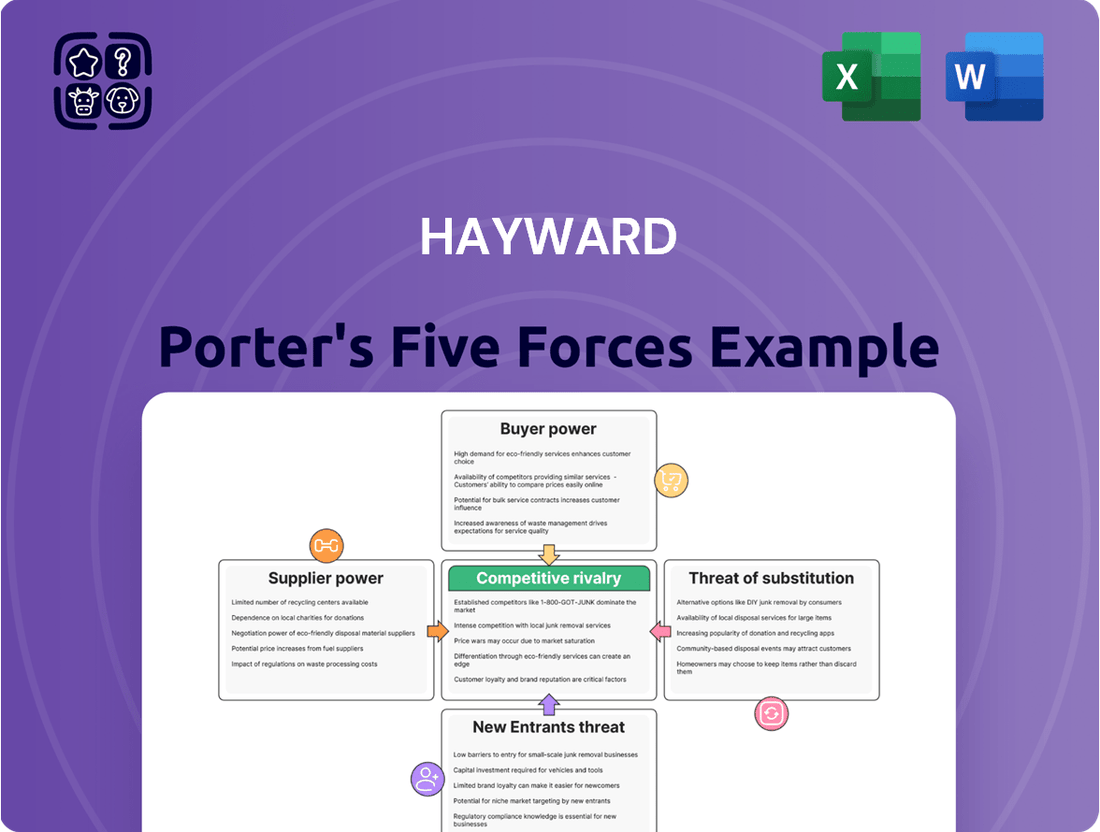

Hayward Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hayward Bundle

Hayward's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any business operating within or looking to enter this market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hayward’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Hayward is significantly influenced by the concentration of its supplier base. When a limited number of companies provide essential components like specialized pool pump motors or advanced filtration membranes, these suppliers gain considerable leverage. For instance, if only two or three global manufacturers produce a critical, proprietary component, they can effectively set prices and terms, as Hayward has few alternatives.

The uniqueness of inputs is a critical factor in determining supplier bargaining power for Hayward. If Hayward relies on suppliers for proprietary technology, patented components, or highly specialized materials that are difficult to source elsewhere, these suppliers gain significant leverage. This is especially relevant in the pool industry, where innovation in energy-efficient or smart pool technologies often relies on unique inputs.

Hayward faces significant supplier bargaining power due to high switching costs. If Hayward needed to change a key supplier, it would likely incur substantial expenses related to retooling its manufacturing processes and potentially redesigning its products to accommodate new components. For instance, in 2024, the average cost for manufacturers to qualify a new component supplier can range from tens of thousands to hundreds of thousands of dollars, depending on the complexity and regulatory requirements.

