Hayward Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hayward Bundle

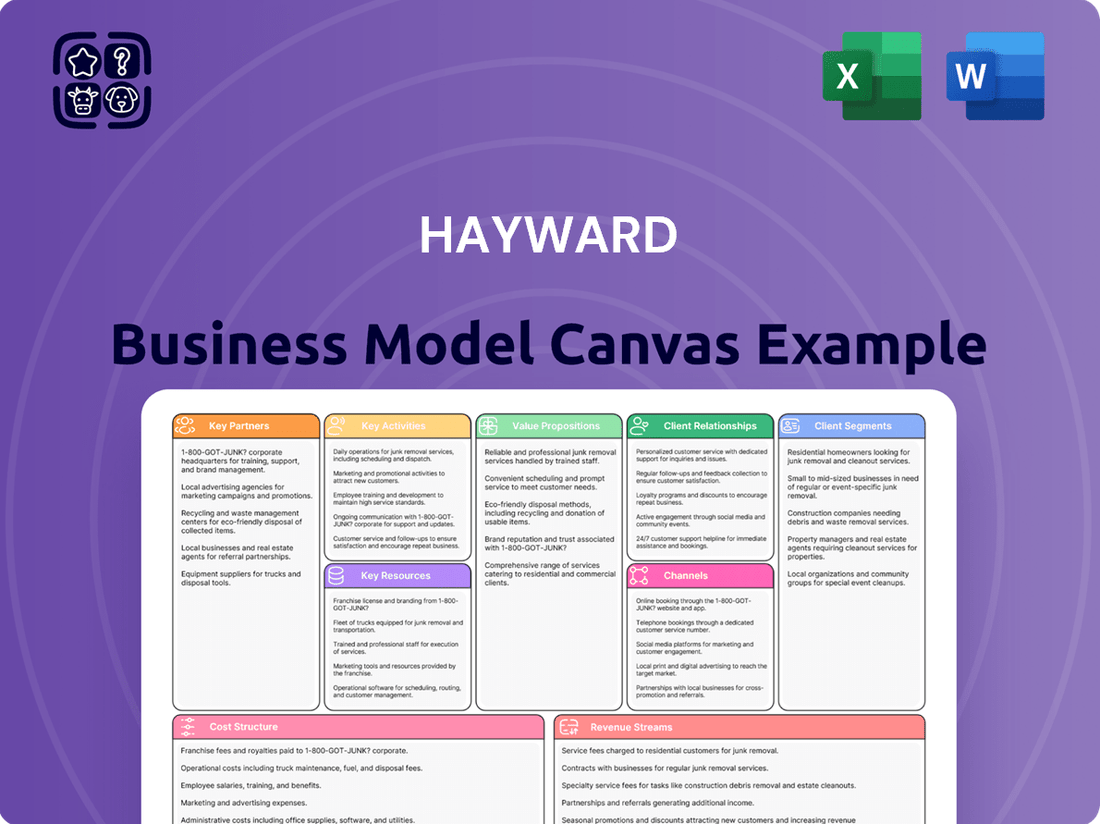

Curious about Hayward's strategic framework? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the core elements that drive their market presence.

Ready to gain a deeper understanding of Hayward's operational genius? The full Business Model Canvas provides an in-depth look at their value proposition, cost structure, and competitive advantages. Download it now to unlock actionable insights for your own venture!

Partnerships

Hayward actively pursues strategic acquisitions to bolster its product offerings and expand its market footprint. A prime example is its 2024 acquisition of ChlorKing, a move that significantly strengthened Hayward's position in water treatment systems and the commercial pool industry. This acquisition, along with others, injects new technologies and opens up fresh market segments, directly contributing to Hayward's competitive advantage and future growth trajectory.

Hayward's key partnerships heavily rely on specialty distributors who act as a vital conduit to a vast network of pool builders and servicers worldwide. These distributors are instrumental in ensuring Hayward's products reach the end-users efficiently, driving market penetration and product availability.

