Helios Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helios Technologies Bundle

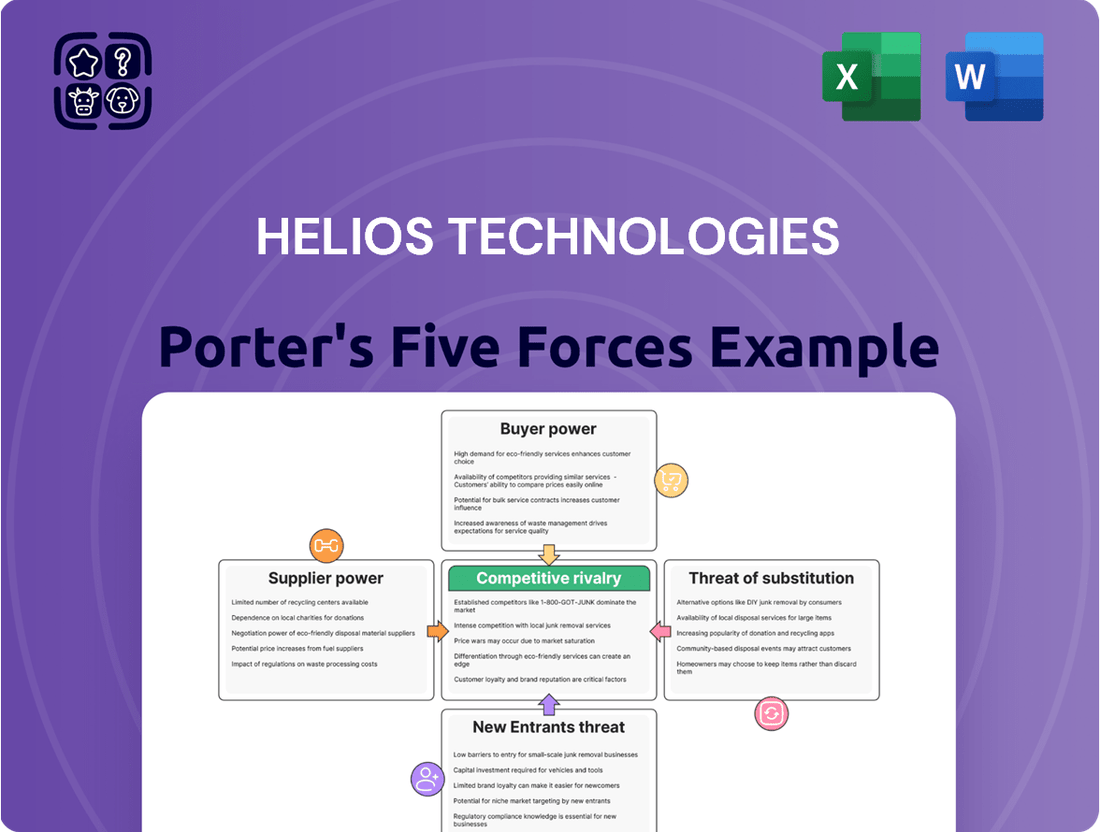

Helios Technologies operates within a dynamic landscape shaped by significant competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes is crucial for strategic planning. This analysis highlights key areas where Helios Technologies can leverage its strengths and mitigate potential weaknesses.

The complete report reveals the real forces shaping Helios Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Helios Technologies' global operations and diverse sourcing typically limit the bargaining power of any single supplier. However, the specialized components required for their advanced motion control and electronic systems can shift power towards critical suppliers. For instance, a key supplier of proprietary semiconductor chips essential for Helios' advanced servo drives might command higher prices or dictate terms, especially if alternative sources are limited or require extensive re-engineering.

Helios Technologies faces significant bargaining power from its suppliers, particularly due to the high switching costs associated with its specialized hydraulic and electronic components. These costs can encompass extensive redesign efforts, rigorous retesting procedures, and the complex requalification of new parts, all of which demand substantial time and financial investment. For example, in 2024, the average cost for integrating a new supplier for critical electronic components in complex machinery could range from $50,000 to over $200,000, depending on the component’s criticality and Helios’s existing infrastructure.

