Hobby Lobby Stores Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hobby Lobby Stores Bundle

Hobby Lobby's competitive landscape is shaped by moderate buyer power, as customers have choices but are often drawn to its unique product mix and pricing. The threat of new entrants is somewhat limited by capital requirements and brand loyalty, while the bargaining power of suppliers is a key factor in managing costs for its diverse inventory.

The complete report reveals the real forces shaping Hobby Lobby Stores’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hobby Lobby sources a wide variety of arts, crafts, and home decor products from numerous manufacturers and distributors worldwide. For many common craft items and seasonal decor, this broad supplier network typically dilutes the bargaining power of individual suppliers.

While the overall supplier base is fragmented, the concentration of suppliers can increase for niche or proprietary items. In these instances, where Hobby Lobby has fewer alternatives for specific, unique products, the bargaining power of those particular suppliers would likely be more pronounced.

While many craft supplies are readily available from numerous sources, Hobby Lobby may encounter situations where certain specialized materials, unique designs, or proprietary tools are sourced from a limited number of suppliers. This can give those specific suppliers more leverage.

However, Hobby Lobby's significant investment in private label products, which represent over 60% of its inventory, likely mitigates overall supplier power. By manufacturing many of its own goods or securing exclusive agreements, Hobby Lobby gains considerable control over its supply chain, reducing its dependence on external vendors for a substantial portion of its business.

Switching costs for Hobby Lobby's suppliers can fluctuate. For readily available, mass-produced goods, the ease of finding alternative sources keeps these costs low. However, when dealing with specialized or custom-made inventory, the expense and effort involved in sourcing new suppliers, potential retooling, or reconfiguring logistics can become substantial, indicating a moderate to high switching cost for specific product categories.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into retail is generally low for Hobby Lobby. Most suppliers lack the necessary retail expertise, significant capital, and established distribution networks to effectively compete with large-format retailers like Hobby Lobby.

However, a small segment of the market might see niche or specialized suppliers selling directly to consumers online. This bypasses traditional retail channels, though it's more common for unique artisan goods rather than the mass-market craft supplies Hobby Lobby typically offers.

- Low Threat: Suppliers generally lack the scale and expertise for forward integration into retail.

- Niche Online Sales: Some specialized suppliers may sell directly to consumers online.

- Limited Impact: This direct-to-consumer trend primarily affects unique artisan goods, not mass-market craft supplies.

Impact of Global Supply Chain Issues

Global supply chain disruptions continued to be a significant factor in 2024, with labor shortages and geopolitical tensions impacting availability and costs. These persistent challenges have generally bolstered the bargaining power of suppliers across many sectors. For Hobby Lobby, this means suppliers may have more leverage in price negotiations or delivery schedules, potentially increasing procurement expenses or causing stock delays.

The impact of these ongoing supply chain issues can translate directly into higher costs for raw materials and finished goods. For instance, shipping container costs, while fluctuating, remained elevated in early 2024 compared to pre-pandemic levels, directly affecting the landed cost of imported goods. This environment empowers suppliers who can guarantee consistent supply or offer more stable pricing, giving them an advantage over retailers like Hobby Lobby.

- Increased Procurement Costs: Persistent supply chain issues in 2024 have led to an average increase in raw material costs for many retailers.

- Supplier Leverage: Companies with stable production and logistics in 2024 have seen their bargaining power strengthen.

- Delivery Delays: Geopolitical events and labor shortages in 2024 have contributed to longer lead times for many product categories.

Hobby Lobby's bargaining power with suppliers is generally moderate to low due to its vast supplier network for common craft items, though niche products can shift this balance. The company's significant investment in private label goods, exceeding 60% of its inventory, further strengthens its position by reducing reliance on external vendors.

In 2024, global supply chain disruptions, including labor shortages and geopolitical tensions, generally increased supplier leverage, potentially leading to higher procurement costs for Hobby Lobby. For example, while specific data for Hobby Lobby isn't public, the broader retail sector saw continued elevated shipping costs in early 2024, impacting the landed cost of imported goods.