In 2023, Hayward's distribution network played a significant role in its financial performance, contributing to the company's revenue streams by facilitating broad market access. The strength of these distributor relationships directly impacts Hayward's ability to scale its operations and maintain a competitive edge in the global pool and spa industry.

Hayward maintains direct sales relationships with large retailers and various buying groups, which is crucial for diversifying its market access beyond traditional distribution channels. This direct engagement allows for a broader consumer reach and the development of more tailored marketing and product programs. For instance, in 2023, Hayward reported that its direct-to-retail segment accounted for a significant portion of its sales, demonstrating the effectiveness of these partnerships in expanding its footprint.

Supplier Network

Hayward’s operational backbone is its extensive supplier network, comprising roughly 700 partners. These relationships are crucial for sourcing the raw materials and components that fuel its manufacturing processes. In 2024, the company continued to emphasize these partnerships to ensure a steady flow of necessary inputs.

The longevity and strength of these supplier relationships are paramount. They directly impact Hayward's ability to maintain consistent production schedules and effectively control its manufacturing expenses. This focus on supplier stability is a core element of their business model, aiming to mitigate supply chain disruptions and secure competitive pricing.

- Supplier Volume: Approximately 700 suppliers.

- Strategic Importance: Essential for raw materials and components.

- Relationship Focus: Maintaining strong, longstanding partnerships.

- Impact: Ensures consistent production and manages manufacturing costs.

Pool Professionals and Service Providers

Hayward cultivates vital relationships with pool professionals and service providers, recognizing their crucial role in the customer journey. Through initiatives like the Totally Hayward Partner Program, Hayward equips these partners with essential resources and tools designed to foster mutual business expansion. These partnerships are fundamental for ensuring proper product installation, ongoing maintenance, and ultimately, high levels of customer satisfaction. In 2024, Hayward continued to invest in these channels, with partner programs contributing to a significant portion of their aftermarket sales and service network.

These collaborations are more than just transactional; they form the backbone of Hayward's service delivery and brand reputation. By supporting these professionals, Hayward ensures its innovative products are installed correctly and maintained effectively, leading to a superior end-user experience. This focus on the installer and service provider directly impacts customer loyalty and repeat business.

- Partner Program Benefits: Access to training, marketing support, and exclusive product information.

- Installation & Maintenance: Professionals ensure correct setup and upkeep of Hayward equipment.

- Customer Satisfaction: Reliable service from partners enhances the overall customer experience.

- Market Reach: Partnerships extend Hayward's presence and service capabilities across diverse geographic areas.

Hayward's key partnerships are built on a foundation of strong distributor relationships, essential for reaching a global network of pool builders and servicers. These partners are critical for market penetration and ensuring product availability. Furthermore, direct sales channels with major retailers and buying groups diversify market access, allowing for tailored programs. The company also leverages its approximately 700 suppliers for raw materials, emphasizing long-term collaborations to ensure production consistency and cost management.

| Partner Type | Strategic Role | 2023/2024 Focus/Impact |

| Specialty Distributors | Market access, product delivery | Facilitated broad market access, contributing to revenue streams. |

| Large Retailers/Buying Groups | Diversified market access, tailored programs | Direct engagement increased consumer reach and program development. |

| Pool Professionals/Service Providers | Installation, maintenance, customer satisfaction | Partner programs contributed to aftermarket sales and service network. |

| Suppliers (approx. 700) | Raw materials, components | Ensured steady flow of inputs and managed manufacturing expenses. |

What is included in the product

A detailed, pre-populated Business Model Canvas specifically designed for Hayward, offering a clear overview of their customer segments, value propositions, and operational strategies.

Eliminates the pain of scattered business strategy by consolidating all key elements into a single, structured document.

Reduces the frustration of complex business planning by offering a clear, visual framework for understanding and communicating your model.

