Hobby Lobby Stores Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hobby Lobby Stores Bundle

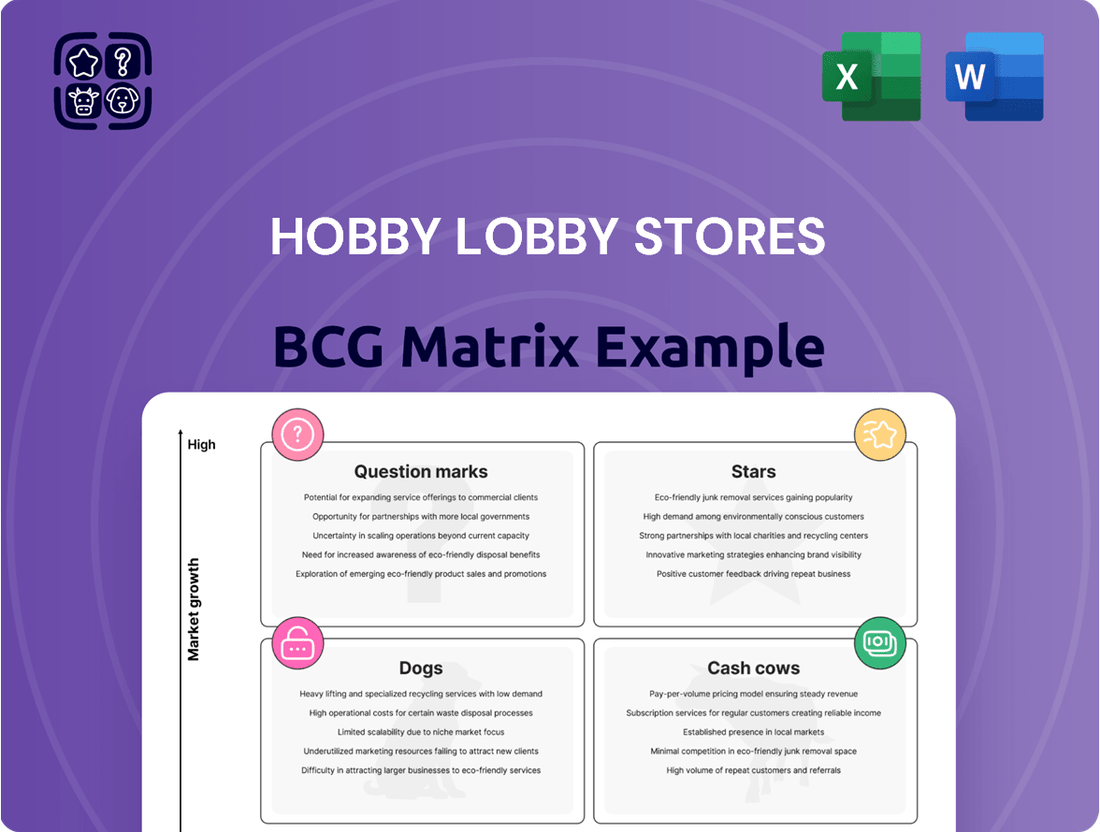

Curious about Hobby Lobby's product portfolio performance? Our BCG Matrix analysis reveals which categories are driving growth (Stars), generating steady income (Cash Cows), lagging behind (Dogs), or hold untapped potential (Question Marks).

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Hobby Lobby.

Stars

Hobby Lobby's extensive arts and crafts supplies represent a significant Star in its business portfolio. The broader arts and crafts market is projected to reach $48.33 billion by 2025, with an impressive 8.1% compound annual growth rate, indicating robust demand.

The company commands a substantial 36.4% market share within the fabric, craft, and sewing supplies sector. This strong position, coupled with the market's growth trajectory, solidifies arts and crafts as a high-growth, high-market-share segment for Hobby Lobby.

The surge in consumer interest for DIY projects and personalization is a significant tailwind for Hobby Lobby's materials segment. This trend means more people are actively crafting unique items, directly boosting demand for the company's vast product selection.

