Hearst Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hearst Bundle

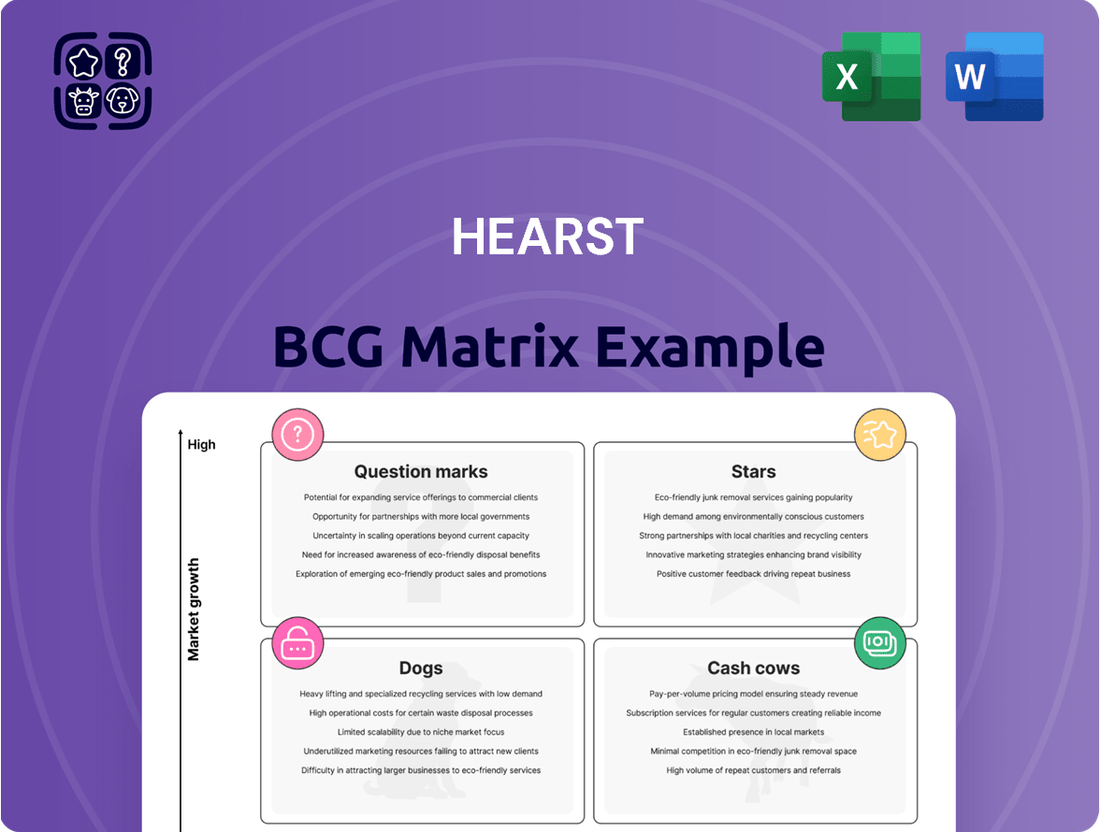

Uncover the strategic positioning of this company's product portfolio with the Hearst BCG Matrix. See at a glance which products are driving growth, which are generating stable revenue, and which might require a second look. Purchase the full BCG Matrix for a comprehensive breakdown of each product's quadrant placement and actionable strategic recommendations to optimize your investments.

Stars

Fitch Group, a cornerstone of Hearst's portfolio, demonstrated robust financial health in 2024, solidifying its position as a market leader in financial information services. The company’s credit rating division, in particular, experienced significant profit growth, directly benefiting from a vibrant bond market and Hearst's strategic capital allocation towards enhancing Fitch's data analytics and operational efficiencies.

Hearst Television, a significant national multimedia entity with a presence in numerous U.S. cities, demonstrated robust performance throughout 2024. This segment was a key contributor to Hearst's overall record revenue for the year.

The television division's strength in 2024 was notably enhanced by the surge in political advertising, a common trend in election years. Coupled with its commitment to high-quality local journalism, this segment successfully maintained a substantial market share.

