Holley Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holley Bundle

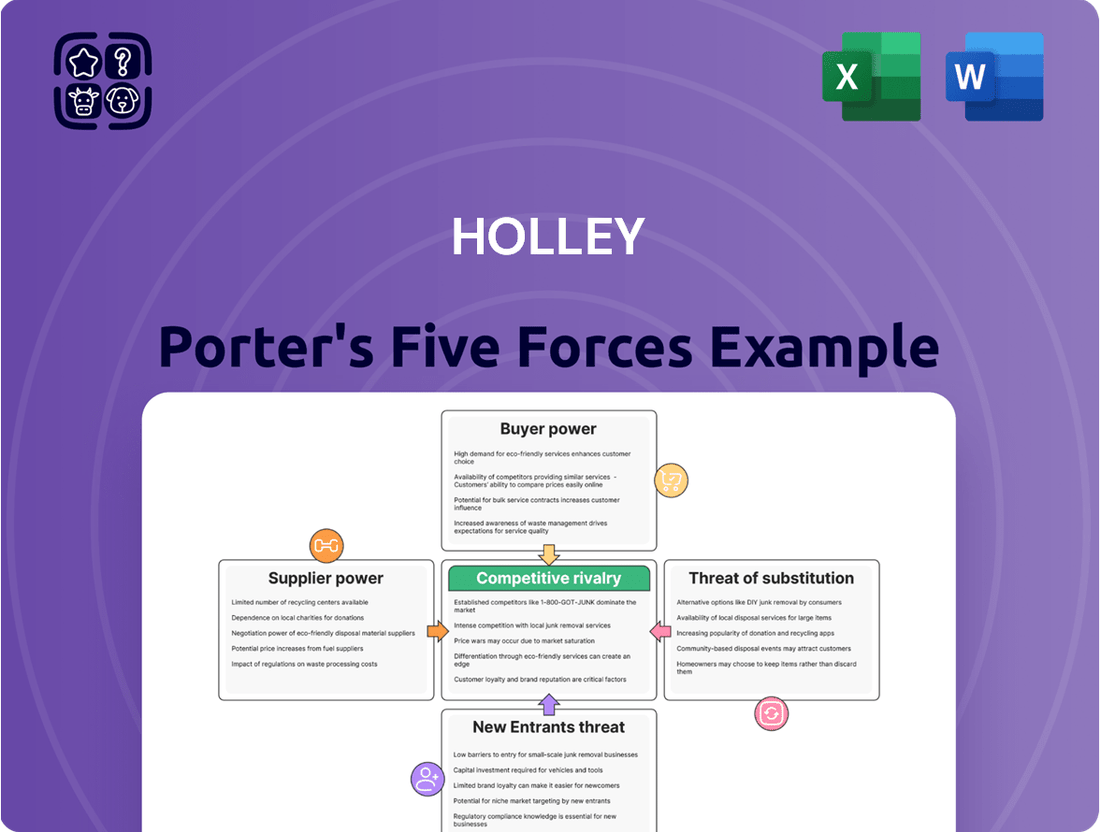

Holley's Five Forces Analysis reveals the intricate competitive landscape shaping its market. Understanding the power of buyers, the threat of new entrants, and the intensity of rivalry is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Holley’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Holley's leverage with its suppliers hinges on how concentrated the market is for specialized automotive performance parts. If a small number of companies control the production of essential components, these suppliers gain significant power, which can translate into increased costs for Holley.

For instance, in 2024, the automotive aftermarket sector, where Holley operates, often relies on a limited pool of manufacturers for high-performance engine components and advanced electronic systems. This scarcity can empower suppliers, allowing them to dictate terms and prices, impacting Holley's profitability.

The switching costs for Holley when dealing with its suppliers are a significant factor in the bargaining power of those suppliers. If it's costly or complicated for Holley to change from one supplier to another for a critical component, then the supplier holds more sway.

