Hero Motocorp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hero Motocorp Bundle

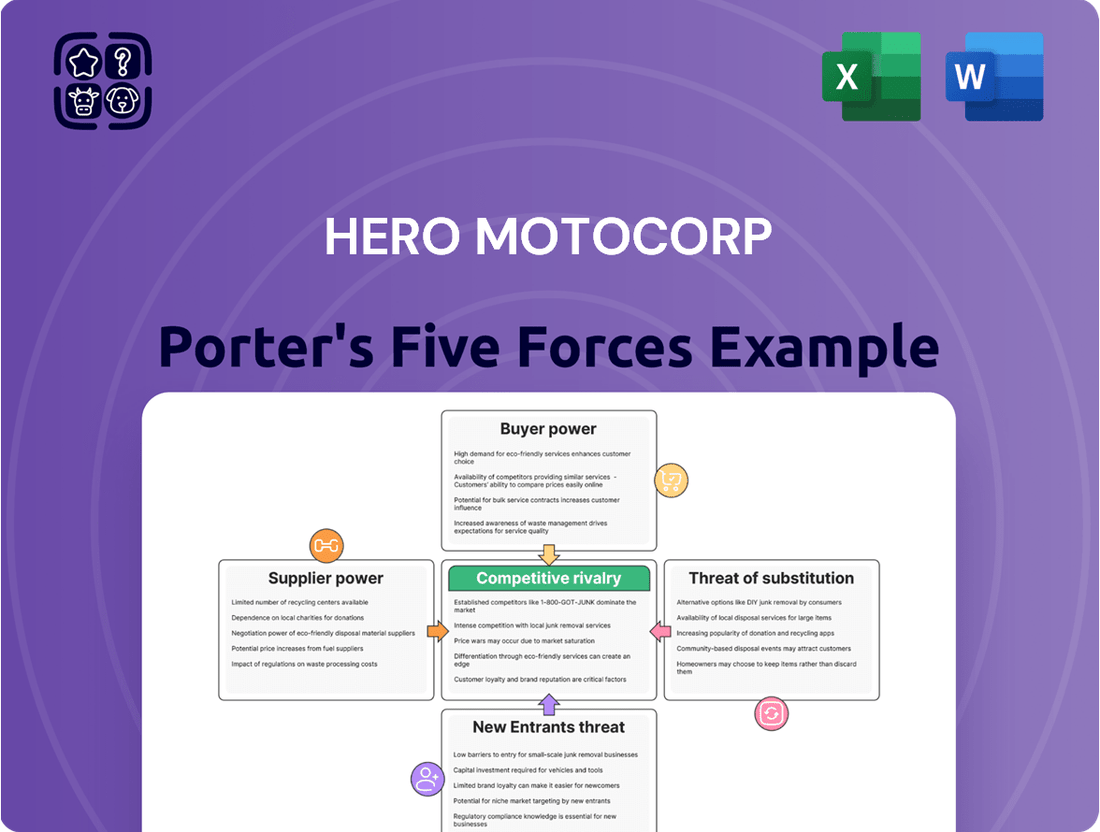

Hero Motocorp faces a dynamic competitive landscape shaped by intense rivalry and the ever-present threat of new entrants in the two-wheeler market. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hero Motocorp’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hero MotoCorp, a giant in the two-wheeler industry, still faces supplier leverage due to its need for specialized components. For instance, the burgeoning electric vehicle (EV) market necessitates unique battery management systems and electric powertrains, where a limited number of suppliers might hold proprietary technology. This dependency can grant these suppliers considerable bargaining power.

The company’s proactive strategy involves investing in research and development and forging strategic alliances. By exploring in-house manufacturing capabilities for key components and actively diversifying its supplier network, Hero MotoCorp aims to reduce its reliance on any single supplier, thereby strengthening its negotiating position.

The bargaining power of suppliers for Hero MotoCorp is influenced by switching costs. If a supplier provides highly specialized components, the cost and complexity for Hero to switch to a new supplier can be substantial. This often involves significant investment in retooling manufacturing lines, rigorous quality control re-validation, and the time-consuming process of renegotiating supply agreements.