In 2024, the arts and crafts market continued its robust growth, with many consumers seeking personalized items. Hobby Lobby's strategy of offering a wide variety of materials at competitive price points perfectly aligns with this expanding DIY culture, ensuring they capture a significant share of this market.

Seasonal home decor is a star performer for Hobby Lobby, experiencing substantial customer traffic during key periods like the back-to-school season and major holidays. This segment consistently shows robust demand and strong sales figures.

Data from August 2024 indicates a 7.9% increase in store visits, directly correlating with back-to-school shopping. Furthermore, December 2023 saw a remarkable 57.7% surge in visits compared to the monthly average, highlighting the immense popularity of holiday-themed decor.

New Store Openings

Hobby Lobby is aggressively expanding its physical footprint. The company plans to open at least 56 net new stores in 2025, a significant move to capture more market share. This expansion includes entering new, high-potential markets.

Key to this growth is the company's entry into major metropolitan areas. For instance, Hobby Lobby opened its first store in Manhattan in 2024, a strategic move into a densely populated and affluent market. This expansion into urban centers signals a focus on new customer demographics and increased accessibility.

- Aggressive Expansion: At least 56 net new stores projected for 2025.

- New Market Entry: First store in Manhattan opened in 2024.

- Geographic Reach: Expansion into states like Idaho and Oregon.

- Market Dominance: Solidifying its position in arts, crafts, and home decor.

Online 'Hobby & Leisure' Category

Hobby Lobby's online 'Hobby & Leisure' category is a standout performer, representing a substantial 58% of all sales on hobbylobby.com in 2024. This dominance within the expanding online arts and crafts market firmly places it as a Star in Hobby Lobby's digital portfolio.

- Dominant Online Segment: The 'Hobby & Leisure' category is the largest contributor to Hobby Lobby's online revenue, making up 58% of total sales in 2024.

- High Market Share: This segment holds a strong position within the growing online retail landscape for arts and crafts supplies.

- Projected Growth: The online store is anticipated to experience a healthy growth rate of 5-10% in 2025.

Hobby Lobby's seasonal home decor segment is a clear Star, drawing significant customer traffic and sales, particularly during peak seasons like back-to-school and holidays. Store visits saw a notable 7.9% increase in August 2024, aligning with back-to-school shopping, and a substantial 57.7% jump in December 2023 compared to the monthly average, demonstrating the segment's powerful seasonal appeal.

The company's aggressive store expansion, with at least 56 net new stores planned for 2025 and a strategic entry into new markets like Manhattan in 2024, solidifies its dominant position in arts, crafts, and home decor. This expansion into densely populated urban centers aims to capture new customer demographics and enhance accessibility, further cementing its Star status.

The 'Hobby & Leisure' online category is a significant Star for Hobby Lobby, accounting for a dominant 58% of all sales on hobbylobby.com in 2024. This segment is poised for continued growth, with the online store projected to see a healthy 5-10% growth rate in 2025, reflecting its strong performance in the expanding digital arts and crafts market.

| Business Segment | BCG Matrix Classification | Key Performance Indicators | Market Trend Impact |

|---|---|---|---|

| Arts & Crafts Materials | Star | 36.4% market share in fabric, craft, sewing; market projected to reach $48.33 billion by 2025 (CAGR 8.1%) | Growing DIY and personalization trends |

| Seasonal Home Decor | Star | 7.9% increase in store visits (Aug 2024); 57.7% surge in visits (Dec 2023) vs. monthly average | Strong seasonal demand, particularly holidays and back-to-school |

| Online 'Hobby & Leisure' | Star | 58% of hobbylobby.com sales (2024); projected 5-10% online store growth (2025) | Expansion of online retail for arts and crafts |

What is included in the product

The Hobby Lobby Stores BCG Matrix provides a tailored analysis of its product portfolio, categorizing items into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

The Hobby Lobby Stores BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

Hobby Lobby's extensive home decor assortment is a prime example of a cash cow within its business. This category consistently generates significant revenue due to its broad appeal and the ongoing consumer interest in personalizing living spaces.

The global home decor market is a massive and expanding sector, with forecasts indicating it will reach $1.1 trillion by 2033. Hobby Lobby's strong presence in this market, offering a wide variety of products, allows it to capture a substantial share of this growth.

This segment thrives on consistent consumer spending, driven by trends in home improvement and interior design. The stable demand translates into high-profit margins for Hobby Lobby, reinforcing its status as a reliable cash cow.

Traditional craft supplies like yarn, fabric, and essential art materials are Hobby Lobby's established cash cows. These categories consistently generate revenue due to a dedicated customer base that regularly buys core crafting necessities. For instance, in 2024, the arts and crafts industry in the US was projected to reach approximately $50 billion, with fabric and sewing supplies alone contributing a significant portion.

Hobby Lobby's extensive brick-and-mortar retail footprint, boasting over 900 large-format stores spread across 47 U.S. states, firmly positions this segment as a significant cash cow. This vast network of well-established physical locations benefits from consistent customer foot traffic and a proven, successful business model, generating a stable and predictable revenue stream for the company.

The strategic suburban placement of these numerous stores enhances accessibility for a broad customer base, fostering repeat business and reinforcing customer loyalty. This widespread physical presence is a key driver of Hobby Lobby's consistent financial performance.

Value-Oriented Pricing Strategy

Hobby Lobby's value-oriented pricing strategy is central to its position as a cash cow. By offering a wide selection of products at consistently competitive prices, the company cultivates a loyal customer base. This strategy, coupled with frequent promotions, drives significant sales volume.

This approach ensures a steady and predictable revenue stream, a hallmark of a cash cow. For instance, in 2024, Hobby Lobby continued its practice of offering weekly ad specials and seasonal discounts, which consistently draw shoppers seeking value.

- Value Proposition: Broad merchandise selection at competitive prices.

- Customer Loyalty: Driven by consistent value and frequent sales.

- Revenue Stability: Ensured by strong sales volume and repeat business.

- Market Position: Dominant in the arts and crafts retail sector due to this strategy.

Loyal Customer Base (Women 40-60)

Hobby Lobby's loyal customer base, predominantly women aged 40 to 60, represents a significant cash cow. This demographic appreciates the store's diverse product selection, which caters to various crafting and home decor needs. Their consistent purchasing habits fuel stable revenue streams.

This core group, often married and with established households, demonstrates high repeat purchase rates. Their affinity for Hobby Lobby's Christian-based values further solidifies their loyalty. This consistent patronage ensures a predictable and substantial cash flow for the company.

- Demographic Loyalty: Women aged 40-60 form a stable, repeat customer base.

- Value Alignment: Christian-based values resonate strongly with this demographic.

- Consistent Demand: This group's purchasing behavior ensures predictable revenue.

- Cash Flow Driver: Their loyalty directly contributes to Hobby Lobby's strong cash flow.

Hobby Lobby's core craft supplies, such as fabric, yarn, and art materials, function as established cash cows. These categories consistently generate substantial revenue due to a loyal customer base that regularly purchases essential crafting items. In 2024, the U.S. arts and crafts industry was estimated to be worth around $50 billion, with fabric and sewing supplies being a significant contributor to this total.

The company's extensive network of over 900 large-format stores across 47 U.S. states solidifies its cash cow status. This widespread physical presence, strategically located in suburban areas, ensures consistent customer traffic and predictable revenue streams, reinforcing its successful business model.

Hobby Lobby's value-driven pricing strategy, featuring competitive prices and frequent promotions like weekly ad specials and seasonal discounts, is a key driver of its cash cow segments. This approach cultivates strong customer loyalty and drives high sales volumes, ensuring a stable and predictable revenue flow.