Consider the expense and effort involved in retooling manufacturing lines, re-engineering product designs to accommodate a new supplier's specifications, or undergoing rigorous requalification processes. These hurdles can make switching suppliers a substantial undertaking, thereby reducing Holley's negotiating leverage.

Suppliers offering highly unique or patented components, for which there are no easy substitutes, naturally wield more influence. This uniqueness makes it difficult for buyers like Holley to switch suppliers without significant disruption or cost. For instance, if a critical component for Holley's performance exhaust systems is only available from a single, specialized manufacturer with a patent, that supplier's bargaining power is amplified.

Holley actively works to diminish this supplier leverage by developing its own proprietary technologies and in-house manufacturing capabilities. By investing in research and development, Holley aims to reduce its reliance on external, unique inputs. In 2024, Holley reported significant investment in its R&D efforts, focusing on developing innovative product features and manufacturing processes, which directly addresses this aspect of supplier bargaining power.

Threat of Forward Integration by Suppliers

If suppliers possess a credible threat of integrating forward into manufacturing or distributing performance products themselves, they can exert significant pressure on Holley. This means suppliers could potentially start making and selling the same types of products Holley offers, cutting out the middleman. Such a move would directly compete with Holley, potentially reducing Holley's market share and profitability.

This threat forces Holley to cultivate and maintain robust relationships with its current suppliers. It also encourages Holley to consider strategic partnerships or even vertical integration of its own to secure its supply chain and competitive position. For instance, if a key component supplier, like a specialized engine part manufacturer, were to announce plans to launch its own line of performance exhaust systems, Holley would need to react strategically.

- Supplier Integration Threat: Suppliers moving into manufacturing or distribution of performance products directly challenges Holley's business model.

- Competitive Pressure: This forward integration by suppliers can lead to increased competition, potentially impacting Holley's pricing power and market share.

- Strategic Responses: Holley must foster strong supplier relationships and consider partnerships or its own integration to mitigate this threat.

- Industry Example: If a major supplier of performance ignition systems were to launch its own branded spark plug wires, it would represent a direct competitive move against Holley's existing product lines.

Importance of Holley to Supplier's Business

The importance of Holley's business to a supplier's overall revenue is a key factor in determining the supplier's bargaining power. If Holley constitutes a significant portion of a supplier's sales, that supplier will likely be more amenable to favorable pricing and terms to secure Holley's continued patronage.

For instance, if a supplier's revenue is heavily reliant on Holley, they may be less inclined to push for higher prices or stricter payment terms, as losing Holley as a customer could severely impact their own financial stability. This dependence can shift the negotiation leverage towards Holley.

- Supplier Revenue Dependence: If Holley represents a substantial percentage of a supplier's total sales, the supplier has less leverage.

- Risk of Customer Loss: A supplier heavily dependent on Holley faces significant risk if Holley seeks alternative suppliers, encouraging concessions.

- Holley's Purchasing Volume: Large order volumes from Holley can give it considerable influence over suppliers' pricing and production schedules.

Suppliers hold significant power when they provide unique or critical components with few alternatives, forcing buyers like Holley to accept less favorable terms. This is amplified if switching suppliers involves high costs, such as retooling or requalification. In 2024, the specialized nature of many automotive performance parts meant that a single supplier could control a crucial element, increasing their leverage.

Suppliers who are themselves vulnerable to forward integration, meaning they could start producing Holley's products, also gain bargaining power. This threat compels Holley to maintain strong supplier relationships and consider its own integration strategies. The risk of a supplier entering Holley's market directly impacts Holley's competitive standing.

Conversely, Holley's bargaining power increases when it represents a substantial portion of a supplier's revenue. In such cases, suppliers are more incentivized to offer better pricing and terms to retain Holley's business. Holley's large purchasing volumes in 2024 likely provided it with considerable influence over its suppliers' pricing and production plans.

| Factor | Impact on Holley | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Limited manufacturers for specialized parts. |

| Switching Costs | High costs empower suppliers. | Retooling and requalification are significant hurdles. |

| Uniqueness of Inputs | Patented or unique components grant suppliers leverage. | Single-source for critical performance components. |

| Supplier Forward Integration Threat | Direct competition risk. | Suppliers could launch competing product lines. |

| Holley's Importance to Supplier | Holley's large volume reduces supplier leverage. | Significant portion of supplier revenue can lead to concessions. |

What is included in the product

Holley Porter's Five Forces Analysis provides a comprehensive framework to understand the competitive intensity and attractiveness of the automotive aftermarket industry. It examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors, offering strategic insights for Holley.