The threat of suppliers integrating forward into retail remains low for Hobby Lobby, as most suppliers lack the scale and expertise to compete directly. While some niche suppliers may engage in direct-to-consumer online sales, this has a limited impact on Hobby Lobby's core business of mass-market craft supplies.

| Factor | Hobby Lobby's Position | 2024 Context |

|---|---|---|

| Supplier Fragmentation | Generally high for common goods | Persistent supply chain issues can empower reliable suppliers. |

| Private Label Dominance | Over 60% of inventory | Reduces overall dependence on external suppliers. |

| Switching Costs | Low for mass goods, moderate/high for specialized items | Elevated shipping and material costs in 2024 can increase switching costs for specific inputs. |

| Forward Integration Threat | Low | Niche online sales by some suppliers have minimal impact. |

What is included in the product

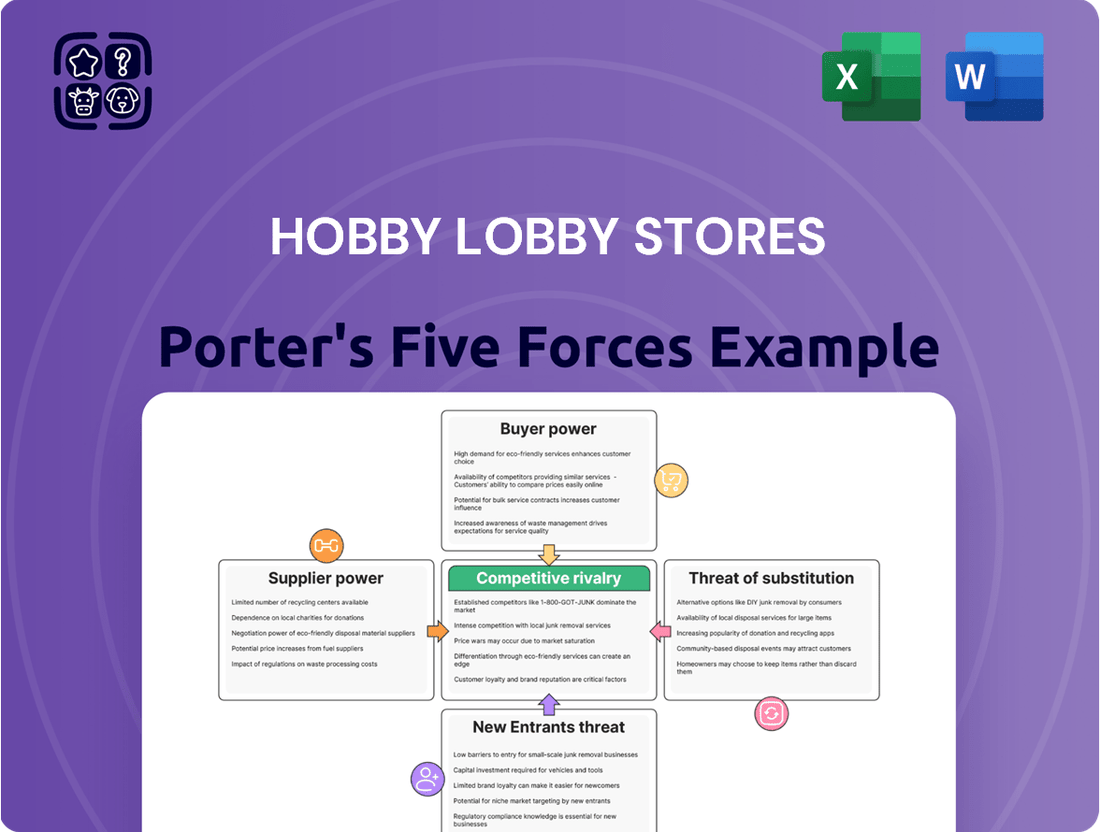

This analysis of Hobby Lobby Stores delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Hobby Lobby's competitive landscape to pinpoint key threats and opportunities.