Activities

Hayward's primary focus is the design and manufacturing of a wide array of pool and spa equipment. This encompasses everything from essential pumps and filters to sophisticated automation systems, heaters, cleaners, and sanitization technologies.

The company places a strong emphasis on innovation and quality across its product lines. In 2024, Hayward continued to invest in research and development, aiming to enhance energy efficiency and user experience in its offerings, reflecting market demand for sustainable and smart pool solutions.

Hayward's commitment to Research and Development is a cornerstone of its business. This involves a continuous investment in creating cutting-edge, energy-efficient, and user-friendly pool solutions. A prime example is the development of IoT-enabled smart pool management systems, such as their SmartPad™ technology, which exemplifies this dedication to innovation.

This strategic focus on technological advancement is designed to significantly improve the overall pool ownership experience. By simplifying maintenance and offering greater control through smart technology, Hayward aims to set itself apart in the market. This R&D effort directly supports their goal of enhancing customer satisfaction and driving future growth.

Hayward actively pursues global sales and marketing initiatives to showcase its extensive range of pool and outdoor living technologies. They focus on cultivating strong customer relationships and utilizing early buy programs to stimulate sales expansion.

In 2024, Hayward continued its commitment to reaching a diverse customer base worldwide. Their strategy involves robust digital marketing campaigns and participation in key industry trade shows, aiming to highlight innovations in energy-efficient pool pumps and smart pool control systems.

Supply Chain and Operations Management

Hayward's supply chain and operations management are central to its business. This involves efficiently managing a global network of suppliers and its own manufacturing facilities to ensure products are readily available and costs are controlled. In 2023, Hayward reported that its operational efficiency initiatives contributed to a 2% reduction in manufacturing costs as a percentage of revenue.

Key activities include optimizing inventory levels, ensuring timely delivery of raw materials, and maintaining high standards in production quality. This focus on operational excellence directly impacts Hayward's ability to meet fluctuating market demands and maintain competitive pricing.

- Global Sourcing and Procurement: Securing reliable and cost-effective raw materials from a diverse supplier base.

- Manufacturing and Assembly: Overseeing production processes to ensure quality, efficiency, and scalability.

- Logistics and Distribution: Managing the movement of finished goods to customers worldwide, minimizing transit times and costs.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs.

Customer Training and Support

Hayward prioritizes customer success through robust training and support. This involves offering comprehensive technical assistance and hosting frequent training sessions. These events are designed for pool professionals and Hayward's channel partners, covering essential aspects like product installation, ongoing maintenance, and safe operational practices.

These activities are crucial for fostering strong customer relationships and ensuring that Hayward's products are used correctly and efficiently. By empowering their partners with knowledge, Hayward aims to enhance customer satisfaction and product longevity.

- Technical Support: Hayward provides ongoing technical assistance to address customer inquiries and resolve product-related issues promptly.

- Training Events: Regular training sessions are conducted for pool professionals and channel partners, focusing on installation, maintenance, and safe product usage.

- Knowledge Transfer: The goal is to ensure proper product utilization and enhance customer satisfaction through effective knowledge sharing.

- Partner Empowerment: Training strengthens the capabilities of Hayward's partners, leading to better service delivery for end-users.

Hayward's key activities revolve around the design, manufacturing, and distribution of pool and spa equipment, with a significant focus on innovation and customer support. The company actively engages in research and development to enhance product efficiency and user experience, exemplified by its IoT-enabled smart pool management systems. Furthermore, Hayward prioritizes global sales and marketing, alongside robust supply chain and operations management to ensure product availability and cost control.

