.6 million, demonstrating a robust liquidity position.

- Disciplined Capital Management: The company consistently manages its capital to support operations, investments, and shareholder returns, maintaining a healthy debt-to-equity ratio.

- Strategic Investment Capability: This financial stability empowers Hooker Furniture to invest in new product development, market expansion, and potential acquisitions, fueling future growth.

- Shareholder Value: The company's commitment to returning value to shareholders is evident through its ongoing share repurchase programs and consistent dividend payments, supported by its strong financial footing.

Hooker Furniture's established supplier relationships, particularly with international manufacturers in Asia and Mexico, are critical for consistent product availability and cost management. These long-standing partnerships ensure access to materials and manufacturing capacity, vital for meeting demand.

The company's proprietary IT systems and e-commerce platform represent a key digital resource. These systems streamline operations, from inventory management to customer order processing, and are essential for reaching customers through various sales channels.

In 2024, Hooker Furniture continued to invest in its digital infrastructure to enhance customer experience and operational efficiency, recognizing the growing importance of online sales and data analytics in the furniture industry.

Hooker Furniture's brand reputation and customer loyalty are intangible yet powerful resources. Decades of delivering quality and style have built trust with consumers and trade partners, translating into repeat business and a strong market position.

The company's commitment to sustainability and ethical sourcing practices, while not always explicitly quantified, is increasingly becoming a key differentiator and resource, appealing to a growing segment of environmentally conscious consumers and business partners.

Value Propositions

Hooker Furniture stands out with its extensive selection of residential furniture, encompassing casegoods, upholstery, and accent pieces. This wide variety ensures they can furnish every room in a home, appealing to a broad customer base. Their commitment to diverse styles, from classic designs to contemporary looks, allows them to meet a wide array of aesthetic preferences.

Hooker Furniture champions superior quality and craftsmanship, presenting its furniture as enduring investments. This focus on durability resonates with consumers valuing longevity in their home furnishings.

In 2023, the company reported net sales of $878.1 million, reflecting customer confidence in their product quality. This commitment to excellence fosters trust and satisfaction, especially in the premium home furnishings segment.

Hooker Furniture’s multi-brand approach, featuring names like Hooker Furniture, Pulaski, Bradington-Young, and Sunset West, allows them to cater to a wide array of consumer needs and market segments. This strategy enables the company to offer distinct value propositions, from accessible price points to high-end, specialized designs.

By segmenting its brand portfolio, Hooker Furniture effectively addresses specific price sensitivities, design preferences, and functional requirements across various customer groups and distribution channels. For example, Bradington-Young focuses on premium, handcrafted upholstery, while Pulaski often targets mid-range consumers with stylish, functional case goods.

This diversification supports Hooker Furniture’s market penetration and resilience. In 2023, the company reported net sales of $1.2 billion, demonstrating the broad appeal and success of its multi-brand strategy in capturing diverse market opportunities within the furniture industry.

Solutions for Residential and Hospitality Markets

Hooker Furniture offers distinct product lines tailored for both individual homeowners and commercial clients in the hospitality sector. This dual market approach allows them to cater to diverse needs, from stylish home decor to robust contract-grade furniture.

For the residential market, Hooker Furniture provides a wide array of stylish and functional pieces designed to enhance home living. In the hospitality and contract segments, the focus shifts to durability, aesthetic appeal, and meeting the specific requirements of environments like hotels, restaurants, and senior living communities.

- Residential Market Value: Stylish, diverse home furnishings for individual consumers.

- Hospitality Market Value: Durable, aesthetically pleasing furniture for commercial use.

- Dual Focus Benefit: Broad market reach and diversified revenue streams.

In 2024, the contract furniture market, which includes hospitality, was projected to see continued growth, driven by new hotel construction and renovations. Hooker Furniture's ability to serve this sector alongside its established residential business positions it to capitalize on these trends.

Commitment to Sustainability

Hooker Furniture's commitment to sustainability is a significant value proposition, appealing to a growing segment of consumers and business partners who prioritize environmental responsibility. This dedication is evident in their operational practices, which include robust recycling programs and efforts to repurpose materials, thereby minimizing waste and resource consumption.