Customers Bargaining Power

Hobby Lobby's business model thrives on competitive pricing and frequent promotions, notably its consistent weekly 40% off coupon. This strategy cultivates a customer base that is highly attuned to price, making them sensitive to discounts and readily comparing options.

This price sensitivity significantly boosts customer bargaining power. Shoppers can easily delay purchases to await sales or utilize coupons, effectively dictating terms by waiting for the best deals. The presence of numerous craft and home décor retailers further amplifies this leverage.

Customers possess significant bargaining power due to the wide array of alternative retailers available for arts, crafts, and home decor. Major competitors like Michaels and Jo-Ann Stores, alongside online giants such as Amazon and Etsy, offer readily accessible substitutes. This abundance of choice allows consumers to easily switch if they find better pricing, a broader product range, or a more convenient shopping experience elsewhere. For instance, in 2024, the online retail sector continued its robust growth, with e-commerce sales projected to reach over $2.7 trillion globally, providing a vast marketplace for consumers seeking alternatives to brick-and-mortar stores like Hobby Lobby.

The growth of e-commerce and social media has dramatically increased customer access to product details, reviews, and price comparisons. For instance, by late 2023, online retail sales represented over 15% of total retail sales in the US, a trend that continues to empower consumers.

This heightened transparency enables shoppers to make more informed choices and to readily identify the best value, directly boosting their leverage when considering purchases from retailers like Hobby Lobby.

Volume of Individual Purchases

The bargaining power of customers at Hobby Lobby is influenced by the volume of individual purchases. While a single customer's purchase is usually small, making them individually weak, their collective strength is considerable. This is especially true given the large number of hobby and craft enthusiasts who are often budget-conscious.

Hobby Lobby's business model directly addresses this by focusing on broad product selection and competitive pricing. This strategy aims to capture the purchasing power of this dispersed customer base. For instance, in 2024, Hobby Lobby continued its practice of offering weekly coupons and seasonal sales, a direct response to the price sensitivity of its core demographic.

- Individual purchases are generally low in volume, reducing the power of any single customer.

- The aggregate purchasing power of Hobby Lobby's large customer base is significant.

- Hobby Lobby counters this by offering diverse product ranges and competitive pricing strategies.

- Weekly coupons and seasonal sales are key tactics used to attract and retain price-sensitive shoppers.

Threat of Backward Integration (DIY)

The arts and crafts market thrives on a Do-It-Yourself (DIY) ethos, where customers actively create their own goods. This DIY spirit can be viewed as a subtle form of backward integration, as consumers essentially produce their own alternatives to finished products. For instance, a customer crafting their own home decor items bypasses the need to purchase pre-made decor from a retailer.

While customers may create finished goods themselves, their reliance on retailers like Hobby Lobby for the necessary raw materials and supplies remains significant. This means that while they integrate backward in the production of the final item, they are still forward-integrated customers in relation to the supply chain of craft components. In 2024, the global arts and crafts market was valued at approximately $40 billion, underscoring the substantial customer base engaged in DIY activities.

- DIY culture reduces demand for finished goods but increases demand for supplies.

- Customers creating items are a form of backward integration, producing their own substitutes.

- The global arts and crafts market reached an estimated $40 billion in 2024.

The bargaining power of Hobby Lobby's customers is substantial, driven by widespread access to alternatives and a strong price-sensitivity cultivated by the company's own promotional strategies. The prevalence of weekly coupons, such as the consistent 40% off offer, trains consumers to expect discounts, encouraging them to delay purchases until favorable pricing is available.

The sheer volume of competitors, ranging from large chains like Michaels and Jo-Ann Stores to online marketplaces like Amazon and Etsy, provides ample substitution options. This competitive landscape, further intensified by the continued growth of e-commerce, which represented over 15% of total US retail sales by late 2023, empowers consumers to easily switch if pricing or product selection elsewhere is more appealing.

