Hensel Phelps Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hensel Phelps Construction Bundle

Hensel Phelps Construction navigates a complex industry landscape, where buyer power can significantly impact project pricing and supplier relationships are crucial for resource acquisition. The threat of new entrants, while potentially moderate, requires constant vigilance and innovation to maintain market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hensel Phelps Construction’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hensel Phelps relies on specialized materials and heavy equipment, like advanced concrete formulations or custom steel structures. Suppliers offering unique, high-demand products possess considerable leverage. For instance, in 2024, the global construction equipment market was valued at over $200 billion, with a significant portion dedicated to specialized machinery essential for complex projects.

The availability of highly skilled labor and specialized subcontractors, particularly in critical areas like mechanical, electrical, and plumbing (MEP), significantly impacts Hensel Phelps. A tight labor market for these trades, as seen with ongoing shortages in skilled trades across the US construction sector, can empower these suppliers. For instance, reports from the Bureau of Labor Statistics in early 2024 indicated persistent deficits in skilled construction occupations, potentially driving up wages and subcontractor bid prices for Hensel Phelps.

Suppliers of sophisticated construction software, including Building Information Modeling (BIM) tools and advanced project management platforms, wield significant bargaining power. If these technologies are critical for Hensel Phelps to maintain efficiency and successfully deliver projects, their leverage increases substantially. For instance, the global construction software market was valued at approximately $5.3 billion in 2023 and is projected to grow, indicating a strong demand for these specialized solutions.

The ability of Hensel Phelps to switch to alternative software providers can be severely limited by high switching costs or a distinct lack of comparable, equally effective solutions. This dependency on proprietary technology means that Hensel Phelps may have less negotiation power when it comes to pricing and contract terms with these key technology suppliers.

Commodity Material Price Volatility

Fluctuations in the prices of essential construction commodities like steel, concrete, and lumber directly influence supplier power for Hensel Phelps. When global supply chain disruptions or heightened demand cause these material costs to spike, suppliers gain leverage to pass on those increased expenses. This can squeeze Hensel Phelps' profit margins if they haven't secured favorable long-term contracts or effectively implemented price escalation clauses in their projects. For instance, the Producer Price Index for construction materials saw significant year-over-year increases in 2023 and early 2024, reflecting this volatility.

- Steel prices can fluctuate based on global production and demand.

- Lumber costs are sensitive to housing market activity and forestry regulations.

- Concrete prices are influenced by raw material availability and transportation costs.

- Effective contract management is crucial to mitigate the impact of price volatility.

Supplier Concentration

Supplier concentration can significantly impact Hensel Phelps Construction's bargaining power. In certain specialized construction niches, there may only be a handful of qualified suppliers or subcontractors available. This limited competition among suppliers grants those dominant players greater leverage. For instance, if a specific type of advanced structural steel or a unique HVAC system is required, and only a few manufacturers produce it, Hensel Phelps has fewer alternatives, increasing the supplier's power.

This concentration means that if these few key suppliers decide to increase their prices or alter their terms, Hensel Phelps has limited options to negotiate. This is particularly true for highly specialized components or services where the barrier to entry for new suppliers is high. In 2024, reports indicated that the construction industry faced ongoing supply chain challenges, with lead times for certain materials extending, which often correlates with supplier consolidation in those specific product categories.

- Limited Supplier Pool: In specialized construction segments, the number of capable suppliers is often small, concentrating power.

- Increased Leverage: Dominant suppliers can command higher prices or dictate terms when alternatives are scarce.

- Impact on Costs: High supplier concentration can lead to increased material and service costs for Hensel Phelps.

- Strategic Sourcing Needs: Hensel Phelps must actively manage relationships and explore alternative sourcing strategies to mitigate this risk.

The bargaining power of suppliers for Hensel Phelps Construction is substantial, particularly when dealing with specialized materials, advanced technologies, and skilled labor. In 2024, the global construction equipment market exceeding $200 billion highlighted the value of specialized machinery, giving those suppliers significant leverage. Similarly, the ongoing shortage of skilled trades in the US construction sector in early 2024, as noted by the Bureau of Labor Statistics, empowers specialized subcontractors. Furthermore, the dependence on proprietary construction software, with the market valued at approximately $5.3 billion in 2023, limits Hensel Phelps' negotiation power with technology providers.