When alternative suppliers for these niche components are limited, or if integrating new ones requires substantial capital outlay, the existing suppliers gain considerable leverage. This power allows them to potentially dictate terms, including pricing and delivery schedules, which can impact Helios's operational efficiency and profitability. The specialized nature of these components means that a failure to maintain good relationships with current suppliers could lead to production delays or increased input costs, as evidenced by industry reports from late 2023 and early 2024 highlighting supply chain vulnerabilities in advanced manufacturing sectors.

The availability of substitute inputs significantly influences the bargaining power of suppliers for companies like Helios Technologies. When alternative materials or components are readily available, it weakens a supplier's leverage. However, the fluid power industry has recently experienced disruptions, including extended lead times for crucial raw materials such as steel and specialized rubber compounds. This scarcity directly impacts Helios, as limited options for essential inputs can empower those suppliers who can still provide them.

Supplier's Product Differentiation

Suppliers providing highly differentiated or patented components essential for Helios Technologies' advanced functionality and performance hold significant bargaining power. This differentiation makes it difficult for Helios to find readily available substitutes, thus strengthening the suppliers' position.

While Helios Technologies reported a decrease in material costs in Q4 2024, indicating some effectiveness in managing supplier relationships, the inherent value of these unique components means suppliers can still command higher prices or more favorable terms. This dynamic requires continuous strategic sourcing and negotiation.

- Supplier Differentiation: Suppliers of unique, patented components critical to Helios' product performance have strong leverage.

- Impact on Helios: Differentiated inputs can lead to higher component costs if not managed effectively through long-term agreements or alternative sourcing strategies.

- Q4 2024 Data: Helios' reported lower material costs in Q4 2024 suggest some success in mitigating supplier power, though this remains an ongoing challenge.

Threat of Forward Integration by Suppliers

A significant threat to Helios Technologies arises if its key suppliers decide to integrate forward into manufacturing complete hydraulic or electronic systems. This would mean suppliers moving up the value chain, potentially competing directly with Helios. For instance, a major supplier of specialized hydraulic valves could start producing entire hydraulic power units, directly challenging Helios's product offerings.

While the capital intensity required for such a move is substantial, and the complexities of Helios's diverse end markets, such as industrial automation and mobile machinery, present significant barriers, this remains a latent possibility. Suppliers would need to invest heavily in research and development, manufacturing capabilities, and sales networks to effectively compete.

Consider the implications: if a supplier like Parker Hannifin, a leading provider of motion and control technologies, were to expand its integrated system offerings, it could significantly alter the competitive landscape for Helios. This would necessitate Helios to adapt its strategy, potentially by strengthening its own product differentiation or exploring strategic partnerships.

- Forward Integration Risk: Suppliers moving into manufacturing complete hydraulic or electronic systems.

- Barriers to Entry: High capital intensity and market complexity for suppliers make this a less immediate threat.

- Strategic Impact: Direct competition from suppliers could necessitate shifts in Helios's product strategy and market positioning.

Helios Technologies' suppliers wield considerable power, particularly those providing highly specialized or patented components like advanced semiconductor chips for servo drives. This leverage stems from the significant costs and time involved in switching suppliers, often exceeding $200,000 in 2024 for critical electronic parts. Limited alternatives for these niche inputs further embolden suppliers to dictate terms, impacting Helios's operational costs and efficiency.

The bargaining power of Helios's suppliers is also amplified by supply chain disruptions, such as extended lead times for essential raw materials like specialized rubber compounds, which were noted in early 2024. When differentiation is high and substitutes are scarce, suppliers can command higher prices or more favorable terms, even with Helios reporting some success in managing material costs in Q4 2024.

| Factor | Description | Impact on Helios | Notes |

| Supplier Differentiation | Suppliers of unique, patented components critical to Helios' product performance have strong leverage. | Can lead to higher component costs if not managed effectively. | Limited alternatives for niche inputs. |

| Switching Costs | High costs for redesign, retesting, and requalification of new parts. | Weakens Helios's ability to switch suppliers easily. | Integration costs for new electronic components in 2024 estimated $50,000-$200,000+. |

| Availability of Substitutes | Limited availability of alternative materials or components. | Empowers existing suppliers. | Recent disruptions in fluid power industry affecting raw material availability. |

What is included in the product

This analysis reveals the competitive intensity within Helios Technologies' operating environment, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly visualize competitive pressures with a dynamic, interactive model that highlights key risks and opportunities.