While individual customer purchases are typically small, their collective purchasing power is significant, especially given the large number of budget-conscious DIY enthusiasts. Hobby Lobby's strategy of offering a vast product selection and frequent discounts directly caters to this dispersed, price-sensitive customer base, a trend that continued to be evident in its 2024 sales strategies.

| Factor | Impact on Hobby Lobby | Supporting Data (2023-2024) |

|---|---|---|

| Availability of Substitutes | High Bargaining Power | Online retail sales projected over $2.7 trillion globally in 2024. |

| Price Sensitivity | High Bargaining Power | Consistent weekly 40% off coupon encourages delayed purchases. |

| Customer Information Access | High Bargaining Power | Over 15% of US retail sales were online by late 2023, facilitating price comparisons. |

| Collective Purchasing Power | Moderate to High Bargaining Power | Global arts and crafts market valued at approx. $40 billion in 2024. |

Full Version Awaits

Hobby Lobby Stores Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Hobby Lobby Stores Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the arts and crafts retail sector.

Rivalry Among Competitors

The arts and crafts retail landscape in the United States is characterized by a concentrated number of large competitors. Hobby Lobby, Michaels Stores, and Jo-Ann Stores are the primary dominant forces, each vying for significant market share. This concentration means that the actions of one major player can directly impact the others.

Hobby Lobby operates a substantial network of over 900 stores across the nation. Michaels also boasts a considerable footprint, making the competition for customer attention and spending particularly fierce. This rivalry is not just about store count but also about product selection, pricing, and in-store experience.

The arts and crafts market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) between 5.6% and 8.1% from 2024 through 2033. This upward trend, fueled by increased interest in mental wellness activities, a sustained focus on home-based living, the rise of e-commerce, and growing sustainability consciousness, presents a dynamic environment for companies like Hobby Lobby.

This substantial market growth, while offering significant opportunities, inherently intensifies competitive rivalry. As the pie gets bigger, more players are drawn in, and existing ones strive to capture a larger slice of this expanding sector. This means Hobby Lobby faces increased pressure from both established competitors and new entrants eager to capitalize on the market's momentum.

Hobby Lobby stands out with its incredibly broad product range, covering everything from craft supplies and home decor to floral arrangements and seasonal decorations. This extensive selection, coupled with competitive pricing and a significant emphasis on private label brands, which account for over 60% of their offerings, creates a strong point of differentiation.

The company's commitment to its Christian-based values also resonates with a dedicated customer segment, fostering loyalty that extends beyond mere product appeal. This value-driven approach can insulate them somewhat from direct price competition, as customers may prioritize the company's ethos.

Exit Barriers

Hobby Lobby faces substantial exit barriers due to the significant capital investment tied up in its operations. The high fixed costs associated with maintaining large retail footprints, managing extensive inventory, and operating established supply chain networks make it difficult and costly for any major player to simply walk away from the market. These costs, estimated in the hundreds of millions for a company of Hobby Lobby's scale, lock companies into continued competition to recover their investments.

These considerable exit barriers mean that even during economic downturns, companies like Hobby Lobby are compelled to compete aggressively to avoid substantial losses. The incentive is to stay in the game and try to make the business work rather than abandon the sunk costs. This dynamic intensifies rivalry as firms fight to maintain market share and profitability.

Adding to these barriers, Hobby Lobby's strategic decision to own a significant portion of its real estate further entrenches its position. This ownership structure means that exiting the business would not only involve liquidating inventory and supply chains but also dealing with the complexities and potential losses from selling or repurposing numerous owned properties, thereby increasing the cost and difficulty of departure.

Key factors contributing to Hobby Lobby's exit barriers:

- High Fixed Costs: Significant investments in retail space, inventory, and supply chains.

- Investment Recovery Incentive: The need to recoup substantial capital outlays encourages continued competition.

- Real Estate Ownership: Owning properties adds another layer of complexity and cost to any potential exit.

Intensity of Price and Promotion Competition

The arts and crafts industry is a battlefield of pricing and promotions. Hobby Lobby's signature 40% off coupon is a prime example of this aggressive strategy, aiming to draw in price-sensitive customers. This constant promotional activity forces other players to either match or find alternative ways to compete, often squeezing profit margins.