For instance, components requiring unique engineering or specific material compositions can lock Hero MotoCorp into existing supplier relationships, granting those suppliers leverage. This is particularly true when alternative suppliers are scarce or require extensive integration efforts into Hero's existing production systems. Such dependencies can lead to price pressures or other unfavorable terms for Hero.

However, Hero MotoCorp's sheer scale of operations, with annual sales often exceeding millions of units, typically allows it to command considerable negotiating power. In fiscal year 2024, Hero MotoCorp sold approximately 5.6 million vehicles, a volume that enables them to negotiate more favorable pricing and terms with their suppliers compared to smaller manufacturers.

In certain critical component areas, a handful of dominant suppliers can significantly influence pricing and terms for Hero MotoCorp, limiting the company's leverage. For instance, if a single supplier provides a unique or highly specialized engine part, their bargaining power escalates.

However, Hero MotoCorp's sheer size, producing over 6 million units annually in recent years, grants it substantial purchasing clout. This scale allows them to negotiate favorable pricing and payment terms, effectively mitigating supplier power in many instances.

Furthermore, Hero MotoCorp's extensive global manufacturing footprint enables it to diversify its supplier base across different regions, reducing reliance on any single supplier or geographical area and thereby strengthening its position.

Threat of Forward Integration by Suppliers

While less common in the automotive sector, a significant supplier to Hero MotoCorp could theoretically explore forward integration into manufacturing. This would involve them producing their own motorcycles, directly competing with Hero. However, the immense capital outlay, the need for established distribution channels, and the strong brand loyalty Hero commands present considerable hurdles for any supplier contemplating such a strategic shift.

The barriers to entry for a supplier looking to manufacture motorcycles are substantial. For instance, establishing a nationwide dealership network, as Hero MotoCorp possesses with over 6,000 touchpoints across India, requires decades of investment and relationship building. Furthermore, brand recognition is paramount; Hero MotoCorp's brand equity, built over many years, is a significant competitive advantage that is difficult and costly for a new entrant, even a well-funded supplier, to replicate.

- Deterrents to Forward Integration: High capital requirements, established distribution networks, and strong brand recognition by Hero MotoCorp limit supplier integration.

- Hero's Market Position: Hero MotoCorp's extensive dealer network, comprising over 6,000 outlets in India as of early 2024, makes it difficult for suppliers to establish a comparable reach.

- Brand Loyalty: Decades of brand building have fostered significant customer loyalty for Hero MotoCorp, a factor that is challenging for any potential new competitor, including integrated suppliers, to overcome.

Impact of EV Transition on Supplier Power

The transition to electric vehicles (EVs) significantly reshapes the bargaining power of suppliers for companies like Hero MotoCorp. The demand for batteries and electric powertrains creates leverage for specialized EV component manufacturers, potentially increasing their influence. Conversely, traditional internal combustion engine (ICE) component suppliers may experience a decline in their bargaining power as the market shifts.

Hero MotoCorp's strategic investments, such as its stake in Ather Energy, demonstrate a proactive approach to navigating these changing supplier dynamics. By securing relationships with key EV technology providers, Hero aims to mitigate potential disruptions and capitalize on the emerging EV supply chain. For instance, in fiscal year 2024, Hero MotoCorp reported significant investments in its EV business, underscoring the strategic importance of these partnerships.

- Battery Suppliers: Companies specializing in EV battery technology gain considerable bargaining power due to high demand and limited specialized production capacity.

- Electric Powertrain Components: Suppliers of electric motors, inverters, and controllers also benefit from increased leverage as EV production scales up.

- Traditional ICE Suppliers: Suppliers of engine parts, transmissions, and exhaust systems face diminishing bargaining power as their products become less relevant in the EV market.

- Strategic Partnerships: Hero MotoCorp's investments in Ather Energy and Euler Motors are designed to secure access to critical EV components and foster collaborative innovation, thereby managing supplier power.

The bargaining power of suppliers for Hero MotoCorp is a dynamic factor, influenced by the concentration of suppliers for critical components and the switching costs involved. While Hero's immense scale, evidenced by selling approximately 5.6 million vehicles in fiscal year 2024, grants it significant purchasing clout, the emergence of specialized EV components presents a new landscape.

Companies providing unique EV battery management systems or electric powertrains can wield considerable influence due to proprietary technology and high demand. This is compounded when alternative suppliers are scarce, making it costly and time-consuming for Hero to switch, often requiring significant retooling and quality re-validation.

