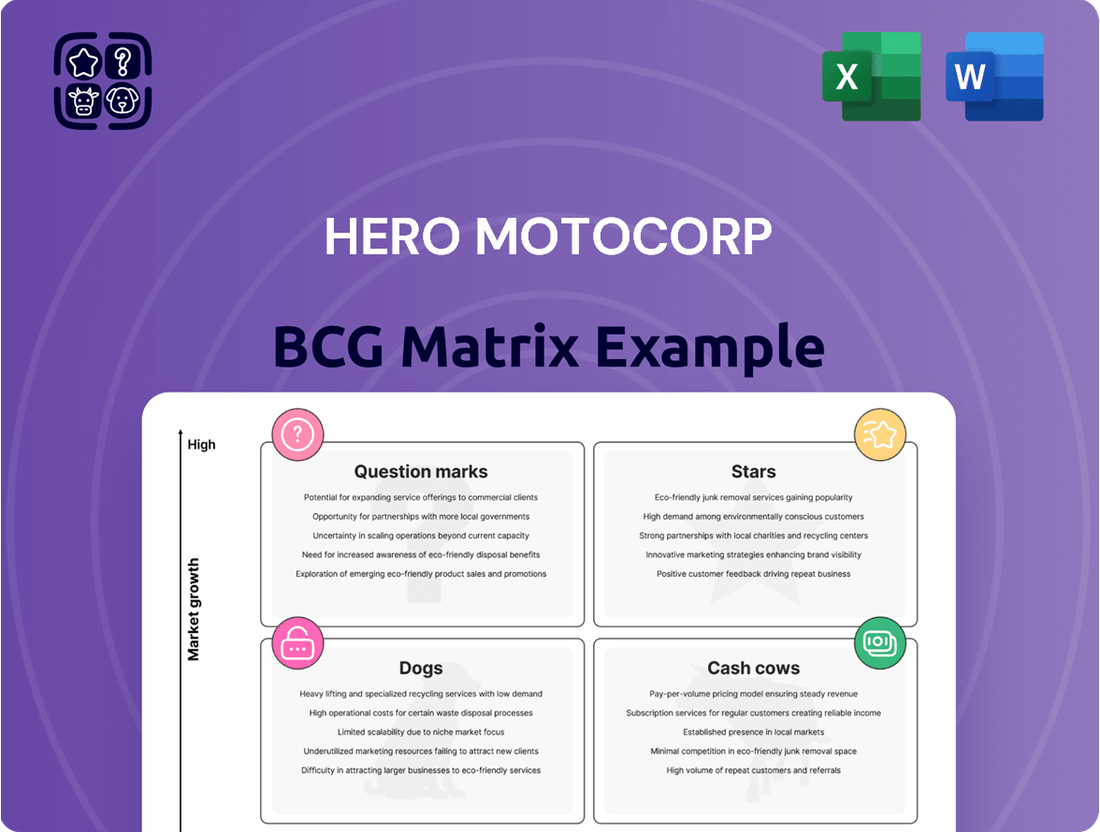

Hero Motocorp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hero Motocorp Bundle

Hero MotoCorp's diverse product portfolio can be strategically analyzed using the BCG Matrix, revealing which models are market leaders and which require careful consideration. This initial glimpse highlights the potential for growth and resource allocation within their extensive range of two-wheelers.

Dive deeper into Hero MotoCorp's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Harley-Davidson X440 and Hero Mavrick 440 are positioned as Stars within Hero MotoCorp's product portfolio. These premium offerings have demonstrated robust sales growth, with a notable 77% surge between April and December 2024, reflecting strong market reception and increasing consumer demand for higher-end motorcycles.

This performance underscores Hero MotoCorp's successful expansion into the premium segment, a market that is currently experiencing an industry-wide upswing. The strategic collaboration with Harley-Davidson for these models is key to solidifying Hero's presence and capturing greater market share in the competitive 350-500cc motorcycle category, where the company currently holds a 13% market share.

