Health Catalyst Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Health Catalyst Bundle

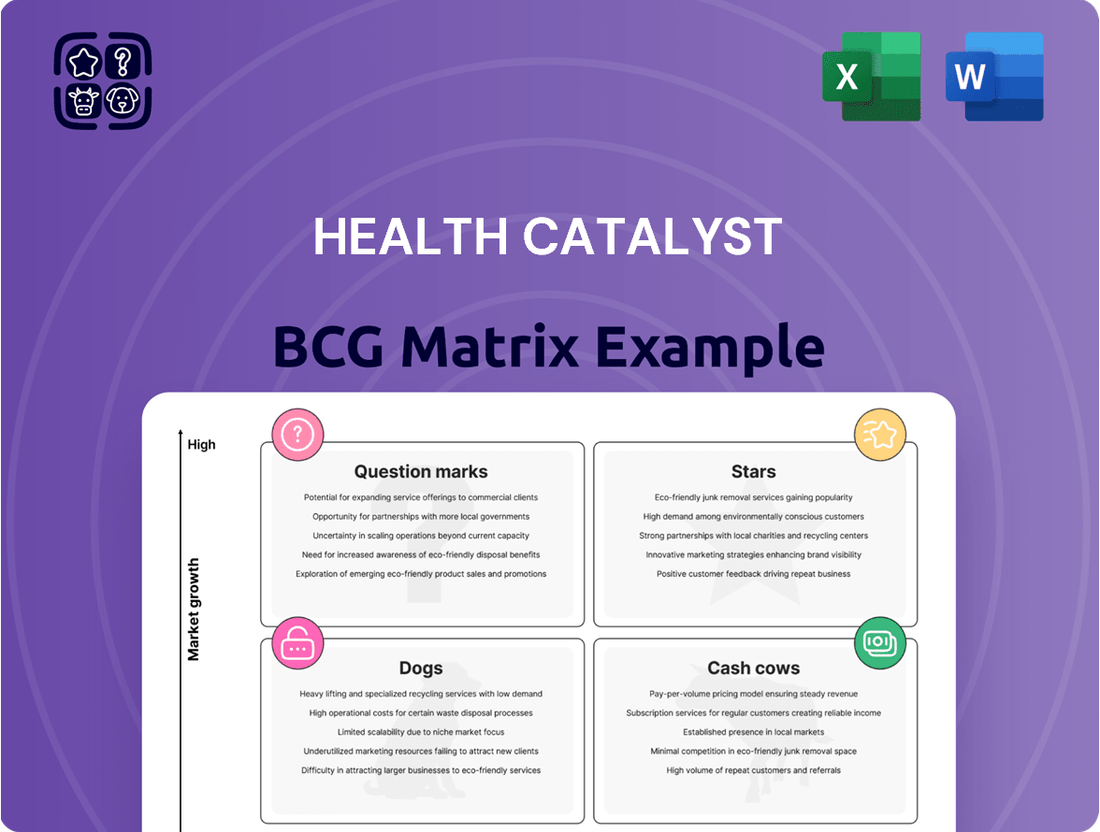

This snapshot offers a glimpse into how Health Catalyst strategically categorizes its offerings, helping you understand potential growth areas and resource allocation. Imagine unlocking the full strategic advantage by seeing precisely which of their products are Stars, Cash Cows, Dogs, or Question Marks.

Don't just see the potential; harness it. Purchase the complete Health Catalyst BCG Matrix to gain actionable insights and a clear roadmap for optimizing your own product portfolio and investment decisions.

Stars

Health Catalyst's July 2025 release of 10 AI-powered data toolkits on the Databricks Marketplace marks a significant entry into the burgeoning AI in healthcare sector. These offerings are designed to tackle pressing issues within healthcare, promising tangible improvements and capitalizing on the surging demand for artificial intelligence in the industry.

This strategic expansion of their analytics capabilities, providing these toolkits at no cost, is poised to enhance Health Catalyst's market presence and solidify its position as a leader in AI-driven healthcare solutions. The company's move aligns with a projected 35% compound annual growth rate for the AI in healthcare market through 2028, highlighting the opportune timing of this initiative.

Health Catalyst Ignite Spark™, launched in 2025, is a modern, low-code data platform and analytics ecosystem tailored for mid-sized healthcare organizations. This offering addresses an underserved market, promising rapid results and enabling efficient, lean teams, which points to substantial growth prospects.

