Huaibei Mining Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huaibei Mining Holdings Bundle

Huaibei Mining Holdings faces significant competitive pressures, with moderate bargaining power from both suppliers and buyers within the coal industry. The threat of new entrants is present but somewhat mitigated by high capital requirements and established infrastructure.

The threat of substitutes, particularly from alternative energy sources, is a growing concern, while the intensity of rivalry among existing players remains high. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Huaibei Mining Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Highly specialized mining equipment suppliers possess considerable bargaining power. The acquisition of advanced machinery for large-scale coal mining, washing, and processing often limits the number of viable suppliers, particularly for high-tech or custom-built equipment. These niche providers can therefore command higher prices due to their specialized expertise and the critical nature of their products for operational efficiency and safety.

For instance, in 2024, the global mining equipment market saw continued demand for advanced automation and digital solutions. Suppliers offering cutting-edge technology, such as autonomous haulage systems or sophisticated mineral processing machinery, are well-positioned to negotiate favorable terms. The significant switching costs associated with integrating new, specialized equipment, including extensive training, system integration, and potential operational downtime, further solidify these suppliers' leverage.

The availability of skilled labor, especially experienced miners and technical staff for coking and power generation, significantly impacts supplier power for Huaibei Mining. A scarcity of qualified professionals or robust labor unions can lead to increased wage demands and benefit packages, directly affecting the company's operational expenses.

In 2024, the mining sector, like many heavy industries, faced ongoing challenges in attracting and retaining specialized talent. For instance, reports from industry associations indicated a persistent shortage of certified heavy equipment operators and process engineers, driving up compensation benchmarks. This tight labor market grants skilled workers considerable bargaining leverage.

As Huaibei Mining Holdings pushes for digitalization, its reliance on specialized technology and software providers for automation and data analytics becomes critical. Companies offering unique or integrated digital solutions, such as those for smart mine management, can hold significant sway. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the concentration of expertise among key players.

The considerable investment and technical expertise required to switch between different digital platforms create a strong incentive for Huaibei Mining to remain with existing vendors. This vendor lock-in effect, common in complex IT environments, empowers suppliers by making it costly and disruptive to change providers, thereby solidifying their bargaining position in future negotiations.

Land Use Rights and Environmental Compliance Services

The bargaining power of suppliers for Huaibei Mining Holdings, particularly concerning land use rights and environmental compliance, is significant. In China, access to land for mining is heavily regulated by the government and contingent on agreements with local communities. These entities act as powerful suppliers, dictating terms for land acquisition, permits, and compensation, directly impacting operational costs and expansion capabilities.

Furthermore, specialized firms providing environmental compliance and remediation services wield considerable influence. Their unique expertise and understanding of China's evolving environmental regulations are crucial for mining operations. For instance, as of late 2024, China continues to emphasize stringent environmental protection, meaning companies like Huaibei Mining must rely on these specialized service providers to navigate complex permitting processes and ensure ongoing compliance, thereby enhancing supplier leverage.

- Government Land Use Regulations: Chinese governmental bodies control land access, setting terms and conditions for mining operations, which can include land lease fees and development requirements.

- Local Community Agreements: Local communities often negotiate directly with mining companies for land use, impacting compensation, employment opportunities, and operational approvals.

- Environmental Compliance Expertise: Specialized environmental consulting and remediation firms possess critical knowledge of regulatory frameworks, making their services indispensable and granting them bargaining power.

- Increasing Environmental Scrutiny: The heightened focus on environmental sustainability by the Chinese government in 2024 and beyond amplifies the importance and leverage of environmental service providers.

Critical Raw Materials for Diversified Products

While coal is Huaibei Mining's core product, its expansion into coking, coal chemicals, and construction materials introduces reliance on other critical raw materials. The availability and cost of these secondary inputs, which can include specialized chemicals or additives, directly influence the profitability of these diversified segments. For instance, fluctuations in global prices for certain industrial chemicals used in coal processing could impact the company's cost of goods sold.

The bargaining power of suppliers for these non-coal materials is a significant consideration. If these inputs are sourced from a concentrated market or are subject to volatile global commodity pricing, Huaibei Mining may face increased costs. This can affect its ability to maintain competitive pricing across its product lines, particularly in the construction materials sector where input costs are a major determinant of profitability.