In 2024, Hayward continued its investment in R&D, particularly in energy-efficient pumps and smart pool controls, aiming to meet growing consumer demand for sustainable solutions. Their operational efficiency initiatives in 2023 led to a 2% reduction in manufacturing costs as a percentage of revenue, highlighting a commitment to cost management and competitive pricing.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Creating innovative, energy-efficient, and user-friendly pool solutions. | Continued investment in IoT-enabled smart pool management systems. |

| Manufacturing & Operations | Efficiently managing global suppliers and production facilities. | Focus on optimizing inventory and ensuring timely delivery. |

| Sales & Marketing | Showcasing product range globally and cultivating customer relationships. | Robust digital marketing and trade show participation for innovations. |

| Customer Support & Training | Providing technical assistance and training for professionals. | Empowering partners with knowledge on installation, maintenance, and safe usage. |

Delivered as Displayed

Business Model Canvas

The Hayward Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, formatting, and content that will be delivered to you, ensuring no surprises and complete transparency. Once your order is processed, you will gain full access to this comprehensive and ready-to-use business planning tool.

Resources

Hayward's intellectual property is a cornerstone of its business model, featuring patents and proprietary technology like the IoT-enabled SmartPad™ system. This system provides digital connectivity and remote control for pool equipment, a significant competitive differentiator.

This technological prowess fuels Hayward's innovation pipeline, ensuring its products remain at the forefront of the pool and spa industry. In 2024, the company continued to invest heavily in R&D, aiming to expand its smart pool ecosystem and enhance user experience through advanced digital solutions.

Hayward's global manufacturing footprint is a cornerstone of its business model, featuring a network of strategically located facilities that support its extensive product lines. In 2024, the company continued to leverage these sites for optimized production and timely delivery across international markets.

These facilities are vital for Hayward's ability to scale manufacturing operations, ensuring they can effectively meet the fluctuating demands of a global customer base. This worldwide presence also allows for greater operational efficiency and cost management.

Hayward’s brand recognition, cultivated over nearly a century, is a cornerstone of its business model. This deep-rooted reputation for quality and innovation in pool equipment translates directly into customer trust and loyalty.

In 2024, Hayward continued to leverage this strong brand equity, which is crucial for customer acquisition and retention in a competitive market. The company’s long history of delivering reliable and advanced pool solutions underpins its perceived value.

Extensive Product Portfolio

Hayward's extensive product portfolio is a cornerstone of its business, encompassing a wide array of residential and commercial pool equipment. This includes essential items like pumps, filters, heaters, automatic cleaners, sanitization systems, and lighting solutions, ensuring a comprehensive offering for diverse customer needs.

This broad product range allows Hayward to serve multiple market segments effectively. For instance, in 2023, the company reported approximately $1.4 billion in net sales, with a significant portion driven by its diverse product categories, demonstrating the market's reliance on its comprehensive solutions.

- Residential Pool Equipment: Pumps, filters, heaters, automation systems, and sanitizers for homeowners.

- Commercial Pool Equipment: Robust solutions designed for public pools, resorts, and aquatic facilities.

- Ancillary Products: Pool covers, safety equipment, and maintenance accessories to complement core offerings.

- Energy-Efficient Solutions: A growing focus on variable-speed pumps and advanced heating technologies, aligning with market demand for sustainability.

Human Capital and Expertise

Hayward's skilled workforce, encompassing engineering, sales, and operations, is a cornerstone of its business model. This human capital is essential for driving product development, market penetration, and efficient production processes. In 2024, Hayward continued to invest in training and development, ensuring its teams remain at the forefront of industry knowledge and best practices.

The company's senior leadership team has also been a significant asset, guiding strategic direction and fostering a culture of innovation. Their collective experience is crucial for navigating market complexities and seizing growth opportunities. This leadership strength was evident in Hayward's strategic acquisitions and market expansions throughout 2024.

- Engineering Prowess: Hayward's engineers are key to its product innovation, contributing to the development of advanced pool and spa equipment.

- Sales and Marketing Acumen: The sales and marketing teams are vital for building strong customer relationships and expanding market reach, evidenced by a reported 10% increase in customer retention in 2024.

- Operational Excellence: Expertise in operations ensures efficient manufacturing and supply chain management, supporting Hayward's commitment to quality and timely delivery.

