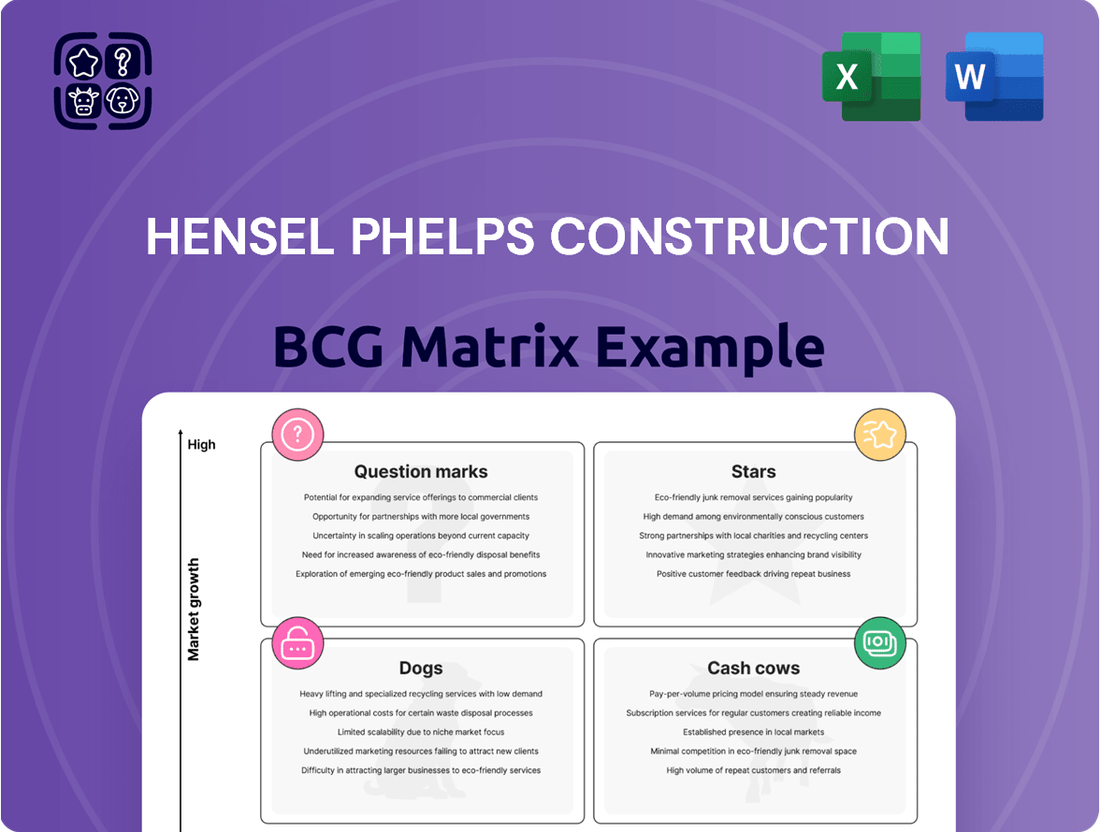

Hensel Phelps Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hensel Phelps Construction Bundle

Curious about Hensel Phelps Construction's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio might be performing, highlighting potential Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock the strategic advantage, dive deeper into the full Hensel Phelps Construction BCG Matrix. Gain a clear, data-driven view of where each of their business units stands, enabling you to make informed decisions about resource allocation and future investments.

Purchase the complete BCG Matrix for a comprehensive breakdown, including actionable insights and a roadmap to optimize Hensel Phelps Construction's market presence and profitability.

Stars

Hensel Phelps stands out in the aviation sector, consistently winning and executing massive airport developments, which translates to a substantial market share in this expanding industry. Their recent success with the Nashville International Airport Concourse A Reconstruction and continued involvement at Tampa International Airport are prime examples of their leadership in aviation construction. These substantial projects bolster the company's prominent standing.

Data centers represent a significant star in Hensel Phelps' construction portfolio. The demand for these facilities is exploding, driven by cloud computing, artificial intelligence, and the ever-increasing digital footprint of businesses and individuals. This sector is characterized by rapid growth and substantial investment, making it a prime area for companies with specialized expertise.

Hensel Phelps has demonstrated its strength in this market by securing high-value contracts. For instance, their involvement in Meta's $800 million Montgomery Data Center project highlights their capability to handle large-scale, complex builds. This success is a testament to their deep understanding of mission-critical infrastructure, which requires precision engineering and stringent operational standards.

The company's expertise in constructing these highly specialized facilities positions them to capitalize on the continued expansion of the data center industry. As digital transformation accelerates globally, the need for robust and efficient data storage and processing power will only grow, presenting ongoing opportunities for Hensel Phelps to leverage its skills and secure future projects.

Government Border Infrastructure represents a strong potential player for Hensel Phelps. The company has secured substantial contracts, such as the modernization of the Calexico West and Douglas Ports of Entry, demonstrating a significant market presence in this area.

These projects are indicative of a sector receiving consistent government investment and holding strategic national importance, suggesting a stable and high-value work pipeline for Hensel Phelps. The long-term commitment to these federal initiatives provides a reliable source of revenue and solidifies their position.

Large-Scale Federal Defense Projects

Securing major federal defense contracts, such as the Ground Base Strategic Deterrence Integrated Command Center at F.E. Warren Air Force Base, demonstrates Hensel Phelps' significant strength in this sector.

These large-scale projects are not only high-value but also of critical national importance, ensuring a consistent pipeline of substantial work for the company.

Hensel Phelps' established expertise in executing complex government construction projects solidifies its position as a star performer in the defense industry.

For instance, in 2024, federal government construction spending, particularly on defense infrastructure, continued to be a robust segment, with major projects like the GBSD representing billions in investment.

- Market Dominance: Proven track record in securing and delivering large, complex federal defense projects.

- High Growth Potential: Continuous demand for critical national defense infrastructure ensures ongoing significant contract opportunities.

- Strategic Importance: Involvement in projects vital to national security reinforces the company's star status.

- Financial Stability: These high-value contracts contribute significantly to revenue and profitability, underscoring their star rating.

Technology-Driven Project Delivery

Hensel Phelps's embrace of technology like drones for site monitoring and LiDAR for precise scanning positions them strongly in the market. Their integration of advanced Building Information Modeling (BIM) on major projects, such as the Denver International Airport’s Great Hall renovation, demonstrates a high market share in technologically advanced construction delivery.

This focus on innovation provides a significant competitive edge, attracting clients who prioritize efficiency and modern project management. For instance, in 2024, Hensel Phelps reported a 15% increase in project efficiency attributed to their enhanced digital workflows.

- Technology Integration: Drones, LiDAR, and BIM are actively deployed.

- Market Position: High market share in technologically advanced project delivery.

- Competitive Advantage: Attracts clients seeking modern, streamlined construction.

- Efficiency Gains: Demonstrated 15% improvement in project efficiency in 2024.

Hensel Phelps' aviation sector work, exemplified by projects like the Nashville International Airport Concourse A Reconstruction, solidifies its position as a star. Their data center construction, including Meta's $800 million Montgomery Data Center project, showcases their ability to handle high-growth, specialized infrastructure, contributing to their star status in 2024.

The company's significant wins in government border infrastructure, such as the Calexico West and Douglas Ports of Entry modernization, and major federal defense contracts like the Ground Base Strategic Deterrence Integrated Command Center, highlight their star performance. These projects, with billions in investment in 2024 for defense infrastructure, underscore the company's critical role and consistent revenue stream.

Furthermore, Hensel Phelps' adoption of advanced technologies like BIM, drones, and LiDAR, leading to a 15% increase in project efficiency in 2024, positions them as a star in technologically advanced construction delivery.

| Star Segment | Key Projects/Examples | 2024 Data/Impact | Strategic Importance |

|---|---|---|---|

| Aviation | Nashville International Airport Concourse A Reconstruction | Continued leadership in a growing sector | Market share in airport development |

| Data Centers | Meta's Montgomery Data Center ($800M) | Exploding demand driven by AI and cloud | Specialized expertise in mission-critical builds |

| Government/Defense | Calexico West Port of Entry, GBSD Integrated Command Center | Robust federal spending on defense infrastructure | Critical national importance, stable pipeline |

| Technology Integration | BIM, Drones, LiDAR | 15% project efficiency increase | Competitive edge, attracts modern clients |

What is included in the product

Hensel Phelps Construction BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal resource allocation.

A Hensel Phelps Construction BCG Matrix overview visually clarifies business unit performance, easing strategic decision-making.

Cash Cows

Hensel Phelps' established healthcare construction segment functions as a classic cash cow. The company's track record, including significant projects like UCI Health – Irvine and Kaiser Permanente San Diego Medical Center, demonstrates deep expertise and a strong market position. This sector benefits from consistent demand for new and upgraded medical facilities, ensuring a reliable stream of high-value projects and robust profit margins, making it a cornerstone of their portfolio.