Its strategic positioning aligns perfectly with the growing adoption of cloud-native analytics. This makes Ignite Spark™ a prime candidate for a Star in the Health Catalyst BCG Matrix, necessitating ongoing investment to secure a significant market share.

Health Catalyst stands out as a leader in Population Health Management (PHM), a sector experiencing robust growth. Their position was solidified by recognition in the 2024 Frost Radar™ report, underscoring their strong market presence. This recognition comes as the global PHM market is expected to expand significantly, fueled by the increasing adoption of data-driven care strategies and artificial intelligence for enhanced insights.

The company's PHM solutions are noted for their adaptability, allowing for customization to meet diverse client requirements. This flexibility is a key factor in their ability to maintain a leading role in the market. With the PHM market projected for substantial growth, driven by the demand for advanced analytics and AI, Health Catalyst is well-positioned to capitalize on these trends.

Strategic Partnership with Microsoft for AI

Health Catalyst's strategic partnership with Microsoft, announced in April 2025, positions it as a Star in the BCG Matrix. This alliance leverages Microsoft Azure and Azure AI Foundry to accelerate AI adoption in healthcare. The goal is to provide advanced AI solutions, aiming for significant market reach and sustainable performance improvements. This high-growth, high-investment initiative is designed to secure market leadership in AI-driven healthcare transformation.

- AI Acceleration: Partnership with Microsoft aims to speed up AI adoption in healthcare.

- Technology Integration: Combines Health Catalyst's expertise with Microsoft Azure and Azure AI Foundry.

- Market Expansion: Expected to significantly extend reach and drive performance improvement.

- Strategic Focus: Represents a high-growth, high-investment area targeting market leadership.

Core Data Operating System (DOS) as an AI Enabler

The Core Data Operating System (DOS) is a foundational element for Health Catalyst's AI and analytics growth, acting as the backbone for its expanding suite of solutions. Its HITRUST r2 certification underscores its strong security and trustworthiness, vital for managing sensitive patient data within these high-demand AI applications.

The DOS's capability to unify disparate data sources and drive sophisticated insights makes it a crucial component supporting the company's high-growth AI initiatives. This seamless integration is key to unlocking the full potential of advanced analytics.

- Data Integration: The DOS consolidates data from various sources, enabling comprehensive analysis for AI.

- Security and Compliance: HITRUST r2 certification ensures robust data protection, critical for healthcare AI.

- AI/Analytics Enablement: It serves as the essential platform powering Health Catalyst's advanced AI and analytics offerings, driving innovation and growth.

Health Catalyst's Population Health Management (PHM) solutions, recognized by Frost Radar in 2024, represent a Star. This sector is experiencing substantial growth, with the global PHM market projected to expand significantly. Their adaptable PHM offerings are key to maintaining market leadership in an area driven by advanced analytics and AI.

The strategic partnership with Microsoft, leveraging Azure and Azure AI Foundry, positions Health Catalyst as a Star. This collaboration aims to accelerate AI adoption in healthcare, targeting significant market reach and performance improvements. It's a high-investment initiative focused on securing market leadership in AI-driven healthcare transformation.

Health Catalyst's Ignite Spark™ platform, launched in 2025, is classified as a Star. It targets mid-sized healthcare organizations with a modern, low-code data platform, addressing an underserved market. This aligns with the growing adoption of cloud-native analytics, indicating strong growth prospects and the need for continued investment.

The Core Data Operating System (DOS) is foundational to Health Catalyst's Star status in AI and analytics. Its HITRUST r2 certification highlights its security and trustworthiness, crucial for managing sensitive patient data. The DOS unifies data sources, enabling sophisticated insights that power the company's high-growth AI initiatives.

| Product/Initiative | BCG Category | Key Growth Drivers | Investment Rationale |

|---|---|---|---|

| Population Health Management (PHM) | Star | Data-driven care strategies, AI adoption, market expansion | Maintain market leadership in a high-growth sector |

| Microsoft Partnership (AI Acceleration) | Star | AI adoption in healthcare, cloud integration, market reach | Secure leadership in AI-driven healthcare transformation |

| Ignite Spark™ | Star | Low-code analytics, mid-sized healthcare market, cloud-native adoption | Capitalize on growth in an underserved market segment |

| Core Data Operating System (DOS) | Star (Enabler) | Data integration, AI/analytics enablement, security | Foundation for high-growth AI and analytics initiatives |

What is included in the product

This Health Catalyst BCG Matrix provides strategic guidance on product portfolio management, highlighting which units to invest in, hold, or divest based on market growth and share.

