Hilton Worldwide Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Worldwide Holdings Bundle

Hilton Worldwide Holdings navigates a complex landscape shaped by intense rivalry and significant buyer power, while the threat of new entrants remains a constant consideration. Understanding these dynamics is crucial for anyone looking to grasp Hilton's strategic positioning.

The complete report reveals the real forces shaping Hilton Worldwide Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hilton Worldwide Holdings often faces a concentrated group of suppliers for specialized hotel equipment and furniture. This limited number of specialized providers can grant them significant leverage in price negotiations. For example, in 2024, the global market for hotel furniture and equipment manufacturing was notably concentrated, with roughly 7 to 10 major suppliers dominating the landscape.

This scarcity of specialized suppliers means Hilton has fewer viable alternatives when sourcing specific, high-quality amenities. Consequently, this can translate into increased procurement costs for the company, as suppliers are aware of their crucial role in Hilton's operations and brand standards.

The bargaining power of suppliers for Hilton Worldwide Holdings is influenced by its global supply chain dependencies. A substantial 78% of Hilton's hotel amenities are sourced internationally, with key manufacturing hubs in China (42%), Vietnam (18%), and India (12%).

These international sourcing arrangements introduce complexities, including average lead times of 6-8 weeks. This extended lead time makes Hilton susceptible to disruptions stemming from geopolitical events or logistical challenges, potentially impacting the availability and cost of essential hotel supplies.

Hilton effectively manages supplier power by securing long-term contracts, often spanning 3 to 7 years. These agreements include specific clauses for price adjustments, offering cost stability.

For instance, in 2024, food and beverage expenses represented about 25% of Hilton's overall revenue. These long-term contracts provide crucial cost predictability and shield the company from immediate price fluctuations in these essential supply chains.

Moderate Power of Food and Beverage Suppliers

Food and beverage suppliers possess moderate bargaining power with Hilton Worldwide Holdings. While Hilton's scale and brand might suggest otherwise, the essential nature of food and beverage offerings means suppliers can exert some influence, particularly for specialized or high-quality ingredients. Hilton's significant reliance on food and beverage revenue, which contributes substantially to its overall profitability, necessitates careful management of these supplier relationships to maintain cost controls and ensure consistent product quality across its vast portfolio.

Hilton's ability to negotiate favorable terms is bolstered by its strong brand recognition and the potential for long-term, exclusive agreements with key suppliers. However, the sheer volume and variety of food and beverage products required across Hilton's diverse hotel brands mean that no single supplier typically dominates its purchasing power. This dynamic allows suppliers of unique or in-demand items to command better pricing, impacting Hilton's operational costs.

- Supplier Concentration: The market for many food and beverage inputs is fragmented, limiting the power of individual suppliers unless they offer highly specialized or proprietary products.

- Switching Costs: While switching suppliers for commodity items is relatively easy, changing suppliers for unique or signature food and beverage items can involve significant costs and potential disruptions to brand consistency.

- Input Importance: Food and beverage quality is a critical component of guest experience and brand reputation for Hilton, giving suppliers of high-quality inputs some leverage.

- Hilton's Purchasing Volume: Hilton's immense scale provides significant purchasing power, which it leverages to negotiate favorable pricing and terms, thereby mitigating supplier power.

Increased Power Due to Sustainability Demands

The increasing consumer and corporate focus on sustainability is significantly boosting the bargaining power of suppliers offering eco-friendly products and services. Hilton's own sustainability initiatives, which are crucial for meeting evolving guest expectations and regulatory requirements, mean they are more reliant on these specialized suppliers.

This reliance allows suppliers to negotiate more favorable terms. The global market for sustainable products was projected to exceed $3.5 trillion in 2024, reflecting the substantial demand that gives these suppliers leverage. Consequently, suppliers of sustainable materials, energy solutions, and waste management services can often command premium pricing due to the unique value they bring and the growing market for their offerings.

- Growing consumer demand for eco-friendly options.

- Hilton's commitment to sustainable sourcing.

- The global sustainable products market valued over $3.5 trillion in 2024.

- Suppliers can leverage specialized nature and high demand for premium pricing.