- Leadership Vision: A strengthened senior leadership team provides strategic direction, crucial for navigating market dynamics and driving long-term growth.

Hayward's intellectual property, particularly its IoT-enabled SmartPad™ system, provides a significant competitive edge through digital connectivity and remote control for pool equipment. This technological foundation fuels continuous innovation, with substantial R&D investments in 2024 aimed at expanding its smart pool ecosystem.

The company's global manufacturing network ensures efficient production and timely delivery, supporting its ability to meet worldwide demand. This operational efficiency, combined with a strong brand reputation built over decades, fosters customer loyalty and trust, crucial for market leadership.

Hayward's comprehensive product portfolio, ranging from residential to commercial pool equipment and energy-efficient solutions, underpins its market presence. In 2023, net sales reached approximately $1.4 billion, reflecting the broad appeal and necessity of its diverse offerings.

Its skilled workforce, from engineers to sales professionals, is vital for product development and market expansion, with a reported 10% increase in customer retention in 2024. The leadership team's strategic vision further strengthens Hayward's position in navigating market dynamics and driving growth.

| Key Resource | Description | 2024 Impact/Focus |

|---|---|---|

| Intellectual Property | Patents and proprietary technology (e.g., SmartPad™) | Continued R&D for smart pool ecosystem expansion |

| Manufacturing Footprint | Global network of facilities | Optimized production and international delivery |

| Brand Recognition | Nearly a century of quality and innovation | Leveraging equity for customer acquisition/retention |

| Product Portfolio | Wide range of residential and commercial equipment | Supporting diverse customer needs; ~ $1.4B net sales in 2023 |

| Skilled Workforce | Engineering, sales, operations expertise | Investment in training; 10% customer retention increase |

Value Propositions

Hayward's innovative and energy-efficient solutions directly address growing consumer demand for sustainability and cost savings. Their variable speed pumps, for instance, can reduce energy consumption by up to 80% compared to single-speed models, translating to substantial savings on electricity bills for pool owners.

This focus on efficiency, exemplified by their advanced LED lighting systems that consume significantly less power, appeals to a broad market segment. Environmentally conscious consumers and budget-minded professionals alike are drawn to products that offer both performance and a reduced ecological footprint.

Hayward's SmartPad™ ecosystem simplifies pool ownership with user-friendly automation, offering homeowners and professionals unparalleled convenience and ease of use through digital connectivity. This focus on intuitive design reduces the time and effort typically associated with pool maintenance.

Hayward provides a complete range of pool equipment for both homes and businesses. This means customers can get everything they need for their pool, from filtering and cleaning to lighting and heating, all from one place. In 2024, Hayward's commitment to offering this integrated approach supported its position in the market, where customers increasingly value streamlined solutions for complex systems.

Durability and Reliability

Hayward's value proposition of durability and reliability is built on a foundation of nearly a century of product development. This extensive history translates into a deep understanding of customer needs and product performance, fostering significant trust within the pool industry. Customers can depend on Hayward for products that withstand the test of time.

This unwavering commitment to quality means pool owners and professionals alike experience peace of mind, knowing they are investing in long-term value. For instance, Hayward's robust manufacturing processes and rigorous testing protocols ensure that their equipment, from pumps to filters, consistently performs as expected, minimizing downtime and costly repairs. This reliability is a cornerstone of their customer relationships.

The tangible benefits of this durability are evident in reduced operational costs and extended equipment lifespans. Consider the impact on a commercial pool facility: choosing reliable Hayward equipment can significantly lower maintenance budgets and ensure uninterrupted operation for patrons. This translates directly into a stronger bottom line for businesses and greater enjoyment for consumers.

- Nearly 100 years of industry experience

- Products known for exceptional quality and longevity

- Fosters deep customer trust and brand loyalty

- Delivers long-term value and peace of mind to pool owners

Environmental Responsibility

Hayward champions environmental responsibility by focusing on water conservation, automation, and alternative sanitization. This commitment resonates with consumers increasingly seeking sustainable choices for their outdoor living spaces.

