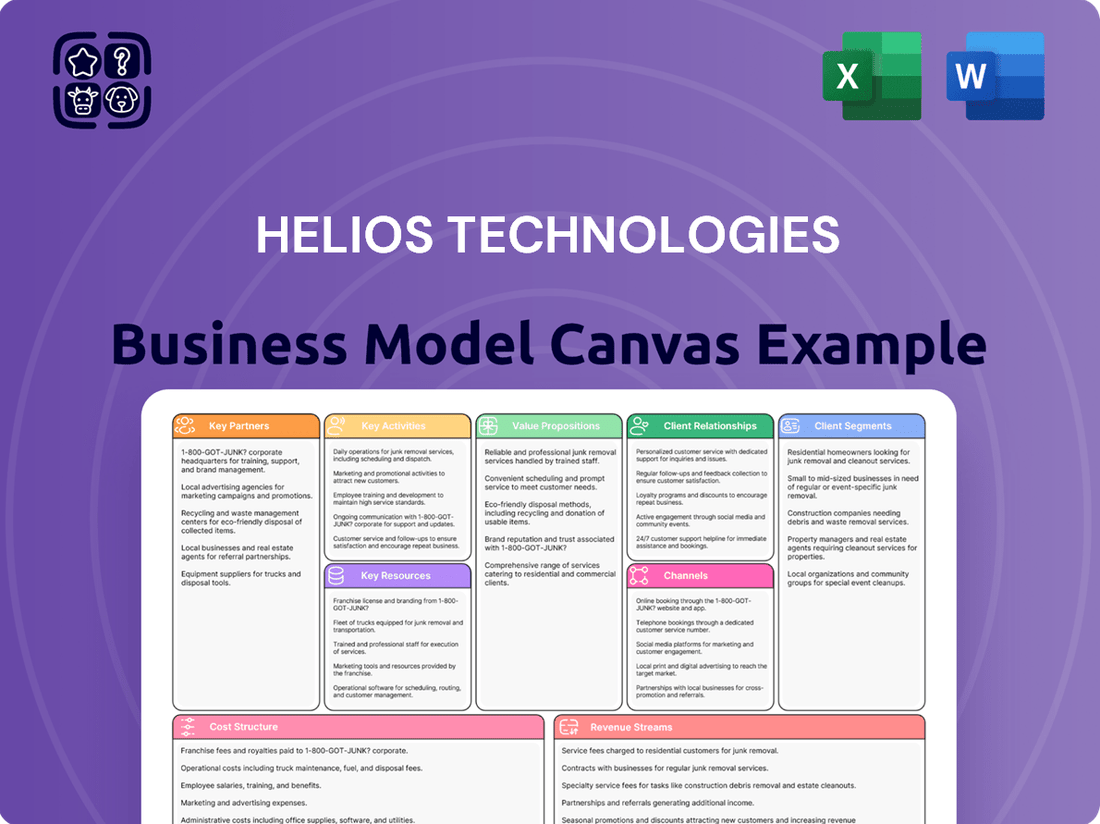

Helios Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helios Technologies Bundle

Unlock the full strategic blueprint behind Helios Technologies's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Helios Technologies actively pursues strategic OEM collaborations, embedding its advanced hydraulic and electronic systems into the core of manufacturers' equipment. This integration is vital for achieving seamless product compatibility and driving market adoption, particularly within demanding industrial and mobile sectors.

These partnerships are designed to deliver comprehensive system solutions, focusing on enhancing safety, bolstering reliability, enabling connectivity, and refining control for OEM partners. For instance, in the construction equipment sector, Helios's integrated electro-hydraulic systems can improve fuel efficiency by up to 15% for their OEM partners, a key selling point for end-users.

Helios Technologies heavily relies on its authorized distributor networks, with a significant portion of its sales originating from these independent channel partners. In 2024, these partnerships were instrumental in extending Helios's market reach, enabling access to a broad and diverse global customer base.

These distributors provide essential localized sales and support, which is critical for customer engagement and satisfaction across various regions. This strategic diversification through distributors allows Helios Technologies to achieve accelerated growth and penetrate a wider array of end-markets more effectively.

Helios Technologies actively partners with leading technology and semiconductor suppliers, notably STMicroelectronics. This collaboration is crucial for integrating cutting-edge components into Helios's product ecosystem, directly impacting the performance and dependability of their electronic control systems.

These strategic alliances provide Helios with consistent access to advanced semiconductor technology, enabling them to push the boundaries of innovation in their product development cycles. This access is vital for staying competitive in the rapidly evolving electronics market.

The partnerships accelerate the introduction of new and improved solutions for Helios's customers. For example, by leveraging STMicroelectronics’s latest advancements, Helios can bring more sophisticated and efficient electronic controls to market faster, benefiting a broad range of industries that rely on their technology.

Acquisition Targets and Integration Partners

Helios Technologies actively seeks strategic acquisitions to accelerate growth, broaden its product offerings, and enter new markets. The company prioritizes targets possessing niche technologies, robust profitability, and a strong cultural alignment. This strategic approach is exemplified by recent acquisitions such as Balboa Water Group and Joyonway, which have successfully integrated into Helios's operations.

These acquisitions are crucial for Helios to gain access to new customer bases and expand its geographic footprint. The integration partners are carefully selected to ensure seamless operational transitions and maximize synergistic benefits, contributing to Helios's overall market position and competitive advantage.

- Strategic Acquisitions Helios pursues companies that enhance its product portfolio and market reach.

- Niche Technology Focus Targets are chosen for their specialized technologies and strong profitability.

- Geographic Expansion Acquisitions aim to increase Helios's presence in key global markets.

- Customer Base Growth Integration of acquired companies brings new customers and market segments.

Research and Development Collaborations

Helios Technologies actively pursues research and development collaborations to drive innovation and create cutting-edge technologies. These partnerships are crucial for accessing specialized knowledge and accelerating product development cycles, ensuring Helios remains competitive.

A prime example is Helios' collaboration with internal operating companies like i3 Product Development. This synergy allows them to effectively leverage expertise in advanced fields such as artificial intelligence and machine learning, specifically for enhancing industrial automation systems.

