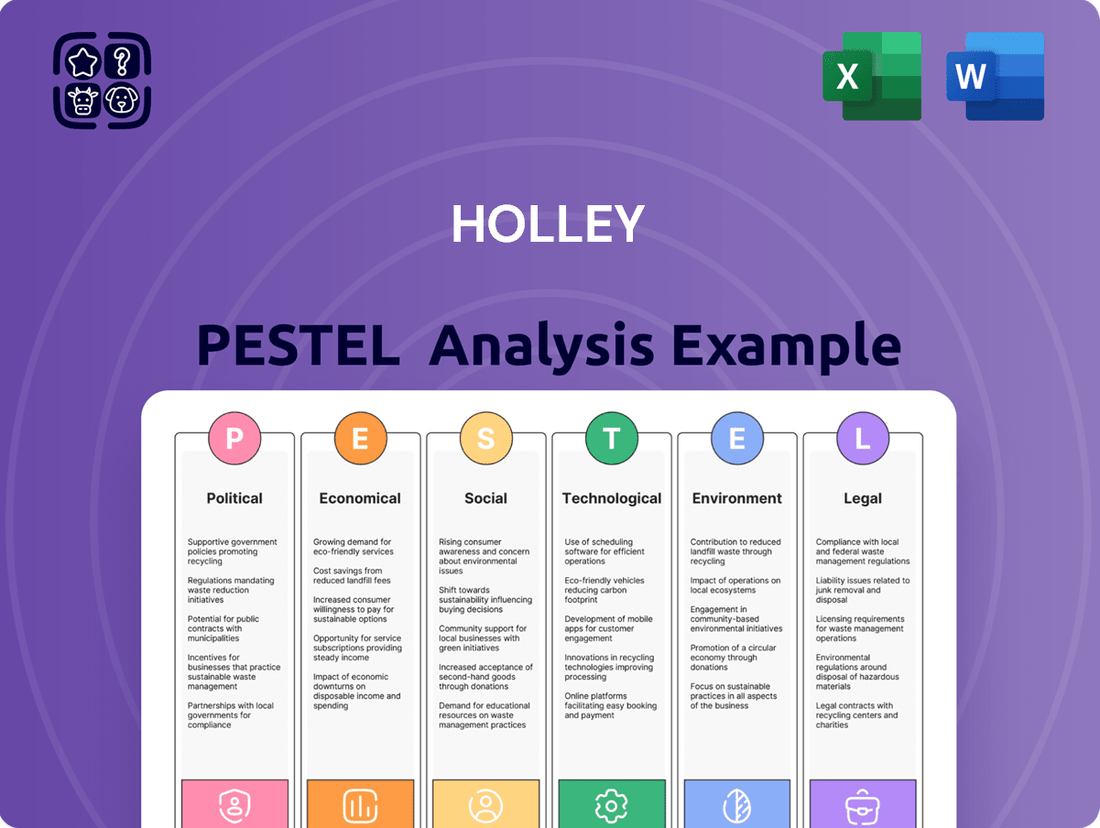

Holley PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holley Bundle

Uncover the critical external factors shaping Holley's trajectory with our meticulously researched PESTLE analysis. From evolving political landscapes to technological advancements, understand the forces driving change in the automotive aftermarket. Download the full report to gain actionable intelligence and refine your strategic approach.

Political factors

Government regulations, especially concerning emissions, are a major force shaping Holley's market. As agencies like the EPA tighten standards, such as those for model years 2027 and beyond, the automotive aftermarket must adapt by creating more fuel-efficient and environmentally conscious products.

This regulatory push presents a dual dynamic for Holley: it poses challenges for their established internal combustion engine (ICE) product lines but simultaneously opens doors for significant growth in developing components for hybrid and electric vehicles (EVs).

Changes in trade policies and tariffs significantly influence Holley's operational costs and supply chain stability. For example, potential tariffs on imported automotive components, as discussed for implementation in 2025, could directly increase the cost of raw materials and finished goods for Holley. This would necessitate adjustments in pricing strategies and could affect overall profitability.

The growing momentum behind Right to Repair legislation, exemplified by proposals like the REPAIR Act, presents a significant political factor for Holley. This movement advocates for broader access to vehicle diagnostic data and replacement parts for independent repair shops and vehicle owners.

Such legislation, if enacted, would likely foster a more competitive aftermarket landscape, potentially increasing demand for Holley's specialized components and services by reducing barriers to entry for independent mechanics. For instance, as of early 2024, over 30 states had introduced or were considering Right to Repair bills, indicating a strong legislative trend.