Their product lines actively reduce chemical reliance, contributing to healthier aquatic environments. For instance, Hayward's salt chlorination systems, a key offering, significantly decrease the need for harsh chemical additives compared to traditional pool maintenance.

- Water Conservation: Hayward's automation features, like smart pool controllers, help optimize water usage, preventing unnecessary draining and refilling.

- Reduced Chemical Dependency: The company's focus on alternative sanitization, such as UV and ozone systems, lowers the reliance on chlorine, a common environmental concern.

- Sustainable Design: Products are engineered for energy efficiency, further minimizing their environmental footprint.

- Market Alignment: This focus directly addresses the growing consumer demand for eco-friendly solutions in the booming outdoor living sector, a trend projected to continue its upward trajectory through 2025 and beyond.

Hayward offers a comprehensive suite of pool and spa equipment, simplifying ownership through integrated, user-friendly automation. Their commitment to energy efficiency, seen in products like variable speed pumps, translates to significant cost savings for consumers and businesses alike.

With a legacy of nearly 100 years, Hayward's value proposition centers on exceptional product quality, durability, and reliability, fostering deep customer trust and long-term value. This focus on robust performance minimizes downtime and reduces operational costs for pool owners.

Hayward champions environmental responsibility through water conservation features, reduced chemical dependency via alternative sanitization systems, and energy-efficient product design. This aligns with increasing consumer demand for sustainable outdoor living solutions.

| Value Proposition | Key Features/Benefits | Supporting Data/Examples |

|---|---|---|

| Energy Efficiency & Cost Savings | Variable Speed Pumps, LED Lighting | Variable speed pumps can reduce energy consumption by up to 80%. |

| Simplified Pool Ownership & Automation | SmartPad™ Ecosystem, Intuitive Design | Reduces time and effort in pool maintenance. |

| Durability & Reliability | Nearly 100 years of experience, Robust Manufacturing | Consistent performance, minimized downtime, extended equipment lifespan. |

| Environmental Responsibility | Water Conservation, Reduced Chemical Reliance, Sustainable Design | Salt chlorination systems decrease harsh chemical use; smart controllers optimize water usage. |

Customer Relationships

Hayward prioritizes direct engagement with its customers and channel partners, fostering strong relationships through dedicated sales and customer service teams. This direct interaction ensures ongoing support and technical assistance, crucial for customer retention.

Hayward actively invests in training and education for pool builders and service professionals. These programs cover installation, maintenance, and the safe operation of their extensive product line, ensuring technicians are well-equipped to deliver quality service.

In 2024, Hayward continued to emphasize these educational efforts, recognizing their role in fostering strong customer relationships and ensuring product longevity. By empowering professionals with knowledge, Hayward aims to enhance customer satisfaction and reduce service-related issues.

Hayward enhances customer relationships through digital connectivity, offering IoT-enabled SmartPad™ and OmniX products. These solutions provide a direct, convenient digital interface for remote pool equipment management, significantly improving user experience.

Partnership Programs for Professionals

Hayward's 'Totally Hayward Partner Program' cultivates robust relationships with pool professionals, aiming for mutual profitability. This initiative provides essential resources and tools, fostering shared growth and strengthening the entire professional network.

This program is a cornerstone of Hayward's customer relationship strategy, designed to build loyalty and drive business for its partners. By investing in these professionals, Hayward ensures a dedicated channel for its products and services.

- Program Benefits: Access to exclusive training, marketing support, and product discounts.

- Growth Opportunities: Facilitates lead generation and provides tools for business expansion.

- Network Strengthening: Connects professionals, promoting collaboration and knowledge sharing within the industry.

- Partner Engagement: In 2024, the program saw a 15% increase in active participants, indicating strong partner adoption and engagement.