The bargaining power of suppliers for Hilton Worldwide Holdings is a key consideration, particularly for specialized hotel equipment and unique food and beverage ingredients. While Hilton's immense scale provides significant leverage, suppliers of niche products or those with strong sustainability credentials can still command premium pricing. This dynamic is further influenced by global supply chain complexities and lead times, which can range from 6 to 8 weeks for international sourcing, impacting cost and availability.

| Supplier Type | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Specialized Hotel Equipment | Moderate to High | Supplier concentration, switching costs for unique items, Hilton's brand standards. |

| Food & Beverage (Commodity) | Low to Moderate | Hilton's purchasing volume, fragmented supplier market, ease of switching. |

| Food & Beverage (Specialty/Unique) | Moderate | Input importance for guest experience, supplier uniqueness, potential for exclusive agreements. |

| Sustainable Products/Services | Moderate to High | Growing consumer demand, Hilton's sustainability initiatives, premium pricing potential. |

What is included in the product

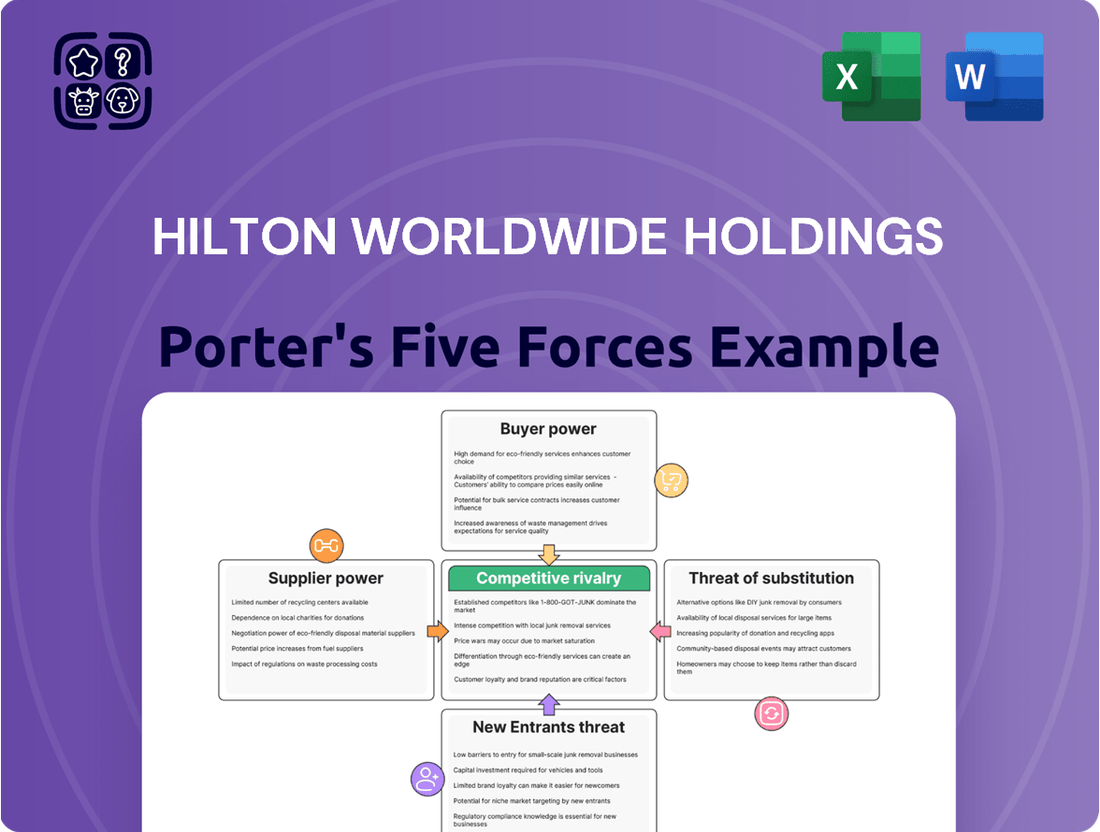

This analysis of Hilton Worldwide Holdings examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes, providing a strategic overview of its competitive environment.

Effortlessly navigate competitive pressures with a visual breakdown of Hilton's Porter's Five Forces, providing immediate clarity on strategic challenges.

Customers Bargaining Power

Customers in the hospitality sector, including those looking at Hilton, wield significant bargaining power. This strength stems from the sheer volume of hotels and alternative lodging choices readily accessible. The global hotel market, projected to reach $700 billion in 2024, offers a competitive landscape where consumers can easily compare prices and services.