Government Support for Electric Vehicles

Government incentives and policies significantly shape the demand for automotive performance parts, including those for electric vehicles (EVs). These initiatives, such as tax credits and charging infrastructure investments, are accelerating EV adoption. For instance, the Inflation Reduction Act in the United States offers substantial tax credits for EV purchases, boosting consumer interest. This trend directly impacts Holley, a company historically focused on internal combustion engine (ICE) vehicles, by creating a growing market for EV-specific performance solutions.

The increasing governmental push for electrification, exemplified by targets set by various nations to phase out ICE vehicle sales, presents both a challenge and an opportunity for Holley. As of early 2025, many countries have announced or are implementing stricter emissions standards, further incentivizing the transition to EVs. This evolving regulatory landscape underscores the strategic imperative for Holley to diversify its product portfolio to include performance components for EVs, ensuring its continued relevance and growth in a transforming automotive industry.

- Government incentives like tax credits and rebates are driving EV adoption.

- The US Inflation Reduction Act provides significant financial incentives for EV buyers.

- Stricter emissions standards globally are accelerating the shift away from ICE vehicles.

- Holley must adapt by developing performance solutions for the growing EV market.

Political Stability and Economic Policy

Holley's performance is significantly influenced by the political landscape. A stable political environment with consistent economic policies fosters a predictable operating environment, crucial for long-term planning and investment in the automotive aftermarket sector. For instance, the U.S. experienced a period of relative political stability leading into 2024, which generally supports consumer confidence and discretionary spending on vehicle enhancements.

Conversely, political uncertainty, such as that surrounding upcoming elections or shifts in regulatory frameworks, can create headwinds. This uncertainty can lead to cautious consumer behavior, potentially reducing demand for aftermarket parts and accessories. Furthermore, periods of political flux might see fluctuations in advertising costs as companies adjust their marketing strategies, impacting Holley's sales and marketing expenditures.

- Political Stability: Consistent government policies in key markets like the U.S. and Europe provide a more predictable operating environment for Holley.

- Economic Policy Impact: Changes in tax laws or trade policies can directly affect Holley's cost of goods sold and international sales performance.

- Election Cycles: Major election periods can lead to temporary dips in consumer discretionary spending on automotive aftermarket products due to economic uncertainty.

Government regulations, particularly those concerning emissions and vehicle repair accessibility, are pivotal for Holley. As of early 2025, many nations are intensifying emissions standards, pushing for greater fuel efficiency and a shift towards electric vehicles (EVs). This trend, coupled with the growing momentum of Right to Repair legislation in over 30 US states by early 2024, directly influences Holley's product development and market strategy.

Government incentives, such as the US Inflation Reduction Act's tax credits, are accelerating EV adoption, creating new market opportunities for EV-specific performance components. Conversely, political instability or shifts in trade policies, like potential tariffs in 2025, can impact Holley's supply chain costs and pricing strategies, necessitating careful navigation of the global political and economic landscape.

| Political Factor | Impact on Holley | Data/Trend (2024-2025) |

|---|---|---|

| Emissions Regulations | Drives demand for cleaner technologies and EV components; challenges ICE product lines. | Stricter standards for model years 2027+; global push for electrification. |

| Right to Repair Legislation | Potentially increases demand for specialized parts and services by fostering aftermarket competition. | Over 30 US states considered or introduced bills by early 2024. |

| Government Incentives (EVs) | Accelerates EV adoption, boosting market for EV performance parts. | Inflation Reduction Act provides significant tax credits for EV purchases. |

| Trade Policies/Tariffs | Affects supply chain costs and pricing strategies. | Potential tariffs on imported automotive components discussed for 2025 implementation. |

| Political Stability | Influences consumer confidence and discretionary spending on aftermarket products. | Relative stability in key markets like the US leading into 2024 supported consumer spending. |

What is included in the product

This Holley PESTLE analysis thoroughly examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

Provides a clear, actionable framework for identifying and mitigating external threats, transforming potential market disruptions into manageable strategic opportunities.

Economic factors

Consumer disposable income is a key driver for Holley's sales, as higher discretionary income allows consumers to spend more on performance automotive products. Recent data from the U.S. Bureau of Economic Analysis in late 2023 and early 2024 shows a steady, albeit sometimes modest, growth in real disposable personal income, suggesting a generally supportive environment for non-essential purchases.

Furthermore, consumer spending habits are showing a positive trend towards automotive repair and maintenance, with industry reports from 2024 indicating this sector is growing at a rate that often exceeds general inflation. This indicates consumers are prioritizing the upkeep and enhancement of their vehicles, which directly benefits Holley's product lines.

The automotive aftermarket is experiencing significant economic growth, a crucial factor for companies like Holley. This sector is expected to see sustained expansion, fueled by rising vehicle ownership globally and a passionate enthusiast base that actively modifies and maintains their vehicles. For instance, the global automotive aftermarket was valued at approximately $450 billion in 2023 and is projected to reach over $650 billion by 2030, indicating a compound annual growth rate of around 5.5%.