The company actively pursues environmental certifications, underscoring their commitment to transparency and adherence to recognized sustainability standards. This focus on environmental stewardship not only enhances their brand image but also creates additional value that extends beyond the tangible quality of their furniture, resonating deeply with eco-conscious stakeholders.

- Recycling and Repurposing: Hooker Furniture implements comprehensive recycling initiatives and actively seeks opportunities to repurpose materials, reducing landfill waste.

- Environmental Certifications: The company pursues and maintains environmental certifications, demonstrating a verifiable commitment to sustainable practices.

- Consumer Resonance: This focus on environmental stewardship attracts and retains customers who value eco-friendly products and business operations.

Hooker Furniture offers a broad range of residential furniture, from casegoods to upholstery, catering to diverse tastes and needs. Their commitment to quality craftsmanship ensures durable pieces, making their furniture a valued long-term addition to any home. This extensive selection and focus on enduring quality are key to their appeal to homeowners.

The company's multi-brand strategy, including names like Pulaski and Bradington-Young, allows them to target different market segments and price points effectively. This diversification not only broadens their customer reach but also strengthens their market position. In 2023, Hooker Furniture reported net sales of $1.2 billion, highlighting the success of this approach.

Hooker Furniture also serves the hospitality and contract markets, providing durable and stylish furniture for commercial spaces. This dual focus on residential and contract clients diversifies their revenue streams. The contract furniture market showed projected growth in 2024, driven by renovations and new constructions.

Customer Relationships

Hooker Furniture cultivates vital partnerships with its furniture retailer network through dedicated product support and comprehensive marketing collateral. In 2024, this commitment was evident in their continued investment in retailer training programs and the provision of digital marketing assets, helping stores effectively showcase Hooker's diverse product lines.

These collaborations are designed to empower retailers, ensuring they have the necessary tools and information to drive sales of Hooker Furniture products. This focus on retailer success strengthens the overall distribution channel, a key component of their business model.

Hooker Furniture cultivates strong relationships with interior designers and the trade by offering dedicated showrooms and specialized programs. These initiatives provide personalized service, access to exclusive product lines, and expert assistance, fostering loyalty and encouraging repeat business from this key demographic.

Hooker Furniture prioritizes responsive customer service and efficient after-sales support to cultivate lasting customer relationships. This commitment involves promptly addressing inquiries, managing warranty claims, and ensuring overall customer satisfaction, which is vital for building a robust brand reputation and fostering repeat business.

Brand-Specific Engagement

Hooker Furniture cultivates brand-specific engagement, recognizing that each of its distinct brands requires a tailored approach to connect with its target customers. This means developing specialized marketing campaigns, providing highly relevant product information, and establishing support channels that align precisely with what customers expect for each unique brand identity.

For instance, the company's marketing efforts are designed to speak directly to the aesthetic and lifestyle preferences of consumers associated with brands like the more traditional Hooker Casegoods versus the contemporary American Leather. This targeted communication aims to build stronger, more resonant connections.

Hooker Furniture's commitment to brand-specific relationships is evident in how they adapt their outreach. In 2024, a significant portion of their marketing budget was allocated to digital channels, with a focus on platforms that allow for granular audience segmentation, ensuring that messages reached the most receptive consumers for each brand.

- Tailored Marketing: Campaigns are customized to reflect the unique value proposition and target demographic of each Hooker Furniture brand, enhancing relevance and impact.

- Brand-Specific Information: Product details and lifestyle content are curated to resonate with the specific tastes and needs of customers for each brand, fostering deeper understanding.

- Differentiated Support: Customer service and engagement strategies are adapted to meet the service expectations and communication preferences associated with individual brands within the Hooker portfolio.

Long-Term Partnerships with Commercial Clients

Hooker Furniture cultivates enduring relationships with its commercial clientele, particularly within the hospitality and contract sectors. This focus is crucial for securing repeat business and large-volume orders from entities like hotels and senior living communities.

These partnerships are built on more than just product delivery; they involve a deep understanding of client needs. Hooker Furniture provides tailored solutions, comprehensive project management, and consistent post-sale support. This approach ensures that the unique requirements of significant commercial projects are met effectively.