- Dependence on specialized inputs: Diversification into coal chemicals and construction materials necessitates sourcing specific additives and intermediate products beyond coal.

- Global commodity price volatility: The pricing of these secondary raw materials can be influenced by international market dynamics, potentially impacting Huaibei Mining's cost structure.

- Supplier concentration: If key secondary inputs are provided by a limited number of suppliers, their bargaining power increases, potentially leading to higher costs for Huaibei Mining.

Suppliers of specialized mining equipment and advanced technology hold significant bargaining power due to high switching costs and limited viable providers, impacting Huaibei Mining's operational efficiency and capital expenditures.

Labor availability, especially for skilled roles in mining and processing, directly influences supplier power through wage demands, with shortages in 2024 exacerbating this trend.

Providers of digital solutions for mine management and automation also possess considerable leverage, as vendor lock-in and integration complexities make changing providers costly for Huaibei Mining.

Government land use regulations and local community agreements in China grant substantial power to these entities as suppliers of essential land access, influencing operational costs and expansion plans.

| Supplier Category | Key Factors Influencing Power | Impact on Huaibei Mining | 2024 Relevance/Data |

|---|---|---|---|

| Specialized Mining Equipment | Limited suppliers, high switching costs, technical expertise | Higher equipment prices, potential delays in upgrades | Global mining equipment market demand for automation remains strong. |

| Skilled Labor | Scarcity of experienced personnel, union strength | Increased wage and benefit costs, potential operational disruptions | Persistent shortage of certified heavy equipment operators and engineers reported in 2024. |

| Digital Solutions Providers | Proprietary technology, integration complexity, vendor lock-in | Higher software licensing and maintenance fees, dependence on specific vendors | Industrial automation market projected to exceed $200 billion in 2024. |

| Land Use & Environmental Services | Government regulations, local community agreements, specialized compliance knowledge | Higher land acquisition costs, permit fees, stringent compliance requirements | China's continued emphasis on stringent environmental protection in 2024 amplifies the leverage of environmental service providers. |