This robust market trajectory is further bolstered by the increasing popularity of motorsports and the do-it-yourself (DIY) culture within the automotive community. As more individuals engage in vehicle customization and performance upgrades, the demand for specialized parts and accessories, which are Holley's core offerings, continues to climb. This creates a fertile economic environment for Holley to capitalize on its product portfolio.

Inflationary pressures and rising interest rates in 2024 and projected into 2025 directly influence Holley's operational costs and the discretionary spending power of its customer base. While the automotive aftermarket has historically demonstrated resilience, sustained high inflation could indeed temper consumer willingness to spend on non-essential vehicle upgrades or maintenance, even with the supportive trend of an aging vehicle fleet.

For instance, the US Consumer Price Index (CPI) saw a notable increase in 2023, and while forecasts for 2024 suggest a moderation, inflation remains a key consideration. Similarly, interest rates, influenced by central bank policies aimed at controlling inflation, affect the cost of borrowing for both consumers and businesses, potentially impacting Holley's financing costs and the affordability of its products for consumers financing larger purchases.

Vehicle Longevity and Aging Fleet

The average age of vehicles on U.S. roads is steadily increasing, a trend that directly benefits the automotive aftermarket. As of 2024, the average age of vehicles in operation (VOI) in the U.S. reached an all-time high of approximately 12.5 years. This aging fleet means more vehicles require maintenance, repairs, and upgrades, driving demand for parts and services.

This extended vehicle lifespan creates a sustained market for companies specializing in aftermarket parts. Consumers are increasingly choosing to repair and enhance their existing vehicles rather than immediately purchasing new ones, especially given economic pressures. This creates a prime opportunity for Holley, as owners of older vehicles often seek performance upgrades or replacement parts to keep their cars running optimally or to personalize them.

- Average Vehicle Age: In 2024, the average age of vehicles on U.S. roads surpassed 12.5 years, a record high.

- Consumer Behavior: Extended ownership periods encourage investment in vehicle maintenance and customization.

- Market Opportunity: An aging fleet directly fuels demand for aftermarket replacement and performance parts.

E-commerce Growth and Digitalization

The automotive aftermarket is experiencing a significant shift towards e-commerce, with consumers increasingly opting for online channels to purchase parts and accessories. This trend presents a dual-edged sword for companies like Holley, creating avenues for expanded reach but also demanding substantial investment in digital infrastructure. By 2024, global e-commerce sales were projected to reach over $6.3 trillion, a figure that continues to climb, underscoring the critical need for a strong online presence in this sector.

To remain competitive, Holley must prioritize the development and enhancement of its digital platforms, ensuring a seamless user experience from browsing to purchase. This includes optimizing website functionality, offering comprehensive product information, and streamlining the checkout process. Furthermore, efficient logistics and supply chain management are paramount to meet the heightened expectations of online shoppers for timely delivery.

- E-commerce Penetration: Online sales are capturing an ever-larger share of the automotive aftermarket, driven by convenience and price transparency.

- Digital Investment: Companies like Holley need to allocate resources towards building and maintaining sophisticated e-commerce platforms and robust digital marketing strategies.

- Logistics and Fulfillment: Efficient warehousing, shipping, and returns processes are crucial for customer satisfaction in the online automotive parts market.

- Consumer Preference: A growing segment of consumers, particularly younger demographics, favor digital channels for their automotive repair and maintenance needs.

Economic growth directly fuels Holley's performance, as increased consumer disposable income translates to more spending on automotive upgrades. Data from late 2023 and early 2024 indicates a steady rise in real disposable income, creating a favorable environment for discretionary purchases. This trend is further supported by a growing preference for vehicle maintenance and customization, a sector projected for sustained expansion.

Inflation and interest rates are key economic considerations for Holley. While the automotive aftermarket has shown resilience, persistent inflation in 2024 and into 2025 could impact consumer spending on non-essential items. For example, the US CPI saw increases in 2023, and while moderating, it remains a factor. Higher interest rates also affect borrowing costs for both consumers and businesses.

The aging vehicle fleet in the U.S., averaging over 12.5 years old as of 2024, is a significant economic driver for Holley. This extended vehicle lifespan necessitates more repairs and upgrades, boosting demand for aftermarket parts. Consumers are increasingly investing in their current vehicles rather than purchasing new ones, directly benefiting companies like Holley that cater to this need.