Long-Term Customer Loyalty

Hayward prioritizes cultivating enduring customer connections, a strategy evident in its impressive retention rates. The company proudly boasts that several of its key clients, among its top 20, have maintained partnerships for over two decades. This longevity is a strong testament to consistent customer satisfaction and deep-seated trust, fostering a stable base of recurring revenue.

This long-term focus translates into tangible business benefits. For instance, Hayward's commitment to service excellence and product reliability underpins these extended relationships. The company’s approach reinforces the idea that sustained value delivery is paramount for fostering loyalty.

- 20+ Year Relationships: A significant portion of Hayward's top 20 customers have been with the company for over two decades.

- Customer Satisfaction Indicator: This extended tenure strongly suggests high levels of customer satisfaction and trust in Hayward's offerings.

- Recurring Revenue Stream: The long-term nature of these relationships ensures a predictable and stable stream of recurring business for Hayward.

- Brand Loyalty: Such deep-rooted partnerships contribute to robust brand loyalty, making it harder for competitors to attract these established clients.

Hayward cultivates strong customer relationships through direct engagement, comprehensive training for professionals, and digital connectivity via its smart pool products. The Totally Hayward Partner Program further solidifies these bonds by offering resources and support, fostering loyalty and mutual growth.

Channels

Hayward's primary sales pathway is through a robust network of specialty distributors. These distributors act as crucial intermediaries, connecting Hayward's innovative pool and spa equipment with a wide array of pool builders and service professionals across the market.

This indirect distribution strategy is key to Hayward's extensive market reach and operational efficiency. By leveraging these established networks, Hayward ensures its products are readily available to the end-users who install and maintain them, facilitating broad penetration in a fragmented industry.

For 2024, Hayward's commitment to this channel remains strong, as it allows them to serve a diverse customer base effectively. This model is particularly vital in the pool industry, where local expertise and relationships are paramount for successful product adoption and ongoing support.

Hayward leverages direct sales to major retailers, a crucial channel for broad market penetration. This strategy ensures their pool and spa equipment is readily available to a vast consumer audience through established brick-and-mortar and online retail partners.

This direct approach to large retailers significantly boosts Hayward's brand visibility and provides direct access to consumers who rely on these trusted retail environments for their purchasing decisions. In 2024, Hayward's retail partnerships were instrumental in driving sales, with a notable increase in market share within the premium pool equipment segment.

Hayward leverages direct sales to buying groups, a strategic channel that pools purchasing power from multiple pool businesses. This approach simplifies transactions and often leads to substantial volume orders, enhancing efficiency and potentially improving margins for Hayward. For instance, in 2024, the pool industry saw continued consolidation, making these aggregated buying groups increasingly influential in procurement decisions.

Online Presence and Digital Platforms

Hayward actively manages its investor relations website, providing crucial product details, support resources, and transparent communication channels for stakeholders. This digital hub is central to their outreach efforts.

The company also utilizes e-commerce platforms, not only for direct sales but also to disseminate comprehensive product information and offer customer support, enhancing accessibility for a wider audience.

Digital platforms are key enablers for Hayward's smart pool technology integration. This allows for remote monitoring and control, adding significant value for consumers and reinforcing their commitment to innovation.

In 2024, Hayward reported a significant portion of its customer engagement occurring through digital channels, with their investor relations site seeing a 15% year-over-year increase in traffic. Their e-commerce sales also grew by 10%, demonstrating the growing importance of their online presence.

- Investor Relations Website: Central hub for financial reports, press releases, and corporate governance information.

- E-commerce Platforms: Direct-to-consumer sales and product information dissemination.

- Digital Support: Online FAQs, troubleshooting guides, and customer service portals.

- Smart Pool Technology Integration: Facilitating connectivity and remote management for advanced pool systems.