The company's primary customer demographic, women aged 40 to 60, are a significant cash cow. This group's consistent purchasing habits, driven by their appreciation for the store's diverse product selection and its Christian-based values, ensure high repeat purchase rates and contribute directly to Hobby Lobby's robust cash flow.

| Category | Role in BCG Matrix | Key Drivers | 2024 Market Context |

|---|---|---|---|

| Core Craft Supplies (Fabric, Yarn, Art Materials) | Cash Cow | Loyal customer base, consistent demand for essentials | U.S. Arts & Crafts Industry: ~$50 billion |

| Home Decor | Cash Cow | Broad appeal, consumer interest in personalization, strong market growth | Global Home Decor Market: Projected to reach $1.1 trillion by 2033 |

| Retail Footprint (900+ Stores) | Cash Cow | Extensive physical presence, suburban placement, proven business model | N/A (Company-specific asset) |

| Value Pricing Strategy | Cash Cow Enabler | Competitive pricing, frequent sales, customer loyalty | Continued practice of weekly specials and seasonal discounts in 2024 |

| Core Demographic (Women 40-60) | Cash Cow Driver | High repeat purchase rates, value alignment, consistent spending | N/A (Customer segment data) |

Full Transparency, Always

Hobby Lobby Stores BCG Matrix

The preview of the Hobby Lobby Stores BCG Matrix you are currently viewing is the complete, unwatermarked document you will receive upon purchase. This means the strategic analysis, including the placement of Hobby Lobby's business units within the Stars, Cash Cows, Question Marks, and Dogs quadrants, is precisely what you'll download. You can confidently use this preview as a direct representation of the high-quality, ready-to-deploy report that will be delivered to you immediately after your transaction, ensuring no surprises and immediate utility for your business planning.

Dogs

Certain craft trends, like intricate needlepoint kits or specialized scrapbooking supplies, can fade from mainstream appeal. This leaves Hobby Lobby with inventory that has low demand and slow sales. For instance, in 2024, the craft industry saw a continued shift towards digital crafting and DIY kits with broader appeal, impacting sales of more niche, traditional craft supplies.

These underperforming items tie up valuable capital and shelf space. They generate minimal returns, making them a drain on resources. In 2023, Hobby Lobby reported that a significant portion of its inventory turnover was concentrated in popular categories, highlighting the challenge of managing slower-moving, niche products.

These products fall into the Dogs category of the BCG Matrix. They operate in a saturated or declining market segment with limited growth prospects. Consequently, they require careful management to minimize losses and free up resources for more promising ventures.

Excess seasonal overstock at Hobby Lobby presents a classic "cash cow" or "dog" scenario depending on its management. While items like Christmas ornaments or Easter decorations are Stars during their respective seasons, unsold inventory rapidly depreciates. For instance, by January 2024, many retailers, including those with seasonal offerings, were heavily discounting leftover holiday inventory, a clear indicator of declining value.

These unsold goods become dogs because they tie up capital and prime retail shelf space that could be used for more profitable, in-demand items. The need for deep markdowns to clear this merchandise in early 2024 meant significantly reduced profit margins, sometimes even resulting in losses, as reported by various retail analysts observing post-holiday sales trends.

Despite Hobby Lobby's general success, certain store locations might be struggling. These could be in areas with fewer people, more competing stores, or places that are harder for customers to find. For example, a store in a town experiencing population decline might see its sales stagnate or even drop.

These underperforming locations often have slow or falling customer traffic and sales. They might not be bringing in enough money to cover their operational expenses, leading to low or negative profits. In the context of a BCG matrix, these would be classified as Dogs.

Specific Discontinued Product Lines

When Hobby Lobby decides to discontinue specific product lines, typically due to declining customer interest or issues with suppliers, these items often fall into the Dog category of the BCG Matrix. For instance, if a particular craft supply consistently underperforms, it might be phased out.

These discontinued items usually necessitate significant markdowns to clear out remaining inventory. The goal is to recover as much capital as possible and free up valuable retail and warehouse space, rather than to generate profit.

- Low Demand: Products with consistently low sales volume are prime candidates for discontinuation.

- Inventory Liquidation: Aggressive clearance sales are common to move these items.