Effortlessly identify and quantify competitive threats, allowing you to proactively address market pressures and safeguard your business.

Customers Bargaining Power

Holley's customer base is diverse, encompassing automotive enthusiasts, racers, and professional builders. While individual enthusiasts typically hold minimal bargaining power, significant customers like large distributors or professional racing teams that purchase in high volumes can indeed exert more influence on pricing and contract terms.

For instance, in 2023, Holley reported that its top ten customers accounted for approximately 30% of its net sales. This concentration, though not overwhelming, highlights the potential leverage held by these larger entities, requiring Holley to manage these relationships carefully to maintain favorable terms.

The company's strategic approach of focusing on four distinct consumer vertical groupings aims to better manage this customer diversity. This segmentation allows Holley to tailor its offerings and sales strategies, potentially mitigating the concentrated bargaining power of any single large customer segment by fostering loyalty and value across multiple channels.

Customers have a wide array of choices when it comes to upgrading their vehicle's performance. They can opt for products from numerous competing aftermarket manufacturers or even select original equipment manufacturer (OEM) parts, which often provide a comparable or superior alternative. This abundance of options directly fuels the bargaining power of customers.

The accessibility of these substitutes makes it relatively simple for customers to switch their allegiance from one brand to another. For instance, in 2024, the aftermarket automotive parts industry is projected to reach over $500 billion globally, demonstrating the sheer volume of competing products available. This ease of switching means customers can readily compare prices and features, pushing manufacturers to offer more competitive pricing and better value to retain their business.

Holley's customer price sensitivity is a key factor in its bargaining power. While performance enthusiasts often prioritize product quality and capability, a segment of the market remains budget-conscious, especially in the aftermarket automotive sector. This can lead to increased price pressure on Holley's offerings.

In 2024, the automotive aftermarket continued to see a bifurcation in demand. While high-performance parts remain sought after by dedicated enthusiasts, economic factors and rising interest rates may have influenced purchasing decisions for a broader customer base. This suggests that while Holley's core customer may be less price-sensitive, the overall market dynamics could amplify this force.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly impacts Holley's bargaining power. If substantial clients, like prominent racing organizations or major aftermarket distributors, possess the means or motivation to manufacture their own performance components, they could lessen their dependence on Holley. This capability would naturally amplify their leverage in negotiations.

For instance, a large professional racing team that spends millions annually on Holley's fuel systems might explore developing in-house manufacturing capabilities if cost savings or customization control become sufficiently attractive. This potential shift could force Holley to offer more favorable pricing or terms to retain such valuable clientele.

- Customer Integration Threat: Large customers, such as major professional racing teams or significant vehicle customizers, might develop the capability or find the incentive to produce their own performance parts.

- Reduced Reliance: If customers can produce parts internally, their reliance on Holley for these components diminishes.

- Increased Bargaining Power: This reduced reliance directly translates to increased bargaining power for these customers, enabling them to negotiate better terms or pricing.

- Market Dynamics: Holley's market position and pricing strategies must account for the potential for key customers to vertically integrate backward.

Customer Information and Transparency

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online platforms provide detailed product specifications, user reviews, and side-by-side price comparisons, empowering buyers to make well-informed decisions. This transparency means companies like Holley, operating in the automotive aftermarket, must offer competitive pricing and superior value to attract and retain customers.

The proliferation of e-commerce in the automotive aftermarket is a prime example of this trend. Customers can effortlessly research and compare offerings from a vast array of suppliers without leaving their homes. For instance, by mid-2024, online sales in the automotive aftermarket were projected to continue their upward trajectory, with many consumers prioritizing convenience and price discovery through digital channels.