The competitive landscape intensified in early 2025 with the Chapter 11 bankruptcy filing of Jo-Ann Stores. This event signals the immense pressure within the sector and creates an opportunity for remaining players like Michaels and Hobby Lobby. These companies are now in a position to absorb Jo-Ann's customer base and market share, further consolidating the competitive environment.

- Aggressive Pricing: Frequent sales and discounts are standard, with Hobby Lobby's 40% off coupon being a notable tactic.

- Promotional Activities: The industry relies heavily on promotions to attract and retain customers.

- Market Consolidation: Jo-Ann Stores' bankruptcy in early 2025 indicates intense competitive pressures, potentially leading to market share gains for rivals like Michaels and Hobby Lobby.

The competitive rivalry within the arts and crafts sector is intense, with Hobby Lobby, Michaels, and the now-bankrupt Jo-Ann Stores historically being the dominant players. Hobby Lobby's strategy of offering a consistent 40% off coupon highlights the industry's reliance on promotions to capture market share. The bankruptcy of Jo-Ann Stores in early 2025 has further intensified this rivalry, creating opportunities for market consolidation among the remaining major retailers.

| Competitor | Store Count (Approx.) | Key Competitive Tactic | Market Share Impact (Post-Jo-Ann Bankruptcy) |

|---|---|---|---|

| Hobby Lobby | 900+ | Broad product range, private labels (60%+), 40% off coupon | Potential gains from Jo-Ann's customer base |

| Michaels Stores | Over 1,000 | Extensive product selection, loyalty programs, online presence | Potential gains from Jo-Ann's customer base |

| Jo-Ann Stores | N/A (Bankrupt 2025) | Fabric and craft focus, promotions | Market share now available to competitors |

SSubstitutes Threaten

The rise of online tutorials, especially on platforms like YouTube and Pinterest, presents a significant threat of substitutes for Hobby Lobby. Consumers can now access a vast library of free content demonstrating how to create various crafts, decor, and even clothing items. This accessibility empowers individuals to become DIY enthusiasts, potentially bypassing the need to purchase specialized supplies or kits from retailers.

For instance, a user looking to learn knitting or advanced scrapbooking techniques can find detailed, step-by-step video guides at no cost. This readily available knowledge directly competes with Hobby Lobby's offerings, as it reduces the perceived value of in-store classes or curated project kits. The sheer volume and ease of access to these digital resources mean consumers can acquire skills and inspiration without making a purchase from traditional craft stores.

The rise of digital crafting tools and software presents a significant threat of substitutes for Hobby Lobby. Programs like Adobe Creative Suite for graphic design and various 3D modeling software allow consumers to create digital designs that can then be brought to life through 3D printing or laser cutting, bypassing the need for traditional craft supplies.

Virtual cutting machines, such as Cricut and Silhouette, offer a digital pathway to creating intricate designs for various projects, from custom apparel to home decor. This technology can reduce reliance on physical craft materials like paper, vinyl, and fabric for certain applications, potentially shifting consumer spending towards digital design subscriptions and the machines themselves.

The global 3D printing market, for instance, was valued at approximately $15.2 billion in 2023 and is projected to reach $77.5 billion by 2030, indicating a substantial and growing segment of the crafting landscape that operates digitally. This digital shift means consumers can design and produce items at home, potentially substituting for purchases of pre-made craft kits or individual components previously sourced from physical retailers.

The threat of substitutes for Hobby Lobby's core offerings is significant, particularly from ready-made goods and mass-produced decor. Consumers can easily find finished home decor, gifts, and seasonal items from general merchandise giants like Walmart and Target, or even from specialized decor retailers. These readily available, often lower-priced alternatives bypass the time and effort associated with DIY projects, presenting a compelling substitute for customers.

Experiences and Services as Substitutes

Leisure activities such as dining out, attending movies, or taking vacations present a significant threat of substitution for Hobby Lobby's core offerings. Consumers often have limited discretionary income and time, forcing choices between crafting supplies and other entertainment options. For instance, the global travel and tourism market was projected to reach over $1.5 trillion in 2024, indicating a substantial draw on consumer spending that could otherwise be allocated to hobbies.