Customers Bargaining Power

Helios Technologies benefits from a broad customer base across various industries like agriculture, construction, and recreational vehicles. This diversity is a significant strength, as in 2024, no single customer represented more than 5% of the company's total net sales. This low customer concentration means that individual buyers have limited leverage to demand lower prices or more favorable terms from Helios.

Helios Technologies' focus on providing integrated 'system solutions' to strategic Original Equipment Manufacturers (OEMs) significantly elevates switching costs for its customers. Because Helios' fluid power and electronic control components are deeply embedded within the OEM's machinery and production processes, replacing them isn't a simple plug-and-play operation.

This deep integration means that a customer considering a switch would face substantial costs related to re-engineering, testing, and validating new components, along with potential disruptions to their own manufacturing lines. For instance, a hypothetical redesign and retooling process for a complex hydraulic system could easily run into hundreds of thousands or even millions of dollars, making a move to a competitor financially prohibitive for many.

The reliance on Helios for critical system functions means customers are effectively locked into their existing supplier relationship due to the sheer complexity and expense of making a change. This reduces their bargaining power, as the effort and risk associated with switching outweigh the potential benefits of finding a cheaper or slightly different alternative.

Customer price sensitivity for Helios Technologies can rise during economic downturns, as seen with the projected 5% decrease in fluid power shipments in early 2025. This economic pressure might lead customers to scrutinize costs more closely, potentially delaying capital expenditure on advanced engineered solutions. Even with Helios' value proposition, budget constraints can force buyers to negotiate harder for better pricing or more favorable payment terms.

Customer Information and Transparency

Customers in industrial and mobile applications, especially large original equipment manufacturers (OEMs), are often highly knowledgeable about product details, prevailing market prices, and available substitute offerings. This heightened awareness directly translates into increased bargaining power, compelling Helios Technologies to consistently innovate and clearly articulate the unique value proposition of its solutions.

The transparency in these markets means customers can easily compare offerings, putting pressure on Helios to maintain competitive pricing and superior performance. For instance, in the industrial automation sector, large clients might leverage quotes from multiple suppliers to negotiate better terms, impacting Helios's margins if it cannot differentiate effectively.

- Informed Customer Base: Large OEMs in industrial and mobile sectors possess detailed knowledge of product specifications and market pricing.

- Price Sensitivity: Customers can readily compare alternative solutions, intensifying price competition and influencing Helios's pricing strategies.

- Demand for Value: Transparency empowers customers to demand continuous innovation and demonstrable value from Helios to justify purchases.

- Impact on Margins: The ability of customers to switch suppliers or negotiate aggressively can directly affect Helios Technologies' profit margins.

Threat of Backward Integration by Customers

For large Original Equipment Manufacturer (OEM) customers of Helios Technologies, the possibility of backward integration, meaning they could start producing their own hydraulic or electronic components, is a consideration. This threat is more pronounced for high-volume, standardized parts where the economics of scale might favor in-house production. For example, if a major OEM was purchasing a significant volume of basic hydraulic valves, they might explore setting up their own manufacturing for those specific components.

However, Helios Technologies' strategic focus on ‘highly engineered’ solutions and its presence in niche markets significantly mitigates this risk for its core, specialized offerings. These complex products often require proprietary technology, extensive R&D, and specialized manufacturing expertise that are difficult and costly for customers to replicate internally. This specialization creates a barrier, making full backward integration less likely for the sophisticated hydraulic and electronic systems that form a substantial part of Helios' portfolio.

- Customer Integration Threat: Large OEMs can potentially integrate backward into producing their own components, particularly for high-volume, standardized parts.

- Helios' Mitigation: Helios' specialization in highly engineered solutions and niche markets makes it difficult and less economical for customers to fully replicate its core, complex offerings internally.

- Market Dynamics: The complexity and proprietary nature of Helios' specialized products act as a deterrent to customer backward integration, preserving Helios' competitive advantage.