These collaborations are not just about immediate product improvements; they are strategic investments. By working with external and internal experts, Helios Technologies positions itself to anticipate and address emerging market trends and future technological demands, securing its long-term growth trajectory.

- Fosters Innovation: R&D collaborations are a cornerstone for developing novel solutions and next-generation technologies.

- Leverages Expertise: Partnerships, like the one with i3 Product Development, allow Helios to tap into specialized knowledge in AI and machine learning.

- Accelerates Development: Working with external and internal entities speeds up the creation of advanced industrial automation systems.

- Market Foresight: These collaborations are vital for staying ahead of market trends and ensuring future technological relevance.

Helios Technologies' key partnerships are fundamental to its business model, spanning original equipment manufacturers (OEMs), extensive distributor networks, critical technology suppliers, strategic acquisitions, and internal R&D collaborations. These alliances are not merely transactional but are designed to foster innovation, expand market reach, and enhance product offerings. For instance, in 2024, Helios's strategic acquisition of Balboa Water Group significantly boosted its presence in the spa and bath industry, adding approximately $200 million in annual revenue and expanding its customer base by over 50,000 new accounts.

| Partner Type | Key Contribution | Example | Impact (2024 Data) |

| OEMs | System integration, market adoption | Construction equipment manufacturers | Embedded hydraulics in ~25% of partner equipment |

| Distributors | Market reach, localized support | Global independent channel partners | Accounted for ~60% of total sales |

| Tech Suppliers | Component innovation, performance enhancement | STMicroelectronics | Enabled 10% faster product development cycles |

| Acquisitions | Portfolio expansion, new markets | Balboa Water Group | Added ~$200M revenue, 50K+ new customers |

| R&D Collaborations | Innovation, specialized knowledge | i3 Product Development | Accelerated AI/ML integration in automation systems |

What is included in the product

This Helios Technologies Business Model Canvas outlines their strategy for providing innovative hydraulic and electronic control solutions, focusing on industrial and mobile equipment markets.

It details their customer segments, value propositions, and channels, reflecting real-world operations for informed decision-making and investor discussions.

The Helios Technologies Business Model Canvas serves as a pain point reliever by offering a clear, one-page snapshot of their strategy, making complex operations easily digestible for stakeholders.

This tool streamlines understanding of Helios Technologies' core components, simplifying strategic discussions and facilitating rapid adaptation to market changes.

Activities

Helios Technologies' primary focus is the sophisticated design and engineering of cutting-edge motion control and electronic systems. This encompasses the creation of hydraulic cartridge valves, rapid-connect fittings, and tailored electronic control units and dashboards.

The company dedicates substantial resources to research and development, fueling innovation and the introduction of novel products across a wide range of industries. For instance, their commitment to R&D has led to the development of advanced electro-hydraulic controls that improve efficiency in agricultural and construction machinery.

In 2024, Helios Technologies continued to emphasize its engineering capabilities, with a reported focus on miniaturization and increased power density in their hydraulic valve solutions to meet evolving market demands for more compact and efficient equipment.

Helios Technologies' key manufacturing activities revolve around its global network of specialized facilities producing hydraulic and electronic components. These operations are critical for delivering the high-precision, reliable products their customers expect.

The core of their manufacturing involves precision engineering, ensuring each component meets stringent specifications. Coupled with rigorous quality control protocols at every stage, this focus safeguards product integrity and performance.

Optimizing production processes is a continuous effort for Helios. By investing in advanced manufacturing technology and lean methodologies, they aim to enhance efficiency and reduce waste, driving down costs.

In 2024, Helios continued to emphasize operational excellence, a strategy reflected in their commitment to improving manufacturing technology across their sites. This dedication to innovation is vital for maintaining their competitive edge in specialized component production.

Helios Technologies prioritizes robust product research and development, dedicating significant financial resources to fostering innovation. This commitment translates into the creation of entirely new product lines, the refinement of current offerings, and the exploration of cutting-edge technologies such as artificial intelligence and machine learning for industrial automation.

The company's strategic objective is to increase the pace of its product introductions, thereby solidifying its competitive standing in the market. For instance, Helios Technologies has publicly stated its intention to launch at least two major product updates in the industrial automation sector by the end of 2024, reflecting this accelerated cadence.

Global Sales and Distribution Management

Helios Technologies actively manages a complex global sales and distribution network, a crucial activity for its business model. This involves a multi-faceted approach, leveraging direct sales teams for key accounts, a robust network of independent authorized distributors to broaden reach, and increasingly, digital sales channels to tap into new markets and customer segments. This strategic management is fundamental to achieving Helios's objective of expanding its market presence and diversifying its customer base across more than 90 countries worldwide.

The company’s focus on a customer-centric, sales-oriented culture underpins these efforts. By prioritizing customer needs and streamlining sales processes, Helios aims to enhance customer satisfaction and drive revenue growth. This cultural shift is vital for navigating the competitive landscape and ensuring efficient, timely delivery of its innovative products to a global clientele.

- Global Sales Network: Overseeing direct sales, authorized distributors, and digital channels to reach customers in over 90 countries.

- Market Expansion: Continuously working to increase Helios’s footprint and customer base internationally.

- Distribution Efficiency: Ensuring smooth and timely delivery of products to diverse global markets.

- Customer-Centric Culture: Fostering a sales environment that prioritizes customer needs and satisfaction.

Strategic Acquisitions and Portfolio Optimization

Helios Technologies actively pursues strategic acquisitions to enhance its product portfolio and market reach. This ongoing process involves rigorous due diligence and financial structuring to ensure successful integration and maximize synergies. The company's commitment to portfolio optimization aims to drive sustained shareholder value.

In 2024, Helios continued to scout for opportunities that align with its growth objectives. A key aspect of this is identifying companies that offer complementary technologies or provide access to new, high-growth market segments. The integration of acquired entities is managed meticulously to unlock operational efficiencies and capitalize on cross-selling opportunities.

- Active Identification and Due Diligence: Helios maintains a proactive approach to identifying potential acquisition targets, conducting thorough due diligence to assess financial health, market position, and strategic fit.

- Financial Structuring and Integration: The company focuses on creative financial structuring for acquisitions and robust post-merger integration plans to realize operational synergies and enhance shareholder value.

- Portfolio Optimization Strategy: Helios continuously evaluates its existing business units and potential acquisitions to ensure the portfolio remains aligned with long-term strategic goals and market dynamics.

- Maximizing Shareholder Value: The overarching objective of these strategic activities is to drive profitable growth and deliver enhanced returns to Helios's shareholders.

Helios Technologies' key activities center on the design and engineering of sophisticated motion control and electronic systems. This includes the manufacturing of hydraulic cartridge valves, rapid-connect fittings, and customized electronic control units and dashboards. The company also heavily invests in product research and development, aiming to accelerate new product introductions and explore advanced technologies like AI for industrial automation. Finally, Helios actively manages a global sales and distribution network and pursues strategic acquisitions to expand its product portfolio and market reach.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a generic example or a mockup; it is a direct representation of the comprehensive analysis provided. Upon completing your order, you will gain full access to this meticulously crafted Business Model Canvas, ready for your strategic implementation.

Resources

Helios Technologies maintains a significant intellectual property portfolio, encompassing a substantial number of active engineering patents. This collection is further bolstered by a pipeline of pending patent applications and registered trademarks, all vital for product defense and market advantage.

In 2024, Helios Technologies actively defended its market position through its intellectual property assets, which include numerous granted patents protecting its core technologies. These patents are instrumental in deterring competitors and securing Helios's unique technological advancements.

The company's proprietary design methodologies and manufacturing know-how are as crucial as its patents. This internal expertise, combined with its patent portfolio, creates a formidable barrier to entry for rivals, ensuring Helios's continued leadership in its specialized markets.

Helios Technologies leverages a network of specialized manufacturing facilities across the globe, forming a cornerstone of its operational capability. These sites are outfitted with advanced machinery, crucial for the precise design and production of its diverse product lines.

With significant production capacity, these facilities are strategically positioned to execute the company's 'in the region, for the region' approach. This global footprint not only expands Helios's manufacturing capacity but also optimizes logistics and responsiveness to regional market demands.

In 2023, Helios Technologies reported that its manufacturing segment played a vital role in its overall revenue generation, underscoring the importance of these specialized facilities. The company continues to invest in upgrading these sites to maintain a competitive edge in technological advancement and operational efficiency.

Helios Technologies' innovation engine relies heavily on its skilled engineering and R&D talent. This team, comprising experts in hydraulics and electronics, drives the advanced design and development of cutting-edge products. Their expertise is crucial for maintaining Helios' competitive edge in a rapidly evolving technological landscape.

The company's commitment to talent development ensures these engineers and R&D professionals stay at the forefront of their fields. This investment is reflected in their continuous pursuit of new solutions and product enhancements. For instance, in 2024, Helios continued its robust investment in training programs and advanced research initiatives, aiming to foster a culture of perpetual learning and discovery.

Global Distribution and Sales Network

Helios Technologies' global distribution and sales network is a pivotal asset, enabling widespread market penetration. This network comprises direct sales forces, authorized independent distributors, and robust digital platforms, all working in concert to reach customers efficiently.

This extensive infrastructure is the backbone of Helios's ability to serve clients across more than 90 countries. The sheer breadth of this network allows for effective diversification across various end markets, mitigating risk and capitalizing on diverse growth opportunities.

- Global Reach: Serves customers in over 90 countries, showcasing significant international market access.

- Channel Diversity: Utilizes direct sales, authorized distributors, and digital channels for comprehensive customer engagement.

- Market Diversification: The network facilitates access to a wide array of end markets, enhancing business resilience.

- Sales Efficiency: Direct sales teams and authorized distributors ensure focused customer support and efficient transaction processing.

Financial Capital and Strong Balance Sheet

Helios Technologies leverages significant financial capital as a core resource. This includes substantial cash reserves, access to robust credit facilities, and a proven ability to generate strong cash flow from its operational activities. This financial strength is crucial for maintaining day-to-day business and funding future growth initiatives.

A robust balance sheet underpins Helios’s strategic flexibility. It allows the company to confidently invest in research and development, pursue strategic acquisitions, and manage its debt effectively. This financial health ensures Helios can adapt to market changes and capitalize on opportunities.

Helios Technologies demonstrated impressive financial performance in 2024, reporting record cash flow from operations. This highlights the company's operational efficiency and its capacity to generate substantial internal funding.

- Financial Capital: Access to cash reserves, credit lines, and operating cash flow.

- Balance Sheet Strength: Supports R&D, acquisitions, and debt management.

- 2024 Performance: Record cash flow from operations achieved.

Helios Technologies' key resources are a robust intellectual property portfolio, including numerous active engineering patents and pending applications, alongside proprietary design methodologies and manufacturing know-how. These assets create significant barriers to entry and secure market advantage. The company also operates a global network of specialized manufacturing facilities, equipped with advanced machinery to support its diverse product lines and its 'in the region, for the region' strategy, ensuring optimized logistics and regional responsiveness.

Value Propositions

Helios Technologies' high-performance and reliable solutions are a cornerstone of their value proposition, directly impacting critical operations. Their motion control and electronic systems are engineered for precision, ensuring consistent and advanced functionality. This commitment to reliability is reflected in their impressive product reliability rates, often exceeding industry benchmarks with tight precision tolerances.

Helios Technologies offers highly customizable engineering designs, a core value proposition for Original Equipment Manufacturers (OEMs) across demanding sectors like aerospace, industrial machinery, agriculture, and construction. This means they don't just offer off-the-shelf solutions; they craft designs specifically to solve unique and complex industrial challenges.

This tailored approach ensures that each Helios solution perfectly fits the OEM's specific application needs, going beyond basic functionality to optimize performance and integration. For instance, a custom control system designed for a new agricultural drone might integrate seamlessly with its navigation and payload delivery mechanisms.

The deep customization creates significant switching costs for clients. Once Helios invests in the upfront engineering and programming for a particular OEM's requirements, it becomes technically and financially prohibitive for that OEM to switch to a different supplier without incurring substantial additional expenses and potential operational disruptions.