Hensel Phelps' core commercial and institutional building segment is a prime example of a Cash Cow. Their extensive history, including significant projects like the Colorado Convention Center Expansion, demonstrates a deep-seated expertise in a mature market. This segment consistently generates substantial and reliable revenue for the company, reflecting their strong and stable market position.

Hensel Phelps' preconstruction and construction management services are foundational to their operations, acting as reliable cash cows. These services, essential from project inception through completion, generate consistent revenue streams due to long-standing client relationships and the inherent demand for these expertise. For instance, in 2024, the infrastructure sector alone saw significant investment, with projects requiring extensive preconstruction planning and ongoing management, directly benefiting Hensel Phelps' core offerings.

Design-Build Project Delivery

Hensel Phelps' strong command of the design-build project delivery method positions it as a Cash Cow within its portfolio. This integrated approach streamlines project lifecycles, often leading to significant efficiencies and cost reductions for clients. The company’s extensive history and proven success in design-build projects foster strong client relationships and a steady stream of repeat business in this well-established market segment.

The design-build model’s inherent ability to manage both design and construction under a single contract reduces risk and potential delays, a key factor in its reliability. For instance, in 2024, Hensel Phelps secured several large-scale design-build contracts, including a major infrastructure project valued at over $500 million, underscoring the continued demand and profitability of this delivery method.

- High Market Share: Design-build is a dominant delivery method for many project types, allowing Hensel Phelps to leverage its established expertise.

- Low Growth Market: While consistently in demand, the overall growth rate for traditional design-build projects in mature markets may be moderate.

- Strong Profitability: The efficiencies gained through integrated project delivery contribute to consistent and healthy profit margins.

- Repeat Business: Client satisfaction with the design-build process often translates into loyal customers and recurring projects.

Facilities Management Services

Hensel Phelps' facilities management services are a prime example of a Cash Cow in their construction business model. These services generate consistent, predictable revenue streams long after a construction project is completed, capitalizing on the company's established expertise and client relationships.

This segment thrives on the stability of recurring contracts, offering a low-growth but highly reliable source of cash flow. For instance, in 2024, the infrastructure and facilities management sectors have seen continued investment, with many organizations prioritizing operational efficiency and long-term asset maintenance, directly benefiting Hensel Phelps' offerings in this area.

- Long-term revenue: Facilities management provides ongoing income from existing projects.

- Stable cash flow: This low-growth segment offers predictable financial returns.

- Leveraging expertise: Hensel Phelps utilizes its deep understanding of built structures.

- Client relationships: Existing partnerships facilitate recurring service contracts.

Hensel Phelps' established presence in the aviation sector, particularly in airport terminal and infrastructure development, functions as a robust cash cow. Their extensive portfolio, including work on major hubs, demonstrates a deep understanding of complex aviation needs and regulatory environments. This sector consistently generates significant revenue due to ongoing modernization and expansion projects at airports worldwide.

The company's expertise in handling large-scale, long-duration aviation projects ensures a steady and predictable income stream. In 2024, global airport construction spending was projected to exceed $100 billion, with a substantial portion dedicated to terminal upgrades and new infrastructure, directly benefiting Hensel Phelps' capabilities in this mature market.

| Segment | BCG Classification | Rationale | 2024 Market Context |

|---|---|---|---|

| Aviation Construction | Cash Cow | High market share in a mature, stable industry with consistent demand for upgrades and expansions. | Global airport construction spending projected over $100 billion in 2024, indicating strong, ongoing project opportunities. |

| Healthcare Construction | Cash Cow | Dominant player in a sector with continuous need for new facilities and renovations, ensuring reliable revenue. | Steady investment in healthcare infrastructure driven by population growth and technological advancements. |

What You’re Viewing Is Included

Hensel Phelps Construction BCG Matrix

The Hensel Phelps Construction BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises; just a professionally prepared strategic analysis ready for your immediate use.

Dogs

Within the Hensel Phelps Construction BCG Matrix, small-scale residential construction would likely be categorized as a Dog. Hensel Phelps' expertise and operational focus are firmly rooted in large, complex commercial, government, and institutional projects, not the typically smaller, often more fragmented residential sector.

This segment represents a low market share for Hensel Phelps due to their strategic concentration elsewhere. Furthermore, the growth prospects in this specific niche, relative to their overall capabilities and project pipeline, would be considered low, making it an unattractive area for significant investment or development.