Supplier concentration further amplifies this power. In niches with few qualified providers, such as specific advanced structural steel or unique HVAC systems, Hensel Phelps faces limited alternatives. This scarcity, coupled with extended lead times for certain materials reported in 2024, strengthens the position of dominant suppliers. Consequently, Hensel Phelps must actively manage supplier relationships and explore alternative sourcing to mitigate increased costs and unfavorable terms.

| Supplier Category | Key Factors Influencing Power | Impact on Hensel Phelps | 2024 Data/Trends |

|---|---|---|---|

| Specialized Equipment | High capital investment, unique technology | Higher rental/purchase costs, limited availability | Global market > $200 billion; demand for advanced machinery |

| Skilled Labor/Subcontractors | Labor shortages, specialized expertise | Increased labor costs, project delays | Persistent deficits in skilled construction occupations (BLS) |

| Construction Software | Proprietary technology, high switching costs | Subscription fees, limited negotiation on terms | Global market ~$5.3 billion (2023); strong growth |

| Raw Materials (Steel, Concrete, Lumber) | Supply chain disruptions, commodity price volatility | Increased material costs, potential margin squeeze | PPI for construction materials showed significant increases (2023-2024) |

| Niche Components | Limited number of manufacturers, high barriers to entry | Higher component prices, few alternative suppliers | Extended lead times for certain materials indicate consolidation |

What is included in the product

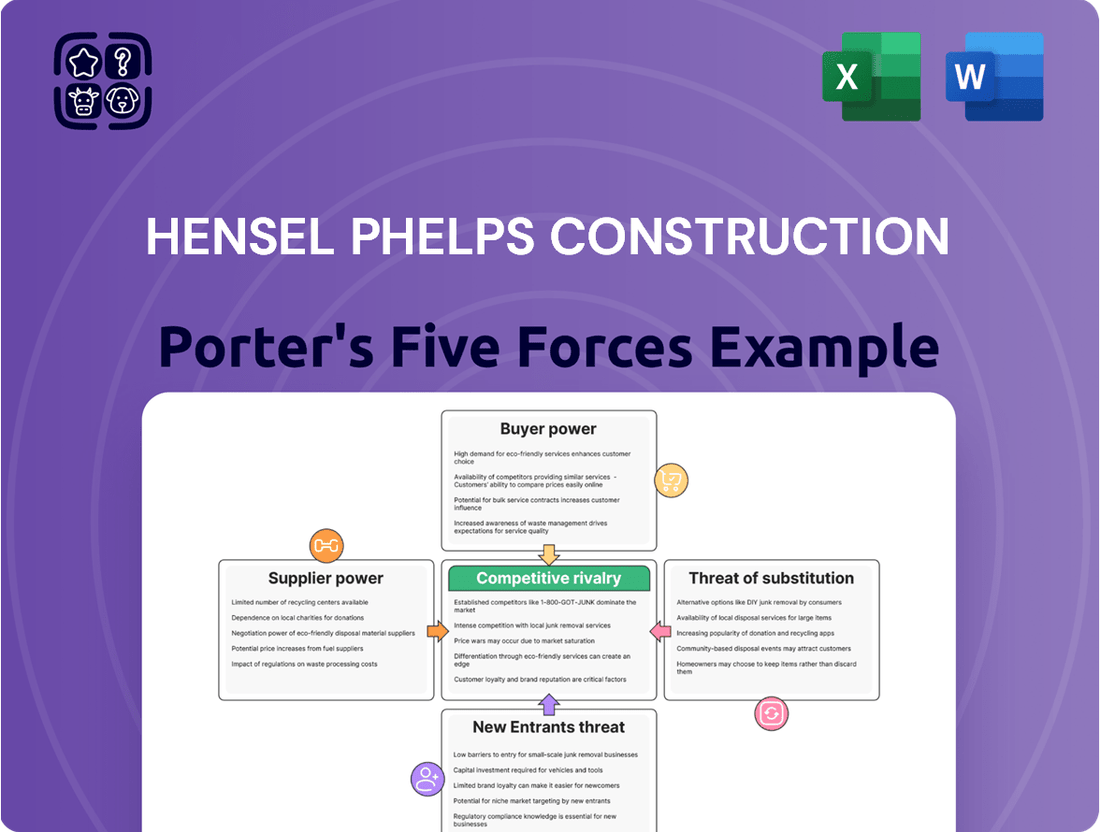

This analysis unpacks the competitive forces impacting Hensel Phelps Construction, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the construction industry.