Online Travel Agencies (OTAs) significantly amplify customer bargaining power by offering transparent pricing and robust comparison tools. This allows travelers to effortlessly identify the most competitive rates across various hotel brands, including Hilton. In 2024, it's estimated that over 40% of global hotel bookings are facilitated through these platforms, underscoring their critical role in customer acquisition and retention.

Modern travelers are increasingly demanding personalized and unique experiences, which significantly shifts the bargaining power towards them. This trend pressures hotel chains like Hilton to constantly adapt their services to meet individual guest expectations.

The expectation for tailored experiences is widespread, with a notable 90% of guests anticipating customized offerings, from room preferences to local activity suggestions. This high expectation empowers customers, forcing Hilton to invest heavily in innovation and differentiation to maintain its competitive edge.

Loyalty Programs and Customer Retention

While customers can exert significant bargaining power, Hilton Worldwide Holdings effectively counters this through its extensive Hilton Honors loyalty program. By the end of 2024, this program boasted over 200 million members globally, demonstrating its broad reach and impact.

These loyalty initiatives are crucial for fostering repeat business and building a dedicated customer base. The program offers a range of benefits designed to incentivize continued patronage.

- Exclusive Perks: Members receive benefits like room upgrades, late check-out, and bonus points, making their stays more rewarding.

- Personalized Offers: Tailored promotions and discounts are provided based on member preferences and past stays, enhancing the customer experience.

- Reduced Churn: The perceived value and tangible benefits of Hilton Honors help to lock in customers, thereby reducing the likelihood of them switching to competitors.

Price Sensitivity and Economic Factors

During periods of economic uncertainty, like early 2024 through mid-2025, customers become significantly more attuned to pricing. This means they actively search for discounts and the best value, which can directly impact Hilton's ability to maintain its pricing and, consequently, its Revenue Per Available Room (RevPAR).

This increased price sensitivity is particularly noticeable when domestic travel rebounds more robustly than international travel. For instance, in Q1 2024, Hilton reported that while overall occupancy was strong, the average daily rate (ADR) saw more moderate growth, reflecting this consumer focus on affordability.

- Heightened Price Sensitivity: Consumers are more budget-conscious, seeking deals and value during economic uncertainty.

- Impact on RevPAR: Increased price sensitivity can pressure Hilton's pricing strategies and overall RevPAR.

- Domestic vs. International Travel: A faster recovery in domestic travel compared to international travel can exacerbate price sensitivity pressures.

- Q1 2024 Data: Hilton's Q1 2024 results showed strong occupancy but more moderate ADR growth, indicative of customer price focus.

Customers possess considerable bargaining power due to the vast array of lodging options and the ease of price comparison, especially with online platforms. This power is further amplified by a growing demand for personalized experiences, forcing Hilton to innovate and differentiate its offerings. However, Hilton's loyalty program, with over 200 million members globally by the close of 2024, effectively mitigates this power by fostering customer retention and repeat business.

| Factor | Impact on Hilton | Supporting Data (2024) |

|---|---|---|

| Availability of Substitutes | High | Global hotel market projected at $700 billion |

| Online Travel Agencies (OTAs) | High | Over 40% of hotel bookings via OTAs |

| Customer Demand for Personalization | High | 90% of guests expect customized offerings |

| Price Sensitivity (Economic Uncertainty) | Moderate to High | Q1 2024: Strong occupancy, moderate ADR growth |

| Loyalty Programs (Hilton Honors) | Mitigates Power | Over 200 million members globally |

Preview the Actual Deliverable

Hilton Worldwide Holdings Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Hilton Worldwide Holdings, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes. The document you see here is exactly what you’ll be able to download after payment, providing a comprehensive understanding of the competitive landscape affecting Hilton's strategic positioning.

Rivalry Among Competitors

Hilton Worldwide Holdings operates in a highly competitive landscape, with major global brands like Marriott International, InterContinental Hotels Group (IHG), and Hyatt Hotels Corporation constantly vying for market share. These established players, along with numerous regional and boutique hotel groups, exert significant pressure on pricing and service offerings across all market segments.

Hilton faces fierce competition across its entire brand spectrum. In the luxury space, Waldorf Astoria contends with rivals like Four Seasons and Marriott's Ritz-Carlton, demanding exceptional service and unique experiences.

The mid-scale and economy segments are equally contested, with brands like Hilton Garden Inn and Hampton by Hilton going head-to-head with major players such as Wyndham Hotels & Resorts and Choice Hotels International.