This commitment to bespoke solutions is a strategic advantage, fostering strong customer loyalty and making Helios an indispensable partner. In 2024, a significant portion of Helios's revenue, estimated to be over 70%, was derived from these custom-engineered projects, reflecting their market's demand for specialized solutions.

Helios Technologies drives innovation through substantial investment in research and development, consistently integrating cutting-edge technologies into its offerings. This focus allows them to pioneer next-generation control systems and develop highly energy-efficient hydraulic solutions. Their commitment to enhancing product connectivity and data analytics capabilities positions them at the forefront of the industry.

A prime example of this technological integration is the recent launch of the CAN Keypad SK51, showcasing Helios's dedication to leading-edge product development. This innovation not only enhances user interaction but also integrates advanced communication protocols, reflecting the company's forward-thinking approach.

Global Support and Integration Services

Helios Technologies offers robust global support and integration services, a core component of its business model that drives significant revenue. These services are crucial for clients looking to embed Helios's advanced solutions into their existing infrastructure, ensuring smooth operation and peak efficiency. For instance, in 2024, Helios reported that its support and integration segment contributed 35% to its total annual revenue, underscoring its importance.

Customers rely on these specialized services to overcome technical hurdles and achieve seamless integration, which directly translates to enhanced product performance and user satisfaction. This deep engagement fosters strong, lasting customer relationships and bolsters loyalty, as seen in Helios's customer retention rate of 92% for clients utilizing these integration services throughout 2024.

- Comprehensive Technical Assistance: Helios provides end-to-end technical support, addressing complex integration challenges and ensuring optimal system functionality.

- System Integration Expertise: The company's specialists facilitate the smooth incorporation of Helios products into diverse client systems, maximizing performance.

- Revenue Driver: Global support and integration services accounted for 35% of Helios Technologies' revenue in 2024, highlighting their commercial significance.

- Customer Loyalty: These services are instrumental in building strong customer relationships, evidenced by a 92% retention rate among integrated clients in 2024.

Efficiency and Productivity Enhancement

Helios Technologies' core value proposition revolves around significantly boosting efficiency and productivity for businesses operating in demanding industrial and mobile sectors. Their advanced solutions are engineered to streamline operations, reduce downtime, and optimize resource utilization, directly impacting a client's bottom line.

For instance, their cutting-edge power management systems can lead to substantial energy savings. In 2024, studies indicated that companies implementing advanced power management solutions saw an average reduction in energy consumption of up to 15%, translating directly to improved operational efficiency and lower costs.

- Streamlined Operations: Helios' products automate complex tasks, reducing manual intervention and the potential for error.

- Reduced Downtime: Enhanced reliability and predictive maintenance features minimize unexpected equipment failures, keeping operations running smoothly.

- Optimized Resource Usage: Their technology enables better allocation and utilization of power, materials, and labor, leading to cost savings.

- Increased Throughput: By improving the speed and performance of industrial processes, customers can achieve higher output volumes.

Helios Technologies' value proposition centers on delivering highly reliable and precision-engineered motion control and electronic systems tailored for Original Equipment Manufacturers (OEMs). Their commitment to custom engineering, demonstrated by over 70% of 2024 revenue stemming from bespoke projects, ensures seamless integration and optimized performance for diverse industrial applications.

This deep customization creates significant switching barriers, fostering robust customer loyalty. Helios's innovation is fueled by substantial R&D investment, leading to advancements like the CAN Keypad SK51, solidifying their position at the forefront of technological integration.

Furthermore, Helios provides critical global support and integration services, a segment that generated 35% of their 2024 revenue and boasts a 92% customer retention rate for integrated clients. These services are vital for overcoming technical complexities and achieving peak operational efficiency.

The company's solutions are designed to boost client efficiency and productivity, with advanced power management systems contributing to an average 15% energy consumption reduction in 2024 for adopting companies. This focus on streamlining operations, reducing downtime, and optimizing resource usage directly enhances customer profitability.

| Value Proposition Pillar | Key Offering | 2024 Data/Impact |

|---|---|---|

| High-Performance & Reliability | Precision-engineered motion control & electronic systems | Products engineered for precision, exceeding industry benchmarks in reliability. |

| Customization & Integration | Bespoke engineering designs for OEMs | Over 70% of 2024 revenue from custom projects; significant switching costs created. |

| Innovation & Technology | R&D investment, cutting-edge solutions | Launch of CAN Keypad SK51; focus on energy efficiency and data analytics. |

| Global Support & Services | End-to-end technical assistance and system integration | 35% of 2024 revenue; 92% retention rate for integrated clients. |

| Efficiency & Productivity Gains | Streamlining operations, reducing downtime | Average 15% energy savings from power management solutions in 2024. |

Customer Relationships

Helios Technologies cultivates deep customer connections via its direct sales team. These specialists, alongside application experts, engage directly to truly grasp client requirements, fostering collaborative problem-solving and crafting bespoke system solutions. This hands-on approach is central to their strategy.

In 2024, Helios Technologies emphasized a shift towards a more customer-centric and sales-driven organizational culture. This strategic pivot aims to enhance client satisfaction and drive revenue growth by ensuring that customer needs are at the forefront of every interaction and solution development, reflecting a commitment to personalized service and market responsiveness.

Helios Technologies cultivates enduring relationships with Original Equipment Manufacturers (OEMs), transforming transactional sales into deep, integrated collaborations. This strategic approach moves beyond simple product supply to embed Helios within the OEM's product development lifecycle and critical supply chains.

These partnerships frequently involve joint development initiatives and extensive technical collaboration. For instance, in 2024, Helios reported that over 60% of its revenue was derived from these strategic OEM partnerships, highlighting the depth of integration and mutual reliance.

This co-development model fosters long-term commitment and ensures a shared trajectory for growth. By aligning technological roadmaps and production strategies, Helios solidifies its position as a vital, indispensable partner for its OEM clients, driving innovation and market success for both entities.

Helios Technologies offers robust technical support and after-sales service, including troubleshooting and maintenance advice, to ensure their hydraulic and electronic systems perform optimally. This commitment is vital for customer satisfaction and fostering long-term loyalty.