- Customized Solutions: Tailoring furniture designs and specifications to align with the aesthetic and functional demands of commercial spaces, such as hotel lobbies or guest rooms.

- Project Management: Overseeing the entire process from design to delivery and installation, ensuring seamless execution for large-scale projects.

- Ongoing Support: Providing continued assistance and service to maintain client satisfaction and address any evolving needs or issues that arise post-installation.

- Client Retention: The strategy aims to foster loyalty, leading to sustained revenue streams and a stable client base, as evidenced by their consistent performance in these segments. For instance, in fiscal year 2024, Hooker Furniture reported continued strength in its contract business, contributing significantly to overall sales.

Hooker Furniture fosters strong relationships with its retailer network through dedicated support and marketing resources. In 2024, this included enhanced digital assets and training, empowering retailers to effectively showcase products and drive sales.

The company also cultivates loyalty with interior designers and the trade via specialized showrooms and programs, offering personalized service and exclusive access. For commercial clients in hospitality and contract sectors, Hooker provides tailored solutions and project management, securing repeat business and large orders, a trend that continued to show strength in their fiscal year 2024 results.

Furthermore, Hooker Furniture emphasizes brand-specific engagement, adapting marketing and support to resonate with distinct customer bases for each of its brands. This targeted approach, amplified by significant 2024 digital marketing investments, ensures deeper customer connections and brand relevance.

| Customer Relationship Type | Key Engagement Strategies | 2024 Focus/Data Point |

| Retailer Network | Product support, marketing collateral, training programs | Investment in digital marketing assets for retailers |

| Interior Designers & Trade | Dedicated showrooms, specialized programs, personalized service | Fostering loyalty and repeat business through exclusive access |

| Commercial Clients (Hospitality/Contract) | Tailored solutions, project management, post-sale support | Continued strength in contract business contributing to overall sales |

| Brand-Specific Customers | Tailored marketing campaigns, relevant product info, differentiated support | Increased digital marketing budget for segmented audience outreach |

Channels

Independent furniture retailers are a cornerstone of Hooker Furniture's distribution strategy, acting as vital touchpoints for customers seeking a more personalized shopping experience. These stores often feature a carefully chosen assortment of Hooker's extensive product offerings, allowing consumers to see and feel the quality firsthand.

In 2024, the independent furniture retail sector continued to navigate a dynamic market. While specific data for Hooker's independent retail partners isn't publicly itemized, the broader independent furniture retail segment in the U.S. has shown resilience, with many stores adapting to e-commerce trends while emphasizing in-store customer service and unique product curation, which aligns with Hooker's brand appeal.

Hooker Furniture leverages major furniture chains and mass merchants to connect with a wider audience. This strategy is key for achieving high sales volumes and boosting brand recognition across diverse consumer groups.

By partnering with these large retailers, the company taps into established customer bases and distribution networks. For instance, in 2023, the furniture retail sector in the U.S. saw significant activity, with major chains and mass merchants playing a crucial role in product accessibility and consumer purchasing decisions.

Hooker Furniture strategically utilizes company-owned showrooms in major furniture markets such as High Point, North Carolina; Las Vegas, Nevada; and Atlanta, Georgia. These physical spaces are crucial for displaying their extensive product lines and new introductions to a professional audience.

These showrooms act as key engagement hubs, allowing Hooker Furniture to connect directly with interior designers and buyers from retail establishments. They facilitate the order process and provide a tangible experience of the furniture quality and design.

In 2023, Hooker Furniture reported net sales of $740.4 million, underscoring the importance of these direct-to-business channels in driving revenue and fostering strong relationships within the industry.

E-commerce Platforms

Hooker Furniture is actively expanding its e-commerce presence, recognizing the shift in consumer behavior towards online shopping. This direct-to-consumer (DTC) approach allows them to bypass traditional retail limitations and connect with a broader customer base. In 2024, e-commerce sales are projected to continue their upward trajectory, with many furniture retailers seeing double-digit growth in their online channels.

The company leverages various online platforms to showcase its product catalog, manage orders, and handle customer service. This omnichannel strategy is crucial for meeting customers where they are, whether in a physical showroom or browsing online. For instance, a significant portion of furniture sales now originate from online research, even if the final purchase occurs in-store.