Helios Technologies benefits from a diversified customer base, with no single customer exceeding 5% of total net sales in 2024. This broad distribution limits the bargaining power of individual buyers. Furthermore, Helios's integrated system solutions create high switching costs for Original Equipment Manufacturers (OEMs), as their components are deeply embedded in customer machinery. This integration makes it economically challenging and disruptive for customers to switch suppliers, thereby reducing their leverage.

| Factor | Helios Technologies Impact | Customer Bargaining Power |

| Customer Concentration | Low (No single customer > 5% in 2024) | Weak |

| Switching Costs | High (Due to integrated system solutions and embedded components) | Weak |

| Customer Knowledge & Price Sensitivity | High (Especially for large OEMs) | Moderate to Strong (influenced by market conditions) |

| Threat of Backward Integration | Low (For specialized, highly engineered solutions) | Weak |

Same Document Delivered

Helios Technologies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Helios Technologies' competitive landscape through a Porter's Five Forces analysis, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes. Understanding these forces is crucial for assessing Helios' market position and strategic opportunities.

Rivalry Among Competitors

The fluid power and electronic control systems sectors are showing positive momentum. Specifically, the fluid power equipment market is anticipated to expand at a compound annual growth rate of 7.5% between 2024 and 2025, signaling a healthy expansion phase.

However, the market's cyclical nature can temper growth's benefits. A recent downturn in mobile hydraulics shipments during 2024, with recovery expected in 2025, highlights how economic fluctuations can heighten competitive pressures as companies vie for market share during slower periods.

Helios Technologies operates in a market populated by formidable competitors, including giants like Parker-Hannifin, Continental AG, Danfoss A/S, Bosch Rexroth, and ITT. These established companies possess significant market share and resources, creating an intense competitive environment.

The sheer size and global reach of these players mean Helios must continually innovate and differentiate to maintain its leadership in specialized segments of the hydraulics and electronics markets. For instance, Parker-Hannifin reported revenues of $15.8 billion for its fiscal year ending June 30, 2023, illustrating the scale Helios is up against.

Despite this, Helios has strategically positioned itself to excel in niche areas where its specialized solutions offer distinct advantages. This focus allows Helios to carve out profitable market positions even when facing much larger, more diversified entities.

Helios Technologies actively differentiates itself by consistently introducing innovative products in both its hydraulics and electronics divisions. This commitment to new product development is a cornerstone of its strategy to stand out in the market.

The company’s approach focuses on delivering highly engineered solutions and integrated system solutions, moving beyond simple price competition. This strategy is particularly effective in niche applications where performance and specialized capabilities are paramount.

For instance, Helios's investment in research and development, which has seen significant growth in recent years, directly fuels this product differentiation. In 2023, the company reported R&D expenses of $105.2 million, a notable increase that underscores its dedication to innovation.

This emphasis on unique, value-added offerings helps Helios maintain a competitive edge against rivals who may compete primarily on cost, allowing it to capture higher margins in specialized markets.

Exit Barriers

Helios Technologies operates within an industry characterized by substantial exit barriers. The significant capital outlay required for manufacturing plants and specialized research and development activities, combined with extended product lifecycles typical in industrial sectors, makes it difficult for companies to leave the market. For instance, in the industrial automation sector where Helios is active, the cost of setting up advanced manufacturing lines can easily run into tens or even hundreds of millions of dollars.

These high exit barriers have a direct impact on competitive rivalry. When it’s costly to exit, companies are incentivized to remain and compete for market share, even when profitability is challenged. This can lead to prolonged periods of intense competition as firms strive to maintain their positions rather than absorb significant losses from exiting.

- Significant Capital Investment: High upfront costs for manufacturing and R&D create substantial financial commitments.

- Long Product Lifecycles: Extended product life in industrial applications means investments remain tied up for longer periods.

- Intensified Rivalry: Companies are more likely to stay and fight for market share due to the difficulty and cost of exiting.

- Strategic Stalemate: Exit barriers can foster situations where companies continue to compete fiercely, even in down cycles.

Diversity of Competitors

Helios Technologies operates within a highly competitive landscape, featuring a broad spectrum of rivals. These range from massive, diversified industrial conglomerates to smaller, more specialized companies, each pursuing distinct strategic goals and possessing unique cost structures. This inherent diversity means competitors employ a wide array of tactics, from aggressive pricing and rapid innovation to forming strategic alliances, thus creating a multifaceted and dynamic competitive environment.

For instance, in the broader industrial automation sector where Helios Technologies has a presence, companies like Siemens and Rockwell Automation represent large conglomerates with extensive product portfolios and global reach. Conversely, more niche players might focus on specific sensor technologies or advanced software solutions, often exhibiting greater agility and specialized expertise. This varied competitive intensity directly impacts pricing power and the pace of technological advancement.

- Diverse Competitor Profiles: Rivals include large, diversified industrial conglomerates and specialized niche firms, each with varying strategic objectives and cost bases.

- Varied Competitive Tactics: Competitors engage in aggressive pricing, rapid innovation, and strategic partnerships to gain market share.

- Impact on Market Dynamics: This diversity creates a complex competitive environment that influences pricing, innovation cycles, and partnership opportunities.

- Examples of Competitors: Major players like Siemens and Rockwell Automation, alongside numerous specialized technology providers, highlight the breadth of the competitive field.

Competitive rivalry for Helios Technologies is intense, driven by large, diversified players like Parker-Hannifin, Continental AG, and Bosch Rexroth, alongside agile niche specialists. The fluid power equipment market's projected 7.5% CAGR through 2025 fuels this, but market cyclicality, as seen in 2024 mobile hydraulics downturns, exacerbates pressure as companies fight for share. Helios counters by focusing on innovation and highly engineered solutions in specialized segments, investing $105.2 million in R&D in 2023 to differentiate.

| Competitor | Approximate Revenue (USD) | Key Market Segments |

|---|---|---|

| Parker-Hannifin | $15.8 billion (FY23) | Motion & Control Technologies, Filtration |

| Continental AG | €41.46 billion (2023) | Automotive, Tires, Industrial Technologies |

| Danfoss A/S | €10.1 billion (2023) | Climate Solutions, Drives, Power Solutions |

| Bosch Rexroth | €7.3 billion (2023) | Mobile & Industrial Hydraulics, Automation |

SSubstitutes Threaten

The most significant threat of substitution for Helios Technologies stems from the growing adoption of electric actuators and electromechanical systems, especially within the hydraulics market. These electric alternatives are increasingly favored for their enhanced programmability and seamless integration with modern digital control architectures, presenting a substantial challenge to established hydraulic technologies.

For instance, the global market for electric linear actuators was projected to reach approximately $9.6 billion in 2024, with an expected compound annual growth rate of over 6% through 2030, according to recent market analyses. This robust growth underscores the increasing preference for electric solutions over traditional hydraulic systems in various industrial applications.

While electric systems offer impressive precision and digital control, a complete takeover by hydraulics in high-power applications remains improbable. Hydraulic systems continue to dominate where their inherent power density and robustness are paramount. For instance, in heavy construction equipment, the sheer force and durability provided by hydraulics are often unmatched by purely electric alternatives.

However, the landscape is evolving. The emergence and increasing sophistication of electro-hydraulic systems present a more nuanced threat. These hybrid solutions integrate electric power with hydraulic actuation, aiming to capture the best of both worlds. This evolution could significantly mitigate the direct threat of full substitution by offering a compelling alternative that balances efficiency with power.

Customers in Helios' diverse markets, including agriculture and construction, place a high value on dependability, operational effectiveness, and robust performance, especially in mission-critical tasks. Their willingness to consider alternatives hinges on whether these substitutes can reliably deliver on these stringent demands while remaining economically viable over time. For instance, in the demanding agricultural sector, a farmer considering a new hydraulic pump would weigh the upfront cost against the projected uptime and maintenance expenses compared to their current Helios unit.

Differentiation of Helios' Products

Helios Technologies actively combats the threat of substitutes by developing highly specialized and engineered solutions crucial for its clients' fluid power and electronic control systems. These integrated system solutions offer unique value that generic alternatives struggle to match. For instance, in 2023, Helios reported that over 80% of its revenue came from customized or highly integrated products, demonstrating a strong barrier against commoditized substitutes.

The company’s focus on providing comprehensive system solutions, rather than individual components, creates a sticky customer base. This approach makes it challenging for competitors offering standalone or less integrated products to gain significant traction. Helios' commitment to innovation, evidenced by its $38.3 million investment in research and development in 2023, further solidifies its differentiation.

- Specialized Engineering: Helios' fluid power and electronic control solutions are tailored to specific customer needs, making them hard to replace with off-the-shelf alternatives.

- Integrated System Approach: By offering complete system solutions, Helios creates a more holistic and difficult-to-replicate value proposition compared to single-component suppliers.

- Customer Integration: The deep integration of Helios' products into customer operations creates switching costs, thereby reducing the appeal of substitutes.

- Innovation Investment: Significant R&D spending, like the $38.3 million in 2023, ensures Helios stays ahead of potential substitute technologies.

