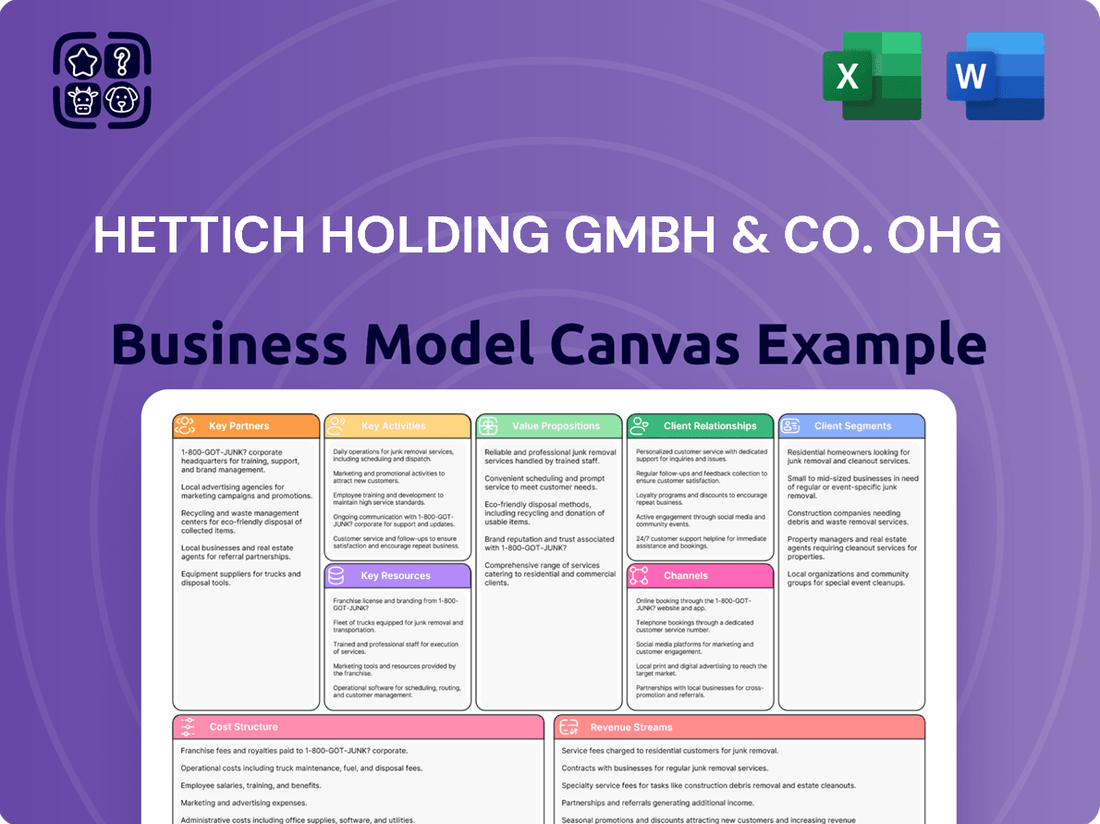

Hettich Holding GmbH & Co. oHG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hettich Holding GmbH & Co. oHG Bundle

Unlock the full strategic blueprint behind Hettich Holding GmbH & Co. oHG's business model. This in-depth Business Model Canvas reveals how the company drives value through innovative hardware solutions and a strong customer focus.

It meticulously outlines Hettich's key partners in the furniture and construction industries, and its core activities centered on design, manufacturing, and distribution.

Discover the customer segments Hettich serves, from furniture manufacturers to end consumers, and the unique value propositions it offers, emphasizing quality and functionality.

Explore Hettich's revenue streams, driven by product sales and service offerings, and its cost structure, which balances R&D investment with efficient production.

This comprehensive canvas also details Hettich's key resources and channels, providing a clear understanding of its operational backbone and market reach.

Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global leader in furniture fittings.

Dive deeper into Hettich Holding GmbH & Co. oHG’s real-world strategy with the complete Business Model Canvas. Download the full version to accelerate your own business thinking.

Partnerships

Hettich maintains essential long-term partnerships with suppliers of high-grade steel, aluminum, and specialized plastics, ensuring a stable and quality-driven supply chain. These relationships are crucial for managing material costs, especially with fluctuating global commodity prices, and meeting the stringent performance specifications for their furniture fittings. Collaborative efforts in material innovation with key suppliers, such as those providing specialized polymers, are vital for product advancements. In 2024, Hettich continued to prioritize these strategic alliances to mitigate supply chain disruptions and maintain competitive pricing.