- Direct-to-Consumer (DTC) Sales Growth: E-commerce platforms enable Hooker Furniture to capture a larger share of the retail margin by selling directly to end consumers, bypassing traditional wholesale models.

- Expanded Market Reach: Online channels allow access to customers nationwide and potentially internationally, transcending geographical limitations of physical stores.

- Adaptation to Consumer Trends: With a growing percentage of consumers, particularly millennials and Gen Z, preferring online purchasing for home goods, e-commerce is a vital channel for staying competitive.

- Data Analytics and Personalization: Online platforms provide valuable data on customer preferences and purchasing habits, enabling more targeted marketing and product development.

Direct Sales to Hospitality and Contract Clients

Hooker Furniture utilizes direct sales for its H Contract and Samuel Lawrence Hospitality brands, targeting commercial clients like hotels and senior living communities. This approach allows for tailored solutions and dedicated support for large-scale projects.

These specialized sales teams manage the intricate requirements of the hospitality and contract sectors, ensuring project timelines and specifications are met. The company's ability to directly engage with these clients fosters strong relationships and facilitates customized product offerings.

- Direct Engagement: Sales teams work directly with hospitality and contract clients, understanding their specific needs.

- Project Focus: Emphasis on project management for commercial installations like hotels and senior living facilities.

- Brand Specialization: Leverages H Contract and Samuel Lawrence Hospitality brands for targeted market penetration.

Hooker Furniture's channels are diverse, encompassing independent retailers, major furniture chains, company-owned showrooms, and a growing e-commerce presence. For its contract business, direct sales to commercial clients are paramount.

The company's net sales in 2023 reached $740.4 million, reflecting the broad reach of these varied distribution and sales channels. While specific channel performance breakdowns are not detailed, the overall sales figure highlights the effectiveness of this multi-pronged approach in reaching both consumer and business markets.

The independent retail segment, though not itemized, aligns with broader U.S. furniture retail trends where adaptation to online sales and in-store experience remain key. Major chains and mass merchants continue to be critical for volume and accessibility, a trend observed throughout 2023.

E-commerce is a significant growth area, with projections for continued double-digit growth in online furniture sales for 2024. Direct sales for H Contract and Samuel Lawrence Hospitality focus on tailored solutions for large commercial projects.

Customer Segments

This segment comprises individual homeowners who are actively furnishing their residences, encompassing a wide array of needs from bedrooms and dining areas to home offices and living rooms. Hooker Furniture targets consumers who value a blend of quality craftsmanship and appealing design within an accessible, upper-medium to moderate price range.

In 2024, the home furnishings market continued to see robust demand from this demographic, with consumer spending on furniture and bedding reaching an estimated $130 billion in the U.S. alone. This indicates a significant opportunity for Hooker Furniture to capture market share by offering stylish and durable options that meet the aesthetic and budgetary requirements of a broad base of homeowners.

Interior designers represent a crucial customer segment for Hooker Furniture, as they frequently select and purchase furnishings for both home and business spaces. Hooker Furniture's commitment to offering a wide array of stylish and well-crafted pieces, coupled with dedicated trade programs, directly addresses the professional needs of these designers. This focus allows designers to source unique and high-quality items that align with their clients' visions and project requirements.

Hooker Furniture's hospitality and contract market segment caters to a diverse range of commercial clients, including hotels, resorts, and senior living facilities. These businesses prioritize furniture that is both robust and visually appealing to enhance guest experiences and operational longevity. For instance, the company's Samuel Lawrence Hospitality and H Contract brands are specifically designed to meet the demanding requirements of this sector.

Youth and Value-Conscious Consumers

Hooker Furniture, through its brands like Samuel Lawrence Furniture and Opus Designs, actively courts younger consumers and those prioritizing value. This demographic is on the lookout for furniture that is both practical and aesthetically pleasing, all while fitting a more budget-friendly price range. For instance, the company's strategy often involves offering versatile pieces that can adapt to evolving living spaces, a key consideration for many young adults.