The shift towards e-commerce in the automotive aftermarket is substantial, with global online sales projected to exceed $6.3 trillion by 2024. This necessitates strong digital platforms and efficient logistics for companies like Holley to meet consumer expectations for convenience and timely delivery.

| Economic Factor | 2023/2024 Data Point | Implication for Holley |

| Real Disposable Income Growth | Steady growth reported late 2023/early 2024 | Supports discretionary spending on performance parts |

| Average Vehicle Age (U.S.) | Over 12.5 years in 2024 (record high) | Drives demand for maintenance and upgrade parts |

| Inflation (U.S. CPI) | Notable increase in 2023, moderating in 2024 forecasts | Potential impact on consumer spending power; requires cost management |

| Interest Rates | Influenced by central bank policy | Affects borrowing costs for consumers and Holley; impacts affordability |

| E-commerce Sales (Global) | Projected to exceed $6.3 trillion by 2024 | Highlights need for robust online presence and digital investment |

Preview the Actual Deliverable

Holley PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Holley PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You’ll gain valuable insights into the external forces shaping Holley's strategic landscape, presented in a clear and actionable format.

Sociological factors

The robust culture of automotive enthusiasts, deeply invested in personalizing and upgrading their vehicles, is a cornerstone of Holley's market. This passion translates directly into consistent demand for Holley's performance parts and accessories, catering to both racing aficionados and those seeking enhanced street-driving experiences.

The aftermarket automotive industry, where Holley operates, saw significant growth, with U.S. retail sales of aftermarket parts and accessories reaching an estimated $50 billion in 2024. This surge highlights the enduring appeal of customization and performance enhancement among car owners.

Consumer tastes are definitely changing, with electric vehicles (EVs) gaining traction and the enduring appeal of SUVs, particularly those geared for off-road adventures. This shift means Holley must innovate its product line to meet demand in these growing markets, focusing on performance enhancements for EVs and parts for the truck and off-road segments.

The ongoing tug-of-war between DIY and DIFM (Do-It-For-Me) preferences directly shapes Holley's approach to sales and marketing. A strong DIY ethos persists, especially in established aftermarket categories, but the growing technical sophistication of modern vehicles is nudging more consumers toward professional installation services.

This shift is evident in the automotive aftermarket sector, where, according to industry reports from late 2024, nearly 60% of vehicle owners now prefer professional installation for complex electronic or powertrain upgrades, up from 52% in 2022. This trend necessitates that Holley adapt its product development and support to cater to both enthusiast DIYers and those seeking professional solutions.

Impact of Social Media and Online Communities

Social media and online communities are powerful forces in the automotive enthusiast world, significantly shaping trends and influencing what people buy. Holley can tap into this by using platforms like Instagram, Facebook groups, and YouTube channels to showcase new products and connect directly with its customers. For instance, in 2024, automotive content creators on YouTube saw continued growth, with many channels dedicated to performance parts and vehicle modifications attracting millions of views, demonstrating the reach of these platforms.

Leveraging these digital spaces allows Holley to not only market its products but also to gather valuable feedback and build brand loyalty. Engagement through live Q&A sessions or user-generated content campaigns can foster a strong sense of community around Holley products. By early 2025, it's anticipated that social commerce, where purchases are made directly through social media platforms, will continue its upward trajectory, making direct engagement even more critical for brands like Holley.

- Trend Shaping: Online communities, particularly forums and social media groups focused on specific vehicle makes and models, are primary drivers of emerging automotive trends.

- Purchasing Influence: Peer recommendations and influencer endorsements within these digital spaces heavily sway purchasing decisions for performance parts and accessories.

- Marketing Opportunities: Holley can utilize targeted advertising and content marketing on platforms like TikTok and Instagram Reels to reach specific automotive demographics effectively.

- Customer Engagement: Direct interaction through social media allows Holley to build relationships, gather product insights, and foster brand advocacy among enthusiasts.

Generational Shifts in Vehicle Ownership

Generational shifts are reshaping how people own and use vehicles, which in turn impacts the automotive aftermarket. For instance, younger generations, particularly Gen Z, are showing a trend towards consolidating vehicles within households or opting for alternative transportation methods, potentially reducing the overall number of vehicles requiring aftermarket attention. This is a notable change from previous generations who might have prioritized individual vehicle ownership more heavily.

Despite these shifts, a strong underlying interest in personal vehicles persists, driving demand for maintenance and customization. Data from 2024 indicates that while new car sales might fluctuate, the average age of vehicles on the road continues to increase. For example, the average age of light vehicles in operation in the U.S. was projected to reach over 12.5 years in 2024, a record high. This prolonging of vehicle life directly fuels the need for replacement parts, repair services, and performance enhancements, benefiting the aftermarket sector.

The desire to personalize and maintain vehicles remains a significant driver for the aftermarket industry. This includes everything from routine maintenance parts to more specialized performance and aesthetic upgrades. The continued engagement with vehicles, even with changing ownership patterns, ensures a robust market for aftermarket products and services.

- Vehicle Age: The average age of vehicles on U.S. roads is expected to exceed 12.5 years in 2024, increasing demand for maintenance and replacement parts.