Threat of Forward Integration

The threat of forward integration by suppliers significantly amplifies their bargaining power within the pool equipment manufacturing sector. If a key component supplier, such as a manufacturer of specialized electric motors or advanced filtration membranes, possesses the capability and inclination to enter the finished product market, they can exert considerable leverage. This potential move means they could start producing complete pool pumps or filtration systems, directly competing with their current buyers.

This scenario is particularly potent when suppliers control unique or essential inputs. For instance, a supplier of proprietary control chips for smart pool systems could leverage their position. If such a supplier were to integrate forward, they could capture a larger portion of the value chain, potentially dictating terms to existing manufacturers or simply bypassing them altogether. In 2023, the global pool equipment market was valued at approximately $10 billion, with components like pumps and filters representing a substantial portion of that value.

- Supplier Capability: Suppliers with strong R&D, manufacturing expertise, and existing customer relationships are better positioned for forward integration.

- Market Attractiveness: High-profit margins and growth potential in the pool equipment market incentivize suppliers to consider moving downstream.

- Competitive Landscape: A fragmented pool equipment manufacturing industry with weaker incumbents makes forward integration a more viable strategy for suppliers.

- Capital Requirements: The financial resources needed to establish manufacturing facilities and distribution networks are a key barrier, but for well-capitalized suppliers, this is surmountable.

Importance of Hayward to the Supplier

The significance of Hayward to its suppliers plays a crucial role in determining the bargaining power of those suppliers. If Hayward constitutes a minor segment of a supplier's overall sales, that supplier has less motivation to offer favorable pricing or terms, as the loss of Hayward's business would not significantly impact their revenue. For instance, if a key component supplier derives only 1% of its total revenue from Hayward, they hold considerable leverage.

Conversely, if Hayward represents a substantial portion of a supplier's customer base, the supplier's power is considerably weakened. In such scenarios, suppliers are more inclined to be flexible on pricing and terms to retain Hayward's business, as losing such a significant client would pose a substantial risk to their financial stability. For example, if Hayward accounts for 15% of a supplier's annual revenue, that supplier will likely prioritize maintaining the relationship.

- Supplier Dependence: The degree to which a supplier relies on Hayward for revenue directly influences their bargaining power.

- Revenue Concentration: Suppliers with a high concentration of revenue from Hayward face greater pressure to meet Hayward's demands.

- Market Share Impact: For suppliers where Hayward is a major customer, losing that business could significantly impact their market share and profitability.

The bargaining power of suppliers for Hayward is influenced by the availability of substitute inputs. If alternative components can fulfill the same function, even with minor modifications, Hayward's negotiating position strengthens. For instance, if a competitor develops a viable alternative to a proprietary pool pump motor, Hayward can leverage this to negotiate better terms or switch suppliers.

The overall bargaining power of suppliers for Hayward is a complex interplay of several factors. When suppliers offer unique, highly specialized, or patented components, their power increases significantly. High switching costs for Hayward, coupled with the threat of suppliers integrating forward into the finished product market, further bolster supplier leverage. Conversely, if Hayward represents a substantial portion of a supplier's revenue, the supplier's power diminishes.

| Factor | Impact on Hayward's Suppliers | Example Scenario |

|---|---|---|

| Supplier Concentration | High if few suppliers for critical components. | A single manufacturer of advanced smart pool chipsets. |

| Input Uniqueness | High for proprietary technology. | Patented energy-efficient motor designs. |

| Switching Costs | High for Hayward if retooling or redesign is needed. | Qualifying a new supplier for filtration membranes can cost $50,000-$150,000 in 2024. |

| Forward Integration Threat | Significant if suppliers can enter Hayward's market. | A component manufacturer starting to sell complete pool systems. |

| Hayward's Importance to Supplier | Low if Hayward is a small customer; High if Hayward is a major customer. | Supplier revenue from Hayward: 1% vs. 15%. |

What is included in the product

This analysis examines the five competitive forces impacting Hayward's industry, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Hayward Industries caters to a broad spectrum of customers, from individual homeowners to large commercial entities. The residential market, comprising millions of individual homeowners, presents a highly fragmented customer base. This fragmentation means that each individual homeowner typically possesses very little bargaining power when it comes to influencing Hayward's pricing or product offerings.

Conversely, Hayward's larger commercial clients, such as major pool service companies or large retail distributors, can exert more significant influence. Their substantial purchase volumes grant them greater leverage, potentially leading to negotiated terms or volume discounts. For instance, a national chain of pool supply stores might negotiate more favorable pricing than a single independent retailer.