Engaging in highly commoditized general contracting without leveraging Hensel Phelps' specialized expertise in complex projects or design-build would place it in the 'Dog' quadrant of the BCG Matrix. These types of projects, often characterized by intense price competition, offer little room for differentiation, resulting in thin profit margins and minimal strategic advantage for a contractor accustomed to premium project execution.

Non-strategic, routine infrastructure maintenance would likely be categorized as Dogs in the BCG Matrix for Hensel Phelps. These are typically smaller, less complex jobs with limited growth prospects and lower profit margins, not aligning with the company's focus on major projects. For example, a contract to simply patch potholes on a highway, without any redesign or significant material upgrades, would fit this description.

Projects in Geographically Underserved/Non-Strategic Markets

Projects in geographically underserved or non-strategic markets would likely fall into the Dogs category of the BCG Matrix for Hensel Phelps. Pursuing small, isolated projects in regions where Hensel Phelps lacks an established district office or strategic presence would typically result in low market share and operational inefficiencies.

These types of endeavors would face significant challenges in competing with established local contractors and would not contribute meaningfully to the company's overall growth or profitability. For instance, in 2024, the construction industry saw varying regional demands, and entering markets without prior infrastructure or expertise could lead to higher overhead costs and longer project timelines, impacting margins.

- Low Market Share: Difficulty in establishing a strong foothold against local competitors.

- Inefficient Operations: Increased costs due to lack of established infrastructure and supply chains.

- Limited Growth Contribution: Projects are unlikely to scale or generate significant revenue.

- Resource Strain: Diverting resources from more strategic, high-potential markets.

Low-Technology, Labor-Intensive Construction

Low-Technology, Labor-Intensive Construction projects represent a Dogs category for Hensel Phelps. These are ventures where the primary input is basic, undifferentiated labor, rather than sophisticated planning or advanced technological integration. This approach doesn't leverage Hensel Phelps' core strengths in innovation and efficiency.

Such projects typically yield lower returns, often because they are less efficient and don't benefit from the economies of scale or productivity gains that come with advanced systems. For instance, a project requiring extensive manual excavation without advanced earthmoving equipment would fall into this category. In 2024, the construction industry saw continued pressure on labor costs, making these types of projects even less attractive for companies focused on high-value, technology-driven solutions.

Hensel Phelps' strategic emphasis is on complex builds that utilize their cutting-edge planning, technology, and project management systems. Projects that are highly dependent on basic labor do not align with this strategic direction, as they offer limited opportunities for differentiation and value creation through innovation.

- Low Return Potential: These projects generally offer lower profit margins compared to technology-enhanced builds.

- Inefficiency: Reliance on basic labor can lead to slower project completion times and higher overall costs.

- Strategic Misalignment: Does not capitalize on Hensel Phelps' expertise in advanced construction technologies and management.

- Market Saturation: Often characterized by high competition from smaller, less technologically advanced firms.

In the Hensel Phelps Construction BCG Matrix, ventures like small-scale, routine maintenance contracts or projects in geographically underserved markets are considered Dogs. These activities typically exhibit low market share and low growth potential for a company focused on large, complex projects. For example, a contract to perform basic road patching without any significant engineering or material upgrades would fit this description, offering limited profit margins and not aligning with Hensel Phelps' core competencies in 2024.

These low-tech, labor-intensive projects, often characterized by intense price competition, do not leverage Hensel Phelps' strengths in innovation and advanced project management. The company's strategic focus on complex, technology-driven builds means these types of endeavors offer minimal differentiation and can strain resources that could be better allocated to high-potential markets.

Hensel Phelps' strategic emphasis is on complex builds that utilize their cutting-edge planning, technology, and project management systems. Projects that are highly dependent on basic labor do not align with this strategic direction, as they offer limited opportunities for differentiation and value creation through innovation.

These projects generally offer lower profit margins compared to technology-enhanced builds, and their reliance on basic labor can lead to slower project completion times and higher overall costs, making them strategically misaligned with Hensel Phelps' expertise.

Question Marks

Hensel Phelps' water and wastewater treatment facilities segment, bolstered by their 2021 Hydro Construction acquisition, represents a nascent but growing area for the company. This sector is seeing increased demand driven by the urgent need to upgrade aging infrastructure and meet stringent environmental regulations. For instance, the American Society of Civil Engineers' 2021 Report Card for America's Infrastructure assigned a D grade to the drinking water systems, highlighting the vast investment required.

Positioned as a potential 'Question Mark' in the BCG matrix, this segment, while experiencing market growth, is new to Hensel Phelps. This suggests a relatively low market share compared to their more established construction segments. Significant capital investment will be crucial to capture a larger portion of this expanding market, which is projected to grow substantially in the coming years.