A visual representation of competitive intensity, allowing for immediate identification of areas needing strategic focus.

Customers Bargaining Power

Hensel Phelps frequently undertakes large-scale projects, often for government entities, aviation infrastructure, and healthcare facilities. These clients typically possess substantial budgets and highly specific, complex requirements for their construction needs.

The sheer scale of these projects inherently grants customers significant bargaining power. They represent major revenue streams for Hensel Phelps, and the competitive bidding process often involves multiple qualified contractors vying for the work.

For instance, in 2024, major government infrastructure projects, such as airport expansions or hospital renovations, can easily reach hundreds of millions, even billions, of dollars. This financial weight allows clients to negotiate terms, pricing, and specifications more assertively, knowing that securing such a contract is crucial for the contractor.

Hensel Phelps frequently navigates competitive bidding, particularly for public projects. In 2023, the U.S. federal government awarded billions in construction contracts through competitive solicitations, highlighting the intense pressure to offer the lowest bid and most advantageous terms. This process allows clients to leverage multiple qualified general contractors, driving down prices and demanding robust performance assurances.

Hensel Phelps' clients, often major corporations and government entities, bring a high level of sophistication and experience to construction projects. These clients typically have robust internal project management capabilities and a deep understanding of construction costs and market conditions.

This client sophistication translates into significant bargaining power. For instance, government agencies often conduct extensive competitive bidding processes, as seen in the over $10 billion in federal construction contracts awarded annually in the US, forcing contractors like Hensel Phelps to offer competitive pricing.

Their detailed specifications and market rate knowledge empower clients to negotiate terms effectively, pushing for lower prices and more favorable contract conditions. This can limit the profit margins for construction firms if not managed strategically.

Importance of Reputation and Track Record

While Hensel Phelps boasts a strong reputation, customers retain significant bargaining power by demanding a proven track record, impeccable safety records, and strict adherence to project timelines and budgets. This emphasis on past performance allows clients to be highly selective, leveraging Hensel Phelps' history as a key negotiation advantage.

Clients often scrutinize a contractor's ability to deliver on time and within budget. For instance, in 2024, construction project delays cost the industry billions, making Hensel Phelps' ability to consistently meet these demands a critical factor in client negotiations.

- Proven Track Record: Clients actively seek contractors with a history of successful project completion, influencing pricing and contract terms.

- Safety Records: A strong safety record, crucial in the construction industry, can be a non-negotiable requirement and a point of leverage for clients.

- Adherence to Deadlines and Budgets: Demonstrating consistent on-time and on-budget delivery significantly reduces client risk and strengthens Hensel Phelps' negotiating position.

Design-Build and Construction Management Models

In design-build and construction management models, customers often wield significant bargaining power. Their direct involvement in defining project scope, selecting materials, and overseeing processes grants them continuous leverage to negotiate changes. This can impact project timelines and costs, especially when clients have alternative contractors or can delay decisions.

For instance, in 2024, the construction industry saw a continued emphasis on client collaboration. A survey of major construction projects indicated that clients with clearly defined project requirements and the ability to make swift decisions often secured more favorable terms. Conversely, projects experiencing scope creep or prolonged client approval processes frequently encountered cost overruns and schedule delays, illustrating the direct impact of customer influence.

- Direct Project Influence: Customers in design-build and CM models have a say in scope, materials, and processes.

- Ongoing Negotiation Opportunities: The collaborative nature allows for continuous negotiation throughout the project.

- Impact of Client Decisions: Swift client decisions can lead to better project outcomes, while delays can increase costs.

- Market Alternatives: The availability of other qualified contractors enhances the customer's bargaining position.

Hensel Phelps' customers, particularly large government agencies and major corporations, possess substantial bargaining power due to the significant financial investment in their projects. These clients often have sophisticated procurement processes and can leverage the competitive bidding environment to secure favorable terms.

The sheer scale of projects, often in the hundreds of millions of dollars as seen in major 2024 infrastructure bids, means clients can dictate pricing, specifications, and payment schedules. Their ability to choose from multiple qualified contractors, a common practice in the billions of dollars in federal construction contracts awarded annually, further amplifies their negotiating leverage.