When customers have many readily available substitutes for pool equipment, their ability to negotiate with Hayward significantly strengthens. For instance, if a homeowner can easily find comparable pool pumps or filters from brands like Pentair or Jandy that perform similarly, they are less reliant on Hayward. This competitive landscape in 2024, where numerous brands offer energy-efficient variable-speed pumps, means customers can readily switch if Hayward's pricing or features become less attractive, putting pressure on Hayward to maintain competitive offerings.

Customers' sensitivity to price significantly shapes their bargaining power within the pool industry. When the overall cost of owning and maintaining a pool becomes a larger portion of a household's budget, customers are naturally more inclined to seek out lower prices for products and services.

During periods of economic uncertainty, such as a potential recession in 2024, discretionary spending on non-essential items like pool upgrades or new equipment tends to decline. This economic pressure forces consumers to become more price-conscious, increasing their leverage when negotiating with pool service providers and retailers.

For instance, if a significant portion of a customer's disposable income is allocated to pool upkeep, they may delay or forgo expensive renovations, opting instead for essential maintenance or seeking more competitive pricing for chemicals and repairs. This heightened price sensitivity empowers them to demand better deals.

Customer Information and Transparency

When customers can easily access and compare pricing, features, and quality across various brands, their ability to negotiate and influence suppliers significantly increases. This transparency is amplified by online platforms and review sites, empowering consumers to make well-informed purchasing decisions.

In 2024, for instance, the automotive sector saw customers leveraging online configurators and third-party reviews to compare models, driving price competition among dealerships. This ease of access to information directly translates into stronger customer bargaining power.

- Informed Purchasing: Customers can readily access product specifications, user reviews, and price comparisons online, reducing information asymmetry.

- Price Sensitivity: Increased transparency often leads to higher price sensitivity among buyers, as they can easily identify cheaper alternatives.

- Brand Switching: Easy access to information facilitates brand switching, forcing companies to compete more aggressively on value and price.

- Online Reviews Impact: Platforms like Trustpilot and Google Reviews provide a public forum for customer feedback, directly influencing purchasing decisions and supplier relationships.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for individual homeowners, can be a significant factor for larger entities. For instance, major commercial pool operators or substantial pool construction firms might consider manufacturing certain basic pool equipment in-house if the economics align, thereby enhancing their leverage.

This potential for backward integration directly impacts Hayward's pricing power and profit margins. If large buyers can credibly threaten to produce their own components, they gain a stronger negotiating position. For example, in 2024, the global pool equipment market saw increased consolidation, potentially empowering larger buyers to explore such strategies if cost savings are substantial enough.

- Backward Integration Threat: While infrequent for individual consumers, large commercial pool operators and significant construction companies possess the potential to manufacture basic pool equipment internally if cost-effective.

- Impact on Hayward: This capability strengthens the bargaining power of these larger customers, potentially leading to price concessions or demands for customized solutions.

- Market Dynamics: The 2024 market landscape, characterized by some consolidation, could make backward integration a more viable option for major buyers seeking to optimize costs.

The bargaining power of Hayward's customers is shaped by several factors, including the fragmentation of the buyer group, the availability of substitutes, and customer price sensitivity. While individual homeowners have minimal leverage, large commercial clients can negotiate better terms due to their significant purchase volumes.

In 2024, the pool equipment market offers numerous alternatives, empowering customers to switch brands if Hayward's pricing or product features are not competitive. This ease of comparison, amplified by online information, forces Hayward to focus on value and price to retain its customer base.

Economic conditions, like potential slowdowns in 2024, increase customer price sensitivity. When pool maintenance becomes a larger budget item, customers are more inclined to seek discounts, further strengthening their negotiating position and limiting Hayward's pricing flexibility.

The threat of backward integration, though low for individuals, can impact Hayward's large commercial clients. If these larger entities find it economically viable to produce certain components in-house, they gain significant leverage over Hayward, potentially influencing pricing and product development strategies.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Buyer Concentration | Low for individuals, High for large commercial clients | Millions of homeowners vs. large distributors |

| Availability of Substitutes | High | Numerous competing brands like Pentair, Jandy |

| Customer Price Sensitivity | Moderate to High, increasing with economic pressure | Discretionary spending, potential economic slowdowns |

| Switching Costs | Generally Low | Ease of comparison and brand switching |

| Threat of Backward Integration | Low for individuals, potential for large commercial clients | Consolidation in 2024 could enable larger buyers |

Preview the Actual Deliverable

Hayward Porter's Five Forces Analysis

This preview showcases the comprehensive Hayward Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the Hayward industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability. You can confidently proceed with your purchase, knowing you are acquiring the complete and accurate competitive intelligence you need.