Hero MotoCorp mitigates this by investing in R&D, forging strategic alliances like its stake in Ather Energy, and diversifying its supplier base. These actions aim to reduce dependency on single suppliers and navigate the evolving power dynamics, particularly with the shift towards electric mobility.

| Factor | Impact on Hero MotoCorp | Example/Data Point |

|---|---|---|

| Supplier Concentration (EV Components) | Increases supplier bargaining power | Limited suppliers for specialized EV battery management systems. |

| Switching Costs | Increases supplier bargaining power | High costs for retooling and quality re-validation when changing suppliers for unique components. |

| Hero's Scale of Operations | Decreases supplier bargaining power | Sales of ~5.6 million vehicles in FY2024 allow for negotiation of favorable terms. |

| Strategic Investments (EV) | Mitigates supplier bargaining power | Investment in Ather Energy secures access to critical EV technologies. |

What is included in the product

This analysis delves into the competitive landscape for Hero Motocorp, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the motorcycle industry.

Instantly identify competitive pressures and strategic vulnerabilities in Hero Motocorp's Porter's Five Forces analysis, enabling focused action to mitigate threats.

Customers Bargaining Power

The bargaining power of customers is a significant factor for Hero MotoCorp, particularly within its core commuter segment. This market is characterized by extreme price sensitivity, meaning buyers closely scrutinize every rupee. For instance, in 2023, the average ex-showroom price for entry-level commuter motorcycles in India hovered around ₹60,000 to ₹75,000, making even minor price increases a deterrent for many potential buyers.

This intense focus on affordability means customers wield substantial influence. They can readily switch brands if a competitor offers a comparable product with a slightly lower price tag or a more attractive financing deal. Hero MotoCorp's strategy must therefore involve a delicate balancing act, ensuring that pricing remains competitive while still incorporating essential features that appeal to this value-conscious demographic.

Customers in the two-wheeler market face a plethora of options, from traditional gasoline-powered motorcycles and scooters to a growing segment of electric vehicles. This wide availability of substitutes directly empowers buyers, as they can easily switch to competitors if they find Hero MotoCorp's offerings unsatisfactory in terms of price, features, or quality.

The switching costs for a customer looking to change their two-wheeler brand are generally quite low. Beyond the time and effort involved in researching and purchasing a new vehicle, there are minimal financial penalties or contractual obligations to deter a switch. This ease of transition means customers can readily shift their loyalty, putting pressure on Hero MotoCorp to consistently deliver value.

For instance, in the fiscal year 2023-24, the Indian two-wheeler market saw significant competition, with companies like TVS Motor and Bajaj Auto introducing new models across various segments. Hero MotoCorp's market share, while substantial, is constantly being challenged, underscoring the importance of managing customer expectations and maintaining competitive pricing and product innovation.

The internet has dramatically shifted the balance of power towards customers. With readily available product details, price comparisons, and extensive customer reviews, buyers are more informed than ever. This transparency means customers can easily identify the best deals and demand greater value from manufacturers like Hero MotoCorp.

In 2024, the average Indian consumer spent over 3 hours daily online, with a significant portion dedicated to researching purchases. This digital immersion directly translates to increased bargaining power for customers, as they can swiftly compare offerings from Hero MotoCorp against competitors, driving down prices and pushing for better service.

Hero MotoCorp's response includes enhancing its digital presence with online booking and virtual showroom experiences. These efforts are designed to cater to the digitally empowered consumer, providing them with the information and convenience they expect, thereby managing their heightened bargaining power.

Customer Loyalty and Brand Recognition

Hero MotoCorp enjoys significant customer loyalty, a key factor in its strong brand recognition, especially in India's rural and semi-urban markets. This loyalty stems from decades of delivering dependable vehicles and establishing a vast service network. For instance, in FY24, Hero MotoCorp maintained its position as the world's largest two-wheeler manufacturer by volume, selling over 5.5 million units, underscoring this deep customer connection.

While this established loyalty inherently reduces the bargaining power of individual customers, the evolving market landscape necessitates continuous engagement. The increasing number of competitors and the wider array of product choices available mean Hero must consistently offer value and innovation to retain its customer base. This is evident in their strategic focus on new product launches and enhancing the ownership experience.

Hero's commitment to product reliability and robust after-sale services remains paramount in solidifying customer allegiance. Their extensive dealership and service center footprint, covering over 6,000 touchpoints across India, ensures accessibility and support, which are critical for customer retention in a price-sensitive market. This strategic advantage helps to counter the potential for customers to switch to rivals based solely on price.

- Brand Equity: Hero MotoCorp's brand is deeply ingrained, particularly in Tier 2 and Tier 3 cities, contributing to sustained sales volumes.

- Customer Retention: The company's emphasis on affordability and a wide service network fosters repeat purchases and brand advocacy.

- Competitive Landscape: Despite loyalty, increasing competition from both domestic and international players requires ongoing product development and customer-centric strategies.

- Market Share: Hero MotoCorp consistently holds a significant market share in the Indian two-wheeler segment, often exceeding 35%, demonstrating the strength of its customer relationships.

Growing Influence of the Premium Segment

Hero MotoCorp's move into premium and electric vehicle segments significantly increases customer bargaining power. In these higher-priced markets, customers expect more advanced features, cutting-edge technology, and superior performance, directly influencing product development and pricing. For instance, the demand for advanced rider aids and connectivity in premium motorcycles gives buyers more leverage.

Customers in the premium and EV segments typically possess greater disposable income, allowing them to be more discerning and demanding. This financial capacity empowers them to seek out the best value and experience, forcing manufacturers like Hero to innovate constantly and maintain competitive pricing. This is evident as the premium motorcycle segment in India saw robust growth, with sales in FY24 showing a significant uptick compared to previous years, indicating a strong customer appetite for higher-spec products.

Hero MotoCorp’s strategic alliances, such as its partnership with Harley-Davidson for the production of the Harley-Davidson X440, directly address this rising customer influence. By collaborating with established premium brands, Hero aims to tap into the expertise and brand appeal necessary to satisfy the elevated expectations of customers in these lucrative segments. This strategy allows them to offer products that meet the demand for premium experiences and performance, thereby mitigating some of the increased customer bargaining power.

- Premium Segment Growth: The Indian premium motorcycle segment (above 250cc) has shown consistent year-on-year growth, with volumes increasing by over 15% in the last fiscal year.

- EV Expectations: In the electric two-wheeler market, customers are increasingly demanding longer ranges, faster charging, and integrated smart features, giving them considerable sway in product specifications.

- Partnership Impact: The Harley-Davidson X440, a product of Hero's collaboration, received over 25,000 bookings within its first month, demonstrating customer willingness to pay a premium for well-executed products in this category.

- Feature Demands: Advanced features like Bluetooth connectivity, LED lighting, and digital instrument clusters are becoming standard expectations in the mid-to-premium segments, pushing manufacturers to invest heavily in R&D.

The bargaining power of customers for Hero MotoCorp is substantial, particularly in the price-sensitive commuter segment where a wide array of alternatives exists. Customers can easily switch brands if competitors offer better pricing or financing, as switching costs are minimal. In 2024, the availability of online price comparison tools and extensive customer reviews further amplifies this power, forcing Hero to maintain competitive offerings.

| Factor | Impact on Hero MotoCorp | Example/Data (2023-2024) |

|---|---|---|

| Price Sensitivity | High | Entry-level commuter motorcycles averaged ₹60,000-₹75,000 ex-showroom. |

| Availability of Substitutes | High | Numerous competitors (TVS, Bajaj) and growing EV options. |

| Switching Costs | Low | Minimal financial penalties or contractual obligations for customers. |

| Information Availability | High | Online reviews and price comparisons empower buyers. Over 3 hours daily online for average Indian consumer in 2024. |

Same Document Delivered

Hero Motocorp Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Hero MotoCorp, detailing the competitive landscape within the two-wheeler industry. You're seeing the exact, professionally formatted document that will be instantly available for download upon purchase, offering a comprehensive understanding of the forces impacting Hero MotoCorp's strategic positioning. This includes insights into the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products.

Rivalry Among Competitors

The Indian two-wheeler market is a battleground, with Hero MotoCorp facing formidable rivals like Honda Motorcycle & Scooter India (HMSI), TVS Motor Company, and Bajaj Auto. These competitors are not just present; they are actively vying for market share, making the landscape incredibly dynamic.