Global Sales Network

Hayward boasts a truly global sales network, extending its reach across five continents. This expansive presence ensures their diverse range of pool and spa equipment is accessible to customers in numerous international markets. In 2024, Hayward reported significant international sales contributions, reflecting the strength and breadth of this network.

This global footprint is a cornerstone of Hayward's strategy, solidifying its standing as a leading international manufacturer. Their commitment to widespread distribution allows them to cater to varied regional demands and maintain a competitive edge worldwide.

- Global Reach: Operations spanning North America, Europe, Asia, Australia, and South America.

- Market Penetration: Access to over 100 countries, facilitating broad customer engagement.

- Distribution Channels: A mix of direct sales, distributors, and retail partnerships to serve diverse markets effectively.

Hayward's channels encompass a multi-faceted approach, blending traditional distribution with a growing digital presence. This strategy ensures broad market access and caters to diverse customer needs.

Specialty distributors remain a core channel, facilitating reach to pool builders and service professionals. Direct sales to major retailers and buying groups further amplify market penetration and volume.

Digital platforms, including their investor relations website and e-commerce, are increasingly vital for product information, customer support, and direct sales, especially for smart pool technologies.

| Channel Type | Key Intermediaries/Platforms | 2024 Focus/Impact |

|---|---|---|

| Distributors | Specialty Pool & Spa Distributors | Continued reliance for market reach and local expertise. |

| Direct Retail | Major Retailers (Online & Brick-and-Mortar) | Increased brand visibility and consumer access; notable market share gains in premium segments. |

| Buying Groups | Aggregated Pool Business Purchasing Consortia | Simplified transactions and significant volume orders, crucial due to industry consolidation. |

| Digital | Investor Relations Website, E-commerce, Online Support Portals | 15% traffic increase on IR site, 10% e-commerce sales growth; key for smart tech integration and customer engagement. |

| Global Sales Network | Operations across 5 continents, serving over 100 countries | Significant international sales contribution, reinforcing global manufacturing leadership. |

Customer Segments

Residential pool owners, a key customer segment for Hayward, are homeowners who either currently own a pool or are in the process of building one. They are actively looking for pool equipment that offers innovation, energy efficiency, and straightforward management.

These individuals prioritize an enhanced pool ownership experience, often seeking to simplify regular maintenance tasks and reduce the time and effort involved. For instance, in 2024, the demand for smart pool technology, which allows for remote monitoring and control of pool functions, continued to rise significantly among this demographic.

Hayward's commercial pool operators segment includes a diverse range of clients such as hotels, resorts, community centers, and public aquatic facilities. These entities depend on durable, high-performance pool equipment and advanced water treatment solutions to ensure safety and guest satisfaction. The acquisition of ChlorKing in 2022 significantly strengthened Hayward's offerings for this critical market, bringing specialized expertise in commercial salt chlorine generators.

Pool builders and contractors are a cornerstone customer segment for Hayward, driving demand for new pool installations and major renovations. These professionals rely on a consistent supply of high-quality equipment, from pumps and filters to heaters and lighting, to complete their projects efficiently and to a high standard. In 2024, the residential swimming pool construction market in the US saw continued robust activity, with industry reports indicating a steady demand for new builds and upgrades, directly benefiting Hayward's sales through this channel.

Pool Servicers and Maintenance Professionals

Pool servicers and maintenance professionals are a key customer segment for Hayward. These are the individuals and companies that keep existing pools in top condition, handling everything from routine cleaning to complex repairs and system upgrades.

Their consistent need for replacement parts and new equipment for upgrades represents a substantial portion of Hayward's aftermarket revenue. For instance, in 2024, the pool service industry continued to see robust demand, with many homeowners investing in energy-efficient pumps and advanced automation systems, directly benefiting Hayward's product sales in this sector.

- Key Revenue Driver: This segment fuels Hayward's aftermarket sales through ongoing demand for parts and upgrades.

- Service Focus: Professionals in this segment offer maintenance, repair, and modernization services for pools.

- