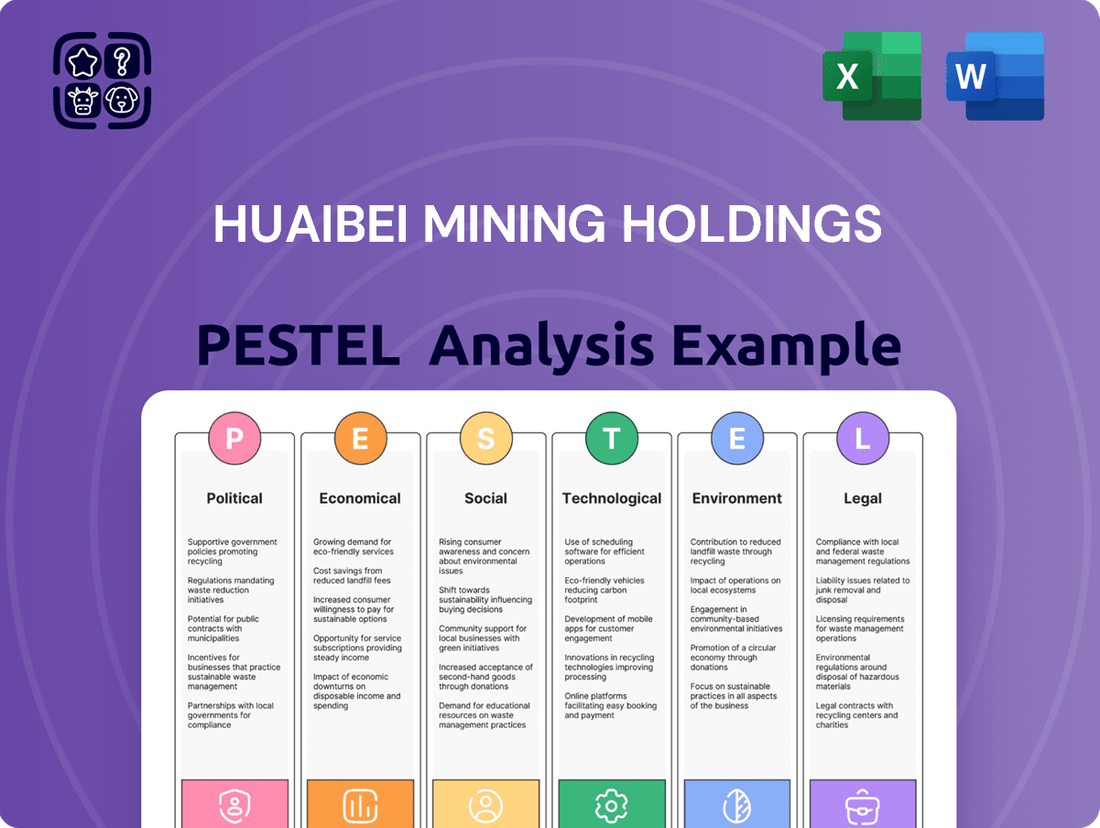

Huaibei Mining Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huaibei Mining Holdings Bundle

Huaibei Mining Holdings operates within a dynamic external environment, significantly influenced by political stability, economic growth cycles, and technological advancements in the mining sector. Understanding these forces is crucial for navigating market challenges and identifying opportunities. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights for strategic planning.

Gain a competitive edge by exploring the political, economic, social, technological, legal, and environmental factors impacting Huaibei Mining Holdings. This ready-made analysis provides expert-level intelligence, perfect for investors and strategic planners seeking to understand the company's landscape. Purchase the full version now for immediate access to these vital insights.

Political factors

China's government is navigating a complex energy landscape, aiming to bolster energy security through coal while pursuing decarbonization. Policies in 2024 and 2025 reflect this, with continued approvals for new coal-fired power plants to meet rising demand and ensure grid stability. For instance, the State Council's directives emphasize increasing non-fossil fuel consumption but also sanctioning coal capacity to bridge energy gaps.

China's ambitious 'Dual Carbon' goals, aiming for peak carbon emissions before 2030 and carbon neutrality by 2060, are fundamentally reshaping its industrial landscape. This national agenda directly pressures heavy industries like coal mining, pushing for a significant reduction in carbon intensity and enhanced energy conservation measures.

The implementation of policies such as the '1+N' framework, which includes a series of supporting measures and action plans, underscores the government's commitment to this transition. These initiatives target high-emitting sectors, including coal, by setting clear targets for emissions reduction and promoting the adoption of cleaner energy technologies.

As a major player in the coal sector, Huaibei Mining Holdings faces direct implications from these stringent environmental policies. The company must strategically adapt its operational model and diversify its product offerings to align with national decarbonization objectives, potentially involving investments in green technologies or shifting towards less carbon-intensive energy sources.

As a major Chinese State-Owned Enterprise (SOE), Huaibei Mining Holdings is navigating significant reform initiatives. These reforms, ongoing through 2024 and into 2025, focus on boosting SOE efficiency and market competitiveness. The Chinese government's push for SOE modernization, as evidenced by directives encouraging innovation and structural optimization, directly impacts companies like Huaibei Mining.

Regional Energy Policies and Local Priorities

While national energy policies in China aim for decarbonization, regional governments often balance these goals with local economic development and energy security. This can result in continued support for coal projects in certain provinces, creating a complex regulatory environment for companies like Huaibei Mining.

For instance, in 2023, despite national targets, several provinces, particularly in the north and northeast, continued to approve new coal-fired power plants to ensure grid stability and meet local energy demands. Huaibei Mining, with operations concentrated in Anhui province, must therefore adapt to specific provincial directives that may differ from national mandates.

- Provincial Energy Plans: Regional governments develop their own energy development plans, which can influence the pace of transition away from coal.

- Local Economic Impact: The economic importance of mining and coal-fired power to local employment and tax revenues often leads provincial authorities to favor continued operations.

- Energy Security Concerns: Ensuring a stable and affordable energy supply remains a top priority for many regional governments, sometimes leading to continued reliance on domestic coal.

International Trade and Geopolitical Influence

China's evolving geopolitical strategies and international trade relations can subtly impact the coal sector, especially concerning critical minerals and energy supply chains. While Huaibei Mining Holdings primarily operates domestically, shifts in global energy markets or trade dynamics could influence demand for its coal or the accessibility of essential equipment and advanced technologies. For instance, in 2024, China's commitment to diversifying its energy sources, while still reliant on coal for a significant portion of its power generation, means that international relations can affect the cost and availability of mining machinery and spare parts.

The Chinese government's ongoing emphasis on energy sovereignty further underscores the strategic importance of robust domestic resource production. This policy aims to reduce reliance on external suppliers for energy needs, which indirectly supports companies like Huaibei Mining by prioritizing national resource development. As of early 2025, China continues to be the world's largest coal consumer and producer, with domestic production accounting for over 4.2 billion tonnes annually, highlighting the critical role of national energy security in policy decisions affecting the mining industry.

- Geopolitical Alignment: China's participation in international trade agreements and its relationships with key trading partners can influence the overall economic climate, indirectly affecting industrial demand for coal.

- Energy Market Volatility: Global fluctuations in oil and gas prices, driven by geopolitical events, can sometimes lead to shifts in energy consumption patterns, potentially increasing or decreasing reliance on coal.

- Technological Access: International trade policies can impact the import of advanced mining equipment and environmental control technologies, which are crucial for operational efficiency and compliance in the coal industry.

- Supply Chain Resilience: Geopolitical tensions can disrupt global supply chains for essential mining inputs, necessitating a focus on domestic sourcing and production capabilities for companies like Huaibei Mining.

China's dual focus on energy security and decarbonization creates a dynamic political landscape for Huaibei Mining. Government directives in 2024 and 2025 continue to balance the need for coal-fired power to ensure grid stability with ambitious 'Dual Carbon' goals, pushing for reduced emissions intensity. This means companies like Huaibei must navigate evolving regulations, potentially investing in cleaner technologies or diversifying their energy portfolios to align with national environmental targets.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Huaibei Mining Holdings, offering a comprehensive view of political, economic, social, technological, environmental, and legal factors.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within the mining sector.

A PESTLE analysis for Huaibei Mining Holdings offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings.

This analysis, segmented by PESTEL categories, provides quick interpretation at a glance, alleviating the pain of sifting through dense reports and enabling faster strategic decision-making.