In 2024, the furniture market saw a continued emphasis on affordability and durability, especially among Gen Z and Millennial buyers. These groups often research extensively online, comparing prices and reading reviews before making purchasing decisions. Hooker Furniture's approach aims to capture this segment by balancing design trends with accessible pricing, a strategy that resonates in a competitive retail landscape.

- Targeting Value: Brands like Samuel Lawrence Furniture offer stylish options at more approachable price points, appealing to budget-conscious shoppers.

- Youth Market Focus: Opus Designs, in particular, caters to the aesthetic preferences and functional needs of younger consumers.

- Market Trends: In 2024, the furniture industry observed a significant demand from younger demographics for functional, trend-aware pieces that don't break the bank.

- Accessibility: Hooker Furniture's strategy includes making well-designed furniture accessible to a broader consumer base, including those new to homeownership or establishing their first independent living spaces.

High-End/Custom Upholstery Buyers

High-end and custom upholstery buyers are a discerning group looking for unique, premium pieces. Brands such as Bradington-Young and HF Custom within Hooker Furniture's portfolio specifically target this segment by offering extensive customization options. This allows customers to select from a wide array of materials, finishes, and design elements to create furniture that perfectly matches their individual style and home décor.

This customer segment values craftsmanship and personalization above all else. They are willing to invest more for furniture that is not only aesthetically pleasing but also built to last and reflects their personal taste. The ability to tailor every detail, from the fabric and stitching to the frame and leg style, is a key driver for these buyers.

- Niche Market: Focuses on consumers seeking exclusive, tailor-made upholstered furniture.

- Brand Appeal: Bradington-Young and HF Custom are key brands serving this segment.

- Customization Focus: Offers extensive choices in materials, finishes, and designs.

- Value Proposition: Emphasizes quality, craftsmanship, and personalization for a premium price point.

Hooker Furniture serves a diverse customer base, from individual homeowners seeking stylish and quality furnishings to interior designers sourcing pieces for clients. The company also caters to the hospitality and contract markets, requiring durable and aesthetically pleasing furniture for commercial spaces like hotels and senior living facilities.

Additionally, Hooker Furniture targets younger consumers and those prioritizing value through brands like Samuel Lawrence Furniture and Opus Designs, offering practical and trendy options at accessible price points. High-end upholstery buyers are another key segment, drawn to brands such as Bradington-Young and HF Custom for their extensive customization and premium craftsmanship.

| Customer Segment | Key Characteristics | Hooker Furniture Brands | 2024 Market Relevance |

| Homeowners | Furnishing residences, value quality and design, mid-to-moderate price | Hooker Furniture, Sam Moore | US furniture & bedding spending estimated $130 billion |

| Interior Designers | Source for home & business spaces, need style & quality | All brands | Crucial channel for commercial and residential projects |

| Hospitality & Contract | Hotels, resorts, senior living; need durability & appeal | Samuel Lawrence Hospitality, H Contract | Demand for long-lasting, guest-experience enhancing furniture |

| Value-Conscious/Younger Consumers | Seek practical, trendy, budget-friendly options | Samuel Lawrence Furniture, Opus Designs | Continued emphasis on affordability and durability |

| High-End Upholstery Buyers | Desire unique, premium, customizable pieces | Bradington-Young, HF Custom | Focus on craftsmanship and personalization drives premium sales |

Cost Structure

The cost of goods sold (COGS) is a significant element of Hooker Furniture's cost structure. This includes the price of raw materials like wood, metal, fabric, and leather, as well as the labor involved in manufacturing. Overhead costs tied to production, whether in the US or overseas, also fall under COGS.

For instance, in the fiscal year ending January 28, 2024, Hooker Furniture reported a Cost of Goods Sold of $776.4 million. This figure highlights the substantial investment in materials and production necessary to bring their furniture to market.

External factors heavily influence this cost. Changes in the price of key materials and the expense of shipping and freight rates can directly affect the overall COGS, impacting profitability.

Hooker Furniture dedicates substantial resources to its sales and marketing efforts. These costs are essential for maintaining its presence in the competitive furniture market, encompassing the operation of showrooms, extensive advertising campaigns, and various promotional activities designed to engage both retailers and end consumers.

The company's investment in sales teams is crucial for building and nurturing relationships with a broad network of clients, including furniture retailers and interior designers. Furthermore, significant expenditure goes into brand management, ensuring Hooker Furniture remains a recognized and trusted name in the industry.

