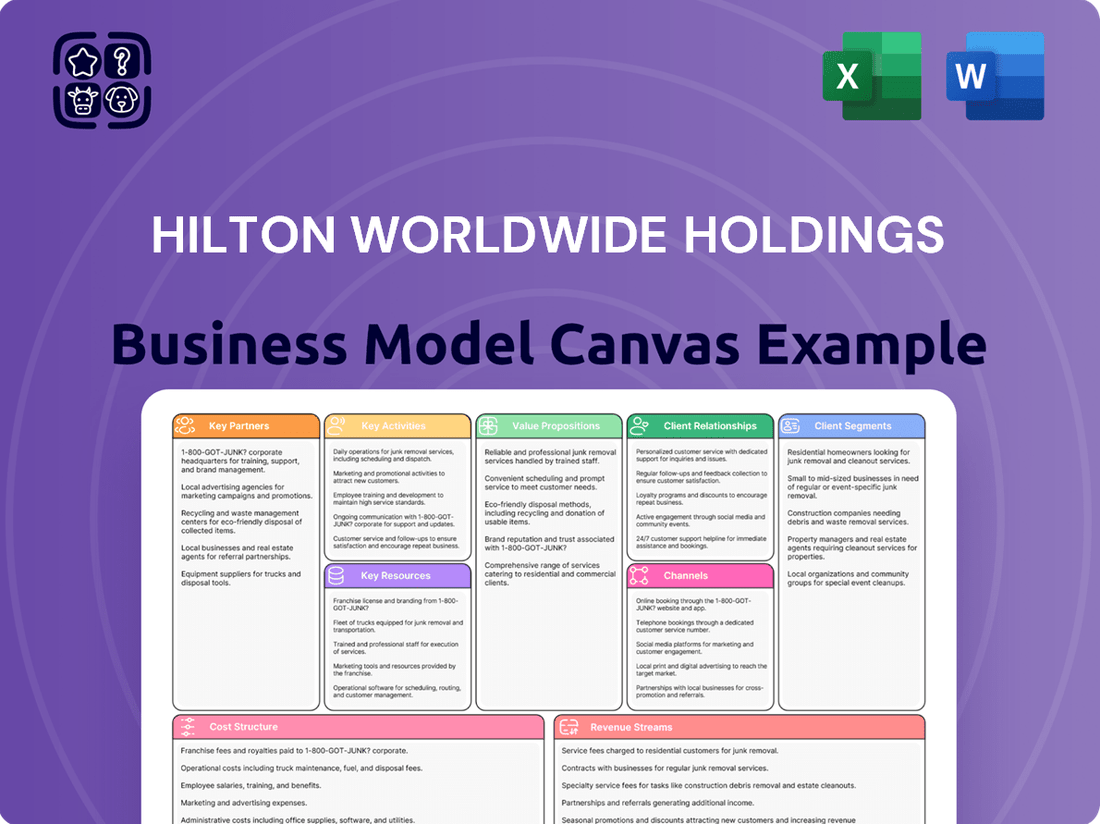

Hilton Worldwide Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Worldwide Holdings Bundle

Unlock the core of Hilton Worldwide Holdings's success with our comprehensive Business Model Canvas. Discover how they leverage their vast hotel portfolio, franchise agreements, and loyalty programs to create value for diverse customer segments. This detailed analysis is your key to understanding their strategic advantages.

Dive deeper into the operational genius of Hilton Worldwide Holdings. Our Business Model Canvas breaks down their key partners, revenue streams, and cost structures, offering a clear roadmap to their market dominance. Ideal for anyone seeking to emulate or compete with industry leaders.

See how Hilton Worldwide Holdings masterfully connects its value propositions to its customer relationships and channels. This full Business Model Canvas provides an actionable blueprint for understanding their growth engine. Download it now to gain a competitive edge.

Partnerships

Hilton Worldwide Holdings cultivates a vital network of franchisees and independent hotel owners. These partners are instrumental in extending Hilton's global reach, allowing for market penetration without the full capital burden of company-owned assets.

In 2024, Hilton's franchise model remained a cornerstone of its growth strategy, contributing significantly to its extensive portfolio. This symbiotic relationship allows franchisees access to Hilton's robust brand equity, sophisticated reservation platforms, and comprehensive operational expertise.

Hilton's growth strategy heavily relies on collaborations with real estate developers and institutional investors. These crucial partnerships are instrumental in funding and executing the construction of new hotels, expanding Hilton's presence across various market segments. For instance, in 2024, Hilton continued to announce new development projects, often in collaboration with these key partners, to meet increasing travel demand.

Hilton strategically partners with technology providers and platforms to bolster its digital capabilities. These alliances are crucial for optimizing property management systems, enhancing customer relationship management (CRM) through software like Salesforce, and fortifying cybersecurity defenses. For instance, in 2024, Hilton continued to invest heavily in its digital infrastructure, aiming to streamline operations and personalize guest experiences, a trend consistent with previous years' digital transformation initiatives.

Online Travel Agencies (OTAs) and Global Distribution Systems (GDS)

Hilton Worldwide Holdings strategically partners with Online Travel Agencies (OTAs) like Booking.com and Expedia, and Global Distribution Systems (GDS) such as Amadeus and Sabre. These collaborations are crucial for expanding Hilton’s market reach, ensuring its properties are visible to a vast global customer base. In 2024, OTAs continued to be a significant booking channel for the hospitality industry, with Hilton leveraging these platforms to capture travelers who may not book directly.

While Hilton actively promotes direct bookings through its own channels to foster loyalty and reduce commission costs, the partnerships with OTAs and GDS are essential for broad market penetration. These channels offer access to millions of travelers actively searching for accommodation. Hilton's strategy involves carefully managing these relationships to balance the benefits of wide distribution with incentives for guests to book directly, thereby optimizing its overall booking strategy.

- Expanded Reach: OTAs and GDS provide access to a global traveler audience, significantly increasing booking potential.

- Distribution Channel Diversification: These partnerships ensure Hilton's inventory is available across multiple online platforms, catering to diverse booking preferences.

- Strategic Balance: Hilton manages these relationships to encourage direct bookings while still benefiting from the broad visibility offered by third-party channels.