Regulatory and Environmental Factors

Increasing environmental regulations and a stronger focus on energy efficiency present a significant threat of substitutes for Helios Technologies. As governments worldwide implement stricter standards, there's a growing demand for solutions that minimize energy consumption and environmental impact. This trend can accelerate the adoption of alternative technologies that are perceived as greener or more efficient, potentially diverting customers away from traditional hydraulic systems. For instance, the European Union's ongoing efforts to enhance energy efficiency across industrial sectors, as outlined in various directives and targets leading up to 2024, directly influences the market for hydraulic components.

Helios' strategic response to these evolving environmental mandates is critical. The company's continued investment in developing advanced hydraulic systems that offer improved energy efficiency, such as those incorporating regenerative braking or optimized fluid dynamics, directly counters this threat. By adapting to new requirements, like those promoting reduced energy usage in machinery, Helios can maintain its competitive edge and even leverage these regulations as an opportunity for innovation. For example, in 2024, many manufacturers are actively seeking hydraulic solutions that can demonstrably lower operational costs through reduced energy expenditure, a direct response to regulatory pressures and market demand for sustainability.

- Growing demand for energy-efficient alternatives: Stricter environmental regulations worldwide are pushing industries towards substitutes that offer lower energy consumption.

- Helios' adaptive strategy: The company's focus on developing advanced, energy-efficient hydraulic systems is key to mitigating the threat of substitutes.

- Impact of regulatory frameworks: Initiatives like the EU's energy efficiency targets underscore the growing pressure to adopt eco-friendly technologies.

- Market opportunity in sustainability: Helios can capitalize on the demand for hydraulic solutions that reduce operational energy costs, aligning with regulatory and market expectations in 2024.

The threat of substitutes for Helios Technologies is moderate, primarily driven by advancements in electric and electro-hydraulic systems. While electric actuators are gaining traction for their programmability, hydraulics remain dominant in high-power applications. Helios mitigates this by focusing on specialized, integrated system solutions that are difficult to replicate with generic alternatives.

The market for electric linear actuators, projected to reach around $9.6 billion in 2024, highlights the growing appeal of electric alternatives. However, Helios' strong emphasis on customized solutions, which accounted for over 80% of its revenue in 2023, creates a significant barrier against commoditized substitutes.

Furthermore, evolving environmental regulations are pushing industries toward more energy-efficient solutions, potentially favoring substitutes. Helios counters this by investing in advanced, energy-efficient hydraulics, as evidenced by its $38.3 million R&D expenditure in 2023, aiming to align its offerings with market demands for sustainability.

| Threat of Substitutes Factor | Helios Technologies' Position | Impact on Helios |

|---|---|---|

| Advancements in Electric Actuators | Growing adoption, favored for programmability | Moderate threat, especially in integration-focused applications |

| Dominance of Hydraulics in High Power | Hydraulics remain superior for power density and robustness | Limited substitution in core heavy-duty markets |

| Electro-Hydraulic Systems | Hybrid solutions offering a blend of benefits | Evolving threat, potentially reducing direct substitution |

| Customer Value on Dependability and Performance | Helios excels in delivering robust, mission-critical solutions | Strong customer loyalty, higher switching costs for substitutes |

| Environmental Regulations & Energy Efficiency | Increasing demand for greener alternatives | Potential threat, but also an opportunity for innovation in efficient hydraulics |

Entrants Threaten

The hydraulics and electronics sectors, especially those focused on advanced, engineered solutions, demand considerable financial commitment. This includes significant investment in research and development, state-of-the-art manufacturing plants, and highly specialized machinery, creating a formidable hurdle for newcomers.

For instance, establishing a new, fully operational hydraulics manufacturing facility capable of producing complex systems could easily run into tens of millions of dollars, covering machinery, cleanroom environments, and sophisticated testing equipment. In 2024, companies like Bosch Rexroth continue to invest heavily in advanced manufacturing technologies, signaling the high entry cost.

The need for extensive R&D to develop innovative and efficient hydraulic and electronic components means that potential entrants must also allocate substantial funds to innovation, often exceeding tens of millions annually for leading players, to remain competitive.

This substantial capital requirement acts as a powerful deterrent, effectively limiting the number of new companies that can realistically enter the market and compete with established players like Helios Technologies.