For the fiscal year ending January 28, 2024, Hooker Furniture reported total selling, general, and administrative expenses of $171.1 million. This figure reflects the considerable outlay required to support their sales channels and marketing initiatives.

Logistics and distribution are significant cost drivers for Hooker Furniture due to the bulk and weight of its products. These expenses encompass warehousing, ocean freight for international sourcing, domestic transportation, and meticulous inventory management. For instance, in fiscal year 2023, Hooker Furniture reported that transportation and warehousing costs represented a notable portion of their overall operating expenses.

The company is committed to mitigating these substantial costs through ongoing supply chain optimization initiatives. This includes strategies aimed at improving efficiency in warehousing operations and negotiating better terms for domestic and international shipping. Hooker Furniture's focus on streamlining these processes is crucial for maintaining competitive pricing and profitability in the furniture market.

Administrative and Overhead Costs

Hooker Furniture's administrative and overhead costs are a significant component of its overall expense structure. These costs encompass a broad range of operational necessities that keep the business running smoothly. For instance, executive salaries, the backbone of leadership and strategic direction, are included here. Furthermore, the company invests heavily in its IT infrastructure, which is crucial for managing complex operations. This includes the development and maintenance of enterprise resource planning (ERP) systems, vital for integrating various business functions.

Legal fees, essential for navigating regulatory landscapes and contractual agreements, also fall under this category. Corporate office operations, including rent, utilities, and support staff, contribute to the fixed overhead. Hooker Furniture's commitment to technology means ongoing investments in system upgrades and new implementations are a constant. For example, in 2023, the company reported selling, general, and administrative expenses of $161.3 million, highlighting the scale of these administrative outlays.

- General and Administrative Expenses: Includes executive salaries and corporate office operations.

- IT Infrastructure: Significant investment in systems like ERP for operational efficiency.

- Legal and Professional Fees: Costs associated with compliance and advisory services.

- Ongoing Technology Investments: Continuous upgrades and system enhancements.

Research and Development (R&D) and Design Costs

Hooker Furniture dedicates resources to Research and Development (R&D) and Design Costs, focusing on creating new furniture collections and understanding market trends. These investments are vital for keeping their product line fresh and competitive within the furniture industry.

While not dominating their cost structure compared to manufacturing, these R&D and design expenses are significant. For instance, in their fiscal year ending January 29, 2023, Hooker Furniture reported selling, general, and administrative expenses of $169.5 million, which would encompass a portion of these innovation-driving costs. These expenditures are essential for staying ahead of consumer preferences and technological advancements in furniture design and materials.

- Product Innovation: Costs cover the conceptualization, prototyping, and refinement of new furniture designs and collections.

- Market Intelligence: Investments are made in market research to identify emerging trends, consumer demands, and competitive landscape shifts.

- Design Expertise: Expenses include salaries for designers, material sourcing specialists, and product development teams.

- Competitive Edge: These costs are crucial for differentiating Hooker Furniture's offerings and maintaining market relevance.

Hooker Furniture's cost structure is heavily influenced by its Cost of Goods Sold (COGS), which reached $776.4 million in fiscal year 2024. This includes raw materials, manufacturing labor, and production overhead. Sales, General, and Administrative (SG&A) expenses were $171.1 million in fiscal year 2024, covering marketing, showrooms, and administrative operations. Logistics and distribution costs are also substantial due to product size and weight, impacting overall operational expenses.

| Cost Category | Fiscal Year Ending Jan 28, 2024 | Fiscal Year Ending Jan 29, 2023 |

|---|---|---|

| Cost of Goods Sold (COGS) | $776.4 million | $715.0 million |

| Selling, General, and Administrative (SG&A) Expenses | $171.1 million | $169.5 million |

Revenue Streams

Hooker Furniture's core revenue generation hinges on the sale of casegoods. These are typically wooden or metal furniture pieces designed for various home settings, including bedrooms, dining rooms, and living spaces.

The company markets these products under well-established brands such as Hooker Casegoods, Pulaski, and Samuel Lawrence Furniture. In 2023, Hooker Furniture reported net sales of $1.15 billion, with casegoods representing a significant portion of this figure, underscoring their importance to the business.