- Gen Z Trends: Emerging data suggests younger generations may favor vehicle consolidation or alternative transport, influencing household vehicle numbers.

- Aftermarket Demand: Despite generational shifts, a persistent interest in vehicle ownership and longevity sustains demand for aftermarket parts and services.

The strong passion for automotive customization remains a key sociological driver for Holley. This enthusiast culture fuels consistent demand for performance parts and accessories. Industry data from late 2024 shows the U.S. automotive aftermarket sales are robust, with a significant portion driven by personalization trends.

Social media platforms are increasingly influential, shaping trends and purchasing decisions within the enthusiast community. By early 2025, social commerce is expected to grow, making direct engagement on platforms like Instagram and YouTube crucial for brands like Holley to connect with their audience and foster loyalty.

Generational shifts are also impacting vehicle ownership and usage, though the average age of vehicles on the road continues to climb. In 2024, the average age of U.S. vehicles was projected to exceed 12.5 years, indicating a sustained need for maintenance and aftermarket upgrades, benefiting companies like Holley.

Technological factors

Technological advancements in manufacturing are significantly reshaping the automotive parts landscape. Innovations like additive manufacturing, commonly known as 3D printing, and the implementation of smart factories are key drivers. These technologies offer Holley the potential to boost production efficiency, drastically cut down on lead times for new parts, and facilitate the design and production of more intricate and lighter-weight components, which is vital for modern vehicle performance and fuel economy.

For instance, the global 3D printing market in automotive is projected to grow considerably, with some estimates suggesting it could reach tens of billions of dollars by the early 2030s. This growth underscores the increasing adoption of these technologies for prototyping, tooling, and even direct production of end-use parts. Holley's ability to leverage these advancements will be critical in maintaining its competitive edge within the rapidly evolving automotive aftermarket and original equipment manufacturer (OEM) supply chains.

The accelerating adoption of electric vehicles (EVs) presents a significant technological shift, compelling companies like Holley to pivot towards developing specialized performance parts. This means moving beyond traditional internal combustion engine components to focus on areas critical for EV enhancement.

Innovation in battery management systems, advanced charging solutions, and the creation of lightweight, aerodynamic components are paramount. For instance, the global EV battery market was valued at approximately $105 billion in 2023 and is projected to reach over $400 billion by 2030, indicating a massive opportunity for companies that can supply performance-enhancing parts for these systems.

Holley's strategic focus must therefore encompass research and development in these nascent EV-specific technologies. This includes engineering power electronics, thermal management solutions for batteries, and high-performance electric drivetrains. By doing so, Holley can capitalize on the burgeoning EV aftermarket and maintain its relevance in the evolving automotive landscape.

The automotive aftermarket is seeing a significant uptake of AI and machine learning. These technologies are being applied to forecast demand more accurately, optimize inventory levels, and even refine the design of automotive parts, leading to more efficient operations and potentially better products.

Holley can harness AI to gain a competitive edge. By integrating these advanced analytical tools, the company can make more informed strategic decisions, improve operational efficiency, and ultimately elevate customer satisfaction through personalized experiences and better product availability.

For instance, AI-powered inventory management systems could help Holley reduce carrying costs by an estimated 10-15% in 2024, while predictive maintenance algorithms for their own manufacturing equipment could boost uptime by up to 5%.

Smart and Connected Performance Parts

The automotive aftermarket is seeing a significant shift towards smart and connected performance parts. These components, integrated with sensors, communication modules, and electronic control units (ECUs), are transforming how vehicles are tuned and maintained. This trend offers Holley a substantial opportunity to innovate and expand its product lines.

By incorporating these advanced technologies, Holley can develop parts that provide real-time data, enabling more precise performance tuning and sophisticated diagnostics. This connectivity also opens doors for over-the-air updates and remote monitoring, enhancing user experience and product value.

- Enhanced Functionality: Smart parts can offer features like adaptive performance tuning based on driving conditions and predictive maintenance alerts.

- New Revenue Streams: Connected diagnostics and performance data services could create recurring revenue opportunities for Holley.

- Market Differentiation: Early adoption and superior integration of smart technology can position Holley as a leader in the evolving performance parts market.

- Data-Driven Development: Insights gathered from connected parts can inform future product development, ensuring Holley stays ahead of market demands.

Digitalization and E-commerce Platforms

The automotive aftermarket's shift towards digitalization is accelerating, with e-commerce platforms becoming central to how consumers shop. Holley must adapt by strengthening its online capabilities and direct-to-consumer (DTC) approaches to align with these changing buying habits.

This digital transformation is evident in the growth of online sales within the auto parts sector. For instance, e-commerce sales in the automotive aftermarket are projected to continue their upward trend, with many analysts anticipating double-digit growth through 2025, driven by convenience and wider product availability.