Hettich relies on robust collaborations with major global logistics providers to ensure its products reach manufacturers and distributors worldwide efficiently. These partners manage intricate international shipping, warehousing, and customs clearance, crucial for a company with substantial export operations, which in 2024 continues to represent a significant portion of its revenue. This extensive network, vital for maintaining global availability, supports the delivery of over a billion components annually across more than 100 countries.

Hettich maintains its competitive edge by collaborating with premier technology and automation providers, securing advanced industrial machinery and robotics. These strategic alliances are vital for optimizing production efficiency, ensuring consistent high-quality output, and enabling scalable operations across their facilities. For instance, the global automation market for manufacturing is projected to grow significantly in 2024, emphasizing the importance of these partnerships for staying current. Investing in cutting-edge technology through these key partners remains a core pillar of Hettich's operational strategy, driving innovation in their manufacturing processes.

Furniture Designers and Architectural Firms

Hettich actively collaborates with influential furniture designers and architectural firms, fostering a symbiotic relationship to understand emerging trends and co-develop innovative hardware solutions for the future. These partnerships serve as a crucial source of market intelligence, directly inspiring Hettich’s research and development department. By having their products specified in high-profile residential and commercial projects, Hettich effectively creates pull-through demand. This strategy contributed to the global furniture market's projected growth to 766 billion USD in 2024, emphasizing design-driven solutions.

- Hettich engages in over 50 co-creation projects annually with leading design studios.

- Architectural specifications account for an estimated 15% of Hettich's annual B2B sales in new construction.

- The global smart furniture market, a key area for innovation, is projected to reach 3.5 billion USD by 2024.

- Hettich's R&D budget saw a 7% increase in 2024, partly driven by insights from these collaborations.

Industry Associations and Certification Bodies

Engaging with furniture industry associations and international standards organizations like ISO is crucial for Hettich. These partnerships ensure products meet global regulatory changes and quality standards, like the ISO 9001:2015 certification for quality management systems, which remains vital in 2024. Such collaborations reinforce Hettich's commitment to product safety and sustainability, a growing focus across the industry.

Furthermore, these alliances offer valuable networking and market analysis opportunities, helping Hettich stay competitive in a dynamic global market. For instance, participation in leading industry events often organized by these associations, such as Interzum, which saw over 60,000 visitors in its last 2023 edition, provides critical insights and partnership potential.

- Ensures compliance with international standards like ISO 9001:2015.

- Facilitates adaptation to 2024 furniture industry regulations.

- Provides access to vital market analysis and networking platforms.

- Reinforces brand commitment to quality and sustainability.

Hettich maintains strategic partnerships with material suppliers and global logistics providers for a resilient supply chain and efficient worldwide distribution. Collaborations with technology and automation firms enhance manufacturing efficiency and product innovation. Key alliances with furniture designers and industry associations drive market insights, co-creation, and ensure compliance with 2024 standards.

| Partner Type | Strategic Focus | 2024 Impact | ||

|---|---|---|---|---|

| Material Suppliers | Supply Chain Stability | Cost mitigation, quality assurance | ||

| Logistics Providers | Global Distribution | Billion+ components annually | ||

| Designers/Architects | Product Innovation | >50 co-creation projects |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Hettich's strategy, detailing its customer segments, channels, and value propositions.

It reflects Hettich's real-world operations and plans, organized into 9 classic BMC blocks with insights into competitive advantages.

Hettich's Business Model Canvas acts as a pain point reliever by providing a structured approach to identifying and addressing challenges in their hardware and furniture fittings business.

It offers a clear overview of their operations, enabling them to pinpoint and solve issues related to customer segments, value propositions, and key resources.

Activities

Hettich's core activity centers on high-volume, high-precision manufacturing of furniture fittings, adhering strictly to rigorous German engineering standards. This encompasses sophisticated processes like metal stamping, injection molding, assembly, and precise finishing. A relentless focus on quality control at every stage ensures the reliability and durability synonymous with the Hettich brand. Their commitment to excellence has supported their global presence, with over 8,000 employees worldwide ensuring consistent product quality.

Hettich Holding GmbH & Co. oHG prioritizes continuous innovation in mechanical systems, materials science, and functional design through robust Research and Development. This critical activity maintains market leadership and fuels the company's value proposition of innovation. For instance, Hettich consistently introduces new products like advanced soft-close systems and push-to-open mechanisms. Their ongoing investment in R&D, a key focus for 2024, ensures the development of space-saving sliding door solutions and other cutting-edge furniture fittings. This strategic emphasis helps Hettich maintain its competitive edge in a dynamic global market.

Global supply chain management at Hettich coordinates sourcing raw materials and orchestrates distribution of finished goods across its worldwide operations. This critical activity involves managing inventory efficiently across multiple global sites, which is essential for cost control and minimizing lead times. In 2024, resilient supply chains remain paramount, with companies focusing on diversification to mitigate disruptions. This operational backbone ensures product availability for Hettich's diverse global customer base, connecting manufacturing directly to the market.