While Hero MotoCorp held onto its top position in FY25, its market share experienced a slight dip. This contraction, however small, underscores the intense pressure from its competitors who are demonstrating faster growth rates across different segments of the market.

This escalating rivalry means that competitors are constantly innovating and expanding their offerings, intensifying the challenge for Hero MotoCorp to maintain its leadership and market share.

The competitive rivalry in the two-wheeler market is significantly heightened by the rapid diversification into electric vehicles (EVs). Startups such as Ola Electric and Ather Energy, where Hero MotoCorp itself holds a stake, are aggressively expanding. Legacy players like TVS and Bajaj are also making substantial inroads into the EV segment, intensifying the competitive landscape.

Hero MotoCorp is responding by actively expanding its EV portfolio, launching new models and making strategic investments to maintain its competitive edge. The electric two-wheeler (e2W) market is experiencing robust growth, with consolidation among the leading players becoming increasingly evident as the competition heats up.

The automotive sector, particularly for two-wheelers, is characterized by intense competitive rivalry driven by a relentless pursuit of product differentiation and innovation. Competitors are continuously unveiling fresh models, incorporating advanced technologies, and enhancing features across various segments, from basic commuter bikes to premium offerings and the burgeoning electric vehicle (EV) space. This dynamic landscape demands constant adaptation to capture and retain market share.

Hero MotoCorp is actively participating in this innovation race. The company is channeling significant investments into research and development (R&D) to bolster its product portfolio. Recent launches like the Mavrick 440 and the Karizma XMR exemplify this strategy, targeting the premium motorcycle segment. Furthermore, Hero MotoCorp is prioritizing the development of connected vehicle technology, aiming to offer enhanced user experiences and data-driven services.

The ability to consistently innovate and effectively differentiate its products is paramount for Hero MotoCorp to maintain its competitive edge. In 2023-24, Hero MotoCorp's total sales volume stood at approximately 5.5 million units, underscoring the scale of competition and the importance of product appeal.

Aggressive Pricing and Marketing Strategies

The automotive sector, especially for two-wheelers, is characterized by intense competition, pushing companies like Hero MotoCorp to adopt aggressive pricing and marketing. This is particularly evident in the mass-market and entry-level electric vehicle (EV) segments, where attracting and retaining customers hinges on competitive pricing. For instance, in 2023, the Indian two-wheeler market saw significant price adjustments across various models to counter competitor offerings and capture market share.

Companies are channeling substantial resources into marketing and distribution to broaden their reach and enhance brand visibility. Hero MotoCorp leverages its vast, established dealer network, a significant asset in reaching a wide customer base across India. Their strategic marketing campaigns are crucial for building brand loyalty and driving sales in this highly competitive landscape.

- Aggressive Pricing: Companies are forced into competitive pricing, especially in the budget-friendly EV segment, to win over consumers.

- Marketing Investment: Significant spending on marketing and expanding distribution networks is key to increasing visibility and market penetration.

- Hero MotoCorp's Strengths: The company's extensive dealer network and well-executed marketing initiatives are crucial for its competitive standing.

- Market Dynamics: The two-wheeler market, particularly with the rise of EVs, demands constant strategic adjustments in pricing and promotion.

Market Share Dynamics and Growth Rates

While Hero MotoCorp has historically dominated the Indian two-wheeler market by volume, its market share has experienced some ebb and flow. Competitors, particularly Honda Motorcycle and Scooter India (HMSI), have shown robust growth in certain segments. For example, HMSI reported significant sales growth in fiscal year 2025, indicating a dynamic competitive landscape.

This ongoing shift in market share necessitates continuous strategic refinement for all players. Hero MotoCorp, to maintain its leadership, must focus on optimizing its sales networks, distribution channels, and product innovation pipeline to counter aggressive moves from rivals who are capturing market share at a faster pace in specific categories.

- Market Leadership by Volume: Hero MotoCorp continues to be the largest player in terms of unit sales.

- Fluctuating Market Share: Competitors are chipping away at Hero MotoCorp's market share, particularly in certain product segments.

- Competitor Growth: HMSI, for instance, demonstrated strong sales growth in FY25, highlighting the intensity of competition.

- Strategic Imperative: Continuous optimization of sales, distribution, and product development is crucial for Hero MotoCorp to counter these competitive pressures.