- E-commerce Growth: The online channel is increasingly dominating aftermarket sales, offering consumers greater choice and competitive pricing.

- Logistics Enhancement: Investments in sophisticated logistics networks by competitors and industry players are setting new standards for delivery speed and efficiency.

- DTC Strategy: Holley's ability to effectively engage customers directly through its digital channels is crucial for building brand loyalty and capturing market share.

- Data Analytics: Leveraging data analytics from online interactions allows for personalized marketing and product development, crucial for staying ahead in a competitive digital landscape.

Technological advancements like additive manufacturing and smart factories are revolutionizing automotive parts production, promising increased efficiency and reduced lead times for Holley. The global 3D printing market in automotive is expected to reach tens of billions of dollars by the early 2030s, highlighting the growing adoption of these innovative manufacturing techniques.

The rise of electric vehicles (EVs) necessitates a strategic shift for Holley towards specialized performance parts, with the EV battery market alone projected to exceed $400 billion by 2030. This presents a significant opportunity for companies to develop components for advanced charging solutions and lightweight EV systems.

AI and machine learning are increasingly being used in the automotive aftermarket for demand forecasting and inventory optimization, potentially reducing carrying costs by 10-15% in 2024. Holley can leverage these tools for more informed decision-making and improved operational efficiency.

The trend towards smart and connected performance parts, integrated with sensors and ECUs, offers Holley a chance to innovate with real-time data capabilities and enhanced user experiences. E-commerce sales in the automotive aftermarket are anticipated to see double-digit growth through 2025, emphasizing the need for Holley to strengthen its digital and direct-to-consumer strategies.

Legal factors

Stringent emissions regulations from bodies like the Environmental Protection Agency (EPA) present ongoing legal hurdles for Holley, especially concerning products designed for internal combustion engines. For instance, the EPA's proposed emissions standards for model year 2027 and beyond aim to significantly reduce greenhouse gas emissions from light-duty vehicles, impacting aftermarket parts manufacturers.

Maintaining compliance with these evolving standards, which are slated for phased implementation through 2032, is paramount. Failure to adhere to these regulations can result in substantial penalties, potentially reaching millions of dollars, and could jeopardize market access for Holley's product lines.

The increasing momentum of Right to Repair legislation, exemplified by proposals like the REPAIR Act, poses a significant consideration for Holley. This legislation could compel manufacturers to grant broader access to vehicle diagnostic data and parts, directly affecting Holley's product development and sales strategies.

Such laws are designed to cultivate a more open and competitive aftermarket repair sector. This environment could benefit Holley by potentially lowering barriers to entry for their products and services, fostering greater consumer choice in vehicle maintenance and modification.

The imposition of tariffs on imported automotive parts, such as the 25% tariffs that took effect in 2025, directly impacts Holley's cost of goods sold and overall profitability. This legal framework necessitates careful consideration of supply chain diversification and potential price adjustments to maintain competitive positioning in the market.

Product Liability and Safety Standards

Holley, a prominent player in the performance automotive aftermarket, operates under a stringent legal framework concerning product liability and safety. As a manufacturer, the company is obligated to ensure its products not only meet but exceed all applicable safety regulations. This is especially critical in the high-performance segment where product failures can have significant safety implications for consumers.

Failure to comply with these standards can lead to substantial financial penalties, recalls, and damage to Holley's brand reputation. For instance, in 2023, the automotive industry saw numerous recalls impacting millions of vehicles due to safety defects, highlighting the severe consequences of non-compliance. Holley's commitment to rigorous testing and quality control directly mitigates these risks.

- Product Safety Compliance: Holley must ensure all performance parts, from engine components to exhaust systems, meet federal safety standards like those set by the EPA and NHTSA.

- Liability Mitigation: Implementing robust quality assurance processes and clear product usage guidelines helps Holley minimize its exposure to product liability lawsuits.

- Regulatory Adherence: Staying abreast of evolving safety regulations, particularly those related to emissions and vehicle modifications, is crucial for continued market access and legal standing.

- Consumer Trust: Demonstrating a strong commitment to safety through product design and manufacturing builds consumer trust, a vital asset in the performance automotive market.

Intellectual Property Rights

Intellectual property rights are crucial for Holley, a company deeply invested in developing innovative performance automotive products. Protecting its patents, trademarks, and unique designs is essential to maintain its competitive edge and prevent unauthorized use.

Legal frameworks safeguarding these innovations are vital for Holley to combat counterfeiting and the unauthorized reproduction of its technologies in the aftermarket. This ensures the integrity of its brand and the value of its proprietary solutions.