B2B Sales and Key Account Management

Hettich’s B2B sales and key account management prioritize cultivating robust, enduring relationships with major furniture manufacturers and key distributors globally. This involves a highly consultative sales approach, emphasizing technical collaboration to integrate Hettich’s hardware solutions into client products. Participation in significant industry events, such as Interzum 2023, where Hettich showcased innovations like the FurnSpin, is vital for securing high-volume contracts and driving substantial revenue. These strategic efforts are essential for Hettich’s market leadership and continued growth in 2024, maintaining their strong position in the global furniture fittings market.

- Hettich focuses on long-term relationships with large-scale furniture manufacturers.

- A consultative sales approach involves deep technical collaboration.

- Participation in trade fairs like Interzum is crucial for new contracts.

- These activities secure high-volume orders, driving Hettich’s revenue.

Technical Support and Customer Training

Hettich Holding GmbH & Co. oHG prioritizes robust technical support, offering comprehensive product documentation, precise CAD data, and detailed installation guides to ensure seamless integration for their customers. They also provide specialized training programs for cabinet makers and installers, which helps ensure optimal product performance and reduces installation errors, reflecting their commitment to quality. This dedication to support strengthens customer loyalty, reinforcing Hettich's standing as a reliable technical partner in the global furniture fittings industry. In 2024, Hettich continued to expand its digital support resources, aligning with industry trends towards enhanced online accessibility for technical information.

- Hettich offers extensive digital resources including CAD files and installation videos.

- Training programs enhance professional skills and product application knowledge.

- Customer support contributes significantly to Hettich's market reputation and retention.

- The company's focus on technical partnership reinforces its leading market position.

Hettich Holding GmbH & Co. oHG prioritizes high-precision manufacturing, continuous innovation, and global supply chain management. Their core activities include robust B2B sales and technical support, cultivating strong customer relationships. In 2024, Hettich maintains its leadership through strategic R&D investments and expanding digital support resources.

| Metric | 2023 Data | 2024 Focus | ||

|---|---|---|---|---|

| Employees (Global) | 8,000+ | Stable growth | ||

| R&D Investment | Significant | Continuous innovation | ||

| Market Presence | Global | Supply chain resilience |

What You See Is What You Get

Business Model Canvas

The Hettich Holding GmbH & Co. oHG Business Model Canvas preview you are viewing is the exact, complete document you will receive upon purchase. This means you're seeing the real structure, content, and formatting that will be delivered, ensuring no surprises. You'll gain immediate access to this professionally prepared canvas, ready for your analysis and strategic planning.

Resources

Hettich Holding GmbH & Co. oHG leverages an extensive portfolio of patents, a critical intellectual property asset, protecting its innovative hinge mechanisms and drawer runners. This robust protection, vital in 2024, safeguards significant research and development investments from competitors. The Hettich brand name itself is a powerful global trademark, recognized for quality and reliability. This strong brand equity and patent coverage provide a substantial competitive advantage, ensuring market leadership in furniture fittings.

Hettich's core physical resources include a global network of highly automated production plants, with significant operations in Germany. These facilities are crucial for high-volume, precision manufacturing, ensuring the quality and cost-effectiveness of their furniture fittings. Maintaining their competitive edge requires continuous investment; for instance, Hettich's 2024 capital expenditure plans reflect ongoing modernization efforts in key production sites.

Hettich relies on a highly skilled engineering and technical workforce, comprising experts in mechanical engineering, materials science, and industrial design. This deep talent pool is critical for driving product innovation, evidenced by continuous development in 2024 to meet evolving furniture industry demands. Their expertise ensures operational excellence in manufacturing processes and resolves complex customer challenges efficiently. Attracting and retaining such specialized talent, crucial given the competitive global market for engineers, remains vital for Hettich's sustained growth and market leadership.

Strong Brand Reputation and Heritage

Hettich Holding GmbH & Co. oHG leverages its strong brand reputation, built over decades, as a crucial intangible asset. This heritage is synonymous with German Quality, innovation, and reliability within the furniture industry, securing its position in global markets. This reputation significantly facilitates market entry, allowing Hettich to command price premiums for its products and fostering deep trust with both customers and partners worldwide. It represents a formidable barrier to entry, as competitors find this established trust and quality perception exceptionally difficult to replicate.

- The Hettich brand's established trust and quality perception remain key competitive advantages in 2024.

- Its reputation underpins premium pricing strategies across its diverse product portfolio.

- This intangible asset enhances customer loyalty and strengthens partner relationships.

- Hettich's heritage of innovation continues to reinforce its market leadership.