- Increased Information Access: Online reviews and detailed product data empower consumers to compare options easily.

- Price Transparency: Digital platforms facilitate direct price comparisons across multiple vendors, driving down margins for suppliers.

- E-commerce Growth: The automotive aftermarket saw continued growth in online sales throughout 2024, with customers readily utilizing digital tools for research and purchasing.

The bargaining power of customers for Holley is influenced by several factors, including the availability of substitutes, customer price sensitivity, and the threat of backward integration. With a vast global aftermarket projected to exceed $500 billion in 2024, customers have numerous alternatives to Holley's products, from other aftermarket manufacturers to OEM parts.

While performance enthusiasts may be less price-sensitive, economic conditions in 2024 could increase price pressure on a broader customer base. Furthermore, significant customers like large distributors or racing teams, who accounted for about 30% of Holley's net sales in 2023, possess leverage due to their volume purchases and the potential to develop in-house manufacturing capabilities.

| Factor | Impact on Holley | Supporting Data (2023-2024) |

|---|---|---|

| Availability of Substitutes | High | Global automotive aftermarket projected over $500 billion in 2024. |

| Customer Price Sensitivity | Moderate to High | Economic factors in 2024 may increase sensitivity for some customer segments. |

| Customer Concentration | Moderate | Top ten customers represented ~30% of net sales in 2023. |

| Threat of Backward Integration | Moderate | Large customers may develop in-house manufacturing for cost or control. |

Preview the Actual Deliverable

Holley Porter's Five Forces Analysis

This preview showcases the exact Holley Porter's Five Forces Analysis you will receive immediately after purchase, providing a comprehensive understanding of competitive forces within an industry. You'll gain actionable insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. This professionally formatted document is ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

The automotive aftermarket for performance products is a crowded space, featuring a wide array of competitors. These range from major, well-established brands with extensive product lines to smaller, specialized manufacturers focusing on specific niches. Holley itself, with its vast collection of over 70 brands, navigates this highly competitive environment where numerous companies actively seek to capture market share.

The automotive aftermarket industry is demonstrating robust growth, with forecasts pointing towards continued expansion. For instance, the global automotive aftermarket was valued at approximately $478 billion in 2023 and is projected to reach over $700 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 5.7%.

While this overall expansion can soften the intensity of competition by creating more opportunities, it doesn't eliminate it. Intense rivalry can still be observed within specific niches or for particular product lines, as companies vie for market share in these growing segments.

Holley's competitive edge hinges on its product differentiation, achieved through a blend of innovation, strong brand equity, and superior quality. The company actively distinguishes its offerings in the automotive aftermarket by focusing on specialized applications and cultivating a portfolio of iconic brands like Holley EFI, MSD, and Flowmaster. This strategy allows Holley to command premium pricing and foster customer loyalty by providing distinct value propositions.

Switching Costs for Customers

The performance parts industry, including segments where Holley operates, often features relatively low switching costs for customers. This means it's generally easy for consumers to move from one brand of performance part to another, which in turn fuels a more intense competitive rivalry among manufacturers. For instance, a customer looking to upgrade their vehicle's exhaust system might find numerous brands offering comparable products with similar installation processes, making brand loyalty a significant challenge.

Holley actively works to counteract these low switching costs by focusing on building strong brand loyalty. They achieve this through a multi-pronged approach emphasizing superior product quality, demonstrable performance gains, and a positive overall customer experience. This commitment is reflected in their consistent investment in research and development, aiming to deliver innovative and reliable components that resonate with enthusiasts.

- Low Switching Costs: Customers can easily switch between performance part brands, increasing competitive pressure.

- Brand Loyalty Focus: Holley aims to retain customers through high-quality products and performance.

- Customer Experience: A positive interaction and support system are key to building loyalty.

- Industry Trend: The ease of switching is a common characteristic across many automotive aftermarket segments.