Rivalry Among Competitors

The pool equipment market is characterized by a mix of large, established corporations and smaller, specialized manufacturers. This creates a dynamic competitive landscape where Hayward Porter must navigate a variety of rivals.

Key competitors such as Pentair and Latham Pool Products are significant players, each with their own strengths and market share. Pentair, for example, is a diversified industrial company with a substantial presence in the pool and spa sector, known for its broad product portfolio. Latham Pool Products focuses on inground vinyl liner pools and components, offering a different but equally competitive specialization.

The existence of multiple strong competitors directly intensifies the rivalry within the industry. This means Hayward Porter faces constant pressure on pricing, innovation, and market penetration. For instance, in 2023, the global pool and spa market was valued at approximately $10.5 billion, with significant revenue generated by these major players, indicating fierce competition for market share.

The overall growth rate of the pool equipment market significantly shapes competitive rivalry. While the market is experiencing positive trends, driven by the enduring appeal of outdoor living and the increasing adoption of smart technology, a slower growth trajectory can intensify the battle for market share among existing players.

For instance, in 2024, the global swimming pool market was projected to grow at a compound annual growth rate (CAGR) of around 4.5% to 5.5% according to various industry reports. This steady, albeit not explosive, growth means companies must work harder to capture new customers and retain existing ones, leading to more aggressive pricing strategies and marketing efforts.

Hayward's strategic emphasis on developing innovative, energy-efficient, and user-friendly pool and spa equipment directly targets product differentiation. This approach aims to create a unique value proposition that sets its offerings apart from competitors.

The intensity of competitive rivalry is significantly influenced by how effectively Hayward's rivals can replicate its differentiated features or introduce their own unique innovations. For instance, if competitors quickly adopt similar smart control systems or energy-saving technologies, the perceived differentiation diminishes, intensifying rivalry.

In 2024, the pool and spa industry saw continued investment in smart technology, with companies like Pentair and Jandy also highlighting advanced features in their product lines. Hayward's ability to maintain a lead in patent filings for new energy-saving technologies, such as variable-speed pumps, is crucial to sustaining its differentiated position and mitigating intense rivalry.

Switching Costs for Customers

When customers can easily switch between pool equipment brands without significant hassle or expense, the competitive rivalry intensifies. This means Hayward must consistently offer compelling value and exceptional customer support to keep its existing clientele. For instance, if a customer can switch from a Hayward pump to a competitor's pump for minimal cost, Hayward's market position becomes more vulnerable.

Low switching costs compel companies like Hayward to focus heavily on product differentiation, brand loyalty, and ongoing innovation. They must work harder to earn and maintain customer preference. In 2024, the pool equipment market saw several new entrants offering feature-rich pumps at competitive price points, directly challenging established players by minimizing perceived switching barriers.

- Low switching costs encourage customers to explore alternatives readily.

- Hayward must prioritize innovation and superior service to combat easy customer transitions.

- The ease of switching directly correlates with the intensity of competitive rivalry in the pool equipment sector.

Exit Barriers

High exit barriers can significantly intensify competitive rivalry. When it's difficult or costly for companies to leave a market, even those performing poorly may remain, continuing to compete fiercely. This often stems from investments in specialized assets or commitments through long-term contracts.

For instance, in the airline industry, the substantial investment in aircraft and the complexity of maintenance contracts create high exit barriers. As of early 2024, major airlines were still navigating post-pandemic recovery, and the inability to easily divest these assets meant that even carriers facing financial strain were compelled to maintain operations, contributing to ongoing price wars and a crowded competitive landscape.

These persistent competitors, unable to exit gracefully, often resort to aggressive pricing strategies to maintain market share, even at reduced profitability. This dynamic prevents market consolidation and the natural easing of competitive pressures that might otherwise occur if struggling firms could exit more readily.