Health Catalyst's BCG Matrix provides a clear, visual roadmap to prioritize investments, relieving the pain of resource allocation uncertainty.

Cash Cows

Health Catalyst's established cloud-based data platform and analytics applications, including the Health Catalyst Ignite™ ecosystem, are considered cash cows. These mature offerings are utilized by over 1,000 organizations globally, demonstrating a significant market presence in a foundational healthcare IT segment.

The consistent and reliable revenue generated by these established solutions provides considerable financial stability for Health Catalyst. Their high market share in this core area means lower promotional investment is needed, thanks to existing strong client relationships.

Professional services for data strategy and implementation are a cornerstone of Health Catalyst's offerings, acting as a vital support system for healthcare organizations adopting their platform. These services are designed to maximize the value clients derive from Health Catalyst's technology.

Leveraging extensive healthcare domain expertise, these teams guide clients through complex data challenges, ensuring successful platform adoption and driving operational efficiencies. This deep engagement translates directly into increased cash flow for their clients by optimizing processes and reducing waste.

While this segment may not exhibit explosive growth, it is critical for client retention and overall platform success. In 2023, Health Catalyst reported that their professional services, alongside their software and data warehousing segments, contributed to their overall revenue growth, with a particular emphasis on the sticky nature of these services once implemented.

The consistent, high-margin revenue generated by these services solidifies their position as a cash cow. They represent a stable income stream that underpins the company's financial health, allowing for continued investment in innovation and growth in other areas.

Health Catalyst's dollar-based retention rate hit an impressive 102% in 2024. This means existing clients are not only sticking around but are also spending more on Health Catalyst's offerings. This metric is a strong indicator of customer loyalty and the value they derive from the company's solutions.

A retention rate exceeding 100% is a hallmark of a cash cow. It demonstrates that Health Catalyst has successfully cultivated deep relationships with its clients, fostering continued engagement and upselling opportunities. This stability is crucial in a mature market where growth often comes from deepening existing partnerships.

This high retention rate translates into a predictable and reliable revenue stream for Health Catalyst. It allows the company to generate consistent cash flow, which can then be reinvested in other areas of the business or returned to shareholders. The 2024 figure of 102% underscores the strength of their established client base.

Clinical Quality Improvement and Patient Safety Solutions

Health Catalyst's clinical quality improvement and patient safety solutions are vital for healthcare organizations, often boasting a significant existing customer base. These offerings directly contribute to achieving better patient outcomes and are deeply embedded in daily operations.

These mature solutions generate consistent revenue, acting as reliable cash cows for Health Catalyst. While they require ongoing support and maintenance, they typically do not necessitate substantial new investment for high growth.

- Proven Impact: Health Catalyst's solutions have demonstrated success in improving key quality metrics and reducing adverse events. For instance, their work with various health systems has shown reductions in hospital-acquired infections and readmission rates.

- Installed Base: A substantial portion of their revenue is likely derived from long-standing contracts with hospitals and health systems that rely on these tools for core operational functions.

- Stable Demand: The continuous focus on patient safety and quality improvement ensures a consistent demand for these types of solutions, making them a predictable revenue stream.

- Low Growth, High Profit: While not high-growth areas, these established offerings typically provide strong profit margins due to their mature nature and efficient delivery.

Revenue Cycle Management and Cost Management Applications

Revenue cycle management and cost management applications are foundational for healthcare providers, often representing mature products within a company's portfolio. These solutions are designed to streamline financial operations, from patient registration and billing to claims processing and denial management, directly impacting the organization's bottom line. For instance, Health Catalyst's offerings in this space aim to improve revenue capture and reduce administrative overhead, contributing to a more stable financial performance.

These established solutions typically operate in a stable market, meaning they have a proven track record and a consistent demand from healthcare organizations seeking to optimize their financial workflows. Their maturity translates into predictable revenue streams and a reduced need for significant ongoing research and development investment. This characteristic aligns them with the definition of a cash cow in a business portfolio, generating substantial cash flow that can be reinvested in other, more growth-oriented areas.