Economic factors

Huaibei Mining Holdings' financial health is closely tied to the unpredictable swings in coal and coking coal prices. These commodities have seen a downward trend recently, directly impacting the company's bottom line.

For the full year 2024, Huaibei Mining reported a substantial drop in net income. This decline was largely driven by falling coking coal prices, a trend expected to continue with a projected further decrease in net income for the first half of 2025.

This sensitivity to price fluctuations means that revenue and profitability can change dramatically. To manage this, Huaibei Mining needs strong market analysis and effective hedging strategies to cushion the impact of these volatile commodity markets.

The performance of China's economy is a critical driver for Huaibei Mining Holdings. Slowing GDP growth, such as the projected 5.0% for 2024, can directly dampen demand from key industrial sectors like steel and power generation, impacting coal consumption. Conversely, robust industrial expansion, as seen in the 4.6% GDP growth in Q1 2024, typically translates to higher sales volumes for the company's core products.

Huaibei Mining is actively diversifying its operations beyond traditional coal mining, expanding into areas like coking, electricity generation, coal chemicals, and construction materials. This strategic move aims to build a more robust and resilient industrial chain.

Recognizing the global energy transition, Huaibei Mining has also signaled its intent to invest in renewable energy projects. This pivot is designed to lessen dependence on coal and tap into emerging, sustainable revenue streams.

For instance, China's renewable energy sector saw significant growth, with solar and wind power capacity increasing substantially in 2024. Huaibei Mining's move aligns with this broader economic trend, positioning them for long-term viability.

Company Financial Performance and Profitability

Recent financial reports for Huaibei Mining Holdings paint a picture of a challenging period. Sales, revenue, and net income saw a decline in 2024, and projections suggest this downward trend will persist into the first half of 2025. This performance is largely attributed to broader industry headwinds impacting the mining sector.

In response to these financial pressures, Huaibei Mining Holdings is focusing on implementing cost-reduction measures and enhancing operational efficiencies. These initiatives are crucial for navigating the current economic climate and improving profitability. The company is also working to refine its mid-term dividend mechanism, aiming to boost shareholder returns despite the challenging environment.

- Revenue Decline: Huaibei Mining Holdings reported a significant drop in revenue for 2024, with further decreases anticipated in early 2025.

- Profitability Squeeze: Net income has been negatively impacted, necessitating a strong focus on cost management.

- Shareholder Returns: The company is actively reviewing its dividend policy to ensure it remains attractive to investors.

- Operational Focus: Efforts are underway to streamline operations and identify areas for efficiency gains.

Risk of Coal Oversupply and Market Dynamics

Despite global decarbonization trends, China's ongoing approval and construction of new coal mines and power plants present a significant economic risk for coal producers like Huaibei Mining. This expansion could lead to a substantial oversupply in the coal market, mirroring past periods of overcapacity.

Such oversupply would likely drive down coal prices, directly impacting Huaibei Mining's revenue and profitability. For instance, while China's coal production reached 4.71 billion tonnes in 2023, an increase from 4.54 billion tonnes in 2022, continued capacity additions could exacerbate price pressures. The interplay between government policy, domestic demand, and international market conditions will be crucial in shaping these dynamics.

- Potential Oversupply: Continued new mine and power plant approvals in China could lead to a glut in the coal market.

- Price Pressure: Oversupply typically results in lower coal prices, squeezing profit margins for producers.

- Market Volatility: The balance between supply, demand, and policy interventions creates inherent market volatility.

- Profitability Impact: Huaibei Mining's financial performance is directly sensitive to these market price fluctuations.

The economic landscape significantly influences Huaibei Mining Holdings, with China's GDP growth directly impacting demand for its products. For example, Q1 2024 saw a 4.6% GDP growth, which generally supports industrial activity and thus coal consumption. However, a projected 5.0% GDP growth for the full year 2024 indicates a moderation that could temper demand.

Coal and coking coal prices remain a critical economic factor, with recent downward trends impacting Huaibei Mining's financial performance. The company reported a substantial net income drop in 2024, largely due to falling coking coal prices, with further declines anticipated in the first half of 2025.