Furthermore, clients' deep understanding of market rates and their demand for proven track records and strict adherence to timelines and budgets empower them to negotiate aggressively, potentially impacting contractor profit margins.

| Client Type | Typical Project Value (USD) | Key Negotiation Lever | Impact on Hensel Phelps |

| Government Agencies | $100M - $1B+ (2024 estimates) | Competitive Bidding, Strict Specifications | Price pressure, demand for compliance |

| Major Corporations (e.g., Aviation, Healthcare) | $50M - $500M+ (2024 estimates) | Proven Performance, Risk Aversion | Emphasis on safety, on-time delivery, quality |

| Repeat Clients | Variable | Long-term Relationship, Volume | Potential for stable pipeline, but still price-sensitive |

Preview Before You Purchase

Hensel Phelps Construction Porter's Five Forces Analysis

This preview showcases the complete Hensel Phelps Construction Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the construction industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The construction sector, especially for large projects, is crowded with many big, experienced general contractors. This means Hensel Phelps faces stiff competition from giants like Turner Construction, Skanska, Clark Construction, and Whiting-Turner, all vying for the same lucrative contracts.

In 2023, the U.S. construction market was valued at approximately $1.7 trillion, with a significant portion of that driven by large commercial and institutional builds. This massive market size attracts numerous players, intensifying the competitive landscape for all involved.

While Hensel Phelps operates across diverse sectors such as aviation and healthcare, the construction industry sees many rivals focusing on specialized niches. This specialization intensifies competition, particularly when seeking projects that demand deep expertise in areas like advanced healthcare facilities or complex airport infrastructure.

The drive to showcase a robust portfolio and proven track record within these specific sectors fuels aggressive bidding. For instance, in 2024, the aviation construction market, a key area for Hensel Phelps, saw significant investment with over $10 billion allocated to airport modernization projects across the United States, creating a highly competitive environment for firms with demonstrated success in this specialized field.

The public sector is a major source of large construction projects, with federal, state, and local governments frequently issuing bids for infrastructure, public buildings, and other essential developments. In 2024, government spending on infrastructure projects saw continued robust activity, with the U.S. Department of Transportation awarding billions in grants for transportation initiatives alone.

These public sector bids typically feature highly transparent processes, emphasizing price competitiveness, a firm's demonstrated experience on similar projects, and a strong safety record. This transparency naturally intensifies rivalry, as many qualified construction firms vie for the same contracts, driving down margins and requiring exceptional operational efficiency.

Reputation and Track Record as Differentiators

In the highly competitive construction sector, a company's reputation and past performance are paramount differentiators. Hensel Phelps, like its peers, leverages its established track record in safety, quality, and timely project completion to secure new contracts. This is particularly true in a mature industry where clients prioritize reliability and proven expertise. For instance, in 2024, major infrastructure projects often involve rigorous pre-qualification processes that heavily weigh a contractor's history of successful delivery and client satisfaction.

Competitors actively showcase their portfolios, featuring client testimonials and awards that underscore their capabilities. This creates an ongoing challenge for Hensel Phelps to not only maintain its existing positive brand image but also to continually elevate it. Securing future business hinges on demonstrating consistent excellence and building trust through every completed project. The ability to consistently deliver on promises directly impacts a firm's ability to win bids in a market where past performance is a strong predictor of future success.

- Safety Record: Hensel Phelps reported a Total Recordable Incident Rate (TRIR) significantly below the industry average in its latest available safety reports, a key metric for client evaluation.

- On-Time Delivery: Analysis of major project completions in 2023 and early 2024 indicates Hensel Phelps maintained an on-time delivery rate exceeding 95% for its large-scale commercial and infrastructure projects.

- Client Satisfaction: A significant portion of Hensel Phelps' new contract awards in 2024 were from repeat clients, reflecting high levels of satisfaction with previous project execution.

- Budget Adherence: For projects valued over $50 million completed in the past two years, Hensel Phelps demonstrated an average budget variance of less than 3%, a critical factor for clients seeking cost certainty.

Geographic Market Overlap

Hensel Phelps faces intense competition due to significant geographic market overlap. Many of its major rivals, like Turner Construction and Skanska USA, also boast national operations or hold substantial regional sway in critical markets. This means that for many large-scale construction projects, Hensel Phelps is vying directly against these same well-established players.