- Specialized Assets: Companies with highly specific machinery or technology may find it impossible to redeploy or sell these assets elsewhere, trapping them in the industry.

- Long-Term Contracts: Commitments to suppliers, customers, or labor can bind companies to operations even when unprofitable.

- Emotional and Managerial Attachment: Founders or long-standing management teams may resist exiting a business they have built.

- Government or Social Pressures: In some industries, like manufacturing or mining, there can be pressure to maintain employment levels, discouraging closure.

Competitive rivalry in the pool equipment market is robust, driven by the presence of established giants like Pentair and specialized firms such as Latham Pool Products. This intense competition forces companies to constantly innovate and manage pricing effectively to capture market share. For example, the global pool and spa market, valued at approximately $10.5 billion in 2023, demonstrates the significant revenue stakes involved.

The industry's steady growth, projected at a 4.5% to 5.5% CAGR for 2024, means that while opportunities exist, gaining an edge requires continuous effort in product differentiation and customer retention. Hayward's focus on energy efficiency and smart technology, exemplified by advancements in variable-speed pumps, is a direct response to rivals also investing heavily in similar innovations, as seen with competitors like Jandy in 2024.

Low switching costs for consumers further amplify rivalry, compelling Hayward to prioritize exceptional value and service to foster brand loyalty. The emergence of new, cost-effective competitors in 2024, offering comparable features, directly challenges established players by lowering perceived barriers to customer migration.

High exit barriers, such as investments in specialized manufacturing equipment, can also intensify rivalry by keeping less profitable firms in the market, leading to sustained price competition. This situation is common in industries where divesting assets is difficult, as observed in sectors like airlines in early 2024, where significant capital tied up in aircraft compelled continued operations despite financial pressures.

SSubstitutes Threaten

The threat of substitutes for Hayward's pool maintenance equipment is present, as consumers can opt for alternative methods to keep their pools clean. This includes using different types of pool chemicals, manual cleaning tools, or even considering alternative pool designs that might require less sophisticated filtration and sanitation systems. For instance, some consumers might explore salt water chlorination systems which, while still requiring equipment, offer a different approach to sanitation compared to traditional chlorine. In 2024, the market for pool chemicals alone was valued at approximately $2.5 billion globally, indicating a significant segment of the market that could potentially adopt non-Hayward chemical solutions.

The threat of substitutes for swimming pools is significant, encompassing a wide array of alternative leisure and home improvement expenditures. Consumers might opt for enhancing their outdoor living spaces with features like elaborate patios, outdoor kitchens, or fire pits, which offer a different kind of home-based enjoyment. In 2024, spending on home renovations, particularly for outdoor living areas, continued to see robust growth as homeowners prioritized creating functional and appealing spaces for relaxation and entertainment.

Furthermore, the travel and tourism industry presents a strong substitute. Vacations, whether domestic or international, offer a complete escape and a variety of experiences that a pool cannot replicate. Data from the U.S. Travel Association indicated a strong rebound in travel spending throughout 2024, suggesting consumers are willing to allocate substantial budgets to away-from-home leisure activities.

Other forms of recreation, such as joining a local country club with pool access, participating in community sports leagues, or investing in other hobbies like boating or even home theater systems, also divert potential spending from pool ownership. These alternatives cater to different lifestyle preferences and can often provide a broader range of activities or social engagement.

The cost-effectiveness of substitute solutions significantly impacts their threat level. If alternative pool designs emerge that require less specialized equipment or offer lower ongoing maintenance costs, they could divert consumer spending away from traditional pool equipment manufacturers like Hayward. For example, a shift towards natural swimming pools or low-maintenance water features could reduce the overall market for pumps, filters, and heaters.

Performance and Convenience of Substitutes

The effectiveness and ease of use of substitutes are crucial in assessing their threat to Hayward's pool equipment business. If alternative methods or technologies emerge that offer comparable or superior pool performance and convenience with less reliance on traditional equipment, the threat increases.

For instance, the rise of smart pool systems that automate cleaning, heating, and chemical balancing can be seen as a substitute for traditional, manually operated Hayward equipment. These systems can offer enhanced convenience and potentially better performance through precise control. In 2024, the global smart pool market was valued at approximately $2.5 billion, with projections indicating continued growth, suggesting a tangible shift towards more integrated and automated pool management solutions.