Huaibei Mining's strategic diversification into areas like coking, electricity generation, and coal chemicals, alongside planned investments in renewable energy, reflects an adaptation to evolving economic and energy transition trends. This pivot aims to build resilience against commodity price volatility and capitalize on new growth sectors.

| Economic Indicator | 2023 Actual | 2024 Projection | Impact on Huaibei Mining |

|---|---|---|---|

| China GDP Growth | 5.2% | 5.0% | Moderate demand support, potential slowdown |

| Coking Coal Price Trend | Declining | Projected Decline | Revenue and profitability pressure |

| Coal Production (China) | 4.71 billion tonnes | N/A | Potential oversupply risk |

What You See Is What You Get

Huaibei Mining Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Huaibei Mining Holdings covers all critical external factors impacting the company's operations and strategic planning.

You'll gain insights into the Political, Economic, Social, Technological, Legal, and Environmental forces shaping the mining industry and Huaibei Mining Holdings' future. This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

Sociological factors

Public perception of the coal mining industry, including companies like Huaibei Mining, is increasingly shaped by environmental and social concerns, impacting their social license to operate. Growing awareness of issues like air and water pollution, land reclamation challenges, and the broader human impact of mining operations means companies must actively manage these perceptions to retain community and investor trust.

In 2024, for instance, public sentiment in many regions has become more critical of fossil fuel extraction. Huaibei Mining, like its peers, faces pressure to demonstrate robust environmental stewardship and community engagement. Failure to do so can lead to heightened regulatory scrutiny, difficulties in securing new permits, and potential divestment by ESG-focused investors, as seen in the broader energy sector where some funds have exited coal-related assets.

Huaibei Mining Holdings, as a major employer in the coal sector, faces evolving labor dynamics. The ongoing push towards automation in mining operations, a trend accelerating in 2024 and projected to continue, means a potential reduction in manual labor roles. This necessitates proactive strategies for workforce retraining and transitioning employees into new areas, ensuring social stability within the communities where Huaibei operates.

Maintaining robust employment and labor practices is paramount for Huaibei Mining's operational continuity and public image. In 2024, reports indicate a growing emphasis on worker safety and fair compensation across heavy industries. Adherence to stringent labor laws and the provision of comprehensive social welfare programs are not just ethical imperatives but also critical for mitigating industrial disputes and attracting and retaining a skilled workforce, especially as the industry adapts to new technological and environmental demands.

Huaibei Mining's operations significantly affect local communities, influencing land use and infrastructure. The company must actively engage with residents to address concerns and ensure positive contributions to the areas where it operates, especially as the revised Mineral Resources Law, effective from January 1, 2024, mandates ecological restoration but lacks detailed community engagement guidelines.

Occupational Health and Safety

The coal mining sector, including operations like Huaibei Mining, faces inherent and significant occupational health and safety (OHS) risks. In 2023, China's National Mine Safety Administration reported a decrease in mining-related accidents, but the industry still demands constant vigilance. Huaibei Mining must prioritize continuous investment in and strict adherence to safety protocols, alongside the adoption of advanced safety technologies and comprehensive workforce training.

Improving occupational health and working environments is not just a regulatory requirement but a cornerstone of sustainable development for mining enterprises. This focus directly impacts employee well-being and the company's long-term operational viability. For instance, investments in better ventilation systems and dust suppression technologies are crucial for mitigating respiratory illnesses among miners.

- Safety Investment: Huaibei Mining likely allocates substantial resources to safety, aiming to meet or exceed national standards, which are continually updated based on accident analysis.

- Technological Adoption: The company is expected to integrate technologies like remote monitoring systems and automated equipment to reduce human exposure to hazardous conditions.

- Training Programs: Comprehensive and recurrent training on hazard recognition, emergency response, and the proper use of safety equipment is essential for all personnel.

- Sustainability Link: A strong OHS record is increasingly tied to a company's environmental, social, and governance (ESG) ratings, influencing investor confidence and access to capital.

Shifting Energy Consumption Patterns

Societal attitudes are increasingly prioritizing environmental sustainability, leading to a growing demand for cleaner energy alternatives. While coal, a core product for Huaibei Mining, remains a significant energy source, this trend suggests a long-term shift away from heavy reliance on fossil fuels. For instance, global renewable energy capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase from 2022, according to the International Energy Agency (IEA).

This evolving consumer and societal preference necessitates that companies like Huaibei Mining adapt. Diversification into renewable energy sectors, such as solar or wind power, and the adoption of more environmentally friendly mining and operational practices are becoming crucial for long-term viability and alignment with public expectations.