The financial impact is significant. For example, inefficient revenue cycle management can lead to substantial revenue leakage. Industry reports from 2024 indicated that denial rates in healthcare can average between 5% and 10%, representing millions in lost revenue for larger institutions. Solutions that effectively reduce these rates, alongside those that identify and control cost drivers, are therefore invaluable. Health Catalyst's focus on these areas directly addresses these critical financial pain points for hospitals and health systems.

- Optimized Financial Performance: Applications in revenue cycle management and cost management are crucial for maximizing revenue capture and minimizing operational expenses in healthcare.

- Mature Market Segment: These solutions are typically well-established, serving a stable demand from healthcare organizations looking for financial efficiency.

- Consistent Cash Flow Generation: As mature products, they are expected to provide reliable cash flow with lower reinvestment needs compared to growth-stage products.

- Reduced Revenue Leakage: By improving billing accuracy and claims processing, these tools directly combat revenue loss, with industry data showing potential savings from reducing denial rates.

Health Catalyst's established cloud-based data platform and analytics applications, including the Health Catalyst Ignite™ ecosystem, are considered cash cows. These mature offerings are utilized by over 1,000 organizations globally, demonstrating a significant market presence in a foundational healthcare IT segment.

The consistent and reliable revenue generated by these established solutions provides considerable financial stability for Health Catalyst. Their high market share in this core area means lower promotional investment is needed, thanks to existing strong client relationships.

Health Catalyst's dollar-based retention rate hit an impressive 102% in 2024. This means existing clients are not only sticking around but are also spending more on Health Catalyst's offerings. This metric is a strong indicator of customer loyalty and the value they derive from the company's solutions.

A retention rate exceeding 100% is a hallmark of a cash cow. It demonstrates that Health Catalyst has successfully cultivated deep relationships with its clients, fostering continued engagement and upselling opportunities. This stability is crucial in a mature market where growth often comes from deepening existing partnerships.

| Product/Service Area | BCG Category | Revenue Contribution (Illustrative) | Growth Potential | Investment Need |

|---|---|---|---|---|

| Data Platform & Analytics (Ignite™) | Cash Cow | High, Stable | Low | Low (Maintenance) |

| Professional Services | Cash Cow | High, Stable | Low | Low (Talent) |

| Clinical Quality Improvement | Cash Cow | Consistent | Low | Low (Maintenance) |

| Revenue Cycle & Cost Management | Cash Cow | Consistent | Low | Low (Maintenance) |

What You See Is What You Get

Health Catalyst BCG Matrix

The Health Catalyst BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures you get a professional, analysis-ready tool without any watermarks or demo content, allowing for seamless integration into your strategic planning processes.

Dogs

Undifferentiated legacy niche applications within Health Catalyst's portfolio represent older, specialized software that hasn't been fully integrated into their newer cloud-based offerings. These might include specific modules for niche healthcare functions that haven't seen substantial updates.

These legacy systems often face challenges competing with contemporary solutions, resulting in a low market share and very little growth potential. Their inability to keep pace with technological advancements can hinder their utility and appeal.

Such applications can become resource drains, consuming valuable IT and development time without yielding significant returns. In 2024, Health Catalyst, like many tech companies, would be evaluating these assets for potential divestiture or reduced investment to focus on more strategic growth areas.

Certain highly customized, one-off consulting projects that don't utilize Health Catalyst's core platforms or scale across clients could be viewed as low-margin, non-scalable engagements. These might be resource-intensive with slim profit margins and don't drive wider platform adoption, potentially acting as cash traps.

For instance, if such services consume significant internal resources without a clear path to recurring revenue or platform integration, they could drain capital. Health Catalyst's strategic direction, as indicated by their focus on efficiency and higher-margin business segments, suggests a deliberate shift away from these types of offerings.

Health Catalyst's strategic acquisitions, while aimed at portfolio expansion, can introduce "dog" categories if acquired technologies struggle with integration or market acceptance. For instance, if a newly acquired data analytics tool for a niche healthcare sector doesn't seamlessly merge with Health Catalyst's core data platform or fails to gain traction beyond its initial target market, it could represent a dog. This scenario would result in low internal adoption and limited external sales, potentially impacting the overall profitability of the acquired asset.