Helios Technologies' significant intellectual property, boasting around 300 active patents and trademarks, acts as a powerful deterrent to new entrants. This robust portfolio underscores a strong foundation of proprietary technologies and a well-established brand identity within its specialized markets.

These unique technological assets and the trust associated with the Helios brand create substantial barriers to entry, making it challenging for newcomers to replicate the company's offerings or gain immediate market traction.

Helios Technologies' global reach, operating in over 90 countries through established value-added distributors and direct OEM relationships, presents a significant barrier to new entrants. Establishing a comparable distribution network is a monumental undertaking, requiring substantial investment in time and capital to build trust and logistical capabilities. This existing infrastructure makes it incredibly challenging for newcomers to gain efficient market access and compete effectively.

Experience and Learning Curve

The intricate design, manufacturing, and marketing of highly engineered motion control and electronic solutions represent a significant barrier for new entrants due to the inherent complexity and steep learning curve involved. Helios Technologies, with its extensive operational history, has cultivated deep technical expertise and practical know-how that are not easily acquired or replicated.

New companies would face considerable challenges in developing the specialized knowledge and skills necessary to compete effectively in this niche market. This accumulated experience translates into operational efficiencies and product quality advantages for Helios.

For example, the development cycle for advanced motion control systems can span several years, requiring substantial investment in research and development and a highly skilled engineering workforce. Helios’ established R&D capabilities, evidenced by its consistent product innovation, further solidify this advantage.

- Technical Expertise: Helios' decades of experience in motion control and electronics demand specialized engineering talent and deep industry knowledge, a difficult hurdle for newcomers.

- Learning Curve: The complexities of designing and manufacturing these sophisticated solutions mean new entrants face a prolonged and costly learning process.

- Product Development Cycles: The lengthy development times for advanced systems, often taking years, require significant upfront investment and patience, deterring those without established resources.

- Operational Know-How: Helios’ accumulated operational efficiencies and understanding of supply chain intricacies in this specialized sector provide a competitive edge that takes time to build.

Government Policy and Regulations

Government policy and regulations significantly shape the threat of new entrants for Helios Technologies. Industries where Helios operates, such as agriculture, construction, and energy, are inherently subject to rigorous compliance frameworks and safety mandates. For instance, agricultural technology often requires adherence to environmental protection agency (EPA) regulations regarding pesticide application or water usage, adding complexity for newcomers. Similarly, construction equipment must meet evolving safety standards set by bodies like OSHA, impacting design and manufacturing costs.

Navigating these regulatory landscapes presents a substantial hurdle. Obtaining the necessary certifications and approvals can be a time-consuming and capital-intensive endeavor. Companies looking to enter the market must invest heavily in research, development, and legal counsel to ensure compliance, creating a high barrier to entry. This complexity can deter smaller or less-resourced potential competitors from challenging established players like Helios.

The financial implications of regulatory compliance are substantial. For example, in the renewable energy sector, which Helios serves, new entrants must contend with permitting processes that can stretch for years and involve multiple government agencies. According to a 2024 report by the American Clean Power Association, the average interconnection queue for utility-scale solar projects can exceed 18 months, showcasing the delay and cost involved. This lengthy process, coupled with the need for specialized engineering and environmental impact assessments, effectively limits the influx of new competition.

- Regulatory Hurdles: Industries like agriculture, construction, and energy demand strict adherence to safety and environmental standards.

- Certification Costs: Obtaining necessary certifications for products and operations is a significant financial and temporal investment for new entrants.

- Permitting Delays: Processes such as securing permits for renewable energy projects can take over 18 months, as observed in 2024 industry data, delaying market entry.

- Compliance Burden: The ongoing cost of maintaining compliance with evolving regulations acts as a continuous barrier, favoring established companies with existing infrastructure.

The threat of new entrants for Helios Technologies is generally low due to high capital requirements and substantial R&D investment needed for advanced hydraulics and electronics. Companies like Bosch Rexroth's continued investment in manufacturing technology in 2024 highlights the significant financial commitment required. This creates a formidable barrier for any potential new player aiming to compete in this specialized market.

Porter's Five Forces Analysis Data Sources

Our analysis of Helios Technologies' competitive landscape utilizes a comprehensive data strategy, incorporating financial reports, investor presentations, and industry-specific market research. This blend of sources allows for a robust assessment of supplier and buyer power, as well as the threat of new entrants and substitutes.