Hettich Holding GmbH & Co. oHG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hettich Holding GmbH & Co. oHG Bundle

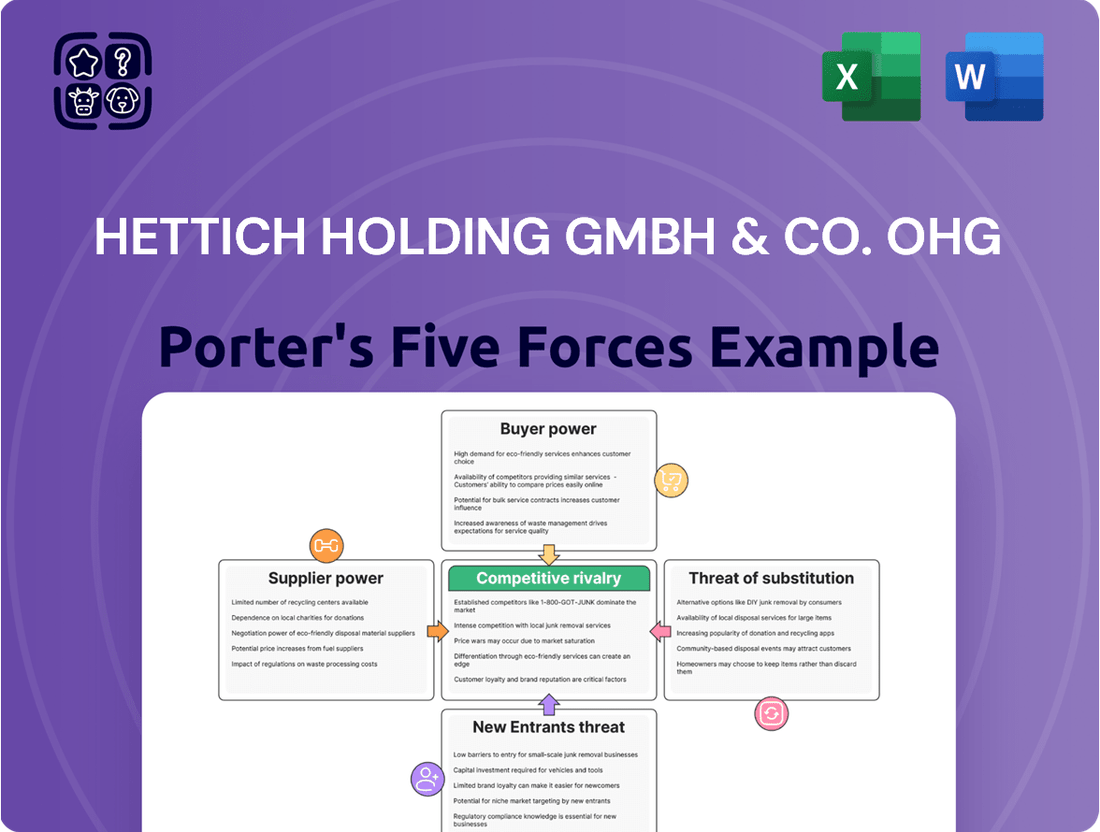

Hettich Holding GmbH & Co. oHG navigates a competitive landscape shaped by moderate buyer power and intense rivalry within the furniture fittings industry. The threat of new entrants is somewhat limited by capital requirements and established distribution channels, but innovation can disrupt the status quo.

Supplier power is generally moderate, with Hettich benefiting from strong relationships and economies of scale, though specialized components can present challenges. The threat of substitutes is present, particularly from emerging materials and smart home technologies, requiring continuous product development.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hettich Holding GmbH & Co. oHG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The furniture fittings industry, including Hettich, heavily relies on specific raw materials such as steel, aluminum, zinc, and various plastics. Suppliers of specialized alloys or high-performance engineered plastics can exert significant power, particularly if they are one of a limited number of providers. For instance, steel prices, a key input, saw volatility in 2024, directly affecting Hettich's production expenses. Despite this, Hettich's substantial global production scale and diversified sourcing strategies help to offset some of this supplier leverage.

Supplier concentration directly impacts Hettich's bargaining power; fewer suppliers for essential components mean higher leverage for them on pricing and terms. Hettich effectively mitigates this risk by cultivating a diverse network of suppliers spanning various regions, alongside forming strategic partnerships. The significant merger with FGV, finalized in early 2024, has further enhanced Hettich's purchasing power and expanded its global supplier network, providing greater negotiation strength and supply chain resilience.