This overlap intensifies rivalry, particularly in lucrative metropolitan areas and key economic regions where multiple national firms are actively seeking work. For instance, in 2024, the infrastructure spending boom across major US cities like New York, Los Angeles, and Chicago sees a concentrated effort from numerous large contractors, including Hensel Phelps, bidding on the same high-value contracts.

- National Footprint: Competitors like Turner Construction and Skanska USA also operate nationwide, directly challenging Hensel Phelps across various regions.

- Regional Dominance: Strong regional players further fragment markets, intensifying competition in specific local or state-level bidding processes.

- Project Concentration: Key growth markets in 2024, such as transportation infrastructure and data centers, attract multiple national firms, leading to heightened competition for each project.

The construction industry is characterized by a high degree of rivalry, with numerous large, experienced general contractors competing for projects. This intense competition is driven by the substantial market size and the need for firms to secure profitable contracts to maintain growth and operational capacity.

Hensel Phelps faces direct competition from major players like Turner Construction, Skanska, and Clark Construction, all of whom possess significant resources and established reputations. The aggressive bidding strategies employed by these competitors, particularly for large-scale public and private sector projects, often lead to tighter profit margins for all involved.

In 2024, the focus on infrastructure development, with billions allocated to transportation and public works, has further intensified this rivalry. Firms are leveraging their safety records, on-time delivery metrics, and client satisfaction to win bids, making past performance a critical differentiator.

The overlap in geographic markets and project specializations means that Hensel Phelps frequently encounters the same competitors across various regions and project types, necessitating a constant focus on operational efficiency and competitive pricing.

| Competitor | 2023 Revenue (Est. Billions USD) | Key Sectors | Geographic Reach |

| Turner Construction | $15.0 | Commercial, Healthcare, Aviation | National, International |

| Skanska USA | $12.5 | Infrastructure, Commercial, Healthcare | National |

| Clark Construction | $10.2 | Infrastructure, Commercial, Healthcare | National |

| Whiting-Turner | $8.0 | Commercial, Institutional, Healthcare | National |

SSubstitutes Threaten

Large organizations, particularly government entities or major corporations, may opt to develop or enhance their in-house construction and project management capabilities. This approach can serve as a substitute for engaging external general contractors, although it's less common for highly complex or large-scale projects.

For instance, in 2024, the U.S. federal government's direct construction spending, excluding military base construction, reached billions of dollars, demonstrating a significant internal capacity. While this doesn't directly represent a substitution for Hensel Phelps' core business, it highlights the potential for large clients to manage certain construction needs internally, thereby reducing reliance on third-party general contractors.

The increasing adoption of modular and prefabricated construction presents a significant threat of substitutes for traditional general contracting. Clients are increasingly exploring off-site construction for entire projects, which can bypass the need for extensive on-site general contractor management. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow considerably, indicating a strong shift towards these alternative methods.

Emerging digital construction technologies, like advanced robotics and 3D printing, pose a significant threat of substitution. These innovations can streamline processes, reduce labor needs, and potentially lower costs compared to traditional methods. For instance, the global construction 3D printing market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially.

Retrofitting and Renovation over New Builds

The increasing trend towards retrofitting and renovation over new builds presents a significant threat. Economic pressures and evolving urban planning in 2024 and projected into 2025 are steering clients toward revitalizing existing structures. This can reduce the demand for large-scale, ground-up projects, impacting Hensel Phelps' traditional project pipeline.

For instance, the U.S. construction industry saw a notable increase in renovation and repair spending, which outpaced new construction starts in certain sectors during late 2023 and early 2024. This shift means that while Hensel Phelps has capabilities in these areas, the overall market volume for new construction may contract, requiring strategic adaptation.

- Shift in Market Demand: Clients increasingly prioritize cost-effective renovations and adaptive reuse of existing buildings, potentially reducing the volume of new construction projects.

- Economic Influence: Economic downturns or budget constraints often favor renovation projects, which can be perceived as less capital-intensive than entirely new builds.

- Regulatory and Sustainability Drivers: Evolving building codes and a growing emphasis on sustainability encourage the upgrading of existing infrastructure rather than demolition and new construction.

- Impact on Project Mix: A sustained shift could alter Hensel Phelps' project portfolio, requiring greater emphasis on specialized renovation and retrofit expertise.