- Growing environmental consciousness: Public awareness of climate change fuels demand for sustainable energy.

- Policy support for renewables: Government incentives and regulations favor cleaner energy adoption.

- Corporate social responsibility: Companies are pressured to demonstrate commitment to environmental stewardship.

- Technological advancements: Innovations in clean energy are making them more competitive and accessible.

Societal expectations for corporate responsibility are intensifying, pushing Huaibei Mining to demonstrate strong environmental stewardship and community engagement. Public perception, increasingly influenced by climate change awareness, favors sustainable practices, impacting the social license to operate for coal companies. For example, the global push for decarbonization, evidenced by renewable energy capacity additions reaching 510 GW in 2023, signals a long-term shift away from fossil fuels.

The labor market is evolving, with automation impacting traditional mining roles. Huaibei Mining must navigate this by investing in workforce retraining and ensuring fair labor practices to maintain social stability in its operating regions. Adherence to safety standards and worker well-being is critical, as demonstrated by China's ongoing efforts to reduce mining accidents, with the National Mine Safety Administration reporting decreases in 2023.

Community relations are vital, especially as regulations like China's revised Mineral Resources Law, effective January 2024, emphasize ecological restoration but offer less guidance on community involvement. Huaibei Mining's commitment to local development and addressing land use impacts is essential for its long-term social acceptance and operational continuity.

Technological factors

China's push for intelligent mining is transforming the coal sector, with a focus on large-scale operations adopting autonomous systems and robotics, particularly in hazardous zones. This strategic shift aims to boost efficiency and worker safety.

Huaibei Mining is expected to be a key player in this transformation, investing significantly in technological upgrades and automation. By 2025, the expectation is that large-scale Chinese coal mines will largely operate intelligently, a trend Huaibei Mining is likely aligning with to enhance its competitive edge and operational performance.

Carbon Capture, Utilization, and Storage (CCUS) technologies are gaining significant traction in China, recognized as a crucial pathway for mitigating emissions from established coal-fired power plants. China's commitment to advancing these demonstration projects underscores a growing focus on decarbonizing its energy sector.

For Huaibei Mining, whose operations span mining, electricity generation, and coal chemical products, the evolution of CCUS presents a strategic consideration. While not directly involved in CCUS development, the increasing viability and deployment of these technologies could influence the long-term sustainability and operational costs of its power generation and chemical segments, impacting its decarbonization efforts.

China is actively pushing for the cleaner and more efficient use of coal, aiming to develop more flexible coal power systems that can better integrate with the expansion of renewable energy sources like wind and solar. New coal-fired power plants are now mandated to have lower carbon emissions per megawatt-hour generated than existing facilities.

These evolving standards directly impact Huaibei Mining's core businesses, influencing its coal washing and sales operations as well as its power generation segment. For instance, the push for efficiency means that coal processed by Huaibei Mining must meet stricter quality and environmental criteria to be suitable for these advanced power plants.

Development of Alternative Energy Technologies

China's commitment to renewable energy is a significant technological factor. The nation's plan targets a substantial increase in renewable energy consumption, aiming for 20% of primary energy consumption from non-fossil sources by 2025 and 35% by 2030. This aggressive policy shift directly impacts the coal industry, creating a more competitive environment for traditional energy providers like Huaibei Mining.

The development of alternative energy technologies, particularly wind and solar power, presents both challenges and opportunities for Huaibei Mining. While it intensifies competition for coal, it also opens avenues for diversification. For instance, in 2023, China's installed renewable energy capacity surpassed 50% of its total installed power generation capacity, a milestone that underscores the rapid growth in this sector. Huaibei Mining could explore strategic investments in these burgeoning renewable energy markets to build a more resilient and diversified business model.

Huaibei Mining's strategic response to these technological shifts could involve several key actions:

- Investing in renewable energy projects: Direct investment in solar, wind, or other clean energy infrastructure.

- Exploring energy storage solutions: Developing or acquiring capabilities in battery storage or other energy storage technologies to complement intermittent renewable sources.

- Integrating renewables into existing operations: Potentially using renewable energy to power its own mining and processing facilities, reducing operational costs and carbon footprint.

- Developing new business lines: Expanding into areas like green hydrogen production or carbon capture utilization and storage (CCUS) technologies.