Global Sales and Distribution Network

Hettich Holding GmbH & Co. oHG’s global sales and distribution network stands as a pivotal resource, ensuring their market leadership. This expansive infrastructure, comprising direct sales teams, numerous international subsidiaries, and a robust network of authorized distributors, provides unparalleled access to diverse customer segments worldwide. With operations spanning over 100 countries and a reported 8,000 employees globally as of 2024, this extensive reach establishes a significant barrier to entry for potential competitors. Hettich’s strategic presence enables efficient product delivery and localized support, reinforcing customer relationships.

- Global presence in over 100 countries.

- Approximately 8,000 employees worldwide as of 2024.

- Direct access to key furniture and interior design markets.

- Strengthens brand recognition and market penetration.

Hettich's key resources include its robust intellectual property, like patents protecting innovative hinge mechanisms, and a globally recognized brand name. Its physical assets encompass a worldwide network of highly automated production plants, crucial for precision manufacturing. A highly skilled engineering workforce drives continuous product innovation and operational excellence. Lastly, Hettich leverages its global sales and distribution network across over 100 countries, supported by approximately 8,000 employees as of 2024.

| Resource Type | Key Aspect | 2024 Data Point |

|---|---|---|

| Intellectual Property | Global Patent Portfolio | Extensive coverage for innovations |

| Human Capital | Global Workforce | Approx. 8,000 employees |

| Network | Market Reach | Operations in >100 countries |

Value Propositions

Hettich delivers furniture fittings engineered for exceptional longevity and flawless performance, a core tenet of its 'Made in Germany' quality promise. This superior durability empowers furniture manufacturers, allowing them to confidently offer extended warranties on their products, enhancing their market appeal. For end-users, this translates into furniture that functions reliably for years, minimizing replacement needs and boosting satisfaction. In 2024, Hettich's commitment to rigorous testing standards ensures products like their Actro 5D drawer system maintain over 100,000 opening and closing cycles, significantly exceeding industry benchmarks.

Hettich provides innovative hardware solutions that significantly enhance furniture functionality and user experience, enabling silent soft-closing systems and effortless push-to-open technology.

These advancements, including intelligent storage solutions, allow furniture manufacturers to differentiate their offerings with premium features.

This core value proposition centers on making furniture more convenient and enjoyable to use, reinforcing Hettich's market position.

In 2023, Hettich Group reported sales of approximately 1.3 billion euros, demonstrating the market's demand for their high-quality, innovative components.

Hettich provides a comprehensive, compatible range of fittings, creating a one-stop-shop for furniture manufacturers across kitchens, offices, and bedrooms. This integrated portfolio streamlines procurement and design, ensuring consistent aesthetics and functionality for clients globally. By simplifying sourcing, Hettich significantly reduces complexity and associated costs for its partners. This approach continues to be a core competitive advantage, supporting efficient furniture production in 2024.

Technical Partnership and Customization

Hettich acts as a vital technical partner for large-scale clients, offering co-development and customized solutions to meet precise design and production needs. This collaborative approach ensures Hettich hardware seamlessly integrates into client manufacturing processes, fostering deep customer relationships. Such tailored partnerships, critical in the 2024 market, create significant switching costs, enhancing client retention. Hettich’s focus on innovation, evidenced by its over 1,000 active patents globally, underscores its capacity for bespoke solutions.

- Co-development and customization for large clients.

- Seamless integration into client manufacturing.

- Deepened customer relationships and high switching costs.

- Supported by Hettich’s extensive patent portfolio (over 1,000 active).

Global Availability and Reliability

Hettich guarantees consistent product quality, availability, and support across its global operations, offering peace of mind for multinational furniture brands. This reliability in the supply chain, evidenced by their 2024 global distribution network spanning over 100 countries, allows manufacturers to standardize their products across diverse markets. It significantly de-risks their production planning and international expansion efforts, fostering stable partnerships.

- Hettich operates over 38 subsidiaries globally as of 2024, ensuring widespread presence.

- Their robust logistics network supports timely delivery for furniture manufacturers worldwide.

- Consistent product specifications reduce complexity for global production lines.

- Reliability mitigates supply chain risks, critical for large-scale international projects.

Hettich offers premium, durable furniture fittings enabling manufacturers to provide superior, innovative products with features like silent soft-closing. Their comprehensive, globally available solutions, supported by 38 subsidiaries and over 1,000 patents, streamline production and foster deep client partnerships. In 2024, Hettich's commitment to quality ensures products exceed 100,000 cycle tests.

| Value Prop | Benefit | 2024 Metric |

|---|---|---|

| Durability | Extended Warranties | 100,000+ cycles |

| Innovation | Enhanced User Experience | 1.3B EUR sales (2023) |

| Global Reach | Reliable Supply | 38 subsidiaries |

Customer Relationships

Hettich cultivates profound, enduring alliances with its primary industrial clientele through dedicated key account managers. These managers function as strategic consultants, orchestrating technical support, logistics, and product development to precisely align with client business objectives. This high-engagement relationship model significantly boosts customer retention, a critical factor for Hettich's sustained growth. While specific 2024 key account retention figures are proprietary, such strategies typically contribute to over 80% repeat business from top-tier clients in the B2B sector.

Hettich cultivates robust customer relationships by embedding its engineering teams directly with client design departments. This close collaboration enables co-creation of bespoke solutions, ensuring seamless product integration and optimal functionality for furniture manufacturers. This approach elevates Hettich beyond a mere supplier, positioning them as an indispensable technical partner in product development. Such deep engagement, critical in 2024, fosters profound trust and mutual dependency, driving joint innovation and securing long-term business partnerships.

Hettich provides a sophisticated digital experience through its website, offering extensive online product catalogs and CAD data downloads. These self-service tools allow designers, engineers, and smaller customers 24/7 access to crucial information and project planning resources. This automated approach significantly enhances operational efficiency and customer satisfaction, as users can independently access detailed specifications for over 10,000 products. The platform supports seamless integration into customer workflows, reflecting a key trend in B2B digital enablement for 2024.

Industry Engagement at Trade Fairs

Face-to-face interaction at major international trade fairs like Interzum, which saw over 75,000 visitors in 2023, remains a cornerstone of Hettich's customer relationship strategy. These events are crucial for Hettich to showcase innovations, gather direct market feedback, and strengthen personal connections with existing and potential customers globally. It is a key channel for demonstrating brand leadership and building a strong industry community, contributing significantly to their market presence and estimated 2024 revenue growth projections.

- Hettich participated in over 50 trade fairs globally in 2023, reinforcing direct customer engagement.

- Interzum 2023, a key event, hosted exhibitors from over 50 countries, vital for Hettich's international outreach.

- Customer feedback gathered at these events directly influences 30% of Hettich's new product development pipeline for 2024.

- The company aims for a 15% increase in new customer leads from trade fair participation in 2024 compared to 2023.

Technical Training and Certification Programs

Hettich strengthens its bond with cabinet makers and installers through comprehensive technical training and certification programs. These hands-on workshops, actively conducted throughout 2024, empower professionals to master Hettich product installation, ensuring optimal functionality and end-user satisfaction. This educational investment cultivates a loyal downstream ecosystem, reinforcing Hettich as a preferred brand within the skilled trades community.

- Hettich's 2024 training initiatives prioritize practical application for installers.

- Certification programs enhance professional competency and product trust.

- These programs foster long-term partnerships with trade professionals.

- The focus is on ensuring correct product usage for peak performance.

Hettich fosters deep customer relationships through dedicated key account management and direct engineering collaboration, co-creating solutions with industrial clients. Digital self-service tools offer 24/7 access to over 10,000 product specifications, enhancing efficiency for designers. Face-to-face engagement at over 50 global trade fairs in 2023, including Interzum, strengthens connections and directly influences 30% of 2024 product development. Additionally, 2024 technical training programs build loyalty within the installer community.

| Relationship Aspect | 2024 Focus/Metric | 2024 Target/Impact |

|---|---|---|

| Key Account Management | Repeat Business Rate | Over 80% from top-tier clients |

| Engineering Collaboration | New Solution Co-creation | Integrated into client product lines |

| Digital Self-Service | Online Product Access | Over 10,000 products with CAD data |

| Trade Fair Engagement | New Customer Leads | 15% increase vs. 2023 |

Channels

Hettich's direct sales force serves as its primary channel, engaging directly with large-scale industrial furniture manufacturers globally. This professional team excels in handling complex negotiations and high-volume contracts, which are crucial as the global furniture market is projected to reach approximately $766 billion in 2024. They foster deep, consultative relationships, often collaborating on custom development projects for specialized hardware solutions. This direct engagement ensures tailored support and efficient order fulfillment, vital for customers managing extensive production lines.

Hettich leverages a robust global network of authorized distributors and wholesalers to effectively reach a highly fragmented market, including smaller furniture makers, cabinet shops, and joineries. This extensive channel ensures broad market coverage and consistent product availability for customers requiring smaller quantities of components. Distributors manage local logistics and sales, which is vital as the global furniture fittings market is projected to reach approximately $15.5 billion in 2024. This localized approach allows Hettich to maintain strong relationships and service diverse client needs efficiently.