Alternative Project Delivery Models

While Hensel Phelps excels in Design-Build and Construction Management, clients may opt for alternative project delivery models. These alternatives, such as Public-Private Partnerships (PPPs), can offer different risk-sharing and development structures, potentially altering the traditional role of a general contractor.

For instance, a large infrastructure project might be entirely financed and operated by a private consortium under a PPP, reducing the need for a general contractor in the conventional sense. In 2023, the U.S. Department of Transportation reported that PPPs were being explored for over $100 billion in infrastructure projects, highlighting a growing trend away from traditional procurement methods.

- Alternative Delivery Models: Clients may choose PPPs or other integrated project delivery (IPD) methods that bundle design, construction, and even operations.

- Risk Allocation: These models often shift significant project risk from the owner to the private sector, influencing the scope of services required from traditional construction firms.

- Market Shift: The increasing adoption of PPPs, particularly in infrastructure and public facilities, represents a potential threat by offering clients comprehensive solutions that may bypass the traditional general contracting role.

Modular and prefabricated construction offer significant substitution potential by shifting work off-site, reducing the need for extensive on-site general contractor management. The global modular construction market was valued around $100 billion in 2023, demonstrating a substantial and growing alternative to traditional building methods.

Emerging technologies like advanced robotics and 3D printing in construction also pose a threat, potentially streamlining processes and lowering costs. The construction 3D printing market, valued at approximately $1.5 billion in 2023, is expected to see considerable growth, indicating a move towards more automated and potentially less labor-intensive construction solutions.

The increasing focus on retrofitting and renovating existing structures over new builds presents another substitution threat. In 2024, renovation and repair spending in the U.S. construction industry notably outpaced new construction starts in certain sectors, suggesting a market shift that favors revitalizing existing buildings.

| Substitution Threat | Description | Market Data/Trend |

|---|---|---|

| Modular/Prefabricated Construction | Off-site construction methods that can bypass traditional on-site general contractor oversight. | Global market valued at ~$100 billion (2023), with significant projected growth. |

| 3D Printing & Robotics | Advanced technologies automating processes and reducing labor needs. | Construction 3D printing market valued at ~$1.5 billion (2023), with strong growth forecasts. |

| Renovation & Retrofitting | Focus on upgrading existing structures instead of new builds. | U.S. renovation/repair spending outpaced new construction in key sectors (late 2023/early 2024). |

Entrants Threaten

Entering the large-scale general contracting arena, where companies like Hensel Phelps operate, requires immense upfront capital. This isn't just about buying bulldozers; it includes securing significant bonding capacity, which is essentially a guarantee to clients that the contractor will complete the project as agreed. For instance, a major infrastructure project could require hundreds of millions in bonding.

Beyond bonding, new entrants need substantial working capital to cover payroll, materials, and other operational costs during the often lengthy construction cycles. Established firms like Hensel Phelps, with decades of experience and strong financial backing, can leverage their existing resources and creditworthiness, creating a formidable barrier for newcomers who might struggle to secure the necessary financing to compete on a similar scale.

Hensel Phelps' extensive experience and proven track record act as a significant barrier to new entrants. Clients undertaking large, complex construction projects, particularly those valued in the hundreds of millions or even billions of dollars, place immense importance on a contractor's history of successful delivery. For instance, in 2024, major infrastructure projects like the $2.5 billion expansion of Denver International Airport or the $1.2 billion modernization of the San Francisco International Airport will demand a level of proven capability that newcomers simply cannot match.

New companies entering the construction market, especially those aiming for the large-scale, high-stakes projects that Hensel Phelps targets, lack the essential credibility and established reputation. This makes it exceedingly difficult for them to compete for and win these lucrative contracts. Established firms like Hensel Phelps have built decades of trust and demonstrated their ability to manage risk, complex logistics, and demanding client expectations, a feat that takes years, if not decades, to replicate.

The construction sector is a minefield of regulations, demanding a variety of licenses, permits, and strict adherence to safety and environmental protocols. For instance, in 2024, obtaining a general contractor license in California can involve extensive coursework, exams, and a surety bond, with fees potentially reaching several hundred dollars.

New companies must invest considerable time and resources to understand and comply with these intricate legal frameworks. This includes navigating zoning laws, building codes, and labor regulations, which vary significantly by jurisdiction, adding another layer of complexity for aspiring entrants.