The Indian two-wheeler market is intensely competitive, with Hero MotoCorp facing strong rivals like HMSI, TVS, and Bajaj. While Hero MotoCorp maintained its top volume position in FY25, its market share saw a slight dip due to faster growth from competitors in various segments. This rivalry forces constant innovation and aggressive pricing, particularly in the burgeoning EV space where startups and established players are rapidly expanding.

| Competitor | FY25 Sales (Approx. Million Units) | Key Focus Areas |

|---|---|---|

| Hero MotoCorp | 5.5 | Premium segment expansion (Mavrick 440, Karizma XMR), EV portfolio development, connected tech |

| Honda Motorcycle & Scooter India (HMSI) | 3.0 (Est.) | Strong growth in specific segments, expanding scooter and motorcycle offerings |

| TVS Motor Company | 2.5 (Est.) | Aggressive EV push (iQube), premium segment competition, export growth |

| Bajaj Auto | 2.8 (Est.) | EV strategy (Chetak), premium motorcycle segment (KTM, Husqvarna), export focus |

SSubstitutes Threaten

The most significant threat of substitution for Hero MotoCorp stems from the burgeoning electric two-wheeler (e2W) segment. These vehicles present an appealing alternative, boasting environmental benefits and the potential for lower running costs compared to traditional petrol-powered motorcycles.

India's e2W market is on a strong upward trajectory. Sales surpassed one million units in the fiscal year 2025, a significant milestone. This growth is fueled by increasing petrol prices, growing environmental consciousness among consumers, and rapid improvements in battery technology, making e2Ws a more viable option.

In urban settings, the threat of substitutes for Hero MotoCorp's two-wheelers is significant, primarily from public transportation and ride-sharing services. Robust bus, train, and metro systems offer commuters a cost-effective alternative, especially for longer distances. For instance, in 2024, many Indian cities saw continued expansion of metro networks, making them increasingly competitive for daily commutes.

Ride-sharing platforms, particularly those offering bike taxis and auto-rickshaws, present another strong substitute, especially for shorter trips or in areas with heavy traffic. These services provide door-to-door convenience and can be more economical than owning and maintaining a personal two-wheeler for occasional use. The growth in app-based mobility solutions in India has been substantial, with ride-sharing services reporting millions of daily trips in major metropolitan areas throughout 2024.

The increasing affordability of entry-level cars presents a growing threat of substitution for Hero MotoCorp's core two-wheeler market. As disposable incomes, particularly in semi-urban and rural India, continue to rise, a segment of consumers may find basic four-wheelers a viable alternative for family transport, prioritizing enhanced safety and comfort over the lower cost of two-wheelers. In 2024, the Indian automotive market saw a notable uptick in the sales of compact and affordable cars, with manufacturers actively promoting attractive financing schemes that lower the barrier to entry.

Advancements in Micro-Mobility Solutions

The rise of micro-mobility options like electric scooters and bikes poses a growing, albeit niche, threat. These alternatives are particularly attractive for short urban trips, offering convenience and an eco-friendly appeal. While they may not directly challenge Hero MotoCorp's dominant motorcycle segment, they could nibble at their scooter market share and reshape urban commuting habits.

Consider the impact on Hero MotoCorp's scooter sales. For instance, in 2023, the Indian electric scooter market saw significant growth, with sales of electric two-wheelers reaching over 850,000 units, a substantial increase from previous years. This trend highlights a shift in consumer preference for shorter, urban commutes, where micro-mobility solutions can be a viable alternative.

- Growing Electric Scooter Market: The Indian electric two-wheeler market is expanding rapidly, with sales projected to continue their upward trajectory.

- Urban Commuting Shift: Consumers in metropolitan areas are increasingly seeking convenient and sustainable options for last-mile connectivity.

- Niche Threat to Scooters: While not a direct replacement for motorcycles, electric scooters and bikes can cannibalize sales in Hero MotoCorp's scooter segment.

- Environmental Consciousness: Increasing environmental awareness is driving demand for greener transportation alternatives.

Consumer Preference Shifts and Lifestyle Choices

Consumer preference shifts are a significant threat to Hero MotoCorp. A growing demand for sustainability and advanced connected features is pushing consumers towards alternative mobility solutions and different types of two-wheelers. For instance, by the end of 2024, the global electric two-wheeler market is projected to reach approximately $70 billion, indicating a strong shift in consumer interest.