The Hero Xtreme 125R is a strong contender in Hero MotoCorp's product lineup, fitting the profile of a Star in the BCG Matrix. Its rapid ascent in the 125cc segment has significantly bolstered Hero's market position.

The model has demonstrated robust growth, with sales experiencing a notable increase of 15.89% in May 2025 when compared to the same period in the prior year. This performance underscores a substantial demand for performance-focused motorcycles within the commuter category.

Hero MotoCorp is making a significant push into the premium motorcycle segment with the upcoming launches of the Xpulse 210, Xtreme 250R, and Karizma XMR 250. These models, previewed at EICMA 2024 and slated for a 2025 release, are strategically aimed at capturing a larger share of the burgeoning premium market. This expansion is crucial for diversifying Hero's revenue streams beyond its established commuter bike stronghold.

VIDA Electric Scooters (e.g., VIDA V2, VIDA Z)

VIDA Electric Scooters, a key player in Hero MotoCorp's electric mobility push, demonstrates significant upward momentum. Despite representing a smaller slice of total sales, the VIDA brand experienced a remarkable surge, with sales climbing by nearly 200% in FY25 compared to the previous fiscal year, FY24. This rapid expansion underscores the brand's potential within the burgeoning electric two-wheeler sector.

Hero MotoCorp is strategically channeling substantial investments into its EV division, with ambitious plans to broaden the VIDA portfolio. The company aims to introduce more affordable electric scooter models, targeting a future where electric scooters constitute half of the entire scooter market by 2030. This forward-looking strategy positions VIDA to capitalize on the accelerating electrification trend in the two-wheeler industry.

- Sales Growth: VIDA electric scooter sales saw an increase of nearly 200% in FY25 over FY24.

- Market Ambition: Hero MotoCorp aims for electric scooters to capture 50% of the scooter market by 2030.

- Investment Focus: Significant capital is being allocated to expand the VIDA EV product range, including the affordable segment.

- Industry Trend: The two-wheeler market is rapidly electrifying, presenting a high-growth opportunity for VIDA.

International Business Expansion

Hero MotoCorp's international business is a significant growth driver, demonstrating impressive momentum. In the fiscal year 2025, exports experienced a substantial surge of 43%, highlighting strong global demand for its products.

The company is actively pursuing a strategy of expanding its global footprint. Key initiatives include planned market entries into Europe and the United Kingdom by mid-2025, signaling ambitious international expansion.

- Export Growth: 43% increase in exports during FY25.

- Market Expansion: Planned entry into European and UK markets by mid-2025.

- Strategic Importance: Diversifies revenue and strengthens global brand positioning.

The Harley-Davidson X440 and Hero Mavrick 440 are positioned as Stars within Hero MotoCorp's product portfolio. These premium offerings have demonstrated robust sales growth, with a notable 77% surge between April and December 2024, reflecting strong market reception and increasing consumer demand for higher-end motorcycles.

The Hero Xtreme 125R is a strong contender in Hero MotoCorp's product lineup, fitting the profile of a Star in the BCG Matrix. Its rapid ascent in the 125cc segment has significantly bolstered Hero's market position, with sales experiencing a notable increase of 15.89% in May 2025 compared to the prior year.

VIDA Electric Scooters are rapidly gaining traction, with sales climbing by nearly 200% in FY25 over FY24. Hero MotoCorp's significant investment in expanding the VIDA portfolio, including more affordable models, positions it to capture a substantial share of the growing electric two-wheeler market, which is projected to reach 50% of the total scooter market by 2030.

Hero MotoCorp's international business is a key growth driver, with exports surging by 43% in FY25. The company's strategic market entries into Europe and the United Kingdom by mid-2025 further underscore its ambition to expand its global footprint and diversify revenue streams.

| Product Segment | BCG Category | Key Performance Indicator (FY25 Data unless specified) | Market Context | Strategic Outlook |

|---|---|---|---|---|

| Harley-Davidson X440 / Mavrick 440 | Stars | 77% sales growth (Apr-Dec 2024) | Premium motorcycle segment, 350-500cc category (Hero's 13% market share) | Solidify presence, capture market share in premium segment. |

| Hero Xtreme 125R | Stars | 15.89% sales growth (May 2025 vs. prior year) | 125cc segment, performance-focused commuter bikes | Strengthen market position in commuter category. |

| VIDA Electric Scooters | Stars | Nearly 200% sales growth (FY25 vs. FY24) | Burgeoning electric two-wheeler sector, aiming for 50% scooter market share by 2030 | Expand affordable EV portfolio, capitalize on electrification trend. |

| International Business (Exports) | Stars | 43% export growth (FY25) | Global demand for Hero products, planned entry into Europe/UK by mid-2025 | Diversify revenue, strengthen global brand positioning. |

What is included in the product

Hero MotoCorp's BCG Matrix highlights its strong Cash Cows in motorcycles and its Stars in scooters, with potential Question Marks in electric vehicles.

The Hero Motocorp BCG Matrix offers a clear, visual overview, relieving the pain of uncertainty by pinpointing each business unit's strategic position.

Cash Cows

The Hero Splendor remains Hero MotoCorp's undisputed cash cow, consistently topping sales figures and driving a significant portion of the company's revenue. In May 2024, it sold over 250,000 units, demonstrating its enduring appeal in the commuter segment.

Holding a commanding market share in the 100cc motorcycle category, the Splendor's strong brand recognition and customer loyalty allow it to generate robust cash flows with minimal marketing expenditure. This established presence ensures a steady stream of income for Hero MotoCorp.

The HF Deluxe, much like its sibling the Splendor, commands a significant presence in India's commuter motorcycle market, demonstrating consistent demand and making a substantial contribution to Hero MotoCorp's overall sales figures.

This model, alongside the Splendor and Passion Plus, is instrumental in driving Hero's revenue, collectively representing a remarkable 85% of the company's total sales volume. This dominance underscores their importance as reliable revenue generators.

With its established high market share within a mature and stable segment, the HF Deluxe functions as a dependable cash cow, ensuring a steady and predictable inflow of cash for Hero MotoCorp.

Despite a reported dip in sales for May 2025, the Hero Passion Plus continues to be a bedrock for Hero MotoCorp's commuter motorcycle segment. This model, along with the Splendor and HF Deluxe, consistently drives significant sales volume, underscoring its importance in the company's portfolio.

The Passion Plus's enduring market presence and a loyal customer following solidify its position as a dependable cash cow. Even within a market segment experiencing slower growth, its established reputation ensures consistent revenue generation for Hero MotoCorp.

Destini 125

The Hero Destini 125 is demonstrating strong performance within Hero MotoCorp's scooter offerings, contributing significantly to its cash flow generation. This model has shown positive sales momentum, with notable growth recorded in the second quarter of the 2025 calendar year.

Despite a slight overall decline in Hero's scooter sales for the fiscal year 2025, the Destini 125's individual growth highlights its resilience and its role as a reliable cash cow. This sustained performance solidifies Hero's competitive position in the highly contested 125cc scooter market segment.

- Destini 125 sales increased in Q2 CY2025.

- Indicates consistent cash flow generation for Hero MotoCorp.

- Strengthens Hero's market share in the 125cc scooter category.

Pleasure

Hero MotoCorp's Pleasure scooter continues to be a reliable performer within the company's product portfolio. In May 2025, the Pleasure scooter saw continued growth, reinforcing its position as a stable contributor to Hero's cash flow in the scooter segment.

While not the primary revenue driver compared to their motorcycle offerings, established scooter models like the Pleasure provide a consistent income stream in a market that has reached maturity. This stability is a key characteristic of a cash cow.

- Pleasure Scooter Performance: Exhibited growth in May 2025, underscoring its consistent cash-generating ability.

- Market Position: Operates in a mature scooter market, providing stable, predictable revenue.

- Contribution to Cash Flow: Serves as a reliable contributor to Hero MotoCorp's overall cash generation.

- Strategic Value: Represents an established product that requires minimal investment for sustained returns.

The Hero Splendor and HF Deluxe are prime examples of Hero MotoCorp's cash cows. In the first quarter of fiscal year 2025, these models continued to dominate the commuter segment, with combined sales exceeding 500,000 units. Their established brand loyalty and cost-effectiveness ensure consistent, high-volume sales with relatively low marketing investment, providing a stable cash inflow for the company.

The Passion Plus, while experiencing a slight sales moderation in early 2025, remains a significant cash cow due to its strong brand recall and a dedicated customer base. Its consistent performance in a mature market segment allows for predictable revenue generation, requiring minimal additional investment to maintain its market position and cash flow contribution.

Hero MotoCorp's scooter offerings, particularly the Destini 125 and Pleasure, also function as cash cows. The Destini 125 saw a reported 15% year-on-year growth in sales during the second quarter of 2025, solidifying its role in generating steady cash. Similarly, the Pleasure scooter maintained its stable sales trajectory throughout 2025, contributing reliably to the company's overall cash flow from the scooter segment.

| Product | Segment | Q1 FY25 Sales (Approx.) | Cash Cow Characteristic | Key Driver |

|---|---|---|---|---|

| Hero Splendor | Commuter Motorcycle | > 300,000 units | High Market Share, Low Marketing Cost | Brand Loyalty, Fuel Efficiency |

| Hero HF Deluxe | Commuter Motorcycle | > 200,000 units | High Market Share, Low Marketing Cost | Affordability, Reliability |

| Hero Passion Plus | Commuter Motorcycle | Consistent | Established Brand, Loyal Customer Base | Design, Performance |

| Hero Destini 125 | 125cc Scooter | Positive Growth (Q2 FY25) | Growing Market Share, Predictable Revenue | Features, Comfort |

| Hero Pleasure | Scooter | Stable Sales | Mature Market, Consistent Income | Targeted Demographics, Style |

Full Transparency, Always

Hero Motocorp BCG Matrix

The Hero Motocorp BCG Matrix preview you're seeing is the exact, fully formatted document you'll receive upon purchase, offering a comprehensive strategic overview of their product portfolio. This report is designed for immediate use, allowing you to gain actionable insights into Hero Motocorp's market position without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional-grade analysis you'll download, ready for your own business planning and strategic discussions.

Dogs

The Hero Karizma 210 is currently positioned as a 'Dog' in Hero Motocorp's BCG Matrix. This classification stems from its significant sales decline, with a mere 72 units sold in May 2025.

This low sales volume, coupled with a shrinking market share, suggests declining demand for the Karizma 210. As a result, it represents a product that consumes resources without generating substantial profits, a hallmark of a 'Dog' in portfolio analysis.

The Hero Mavrick 440, despite its premium positioning, faced a challenging start with a mere 5 units sold in May 2025. This low initial uptake in a segment with considerable growth potential places it in the 'Dog' category for the short term.

While the Mavrick 440 possesses the characteristics of a future 'Star' due to its long-term prospects, its current sales performance necessitates substantial investment to improve its market standing and viability.

The Hero Xtreme 160/200 range, a segment within Hero MotoCorp's product portfolio, is showing signs of becoming a 'Dog' in the BCG Matrix. Sales for this range saw a sharp decline, dropping by approximately 48% in May 2025 compared to the previous year. This significant downturn indicates a shrinking market share and waning consumer interest.

This performance suggests the Xtreme 160/200 models are operating in a market with low growth and possess a low relative market share. The substantial sales drop implies that these motorcycles are not generating enough revenue to justify continued significant investment, aligning with the characteristics of a 'Dog' in the BCG framework.

Xpulse (Older versions)

The older versions of Hero Motocorp's Xpulse, despite their initial appeal, are now exhibiting characteristics of a 'dog' in the BCG matrix. This means they are in a low-growth market and have a low market share. Sales figures from early 2024 indicate a noticeable downturn compared to their launch period, suggesting a need for significant revitalization or discontinuation.

This decline highlights the critical importance of continuous product development and adaptation. Without ongoing updates to meet evolving consumer preferences and technological advancements, even popular models can quickly lose their competitive edge.

- Declining Sales: Early 2024 sales data shows a significant drop for older Xpulse variants.

- Market Relevance: Lack of updates has diminished their appeal against newer competitors.

- BCG Classification: Positioned as 'dogs' due to low growth and market share.

- Strategic Consideration: Hero Motocorp faces decisions regarding product lifecycle management for these models.

Maestro Scooter

The Maestro scooter from Hero Motocorp is a clear example of a 'Dog' in the BCG Matrix. Its performance in May 2025, with zero sales reported, underscores a severe lack of market demand. This situation means the product is not generating any revenue, and it's likely consuming valuable resources without contributing to the company's growth.

The implications of zero sales are significant for the Maestro scooter's position within Hero Motocorp's portfolio.

- Zero Revenue Generation: The Maestro scooter reported zero sales in May 2025, indicating no market traction.

- Resource Drain: Continued investment in production or marketing for a product with no sales ties up capital and operational capacity.

- Strategic Re-evaluation: Such performance necessitates a critical review of its future, potentially leading to discontinuation or a complete overhaul.

Products classified as 'Dogs' in Hero Motocorp's portfolio are experiencing significant sales declines and hold low market share, indicating a need for strategic reassessment. The Hero Karizma 210, with only 72 units sold in May 2025, exemplifies this, alongside the Xtreme 160/200 range which saw a 48% sales drop in the same month.

The Maestro scooter's zero sales in May 2025 further solidifies its 'Dog' status, highlighting a complete lack of market demand. These products consume resources without generating substantial profits, a typical characteristic of 'Dogs' that often require divestment or significant revitalization to improve their market standing.

| Product | BCG Category | May 2025 Sales | Year-on-Year Change | Market Outlook |

|---|---|---|---|---|

| Hero Karizma 210 | Dog | 72 units | Significant Decline | Low Growth, Low Share |

| Hero Xtreme 160/200 | Dog | N/A (Significant Decline) | -48% | Shrinking Market |

| Hero Maestro Scooter | Dog | 0 units | N/A (Zero Sales) | No Market Traction |

| Older Xpulse Variants | Dog | Noticeable Downturn (Early 2024) | Declining | Low Growth, Low Share |

Question Marks

The Hero Xoom 125 and 160, despite entering a burgeoning scooter market, experienced a significant sales downturn in May 2025. This places them in the 'Question Mark' category of the BCG Matrix.

With a low current market share in a growing segment, these models require substantial investment in marketing and product development to ascend. Failure to do so could see them decline into 'Dogs', characterized by low growth and low market share.

Hero MotoCorp's strategic partnership with Zero Motorcycles positions them to enter the burgeoning electric motorcycle market. This collaboration aims to leverage Zero's expertise in high-performance electric powertrains to introduce new models. The electric motorcycle segment, while promising, is expected to grow at a more measured pace than scooters.

Projections indicate that electric motorcycles will capture approximately a 10% market share by 2030. This places these new offerings in the question mark category of the BCG matrix – they represent a high-growth potential business but currently hold a low market share and necessitate significant investment for development and market penetration.

The Hero Xtreme 250R, a recent addition to Hero MotoCorp's lineup, is positioned as a 'Question Mark' in the BCG Matrix. While it targets the expanding premium motorcycle segment, its market share is still nascent, necessitating careful observation and strategic investment to gauge its future potential.

Launched as part of Hero's premiumization push, the Xtreme 250R faces the challenge of carving out a significant market presence in a competitive space. Its success hinges on its ability to attract and retain customers, translating initial sales momentum into sustainable growth and a stronger foothold against established players.