For instance, in 2023, the global market for counterfeit goods was estimated to be worth hundreds of billions of dollars, highlighting the significant threat Holley faces. Robust IP protection can directly impact revenue streams and brand reputation.

- Patent Protection: Securing patents for new product designs and manufacturing processes prevents competitors from legally copying Holley's innovations.

- Trademark Enforcement: Protecting brand names and logos through trademarks ensures consumers recognize and trust genuine Holley products, deterring imitations.

- Design Registrations: Registering unique product designs offers legal recourse against unauthorized replication of Holley's aesthetic and functional elements.

- Legal Recourse: Holley can pursue legal action against entities infringing on its intellectual property, seeking damages and injunctions to stop illicit activities.

Holley's legal landscape is shaped by evolving environmental regulations, particularly concerning emissions standards for internal combustion engines. The EPA's proposed rules for model years 2027 and beyond, with phased implementation through 2032, directly impact aftermarket parts manufacturers like Holley. Non-compliance can lead to substantial penalties, potentially millions of dollars, and could restrict market access for certain product lines.

Furthermore, the rise of Right to Repair legislation, such as the REPAIR Act, presents a significant consideration. These laws aim to promote a more open aftermarket by mandating access to diagnostic data and parts, which could influence Holley's product development and sales strategies by potentially lowering entry barriers for their offerings.

Tariffs on imported automotive parts, like the 25% tariffs implemented in 2025, directly affect Holley's cost of goods sold and profitability. This necessitates strategic supply chain diversification and potential price adjustments to maintain market competitiveness.

Holley faces stringent product liability and safety regulations, requiring its performance parts to meet or exceed standards set by agencies like the EPA and NHTSA. Robust quality control and clear usage guidelines are crucial to mitigate risks of lawsuits and brand damage, especially given the industry's history of recalls, such as those affecting millions of vehicles in 2023 due to safety defects.

Intellectual property protection is vital for Holley to safeguard its innovations and maintain a competitive edge. The global market for counterfeit goods, estimated in the hundreds of billions of dollars in 2023, underscores the threat of unauthorized reproduction of technologies. Protecting patents, trademarks, and designs is essential to prevent revenue loss and brand dilution.

| Legal Factor | Impact on Holley | Example/Data Point |

|---|---|---|

| Emissions Regulations | Compliance costs, potential market restrictions | EPA proposed standards for MY2027+ impacting aftermarket parts |

| Right to Repair | Changes in product development and sales strategies | REPAIR Act proposals for data and parts access |

| Tariffs | Increased cost of goods sold, profitability pressure | 25% tariffs on imported automotive parts (effective 2025) |

| Product Liability & Safety | Need for rigorous quality control, risk of recalls/penalties | Industry recalls in 2023 impacted millions of vehicles |

| Intellectual Property | Protection of innovation, revenue stream integrity | Global counterfeit market valued in hundreds of billions (2023) |

Environmental factors

The global automotive industry is undergoing a dramatic transformation, with a pronounced shift towards electric vehicles (EVs) driven by increasing environmental consciousness and regulatory pressures. By the end of 2024, EV sales are projected to reach over 16 million units globally, a substantial leap from previous years, signaling a permanent change in consumer preference and infrastructure development.

This evolving landscape directly impacts companies like Holley, which have historically focused on internal combustion engine (ICE) performance parts. To maintain market relevance and capitalize on new opportunities, Holley must innovate and develop performance-enhancing components specifically designed for EVs, such as advanced battery cooling systems, electric motor efficiency upgrades, and specialized drivetrain solutions.

The market for EV aftermarket parts is rapidly expanding, with projections suggesting it could reach hundreds of billions of dollars by 2030. This presents a critical need for Holley to adapt its product portfolio and manufacturing capabilities to cater to this burgeoning sector, ensuring its continued growth and competitiveness in the future of automotive performance.

The automotive industry's increasing emphasis on fuel efficiency and emissions reduction directly influences the market for performance parts. For Holley, this trend means a growing demand for products that can enhance vehicle performance without compromising on environmental standards. For instance, in 2024, global regulations like Euro 7 are pushing manufacturers towards stricter emission controls, impacting aftermarket component design.

Holley must innovate by creating solutions that offer both improved performance and better fuel economy. This strategic pivot is crucial to align with evolving consumer preferences and increasingly stringent environmental regulations worldwide. The company's research and development in areas like advanced fuel injection systems and efficient exhaust technologies will be key to capturing market share in this changing landscape.

Growing environmental consciousness is a significant driver for manufacturers like Holley to embrace sustainable production. This trend means adopting greener materials, minimizing waste streams, and optimizing energy usage throughout the manufacturing cycle to align with stricter regulations and consumer preferences.