Exit Barriers

High exit barriers, like specialized machinery or deeply ingrained brand loyalty, can trap companies in an industry even when they are not profitable. This persistence by struggling firms intensifies competition, often leading to price wars or aggressive promotional efforts as these companies fight to survive.

For instance, in the automotive sector, the significant investment in specialized manufacturing plants and tooling represents a substantial exit barrier. Companies that have invested heavily in these assets may continue production at a loss rather than abandon their investment, impacting overall industry profitability and competitive dynamics.

- Specialized Assets: High upfront costs for unique equipment make exiting difficult.

- Brand Loyalty: Strong customer relationships can tie companies to a market.

- Management Disagreement: Differing views on when to exit can prolong operations.

- Emotional Factors: Founders or long-term employees may resist leaving a familiar industry.

The automotive aftermarket is intensely competitive, with numerous players ranging from large corporations to niche specialists. This environment is characterized by relatively low switching costs for consumers, meaning customers can easily shift between brands, which amplizes the rivalry. Holley combats this by fostering strong brand loyalty through superior product quality and performance, as seen in its investments in R&D.

| Factor | Description | Impact on Holley |

|---|---|---|

| Competitor Landscape | Fragmented market with established brands and specialized niche players. | Requires continuous innovation and strong brand differentiation. |

| Switching Costs | Generally low for consumers, allowing easy brand transitions. | Intensifies price and feature competition; necessitates loyalty-building strategies. |

| Brand Loyalty | Holley focuses on building loyalty through quality, performance, and customer experience. | A key strategy to mitigate low switching costs and retain market share. |

| Industry Growth | Global automotive aftermarket projected to exceed $700 billion by 2030 (from $478 billion in 2023). | Growth can absorb some competitive pressure, but intense rivalry persists in specific segments. |

SSubstitutes Threaten

The threat of substitutes for Holley's performance-enhancing products is significant. Automotive enthusiasts have several alternatives to modifying their existing vehicles. This includes focusing on routine maintenance and repairs, which can improve a car's existing performance without aftermarket parts.

Furthermore, consumers can opt to purchase new vehicles that come equipped with higher stock performance capabilities, bypassing the need for aftermarket upgrades altogether. For instance, the average transaction price for a new vehicle in the U.S. reached an estimated $48,500 in early 2024, a figure that can make a new, higher-performing car a viable, albeit expensive, substitute for modifying an older one.

Technological advancements in vehicle design pose a significant threat of substitution for aftermarket performance parts. As original equipment manufacturers (OEMs) increasingly build advanced performance features directly into new vehicles, the demand for certain aftermarket modifications may decline. For example, many 2024 performance sedans now offer factory-tuned engines and sophisticated adaptive suspension systems that previously required aftermarket upgrades.

The accelerating shift towards electric vehicles (EVs) further diversifies this threat. While EVs open new avenues for specialized aftermarket services, they fundamentally alter the nature of performance enhancement. The 2024 market saw a notable increase in EV sales, with projections indicating continued strong growth, meaning traditional internal combustion engine (ICE) performance parts face a shrinking, albeit still substantial, market segment.

The automotive aftermarket is split between Do-It-Yourself (DIY) and Do-It-For-Me (DIFM) customers. Holley primarily targets DIY enthusiasts, but a growing trend towards DIFM, driven by the increasing complexity of modern vehicles, presents a potential threat. If professional installers increasingly opt for Original Equipment Manufacturer (OEM) parts or specific competitor brands for newer, more technologically advanced vehicles, demand for certain Holley products could decline. For example, the average age of vehicles on the road in the US remained around 12.5 years in 2023, but newer vehicles often require specialized tools and knowledge for maintenance, pushing owners towards DIFM services.

Cost-Effectiveness of Substitutes

The threat of substitutes for Holley is heightened if alternative solutions provide comparable performance at a substantially lower price point. For instance, the availability of less expensive, generic aftermarket parts or alternative engine tuning methods that achieve similar performance gains presents a direct challenge. In 2023, the aftermarket automotive parts industry saw significant growth, with some segments experiencing price competition as more accessible options emerged.