- Resource Reallocation: Discontinuing Dogs allows Hobby Lobby to focus resources on more promising product categories.

Less Competitive Online Sub-categories

While Hobby Lobby's overall online sales are on an upward trajectory, certain niche sub-categories on hobbylobby.com may exhibit lower market share and less aggressive pricing when stacked against dedicated online specialists. For instance, in 2024, while overall e-commerce saw robust growth, specific craft supply segments might not have kept pace with the specialized offerings of platforms like Etsy or Amazon Handmade, indicating a more fragmented competitive landscape for these particular items.

If these less competitive online sub-categories consistently show underperformance in key metrics such as conversion rates or website traffic, they could be strategically categorized as Dogs within the digital space. This classification suggests they require a more cautious approach, potentially involving minimal further investment or even consideration for divestment to reallocate resources to more promising areas of the online business.

- Lower Market Share: Certain specialized craft supplies on hobbylobby.com may hold a smaller percentage of the online market compared to direct competitors.

- Less Competitive Pricing: Pricing in these sub-categories might not be as aggressive as that found on platforms focused solely on specific craft niches.

- Underperformance Metrics: Consistent low conversion rates and traffic can signal a Dog status in the digital BCG matrix.

- Strategic Consideration: These segments may warrant minimal investment or potential divestment to optimize resource allocation.

Products categorized as Dogs within Hobby Lobby's BCG Matrix represent items with low market share in slow-growing industries. These often include niche craft supplies or seasonal overstock that fails to sell through at full price. For example, in early 2024, many retailers, including Hobby Lobby, faced challenges with unsold holiday inventory, leading to significant markdowns that diminished profitability.

These underperforming products tie up capital and retail space, generating minimal returns. In 2023, reports indicated that a substantial portion of inventory turnover for craft retailers was concentrated in popular, fast-moving categories, underscoring the drag of slow-moving items. Consequently, Hobby Lobby must manage these Dogs carefully, often by liquidating them to free up resources for more profitable ventures.

The strategic approach for Dogs involves minimizing losses and reallocating capital. This might mean discontinuing product lines with declining customer interest, as seen with certain traditional craft supplies in 2024 that couldn't compete with the rise of digital crafting. By clearing out these low-performing items, often through aggressive sales, Hobby Lobby can optimize its inventory and focus on categories with higher growth potential.

Question Marks

Hobby Lobby's e-commerce platform, hobbylobby.com, achieved $557 million in sales in 2024. However, its conversion rate, hovering between 0.50% and 1.00%, lags considerably behind industry benchmarks, notably Michaels.com's 2.50% to 3.00%.

This presents a clear opportunity for Hobby Lobby to boost its market share in the expanding online retail sector. Significant investment in optimizing the user experience, expanding digital marketing efforts, and enhancing overall e-commerce functionality is crucial.

While Hobby Lobby boasts a strong physical presence, its online segment, despite its growth, represents a high-potential area where its market share is currently underdeveloped relative to its established brand strength.

The arts and crafts market is evolving, with a growing demand for tech-integrated products and innovative tools. Hobby Lobby's expansion into this segment, offering more advanced crafting supplies, positions them as a Question Mark in the BCG Matrix. This strategic move requires substantial investment in research, development, and marketing to gain traction in this dynamic niche.

Consumer demand for sustainable and eco-friendly products is a significant growth driver in both the arts and crafts and home decor sectors. This trend presents a substantial opportunity for Hobby Lobby. For instance, a 2024 report indicated that 65% of consumers are willing to pay more for sustainable products, a figure that has steadily climbed over the past few years.

While this is a high-growth market, Hobby Lobby's current market share in explicitly branded or heavily promoted sustainable product lines appears to be relatively nascent. This suggests that while the overall category is expanding rapidly, Hobby Lobby's penetration might not yet reflect this growth. The company reported a 5% increase in sales for its naturally sourced materials category in Q1 2024, indicating early traction.