Switching suppliers for Hettich involves significant costs, including qualifying new materials, retooling production lines, and potential disruptions to their intricate supply chain. This substantial investment elevates the bargaining power of Hettich's existing suppliers. Given Hettich's stringent requirements for quality and precision engineering, any new supplier must undergo rigorous qualification, further increasing these transition expenses. For instance, ensuring compatibility for components like drawer runners or hinges, critical to Hettich's global market leadership in 2024, necessitates extensive testing and validation, making supplier changes economically challenging.

Importance of Quality and Consistency

As a leading manufacturer of high-quality furniture fittings, Hettich Holding GmbH & Co. oHG relies heavily on suppliers to deliver materials that consistently meet precise specifications. Suppliers who can consistently guarantee superior quality and reliability, like those providing specialized steel or advanced plastics, possess stronger bargaining power. This is paramount for Hettich to uphold its esteemed brand reputation for durability and performance, especially as the furniture market demands increasingly robust solutions. Maintaining high product standards directly impacts customer satisfaction and market share.

- Hettich's 2024 commitment to quality ensures its fittings, used in over 100 countries, meet global standards.

- The company's robust supply chain management focuses on long-term partnerships with certified suppliers.

- Supplier quality directly impacts Hettich's product warranty claims and overall operational efficiency.

- In 2024, the global furniture fittings market continues to emphasize durable and sustainable components, increasing pressure on supplier quality.

Potential for Forward Integration

While less common, a powerful supplier to Hettich could theoretically enter the furniture fittings manufacturing market, directly becoming a competitor. This threat of forward integration is generally low for Hettich Holding GmbH & Co. oHG, largely due to the significant barriers to entry in the highly specialized furniture fittings industry. Hettich’s established brand reputation, extensive global distribution network, and advanced technological expertise act as substantial deterrents, making it incredibly challenging for a new entrant to compete effectively. For instance, establishing the necessary production infrastructure and sales channels to rival a market leader like Hettich, which reported sales of approximately 1.3 billion euros in 2023, requires immense capital and time.

- High capital investment for machinery and R&D.

- Need for established global distribution networks.

- Years required to build brand trust and customer loyalty.

- Expertise in precision engineering and material science.

Suppliers hold moderate power over Hettich due to reliance on specialized materials, with steel prices seeing volatility in 2024. Hettich's substantial scale and the early 2024 FGV merger significantly boost its purchasing leverage and diversify its global supplier base. High switching costs and strict quality demands for components like drawer runners further strengthen existing supplier positions, vital for Hettich's 2024 market leadership.

| Input | 2024 Trend | Impact on Hettich |

|---|---|---|

| Steel | Volatile | Direct cost pressure |

| Plastics | Stable to rising | Production expense |

| Special Alloys | Supply-dependent | Quality-critical |

What is included in the product

This analysis of Hettich Holding GmbH & Co. oHG meticulously examines the competitive landscape, focusing on the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Visualize Hettich's competitive landscape with a dynamic Porter's Five Forces model, enabling swift identification of industry pressures and strategic opportunities.

Customers Bargaining Power

Hettich serves a diverse customer base, ranging from major multinational furniture manufacturers to numerous smaller, local cabinet makers and retailers across Europe and globally. This significant fragmentation of its customer base inherently dilutes the bargaining power of any single buyer, as no one customer typically accounts for a dominant share of Hettich’s 2024 revenue. However, large-volume clients, particularly major furniture brands, can still leverage their purchasing scale to negotiate more favorable pricing and terms, reflecting their strategic importance in a competitive market.

In the highly competitive global furniture market, customers, particularly large-scale furniture manufacturers, exhibit significant price sensitivity. For standardized components like drawer runners or hinges, buyers can readily compare offerings and switch suppliers based on cost, as seen with fluctuating raw material prices impacting component costs by over 10% in early 2024. Hettich counters this pressure by emphasizing its innovative, high-quality products, which deliver value beyond just price, such as enhanced durability and ease of assembly, crucial for manufacturer efficiency.

For standard furniture fittings, the cost for a manufacturer to switch from Hettich to rivals like Blum or Hafele is often low, enhancing customer bargaining power. This ease of transition means customers can readily seek better prices or features from competing suppliers in 2024. However, Hettich strategically counters this by fostering strong customer relationships, offering extensive technical support, and developing innovative product systems. These efforts aim to create customer stickiness, making it less appealing for clients to move despite the low direct switching costs.

Access to Information

The internet and e-commerce platforms significantly empower Hettich customers by providing unprecedented access to information. Buyers can easily compare prices, product specifications, and reviews for furniture fittings from various global suppliers in 2024, enhancing their bargaining power. This increased transparency compels Hettich to maintain a robust and competitive online presence, clearly communicating its unique value proposition and product advantages. For instance, the global e-commerce market is projected to reach over 6.9 trillion USD in 2024, emphasizing digital comparison shopping.