Digitalization and Data Analytics in Operations

The coal industry's embrace of digitalization and data analytics is transforming operations. Huaibei Mining Holdings can leverage advanced information automation technologies like the Internet of Things (IoT), big data, cloud computing, and artificial intelligence to develop smart mines. This technological shift is crucial for enhancing production efficiency, bolstering occupational health and safety protocols, and streamlining technical and logistical support. For instance, by 2024, smart mining initiatives in China are projected to boost productivity by an average of 15-20%, according to industry reports.

The integration of these digital tools directly impacts Huaibei Mining's operational efficiency and overall competitiveness. Smart mines utilize real-time data collection and analysis to optimize resource allocation, predict equipment failures, and improve safety monitoring. This data-driven approach allows for more informed decision-making, leading to reduced operational costs and increased output. By 2025, it's estimated that AI-powered predictive maintenance in the mining sector could reduce downtime by up to 30%.

- Smart Mine Development: Implementing IoT sensors and AI for real-time monitoring and control of mining processes.

- Data-Driven Optimization: Utilizing big data analytics to improve resource extraction, energy consumption, and logistics.

- Enhanced Safety: Deploying AI-powered systems for hazard detection and worker safety monitoring, potentially reducing accidents by over 25% by 2025.

- Improved Technical Support: Leveraging cloud computing for efficient data management and remote diagnostics of mining equipment.

China's drive towards intelligent mining, featuring autonomous systems and robotics, is significantly boosting efficiency and safety in large-scale operations, a trend Huaibei Mining is actively pursuing through technological investments. By 2025, intelligent operations are expected to be widespread in Chinese coal mines, enhancing competitive advantages.

The increasing adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies in China, aimed at decarbonizing the energy sector, presents a strategic consideration for Huaibei Mining's power generation and chemical segments. Furthermore, evolving standards for cleaner and more efficient coal utilization directly impact the quality requirements for Huaibei Mining's coal products and its power generation business.

The rapid expansion of renewable energy in China, with installed capacity surpassing 50% of the total by 2023, intensifies competition for coal but also offers diversification opportunities for Huaibei Mining. Embracing digitalization, smart mine development, and data analytics is crucial for improving operational efficiency and safety, with AI-powered predictive maintenance potentially reducing equipment downtime by up to 30% by 2025.

Legal factors

China's revised Mineral Resources Law, effective July 1, 2025, introduces a significant shift by requiring mining companies like Huaibei Mining to develop ecological restoration plans prior to commencing operations and to actively implement measures aimed at minimizing ecosystem damage. This new legislation underscores a proactive approach to environmental stewardship in the mining sector.

Furthermore, the introduction of new national standards for the ecological restoration of active mine sites in April 2024 signifies a reinforced commitment to environmental rehabilitation. Huaibei Mining will need to align with these more rigorous guidelines, which will likely necessitate substantial capital allocation towards environmental management and site reclamation efforts.

The revised Mineral Resources Law, effective July 1, 2025, mandates increased reserves and production of strategic minerals, alongside enhanced environmental protection measures. This legislation directly impacts Huaibei Mining's ability to secure and maintain exploration and extraction licenses.

Furthermore, China's 2025 Ecological Protection Law Amendments link mining permits to stringent emissions standards and water protection requirements. These regulations will necessitate significant investment in environmental compliance for Huaibei Mining's operations, potentially affecting operational costs and expansion plans.

China's new Energy Law, effective January 1, 2025, is a game-changer for the industry, explicitly prioritizing carbon emissions reduction and implementing a dual-control system. This foundational legislation will shape energy policies, directly impacting coal consumption and production. Huaibei Mining must ensure its operations are fully compliant with these new mandates to navigate the evolving energy landscape.

Emissions Trading Schemes (ETS) and Carbon Pricing

China's national Emissions Trading Scheme (ETS) is expanding, with new sectors facing compliance deadlines by the end of 2025 for their 2024 emissions. This regulatory shift, particularly impacting industries like steel, cement, and aluminum, signals a broader commitment to carbon pricing. Consequently, Huaibei Mining, with its reliance on coal, will experience heightened pressure to reduce its carbon emissions and potentially engage in carbon credit trading.