The allure of traditional motorcycles might wane for certain demographics if electric or technologically superior alternatives provide a more compelling overall experience. This trend is evident as many urban commuters increasingly opt for electric scooters due to lower running costs and environmental consciousness. Hero MotoCorp is actively responding to this by expanding its product range and investing in the development of next-generation platforms, including electric vehicles.

- Growing Demand for Electric and Connected Mobility: Consumer interest in electric vehicles and vehicles with advanced connectivity features is on the rise.

- Potential Decline in Traditional Motorcycle Appeal: If alternatives offer a superior experience, the market share of traditional motorcycles could shrink.

- Hero MotoCorp's Strategic Response: The company is diversifying its portfolio and investing in future technologies to counter this threat.

- Market Data Supporting the Shift: The projected growth of the electric two-wheeler market underscores the changing consumer landscape.

The threat of substitutes for Hero MotoCorp is multifaceted, encompassing electric two-wheelers, public transport, ride-sharing, and even entry-level cars. The burgeoning electric two-wheeler market, projected to reach significant sales figures in fiscal year 2025, presents a direct challenge due to environmental benefits and lower running costs. Urban commuters also increasingly turn to efficient public transport networks, which saw continued expansion in many Indian cities during 2024, and convenient ride-sharing services that facilitate millions of daily trips.

| Substitute Category | Key Drivers | Impact on Hero MotoCorp |

| Electric Two-Wheelers (e2W) | Environmental consciousness, lower running costs, battery tech advancements | Direct competition, potential market share erosion in scooter segment |

| Public Transportation | Cost-effectiveness, urban network expansion (e.g., metro lines in 2024) | Reduced demand for commuter two-wheelers in urban areas |

| Ride-Sharing Services | Convenience, affordability for short trips, app-based solutions | Cannibalization of sales for occasional two-wheeler use |

| Entry-Level Cars | Rising disposable incomes, demand for safety and comfort | Potential shift for family transport needs, especially in semi-urban/rural areas |

Entrants Threaten

The threat of new entrants in the two-wheeler manufacturing sector, particularly concerning Hero MotoCorp, is significantly mitigated by the sheer magnitude of capital required. Establishing a presence demands hefty investments in research and development, sophisticated manufacturing plants, and a widespread distribution and service network. For instance, setting up a modern automotive manufacturing facility can easily run into hundreds of millions of dollars, a figure that presents a formidable hurdle for aspiring newcomers.

Hero MotoCorp, with its long-standing operational history, has cultivated substantial economies of scale. This means their cost per unit is considerably lower due to high production volumes. In 2023-24, Hero MotoCorp reported a production volume of over 5 million units, a testament to their established manufacturing prowess. This scale allows them to offer competitive pricing, making it exceedingly difficult for new entrants to match their cost efficiency and production capacity from the outset, thereby deterring many potential competitors.

Hero MotoCorp's deeply entrenched brand loyalty and vast distribution network present a significant hurdle for new entrants. For instance, as of the fiscal year ending March 31, 2024, Hero MotoCorp maintained a robust presence with over 6,000 customer touchpoints across India, a testament to decades of building trust and accessibility, especially in rural markets.

New players would need to invest heavily in marketing and time to replicate this level of market penetration and customer confidence. The sheer scale of Hero's established reach, covering approximately 90% of India's total serviceable rural market, makes it exceptionally difficult for newcomers to gain comparable traction and brand recognition.

The Indian automotive sector faces a dynamic regulatory landscape, with frequent updates to emission standards like BS-VI (Bharat Stage VI) and stringent safety regulations. For instance, the implementation of BS-VI norms in April 2020 required substantial investment in new engine technologies for all manufacturers.

New entrants must contend with these complex compliance frameworks and the substantial capital expenditure involved in meeting them, creating a significant barrier. These costs can include R&D for cleaner technologies and upgrades to manufacturing processes.

Established players like Hero MotoCorp, with their existing infrastructure and financial strength, are better positioned to absorb and adapt to these evolving regulatory demands. Their experience in navigating past regulatory shifts provides a competitive advantage.