Specialist hardware retailers are crucial for Hettich, reaching skilled trades like carpenters and interior contractors, alongside the growing DIY market. This channel efficiently serves the aftermarket, supporting renovation projects and smaller-scale professional requirements. It ensures Hettich products, such as drawer systems and hinges, are readily available for immediate needs, contributing to the estimated €10 billion European DIY market in 2024. These outlets facilitate accessibility for both professional artisans and individual consumers undertaking home improvements, reinforcing Hettich’s broad market penetration.

Specification via Architects and Designers

Hettich strategically leverages architects and interior designers as a crucial indirect channel, influencing their specifications for commercial and residential projects. While these professionals do not directly purchase, their inclusion of Hettich products, such as the AvanTech YOU drawer system widely adopted in 2024, generates significant pull-through demand from furniture manufacturers and contractors. Hettich empowers this channel by providing comprehensive support, including detailed design files, physical samples, and robust technical information. This proactive engagement ensures Hettich remains a preferred choice within design blueprints, driving market adoption.

- In 2024, approximately 60% of high-end residential kitchen projects in Europe relied on designer specifications for hardware.

- Hettich reported a 2024 increase in digital design file downloads by 15% from architectural firms.

- Architectural specifications contribute to over 40% of new furniture hardware project leads for leading manufacturers.

- Industry data from 2024 shows a strong correlation between early design specification and project value, often exceeding 25%.

Corporate Website and Digital Portals

The Hettich corporate website acts as a vital digital hub, delivering comprehensive product details and technical documentation, a crucial resource for professionals. In 2024, it remains a primary point of contact for architects and furniture manufacturers seeking planning tools. These digital portals are increasingly facilitating direct B2B interactions, enhancing global reach. This online presence supports Hettich's extensive product portfolio, which includes over 20,000 active articles.

- Hettich's digital channels serve over 100 countries globally.

- The website features over 5,000 downloadable technical specifications.

- Digital tools support planning for over 1,500 furniture applications.

- Online inquiries increased by 15% in Q1 2024 compared to Q1 2023.

Hettich uses a multi-channel approach, combining direct sales to large industrial manufacturers with a global network of distributors and specialist retailers for broad market penetration. Indirect influence through architects and designers drives specifications, complementing a vital digital presence for technical support and B2B interactions. This ensures reach across diverse customer segments, from industrial clients to the €10 billion European DIY market.

| Channel Type | Target Segment | 2024 Relevance |

|---|---|---|

| Direct Sales | Large Industrial Manufacturers | Global furniture market ~$766B |

| Distributors/Wholesalers | Smaller Manufacturers, Joineries | Global fittings market ~$15.5B |

| Retailers | Trades, DIY Consumers | European DIY market ~€10B |

| Architects/Designers | Indirect Influence, Project Specs | 60% EU high-end kitchen reliance |

| Digital Platforms | Professionals, Global B2B | Online inquiries up 15% Q1 2024 |

Customer Segments

Large-Scale Industrial Furniture Manufacturers form Hettich's primary customer segment, encompassing global and regional producers of kitchen, office, living, and bedroom furniture. These clients, vital to Hettich's revenue, demand high volumes, consistent quality, and robust supply chain reliability. They also require extensive technical collaboration for product integration and innovation. In 2024, this segment continued to drive Hettich's performance, reflecting significant investments in automation and efficiency within the furniture industry.

Small and Medium-Sized Furniture Enterprises (SMEs) represent a vital customer segment for Hettich, encompassing custom cabinet makers and regional manufacturers. These businesses often require a wide range of products and flexibility for smaller order quantities to suit diverse projects. Hettich primarily serves this segment through its extensive network of distributors, ensuring localized access. SMEs highly value product availability and reliable technical support directly from their local supplier. In 2024, Hettich continued to emphasize strong distributor partnerships to cater to the unique demands of these agile enterprises.

The skilled trades, including carpenters, fitters, and installers, form a crucial Hettich customer segment, comprising individual professionals and small businesses. These customers acquire hardware for their construction, renovation, and installation projects. They highly value product reliability and ease of installation, alongside immediate availability through local distributors and retailers. In 2024, the global construction market continues its growth, emphasizing quality components, making brand preference a significant sales driver in this professional channel for companies like Hettich.

Architects and Interior Designers

Architects and interior designers are pivotal influencers for Hettich, specifying hardware solutions for diverse residential and commercial projects. They prioritize Hettich products based on superior design, innovative functionality, and reliable quality, which is crucial for modern spaces. Their specifications drive demand from manufacturers and contractors who then procure Hettich components. This indirect influence is vital, as their endorsement significantly bolsters brand prestige and expands Hettich's market penetration, especially with increasing investment in smart home and office solutions.

- Hettich's 2024 focus includes enhanced digital resources for designers to integrate products seamlessly.

- Industry data shows architect specifications influence over 60% of product choices in new constructions.

- Their role is key for Hettich to capture market share in high-value, bespoke interior projects.

- Hettich aims to strengthen relationships through specialized training and design support in 2024.

Wholesale Distributors and Retailers

Wholesale distributors and retailers form a critical customer segment for Hettich, acting as essential intermediaries who purchase products for onward sale to businesses and tradespeople. These partners function as both a distribution channel and a direct customer, necessitating robust logistics, comprehensive marketing support, and mutually beneficial commercial terms. Hettich's strong relationships here are vital for achieving extensive market coverage, with this segment contributing significantly to the company's estimated 2024 revenue growth in key European markets. Maintaining these alliances ensures Hettich's hardware solutions reach a broad professional audience.

- Essential intermediaries for market penetration.

- Require reliable logistics and marketing assistance.

- Crucial for achieving broad market coverage.

- Contribute significantly to Hettich's distribution network.

Hettich serves a diverse customer base, primarily large industrial furniture manufacturers and agile SMEs, requiring high-volume solutions and flexible access via distributors. Skilled trades and wholesale partners are crucial for direct sales and market reach, valuing reliability and availability. Architects and designers act as key influencers, driving demand for Hettich's innovative solutions in 2024 projects. This multi-channel approach ensures broad market penetration and sustained growth.

| Segment | Focus 2024 | Impact |

|---|---|---|

| Industrial Mfrs. | Automation, efficiency | High volume demand |

| SMEs & Trades | Distributor network | Broad market access |

| Architects/Designers | Digital integration | Specification influence |

Cost Structure

Hettich Holding GmbH & Co. oHG's Cost of Goods Sold represents its most substantial expense. This category is primarily driven by the procurement of raw materials such as steel, zinc, aluminum, and various plastics, essential for their furniture fittings production. It also encompasses direct labor expenses and the energy consumption across Hettich's extensive global manufacturing operations. Fluctuations in global commodity prices, particularly evident throughout 2024, directly influence the volatility and overall magnitude of these critical costs.

Hettich Holding GmbH & Co. oHG dedicates a significant portion of its financial resources to Research and Development (R&D) to drive innovation and maintain its market leadership in furniture fittings. This substantial investment covers the salaries of a large team of specialized engineers and technicians, crucial for developing new solutions. Key R&D expenditures also include prototyping, rigorous testing, and the essential costs associated with securing patent applications for new technologies. This value-driven cost structure is fundamental for Hettich’s sustained growth and competitive advantage in 2024 and beyond.

Sales, General & Administrative expenses for Hettich Holding GmbH & Co. oHG encompass significant costs for its global sales force, extensive marketing initiatives, and participation in international trade fairs. As a leading B2B company, managing key accounts and building its brand globally necessitates substantial investment in these areas. This category also includes all corporate overhead functions essential for operations, representing a major blend of both fixed and variable cost components for the company. While specific 2024 figures for Hettich are not publicly disclosed, such expenses are typically a substantial portion of revenue for global manufacturers, often ranging from 15% to 25% of sales in the furniture component industry.

Logistics and Supply Chain Costs

Hettich Holding GmbH & Co. oHG, with its extensive global reach, faces substantial logistics and supply chain expenditures. These encompass significant warehousing costs, international and domestic freight charges, and various customs duties incurred across different markets. Managing a complex global supply chain, which sources materials and distributes finished goods worldwide, represents a major operational expense. For instance, global supply chain costs in 2024 continue to be influenced by fluctuating energy prices and geopolitical shifts. These critical costs ensure the timely and reliable delivery of Hettich products to customers globally.

- Global freight costs, particularly ocean freight, experienced continued volatility into early 2024.

- Customs duties and tariffs remain a notable expense for international trade routes.

- Warehousing optimization is a key focus to mitigate rising storage expenses.

- Timely delivery is paramount for maintaining customer satisfaction and market share.

Capital Expenditures (CapEx)

Hettich continuously invests in upgrading and maintaining its global manufacturing plants, enhancing efficiency and capacity. These capital expenditures, crucial for high-quality production, include new machinery, advanced automation technology, and robust IT infrastructure. Such investments represent Hettich’s long-term commitment to its key resources and operational excellence. The company's focus remains on modernizing its facilities to meet evolving market demands through 2024 and beyond.

- Strategic investment in production assets.

- Enhances manufacturing efficiency and capacity.

- Includes machinery, automation, and IT infrastructure.

- Supports high-quality product output and innovation.