The expansion of the ETS means that more industrial activities will be directly impacted by carbon costs, affecting the profitability of carbon-intensive operations. For Huaibei Mining, this translates to a need for proactive strategies to manage its environmental impact and adapt to a market where carbon emissions have a quantifiable economic consequence. The company must navigate these evolving regulations to maintain its competitive edge.

- ETS Expansion: China's national ETS now covers more high-emitting sectors, with a compliance deadline of end-2025 for 2024 emissions.

- Carbon Pricing Impact: The move towards carbon pricing directly affects the economic viability of coal mining and related industries.

- Huaibei Mining's Challenge: The company faces increasing pressure to manage its carbon footprint and potentially participate in carbon markets.

Workplace Safety Regulations and Compliance

Workplace safety is paramount in coal mining, with strict regulations designed to protect workers. Huaibei Mining must adhere to these evolving standards, which include investing in advanced safety technologies and comprehensive management systems. For instance, in 2024, China's Ministry of Emergency Management reported a 10% decrease in mining-related fatalities compared to the previous year, underscoring the impact of enhanced safety measures.

- Regulatory Compliance: Huaibei Mining faces continuous scrutiny to ensure adherence to national and provincial workplace safety laws, including those related to ventilation, dust control, and equipment maintenance.

- Investment in Safety: The company is expected to allocate significant capital towards safety upgrades, such as advanced monitoring systems and personal protective equipment, reflecting industry trends where safety investments are seen as crucial for operational continuity and reputation.

- Accident Prevention: Compliance involves rigorous training programs and the implementation of robust safety protocols to mitigate risks associated with mining operations, aiming to prevent incidents like gas explosions or roof collapses.

China's evolving legal landscape places significant emphasis on environmental responsibility and operational safety for mining entities like Huaibei Mining. New regulations effective July 1, 2025, mandate ecological restoration plans and stricter emissions standards, directly impacting licensing and operational costs.

The expansion of China's Emissions Trading Scheme (ETS) by the end of 2025 will increase pressure on coal producers to reduce carbon footprints, potentially requiring investment in carbon credit trading and emission reduction technologies.

Workplace safety remains a critical legal factor, with ongoing requirements for advanced safety technologies and rigorous training programs to mitigate risks, as evidenced by a reported 10% decrease in mining fatalities in 2024 due to enhanced safety measures.

The revised Mineral Resources Law also mandates increased production of strategic minerals, which could affect Huaibei Mining's licensing and exploration rights depending on its compliance with environmental and safety mandates.

Environmental factors

China's commitment to achieving carbon peaking before 2030 and carbon neutrality by 2060 significantly shapes the environmental landscape for industries like mining. These ambitious 'dual carbon' goals are driving a fundamental shift towards decarbonization across the nation's economy.

In response, Huaibei Mining has set a clear target to reduce its carbon intensity by 10% by 2025. This company-specific objective aligns with the broader national agenda and signals a proactive approach to environmental stewardship.

Meeting these stringent targets, both at the national and corporate level, will require substantial capital allocation towards advanced, cleaner production technologies and operational modifications. The focus is on minimizing greenhouse gas emissions throughout the mining lifecycle.

Beyond carbon dioxide, methane released during coal mining is a major environmental issue. Methane is a much more potent greenhouse gas than CO2, contributing significantly to global warming. In 2023, China's coal production reached 4.7 billion tonnes, a record high, indicating continued reliance on coal and a potential increase in methane emissions.

China's commitment to its climate targets, including reaching peak carbon emissions before 2030 and achieving carbon neutrality by 2060, faces challenges from ongoing coal expansion. Increased methane emissions from the sector directly hinder progress towards these goals. For instance, the International Energy Agency reported that coal mining was responsible for approximately 10% of global methane emissions in 2022.

Huaibei Mining, as a significant player in China's coal industry, will likely encounter escalating pressure from both domestic and international bodies to manage and reduce methane leaks. This could translate into stricter regulations, increased monitoring requirements, and potential carbon pricing mechanisms impacting their operational costs and strategic planning.

Coal mining, a core activity for Huaibei Mining, inherently causes significant land degradation and ecological damage, including soil erosion and loss of biodiversity. China's commitment to environmental protection is evident in its revised Mineral Resources Law and updated national standards for ecological restoration, requiring companies like Huaibei Mining to develop and execute detailed restoration plans.