Significant strategic investment in sourcing, developing, and marketing proprietary eco-friendly product lines could elevate these offerings from a potential Question Mark to a Star within the BCG matrix. By capitalizing on this burgeoning consumer preference, Hobby Lobby could secure a dominant position in this expanding market segment, mirroring the success seen by competitors who have already invested heavily in green initiatives.

Personalized and Custom Offerings

The market for personalized and custom-made items, particularly in home decor and crafts, is experiencing robust growth. Consumers are increasingly seeking unique products that reflect their individual tastes and styles. This trend presents a significant opportunity for retailers like Hobby Lobby.

Hobby Lobby's strategic focus on expanding or introducing personalized offerings, such as custom framing, bespoke home decor pieces, and customizable craft kits, directly addresses this growing consumer demand. These ventures are positioned to capture a larger share of this expanding market segment.

- Market Growth: The personalized gifts and home decor market was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2028.

- Hobby Lobby's Investment: Initiatives like enhancing custom framing services or developing new personalized product lines require significant capital for specialized equipment, skilled labor, and marketing to build brand awareness and customer loyalty in this niche.

- Competitive Landscape: While the demand is high, the space is becoming more competitive with both online platforms and other brick-and-mortar retailers investing in customization capabilities.

Expansion into Untapped Urban Markets

Hobby Lobby's move into previously untapped urban markets, such as its debut in Manhattan, positions these ventures as Question Marks in the BCG Matrix. This expansion requires substantial capital for market analysis and adapting product assortments to suit diverse urban demographics. The company's 2024 strategy involves careful consideration of these new environments, which differ significantly from its established suburban base.

These urban markets present unique challenges, including different consumer preferences and a more intense competitive landscape. Hobby Lobby's success hinges on investing in thorough market research and localized marketing efforts to build brand awareness and customer loyalty. For instance, opening a store in a high-density area like Manhattan necessitates a different approach than its typical store rollout.

- Market Penetration Challenges: Urban areas often feature higher operating costs and intense competition from established retailers.

- Demographic Adaptation: Tailoring inventory and marketing to the specific needs and tastes of urban consumers is crucial for success.

- Investment Requirements: Significant financial outlay is needed for market research, store design, and localized promotional campaigns.

- Potential for Growth: While risky, successful entry into these markets could unlock substantial new revenue streams and customer bases for Hobby Lobby.

Hobby Lobby's foray into advanced crafting technologies and tech-integrated products places these initiatives in the Question Mark category. The company's expansion into this niche, requiring significant R&D and marketing investment, aims to capture a growing market segment. Success here could transform these ventures into Stars.

The company's investment in developing and promoting proprietary eco-friendly product lines also positions it as a Question Mark. While consumer demand for sustainability is high, with 65% of consumers willing to pay more for sustainable products as of 2024, Hobby Lobby's market share in this specific area is still developing. Its 5% sales increase in naturally sourced materials in Q1 2024 shows early promise.

Similarly, Hobby Lobby's strategic expansion into personalized and custom-made items, a market valued at approximately $30 billion in 2023, also falls into the Question Mark quadrant. These ventures require substantial capital for specialized equipment and marketing to compete effectively in this growing, yet increasingly competitive, space.

The company's entry into new urban markets, such as its Manhattan store opening in 2024, represents Question Marks due to the higher operating costs, intense competition, and need for demographic adaptation. Success in these markets, which differ significantly from its traditional base, hinges on substantial investment in localized marketing and inventory strategies.

| Initiative | BCG Category | Market Growth | Hobby Lobby's Share | Investment Needs |

|---|---|---|---|---|

| Tech-Integrated Crafting | Question Mark | High | Low/Developing | High (R&D, Marketing) |

| Eco-Friendly Product Lines | Question Mark | High | Low/Developing | High (Sourcing, Marketing) |

| Personalized & Custom Items | Question Mark | High (7% CAGR) | Low/Developing | High (Equipment, Marketing) |

| Urban Market Expansion | Question Mark | Varies by Market | Low/Developing | High (Research, Localization) |

BCG Matrix Data Sources

Our Hobby Lobby BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.