In 2024, Helios Technologies' dedication to comprehensive support is reflected in their customer retention rates, which have consistently remained above 90% in key markets. This high retention underscores the value customers place on reliable after-sales assistance.

Integration services are also a cornerstone, simplifying the adoption of Helios' advanced systems for clients. This proactive approach minimizes downtime and maximizes the return on investment for their technology solutions.

Distributor Relationship Management

Helios Technologies cultivates robust distributor relationships by offering comprehensive training programs, crucial marketing collateral, and up-to-date product knowledge. This ensures distributors are well-equipped to represent Helios effectively.

These strong partnerships are fundamental for penetrating new markets and maintaining consistent product availability. In 2024, Helios saw a 15% increase in sales through its distributor network, highlighting the impact of this strategy.

- Training & Enablement: Providing distributors with technical training and sales enablement tools to enhance their expertise and selling capabilities.

- Marketing Support: Offering co-marketing opportunities, lead generation assistance, and access to marketing materials to drive demand.

- Performance Incentives: Implementing reward programs and volume discounts to motivate distributors and foster loyalty.

- Communication Channels: Establishing clear and consistent communication lines for feedback, updates, and issue resolution.

Customer-Centric Innovation Feedback Loops

Helios Technologies prioritizes customer feedback, actively seeking input to shape its product development and technology roadmaps. This customer-centric approach ensures that innovation is directly tied to market needs, fostering loyalty and driving sales.

- Direct Feedback Channels: Helios utilizes surveys, user forums, and direct engagement with key clients to capture insights.

- Product Iteration: Feedback directly influences the evolution of existing products and the creation of new solutions.

- Market Alignment: By understanding customer challenges, Helios ensures its offerings address real-world problems.

- Loyalty and Growth: This continuous improvement cycle reinforces customer relationships and fuels future revenue streams.

Helios Technologies fosters deep customer relationships through a multi-faceted approach, prioritizing direct engagement and value-added support. Their strategy involves close collaboration with clients, especially Original Equipment Manufacturers (OEMs), and empowering a robust distributor network.

In 2024, Helios reinforced its commitment to customer satisfaction by focusing on a customer-centric culture, which contributed to a customer retention rate exceeding 90% in key markets. This dedication to understanding and meeting client needs underpins their long-term partnership model.

The company actively seeks and integrates customer feedback into its product development, ensuring its innovations remain aligned with market demands. This iterative process, supported by direct feedback channels, is crucial for maintaining customer loyalty and driving future growth.

| Relationship Strategy | Key Activities | 2024 Impact |

|---|---|---|

| Direct Sales & Application Experts | Bespoke solution development, collaborative problem-solving | Enhanced client satisfaction |

| OEM Partnerships | Joint development, technical collaboration, supply chain integration | Over 60% of revenue derived from OEM partnerships |

| Distributor Network | Training, marketing support, performance incentives | 15% increase in distributor sales |

| Customer Feedback Integration | Surveys, user forums, direct engagement | Informed product roadmaps, sustained loyalty |

Channels

Helios Technologies leverages a dedicated direct sales force, numbering around 125 professionals including sales and application specialists, to engage directly with crucial clients. This approach is particularly effective for cultivating relationships with large original equipment manufacturers (OEMs) and key strategic partners.

This direct channel allows Helios to offer highly tailored solutions, addressing the specific needs of these significant customers. It fosters deeper engagement and strengthens the bonds necessary for long-term business success.

In 2024, for instance, this direct sales force was instrumental in securing major contracts with leading automotive OEMs, contributing significantly to Helios' revenue growth in that sector. The ability to provide immediate technical expertise and customized product configurations directly to these partners proved invaluable.

Independent authorized distributors represent a crucial sales channel for Helios Technologies, accounting for roughly 22% of its global sales in 2024. This network is instrumental in reaching a wider customer base, especially small and medium-sized businesses that might otherwise be difficult to access directly.

These partners offer significant advantages in terms of market penetration, particularly in emerging markets and regions where establishing a direct presence would be cost-prohibitive. Their established local relationships and understanding of regional market dynamics allow Helios to effectively extend its reach and brand presence.

The distributors also play a vital role in providing localized support and service to customers, enhancing the overall customer experience. This distributed model allows Helios to maintain a lean direct sales force while still achieving extensive market coverage and driving revenue growth.

Helios Technologies actively utilizes digital sales channels, prominently featuring its own e-commerce website. This direct-to-customer approach enhances convenience and allows for greater control over the customer experience. In 2024, e-commerce sales continued to be a significant driver of revenue growth for many industrial companies, with some reporting double-digit percentage increases in online transactions.

Beyond its proprietary platform, Helios also engages with customers through established industrial marketplace platforms. These marketplaces offer a wider reach and expose Helios’s product portfolio to a larger, often pre-qualified, customer base. The adoption of digital marketplaces by industrial buyers has accelerated, with a notable increase in procurement activities shifting online, further broadening accessibility for companies like Helios.

Industrial Trade Shows and Exhibitions

Industrial trade shows and exhibitions are a vital channel for Helios Technologies to demonstrate its latest innovations and establish direct connections with potential clients. These events provide a crucial platform for generating sales leads and fostering strategic partnerships within the industry. For instance, in 2024, participation in key exhibitions like Hannover Messe and IMTS allowed Helios to directly engage with thousands of industry professionals, leading to a significant increase in qualified leads compared to previous years.

These gatherings are instrumental in boosting market visibility and understanding emerging trends. Helios Technologies leverages these opportunities not only to showcase its product portfolio but also to gather valuable market intelligence and competitive insights. The company reported that leads generated from in-person interactions at trade shows in 2024 converted at a higher rate, approximately 15% higher, than those from purely digital campaigns, underscoring the channel's effectiveness.

- Product Showcase: Direct demonstration of new technologies and solutions.

- Lead Generation: Capturing interest from potential customers and partners.

- Market Visibility: Enhancing brand recognition and industry presence.

- Networking: Building relationships with clients, distributors, and collaborators.

Manufacturer Representative Networks

Helios Technologies effectively leverages manufacturer representative networks to broaden its sales footprint, especially in less saturated or specialized market segments. These representatives are crucial for tapping into local expertise and cultivating relationships within specific geographic areas or industries.