In 2023, China's Ministry of Natural Resources reported that over 1.2 million hectares of land had been impacted by mining, with a focus on increasing restoration efforts. Huaibei Mining's strategy must therefore integrate robust preventive measures to minimize its footprint during extraction and invest heavily in comprehensive post-mining ecological rehabilitation to meet these evolving regulatory demands and environmental expectations.

Water Pollution and Resource Management

Mining, by its nature, demands substantial water resources and carries the inherent risk of water contamination. Huaibei Mining Holdings must navigate China's tightening environmental regulations, which increasingly scrutinize water usage and discharge from mining activities. For instance, in 2023, China's Ministry of Ecology and Environment continued to emphasize stringent water quality standards for industrial wastewater, with potential penalties for non-compliance.

To address these challenges and maintain operational viability, Huaibei Mining needs robust water management systems. This includes investing in advanced wastewater treatment technologies to purify discharged water and implementing water conservation initiatives across its operations. A proactive approach to water resource management is crucial not only for regulatory adherence but also for mitigating environmental impact and ensuring long-term sustainability.

Key areas for Huaibei Mining's focus in water management include:

- Wastewater Treatment: Implementing advanced filtration and purification systems to meet or exceed national discharge standards, potentially reducing water intake from fresh sources.

- Water Conservation: Exploring closed-loop water systems and optimizing water usage in mining processes, aiming to decrease overall consumption.

- Regulatory Compliance: Staying abreast of evolving water protection policies and ensuring all mining permits reflect current environmental requirements.

Sustainable Mining Practices and Green Transformation

China's push for 'green mines' is a significant environmental factor. This involves optimizing mining operations, maximizing the use of solid waste, and reducing land impact. Huaibei Mining is expected to integrate these sustainable practices to meet national environmental goals.

The company's commitment to green transformation is crucial for its long-term viability and social license to operate. By embracing cleaner technologies and waste management, Huaibei Mining can enhance its corporate social responsibility profile.

- Green Mine Construction: China aims to develop a significant number of green mines by 2025, with a focus on resource efficiency and ecological protection.

- Solid Waste Utilization: By 2024, the utilization rate of solid waste in key mining areas is targeted to increase substantially, reducing environmental burden.

- Land Reclamation: Efforts are underway to improve land reclamation rates in mining areas, with specific targets set for 2025 to restore mined land.

China's ambitious environmental goals, including carbon peaking by 2030 and carbon neutrality by 2060, directly impact Huaibei Mining. The country's ongoing reliance on coal, with production reaching 4.7 billion tonnes in 2023, presents a challenge in reducing methane emissions, a potent greenhouse gas. For instance, coal mining accounted for about 10% of global methane emissions in 2022.

Huaibei Mining faces increasing pressure to manage land degradation and water contamination, with over 1.2 million hectares impacted by mining in China as of 2023. Stricter regulations, like those emphasizing ecological restoration and water quality standards for industrial wastewater, necessitate significant investment in cleaner technologies and robust water management systems.

The push for 'green mines' by 2025, focusing on resource efficiency and solid waste utilization (with targets for increased utilization by 2024), requires Huaibei Mining to adopt sustainable practices. This includes improving land reclamation rates, a key objective for 2025, to minimize its ecological footprint and maintain its social license to operate.

| Environmental Factor | Key Data/Target | Implication for Huaibei Mining |

|---|---|---|

| Climate Goals | Carbon Peaking by 2030, Carbon Neutrality by 2060 | Pressure to decarbonize operations, reduce methane emissions. |

| Methane Emissions | Coal mining responsible for ~10% of global methane emissions (2022) | Need for advanced methane capture and reduction technologies. |

| Land Degradation | 1.2 million+ hectares impacted by mining in China (2023) | Requirement for robust land restoration and minimization of footprint. |

| Water Management | Stringent water quality standards for industrial wastewater (2023) | Investment in advanced wastewater treatment and water conservation. |

| Green Mines Initiative | Green mine development by 2025; increased solid waste utilization by 2024 | Integration of resource efficiency and waste management practices. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Huaibei Mining Holdings is built on a foundation of official government reports from China, economic data from international financial institutions, and industry-specific analyses from reputable mining sector research firms. We ensure each factor is informed by current policy, market dynamics, and technological advancements.