Consider these points regarding the cost-effectiveness of substitutes:

- Lower-Priced Generic Parts: The presence of generic automotive components that offer similar functionality to Holley's specialized products at a reduced cost erodes Holley's pricing power.

- Alternative Tuning Solutions: The emergence of readily available, less expensive engine tuning software or hardware that delivers comparable horsepower or efficiency improvements directly competes with Holley's performance-oriented offerings.

- DIY vs. Professional Solutions: If do-it-yourself tuning or modification kits become significantly cheaper and easier to implement than Holley's professional-grade solutions, it could draw customers seeking cost savings.

- Impact on Market Share: A significant price differential in favor of substitutes could lead to a noticeable shift in market share, particularly among price-sensitive consumers within the automotive aftermarket.

Changing Consumer Preferences

Evolving consumer preferences represent a significant threat of substitutes for Holley. A growing interest in electric vehicles (EVs) or a broader shift towards sustainability could decrease demand for traditional internal combustion engine (ICE) performance products. For instance, in 2024, EV sales continued to climb, capturing a larger market share, which directly impacts the long-term viability of ICE-centric aftermarket parts.

Holley's strategic focus includes adapting to these evolving trends. The broader automotive aftermarket is already seeing this shift, with companies investing in EV-compatible components and services. This means that while Holley's core business is ICE performance, the potential for substitutes in the form of EV aftermarket solutions is a growing concern.

- Shifting Market Demand: Increased consumer adoption of EVs directly reduces the addressable market for traditional ICE performance parts.

- Sustainability Focus: A growing consumer emphasis on environmental impact can steer purchasing decisions away from high-performance ICE vehicles and their associated aftermarket products.

- Technological Advancements: Innovations in EV technology may offer performance characteristics that appeal to consumers, presenting a substitute for traditional performance upgrades.

- Regulatory Pressures: Government regulations promoting EVs and restricting ICE vehicles further accelerate the shift in consumer preference and the threat of substitutes.

The threat of substitutes for Holley's performance parts is substantial, encompassing everything from buying new, high-performance vehicles to opting for simpler maintenance. The increasing complexity of modern cars also pushes consumers towards professional installation (DIFM), potentially favoring OEM parts over aftermarket solutions.

Furthermore, the rapid rise of electric vehicles (EVs) presents a significant long-term substitute, fundamentally altering the performance modification landscape. As EVs gain market share, the demand for traditional internal combustion engine (ICE) performance parts naturally shrinks. For instance, EV sales in the US continued their upward trajectory through early 2024, capturing an increasing percentage of the overall automotive market.

The availability of lower-priced generic parts or alternative tuning methods also poses a direct challenge to Holley's premium offerings. Consumers seeking cost savings may opt for these less expensive alternatives, impacting Holley's market share, especially among price-sensitive segments of the automotive aftermarket.

| Substitute Category | Example | Impact on Holley | 2024 Market Trend/Data Point |

|---|---|---|---|

| New Vehicle Purchase | Buying a factory-tuned performance car | Reduces demand for aftermarket upgrades | Average new vehicle transaction price in U.S. estimated at $48,500 in early 2024 |

| Routine Maintenance | Focusing on engine upkeep | Bypasses need for performance parts | |

| EV Adoption | Purchasing an electric vehicle | Shrinks the ICE performance market | Continued strong growth in EV sales throughout 2024 |

| Generic Aftermarket Parts | Less expensive, non-branded components | Price competition and market share erosion | Growth in accessible aftermarket options noted in 2023 |

| Alternative Tuning | Cheaper engine tuning software | Direct competition for performance gains |

Entrants Threaten

The automotive performance products sector demands substantial upfront investment. Companies need to fund extensive research and development to create innovative products, build or acquire state-of-the-art manufacturing facilities, and establish robust distribution channels to reach customers effectively. For instance, a new entrant might need to invest hundreds of millions of dollars just to get a new engine component line off the ground.