Loyalty Program Partners and Credit Card Companies

Hilton's loyalty program, Hilton Honors, thrives on strategic collaborations with airlines and credit card companies. These partnerships significantly boost the program's appeal, allowing members to earn and redeem points not just on stays but also through flights and everyday spending. For instance, in 2024, Hilton continued to deepen its ties with major airlines, offering members more avenues to accumulate points, thereby fostering greater guest loyalty and driving repeat bookings.

These alliances extend to co-branded credit cards, which are a cornerstone of Hilton's loyalty strategy. By partnering with financial institutions, Hilton provides members with cards that offer accelerated point earning and exclusive benefits, making it more attractive for consumers to choose Hilton brands. This synergy between travel and financial services creates a robust ecosystem that reinforces customer engagement and encourages higher spending across all partnered platforms.

- Airline Collaborations: Continued integration with leading airlines in 2024 to expand point-earning and redemption opportunities for Hilton Honors members.

- Credit Card Partnerships: Ongoing development and promotion of co-branded credit cards that offer enhanced rewards and benefits, driving incremental spend and loyalty.

- Brand Ecosystem: Strengthening the overall value proposition of Hilton Honors by embedding it within a wider network of consumer brands, increasing member engagement and retention.

Hilton's key partnerships are foundational to its expansive business model, enabling global reach and operational efficiency. These include a strong network of franchisees and property owners, crucial for market penetration without significant capital outlay.

In 2024, Hilton's franchise system continued to be a primary growth driver, with franchisees benefiting from Hilton's brand strength and operational support. Real estate developers and institutional investors are vital partners for funding new hotel developments, ensuring Hilton keeps pace with travel demand. For example, Hilton announced numerous new projects in 2024, often in collaboration with these financial backers.

Hilton also collaborates with technology providers to enhance its digital infrastructure and customer relationship management, as seen in its continued investment in platforms like Salesforce for improved guest experiences. Furthermore, partnerships with Online Travel Agencies (OTAs) and Global Distribution Systems (GDS) remain critical for broad market visibility, even as Hilton encourages direct bookings.

The Hilton Honors loyalty program's success is amplified by strategic alliances with airlines and credit card companies, offering members diverse ways to earn and redeem points, thereby fostering strong customer loyalty. These partnerships, including co-branded credit cards, create a robust ecosystem that drives engagement and spending.

| Partnership Type | Key Benefit | 2024 Relevance |

|---|---|---|

| Franchisees & Owners | Global Expansion, Reduced Capital Burden | Cornerstone of growth strategy, extending brand reach. |

| Real Estate Developers & Investors | Funding for New Hotel Construction | Essential for executing development projects to meet demand. |

| Technology Providers | Digital Capabilities Enhancement, Operational Efficiency | Crucial for optimizing systems and guest experience platforms. |

| OTAs & GDS | Market Visibility, Broad Customer Access | Significant booking channels for reaching a global traveler base. |

| Airlines & Credit Card Companies | Loyalty Program Enhancement, Increased Engagement | Drives member loyalty and repeat bookings through co-branded initiatives. |

What is included in the product

This Business Model Canvas outlines Hilton's strategy of leveraging a diverse portfolio of brands and a robust loyalty program to attract and retain a broad range of travelers, operating through franchised and managed hotels globally.

It details how Hilton creates value by offering consistent quality and experiences across its segments, delivered through direct bookings and third-party channels, supported by strong partnerships and efficient cost structures.

Hilton's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying the identification of key customer segments and value propositions for easier strategic alignment.

Activities

Hilton's brand management is a cornerstone, focusing on nurturing its 22 distinct brands to resonate with a wide range of travelers. This involves meticulous oversight of brand identity, guest experience standards, and market positioning. In 2024, Hilton continued to refine its brand architecture, ensuring each brand offers a unique value proposition to attract and retain both loyal guests and potential franchisees.

The development of new brand concepts is crucial for staying ahead. Hilton actively researches market trends and consumer preferences to identify opportunities for expansion and innovation. This strategic approach to brand creation and evolution underpins their ability to capture new market segments and maintain a competitive edge in the dynamic hospitality industry.

Hilton's franchise operations are a cornerstone of its business, involving extensive support for its partners. This includes providing detailed operational manuals, robust marketing strategies, comprehensive training modules, and access to Hilton's advanced proprietary technology platforms.

This support system is designed to ensure every franchised hotel maintains Hilton's stringent quality standards and leverages the immense power of its brand recognition. For instance, in 2023, Hilton's systemwide revenue exceeded $10 billion, a significant portion of which was generated by its franchised properties, demonstrating the economic impact of this model.

The success of this franchised approach hinges on this continuous and effective support, directly contributing to the brand's global expansion and consistent guest experience across thousands of properties worldwide.

Hilton actively manages a vast portfolio of hotels and resorts, acting as a trusted partner for property owners. This involves overseeing all aspects of daily operations, from guest services and maintenance to sophisticated revenue management strategies designed to maximize profitability. In 2023, Hilton's managed and franchised portfolio comprised over 7,000 properties globally, demonstrating the scale of their operational expertise.

These comprehensive management services are built on Hilton's deep industry knowledge, encompassing sales and marketing initiatives, talent acquisition and development for human resources, and rigorous financial reporting. By leveraging Hilton's established brand and operational best practices, property owners benefit from optimized performance and enhanced asset value.

Sales, Marketing, and Revenue Management

Hilton's sales and marketing engine is a core activity, designed to draw guests from every travel category. This involves broad-reaching advertising, a strong digital presence, and leveraging their Hilton Honors loyalty program for repeat business. For instance, in 2023, Hilton's marketing efforts contributed to a system-wide revenue per available room (RevPAR) increase of 11.4% compared to 2022.

Central to their strategy is sophisticated revenue management. This ensures optimal pricing and occupancy across their vast hotel portfolio, maximizing profitability. In the first quarter of 2024, Hilton reported a 5.2% increase in comparable RevPAR, reflecting effective yield management.

- Global Advertising & Digital Marketing: Reaching diverse customer segments through various channels.

- Loyalty Program Promotions: Driving repeat business and engagement via Hilton Honors.

- Strategic Pricing & Revenue Management: Maximizing profitability through dynamic rate adjustments.

- 2023 System-wide RevPAR Growth: 11.4% increase year-over-year.

Technology Innovation and Digital Transformation

Hilton's commitment to technology innovation and digital transformation is a core activity, driving enhancements in both guest experience and operational efficiency. This focus is evident in their continuous investment in digital platforms and guest-facing technologies.

Key digital initiatives include the development and ongoing maintenance of their sophisticated booking platforms and the popular Hilton Honors mobile app. These digital tools are designed to provide seamless interactions, from reservation to check-in and in-room services.

Hilton actively innovates with in-room technologies, aiming to personalize the guest stay and offer greater convenience. This forward-thinking approach is vital for maintaining a competitive edge in the rapidly evolving hospitality industry and meeting the expectations of today's tech-savvy travelers.

- Digital Investment: Hilton consistently invests in its digital infrastructure, including its booking engine and mobile app, to improve user experience and operational efficiency.

- Guest Experience Enhancement: Technology innovation focuses on creating personalized and convenient guest journeys, from booking to in-room controls and service requests.

- Mobile App Functionality: The Hilton Honors app is a critical digital touchpoint, offering features like digital check-in, room selection, and keyless entry, which saw significant adoption and usage in 2024.

- Operational Streamlining: Digital transformation efforts also target back-of-house operations, utilizing technology to optimize revenue management, property management systems, and staff communication.

Hilton's key activities center on managing and growing its extensive brand portfolio, which encompasses 22 distinct brands catering to various traveler needs. This involves robust franchise support, providing operational, marketing, and technological assistance to franchise partners. The company also actively manages a significant number of properties, ensuring high operational standards and profitability. Furthermore, Hilton drives demand through comprehensive sales and marketing initiatives, with a strong emphasis on its Hilton Honors loyalty program and sophisticated revenue management strategies.

Technology and digital innovation are paramount, focusing on enhancing the guest experience through advanced booking platforms and mobile app functionalities, while also streamlining back-of-house operations. In 2023, Hilton's system-wide revenue exceeded $10 billion, with a substantial contribution from franchised properties. The first quarter of 2024 saw a 5.2% increase in comparable RevPAR, highlighting the effectiveness of their revenue management. Hilton's managed and franchised portfolio reached over 7,000 properties globally in 2023.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Brand Management & Development | Nurturing 22 distinct brands and developing new concepts. | Continued refinement of brand architecture in 2024. |

| Franchise Operations Support | Providing operational, marketing, and technology support to franchisees. | System-wide revenue exceeded $10 billion in 2023, largely from franchised properties. |

| Property Management | Overseeing daily operations for managed and franchised hotels. | Portfolio comprised over 7,000 properties globally in 2023. |

| Sales & Marketing / Revenue Management | Driving demand through advertising, digital presence, and loyalty programs, with optimized pricing. | System-wide RevPAR increased 11.4% in 2023; Q1 2024 comparable RevPAR up 5.2%. |

| Technology & Digital Innovation | Enhancing guest experience and operational efficiency through digital platforms and mobile apps. | Significant investment in booking platforms and Hilton Honors app in 2024. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing for Hilton Worldwide Holdings is the exact document you will receive upon purchase. This comprehensive analysis details Hilton's key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be confident that what you see here is the complete, ready-to-use deliverable, providing a professional and insightful overview of Hilton's strategic framework.

Resources

Hilton's extensive portfolio, featuring globally recognized brands like Waldorf Astoria, Conrad, Hilton, DoubleTree, and Hampton by Hilton, is a cornerstone of its business. These brands are not just names; they represent a significant intangible asset, crucial for its franchising and management strategies.

The intellectual property, encompassing trademarks and proprietary operating systems, underpins Hilton's ability to attract both guests and hotel owners. In 2024, the strength and recognition of these brands continue to be a primary driver of customer loyalty and owner engagement, directly contributing to the company's market position and revenue generation.

While Hilton Worldwide Holdings heavily relies on management and franchising, it strategically owns and leases a select portfolio of hotels. These owned and leased properties, often flagship locations or those in crucial markets, offer direct operational control and act as living laboratories for brand excellence and new initiatives. As of the first quarter of 2024, Hilton's owned and leased portfolio remained a smaller, yet significant, part of its overall business, contributing directly to its financial performance.

Hilton's sophisticated global distribution system (GDS) and proprietary reservation platforms are essential for their operations. These systems act as the backbone, connecting their vast network of properties with travel agents, online travel agencies (OTAs), and directly with guests. In 2024, Hilton continued to leverage these robust technologies to manage inventory and facilitate bookings across its brands.

The efficiency of these systems is paramount. They enable seamless transactions and real-time updates, crucial for maximizing occupancy rates and, consequently, revenue. Hilton's investment in these digital infrastructures ensures they can effectively reach a global customer base and manage the complexities of a large hotel portfolio.

Human Capital and Expertise

Hilton Worldwide Holdings relies heavily on its extensive network of skilled professionals. This includes experienced hotel management teams who ensure day-to-day operations run smoothly, operational experts who optimize efficiency, and dedicated sales and marketing specialists who drive revenue. A significant portion of their corporate staff also provides crucial support functions.

The collective expertise and commitment to service excellence from this human capital are fundamental to Hilton's ability to maintain its high standards and deliver consistent, memorable guest experiences across its diverse portfolio of brands. This deep well of industry knowledge is a competitive differentiator.

Investing in talent development is a strategic imperative for Hilton. This focus ensures their workforce remains at the forefront of hospitality trends and service innovation. For instance, in 2023, Hilton continued its robust training programs, aiming to enhance the skills of its over 200,000 team members globally, reinforcing their commitment to employee growth and customer satisfaction.

- Skilled Workforce: Hilton employs a vast global workforce comprising hotel management, operations, sales, marketing, and corporate professionals.

- Expertise and Service Excellence: The collective experience and dedication of these employees are vital for upholding brand standards and ensuring exceptional guest experiences.

- Talent Investment: Continuous investment in employee training and development is a key strategy to maintain a competitive edge and foster innovation in hospitality.

- Global Reach: With over 200,000 team members worldwide as of 2023, Hilton's human capital is a critical component of its expansive operational footprint.

Hilton Honors Loyalty Program and Customer Data

The Hilton Honors loyalty program is a cornerstone of Hilton Worldwide Holdings' business model, acting as a significant driver of customer retention and engagement. This program boasts a massive, active membership base, which translates directly into consistent revenue streams as members are incentivized to choose Hilton properties for their stays.

The sheer volume of data generated by Hilton Honors members is a critical resource. This data offers deep insights into guest preferences, travel patterns, and spending habits. For instance, by analyzing booking data, Hilton can identify trends in popular destinations or preferred room amenities. This granular understanding allows for highly targeted marketing campaigns and the development of personalized guest experiences, which in turn, strengthens loyalty and encourages further engagement.

- Hilton Honors Membership: As of the end of 2023, Hilton Honors had over 173 million members globally.

- Data-Driven Personalization: Insights from member data enable tailored offers and promotions, increasing booking conversion rates.

- Repeat Business: The program directly contributes to higher occupancy rates and RevPAR (Revenue Per Available Room) through member loyalty.

- Strategic Asset: Customer data is leveraged to inform new product development and service improvements, fostering long-term growth.

Hilton's key resources include its globally recognized brand portfolio, such as Waldorf Astoria and Hampton by Hilton, which serve as significant intangible assets. Intellectual property, including trademarks and proprietary operating systems, is vital for attracting guests and hotel owners. While a smaller portion of its business, Hilton also strategically owns and leases flagship properties in key markets, providing direct operational control and serving as centers for brand excellence.

Value Propositions

Hilton Worldwide Holdings delivers a promise of consistent quality, comfort, and service excellence across its many brands, from luxury to select-service. This reliability ensures travelers experience a predictable and satisfying stay, building significant brand trust and loyalty. In 2024, Hilton's commitment to these standards translated into strong guest satisfaction scores, with over 90% of guests reporting a positive experience.

Hilton's global accessibility is a cornerstone of its value proposition, with a presence in over 120 countries and territories as of early 2024. This expansive network ensures travelers can find accommodations in virtually any major city or popular tourist destination across the globe.

The company offers a diverse portfolio of brands, catering to a wide spectrum of traveler needs and budgets. From the luxury of Waldorf Astoria and Conrad to the mid-scale appeal of Hilton Garden Inn and the efficiency of Hampton by Hilton, this variety provides unparalleled choice.

This broad range of options, coupled with their widespread locations, translates into significant convenience and choice for customers. For instance, in 2023, Hilton opened a record number of new hotels, further expanding its reach and ensuring more travelers have access to their offerings.

For hotel owners, Hilton offers a compelling value proposition centered on operational excellence and the immense power of its brand portfolio. This means franchisees gain access to Hilton's time-tested operating procedures, robust training programs, and centralized support services, all designed to drive efficiency and guest satisfaction.

Leveraging Hilton's globally recognized brands, such as Hilton Hotels & Resorts, DoubleTree by Hilton, and Hampton by Hilton, provides owners with immediate market recognition and a built-in customer base. In 2023, Hilton's brands consistently demonstrated strong performance, with many properties achieving occupancy rates exceeding the industry average, directly translating into enhanced revenue potential for owners.

The strategic advantage for owners lies in tapping into Hilton's extensive marketing reach and loyalty programs, like Hilton Honors, which boasts over 150 million members as of early 2024. This scale allows owners to benefit from increased visibility and a predictable stream of guests, ultimately contributing to improved profitability and a stronger return on investment.

Rewarding Loyalty Program and Personalized Experiences

Hilton Honors stands as a cornerstone of Hilton's value proposition, directly rewarding customer loyalty. This program offers tangible benefits like points accumulation for free nights and exclusive access to perks such as room upgrades and late check-outs. In 2024, Hilton continued to emphasize personalized offers, leveraging data to tailor promotions and experiences to individual member preferences, thereby deepening engagement and driving repeat business.

The program's structure incentivizes continued patronage by offering tiered elite status levels, each with increasing benefits. These benefits, ranging from bonus points to executive lounge access, create a compelling reason for frequent travelers to consistently choose Hilton brands. This strategic loyalty initiative is designed to foster a committed customer base, a key element in maintaining market share and driving consistent revenue streams.

- Hilton Honors members earned over 100 billion points in 2023.

- The program offers 18 different ways to earn points, including stays, dining, and car rentals.

- Personalized offers are sent to millions of members weekly, increasing booking conversion rates.

- Elite members enjoy benefits like space-available room upgrades and late check-out, enhancing their stay experience.

Innovative Technology and Seamless Digital Experience

Hilton is committed to offering guests a smooth and intuitive digital journey. This is achieved through its sophisticated mobile app, user-friendly online booking systems, and advanced in-room technology. Features such as digital key access, online check-in, and tailored recommendations significantly boost guest convenience and overall satisfaction.

These technological advancements are designed to streamline the entire travel experience, making each stay more pleasant and efficient. For instance, in 2023, Hilton's Honors app saw continued growth in engagement, with millions of members utilizing digital check-in and room selection features, demonstrating a clear preference for digital convenience.

- Digital Key Adoption: Millions of Hilton Honors members have adopted the digital key feature, allowing them to bypass the front desk and access their rooms directly via their smartphones.

- Mobile App Usage: The Hilton Honors app is a central hub for booking, managing stays, and accessing personalized offers, with a significant percentage of bookings originating through the app.

- Personalized Guest Experiences: Leveraging data, Hilton provides personalized recommendations for dining, activities, and room preferences, enhancing the individual guest experience.

- Streamlined Operations: Technology integration aims to optimize hotel operations, from check-in to in-room services, contributing to greater efficiency and guest satisfaction.

Hilton's value proposition for guests centers on reliable quality and service across its diverse brand portfolio, ensuring a consistent and satisfying experience. This commitment is reflected in strong guest satisfaction, with over 90% reporting positive stays in 2024. The company's extensive global footprint, present in over 120 countries by early 2024, offers unparalleled accessibility for travelers worldwide.

For hotel owners, Hilton provides operational expertise and brand leverage, offering proven procedures and training to drive efficiency. Franchisees benefit from immediate market recognition through globally recognized brands, leading to enhanced revenue potential, as many Hilton properties exceeded industry average occupancy rates in 2023.

The Hilton Honors loyalty program is a key value driver, rewarding members with points, exclusive perks, and tiered elite status. With over 150 million members globally as of early 2024, the program incentivizes repeat business through personalized offers and tangible benefits, fostering a committed customer base and consistent revenue.

Hilton enhances the guest experience through a seamless digital journey, featuring a robust mobile app and user-friendly online systems. Features like digital key access and online check-in streamline travel, with millions of Honors members actively using these conveniences, as seen in the app's growing engagement in 2023.

| Value Proposition | Description | Key Metric/Fact (as of early 2024 or 2023) |

|---|---|---|

| Consistent Quality & Service | Reliable and satisfying guest experiences across all brands. | Over 90% guest satisfaction in 2024. |

| Global Accessibility | Presence in over 120 countries and territories. | Extensive network ensures accommodation in major cities and tourist destinations. |

| Brand Diversity & Choice | Catering to various traveler needs and budgets with multiple brands. | Record number of new hotels opened in 2023, expanding reach. |

| Owner Operational Excellence | Proven operating procedures, training, and support for franchisees. | Strong brand performance with many properties exceeding industry average occupancy in 2023. |

| Hilton Honors Loyalty Program | Rewarding customer loyalty with points, elite status, and personalized offers. | Over 150 million members globally; members earned over 100 billion points in 2023. |

| Digital Convenience | Seamless digital journey via mobile app and online systems. | Millions of Honors members use digital key and app features for booking and managing stays. |

Customer Relationships

The Hilton Honors loyalty program is the cornerstone of Hilton's customer relationships, driving engagement through personalized rewards and exclusive benefits. This program cultivates a strong sense of guest appreciation, directly encouraging repeat business and fostering brand loyalty. Hilton consistently uses targeted offers and elite status recognition to deepen these connections, making guests feel valued and understood.

Hilton's digital and mobile application interaction is a cornerstone of its customer relationships, enabling direct guest engagement. Features like mobile check-in, digital keys, and direct messaging with hotel staff streamline the guest journey, offering unparalleled convenience and personalization.

This digital channel fosters real-time communication and service delivery. In 2024, Hilton's app usage continued to grow, with millions of downloads and frequent engagement, underscoring its importance in enhancing the guest experience and building loyalty.

Hilton cultivates strong customer relationships through direct, personalized guest service at the hotel level. This includes attentive front desk interactions, helpful concierge services, and staff who make guests feel genuinely valued.

The company's commitment to service excellence is a cornerstone, aiming to create memorable stays that foster guest loyalty. In 2024, Hilton's dedication to guest satisfaction was reflected in its continued strong performance, with a focus on enhancing on-property experiences across its diverse portfolio.

Dedicated Support for Franchisees and Owners

Hilton Worldwide Holdings cultivates strong connections with its franchisees and owners through dedicated relationship management teams. These teams provide ongoing operational guidance, conduct regular performance reviews, and offer access to a wealth of resources designed to enhance property success.

This proactive support structure is vital for maintaining brand standards and driving profitability across the vast Hilton portfolio. For instance, in 2023, Hilton's franchised and managed hotels represented a significant portion of its overall room count, underscoring the importance of these owner relationships.

- Dedicated Relationship Managers: Provide direct points of contact for franchisees and owners.

- Operational Guidance and Best Practices: Offer support in areas like revenue management, marketing, and guest service standards.

- Performance Monitoring and Feedback: Regular reviews help identify areas for improvement and celebrate successes.

- Access to Resources: Franchisees benefit from Hilton's global marketing, technology platforms, and supply chain advantages.

Customer Service and Feedback Channels

Hilton ensures guests can reach them through various avenues like dedicated call centers, online chat support, and post-stay email surveys. This multi-channel approach is key to their customer service strategy.

By actively collecting and responding to guest feedback, Hilton demonstrates a dedication to improving its offerings. For instance, in 2024, they reported a significant increase in positive sentiment following targeted service enhancements based on guest comments.

- Customer Service Channels: Call centers, online support, post-stay surveys.

- Feedback Integration: Actively listening and addressing guest concerns for continuous improvement.

- Impact: Crucial for issue resolution and gathering insights to enhance guest experiences.

- 2024 Data Point: Hilton noted a measurable uptick in guest satisfaction scores directly linked to service adjustments informed by feedback mechanisms.

Hilton's customer relationships are deeply rooted in its loyalty program, Hilton Honors, which saw continued robust engagement throughout 2024. This program offers tiered benefits, personalized offers, and exclusive experiences, driving repeat bookings and fostering a strong sense of community among its members.

The digital platform, particularly the Hilton Honors app, serves as a critical touchpoint for guest interaction, facilitating seamless experiences from booking to check-out. In 2024, the app's functionality expanded to include more personalized recommendations and direct communication channels, further strengthening guest loyalty.

Beyond digital engagement, Hilton prioritizes high-touch, in-person service at its properties, with staff trained to deliver exceptional guest experiences. This focus on personalized service, a hallmark of the brand, consistently contributes to positive guest feedback and repeat visitation, as evidenced by guest satisfaction metrics in 2024.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Loyalty Program | Hilton Honors: Tiered benefits, personalized offers, exclusive experiences | Continued high member engagement; significant portion of revenue driven by Honors members. |

| Digital Engagement | Hilton Honors App: Mobile check-in, digital key, personalized recommendations, direct messaging | Millions of active users; increased app-driven bookings and service requests. |

| In-Person Service | Attentive staff, personalized guest interactions, service excellence focus | Strong guest satisfaction scores; positive sentiment driven by memorable on-property experiences. |

Channels

Hilton's official website, Hilton.com, alongside dedicated brand websites like WaldorfAstoria.com and Hampton.com, are crucial direct booking channels. These platforms are designed to offer guests detailed property information, exclusive promotions, and highlight the advantages of their Hilton Honors loyalty program, aiming for a smooth and direct reservation process.

In 2023, direct bookings through Hilton's digital channels, including Hilton.com, played a significant role in their revenue strategy. While specific percentages fluctuate, these channels are consistently prioritized for their ability to capture higher margins and foster direct guest relationships, a key component of their customer acquisition strategy.

The Hilton Honors mobile application serves as a primary channel for guest interaction, facilitating bookings, seamless mobile check-ins, and digital key access. This integrated platform enhances the guest experience by offering personalized offers and loyalty program benefits, driving direct bookings.

In 2024, Hilton continued to emphasize digital innovation, with its mobile app playing a pivotal role in guest engagement. The app's functionality, including digital check-in and room key access, has been instrumental in streamlining the guest journey and fostering loyalty.

Hilton's global sales teams are the backbone of its corporate and group business, directly cultivating relationships with major corporations, travel management companies, and event organizers. These dedicated teams work to secure substantial bookings and long-term travel contracts, ensuring a steady stream of business from institutional clients.

In 2024, Hilton continued to emphasize these direct sales channels, recognizing their critical role in driving consistent occupancy and revenue from the lucrative corporate travel segment. This focus on personalized engagement allows Hilton to tailor offerings and build loyalty with key accounts, a strategy that proved essential in navigating the evolving travel landscape.

Online Travel Agencies (OTAs) and Metasearch Engines

Hilton leverages major Online Travel Agencies (OTAs) like Expedia and Booking.com, alongside metasearch engines such as Google Hotels and TripAdvisor, to significantly broaden its customer reach. These platforms are crucial for capturing travelers who initiate their hotel searches on third-party sites, complementing Hilton's efforts to drive direct bookings. In 2023, approximately 45% of Hilton's room nights were booked through digital channels, with OTAs playing a substantial role in this volume.

While direct bookings are financially more advantageous due to lower commission costs, the extensive visibility offered by OTAs and metasearch engines is indispensable for accessing a wider global traveler base. Hilton's strategy involves carefully managing these partnerships to ensure optimal distribution and brand presence. For instance, in Q1 2024, Hilton reported a 7.1% increase in comparable revenue per available room (RevPAR), a metric influenced by the effectiveness of its various distribution channels.

- Global Reach: OTAs and metasearch engines provide access to millions of travelers worldwide who may not directly visit Hilton's website.

- Visibility and Discovery: These platforms are often the first point of contact for many travelers, increasing brand awareness and booking opportunities.

- Distribution Management: Hilton actively manages its presence and rates across these third-party channels to maintain brand integrity and profitability.

- Data Insights: Partnerships with OTAs offer valuable data on booking trends and customer preferences, informing marketing and operational strategies.

Traditional Travel Agencies and Global Distribution Systems (GDS)

Traditional travel agencies and Global Distribution Systems (GDS) continue to be vital for Hilton, particularly for business travelers and those who prefer the personalized service of booking through an agent. Hilton actively manages its presence on these platforms to ensure its extensive portfolio of hotels and competitive rates are readily available to this segment of the market. This strategy acknowledges that while direct bookings are growing, a significant portion of the travel industry still relies on these established channels.

For instance, in 2023, GDS bookings still represented a notable percentage of overall travel transactions, underscoring their enduring relevance. Hilton's commitment to these systems means:

- Accessibility: Hilton's global inventory and pricing are consistently updated and accessible via major GDS platforms like Amadeus, Sabre, and Travelport.

- Targeted Reach: These channels effectively connect Hilton with corporate travel managers and leisure travelers who often utilize travel agents for complex itineraries or group bookings.

- Market Share: While direct booking channels are prioritized, maintaining a strong GDS presence helps Hilton capture bookings from segments that may not engage with direct online channels as frequently.

- Partnerships: Hilton fosters relationships with key travel management companies and consortia that heavily rely on GDS for their operations.

Hilton's direct channels, including Hilton.com and its mobile app, are paramount for driving bookings and fostering guest loyalty through the Hilton Honors program. These platforms offer exclusive deals and a seamless experience, with the app enabling mobile check-in and digital key access. In 2023, direct digital bookings were a key focus, aiming for higher margins and direct customer relationships.

Third-party channels, such as OTAs like Expedia and Booking.com, and metasearch engines, are essential for expanding Hilton's global reach and visibility. While these channels incur commission costs, they are critical for capturing travelers who begin their search on external platforms. Hilton actively manages its presence on these sites to optimize distribution and brand exposure, contributing to overall revenue growth.

Traditional channels, including travel agencies and Global Distribution Systems (GDS), remain vital, especially for corporate and complex travel bookings. Hilton ensures its inventory and rates are accessible through GDS platforms like Amadeus and Sabre, connecting with travel managers and agents. This multi-channel approach ensures Hilton captures bookings across diverse customer segments.

Customer Segments

Leisure travelers, encompassing individuals and families on vacation or holiday, represent a core customer segment for Hilton Worldwide. They are looking for a range of experiences, from opulent resorts to comfortable, value-driven stays. Hilton addresses this broad need through brands like Embassy Suites, known for its spacious accommodations and complimentary breakfast, and Hilton Garden Inn, which offers a balance of quality and affordability.

Business travelers, a core customer segment for Hilton Worldwide, represent individuals journeying for work, conferences, and corporate events. This group places a high value on convenience, robust connectivity, and amenities specifically tailored for business needs, such as meeting rooms and dependable Wi-Fi. In 2024, business travel spending in the U.S. was projected to reach over $360 billion, highlighting the significant market opportunity.

Hilton effectively caters to these professionals through brands like Hilton Hotels & Resorts and Homewood Suites, which offer strategic locations near business hubs and essential services. These travelers often require seamless integration of work and travel, seeking efficient check-in processes and comfortable workspaces within their accommodations.

Corporate clients and event planners represent a crucial segment for Hilton Worldwide Holdings, encompassing businesses booking accommodations for staff travel, team-building events, and large-scale conferences. These clients often seek comprehensive packages that include flexible meeting facilities, diverse catering options, and dedicated on-site event coordination. Hilton's extensive network of convention hotels and specialized event services are specifically designed to cater to the intricate logistical and service requirements of this demanding clientele.

In 2024, Hilton continued to leverage its strong relationships with corporate partners, with group and convention room revenue forming a significant portion of its overall earnings. For instance, in the first quarter of 2024, Hilton reported a robust performance in its largest markets, driven in part by the return of business travel and large-scale events. The company’s focus on providing integrated solutions, from room blocks to audiovisual services, directly addresses the needs of event planners who prioritize seamless execution and client satisfaction.

Hotel Owners and Real Estate Investors

Hotel Owners and Real Estate Investors are a cornerstone of Hilton's business model. These entities, ranging from individual property owners to large investment firms and developers, are drawn to Hilton's established brands and proven operational expertise. They see Hilton's franchising and management services as a pathway to leveraging significant brand equity, achieving operational efficiencies, and ultimately driving robust revenue generation for their assets.

This segment is vital for Hilton's asset-light growth strategy, allowing the company to expand its global footprint without significant capital expenditure on property ownership. For instance, in 2023, Hilton's net income was $1.21 billion, a testament to the success of this model which relies heavily on strong partnerships with owners. By Q1 2024, Hilton had a pipeline of over 250,000 rooms globally, a significant portion of which are under franchise or management agreements with these investor groups.

- Key Motivations: Seeking brand recognition, operational excellence, and maximized returns on hotel investments.

- Services Utilized: Primarily franchising and hotel management agreements.

- Strategic Importance: Underpins Hilton's asset-light growth and global expansion efforts.

- Financial Impact: Contributes significantly to fee-based revenues, supporting profitability and shareholder value.

Loyalty Program Members (Hilton Honors)

Hilton Honors members represent a substantial and expanding customer base for Hilton Worldwide, driven by their consistent travel and engagement with the brand's loyalty program. These individuals actively seek to maximize their earnings and redemptions of points, value the perks associated with elite status, and appreciate tailored guest experiences. In 2024, Hilton continued to see strong engagement from its Honors members, contributing significantly to overall occupancy and revenue across its properties.

The loyalty program is a cornerstone of Hilton's strategy, fostering deep customer relationships and encouraging repeat bookings. This segment’s preference for Hilton properties, influenced by the tangible benefits of the Honors program, directly supports the company’s goal of maintaining high occupancy rates and driving consistent business. As of early 2024, the Hilton Honors program boasted over 150 million members globally, underscoring its importance.

- Loyalty Program Focus: Members prioritize earning and redeeming Hilton Honors points for stays and other benefits.

- Elite Status Value: Frequent travelers seek and benefit from elite status tiers, which offer perks like room upgrades and late check-out.

- Repeat Business Driver: This segment is crucial for generating consistent occupancy and revenue through repeat stays.

- Personalized Experiences: Members expect and value personalized service and offers based on their travel history and preferences.

Hilton Worldwide Holdings serves a diverse customer base, from individual leisure travelers seeking memorable vacations to business professionals requiring efficient and comfortable accommodations. Corporate clients and event planners represent another key segment, relying on Hilton for seamless execution of conferences and events. Furthermore, hotel owners and real estate investors are crucial partners, leveraging Hilton's brand strength and operational expertise to maximize their property investments.

The Hilton Honors loyalty program members form a significant and highly engaged customer segment, driving repeat business and brand loyalty through their pursuit of points and elite status benefits. This segment's consistent patronage is vital for maintaining high occupancy rates and generating predictable revenue streams across Hilton's global portfolio.

| Customer Segment | Key Needs/Motivations | Hilton's Offering | 2024 Relevance |

|---|---|---|---|

| Leisure Travelers | Vacation experiences, value, comfort | Diverse brands (Embassy Suites, Hilton Garden Inn) | Continued strong demand post-pandemic |

| Business Travelers | Convenience, connectivity, business amenities | Strategic locations, reliable Wi-Fi, meeting spaces | Projected U.S. business travel spending over $360 billion |

| Corporate Clients/Event Planners | Comprehensive event services, flexible facilities | Convention hotels, dedicated event coordination | Group & convention revenue significant to earnings |

| Hotel Owners/Investors | Brand equity, operational efficiency, ROI | Franchising, management services, asset-light growth | Over 250,000 rooms in pipeline (early 2024) |

| Hilton Honors Members | Points, elite status perks, personalized service | Loyalty program benefits, tailored experiences | Over 150 million members globally (early 2024) |

Cost Structure

For hotels Hilton directly owns or leases, property operating expenses are a substantial part of their cost structure. These include essential day-to-day costs like staff wages, utility bills, ongoing maintenance, property taxes, and the purchase of necessary supplies. Efficiently managing these operational expenditures is key to ensuring the profitability of these owned and leased hotel assets.

Hilton Worldwide Holdings dedicates significant resources to marketing, advertising, and brand development, recognizing their crucial role in its business model. These investments fuel global campaigns, digital marketing initiatives, and the continuous promotion of its 22 distinct brands, ensuring strong brand recognition and guest attraction.

In 2024, Hilton's commitment to marketing is evident in its ongoing efforts to drive demand and expand market share. For instance, the company's focus on digital marketing and loyalty programs, like Hilton Honors, continues to be a cornerstone of its strategy to engage and retain customers, directly impacting occupancy rates and revenue per available room.

General and administrative expenses for Hilton Worldwide Holdings encompass crucial corporate functions like executive compensation, support staff salaries, legal counsel, and other essential back-office operations that enable the management of its vast global portfolio. These costs are vital for maintaining the central infrastructure and strategic direction of the company, ensuring smooth operations across all brands and properties. For instance, in 2023, Hilton reported SG&A (Selling, General & Administrative) expenses of approximately $3.1 billion, a significant portion of which falls under G&A. Controlling these overheads directly impacts the company's bottom line and its ability to invest in growth initiatives.

Technology and System Development Costs

Hilton Worldwide Holdings dedicates substantial resources to its technology and system development. These costs are essential for maintaining and enhancing their digital infrastructure, which includes everything from booking engines to guest-facing mobile apps. In 2023, Hilton reported capital expenditures of $1.2 billion, a portion of which directly supports these critical technology investments aimed at improving guest experiences and operational efficiency.

These ongoing investments are vital for staying competitive in the rapidly evolving hospitality tech landscape. They ensure Hilton's systems are robust, user-friendly, and capable of supporting new features and integrations. For instance, advancements in their property management systems streamline check-in/check-out processes and personalize guest services.

- Reservation Systems: Continuous development to ensure seamless booking across all channels.

- Mobile Applications: Enhancements for guest convenience, including digital check-in and room key features.

- Property Management Systems: Upgrades to improve operational efficiency and guest data management.

- Data Analytics Platforms: Investment in tools for understanding guest behavior and optimizing services.

Franchise and Management Support Costs

Hilton's franchise and management support costs are crucial for maintaining brand standards and operational excellence across its vast network. These expenses cover essential services like comprehensive training programs for franchisee staff, rigorous quality assurance inspections, and ongoing operational guidance to ensure each property aligns with Hilton's high standards. This investment is fundamental to the success of their asset-light strategy, as it empowers franchisees and ultimately drives brand value and guest satisfaction.

In 2024, Hilton continued to invest heavily in supporting its franchise partners. For instance, the company's global training initiatives aim to equip over 100,000 team members annually with the skills needed to deliver exceptional guest experiences. These support functions, while a significant operational expense, are directly tied to the long-term health and growth of the Hilton brand, ensuring consistency and reliability that guests expect.

- Training and Development: Costs for onboarding new franchisees and continuous skill enhancement for existing property teams.

- Quality Assurance: Expenses related to inspections, audits, and compliance monitoring to uphold brand integrity.

- Operational Support: Investments in technology, systems, and expert advice to optimize property performance.

- Marketing and Brand Initiatives: Contributions to system-wide marketing efforts that benefit all franchised properties.

Hilton's cost structure is significantly influenced by property operating expenses for owned and leased hotels, encompassing staff wages, utilities, and maintenance. Additionally, substantial investments are made in marketing and brand development to promote its 22 brands and loyalty programs like Hilton Honors, crucial for driving demand in 2024. General and administrative expenses, covering corporate functions and executive compensation, also represent a key cost, with SG&A expenses reported around $3.1 billion in 2023. Franchise and management support costs, including training and quality assurance, are vital for maintaining brand standards across its network.

| Cost Category | Description | 2023 Impact (Approx.) |

|---|---|---|

| Property Operating Expenses | Costs for owned/leased hotels (wages, utilities, maintenance) | Significant portion of total operating costs |

| Marketing & Brand Development | Global campaigns, digital marketing, loyalty programs | Key driver of demand and brand recognition |

| General & Administrative (G&A) | Corporate functions, executive compensation, back-office ops | SG&A approx. $3.1 billion in 2023 |

| Technology & System Development | Digital infrastructure, booking engines, mobile apps | Part of $1.2 billion capital expenditures in 2023 |

| Franchise & Management Support | Training, quality assurance, operational guidance | Essential for maintaining brand standards and growth |

Revenue Streams

Franchise fees are a cornerstone of Hilton's revenue generation. These fees encompass initial affiliation charges and recurring royalty payments, usually a percentage of a hotel's gross room revenue. This structure allows Hilton to expand its brand presence without direct capital investment in property ownership.

In 2023, Hilton's franchise and other fee revenue reached $2.7 billion. This demonstrates the significant contribution of its asset-light franchising model to its overall financial performance, providing a predictable and growing income stream.

Hilton generates revenue through management fees earned from operating hotels owned by third parties. These fees typically consist of a base percentage of the hotel's gross revenue, plus an incentive fee tied to the property's gross operating profit. This model allows Hilton to capitalize on its operational expertise and brand recognition without the substantial capital outlay associated with direct ownership.

Hilton Worldwide Holdings generates revenue from hotels it directly owns or leases, encompassing income from room bookings, dining, and other guest services. In 2024, this segment, while representing a smaller portion of their total earnings compared to managed and franchised properties, remains a significant contributor to their overall financial performance.

These owned and leased assets often function as flagship properties, showcasing the brand's standards and capabilities. Their direct operational control allows Hilton to capture the full profit margin from these locations, influencing profitability and providing valuable insights into operational efficiencies.

Loyalty Program Revenue and Fees

Hilton's loyalty program, Hilton Honors, is a substantial revenue generator. This includes fees from co-branded credit card partners, like American Express, for the points they issue to cardholders. In 2024, the company continued to leverage these partnerships, recognizing the loyalty program as a critical driver of customer retention and incremental revenue.

The program also generates revenue through the direct sale of points to partners, such as airlines, for redemption on their flights or other services. This demonstrates the tangible value of Hilton Honors points in fostering broader commercial relationships and enhancing member engagement across various touchpoints.

- Co-branded Credit Card Partnerships: Fees from partners like American Express for points issued.

- Sale of Points: Revenue generated from selling Hilton Honors points to strategic partners.

- Customer Engagement: The program significantly boosts repeat business and customer loyalty.

- Financial Contribution: Loyalty program revenue is a key component of Hilton's overall financial performance.

Licensing and Other Fees

Hilton's revenue extends beyond hotel operations through licensing agreements. These allow third parties to use Hilton's well-recognized brands on residential properties, timeshares, and other ventures, effectively monetizing brand equity.

These licensing and other fees represent a crucial, albeit smaller, component of Hilton's overall income. In 2023, Hilton reported approximately $1.0 billion in "Other Revenue," which encompasses these types of fees, demonstrating their consistent contribution to the company's financial performance.

- Brand Licensing: Fees generated from allowing other entities to use Hilton's brand names on various properties and services.

- Timeshare Operations: Revenue derived from managing and operating timeshare properties under Hilton brands.

- Miscellaneous Fees: Income from other services and agreements not directly tied to traditional hotel stays.

- 2023 Performance: Hilton's "Other Revenue" category, including these streams, reached approximately $1.0 billion in 2023.

Hilton's diverse revenue streams are anchored by its robust franchise and management fee structures. In 2024, the company continued to benefit from its asset-light approach, allowing for brand expansion with minimal capital outlay.

The franchise segment, which includes initial fees and ongoing royalties, remains a significant income driver. Complementing this, management fees are earned from operating hotels owned by third parties, often including performance-based incentives.

Hilton also generates revenue from its loyalty program, Hilton Honors, through co-branded credit card partnerships and the sale of points. Licensing agreements for brands on residential and timeshare properties further diversify its income.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

|---|---|---|

| Franchise Fees | Initial and royalty payments based on gross room revenue. | $2.7 billion (Franchise and other fee revenue) |

| Management Fees | Base fees on gross revenue plus incentive fees based on operating profit. | Included in overall fee revenue. |

| Loyalty Program | Co-branded credit card fees and sale of points. | Significant driver of customer retention and incremental revenue. |

| Licensing & Other | Brand usage on residential, timeshare, and other ventures. | $1.0 billion (Other Revenue) |

Business Model Canvas Data Sources

The Business Model Canvas for Hilton Worldwide Holdings is informed by a blend of proprietary operational data, extensive market research reports, and publicly available financial disclosures. These sources provide a comprehensive view of customer behavior, competitive landscapes, and internal capabilities.