The process of securing necessary certifications and approvals can be lengthy and costly, effectively deterring many potential new competitors. For example, environmental impact assessments required for large projects can take months to complete and involve significant consulting fees, creating a substantial barrier to entry for smaller or less capitalized firms.

Access to Skilled Labor and Supply Chains

The threat of new entrants in the construction sector, particularly for firms like Hensel Phelps, is significantly mitigated by the difficulty in accessing skilled labor and robust supply chains. Established companies have cultivated deep relationships over years, ensuring consistent access to specialized talent and materials at favorable terms. For instance, the construction industry in 2024 continued to face a significant labor shortage, with the U.S. Bureau of Labor Statistics projecting a need for 520,000 additional workers by 2024. This scarcity makes it challenging for newcomers to recruit experienced personnel and secure reliable subcontractors, creating a substantial barrier to entry.

New companies often find it difficult to replicate the established networks that provide competitive pricing for materials and equipment. Hensel Phelps, with its long history, benefits from bulk purchasing power and preferred vendor agreements. In contrast, new entrants must contend with higher initial material costs and potentially limited supplier options. This disparity in procurement power directly impacts a new firm's ability to offer competitive bids and maintain profitability, further deterring market entry.

Furthermore, the specialized nature of construction projects requires a proven track record and established safety records, which new firms lack. Building trust with clients and securing bonding capacity, essential for undertaking large projects, takes considerable time and demonstrated performance. This inherent advantage of established players in securing lucrative contracts and financing makes the landscape particularly challenging for nascent construction businesses attempting to enter the market.

Reputation and Brand Recognition

Building a strong reputation in the construction sector is a long game, often taking decades to cultivate. Hensel Phelps has spent years establishing itself as a reliable, safe, and quality-focused company. This hard-won brand recognition is a significant barrier for newcomers.

New entrants would need substantial financial resources and a consistent track record of successful projects to even begin to rival Hensel Phelps' established name. For instance, in 2024, the average time for a construction company to achieve significant market recognition is estimated to be over 15 years, requiring extensive marketing and project delivery excellence.

- Decades of Reputation Building: Hensel Phelps' established brand is a formidable barrier.

- High Marketing and Project Investment: New entrants need immense resources to gain comparable recognition.

- Industry Trust Factor: Clients often prioritize proven performance, making it difficult for new firms to secure large contracts.

- 2024 Market Data: The average time to build significant market recognition in construction exceeds 15 years.

The threat of new entrants for Hensel Phelps is considerably low due to the immense capital required for bonding and working capital, coupled with the need for extensive experience and a proven track record. New companies struggle to secure the necessary financing and client trust to compete on large-scale projects, where reliability is paramount.

Regulatory hurdles, including licensing, permits, and compliance with safety and environmental standards, present significant challenges for newcomers. These processes are time-consuming and costly, effectively deterring many potential entrants from entering the market for major construction projects.

Access to skilled labor and established supply chains also acts as a barrier. Hensel Phelps benefits from long-standing relationships, ensuring consistent access to talent and materials, while new firms face shortages and higher procurement costs, impacting their ability to bid competitively.

The established reputation and brand recognition of Hensel Phelps, built over decades, is a critical deterrent. Clients prioritize proven performance and trust, making it difficult for new firms to gain the necessary credibility to secure substantial contracts, with significant market recognition often taking over 15 years to achieve as of 2024.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High upfront capital for bonding and operations. | Significant financial hurdle. | Projects requiring hundreds of millions in bonding. |

| Experience & Reputation | Proven track record and client trust. | Difficulty in winning large, complex contracts. | Major infrastructure projects demand proven capability. |

| Regulatory Compliance | Licenses, permits, safety, and environmental standards. | Time-consuming and costly to navigate. | Lengthy environmental assessments can take months. |

| Labor & Supply Chain | Access to skilled labor and established supplier networks. | Challenges in recruitment and procurement costs. | Industry labor shortage projected to require 520,000 additional workers by 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hensel Phelps Construction leverages a comprehensive suite of data sources, including company annual reports, industry-specific market research from firms like IBISWorld, and publicly available SEC filings. These sources provide critical insights into financial performance, operational strategies, and competitive positioning within the construction sector.