Hearst Health, a key player in healthcare information and software, has seen impressive growth, with some segments like MCG achieving over 10% average annual profit growth in recent years. This consistent performance positions it as a strong contender within the portfolio.

The strategic acquisition of QGenda in 2024 underscores Hearst Health's commitment to expanding its footprint in the dynamic healthcare technology sector. This move is expected to further bolster its high-growth potential and market share.

Hearst Transportation (e.g., MOTOR, Bring a Trailer)

Hearst's Transportation segment, encompassing entities like MOTOR and the popular online auction platform Bring a Trailer, demonstrates robust performance with consistent double-digit profit expansion. These businesses are strategically positioned within expanding niche markets, solidifying Hearst's competitive advantage and signaling strong potential.

Bring a Trailer, in particular, has seen significant growth. In 2023, the platform facilitated over $2 billion in sales, a substantial increase from previous years, reflecting its dominance in the enthusiast vehicle market. MOTOR, providing data and software solutions for the automotive industry, also contributes significantly to this sector's success.

- Strong Profitability: The transportation group consistently achieves double-digit profit growth, underscoring its financial strength.

- Market Leadership: Businesses like Bring a Trailer dominate their specialized segments, benefiting from strong brand recognition and customer loyalty.

- Growth Trajectory: The increasing volume and value of transactions on platforms like Bring a Trailer indicate a sustained upward trend in revenue and market share.

- Strategic Positioning: Hearst's investments in these areas leverage growing consumer interest in classic and enthusiast vehicles, aligning with market demand.

Hearst Ventures' Successful Portfolio Companies

Hearst Ventures has a strong track record of identifying and backing innovative companies, particularly in the media and technology sectors. Their strategic investments often target emerging trends and disruptive technologies, leading to significant returns and reinforcing Hearst's position in the evolving media landscape.

Notable successes highlight their acumen. For instance, early investments in companies like Roku, a leading connected TV platform, and Pandora, a pioneer in music streaming, demonstrate their ability to spot high-growth potential. These ventures have not only achieved substantial market penetration but have also provided Hearst with valuable strategic insights and financial gains.

- Roku's Market Position: As of early 2024, Roku commanded a significant share of the U.S. smart TV operating system market, with millions of active accounts, showcasing the success of Hearst Ventures' early backing.

- Pandora's Evolution: While facing market shifts, Pandora's journey as an early streaming service provided a blueprint for digital audio consumption, illustrating Hearst's foresight in digital media.

- Strategic Alignment: These investments align with Hearst's broader strategy of engaging consumers through diverse media platforms and leveraging technology for content distribution and monetization.

Stars represent business units with high market share and high growth potential. These are the ideal investments for Hearst, offering significant future returns. In 2024, segments like Hearst Health, particularly with the strategic acquisition of QGenda, and the Transportation sector, driven by Bring a Trailer's continued sales growth, exemplify this star category. Their strong performance and market positioning indicate substantial future revenue and profit generation for Hearst.

What is included in the product

The Hearst BCG Matrix analyzes Hearst's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Hearst BCG Matrix provides a clear, visual overview of business unit performance, easing the pain of complex strategic analysis.

Cash Cows

Hearst's core magazine portfolio, including titles like Good Housekeeping and Cosmopolitan, represents significant cash cows within their BCG matrix. Despite ongoing shifts in the media landscape impacting print revenue, these established brands continue to command substantial market share and generate robust cash flow, particularly as digital subscriptions and advertiser interest surged in 2024.

These mature products demand comparatively lower investment for maintenance and growth, allowing them to act as consistent revenue generators. For instance, Hearst Magazines saw a notable increase in digital ad revenue in 2024, underscoring the resilience and profitability of these legacy brands in the evolving media market.

Hearst's established newspaper operations, such as the Houston Chronicle and San Antonio Express-News, are classic examples of Cash Cows within the BCG Matrix. While the broader newspaper industry faces challenges with declining print advertising revenue, these entities likely leverage their deep local market penetration and loyal readership to generate consistent, predictable cash flows. For instance, in 2023, the Houston Chronicle reported a significant local market share, demonstrating its enduring relevance despite digital shifts.