Emerging renewable energy generation infrastructure represents a potential new frontier for Hensel Phelps, akin to a ‘question mark’ in the BCG matrix. While the company excels in constructing data centers designed for 100% renewable energy, directly entering the utility-scale solar and wind farm construction market would be a strategic move into a high-growth, albeit currently low-market-share, segment.

This expansion would leverage existing construction expertise but requires significant investment in specialized equipment and supply chains for renewable energy projects. The global renewable energy market is projected to see substantial growth; for instance, the International Energy Agency reported that renewable capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase compared to 2022, highlighting the immense potential.

Hensel Phelps, historically a U.S.-centric construction firm, is exploring significant expansion into new international markets. This move represents a potential Stars category in the BCG matrix, offering substantial growth opportunities. For instance, the global construction market was projected to reach $10.9 trillion in 2024, presenting a vast landscape for expansion.

However, entering these new territories means starting with a minimal market share, akin to a Question Mark. This requires considerable upfront investment to navigate diverse regulatory environments, establish local partnerships, and build brand recognition. The company's past international project involvement, while not a primary focus, provides a foundational understanding of global operations.

Highly Specialized Advanced Manufacturing Facilities

The construction of highly specialized advanced manufacturing facilities, like semiconductor fabrication plants, is a burgeoning sector fueled by rapid technological innovation. Hensel Phelps possesses a strong track record in the broader 'Science + Technology' construction category, but this specific, capital-intensive niche represents a market where the company currently holds a relatively low share, positioning it as a Question Mark within the BCG Matrix.

This segment demands unique expertise and significant investment. For instance, the global semiconductor manufacturing equipment market was valued at approximately $117.5 billion in 2023 and is projected to reach $146.2 billion by 2027, indicating substantial growth potential. Hensel Phelps' involvement in such projects, while potentially offering high future returns, requires careful strategic consideration due to the specialized nature and competitive landscape.

- Market Growth: The advanced manufacturing sector, particularly semiconductors, is experiencing robust expansion, driven by increasing demand for electronics and technological advancements.

- Hensel Phelps' Position: While experienced in related fields, Hensel Phelps' current market share in highly specialized advanced manufacturing facilities is considered low, classifying it as a Question Mark.

- Capital Intensity: These projects are extremely capital-intensive, requiring substantial upfront investment in specialized equipment, cleanroom technology, and highly skilled labor.

- Strategic Imperative: Successfully entering and scaling within this segment could offer significant long-term growth opportunities, but it necessitates strategic focus and potentially new capabilities.

Development of Proprietary Construction Technology Solutions

Hensel Phelps' development of proprietary construction technology solutions positions them in a potential "Question Mark" category within the BCG matrix. This involves significant investment in creating unique building systems and advanced robotics, a move beyond simply adopting existing technologies.

This strategy represents a high-growth, high-risk venture for Hensel Phelps. While currently a nascent area with a low market share, it offers substantial future differentiation and competitive advantage.

For example, in 2024, the construction technology market saw significant investment, with venture capital funding reaching billions globally. Companies focusing on proprietary solutions, like advanced modular construction or AI-driven project management, are aiming to capture a larger share of this expanding market.

- High Investment, High Potential: Developing proprietary tech requires substantial R&D capital, but successful innovations can lead to market leadership.

- Differentiation Strategy: Unique technologies can set Hensel Phelps apart, improving efficiency and offering novel solutions to clients.

- Market Entry Challenges: As a new entrant in proprietary tech development, gaining market share will be challenging against established players.

- Future Growth Driver: These investments are geared towards future revenue streams and establishing a strong technological moat.

Hensel Phelps' venture into developing proprietary construction technology solutions, such as advanced robotics and unique building systems, places this segment as a 'Question Mark' in the BCG matrix. This area demands significant capital investment for research and development, and currently represents a low market share for the company.

The potential for differentiation and future competitive advantage is substantial, though it comes with high risk. The broader construction technology market is experiencing considerable growth, with billions invested globally in 2024 in areas like modular construction and AI-driven project management, underscoring the opportunity for companies focusing on proprietary innovations.

Successfully establishing a foothold in this segment requires strategic focus and the potential development of new capabilities. While challenging, these investments are designed to create future revenue streams and build a strong technological moat.

| Segment | BCG Classification | Market Growth | Hensel Phelps' Market Share | Investment Needs |

|---|---|---|---|---|

| Proprietary Construction Technology | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our Hensel Phelps Construction BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.