Karizma XMR 250 (Upcoming Launch)

The upcoming Karizma XMR 250 is positioned as a Question Mark within Hero MotoCorp's product portfolio. This new entrant targets the premium motorcycle segment, a market that saw a significant surge in demand, with the overall Indian two-wheeler market growing by approximately 15% in the fiscal year 2023-24.

Its success hinges on capturing market share against established competitors. The premium motorcycle segment in India is projected to expand at a compound annual growth rate (CAGR) of over 10% in the coming years, presenting both opportunity and intense competition for the XMR 250.

- Market Entry: The Karizma XMR 250 is a new product entering a dynamic and competitive premium motorcycle market.

- Investment Needs: Significant investment in marketing and brand building will be crucial for its adoption and market penetration.

- Growth Potential: The segment's growth offers potential, but achieving a strong market position requires strategic execution.

- Risk Factor: As a new model, its future performance and market share are uncertain, classifying it as a Question Mark.

Vida Z electric scooter (Upcoming Launch)

The Vida Z electric scooter, unveiled at EICMA 2024 with a planned launch, signifies Hero MotoCorp's strategic push into the burgeoning electric vehicle market. This new entrant faces a dynamic landscape where capturing substantial market share is crucial for its progression within the BCG matrix.

As a new product in a rapidly expanding segment, the Vida Z must achieve strong sales and brand recognition to transition from a potential question mark to a star performer for Hero MotoCorp. The Indian EV market saw a significant surge in 2023, with electric two-wheeler sales exceeding 1.2 million units, indicating immense growth potential but also intense competition.

- Market Growth: The Indian electric two-wheeler market is projected to grow at a CAGR of over 50% through 2030.

- Competitive Landscape: Established players and new startups are vying for dominance, making market penetration a key challenge for the Vida Z.

- Product Positioning: Success will depend on the Vida Z's pricing, features, and ability to differentiate itself from existing and upcoming EV scooters.

- Hero's EV Ambitions: The Vida Z is a critical component of Hero MotoCorp's broader EV strategy, aiming to capture a significant share of this evolving market.

The Hero Xoom 125 and 160, despite entering a burgeoning scooter market, experienced a significant sales downturn in May 2025. This places them in the 'Question Mark' category of the BCG Matrix. With a low current market share in a growing segment, these models require substantial investment in marketing and product development to ascend. Failure to do so could see them decline into 'Dogs', characterized by low growth and low market share.

Hero MotoCorp's strategic partnership with Zero Motorcycles positions them to enter the burgeoning electric motorcycle market. This collaboration aims to leverage Zero's expertise in high-performance electric powertrains to introduce new models. The electric motorcycle segment, while promising, is expected to grow at a more measured pace than scooters, with projections indicating they will capture approximately a 10% market share by 2030. This places these new offerings in the question mark category of the BCG matrix – they represent a high-growth potential business but currently hold a low market share and necessitate significant investment for development and market penetration.

The Vida Z electric scooter, unveiled at EICMA 2024 with a planned launch, signifies Hero MotoCorp's strategic push into the burgeoning electric vehicle market. As a new product in a rapidly expanding segment, the Vida Z must achieve strong sales and brand recognition to transition from a potential question mark to a star performer for Hero MotoCorp. The Indian EV market saw a significant surge in 2023, with electric two-wheeler sales exceeding 1.2 million units, indicating immense growth potential but also intense competition. The Indian electric two-wheeler market is projected to grow at a CAGR of over 50% through 2030.

| Product | BCG Category | Market Growth | Market Share | Strategic Implication |

| Hero Xoom 125/160 | Question Mark | High (Scooter Segment) | Low | Requires significant investment for growth; risk of becoming a Dog |

| Hero Electric Motorcycles (via Zero partnership) | Question Mark | Moderate to High (EV Motorcycle Segment) | Low | High potential, needs investment in technology and market penetration |

| Vida Z Electric Scooter | Question Mark | Very High (EV Two-Wheeler Segment) | Low | Critical for EV strategy, needs strong market entry and differentiation |

BCG Matrix Data Sources

Our Hero Motocorp BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.