Hearst's 50% stake in A+E Networks functions as a classic Cash Cow within the BCG framework. This mature business consistently delivers strong, reliable cash flow, a crucial element for funding other ventures within the Hearst portfolio.

Despite the evolving media landscape, marked by cord-cutting trends and intense competition for advertising dollars, A+E Networks continues to be a significant profit driver for Hearst. For instance, in 2023, A+E Networks reported robust revenue streams, underscoring its enduring value.

ESPN Inc. (20% ownership)

Hearst's 20% ownership in ESPN Inc. positions it as a significant player in the sports media industry. Historically, this stake has been a substantial contributor to Hearst's overall profitability, highlighting ESPN's importance as a cash cow.

Despite the evolving media environment, ESPN continues to demonstrate resilience. Its established brand recognition and growing success in streaming services contribute to its ongoing ability to generate consistent profits for Hearst. For instance, in 2024, ESPN+ saw continued subscriber growth, further solidifying its revenue streams.

- ESPN's strong brand equity supports consistent revenue generation.

- Emerging profitability from streaming services enhances cash flow.

- Hearst's 20% stake represents a significant portion of its overall profits.

- ESPN's financial performance remains a key driver for Hearst's business.

First Databank (FDB)

First Databank (FDB), a key component of Hearst Health, operates as a classic cash cow within the BCG matrix. Its core business involves supplying critical drug and device knowledge to healthcare professionals, a service that has become indispensable to the industry.

As a long-standing leader in this specialized field, FDB consistently generates substantial revenue and robust cash flow. This stability stems from the essential nature of its information services, which are vital for patient safety and effective treatment protocols in healthcare settings.

FDB's position as a cash cow is further solidified by its established market presence and the recurring revenue model associated with its data subscriptions and licensing agreements. For instance, in 2024, the healthcare data analytics market, a sector FDB significantly contributes to, was projected to reach over $30 billion globally, highlighting the demand for such critical information.

- Market Dominance: FDB holds a strong position in the drug and device knowledge sector.

- Consistent Revenue: Its essential services ensure a steady income stream.

- High Profitability: Mature operations lead to significant cash generation.

- Low Investment Needs: FDB requires minimal reinvestment to maintain its market share.

Hearst's magazine brands, like Good Housekeeping and Cosmopolitan, are strong cash cows. These mature titles, despite media shifts, maintained significant market share and generated healthy cash flow in 2024, boosted by digital subscriptions and advertising interest.

These established brands require less investment for upkeep and growth, acting as reliable revenue streams. For example, Hearst Magazines saw a notable rise in digital ad revenue in 2024, proving the enduring profitability of these legacy titles.

Hearst's stake in ESPN Inc. is a prime example of a cash cow. Even with industry changes, ESPN's brand strength and streaming growth, like ESPN+'s continued subscriber increases in 2024, ensure consistent profits for Hearst.

First Databank (FDB), part of Hearst Health, is a classic cash cow. Its indispensable drug and device knowledge services for healthcare professionals generate substantial, recurring revenue through subscriptions and licensing, a sector projected to exceed $30 billion globally in 2024.

| Business Unit | BCG Category | Key Attributes | 2024 Data/Trends |

| Hearst Magazines (e.g., Good Housekeeping) | Cash Cow | High market share, established brands, low investment needs | Increased digital ad revenue, strong digital subscription growth |

| ESPN Inc. (Hearst's 20% stake) | Cash Cow | Strong brand equity, resilient revenue streams | Continued subscriber growth for ESPN+ |

| First Databank (FDB) | Cash Cow | Market leader in healthcare data, recurring revenue model | Healthcare data analytics market projected over $30 billion globally |

What You See Is What You Get

Hearst BCG Matrix

The Hearst BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for your immediate use. You can be confident that the professional formatting and insightful data presented here are precisely what you'll be downloading, allowing you to seamlessly integrate it into your business planning and decision-making processes without any further editing required. This preview serves as a direct representation of the high-quality, actionable report that will be yours to leverage for strategic advantage.

Dogs

Traditional print newspaper operations within Hearst, while historically significant, are experiencing a notable downturn. Circulation figures for many print newspapers have continued to decline, a trend exacerbated by the persistent shift towards digital media consumption. This decline directly impacts print advertising revenue, a crucial income stream for these legacy businesses.

These segments often represent a challenge within the BCG matrix, fitting the description of Dogs. They typically demand significant investment to maintain operations and infrastructure, yet yield minimal returns or growth. For instance, while specific Hearst segment data isn't publicly detailed for 2024, the broader industry trend shows continued revenue contraction in print advertising; in 2023, U.S. print newspaper advertising revenue was estimated to be around $4.7 billion, a substantial drop from its peak.

Hearst UK's 'best' magazine, alongside titles like 'Inside Soap,' are currently facing significant challenges. These publications have seen notable year-on-year declines in their headline ABC figures, a key indicator of circulation performance.

For instance, data from the Audit Bureau of Circulations (ABC) in the UK for the period ending December 2023 showed a considerable drop for many print publications. While specific Hearst UK titles are not publicly detailed in this context, the trend for similar niche magazines points towards a shrinking readership base.

These underperforming titles likely represent products with a low market share within a market segment that is not experiencing substantial growth. This positions them as potential candidates for divestiture or a complete overhaul of their business strategy to find new avenues for revenue or relevance.

Legacy advertising models, primarily print and linear television, are experiencing significant headwinds. The rise of digital alternatives, coupled with consumer shifts like cord-cutting, has led to a more fragmented and competitive advertising landscape. This has resulted in low growth and declining returns for these traditional channels.

In 2024, the challenges for legacy media are stark. For instance, linear TV ad revenue is projected to see a modest decline, while print advertising continues its downward trend. This is largely due to audience migration to streaming services and online content platforms, which capture a larger share of consumer attention and advertising spend.

Non-Strategic or Stagnant Digital Ventures

Non-Strategic or Stagnant Digital Ventures represent digital businesses within a company's portfolio that are underperforming. These are ventures that have not achieved substantial market penetration or consistent profitability, even after initial investment. They often require a strategic decision regarding their future, whether it's divestment, a significant turnaround effort, or integration into other business units.

Identifying these ventures typically involves rigorous internal performance reviews. Metrics such as declining user growth, stagnant revenue, or persistent operational losses are key indicators. For instance, a digital subscription service launched in 2022 that failed to reach 10,000 active subscribers by the end of 2023, while its competitors surpassed 100,000, would likely be categorized here.

- Underperformance Metrics: Ventures showing less than 5% year-over-year revenue growth or a market share below 2% in their segment.

- Profitability Issues: Companies consistently operating at a loss for more than three consecutive fiscal years.

- Lack of Strategic Fit: Digital assets that no longer align with the parent company's core competencies or long-term vision.

- Market Stagnation: Digital products or services that have failed to innovate or adapt to evolving consumer demands, leading to flat or declining engagement.

Small, Niche Publications with Limited Digital Transition

These are the smaller, niche publications within Hearst that haven't fully embraced the digital age. Think of them as the quiet corners of the media world, catering to very specific interests. Their limited digital presence means they're likely stuck in low-growth markets with a small piece of the pie.

Without new ways to make money online, these publications could end up being cash traps. This means they might consume resources without generating much return, especially as the media landscape continues to shift online. For example, a print-only magazine focusing on a very specialized hobby might struggle to attract younger audiences or advertisers accustomed to digital engagement.

- Limited Digital Footprint: These publications often have outdated websites or minimal online advertising revenue.

- Low Market Share & Growth: Operating in niche segments means their overall market share is small, and the market itself may not be expanding.

- Potential Cash Traps: Without successful digital monetization, they can drain company resources.

- Example Scenario: A regional print newspaper with declining readership and no robust digital subscription model would fit this category.

Dogs in the context of the BCG matrix represent business units or products with low market share in slow-growing industries. For Hearst, this translates to legacy print publications and underperforming digital ventures that struggle to gain traction. These segments often require significant investment to maintain but yield minimal returns, posing a challenge to overall portfolio health.

The ongoing shift to digital media continues to impact traditional print operations, leading to declining circulation and advertising revenue. Similarly, digital ventures that fail to achieve significant user growth or profitability can become cash drains. For instance, industry-wide, print advertising revenue has seen a substantial decline, with U.S. print newspaper advertising revenue estimated to be around $4.7 billion in 2023, a stark contrast to its peak years.

These underperforming assets, characterized by low market share and limited growth prospects, necessitate strategic evaluation. Options range from divestiture to a complete overhaul of their business models to adapt to the evolving media landscape and avoid becoming persistent cash traps.

The following table illustrates potential characteristics of "Dog" segments within a media conglomerate like Hearst, based on industry trends and performance indicators.

| Segment Type | Key Characteristics | Financial Indicators (Illustrative) | Industry Trend |

|---|---|---|---|

| Legacy Print Publications | Declining circulation, low digital engagement, shrinking ad revenue | Negative revenue growth, low profit margins | Continued contraction in print advertising spend |

| Underperforming Digital Ventures | Low user acquisition, stagnant revenue, high operational costs | Operating at a loss, market share below 2% | Intense competition, rapid technological change |

| Niche Print Titles | Limited audience reach, minimal online monetization | Low year-over-year revenue growth (<5%) | Audience migration to digital platforms |

Question Marks

Hearst's strategic allocation of capital towards new digital ventures and technology investments, especially in emerging or fast-changing sectors, positions them as question marks within the BCG framework. These ventures, characterized by their high growth potential, currently hold a modest market share, necessitating substantial financial commitment to achieve scalability and market penetration.

For example, Hearst's reported investment of over $300 million in digital media and technology companies in 2023 alone underscores this commitment. These investments span areas like AI-powered content creation, personalized advertising platforms, and digital health solutions, all exhibiting significant growth trajectories but still in the early stages of market development.

The success of these question mark investments hinges on Hearst's ability to nurture these nascent businesses, leveraging their resources and expertise to capture a larger market share. Failure to do so could result in these ventures becoming cash drains, potentially transitioning them to dogs in the BCG matrix.

Hearst is investing in AI-powered products like Aura, a data platform for its magazine division, and AI tools aimed at enhancing newspaper subscriptions. These initiatives target rapidly expanding markets, including artificial intelligence and data analytics, reflecting a strategic push into future growth areas.

While the potential for these AI products is significant, they are still in early development stages. Their ultimate market share and long-term success remain uncertain, placing them in the question mark category of the BCG matrix as Hearst navigates these nascent but promising ventures.

Hearst's recent acquisitions, such as the puzzle games website Puzzmo in December 2023 and the Austin American-Statesman in March 2025, represent strategic moves into markets with demonstrated growth potential, fitting the profile of potential question marks in a BCG Matrix. While Puzzmo taps into the burgeoning digital gaming sector, the Austin American-Statesman targets a specific, albeit evolving, local media market.

The success of these ventures hinges on their ability to integrate smoothly within Hearst's existing diverse portfolio and to significantly expand their market share, a critical factor for question mark entities. For instance, the digital gaming market, where Puzzmo operates, saw global revenue projected to reach over $200 billion in 2024, indicating substantial opportunity.

Similarly, the Austin American-Statesman's acquisition aims to revitalize a legacy media asset in a growing metropolitan area, a move that requires careful execution to capture a larger audience and revenue streams in a competitive landscape. The financial performance and market penetration of these entities will be closely monitored to determine their future position within Hearst's strategic framework.

Direct-to-Consumer Streaming Initiatives (e.g., ESPN's new DTC product, Very Local)

Hearst's strategic move into the direct-to-consumer (DTC) streaming space, exemplified by its investment in ESPN's new offering and the expansion of its Very Local product, signals a clear ambition to capture a significant share of the rapidly growing digital video market. This diversification leverages existing brand strength and content libraries to reach consumers directly.