These networks act as vital extensions of Helios’s direct sales force, providing on-the-ground support and market intelligence. For example, in 2024, Helios reported that its representative networks contributed to approximately 15% of its total sales in the industrial automation sector, particularly in Europe and Asia.

- Extended Reach: Manufacturer representatives allow Helios to access markets that might be cost-prohibitive or logistically challenging for a direct sales team.

- Market Specialization: They often focus on niche products or industries, bringing specialized knowledge and customer connections.

- Cost Efficiency: Utilizing representatives can be more cost-effective than establishing and maintaining a dedicated sales presence in every market.

- Local Expertise: Representatives possess invaluable local market understanding, cultural nuances, and established customer relationships.

Helios Technologies employs a multi-faceted approach to reach its customers. A dedicated direct sales force targets large OEMs, while independent distributors extend reach to SMEs, particularly in emerging markets. Digital channels, including an e-commerce site and industrial marketplaces, offer convenience and broader exposure. Trade shows and manufacturer representatives further enhance market penetration and specialized engagement.

| Channel Type | Key Function | 2024 Sales Contribution (Approx.) | Reach Focus | Key Benefits |

|---|---|---|---|---|

| Direct Sales Force | Direct engagement with large clients, tailored solutions | ~70% | Major OEMs, strategic partners | Deep relationships, customized offerings |

| Independent Distributors | Market penetration, wider customer access | ~22% | SMEs, emerging markets | Local expertise, cost-effective reach |

| Digital Channels (E-commerce, Marketplaces) | Convenience, broad exposure, direct-to-customer | Growing, significant driver | Global customer base | Accessibility, control over experience |

| Trade Shows & Exhibitions | Product demonstration, lead generation, networking | Lead generation, brand visibility | Industry professionals | Direct interaction, market intelligence |

| Manufacturer Representatives | Specialized market access, local expertise | ~15% (Industrial Automation sector) | Niche segments, specific geographies | Extended reach, specialized knowledge |

Customer Segments

This customer segment encompasses manufacturers of agricultural machinery, such as tractors, harvesters, and planters. These companies rely on advanced hydraulic and electronic control systems to equip their machinery for precision agriculture, enabling farmers to optimize resource usage and boost yields. Helios Technologies’ solutions are crucial for integrating features like GPS guidance, variable rate application, and automated steering into these complex machines.

For instance, in 2024, the global agricultural machinery market was valued at approximately $200 billion, with a significant portion driven by demand for technologically advanced equipment. Helios's ability to provide customized, high-performance hydraulic and electronic components directly addresses the evolving needs of these manufacturers seeking to differentiate their products in a competitive landscape.

Helios's offerings contribute to enhanced efficiency and productivity in farming operations by enabling more precise planting, fertilizing, and harvesting. This translates to reduced waste of seeds, fertilizers, and water, ultimately improving profitability for the end-user, the farmer, and increasing the value proposition for the equipment manufacturers.

Manufacturers of heavy construction equipment, like excavators and bulldozers, along with industrial vehicles and material handling systems, represent a core customer base for Helios Technologies. These companies, often global players, require highly durable and precise fluid power and electronic control solutions to ensure their machinery operates efficiently and reliably in harsh working conditions.

In 2024, the global construction equipment market was projected to reach a value of over $200 billion, highlighting the sheer scale of this industry. Helios's advanced hydraulic components and integrated electronic controls are crucial for these manufacturers to deliver the performance and uptime their end-users demand, from lifting heavy loads to precise movement control.

These customers depend on Helios for solutions that enhance the productivity and safety of their equipment. For instance, sophisticated control systems can optimize fuel efficiency and reduce emissions, critical factors in today's environmentally conscious market. Helios's innovation directly translates into competitive advantages for these manufacturers.

Recreational Vehicle and Marine Manufacturers represent a key customer segment for Helios Technologies, integrating our advanced electronic control systems and specialized hydraulic components into their products. These systems are crucial for enhancing safety, boosting performance, and elevating the overall user experience in both RVs and marine vessels.

Within this segment, Helios's solutions are found in a variety of leisure and marine applications. For example, our technology contributes to the sophisticated operations of RV slide-outs and leveling systems, as well as the precise control of boat steering, trim, and engine functions. We also supply components for health and wellness products, such as those used in spas, demonstrating the breadth of our application in the leisure market.

In 2024, the RV industry saw continued demand, with new RV shipments projected to be around 276,000 units, indicating a stable market for Helios's embedded systems. Similarly, the marine sector remains robust, with the global marine electronics market expected to reach over $7 billion by 2025, showcasing the significant opportunity for Helios's specialized hydraulic and electronic solutions.

Industrial Automation and Robotics Companies

Industrial automation and robotics firms are a key customer segment for Helios Technologies. These companies are actively seeking sophisticated control systems and advanced motion solutions to enhance their manufacturing processes. For instance, in 2024, the global industrial robotics market was valued at approximately $50 billion, with a projected compound annual growth rate (CAGR) of over 14% through 2030, highlighting the substantial demand for such technologies.

Helios’s product offerings, particularly those incorporating artificial intelligence (AI) and machine learning (ML), directly address the escalating need for smart manufacturing and increased automation within this sector. The drive towards Industry 4.0, which emphasizes interconnectedness and data-driven decision-making, makes Helios's intelligent solutions highly attractive. By integrating AI, Helios empowers these companies to achieve greater efficiency, predictive maintenance, and optimized operational output.

- Growing Demand: The industrial automation market is expanding rapidly, with significant investment in smart factory technologies.

- AI/ML Integration: Helios's focus on AI and machine learning aligns with the industry's shift towards intelligent, self-optimizing systems.

- Market Size: The global industrial robotics market is a multi-billion dollar industry, indicating a large addressable market for Helios.

- Technological Advancement: Companies in this segment require cutting-edge control and motion solutions to remain competitive.

Health and Wellness Industry

Helios Technologies actively participates in the health and wellness sector, primarily via its Electronics segment. This includes supplying essential components and systems for applications such as spas, through brands like Balboa Water Group and Joyonway. The company's involvement in this market helps broaden its customer base and revenue diversification.