Raw Material Sourcing and Supply Chain Sustainability

The environmental impact of sourcing raw materials and the sustainability of Holley's supply chain are under increasing scrutiny. This pressure is particularly relevant as the company expands into new technologies like electric vehicle (EV) components, where ethical and sustainable sourcing is paramount. For example, the automotive industry, a key market for Holley, saw significant investment in sustainable supply chains, with many manufacturers setting ambitious targets for recycled content and reduced carbon footprints in their materials by 2025.

Holley may face growing demands from consumers and regulators to demonstrate the sustainability of its material sourcing. This includes ensuring that the extraction and processing of materials used in their performance automotive parts and aftermarket products adhere to environmental standards. The push for greener manufacturing practices means that companies like Holley need to actively manage their supply chains to mitigate environmental risks and enhance their brand reputation.

- Supply Chain Transparency: Increased demand for visibility into the origins and environmental impact of raw materials used in automotive components.

- EV Component Sourcing: Growing pressure to ensure ethically and sustainably sourced materials for new technologies, such as rare earth metals for EV batteries and components.

- Regulatory Compliance: Adherence to evolving environmental regulations concerning material sourcing, waste reduction, and carbon emissions throughout the supply chain.

- Consumer Expectations: A rising consumer preference for products from companies demonstrating commitment to environmental responsibility and sustainable practices.

Waste Management and Recycling of Automotive Parts

The environmental impact of automotive parts at the end of their life cycle is a growing concern for regulators and consumers alike. Holley, like other players in the automotive aftermarket, faces increasing pressure to address waste management and recycling. This includes considering the recyclability of its own products and potentially engaging in industry-wide initiatives for responsible disposal and material recovery.

The automotive industry is actively working towards more sustainable practices. For instance, the European Union's End-of-Life Vehicles (ELV) Directive sets targets for recovery and recycling rates. By 2020, the directive mandated that 95% of vehicle weight by average should be reused or recovered, with at least 85% of that being recycled. Manufacturers are increasingly designing components with recyclability in mind, and the aftermarket is expected to follow suit.

Holley's approach to waste management and recycling could involve several key areas:

- Product Design: Incorporating materials that are easily recyclable or made from recycled content.

- Supply Chain: Partnering with suppliers who adhere to environmental standards for material sourcing and waste reduction.

- End-of-Life Solutions: Exploring take-back programs or collaborations with specialized recycling facilities for its products, such as performance exhaust systems or engine components.

- Regulatory Compliance: Staying abreast of evolving environmental regulations globally, particularly those related to material content and disposal of automotive parts.

Environmental factors are increasingly shaping the automotive aftermarket, pushing companies like Holley towards sustainability. Growing consumer awareness of climate change and stricter emissions standards globally are driving demand for greener automotive solutions. By 2024, the global automotive industry is investing heavily in sustainable manufacturing processes, with a significant portion of R&D budgets allocated to reducing carbon footprints and improving material recyclability.

Holley must adapt by embracing eco-friendly materials and production methods, aligning with regulatory pressures and evolving consumer expectations. The company's strategic response to these environmental shifts will be crucial for long-term viability and market competitiveness, especially as the industry moves towards electrification and reduced environmental impact.

The push for sustainability extends to the entire product lifecycle, from sourcing to end-of-life management. Companies are expected to demonstrate transparency in their supply chains and offer products designed for recyclability. By 2025, many major automotive manufacturers aim to incorporate at least 25% recycled content in their vehicle components, setting a precedent for the aftermarket sector.

Holley's commitment to environmental responsibility will be a key differentiator. This includes managing waste streams effectively and exploring circular economy principles in its operations. For instance, the company's efforts in developing high-performance parts that also offer improved fuel efficiency directly address environmental concerns and regulatory demands.

| Environmental Factor | Impact on Holley | Actionable Insight |

|---|---|---|

| Climate Change & Emissions | Increased demand for fuel-efficient and EV-compatible performance parts. Regulatory pressure for reduced emissions. | Develop and market performance upgrades for EVs and hybrid vehicles. Focus on products that improve ICE efficiency. |

| Resource Scarcity & Sourcing | Scrutiny on raw material sourcing for sustainability and ethical practices. | Enhance supply chain transparency and partner with suppliers committed to sustainable sourcing. Explore recycled materials. |

| Waste Management & Recycling | Growing pressure for product recyclability and responsible end-of-life disposal. | Design products with recyclability in mind. Investigate take-back programs or partnerships for product recycling. |

| Consumer Environmental Awareness | Consumer preference for environmentally responsible brands and products. | Communicate Holley's sustainability initiatives and product benefits in terms of environmental impact. |

PESTLE Analysis Data Sources

Our Holley PESTLE Analysis is meticulously crafted using data from reputable sources including government economic reports, industry-specific market research, and analyses of legislative changes. This ensures a comprehensive understanding of the external factors influencing Holley's operational landscape.