Emergence of EV Startups and Niche Players

The electric vehicle (EV) sector presents a unique challenge to established players like Hero MotoCorp. While the automotive industry traditionally has high barriers to entry, the EV landscape has welcomed a surge of new startups and specialized companies. These newcomers often bypass legacy infrastructure and focus on cutting-edge technology, direct-to-consumer sales, and innovative battery solutions, rapidly capturing market share. For instance, by early 2024, several EV startups had achieved significant valuations and sales figures, demonstrating their disruptive potential.

Hero MotoCorp is actively addressing this threat by diversifying its approach. The company has launched its own electric mobility brand, VIDA, to directly compete in the burgeoning EV market. Furthermore, strategic investments and acquisitions in promising EV startups allow Hero MotoCorp to tap into new technologies and market segments more efficiently. This dual strategy aims to leverage emerging opportunities while safeguarding its position against agile, new competitors.

- EV Startups Gaining Traction: Companies like Ather Energy and Ola Electric have captured substantial market share in the Indian electric two-wheeler segment by early 2024, showcasing the vulnerability of traditional players to nimble innovators.

- Focus on Innovation and Digital Models: New entrants often excel in areas like software integration, battery swapping technology, and online sales channels, creating distinct competitive advantages.

- Hero MotoCorp's Strategic Response: The launch of VIDA and investments in EV startups are key initiatives to counter the threat of new entrants by building internal capabilities and acquiring external expertise.

Potential for International Manufacturers to Enter/Expand

The Indian two-wheeler market, while largely shaped by domestic giants like Hero MotoCorp, faces a latent threat from international manufacturers. Established global players could decide to increase their focus on India, or new international competitors might enter the fray. For instance, in 2023, the Indian automotive market saw significant interest from global manufacturers looking to tap into its vast consumer base, with several exploring partnerships or direct entry strategies.

However, the path for these foreign entrants is not straightforward. India's unique market dynamics, characterized by extreme price sensitivity and complex distribution networks, demand substantial investment and adaptation. Consumer preferences, often leaning towards fuel efficiency and specific feature sets, also present a hurdle that requires deep localization. For example, a new entrant would need to establish an extensive service and spare parts network, a significant undertaking in a country with diverse geographical challenges.

Despite these challenges, the sheer size of the Indian market, which sold over 15 million units in the two-wheeler segment in 2023, makes it an attractive proposition. International companies with strong technological capabilities and established global brands could potentially overcome these entry barriers with strategic planning and significant capital infusion. Hero MotoCorp itself is actively pursuing international markets, demonstrating its preparedness to compete on a global stage and potentially counter any increased international competition at home.

- Market Size: India's two-wheeler market surpassed 15 million units in sales in 2023.

- Localization Needs: Foreign entrants must adapt to price sensitivity, distribution, and consumer preferences.

- Competitive Landscape: Domestic players have established strong footholds, creating barriers for new entrants.

- Global Ambitions: Hero MotoCorp's international expansion can serve as a competitive advantage against foreign rivals.

The threat of new entrants for Hero MotoCorp is moderated by substantial capital requirements for manufacturing, R&D, and distribution, alongside significant economies of scale. Hero's production of over 5 million units in 2023-24 highlights its cost advantage, making it difficult for newcomers to compete on price.

Additionally, Hero's extensive network of over 6,000 customer touchpoints as of March 2024 and deep brand loyalty, particularly in rural markets covering 90% of the serviceable area, create formidable barriers.

Navigating stringent regulations like BS-VI norms, which necessitated significant investment in cleaner technologies by April 2020, further deters new players who lack established infrastructure and financial resilience.

The burgeoning EV sector presents a unique challenge, with startups like Ather Energy and Ola Electric capturing market share by early 2024 through innovation and digital models. Hero's response includes launching VIDA and investing in EV startups to counter this agile competition.

International manufacturers also pose a threat, though India's price sensitivity and complex distribution require significant adaptation. The Indian two-wheeler market, exceeding 15 million units sold in 2023, remains attractive, but domestic players' established presence offers a strong defense.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hero MotoCorp is built upon a foundation of robust data, including their annual reports, investor presentations, and filings with regulatory bodies. We also incorporate insights from reputable industry analysis firms and macroeconomic data to provide a comprehensive view of the competitive landscape.