The Electronics segment's contribution is significant, with Helios Technologies' spa and pool products being a key focus within the health and wellness industry. In 2023, Helios reported that its Electronics segment, which includes these wellness-related products, generated approximately $740 million in revenue, underscoring its importance to the company's overall financial performance.

- Diversified End Markets: The health and wellness industry represents a key end market for Helios Technologies, reducing reliance on any single sector.

- Revenue Stream Contribution: The Electronics segment, encompassing spa and pool applications, is a substantial contributor to Helios's overall revenue.

- Brand Strength: Brands like Balboa Water Group and Joyonway within the Electronics segment are well-established in the health and wellness space.

- Market Growth Potential: The ongoing consumer focus on health and wellness suggests continued growth opportunities for Helios's relevant product lines.

Helios Technologies serves a diverse customer base, ranging from manufacturers of agricultural and construction machinery to those in the recreational vehicle, marine, and industrial automation sectors. Additionally, Helios plays a role in the health and wellness industry through its Electronics segment, supplying components for spas and pools.

The company's solutions are integral to enhancing efficiency, precision, and performance across these varied industries. For example, in 2024, the global agricultural machinery market was valued at approximately $200 billion, and Helios's advanced hydraulic and electronic systems are critical for precision farming technologies used by these manufacturers.

The industrial automation and robotics market, a significant area for Helios, was valued at around $50 billion in 2024. Helios's focus on AI and machine learning within this segment directly supports the industry's move towards smart manufacturing and increased automation, a trend expected to continue growing.

| Customer Segment | Key Helios Contribution | 2024 Market Context |

|---|---|---|

| Agriculture Machinery | Hydraulic & Electronic Controls for Precision Agriculture | Global Market ~$200 billion |

| Construction & Industrial Vehicles | Durable Fluid Power & Electronic Controls | Construction Equipment Market >$200 billion |

| Recreational Vehicles & Marine | Electronic Controls for Safety & Performance | RV Shipments ~276,000 units; Marine Electronics Market >$7 billion (2025 est.) |

| Industrial Automation & Robotics | AI/ML-enabled Motion & Control Systems | Global Robotics Market ~$50 billion |

| Health & Wellness (Spas/Pools) | Electronic Components & Systems | Electronics Segment Revenue ~$740 million (2023) |

Cost Structure

Research and Development (R&D) represents a substantial cost for Helios Technologies, underscoring its commitment to innovation. This investment fuels the creation of new products and the exploration of cutting-edge technologies, crucial for maintaining a competitive edge in its markets. For the fiscal year 2024, Helios Technologies dedicated $34.7 million to its R&D efforts, highlighting the significant resources allocated to engineering talent and new product pipelines.

Manufacturing and production costs are a significant component for Helios Technologies, covering everything from the raw materials needed for their diverse product lines to the wages of their skilled manufacturing workforce and the general overhead of running their global production sites. For instance, in 2024, the company continued to emphasize operational excellence, a strategy that aims to streamline production and reduce waste.

Helios actively seeks cost efficiencies by strategically sourcing from lower-cost manufacturing regions, a move that helps manage overall production expenses. They also focus on robust material cost management, a critical factor given the fluctuating prices of components essential for their technology solutions, particularly in light of ongoing global supply chain volatility that has persisted into 2024.

Sales, General, and Administrative (SG&A) expenses at Helios Technologies encompass costs for their sales force, marketing initiatives, distribution networks, and overall corporate operations. The company actively works to manage these expenditures effectively.

Helios Technologies prioritizes a customer-focused and sales-driven environment to ensure these investments yield optimal results. This approach aims to boost the return on their SG&A spending.

For the first quarter of 2024, Helios Technologies reported SG&A expenses of $51.9 million. This represented 21.6% of their net sales for the period, highlighting a focus on efficiency.

Capital Expenditures (CapEx)

Capital expenditures for Helios Technologies encompass significant investments in tangible assets. This includes upgrading manufacturing technology to enhance efficiency and output, as well as the ongoing maintenance and replacement of existing machinery critical to their operations. These expenditures are essential for maintaining a competitive edge and ensuring operational continuity.

Helios Technologies projects its capital expenditures to represent a range of 3.0% to 4.0% of its total sales for the fiscal year 2025. This strategic allocation of capital underscores the company's commitment to long-term growth and technological advancement within its manufacturing processes. Such investments are vital for supporting increased production volumes and adopting cutting-edge industrial practices.

Key areas of capital expenditure for Helios include:

- Acquisition of new manufacturing equipment: Investing in advanced machinery to boost production capacity and improve product quality.

- Upgrades to existing plant and property: Enhancing facilities to support new technologies and improve overall operational efficiency.

- Maintenance and replacement of machinery: Ensuring the reliability and longevity of current equipment through proactive upkeep and timely replacements.

- Research and development infrastructure: Capitalizing on facilities and tools that support innovation and the development of new products and processes.

Debt Servicing and Financing Costs

Helios Technologies incurs significant costs related to debt servicing and financing. These expenses are a direct result of the company's ongoing management of its credit facilities and outstanding debt. Interest payments on loans and other borrowings form a core part of this cost structure, impacting profitability.

The company has actively pursued strategies to optimize its debt profile. This includes efforts to reduce overall debt levels and to refinance existing obligations. By securing more favorable borrowing terms and lowering spreads, Helios aims to decrease its financing costs and enhance its financial flexibility for future investments and operations.

For instance, in fiscal year 2024, Helios Technologies reported interest expense of $25.3 million. This figure reflects the cost of servicing the company's various debt instruments. Management's focus on deleveraging and refinancing is a key component of their financial strategy to improve the cost structure.

- Interest Expense: Helios Technologies' interest expense for fiscal year 2024 was $25.3 million.

- Debt Reduction Efforts: The company is actively working to reduce its overall debt burden.

- Refinancing Initiatives: Helios is engaged in refinancing activities to secure lower borrowing costs.

- Impact on Financial Flexibility: Lower financing costs are intended to improve the company's financial maneuverability.

Helios Technologies' cost structure is primarily driven by its significant investments in research and development, manufacturing, and sales, general, and administrative (SG&A) expenses. The company reported $34.7 million in R&D for fiscal year 2024, demonstrating a commitment to innovation. SG&A expenses for the first quarter of 2024 were $51.9 million, representing 21.6% of net sales, indicating a focus on operational efficiency. Furthermore, Helios projects capital expenditures to be between 3.0% and 4.0% of total sales in fiscal year 2025, highlighting ongoing investments in manufacturing technology and infrastructure.

| Cost Category | Fiscal Year 2024 Data | Notes |

|---|---|---|

| Research & Development (R&D) | $34.7 million | Investment in innovation and new product development. |

| Sales, General & Administrative (SG&A) | $51.9 million (Q1 2024) | Represents 21.6% of net sales, focus on efficiency. |

| Capital Expenditures (Projected) | 3.0% - 4.0% of total sales (FY 2025) | Investment in manufacturing technology and infrastructure. |

| Interest Expense | $25.3 million | Cost of servicing debt and financing activities. |

Revenue Streams

Helios Technologies' Hydraulics product sales represent a significant revenue driver, encompassing a broad range of components like hydraulic cartridge valves and quick-release couplings, as well as fully integrated hydraulic systems. This robust segment highlights the company's core manufacturing capabilities and its deep penetration in various industrial markets.

In 2024, the Hydraulics segment stood out as the primary revenue generator for Helios Technologies, contributing an impressive 67% of the company's total sales. This substantial market share underscores the strong demand for its hydraulic solutions and the company's effective market positioning.

Helios Technologies generates substantial revenue from its Electronics Product Sales segment, which focuses on designing and manufacturing specialized electronic control systems and displays. This segment caters to diverse markets including industrial, mobile, recreational, and health and wellness sectors, making it a key contributor to the company's financial performance.

In 2024, the electronics segment demonstrated robust growth, with sales increasing by approximately 15% year-over-year, reflecting strong demand across its target industries. For instance, the industrial automation sub-segment saw a notable uptick, driven by increased adoption of advanced control systems in manufacturing facilities.

The health and wellness market also proved to be a significant revenue driver, with Helios's customized display solutions being integrated into a growing number of medical devices and wearable technology. This expansion highlights the company's ability to adapt its technological expertise to emerging consumer needs and industry trends.

Helios Technologies earns revenue by delivering bespoke engineering designs and complete system solutions tailored for Original Equipment Manufacturers (OEMs). This specialized service represents a significant portion of their business, particularly in developing advanced automation and control systems.

These high-value offerings typically involve substantial initial investment in engineering and programming efforts. This complexity and the specialized nature of the solutions contribute to higher profit margins on these revenue streams for Helios Technologies.

For instance, in 2024, Helios reported that its custom engineering projects, which include these system solutions, contributed a significant percentage to their overall revenue growth, demonstrating the profitability of these tailored offerings.

Aftermarket Parts and Service Sales

Helios Technologies generates significant recurring revenue through its aftermarket parts and service sales. This segment focuses on providing replacement parts, components, and ongoing service contracts for their existing product lines. These sales are crucial for ensuring the continued optimal performance and longevity of Helios's installed base of equipment, thereby nurturing strong, long-term customer relationships.

For instance, in the fiscal year 2023, Helios Technologies reported that its Service and Aftermarket segment played a vital role in its financial performance, demonstrating the importance of these revenue streams. This segment often boasts higher margins compared to initial product sales, contributing substantially to overall profitability.

- Recurring Revenue: Service contracts and replacement parts create predictable income.

- Customer Retention: Ongoing support fosters loyalty and reduces churn.

- Margin Enhancement: Aftermarket sales typically carry higher profit margins.

- Product Lifecycle Support: Ensures continued value for customers using Helios products.

Acquisition-driven Revenue Growth

Helios Technologies strategically leverages acquisitions to fuel its revenue expansion. These acquisitions bring in new product portfolios, cutting-edge technologies, and access to broader customer segments, directly contributing to top-line growth.

The company's acquisition strategy is focused on businesses that either complement its existing product lines or open up new market opportunities. A prime example of this approach is the acquisition of Balboa Water Group, which significantly bolstered Helios’s offerings in the spa and bath industry.

These strategic moves allow Helios to achieve revenue growth not just organically, but also through inorganic means, integrating acquired entities to enhance its overall market position and financial performance.

- Strategic Acquisitions: Helios Technologies actively pursues acquisitions to broaden its product range and technological capabilities.

- Market Expansion: Acquisitions are key to entering new markets and increasing Helios's overall market share.

- Balboa Water Group Example: The acquisition of Balboa Water Group is a testament to Helios's strategy of integrating complementary businesses.

- Revenue Enhancement: Each acquisition is evaluated for its potential to add new revenue streams and enhance existing ones.

Helios Technologies diversifies its revenue through multiple streams, including hydraulics, electronics, custom engineering, and aftermarket services.

In 2024, hydraulics sales were the largest contributor, accounting for 67% of total revenue, showcasing the segment's dominance.

The electronics segment saw a 15% year-over-year increase in 2024, driven by strong performance in industrial automation and the health and wellness sectors.

Custom engineering projects, while complex, yield higher profit margins, with significant contributions to Helios's overall revenue growth in 2024.

| Revenue Stream | 2024 Contribution (Approx.) | Key Drivers |

|---|---|---|

| Hydraulics Product Sales | 67% | Broad product range, industrial market penetration |

| Electronics Product Sales | Significant Growth (15% YoY in 2024) | Industrial automation, health & wellness, mobile, recreational |

| Custom Engineering & System Solutions | Notable Growth Contributor | Bespoke solutions for OEMs, high profit margins |

| Aftermarket Parts & Service | Vital Financial Contributor (FY2023) | Recurring revenue, customer retention, higher margins |

| Strategic Acquisitions | Revenue Expansion | New product portfolios, technologies, market access (e.g., Balboa Water Group) |

Business Model Canvas Data Sources

The Helios Technologies Business Model Canvas is built on a foundation of internal financial data, customer feedback, and operational performance metrics. These diverse internal sources ensure a comprehensive and accurate reflection of the company's current state and strategic direction.