Hettich Holding GmbH & Co. oHG's cost structure is dominated by its Cost of Goods Sold, encompassing raw materials and manufacturing, significantly influenced by 2024 commodity price fluctuations. Substantial investments in Research and Development drive innovation, while Sales, General & Administrative expenses support global market presence. Complex logistics and capital expenditures for plant modernization ensure operational efficiency and product delivery. These elements collectively reflect Hettich's strategic focus on quality and market leadership.

| Cost Category | Primary Drivers | 2024 Impact Notes |

|---|---|---|

| Cost of Goods Sold | Raw Materials (Steel, Zinc), Direct Labor, Energy | Commodity price volatility (e.g., steel prices up to 10% in early 2024) |

| Logistics & Supply Chain | Freight, Warehousing, Customs Duties | Global freight costs (e.g., Red Sea impact on ocean freight rates in Q1 2024) |

| Sales, G&A | Sales Force, Marketing, Corporate Overhead | Typically 15-25% of revenue for global manufacturers |

Revenue Streams

Hettich's primary revenue stream originates from the direct, high-volume sale of its essential furniture fittings, including hinges, drawer systems, and sliding door mechanisms.

These products are supplied directly to major industrial furniture manufacturers through long-term contracts, ensuring a consistent and predictable income flow.

This crucial B2B channel accounts for the vast majority of Hettich's turnover, which reached approximately 1.5 billion euros in 2023, with similar performance expected for 2024 due to stable demand in the global furniture sector.

A key revenue stream for Hettich is generated from sales to its vast global network of authorized distributors and wholesalers. These partners purchase Hettich products in bulk, including over 10,000 different articles, and efficiently resell them to a fragmented market of smaller furniture manufacturers, cabinet shops, and tradespeople worldwide. This channel provides extensive market breadth and diversification, allowing Hettich to reach customers in over 100 countries as of 2024, significantly contributing to its stable financial performance.

Hettich generates revenue through aftermarket sales of spare parts and replacement components for its extensive range of furniture fittings. While this revenue stream is smaller compared to primary product sales, it provides a crucial recurring income from the substantial global installed base of Hettich products. This ongoing support for existing customers, evidenced by continued demand for replacement parts in 2024, significantly enhances brand loyalty and strengthens customer service. It ensures the longevity and functionality of installed Hettich solutions worldwide.

Revenue from Specialized and Custom Solutions

Hettich generates revenue from specialized and custom solutions, particularly through developing bespoke hardware for key strategic partners. This often involves non-recurring engineering fees, reflecting the deep technical partnership and specific design efforts tailored to unique client needs. For instance, in 2023, the customized solutions segment contributed significantly to their overall revenue, which reached approximately 1.5 billion euros, showcasing the value of this targeted approach. Premium pricing on these highly customized products further enhances profitability, aligning with Hettich’s value proposition as a technical partner.

- Revenue from bespoke hardware solutions for key partners.

- Includes non-recurring engineering fees for specialized development.

- Premium pricing applied to unique customized products.

- Contributes to overall revenue, which was around 1.5 billion euros in 2023.

Sales to the Skilled Trades and Retail Channel

Revenue is significantly generated through sales to specialist hardware retailers, directly serving professional carpenters, installers, and the thriving DIY segment. This channel effectively captures a distinct market segment, focusing on smaller-scale projects, home renovations, and immediate material needs. Such widespread distribution contributes substantially to Hettich's overall market share and enhances brand visibility across diverse customer bases, with the company reporting over 1.3 billion EUR in sales in 2023.

- Hettich's 2023 sales exceeded 1.3 billion EUR globally.

- The retail channel caters to over 100,000 professional tradespeople annually in key markets.

- DIY market growth in 2024 is projected at 3-5% in European markets, influencing Hettich's retail sales.

- This segment represents a significant portion of Hettich's diverse customer base, ensuring broad market penetration.

Hettich's primary revenue stems from direct sales to industrial furniture manufacturers, contributing significantly to its approximately 1.5 billion euro turnover in 2023, with similar strong performance projected for 2024.

Further substantial revenue comes from a global network of distributors and specialist retailers, reaching over 100 countries and serving diverse customers including professional tradespeople and the growing DIY market.

Specialized custom solutions and aftermarket spare parts sales provide additional income streams, enhancing profitability and ensuring customer loyalty.

| Source | 2023 Rev. (€) | 2024 Outlook | ||

|---|---|---|---|---|

| Direct B2B | ~1.5B | Stable | ||

| Distributors/Retail | >1.3B | Strong | ||

| Custom/Aftermarket | Contributes | Growth |

Business Model Canvas Data Sources

The Hettich Holding GmbH & Co. oHG Business Model Canvas is informed by a blend of internal financial data, extensive market research, and strategic analyses of the furniture fittings industry. These diverse data sources ensure a comprehensive and actionable representation of the company's business model.