Solutions Lacking AI Integration in a Rapidly Evolving Market

In the fast-paced healthcare analytics market, Health Catalyst offerings that lag in AI integration risk losing ground. As of early 2024, the demand for AI-powered solutions in healthcare analytics is surging, with a significant portion of healthcare organizations actively seeking or planning to implement AI to improve patient outcomes and operational efficiency. Those Health Catalyst products not keeping pace with AI advancements could be relegated to low-growth, low-share status.

The absence of AI integration makes these Health Catalyst solutions less attractive to clients prioritizing cutting-edge technology. For instance, a 2024 survey indicated that over 60% of healthcare executives consider AI a top priority for their analytics investments. This lack of AI capability directly impacts competitiveness.

- Erosion of Market Share: Products without AI risk declining market presence as competitors offer advanced capabilities.

- Reduced Client Appeal: Healthcare providers increasingly demand AI-driven insights, making non-AI solutions less desirable.

- Low Growth Potential: Without AI, these offerings may struggle to attract new clients or retain existing ones, leading to stagnant or negative growth.

- Competitive Disadvantage: The inability to leverage AI for predictive analytics, personalized medicine, or operational automation puts these solutions at a clear disadvantage.

Underperforming Regional or Niche Market Ventures

If Health Catalyst has expanded into specific regional markets or very narrow healthcare niches where their market penetration remains low and growth is stagnant, these ventures could be considered dogs. These areas might not be yielding sufficient returns to justify continued investment, especially if they divert resources from more promising opportunities. Such segments might be difficult to turn around without significant, risky investment.

- Low Market Penetration: Ventures in underperforming regional or niche markets might show market penetration rates significantly below Health Catalyst's overall average. For instance, a regional market might only capture 5% of its potential customer base compared to a national average of 20%.

- Stagnant Growth: These segments would exhibit minimal revenue growth, perhaps less than 2% annually, failing to keep pace with industry benchmarks or Health Catalyst's other business units.

- Resource Drain: Continued investment in these dog segments could mean that capital and management attention are diverted from high-growth areas like their data and analytics platform, which saw substantial revenue increases in late 2023.

- High Turnaround Cost: Revitalizing these ventures would likely require substantial, potentially risky investments in marketing, product adaptation, or operational restructuring, with no guarantee of success.

Dogs in Health Catalyst's portfolio are offerings with low market share and low growth prospects, often representing legacy systems or poorly integrated acquisitions. These can include undifferentiated niche applications, customized consulting projects that don't scale, or acquired technologies that fail to gain market traction. For example, products lacking AI integration, a critical demand in 2024 with over 60% of healthcare executives prioritizing it, are likely to fall into this category due to reduced client appeal and competitive disadvantage.

These underperforming assets can drain resources and divert attention from more profitable ventures. Health Catalyst's strategic focus on efficiency and higher-margin segments in 2024 suggests a proactive approach to managing these dogs, potentially through divestiture or reduced investment. Ventures in niche regional markets with low penetration, showing less than 2% annual revenue growth, also exemplify this category, posing a risk of becoming cash traps if not addressed.

The company must carefully evaluate these dogs to reallocate capital effectively. For instance, a 2024 analysis might reveal specific legacy software modules that consume significant IT resources without contributing meaningfully to revenue, representing a clear candidate for divestment. Similarly, acquired solutions that haven't achieved significant market penetration, perhaps capturing only 5% of their target market, would be flagged.

Identifying and addressing these "dog" segments is crucial for Health Catalyst to maintain its competitive edge and optimize resource allocation in the evolving healthcare analytics landscape. Their strategic direction points towards shedding these low-return assets to bolster growth in core platforms.

Question Marks

Health Catalyst's strategic acquisitions of Upfront Healthcare and Intraprise Health in 2025, alongside its investment in Glooko, position these solutions as potential Stars in its BCG Matrix. While currently representing a smaller portion of the company's overall market share, these moves significantly bolster Health Catalyst's offerings in critical areas like patient engagement, data interoperability, and remote patient monitoring for chronic conditions. For instance, Glooko's platform supports over 10,000 healthcare providers and 2.5 million users globally, indicating substantial underlying growth potential.

The success of these newly integrated solutions hinges on Health Catalyst's ability to effectively merge their functionalities and drive adoption. Significant investment in seamless integration, targeted marketing campaigns, and robust client onboarding will be paramount. This focus is essential to unlock their high-growth potential and transition them from Question Marks to Stars, contributing to the company's overall market leadership in healthcare data analytics.

Health Catalyst is investing heavily in advanced generative AI for complex healthcare challenges, like improving diagnostic accuracy and automating administrative tasks. These cutting-edge applications are still in early development, meaning they require substantial research and development funding. While their potential for growth is significant, their current market share remains low as they are refined.

The success of these advanced AI initiatives hinges on widespread market adoption and demonstrating clear, measurable value to healthcare providers. For instance, by 2024, the global AI in healthcare market was projected to reach over $20 billion, indicating a strong appetite for innovation, but also highlighting the competitive landscape these new applications will face.

The Health Catalyst Ignite Spark™ Early Adopter Program, while possessing significant market potential (a Star characteristic), currently operates as a Question Mark within the BCG Matrix. Its focus on mid-sized organizations and its early adoption phase mean it has a relatively low current market share, demanding substantial investment to prove its value and acquire clients.

This program targets a high-growth potential segment, aiming to address an underserved market. However, its success hinges on demonstrating a clear value proposition and achieving rapid adoption. The trajectory of Ignite Spark™ will be determined by its ability to convert this potential into tangible market penetration in the coming years.

Emerging Cybersecurity Product Offerings for Healthcare

Health Catalyst's emerging cybersecurity product offerings would likely be positioned as Question Marks in the BCG matrix. The healthcare cybersecurity market is experiencing significant growth, with projections indicating it could reach $34.2 billion by 2025, demonstrating a strong demand. However, Health Catalyst entering this space means facing established players and potentially having a low initial market share for these new, specialized solutions.

Success for these new cybersecurity products hinges on strategic investment in differentiation and aggressive market penetration. The company needs to clearly articulate its unique value proposition to stand out in a crowded field. For instance, a focus on AI-driven threat detection tailored to healthcare data vulnerabilities could be a key differentiator.

- Market Growth: The healthcare cybersecurity market is projected to grow substantially, indicating a favorable overall trend.

- Competitive Landscape: Health Catalyst faces intense competition from both specialized cybersecurity firms and broader health IT vendors.

- Investment Needs: Significant investment in R&D, marketing, and sales is crucial for these offerings to gain traction.

- Differentiation Strategy: A clear focus on unique features or services will be vital for carving out market share.

Expansion into New, Undisclosed International Markets

Health Catalyst's exploration into new, undisclosed international markets would position them as a 'Question Mark' in the BCG matrix. These are ventures with potential for high growth but currently low market share. For instance, if Health Catalyst is entering a market like India or Brazil, which are experiencing significant growth in digital health adoption, they would fit this category.

Such expansions are characterized by high investment needs for adapting their data analytics and AI solutions to local healthcare systems, regulations, and language. The global healthcare IT market is projected to reach over $100 billion by 2025, with emerging markets showing particularly strong growth rates, but success is not guaranteed.

- High Growth Potential: Targeting rapidly expanding international healthcare IT sectors.

- Low Market Share: Limited brand recognition and client base in these new territories.

- Substantial Investment: Requiring significant capital for localization, compliance, and market entry.

- Uncertain Returns: Future profitability is dependent on successful market penetration and adoption.

Question Marks in Health Catalyst's portfolio represent ventures with high growth potential but currently low market share. These require significant investment to develop and gain traction. Their success is contingent on effective strategy execution and market acceptance, aiming to transition them into Stars.

The company's investments in generative AI for healthcare diagnostics and administrative tasks, along with its early-stage international market expansions, exemplify these Question Marks. These initiatives are positioned to capitalize on burgeoning market trends, such as the projected over $20 billion global AI in healthcare market by 2024.

Similarly, the Ignite Spark™ Early Adopter Program and new cybersecurity product lines are also classified as Question Marks. They target high-growth segments but necessitate substantial capital for R&D, marketing, and differentiation to compete effectively and achieve market penetration.

The success of these Question Marks is crucial for Health Catalyst's future growth, as they aim to capture emerging opportunities in a dynamic healthcare technology landscape. Effective management of these investments will determine their evolution within the BCG matrix.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial reports, market research, and competitor analysis, to provide a clear strategic overview.