This intense rivalry across all market tiers, from premium to budget, compels Hilton to continuously innovate and clearly differentiate its offerings to maintain market share and attract guests.

The intense competition within the hospitality sector compels Hilton to prioritize innovation and guest experience differentiation. This means a constant focus on enhancing digital offerings, like their digital key and mobile check-in services, to stay ahead. In 2024 alone, Hilton saw a significant 25% increase in the usage of its digital key feature, highlighting the growing importance of these technological advancements in attracting and retaining customers.

Impact of Online Platforms on Price Comparison

Online platforms significantly intensify competitive rivalry within the hospitality sector by facilitating effortless price comparisons. This transparency empowers consumers to easily scrutinize rates offered by Hilton against those of competitors, including other major hotel chains and a growing array of alternative lodging providers. For instance, in 2024, the average hotel booking site displays hundreds of options within a single search query, directly challenging Hilton's ability to command premium pricing without robust value justification.

This heightened price transparency compels Hilton to adopt more agile and competitive pricing strategies to remain attractive to a broad spectrum of travelers. The ease with which consumers can switch between providers based on price alone means Hilton must continually monitor market rates and adjust its own offerings accordingly. This dynamic environment requires significant investment in revenue management systems and promotional activities to ensure competitiveness.

- Increased Price Sensitivity: Online Travel Agencies (OTAs) and metasearch engines empower consumers with immediate price comparisons, pressuring Hilton’s pricing power.

- Alternative Lodging Growth: The proliferation of platforms like Airbnb continues to offer price-competitive alternatives, fragmenting the market and intensifying rivalry.

- Dynamic Pricing Pressure: Hilton must constantly adjust rates to remain competitive, impacting profit margins and requiring sophisticated yield management.

Market Saturation and Growth in Specific Segments

The hospitality sector, including brands like Hilton, faces intensified rivalry as many established markets reach saturation. This means companies are fighting harder for the same pool of customers, pushing down prices and impacting profit margins. For instance, in 2024, the U.S. hotel occupancy rates hovered around 63%, a slight dip from previous years, indicating a mature market in many regions.

Despite this, Hilton is actively pursuing growth by targeting less saturated emerging markets and focusing on higher-margin segments. Their strategy involves expanding their luxury and lifestyle brands, which often command premium pricing and cater to evolving traveler preferences. This approach helps mitigate the impact of saturation in more developed markets.

- Market Saturation: Many developed regions show high hotel density, leading to increased competition for market share.

- Emerging Market Focus: Hilton is prioritizing expansion in areas with less competition and higher potential for new customer acquisition.

- Portfolio Diversification: Growth in luxury and lifestyle segments aims to capture new demand and improve average daily rates (ADR).

- Competitive Pressure: Saturation intensifies price wars and necessitates innovative service offerings to differentiate.

The competitive rivalry within the hospitality sector remains a dominant force for Hilton Worldwide Holdings. This intense competition, driven by both global giants and niche players, necessitates continuous innovation and a sharp focus on guest value. For example, in 2024, the average daily rate (ADR) for hotels saw a modest increase, but this was often accompanied by increased promotional activity from competitors, forcing Hilton to remain highly agile in its pricing and service offerings to maintain its market position.

The digital landscape has amplified this rivalry, with online travel agencies (OTAs) and direct booking platforms providing consumers with unprecedented price transparency. This means Hilton must not only compete on brand and service but also on the perceived value offered at various price points. The rise of alternative lodging providers further fragments the market, adding another layer of competitive pressure that requires strategic differentiation across Hilton's diverse brand portfolio.

| Competitor | Key Brands | 2024 Estimated Market Share (Global Hotels) |

| Marriott International | Marriott, Ritz-Carlton, Sheraton | ~15-17% |

| InterContinental Hotels Group (IHG) | Holiday Inn, InterContinental, Kimpton | ~10-12% |

| Hyatt Hotels Corporation | Hyatt Regency, Park Hyatt, Grand Hyatt | ~5-7% |

| Wyndham Hotels & Resorts | Wyndham, Days Inn, Super 8 | ~7-9% |

SSubstitutes Threaten

The rise of alternative accommodation options like Airbnb and Vrbo presents a significant threat of substitutes for Hilton Worldwide Holdings. These platforms offer a wider array of unique lodging experiences and often come with more competitive pricing. In 2024, Airbnb's revenue was reported to be around $10 billion, underscoring their substantial market presence and direct challenge to the traditional hotel industry.