What is included in the product

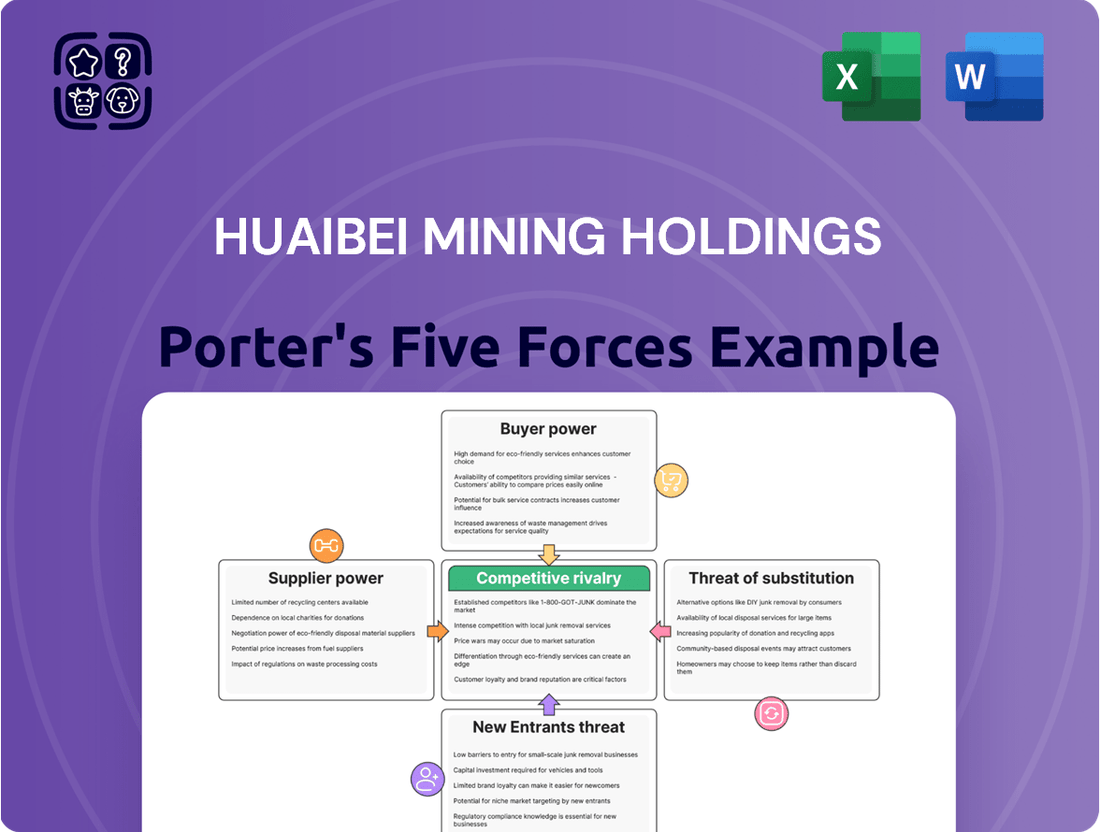

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants and substitutes impacting Huaibei Mining Holdings' profitability and strategic options.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Huaibei Mining Holdings' competitive landscape to pinpoint key vulnerabilities and opportunities.

Customers Bargaining Power

Huaibei Mining's major clients, including substantial power generation firms and steel producers, are significant purchasers of coal and coke, often acquiring these commodities in massive quantities. This sheer volume grants these large customers considerable leverage, enabling them to negotiate for reduced prices or more advantageous contract conditions.

The capacity of these industrial giants to shift their procurement to alternative major coal providers, despite incurring some logistical expenses, exerts considerable pressure on Huaibei Mining's pricing strategies. For instance, in 2023, China's thermal coal prices saw fluctuations, with some periods reflecting strong buyer negotiation power as domestic supply increased.

Government influence significantly shapes the bargaining power of customers for Huaibei Mining, particularly given the prevalence of state-owned enterprises (SOEs) in China's industrial landscape. Many of Huaibei Mining's key buyers are likely SOEs, meaning their purchasing decisions and pricing are often subject to government directives and national energy strategies.

This government oversight can translate into pricing controls and strategic resource allocation, effectively limiting Huaibei Mining's ability to set its own prices and reducing its leverage. For instance, in 2024, China's National Development and Reform Commission (NDRC) continued to manage coal prices through various mechanisms to ensure stable energy supply, directly impacting the pricing flexibility of mining companies like Huaibei Mining.

Customers in China possess considerable bargaining power due to the wide array of alternative coal sources available, both domestically and internationally. This includes significant import options from countries like Indonesia, Australia, and Russia, offering diverse supply chains and competitive pricing structures.

The dynamics of the global coal market directly influence customer leverage. For instance, in 2024, fluctuations in international coal prices, driven by factors such as geopolitical events and global demand shifts, empower Chinese buyers to negotiate more aggressively with domestic suppliers like Huaibei Mining. Lower international prices translate to greater pressure on domestic producers to offer competitive rates to retain market share.

Customer Integration and Diversification Strategies

The bargaining power of customers for Huaibei Mining Holdings is significantly influenced by their potential for integration and diversification. Large industrial consumers, such as power plants or steel manufacturers, may possess the capability to engage in backward integration, establishing their own coal mining operations or securing long-term supply contracts with numerous alternative producers. This reduces their dependence on any single supplier like Huaibei Mining.

Furthermore, customers are increasingly diversifying their energy portfolios, moving away from a sole reliance on coal. This strategic shift, driven by environmental regulations and the pursuit of energy security, diminishes the overall importance of coal to their operational continuity. For instance, by incorporating renewable energy sources or natural gas, customers lessen the leverage Huaibei Mining can exert on pricing and supply terms.

- Backward Integration: Large customers may own mines or have multiple supply agreements, reducing reliance on Huaibei Mining.

- Energy Diversification: Customers are reducing coal dependence by adopting renewables and natural gas, lessening Huaibei Mining's market share importance.

- Pricing Pressure: Customer flexibility through integration and diversification allows them to negotiate more favorable pricing and supply conditions.

Product Homogeneity and Price Sensitivity

Huaibei Mining, despite offering different coal types like thermal and coking coal, operates in a market where coal itself is largely a homogeneous commodity. This means that for many buyers, especially for standard thermal coal used in power generation, price becomes the most significant factor. In 2024, the global thermal coal price index saw fluctuations, but the underlying commodity nature means customers are always looking for the best deal.

This high price sensitivity significantly amplifies the bargaining power of customers. They are quick to shift their business to suppliers offering even slightly lower prices, making it challenging for Huaibei Mining to command premium pricing unless they offer a distinct advantage. This dynamic is a core challenge in the coal industry, where differentiation is often difficult.

- Homogeneous Commodity: Coal's nature as a widely available commodity means fewer unique selling propositions beyond price for many applications.

- Price Sensitivity: Customers, particularly in the thermal coal market, are highly attuned to price differences and readily switch suppliers.

- Competitive Landscape: The presence of numerous coal producers globally intensifies competition, further empowering buyers.

Customers possess significant bargaining power due to the commoditized nature of coal and their high price sensitivity, making them prone to switching suppliers for even minor price differences.

The availability of alternative domestic and international coal sources, coupled with government influence on pricing, further empowers buyers to negotiate favorable terms with Huaibei Mining.

| Factor | Description | Impact on Huaibei Mining |

| Customer Concentration | Large power and steel firms buy in bulk. | Enables negotiation for lower prices. |

| Availability of Substitutes | Access to domestic and international coal. | Increases buyer leverage and price pressure. |

| Government Influence | SOE buyers subject to state directives. | Limits Huaibei Mining's pricing flexibility. |

| Commodity Nature | Coal is largely undifferentiated. | Price becomes the primary negotiation point. |

Preview the Actual Deliverable

Huaibei Mining Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Huaibei Mining Holdings, detailing the competitive landscape including bargaining power of buyers and suppliers, threat of new entrants, threat of substitutes, and industry rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into the company's strategic positioning within the mining sector.

Rivalry Among Competitors

The competitive landscape for Huaibei Mining is characterized by a significant number of large state-owned enterprises (SOEs) and private coal producers in China. This means Huaibei Mining isn't operating in a vacuum; it's part of a crowded market. For instance, it competes directly with behemoths like China Shenhua Energy, which is one of the largest coal enterprises globally, and Datong Coal Mine Group, another major SOE with substantial production capacity.

The sheer volume of competitors, many possessing comparable production capabilities and similar types of coal, naturally fuels intense price wars. Companies are constantly vying for market share, which can put downward pressure on coal prices. This rivalry means that efficiency and cost management are absolutely critical for Huaibei Mining to maintain its profitability and competitive edge.

The Chinese coal market has a history of oversupply, fueling intense price wars. Despite government efforts to trim excess capacity, periods of overproduction can still emerge, especially when the economy slows. This dynamic pressures companies like Huaibei Mining to compete aggressively on price, which can squeeze profitability across the sector.

Huaibei Mining Holdings faces intensified competitive rivalry due to the diversified business models of its peers. Many major Chinese coal enterprises, much like Huaibei Mining, have expanded their operations into coking, power generation, and coal chemicals. This strategic diversification means these companies are not just competing within the coal market but also across these related downstream industries.

This broad competitive landscape elevates the rivalry. Companies are now vying for market share in multiple, interconnected sectors, often utilizing their integrated value chains to secure a competitive edge. For instance, in 2023, China's coal chemical industry saw significant growth, with output from major enterprises often supported by their captive coal supply, creating a more complex competitive dynamic for standalone coal producers.

Regional Market Concentration and Logistics Advantages

While the coal market operates nationally, regional competitive dynamics are particularly pronounced for Huaibei Mining. Its core operations in Anhui province place it in direct competition with other Anhui-based producers and those in adjacent provinces for market share and access to essential resources.

This regional concentration intensifies rivalry, as companies vie for local customers and favorable logistical arrangements. For instance, proximity to major industrial centers like those in eastern China, where demand for coal is high, becomes a critical differentiator.

- Regional Competition: Huaibei Mining faces significant competition from other coal producers located within Anhui province and surrounding regions.

- Logistical Advantages: Proximity to industrial hubs and efficient transportation networks are key competitive factors influencing rivalry in the regional market.

- Customer Access: Intense competition for local customers means that companies like Huaibei Mining must leverage their regional presence and logistical capabilities.

Government Policy and Regulatory Landscape

The Chinese government's influence on the coal industry, including for companies like Huaibei Mining Holdings, is substantial. Policies dictating coal production quotas, environmental protection standards, and efforts towards industry consolidation directly shape the competitive intensity. For instance, in 2024, China continued its push for greener energy, which could lead to stricter regulations on coal-fired power plants, potentially impacting demand and thus rivalry.

These government interventions can significantly alter the playing field. Mandates for capacity reductions or the implementation of new environmental regulations can disproportionately affect smaller or less efficient players, potentially leading to consolidation and a more concentrated market. Companies that can adapt swiftly to evolving policy landscapes, such as investing in cleaner technologies or diversifying their energy portfolios, are better positioned to thrive amidst this dynamic environment.

Government policies also play a role in influencing pricing mechanisms and favoring specific types of energy production. This can create an uneven competitive landscape where companies aligned with national energy strategies may find an advantage. Staying abreast of and proactively responding to these policy shifts is crucial for maintaining competitiveness and navigating the inherent risks within the sector.

- Government Policy Impact: Chinese government policies on coal production, consumption, and environmental standards are key drivers of competitive rivalry.

- Regulatory Adaptability: Companies must quickly adapt to regulatory changes, such as stricter environmental mandates or capacity reduction requirements, to remain competitive.

- Industry Consolidation: Government-led consolidation efforts can reshape the competitive landscape, potentially benefiting larger, more compliant entities.

- Pricing and Favoritism: Policy decisions can influence pricing and create advantages for companies aligned with national energy development strategies.

Competitive rivalry for Huaibei Mining is intense, driven by numerous large state-owned and private coal producers in China, including giants like China Shenhua Energy. This crowded market often leads to price wars, making efficiency and cost control paramount for Huaibei Mining. The industry's history of oversupply exacerbates this, pressuring companies to compete aggressively on price, which can impact profitability across the sector.

Many competitors, similar to Huaibei Mining, have diversified into coking, power generation, and coal chemicals, intensifying rivalry across these interconnected sectors. For instance, in 2023, the growth in China's coal chemical industry was supported by captive coal supply for major enterprises, creating a more complex competitive dynamic. Regional competition within Anhui province and adjacent areas is also a significant factor, with proximity to industrial centers like those in eastern China being a critical differentiator.

| Competitor Type | Key Players | Competitive Factor |

|---|---|---|

| State-Owned Enterprises (SOEs) | China Shenhua Energy, Datong Coal Mine Group | Scale, Production Capacity, Government Support |

| Private Coal Producers | Various entities across China | Agility, Cost Efficiency, Niche Markets |

| Diversified Energy Companies | Integrated coal, power, and chemical firms | Value Chain Integration, Downstream Market Access |

SSubstitutes Threaten

The rapid expansion of renewable energy sources, particularly in China, presents a significant threat of substitution for Huaibei Mining. China, a global frontrunner in clean energy, has poured substantial capital into solar, wind, and hydropower, directly impacting the demand for thermal coal, a primary product for Huaibei Mining.

By 2023, China's installed renewable energy capacity reached over 1.4 billion kilowatts, a testament to its commitment to decarbonization. This surge in renewables, driven by falling costs and increasing efficiency, directly displaces coal's role in electricity generation, a key market segment for Huaibei Mining.

Natural gas is increasingly seen as a more environmentally friendly option than coal, boasting significantly lower emissions. China's commitment to enhancing air quality and diversifying its energy sources has spurred substantial investment in natural gas infrastructure and boosted its consumption.

This growing preference for natural gas, especially in industrial and residential heating, as well as for electricity generation, directly competes with and substitutes coal demand. For instance, in 2023, China's natural gas consumption grew by approximately 10% year-on-year, underscoring this substitution trend and its potential impact on coal producers like Huaibei Mining.

Continuous advancements in energy efficiency technologies, such as improved combustion processes and waste heat recovery systems, directly reduce the demand for coal. For instance, by 2024, many industrial facilities are expected to have integrated more efficient equipment, potentially lowering their coal consumption by 5-10% compared to pre-2020 levels.

Government policies and incentives encouraging energy conservation and the adoption of energy-saving measures by industrial clients present a significant threat. These initiatives can lead to a substantial decrease in coal usage, as businesses actively seek to lower operational costs and environmental impact, effectively substituting coal with energy savings.

Policy-Driven Decarbonization and Emission Reduction Targets

The threat of substitutes for Huaibei Mining Holdings is significantly amplified by policy-driven decarbonization efforts in China. The nation's commitment to achieving carbon neutrality by 2060, with interim targets for peak carbon emissions before 2030, directly pressures the coal industry.

Stricter environmental regulations and the implementation of carbon pricing mechanisms make coal a less economically viable option for power generation and industrial use. For instance, China's national carbon trading scheme, launched in 2021, is gradually expanding its scope, increasing the cost of carbon-intensive activities.

- Policy Pressure: China's ambitious climate goals, including peak carbon emissions before 2030 and carbon neutrality by 2060, are driving a systemic shift away from coal.

- Regulatory Impact: Stricter environmental regulations and carbon pricing mechanisms (like the national ETS) are increasing the cost of coal consumption.

- Incentives for Alternatives: Government incentives for renewable energy sources such as solar and wind power make them increasingly competitive substitutes for coal.

- Accelerated Adoption: These policy-driven changes are accelerating the adoption of cleaner energy alternatives, placing long-term pressure on coal demand for Huaibei Mining Holdings.

Technological Advancements in Alternative Materials and Processes

Technological advancements are creating a significant threat of substitutes across Huaibei Mining's diverse operations. In the coking segment, the push for greener steel production methods, such as those utilizing hydrogen or electric arc furnaces, could dramatically decrease the demand for coking coal. This shift is already gaining traction, with global steelmakers investing heavily in decarbonization technologies, potentially impacting a core revenue stream for Huaibei Mining.

Beyond coking coal, Huaibei Mining faces substitution threats in its coal chemicals and construction materials businesses. Innovations in alternative construction materials, like advanced composites or bio-based products, could displace traditional coal-derived materials. Similarly, the chemical industry is exploring new feedstocks that bypass coal, driven by both environmental concerns and the pursuit of more efficient or specialized chemical processes. For instance, the development of bio-plastics and advanced polymers offers alternatives to certain coal-based chemicals.

- Green Steel Production: Investments in hydrogen-based direct reduction and electric arc furnaces are reducing coking coal dependency.

- Alternative Construction Materials: Advancements in composites, engineered wood, and recycled materials offer substitutes for coal-based construction inputs.

- Chemical Feedstock Diversification: Innovations in bio-based chemicals and recycled plastics are presenting alternatives to coal-derived chemical precursors.

The threat of substitutes is substantial for Huaibei Mining, primarily driven by China's aggressive push towards cleaner energy and technological advancements. Renewables like solar and wind, coupled with natural gas, are increasingly displacing coal in power generation and industrial use. For instance, China's renewable energy capacity surpassed 1.4 billion kilowatts by the end of 2023, directly impacting coal demand.

Furthermore, innovations in areas like green steel production and alternative construction materials are eroding coal's market share in other segments. The growing adoption of energy efficiency technologies also reduces the overall need for coal. These trends are further exacerbated by government policies aimed at decarbonization, making coal a less attractive and more costly option.

| Substitute Category | Key Drivers | Impact on Huaibei Mining |

|---|---|---|

| Renewable Energy (Solar, Wind) | Falling costs, government incentives, decarbonization goals | Direct displacement of coal in power generation |

| Natural Gas | Environmental benefits, infrastructure investment, diversification efforts | Substitution in industrial heating and power generation |

| Energy Efficiency Technologies | Cost savings, environmental regulations | Reduced overall coal consumption by end-users |

| Green Steel Production (Hydrogen, EAF) | Decarbonization of heavy industry | Reduced demand for coking coal |

| Alternative Construction Materials | Sustainability, performance advancements | Potential displacement of coal-derived materials |

Entrants Threaten

The threat of new entrants for Huaibei Mining Holdings is significantly mitigated by the substantial capital investment required to establish large-scale coal mining operations. Developing integrated facilities for coking, power generation, and chemical production demands immense upfront funding for land acquisition, machinery, and infrastructure, creating a formidable barrier.

Newcomers would find it extremely challenging to match the economies of scale that established players like Huaibei Mining have already achieved. In 2023, Huaibei Mining reported total assets of approximately RMB 122.4 billion, illustrating the scale of investment necessary to operate effectively in this sector.

The coal and energy sectors in China are subject to extensive regulatory hurdles and licensing requirements. New entrants must obtain numerous permits and licenses, while also adhering to stringent environmental and safety standards, making market entry a complex and costly undertaking.

Navigating this intricate regulatory environment requires significant time and financial investment, acting as a substantial barrier for potential new competitors looking to enter the market.

Furthermore, the Chinese government's direct control over resource allocation significantly limits the ease with which new players can access essential raw materials, thereby restricting their ability to enter and compete effectively.

Huaibei Mining Holdings benefits significantly from its deeply entrenched relationships with major industrial clients across China. These established ties, cultivated over years of reliable supply, create a formidable barrier for any new player attempting to enter the market. Securing similar customer commitments would require substantial time and proven performance.

The company also possesses extensive and critical logistics infrastructure. This includes dedicated rail lines, strategically located ports, and ample storage facilities specifically designed for efficient coal distribution. For instance, in 2023, China's coal transportation volume via rail reached approximately 3.6 billion tonnes, highlighting the sheer scale of infrastructure required for effective market reach.

New entrants would face immense capital expenditure and operational hurdles in replicating Huaibei Mining's distribution network. Building comparable logistics capabilities, from rail access to port facilities, is not only costly but also time-consuming, presenting a significant deterrent to market entry in the bulk commodity sector.

Proprietary Technology, Expertise, and Brand Recognition

While coal itself is a commodity, the processes involved in its extraction and preparation are far from simple. Efficient and safe mining operations, coupled with advanced coal washing techniques and specialized chemical processes, demand significant technological expertise and deep operational know-how. Huaibei Mining, as an established player, benefits from years of accumulated experience and potentially holds proprietary technologies that are difficult for newcomers to replicate.

Furthermore, the brand recognition and established reliability of companies like Huaibei Mining act as a substantial barrier to entry. Building trust with customers in the coal market takes time and a consistent track record of quality and delivery. New entrants would face the challenge of overcoming this established reputation, which is a significant hurdle in attracting and retaining customers.

- Technological Barriers: Advanced mining and processing technologies require substantial R&D investment and operational expertise, which new entrants may lack.

- Operational Expertise: Years of experience in safe and efficient coal extraction and washing provide established players like Huaibei Mining with a competitive edge.

- Brand Reputation and Trust: Long-standing relationships and a proven track record build customer loyalty, making it difficult for new, unproven companies to gain market share.

Government-Led Industry Consolidation and Supply-Side Reforms

The Chinese government's push for industry consolidation in the coal sector, aiming to phase out smaller, inefficient mines and bolster larger, more integrated entities, significantly raises the barrier to entry. This strategic move by Beijing makes it exceedingly challenging for new, independent companies to establish a foothold, as the government prioritizes strengthening existing dominant players and managing overall supply.

For instance, in 2023, China continued its efforts to optimize coal production capacity, with reports indicating a substantial reduction in the number of small, unsafe mines. This policy environment directly impacts the threat of new entrants by creating a landscape dominated by established, government-supported enterprises.

- Government Consolidation Policies: Beijing's directive to merge and upgrade coal enterprises discourages new market participants.

- Reduced Number of Small Mines: The closure of less efficient mines limits opportunities for smaller, emerging companies.

- Focus on Major Players: Government support and preferential policies are directed towards existing large-scale mining operations.

The threat of new entrants for Huaibei Mining Holdings is very low due to high capital requirements, stringent regulations, and established infrastructure. The significant investment needed for mining operations, coupled with complex licensing and environmental standards, deters new competition. Furthermore, government policies favoring industry consolidation and the immense logistical networks of existing players create formidable barriers.

| Barrier Type | Description | Impact on New Entrants | Example for Huaibei Mining (2023 Data) |

| Capital Requirements | High upfront investment for land, machinery, and infrastructure. | Deters new entrants due to prohibitive costs. | Total Assets: ~RMB 122.4 billion |

| Regulatory Hurdles | Extensive permits, licenses, and compliance with environmental/safety standards. | Increases time and cost for market entry. | Stringent national and provincial mining regulations. |

| Economies of Scale | Established players benefit from lower per-unit costs. | New entrants struggle to compete on price. | Large-scale operations leading to cost efficiencies. |

| Logistics Infrastructure | Extensive distribution networks (rail, ports, storage). | Replicating this network is costly and time-consuming. | Access to dedicated rail lines and storage facilities. |

| Government Policies | Industry consolidation and phase-out of smaller mines. | Favors existing large players, limits new market participants. | Policies promoting industry upgrades and efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Huaibei Mining Holdings is built upon a foundation of publicly available data, including the company's annual reports, SEC filings, and industry-specific market research from reputable sources like S&P Global Market Intelligence.