Furthermore, the availability of professional services that replicate DIY outcomes poses another substitution threat. Services like custom framing shops, personalized gift businesses, and interior design consultants offer convenience and a polished finish that some consumers prefer over undertaking projects themselves. In 2024, the custom framing market alone was estimated to be worth billions, showcasing a segment where consumers are willing to pay for expertise and convenience.

- Consumer Trade-offs: Consumers weigh the cost and time investment of crafting against the immediate gratification and expertise offered by alternative leisure activities and professional services.

- Market Size of Substitutes: The vast market sizes of the travel, entertainment, and professional service industries highlight the significant competition for consumer discretionary spending.

- Convenience vs. DIY: The increasing demand for convenience in modern lifestyles can shift consumer preference away from DIY crafting towards ready-made or professionally executed solutions.

Second-hand and Upcycled Materials

The increasing consumer focus on sustainability is driving a significant shift towards second-hand and upcycled materials in the crafting world. This trend directly impacts retailers like Hobby Lobby by offering a viable alternative to purchasing new craft supplies.

Crafters are increasingly repurposing items they already own or sourcing materials from thrift stores and online marketplaces. This reduces their demand for new components, such as fabrics, embellishments, and decorative items, that Hobby Lobby typically sells.

For instance, the resale market for home goods and clothing, which often contain materials suitable for crafting, has seen substantial growth. In 2024, the online resale market was projected to reach over $35 billion in the US alone, demonstrating a strong consumer appetite for pre-owned goods.

- Growing Sustainability Movement: Consumers are actively seeking eco-friendly options, making upcycled materials an attractive choice.

- Cost-Effectiveness: Second-hand items are often cheaper than new craft supplies, appealing to budget-conscious crafters.

- Unique Material Sourcing: Upcycling allows for the discovery of unique textures and patterns not found in mass-produced craft items.

- Reduced Reliance on Retailers: Crafters repurposing existing items directly substitute for purchases of new materials from traditional craft stores.

The availability of online tutorials and digital crafting tools offers readily accessible, often free, alternatives for skill acquisition and project creation, directly competing with Hobby Lobby's in-store classes and kits. Furthermore, the burgeoning resale market for home goods and clothing provides cost-effective and sustainable materials for crafters, reducing the need for new purchases.

Consumers also face a wide array of substitute leisure activities and ready-made goods from general retailers, presenting compelling alternatives that bypass the time and effort of DIY projects. The significant market sizes of these substitute industries, such as global travel and the online resale market, underscore the intense competition for discretionary consumer spending.

| Substitute Category | Examples | Impact on Hobby Lobby | Market Data Point (2024/2023) |

| Online DIY Resources | YouTube tutorials, Pinterest | Reduces demand for classes/kits | Vast free content availability |

| Digital Crafting Tools | 3D printing, Cricut machines | Shifts spending to technology | 3D printing market ~$15.2B (2023) |

| Ready-Made Goods | Walmart, Target decor | Offers convenience, lower price | General merchandise sales significant |

| Alternative Leisure | Travel, dining out | Competes for discretionary income | Global travel market >$1.5T (projected 2024) |

| Upcycled Materials | Thrift stores, existing items | Decreases demand for new supplies | US online resale market >$35B (projected 2024) |

Entrants Threaten

The significant capital required to establish a retail chain comparable to Hobby Lobby presents a formidable barrier to new entrants. This includes the substantial costs associated with acquiring prime real estate, constructing or renovating large-format stores, and stocking extensive inventory across diverse product categories. For instance, in 2024, the average cost to build a new retail store can range from $150 to $300 per square foot, meaning a 50,000 square foot store could cost between $7.5 million and $15 million before even considering inventory or land acquisition.