Hooker Furniture generates significant revenue through the sale of upholstered furniture. This category encompasses a wide array of products, including sofas, sectionals, chairs, recliners, and various accent pieces designed to furnish living spaces.

The company’s upholstered furniture offerings are diverse, catering to different customer preferences and price points. This includes both custom upholstery manufactured domestically, notably under brands like Bradington-Young and HF Custom, and a range of imported upholstered lines, providing a broad selection for consumers.

For 2024, the upholstered furniture segment is a cornerstone of Hooker Furniture's sales strategy. While specific segment revenue figures for 2024 are still being finalized, the company has historically seen strong performance in this area, with upholstered furniture often representing a substantial portion of total net sales, reflecting consumer demand for comfortable and stylish home furnishings.

Hooker Furniture generates significant revenue by supplying furniture to the hospitality and contract markets. Brands like Samuel Lawrence Hospitality and H Contract cater to hotels, senior living communities, and other commercial clients.

This segment of their business has been a notable growth driver. For instance, in the first quarter of 2024, Hooker Furniture reported that their contract segment experienced a substantial increase in sales, demonstrating the increasing demand for their specialized furniture solutions in these sectors.

Accent and Home Decor Sales

Hooker Furniture generates revenue not only from its main furniture collections but also through the sale of accent pieces, lighting, and various home decor items. These complementary products enhance customer purchases and broaden the company's appeal across different segments of the home furnishings market.

In 2024, this diversified approach is crucial for capturing consumer interest. For instance, sales from these categories often represent a significant portion of a retailer's overall home goods revenue, with many consumers actively seeking these finishing touches to complete their living spaces.

- Accent Furniture: Includes items like accent chairs, console tables, and ottomans that add style and functionality.

- Lighting: Revenue from table lamps, floor lamps, and chandeliers that complement furniture arrangements.

- Home Decor: Sales of items such as mirrors, rugs, wall art, and decorative accessories that complete a room's look.

E-commerce Sales

Hooker Furniture is increasingly leveraging its e-commerce platforms to drive direct-to-consumer (DTC) sales. This digital expansion complements their established wholesale and retail partnerships, opening up a significant new avenue for revenue generation.

In 2024, the company's focus on enhancing its online customer experience and expanding its digital product catalog is expected to further bolster e-commerce sales. This strategic shift aims to capture a larger share of the growing online furniture market.

- Direct-to-Consumer Growth: E-commerce sales represent a growing portion of Hooker Furniture's overall revenue as they invest in their digital infrastructure.

- Market Reach: Online platforms allow Hooker Furniture to reach a broader customer base beyond traditional brick-and-mortar store limitations.

- Sales Diversification: This revenue stream diversifies Hooker Furniture's income, reducing reliance solely on wholesale and physical retail channels.

Hooker Furniture's revenue streams are multifaceted, primarily driven by the sale of casegoods and upholstered furniture. The company also generates substantial income from its hospitality and contract division, alongside a growing e-commerce presence. Complementary sales of accent pieces and home decor further diversify their income.

| Revenue Stream | Key Products | 2023 Net Sales (Approx.) | 2024 Outlook Notes |

|---|---|---|---|

| Casegoods | Bedroom, dining, living room furniture | Significant portion of $1.15 billion | Core offering, strong brand recognition |

| Upholstered Furniture | Sofas, sectionals, chairs, recliners | Substantial portion of $1.15 billion | Cornerstone of sales strategy, diverse options |

| Hospitality & Contract | Hotel, senior living, commercial furniture | Notable growth driver | Q1 2024 sales showed substantial increase |

| Accent Pieces & Home Decor | Accent chairs, lighting, mirrors, art | Broadens market appeal | Enhances customer purchases, captures finishing touches |

| E-commerce (DTC) | Direct sales via online platforms | Growing revenue avenue | Focus on enhancing online experience and catalog |

Business Model Canvas Data Sources

The Hooker Furniture Business Model Canvas is built using comprehensive market research, internal financial reports, and competitive analysis. These data sources ensure each block accurately reflects the company's current operations and strategic direction.