Holley benefits from a strong portfolio of iconic and established brands, such as Holley EFI, MSD, and Flowmaster, which have cultivated significant brand loyalty over decades. This deep-seated customer preference makes it challenging for newcomers to gain traction. For instance, in 2023, Holley's aftermarket segment, which heavily relies on brand recognition, continued to demonstrate resilience, contributing substantially to its overall revenue.

New companies entering the automotive aftermarket often struggle to replicate Holley's established distribution network. This involves securing shelf space with major retailers and building direct-to-consumer sales infrastructure, which requires significant investment and time.

Proprietary Technology and Expertise

Holley's deep-rooted history in developing specialized fuel systems, engine components, and exhaust systems creates a significant barrier for potential new entrants. This established track record of innovation translates into proprietary technologies that are difficult and costly to replicate.

New companies looking to enter the market would face substantial hurdles, requiring massive investments in research and development to create comparable proprietary technologies. Alternatively, they might need to acquire existing specialized firms, a move that could prove prohibitively expensive.

- Proprietary Technology: Holley's extensive patent portfolio in areas like EFI systems and intake manifolds represents a significant competitive moat.

- R&D Investment: Developing comparable technology could cost new entrants tens of millions of dollars in research and development, a figure that was likely even higher in 2024 given ongoing advancements.

- Acquisition Costs: Acquiring a firm with established proprietary technology could involve premiums of 20-30% over market value, further increasing the entry cost.

Regulatory and Safety Standards

The automotive performance industry faces stringent regulatory and safety standards, especially for racing components. New entrants must invest heavily in research, development, and testing to ensure compliance with these complex requirements, creating a substantial barrier to entry.

For instance, organizations like SEMA (Specialty Equipment Market Association) actively engage with regulatory bodies to shape standards, and compliance with emissions regulations, such as those enforced by the EPA in the United States, adds another layer of difficulty. Failure to meet these standards can result in significant fines and product recalls.

- High Compliance Costs: Meeting safety and emissions standards requires significant upfront investment in testing and certification, potentially costing new entrants hundreds of thousands of dollars.

- Technical Expertise: Navigating these regulations demands specialized engineering and legal expertise, which can be a challenge for smaller or less established companies.

- Product Homologation: Obtaining approvals for performance parts in different markets, especially for international sales, involves lengthy and costly homologation processes.

The threat of new entrants in the automotive performance products sector is moderate, largely due to significant capital requirements and established brand loyalty. New companies face high upfront costs for research, development, and manufacturing, estimated to be in the hundreds of millions for new product lines. Holley's strong brand recognition, built over decades with names like Holley EFI and MSD, creates a substantial hurdle for newcomers seeking to capture market share.

Furthermore, replicating Holley's extensive distribution networks and proprietary technologies presents considerable challenges. The need for specialized technical expertise to navigate stringent regulatory and safety standards, such as EPA emissions compliance, adds another layer of difficulty and cost for potential entrants. For example, obtaining product homologation for international markets can be a lengthy and expensive process.

| Barrier to Entry | Estimated Cost/Challenge | Impact on New Entrants |

|---|---|---|

| Capital Investment (R&D, Manufacturing) | Hundreds of millions of dollars | High barrier; requires significant funding |

| Brand Loyalty & Reputation | Decades of customer preference | Difficult to overcome; requires strong marketing |

| Distribution Network Access | Securing retail space, D2C infrastructure | Time-consuming and costly to build |

| Proprietary Technology & Patents | Tens of millions in R&D replication | Requires significant innovation or acquisition |

| Regulatory Compliance (Safety, Emissions) | Hundreds of thousands for testing/certification | Demands specialized expertise and investment |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial reports from industry leaders, comprehensive market research studies, and government economic indicators. This blend of sources allows for a thorough evaluation of industry rivalry, the bargaining power of suppliers and buyers, the threat of new entrants, and the intensity of substitute products.