Established players like Hobby Lobby benefit from significant economies of scale in purchasing, logistics, and marketing due to their large volume of operations. This allows them to negotiate better prices from suppliers and offer competitive pricing to customers. For instance, in 2024, Hobby Lobby's extensive store network and centralized distribution likely enabled them to secure favorable terms with manufacturers of craft supplies and home decor, a feat difficult for a new, smaller competitor to replicate immediately.

Hobby Lobby has built significant brand loyalty over its many years in business, making it a go-to destination for arts and crafts enthusiasts. This deeply ingrained customer trust presents a substantial barrier for any new competitor aiming to enter the market.

Newcomers would need to invest heavily in marketing and time to even begin chipping away at Hobby Lobby's established customer base and brand recognition. For instance, in 2023, Hobby Lobby reported over $6 billion in revenue, showcasing the scale of its existing customer engagement and market presence.

Distribution Channels and Supply Chain Network

Hobby Lobby's formidable distribution channels and supply chain network present a significant barrier to new entrants. With over 900 stores strategically located across 47 states and a robust e-commerce platform, the company has established a physical and digital footprint that is incredibly difficult and costly to replicate. This extensive network, built over decades, provides a competitive advantage in terms of reach, inventory management, and delivery efficiency.

Establishing a comparable distribution system would demand substantial capital investment in real estate, logistics infrastructure, and technology. Newcomers would also need to acquire the intricate knowledge and operational expertise required to manage such a complex supply chain effectively. This includes everything from sourcing products globally to ensuring timely delivery to a vast customer base.

Consider these points regarding Hobby Lobby's distribution and supply chain:

- Extensive Physical Footprint: Operates over 900 retail locations across 47 U.S. states.

- Integrated E-commerce: Maintains a functional online store, extending its reach beyond physical stores.

- Logistical Complexity: Requires significant investment in warehousing, transportation, and inventory management systems.

- Economies of Scale: The sheer volume of operations allows for greater negotiation power with suppliers and logistics providers, driving down costs.

Regulatory Hurdles and Niche Specialization

While the arts and crafts sector isn't heavily regulated like finance or healthcare, new entrants must still navigate retail laws, product safety standards, and import compliance, especially for items like children's craft supplies. For instance, in 2024, the Consumer Product Safety Commission (CPSC) continued to enforce regulations on lead and phthalates in toys and craft materials, adding a layer of compliance cost for newcomers.

Furthermore, establishing expertise and reliable supply chains within specialized craft niches, such as high-end yarn dyeing or custom woodworking supplies, presents a significant barrier. Hobby Lobby benefits from decades of experience in sourcing and quality control for these specialized areas, a knowledge base that takes considerable time and investment to replicate.

- Regulatory Compliance Costs: New entrants face expenses related to adhering to CPSC guidelines and other retail regulations.

- Niche Expertise Development: Building the specialized knowledge and supplier networks critical for success in specific craft segments requires substantial effort.

- Supply Chain Establishment: Securing reliable and cost-effective sourcing for diverse craft materials is a challenge for new businesses.

The threat of new entrants into the arts and crafts retail market, as faced by Hobby Lobby, is significantly mitigated by substantial capital requirements and established economies of scale. Building a retail footprint comparable to Hobby Lobby's over 900 stores, each requiring significant investment, presents a major hurdle. For example, in 2024, the cost to build a new retail store can easily reach millions of dollars.

Hobby Lobby's established brand loyalty, cultivated over decades, acts as a powerful deterrent. Consumers trust the brand for its wide selection and perceived value, making it difficult for newcomers to capture market share. In 2023, Hobby Lobby's revenue exceeded $6 billion, underscoring its deep penetration into the consumer market.

Furthermore, the company's sophisticated distribution network and supply chain expertise are difficult and costly to replicate. This infrastructure, essential for managing a vast inventory and ensuring timely delivery to numerous locations, represents a significant competitive advantage. New entrants would face considerable challenges in developing similar logistical capabilities and securing favorable supplier relationships.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hobby Lobby Stores is built upon a foundation of comprehensive data, including their annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial filings. This blend of internal company data and external industry analysis ensures a robust understanding of the competitive landscape.