The rise of small and boutique hotels poses a significant threat to established brands like Hilton. These independent or smaller chain hotels often provide a more curated and personalized guest experience, attracting travelers looking for unique stays. In 2024, the boutique hotel sector experienced a notable 15% revenue growth, underscoring their increasing market penetration and appeal to a segment of the travel market that may otherwise patronize larger chains.

The availability of non-hotel lodging options, such as staying with friends or family or opting for short-term apartment rentals, presents a significant threat to traditional hotel chains like Hilton. These alternatives are particularly appealing to budget-conscious travelers, directly impacting the demand for standard hotel accommodations. For instance, the growth of platforms like Airbnb, which saw its revenue reach $10.1 billion in 2023, highlights the increasing consumer preference for diverse lodging experiences that can undercut hotel prices.

Changing Consumer Preferences for Experiential Travel

The increasing consumer desire for unique, local, and immersive experiences, often referred to as experiential travel, presents a significant threat to traditional hotel chains like Hilton. This trend diverts spending from standardized accommodations towards alternatives like Airbnb, boutique guesthouses, and curated travel packages. For instance, a 2024 report indicated that over 60% of millennials and Gen Z travelers prioritize experiences over material possessions, directly impacting the demand for conventional hotel rooms.

This shift necessitates continuous innovation within Hilton's service offerings to maintain relevance and attract guests. The company must focus on differentiating its brands and providing more localized and authentic experiences to counter the allure of unique, non-traditional lodging. Failing to adapt could lead to a gradual erosion of market share as travelers increasingly opt for alternatives that better align with their evolving preferences.

- Experiential Travel Growth: A significant portion of travelers, particularly younger demographics, now favor unique experiences over standard hotel stays.

- Alternative Accommodation Popularity: Platforms offering local stays and unique lodging options are gaining traction, directly competing with traditional hotels.

- Hilton's Strategic Imperative: The company must innovate its brand portfolio and service delivery to cater to the demand for authentic, localized experiences.

Technological Accessibility of Substitutes

Technological advancements have dramatically amplified the threat of substitutes for hotel chains like Hilton. Online travel agencies (OTAs) and direct booking platforms make it incredibly simple for consumers to discover, compare, and book alternative accommodations, including vacation rentals and boutique hotels. This accessibility means customers can easily find options that might offer different value propositions, from price to unique experiences, directly impacting Hilton's market share.

The ease of comparison facilitated by technology puts significant competitive pressure on traditional hospitality providers. For instance, platforms like Airbnb reported over 1.5 billion guest arrivals globally by the end of 2023, showcasing the scale of alternative lodging. This readily available information empowers consumers, intensifying the need for Hilton to differentiate its offerings and maintain competitive pricing to retain its customer base.

- Increased Discovery: Technology allows customers to easily find and compare a vast array of lodging options beyond traditional hotels.

- Enhanced Comparison: Online platforms provide tools for direct comparison of amenities, pricing, and reviews, empowering consumer choice.

- Growth of Alternatives: The rise of platforms like Airbnb, which facilitate short-term rentals, presents a significant and growing substitute for hotel stays.

The threat of substitutes for Hilton Worldwide Holdings is substantial, driven by the growing popularity of alternative accommodations and evolving traveler preferences. Platforms like Airbnb and Vrbo offer diverse lodging experiences, often at competitive price points, directly challenging traditional hotel models. In 2024, the short-term rental market continued its robust expansion, with Airbnb alone projecting revenues in the double-digit billions, indicating a significant diversion of consumer spending away from established hotel chains.

| Substitute Category | Key Characteristics | Impact on Hilton | 2024 Market Data Insight |

|---|---|---|---|

| Vacation Rentals (e.g., Airbnb) | Unique stays, local immersion, often lower price points, kitchen facilities | Direct competition for leisure and extended-stay travelers, potential price pressure | Airbnb's revenue exceeded $10 billion in 2023, with continued growth projected for 2024. |

| Boutique & Independent Hotels | Personalized service, unique design, local character | Attracts travelers seeking distinct experiences, can erode market share from mid-tier and upper-mid-tier Hilton brands | The boutique hotel segment saw approximately 15% revenue growth in 2024. |

| Peer-to-Peer Lodging (Friends/Family) | Cost-free, familiar environment | Primarily impacts budget-conscious travelers and those prioritizing social connections over amenities | While difficult to quantify precisely, this remains a persistent, albeit less commercially driven, substitute. |

| Experiential Travel Providers | Focus on activities and local culture, often bundling accommodation | Captures spending that might otherwise go to hotels, especially among younger demographics | Over 60% of millennials and Gen Z travelers in 2024 prioritized experiences, influencing lodging choices. |

Entrants Threaten

The threat of new entrants into the global hospitality sector, especially for a brand like Hilton, is significantly mitigated by the sheer scale of initial capital required. Building and branding new hotels demands massive upfront investment, creating a formidable barrier.