- Customers leverage platforms for real-time price comparisons.

- Digital access to product specifications is immediate.

- Online reviews influence purchasing decisions significantly.

- Hettich must adapt to this informed buyer landscape.

Customer Demand for Innovation and Customization

Customers are increasingly demanding innovative solutions like soft-close mechanisms, push-to-open systems, and smart furniture fittings, which significantly increases their bargaining power. This trend drives manufacturers like Hettich to invest heavily in research and development to meet evolving market needs. Hettich's 2024 focus on digital solutions and smart home integration reflects this customer-driven demand, aiming to stay ahead in a competitive landscape.

- The global smart furniture market is projected to reach $246.3 billion by 2030, highlighting the demand for integrated technology.

- Customer expectations for seamless functionality, like soft-close systems, are now standard, not just a premium feature.

- Hettich's R&D expenditure consistently supports new product launches, maintaining its competitive edge.

- Customization requests for specific finishes and dimensions further empower customers in their purchasing decisions.

Hettich customers, though diverse, gain significant bargaining power from low switching costs for standard components and heightened price sensitivity. The ease of comparing suppliers online and increasing demand for innovative, smart fittings further amplify their influence. This compels Hettich to continuously innovate and offer value beyond price to retain key clients in 2024.

| Factor | Impact on Power | 2024 Data/Trend |

|---|---|---|

| Switching Costs | Low | Easy to move to rivals like Blum |

| Price Sensitivity | High | Raw material price shifts +10% |

| Information Access | High | Global e-commerce >$6.9T |

| Innovation Demand | High | Smart furniture market growing |

Preview the Actual Deliverable

Hettich Holding GmbH & Co. oHG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Hettich Holding GmbH & Co. oHG details the industry's competitive landscape, including the threat of new entrants, the bargaining power of buyers, and the bargaining power of suppliers. It thoroughly assesses the threat of substitute products or services and the intensity of rivalry among existing competitors, providing actionable insights into Hettich's strategic positioning within the furniture fittings and hardware market.

Rivalry Among Competitors

The global furniture fittings market experiences high competitive rivalry, with Hettich facing strong contenders like Blum, Hafele, Grass, and Salice. This intense competition drives significant pressure on pricing strategies, continuous product innovation, and impactful marketing efforts across the industry. To bolster its standing, Hettich strategically merged with FGV in early 2024, a move designed to enhance its global market share and strengthen its competitive edge against key rivals.

Companies in the furniture fittings industry vigorously compete through innovation, product quality, design aesthetics, and enhanced functionality. Hettich Holding GmbH & Co. oHG strategically differentiates itself by emphasizing high-quality engineering and developing innovative features for its solutions. For instance, in 2024, Hettich continued to focus on advancements in its drawer and sliding door systems, showcasing new smart functionalities. The ability to offer a comprehensive portfolio, encompassing hinges, advanced drawer systems, and versatile sliding door systems, remains a critical competitive advantage for Hettich in the global market.

Major competitors, including Hettich, operate on a global scale with extensive distribution networks, intensifying rivalry. Competition is fierce in established markets like Europe and North America, where the furniture fittings market saw continued demand in 2024. Simultaneously, high-growth emerging markets, particularly in Asia, are key battlegrounds; Hettich's recent strategic expansion into Vietnam exemplifies this global competitive push to capture new growth opportunities.

Price-Based Competition

While innovation remains crucial for Hettich, price is a significant competitive factor, especially for standard furniture components. The market sees numerous manufacturers, including those from lower-cost regions in Asia, intensifying price competition. Hettich's strong brand reputation and commitment to quality allow it to command a premium; however, maintaining price competitiveness is essential to sustain market share against rivals. For instance, the global furniture hardware market, valued at approximately $20 billion in 2024, is highly fragmented, necessitating strategic pricing.

- The global furniture hardware market is projected to grow to over $22 billion by 2025.

- Competition from Asian manufacturers, often with lower production costs, pressures pricing.

- Hettich's gross profit margin, a key indicator of pricing power, remains a focus for 2024.

- Maintaining a balance between premium pricing and market share is a constant challenge.

Strategic Alliances and Mergers

The strategic alliance between Hettich and FGV, culminating in a 2024 merger, clearly signals a growing trend toward consolidation within the industry aimed at achieving greater scale and market power. This significant move intensifies competition among leading players as they actively enhance their product portfolios and expand global reach. Such consolidation pressures other market participants to consider similar strategic alliances or acquisitions to maintain their competitive standing. The combined entity's increased market share further shifts the competitive landscape.

- Hettich-FGV merger: 2024 strategic consolidation.

- Intensifies competition for global market share.

- Drives industry-wide pressure for similar alliances.

- Enhances combined product portfolios and reach.

The global furniture fittings market exhibits high competitive rivalry, with Hettich facing strong players like Blum and Hafele. Competition intensifies through product innovation, quality, and aggressive pricing, especially from Asian manufacturers. Hettich's 2024 merger with FGV strategically enhances its global market share and competitive standing. The global furniture hardware market is valued at approximately $20 billion in 2024.

| Rival | Strategy | Impact on Hettich |

|---|---|---|

| Blum | Innovation, design | Pressures R&D |

| Hafele | Global reach, breadth | Challenges market share |

| Asian Mfrs. | Cost efficiency | Drives price competition |

SSubstitutes Threaten

While Hettich's traditional fittings dominate, alternative furniture construction methods like advanced joinery, specialized adhesives, or even emerging 3D-printed connectors pose a substitute threat. However, these methods often cater to niche markets, lacking the universal functionality, robust durability, or mass production efficiency that Hettich's solutions offer. For instance, the global furniture adhesive market, while growing, remains a fraction of the fittings market. The immediate threat from these substitutes is low, yet it could intensify with significant advancements in materials science or additive manufacturing technologies by 2024-2025.

The rise of minimalist furniture designs, often featuring integrated handles or interlocking panels, presents a substitute threat to traditional hardware manufacturers like Hettich. This trend towards handle-less designs reduces the need for conventional pulls and knobs, reflecting a shift in consumer preferences. However, even these modern designs frequently rely on specialized fittings such as push-to-open or soft-close mechanisms, a segment where Hettich holds a strong market position. For instance, the global furniture market is projected to reach $675 billion in 2024, with a growing emphasis on smart and integrated solutions, underpinning Hettich's continued relevance in advanced hardware. This evolution means the threat is more about adaptation than outright displacement for Hettich.

Lower-quality, unbranded hardware from various manufacturers presents a notable substitute threat to Hettich, particularly in price-sensitive market segments. While these alternatives perform basic functions, they often lack the superior durability, performance, and aesthetic appeal synonymous with Hettich’s products. The primary impact of this threat is observed in the lower-end construction and furniture markets, where cost remains a dominant purchasing factor. Hettich's 2024 strategic focus on premium solutions helps mitigate direct competition from these cheaper options.

Rise of Multifunctional and Smart Furniture

The furniture industry's shift towards multifunctional and smart designs presents a notable substitute threat for Hettich. This trend necessitates entirely new hardware and movement systems, potentially bypassing traditional fittings. While posing a risk, this also offers Hettich a significant opportunity to lead innovation, developing next-generation solutions for smart furniture valued at over $150 billion globally in 2024. The dynamic interplay means adapting quickly is crucial.

- Global smart furniture market projected to exceed $150 billion by 2024.

- Demand for integrated technology in home furnishings is rapidly increasing.

- Hettich's R&D focus on advanced motion systems remains critical.

- Innovation in IoT-enabled hardware can transform this threat into market leadership.

DIY and Maker Movement

The rise of the DIY and maker movement could see some individuals seeking simpler, non-traditional solutions for furniture creation, potentially reducing demand for industrial components. However, this segment remains a niche, representing a very small fraction of the broader furniture market, which in 2024 continues to be dominated by large-scale manufacturing. Major industrial suppliers like Hettich, with extensive B2B operations, face minimal threat from this trend due to their scale and specialized product lines. In fact, many discerning DIY enthusiasts still prioritize quality, often choosing high-grade Hettich components for their projects, demonstrating the brand's enduring appeal even in this alternative market.

- DIY furniture market share remains fractional compared to industrial production.

- Hettich primarily supplies B2B manufacturers, a distinct market from individual DIY.

- High-quality component demand persists even among DIY users.

- Global furniture market size in 2024 is projected to exceed $600 billion, dwarfing DIY.

The threat of substitutes for Hettich is generally low, as alternative furniture construction methods or lower-quality hardware lack Hettich's precision and durability. While minimalist designs and smart furniture trends evolve, Hettich adapts by innovating advanced motion systems. Their strong B2B focus minimizes impact from DIY markets. The global furniture market, over $600 billion in 2024, still heavily relies on quality fittings.

| Threat Type | Impact (2024) | Hettich Response |

|---|---|---|

| Alternative Methods | Low, niche adoption | Focus on core durability |

| Smart Furniture | Opportunity for innovation | R&D in advanced systems |

| Low-Quality Hardware | Low for premium segment | Premium market focus |

Entrants Threaten

Establishing a manufacturing facility for high-precision furniture fittings, like those Hettich produces, demands substantial capital investment in specialized machinery, advanced technology, and stringent quality control systems. This inherently creates a significant financial barrier for any new competitor considering market entry. Hettich's consistent reinvestment, with capital expenditures often exceeding 100 million EUR annually in recent years, underscores the scale of ongoing investment required to maintain a competitive edge and production capacity. Such high upfront costs deter potential entrants, solidifying the market position of established players like Hettich in 2024.

Established players like Hettich Holding GmbH & Co. oHG significantly benefit from economies of scale across their operations. With an estimated annual revenue exceeding €1.3 billion as of 2023, Hettich leverages its size in purchasing raw materials, optimizing manufacturing processes, and streamlining global distribution networks. A new entrant would find it exceptionally challenging to replicate this cost efficiency, facing higher per-unit costs for production and logistics. This substantial cost disadvantage makes it very difficult for new players to compete effectively on price in the highly consolidated furniture fittings market.

Hettich Holding GmbH & Co. oHG, alongside main competitors like Blum, benefits from robust brand recognition and deeply established relationships with furniture manufacturers. These bonds are built on decades of trust and consistent reliability, making Hettich a preferred choice in 2024 for essential hardware components. A new entrant would face an immense hurdle, needing substantial capital investment in marketing and product development to even begin to prove its quality and reliability. This significant intangible barrier necessitates demonstrating comparable product lifespan and performance, which is a lengthy and costly endeavor against incumbents with proven track records.

Distribution Channels

Access to global distribution channels is paramount for success in the furniture fittings sector. Established players like Hettich Holding GmbH & Co. oHG boast extensive, well-developed networks, reaching furniture manufacturers and retailers worldwide. As of 2024, Hettich's global presence through its subsidiaries and sales partners spans over 100 countries. A new entrant would face significant barriers, needing to invest heavily in building a comparable infrastructure from scratch.

- Hettich's 2024 global sales network remains a formidable barrier, built over decades.

- Establishing trust and relationships with furniture manufacturers and retailers takes substantial time and capital.

- Logistics and supply chain complexities globally deter new entrants from rapid market penetration.

- New entrants would struggle to match Hettich's distribution efficiency and cost-effectiveness.

Technological Expertise and Patents

The furniture fittings industry demands significant technological expertise and continuous innovation, often safeguarded by extensive patent portfolios. New entrants face substantial hurdles, needing to either develop proprietary technology from scratch or secure costly and time-consuming licensing agreements. Hettich’s persistent investment in research and development, evidenced by its robust patent pipeline, acts as a formidable barrier against potential competitors. For instance, in 2024, the global market for furniture fittings continues to prioritize innovative, durable, and smart solutions, reinforcing the need for patented advancements.

- High R&D investment is crucial; leading companies like Hettich dedicate resources to advanced manufacturing and material science.

- Developing competitive proprietary technology can require hundreds of millions in initial capital.

- Patent protection offers a significant competitive moat, deterring replication and fostering market dominance.

- As of early 2024, the drive for sustainable and smart home solutions further intensifies the need for patented innovation in the sector.

The high capital expenditure, estimated at over €100 million annually for Hettich, and the necessity for advanced technology create significant financial barriers for new entrants in 2024. Established economies of scale, with Hettich’s 2023 revenue exceeding €1.3 billion, provide a substantial cost advantage that new competitors cannot easily match. Robust brand recognition and extensive global distribution networks spanning over 100 countries further deter market entry. Additionally, the industry’s demand for patented innovation and substantial R&D investment, crucial for 2024 market relevance, poses a formidable hurdle.

| Barrier Type | Hettich's Strength (2024 Data) | Impact on New Entrants |

|---|---|---|

| Capital Investment | €100M+ annual Capex | High upfront costs, limited access to funds |

| Economies of Scale | €1.3B+ (2023 Revenue) | Cost disadvantage, higher per-unit costs |

| Distribution & Brand | 100+ countries, decades of trust | Difficulty building networks and trust |

| Technological Expertise | Robust patent portfolio, R&D focus | Need for costly R&D or licensing |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hettich Holding GmbH & Co. oHG is built upon a foundation of comprehensive data, including Hettich's official annual reports, industry-specific market research from reputable firms, and global economic databases. This ensures a robust understanding of the competitive landscape and key industry drivers.