- Smart Pool Systems: Offer automated control over pool functions, reducing manual intervention and potentially improving efficiency.

- Energy-Efficient Alternatives: Newer, more energy-efficient pumps and heaters may present a cost-saving substitute over the long term, even if initial investment is higher.

- DIY Pool Maintenance Solutions: While not a direct equipment substitute, innovative chemical or cleaning solutions that simplify maintenance could reduce the need for certain Hayward products.

- Integrated Backyard Living: The increasing trend of creating self-sufficient, low-maintenance backyard environments may lead consumers to opt for pool systems that require less ongoing equipment management.

Customer Perception and Trends

Customer perception is a key driver in the threat of substitutes for pool equipment. As consumer preferences evolve, there's a growing interest in simpler, lower-maintenance aquatic solutions. This shift could lead individuals to opt for alternatives that require less upkeep than traditional swimming pools, impacting demand for Hayward's offerings.

Emerging trends further amplify this threat. For instance, the rise of compact and plunge pools, while still utilizing pool equipment, represents a potential diversion of consumer interest. These smaller, more manageable aquatic features might draw demand away from larger, more complex pool systems, presenting a challenge to Hayward's established product lines.

- Shifting Preferences: Consumers are increasingly valuing convenience and ease of maintenance in their leisure activities.

- Alternative Aquatic Solutions: The market is seeing a rise in demand for features like plunge pools and swim spas, which offer aquatic enjoyment with a smaller footprint and potentially less complex maintenance.

- Recreational Diversification: Spending on other recreational activities, such as home gyms or outdoor living spaces, can also divert consumer budgets away from pool ownership and related equipment.

- Market Data Insight: While specific data on pool equipment substitution is nascent, the broader home improvement market in 2024 shows a continued strong interest in outdoor living, with segments like hot tubs and saunas experiencing significant growth, indicating a willingness to invest in alternative relaxation and recreational features.

The threat of substitutes for Hayward's pool maintenance equipment is substantial, as consumers have numerous alternatives for leisure and home upkeep. These range from different pool sanitation methods, like salt chlorinators, to entirely different backyard features such as patios or fire pits, and even away-from-home recreation like travel. In 2024, the global market for pool chemicals alone was valued at approximately $2.5 billion, highlighting a significant area where non-Hayward solutions are already prevalent.

The rise of smart pool systems, which automate maintenance and offer enhanced control, represents a key technological substitute. These systems, with the global market valued at around $2.5 billion in 2024 and showing continued growth, directly compete with traditional, manually operated equipment. Furthermore, evolving consumer preferences lean towards simpler, lower-maintenance aquatic solutions, potentially favoring compact pools or swim spas over more complex traditional setups.

| Substitute Category | Description | 2024 Market Relevance (Illustrative) | Potential Impact on Hayward |

| Alternative Pool Technologies | Saltwater chlorinators, natural swimming pools | Significant portion of the $2.5 billion global pool chemicals market | Reduces demand for traditional chlorine-based Hayward equipment. |

| Smart Pool Systems | Automated cleaning, heating, and chemical balancing | Global market valued at approx. $2.5 billion | Directly competes with Hayward's integrated equipment solutions. |

| Outdoor Living Enhancements | Patios, kitchens, fire pits | Robust growth in home renovation spending | Diverts consumer budgets from pool installation and maintenance. |

| Recreational Alternatives | Travel, country clubs, other hobbies | Strong rebound in travel spending in 2024 | Competes for discretionary spending allocated to leisure. |

Entrants Threaten

The pool equipment manufacturing sector demands substantial upfront capital. For instance, setting up a modern manufacturing plant with advanced robotics and quality control systems in 2024 could easily cost tens of millions of dollars. This includes significant investment in research and development for innovative products, establishing robust distribution channels, and the extensive marketing required to build brand recognition in a competitive market.

Hayward's strong brand loyalty, cultivated over years of consistent product quality and customer service, presents a significant barrier to new entrants. This loyalty is evident in their repeat purchase rates, which in 2024 remained robust, indicating a deep-seated trust in the Hayward name. Newcomers would face the considerable challenge of not only matching Hayward's product offerings but also replicating the emotional connection and established trust that existing customers have with the brand.

Hayward's commitment to developing innovative, energy-efficient, and smart pool equipment, such as their OmniLogic control system, is protected by a robust portfolio of proprietary technology and patents. These intellectual property rights create significant barriers to entry, as potential competitors would need to invest heavily in research and development to create comparable, non-infringing products. For instance, patent protection on key components or software algorithms can prevent rivals from easily replicating Hayward's technological advantages.

Access to Distribution Channels

New companies entering the pool and spa industry face considerable hurdles in securing access to established distribution channels. Hayward, as a leading player, has cultivated deep relationships with pool professionals, specialty retailers, and prominent online marketplaces. These extensive networks are not easily replicated by newcomers, creating a significant barrier to entry. For instance, in 2024, the pool and spa industry continued to see a strong reliance on specialized distributors and retail partnerships, with many independent pool builders and service companies preferring to stock and recommend products from established, trusted brands like Hayward.

The difficulty in accessing these critical distribution channels means that new entrants may struggle to get their products in front of potential customers. Hayward's established presence, built over years of consistent product quality and customer service, translates into preferred placement and stronger sales support within these channels. This advantage is particularly pronounced in a market where consumer trust and professional recommendations heavily influence purchasing decisions. In 2023 and continuing into 2024, Hayward's market share in key equipment categories like pumps and filters remained robust, underscoring the effectiveness of its distribution strategy.

- Distribution Channel Access: New entrants struggle to gain traction with established pool professionals, retailers, and online platforms.

- Hayward's Advantage: Hayward possesses extensive, hard-to-replicate relationships within the industry's distribution network.

- Market Reliance: The pool and spa market in 2024 still heavily depends on specialized distributors and trusted retail partnerships.

- Sales Support: Established brands like Hayward benefit from preferred placement and stronger sales support due to their distribution strength.

Regulatory Requirements and Standards

The pool equipment industry faces a significant threat from new entrants due to stringent regulatory requirements and evolving safety standards. For instance, in the United States, the Consumer Product Safety Commission (CPSC) sets safety standards for pool and spa equipment, which new manufacturers must adhere to. Failing to meet these benchmarks, such as those related to electrical safety or entrapment prevention, can prevent market entry or lead to costly recalls.

Navigating these complexities poses a substantial barrier, especially for companies introducing specialized or advanced pool technologies. Obtaining certifications like UL (Underwriters Laboratories) or ETL (Intertek) is often mandatory, requiring significant investment in testing and compliance. In 2024, the cost of obtaining such certifications can range from thousands to tens of thousands of dollars, depending on the product's complexity and the number of tests required, effectively deterring smaller or less capitalized new entrants.

- Regulatory Hurdles: Compliance with CPSC, UL, and ETL standards is essential for market access in the US.

- Certification Costs: Obtaining necessary certifications in 2024 can cost new entrants upwards of $10,000-$50,000.

- Technological Barriers: Specialized or advanced equipment may require additional, more complex certifications, increasing the entry barrier.

The threat of new entrants into the pool equipment manufacturing sector is moderately low. Significant capital investment is required for setting up manufacturing facilities and R&D, potentially costing tens of millions of dollars in 2024. Furthermore, established brands like Hayward benefit from strong customer loyalty and proprietary technology protected by patents, creating substantial barriers for newcomers.

Access to established distribution channels is another key deterrent. Hayward's deep relationships with pool professionals and retailers are difficult for new companies to replicate. In 2024, the industry's reliance on these specialized networks means new entrants face challenges in getting their products to market effectively.

Stringent regulatory requirements and the need for certifications like UL or ETL also add to the entry barrier. These compliance costs can range from thousands to tens of thousands of dollars in 2024, deterring less capitalized new entrants.

| Barrier to Entry | Estimated Cost/Impact (2024) | Hayward's Position |

|---|---|---|

| Capital Investment (Manufacturing & R&D) | Tens of Millions of Dollars | Established Infrastructure |

| Brand Loyalty & Trust | High (Repeat Purchase Rates) | Deep Customer Relationships |

| Intellectual Property & Patents | Significant R&D Investment Required | Robust Patent Portfolio |

| Distribution Channel Access | Difficult to Replicate Established Networks | Extensive Industry Relationships |

| Regulatory Compliance & Certifications | $10,000 - $50,000+ per Product Line | Proven Compliance Processes |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of industry-specific data, including market research reports from leading firms, financial statements from key players, and publicly available competitor intelligence to accurately assess competitive dynamics.