For instance, in 2023, the cost to develop a single hotel room could easily fall between $150,000 and $350,000. This substantial financial hurdle makes it exceedingly difficult for smaller players or new companies to enter the market and compete effectively with established giants.

Hilton's formidable brand equity, valued at around $8.7 billion in 2023, acts as a significant deterrent to potential new entrants. This immense brand recognition, coupled with a vast portfolio encompassing over 8,800 properties under 24 distinct brands, fosters deep customer loyalty.

Hilton's formidable global footprint, spanning 139 countries and territories as of early 2024, presents a substantial barrier to new entrants. This extensive reach is complemented by highly developed distribution networks, including its digital platforms and established travel partnerships, which are difficult and costly for newcomers to replicate.

Economies of Scale and Cost Advantages

Hilton's significant economies of scale create substantial cost advantages for new entrants. As a global leader, Hilton leverages its massive purchasing power for supplies, marketing reach, and operational efficiencies, making it difficult for smaller, newer players to compete on price. For instance, in 2024, Hilton continued to benefit from its vast network, enabling lower per-unit costs in areas like advertising and technology adoption, which new entrants would struggle to replicate without a similar scale of operations.

These cost advantages allow Hilton to invest more heavily in guest experience and innovative technologies. Newcomers would face immense capital requirements to build comparable brand recognition and operational infrastructure. This disparity in resources directly impacts pricing flexibility and the ability to absorb initial market entry costs, posing a significant barrier.

Key cost advantages for Hilton include:

- Procurement Power: Bulk purchasing of goods and services leads to lower unit costs.

- Marketing Efficiency: Wider reach and brand recognition reduce the cost per customer acquisition.

- Operational Scale: Centralized functions and standardized processes drive down overheads.

- Technology Investment: Ability to fund large-scale tech upgrades that improve efficiency.

Regulatory and Legal Barriers

Regulatory and legal barriers significantly deter new entrants in the hospitality sector. For instance, obtaining necessary licenses and permits, adhering to zoning laws, and meeting stringent health and safety standards require substantial investment and expertise. In 2024, the complexity and cost associated with compliance remain a significant hurdle, making it difficult for smaller, less capitalized players to enter markets dominated by established brands like Hilton Worldwide Holdings.

These extensive compliance requirements act as a formidable barrier, increasing the capital and time needed for market entry. Navigating these regulations can be particularly challenging for new businesses lacking established relationships with legal and regulatory bodies. This difficulty is compounded by the fact that regulatory landscapes can change, requiring ongoing adaptation and investment.

- Zoning Laws: Local zoning ordinances dictate where hotels can be built and what services they can offer, often restricting new developments in prime locations.

- Licensing and Permits: Obtaining operating licenses, liquor licenses, and various permits can be a lengthy and expensive process, varying by jurisdiction.

- Health and Safety Standards: Compliance with food safety, building codes, and sanitation regulations demands significant upfront investment in infrastructure and ongoing operational costs.

The threat of new entrants for Hilton remains relatively low, primarily due to the substantial capital required to establish a hotel brand and infrastructure. For example, the average cost to build a new hotel in the US in 2023 ranged from $20 million to $60 million, a significant barrier for smaller competitors.

Hilton's established brand reputation, a key differentiator, is difficult and costly for newcomers to replicate, requiring extensive marketing and years of consistent service delivery.

Furthermore, economies of scale in purchasing, marketing, and technology adoption provide Hilton with cost advantages that new entrants would struggle to match in the near term.

Regulatory hurdles, including zoning laws and licensing, also add complexity and cost, further limiting the ease of entry for aspiring competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hilton Worldwide Holdings is built upon comprehensive data from Hilton's annual reports and SEC filings, alongside industry insights from reputable sources like Statista and IBISWorld, to provide a robust understanding of the competitive landscape.