These DTC ventures represent substantial capital outlays, with the streaming market characterized by intense competition and evolving consumer preferences. While the potential for high growth is evident, the ultimate market positioning and long-term success of these initiatives remain subject to ongoing market dynamics and subscriber acquisition costs.

- ESPN's DTC Product: Hearst's involvement highlights a commitment to a high-growth sector, though specific investment figures from Hearst are not publicly disclosed.

- Very Local Growth: Hearst Television's Very Local product is expanding its reach, aiming to capitalize on local content demand. In 2024, local streaming services are seeing increased investment and user engagement.

- Market Uncertainty: The DTC streaming landscape is highly competitive, with established players and new entrants vying for subscriber attention, making long-term market share a key variable.

- Investment Requirements: Building and maintaining successful DTC platforms necessitates ongoing investment in technology, content, and marketing to stay competitive.

International Ventures in Developing Markets

Hearst Ventures' strategic investments in developing markets, such as China and Israel, exemplify a focus on high-growth potential, aligning with the question mark category of the BCG Matrix. These ventures are characterized by their operation in potentially less mature markets, where market dominance is not yet secured.

For instance, the investment in Lingochamp, an AI-powered English learning platform in China, taps into a massive and growing edtech sector. Similarly, backing Flash Delivery, a logistics company, targets the expanding e-commerce and on-demand delivery landscape in its respective market.

These international ventures, while offering substantial upside, also present inherent risks. The competitive landscape in these developing markets can be dynamic, and establishing a strong market position requires significant capital and strategic execution. For example, the Chinese edtech market, while large, has seen intense competition and regulatory shifts impacting growth trajectories.

- High Growth Potential: Investments in markets like China and Israel offer access to rapidly expanding economies and consumer bases.

- Uncertain Market Dominance: Companies like Lingochamp and Flash Delivery are in phases where market leadership is not guaranteed, reflecting their question mark status.

- Inherent Risks: Developing markets often come with regulatory uncertainties, intense competition, and varying economic stability, posing challenges to venture success.

- Strategic Expansion: Hearst Ventures' move into these regions signifies a deliberate strategy to diversify its portfolio and capture future growth opportunities beyond established markets.

Hearst's investments in emerging digital ventures, such as AI-driven content platforms and the DTC streaming space, are prime examples of question marks within the BCG framework. These areas offer high growth potential, but their current market share is relatively small, requiring significant ongoing investment to achieve scale and market leadership.

For instance, Hearst's commitment to AI products like Aura for its magazine division and tools for newspaper subscriptions in 2024 reflects a strategic bet on the rapidly expanding AI and data analytics markets. While these ventures are in their nascent stages, their success hinges on Hearst's ability to effectively nurture them and capture a larger slice of these growing markets.

The company's acquisition of Puzzmo in late 2023, targeting the booming digital gaming sector, and its revitalization efforts for the Austin American-Statesman in 2025, illustrate a pattern of investing in markets with strong growth prospects but where market dominance is not yet established. The global digital gaming market alone was projected to exceed $200 billion in 2024, underscoring the significant opportunity.

Hearst's strategic expansion into developing markets through Hearst Ventures, including investments in China's edtech sector with Lingochamp and logistics in Israel with Flash Delivery, also positions these as question marks. These ventures operate in dynamic environments with high growth potential but also face considerable competition and regulatory uncertainties, making their future market share a key unknown.

| Hearst Venture Example | Market | Growth Potential | Current Market Share | Investment Status |

|---|---|---|---|---|

| AI-powered Content Platforms (e.g., Aura) | Artificial Intelligence, Data Analytics | High | Low to Moderate | Significant Investment Required |

| DTC Streaming (e.g., Very Local expansion) | Digital Video, Streaming Services | High | Low | Ongoing Capital Outlay |

| Digital Gaming (e.g., Puzzmo acquisition) | Online Gaming | High (>$200B global revenue projected for 2024) | Low | Strategic Acquisition, Growth Focus |

| Edtech in Developing Markets (e.g., Lingochamp, China) | Education Technology | High | Low to Moderate | Venture Capital Investment, Market Uncertainty |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position each business unit.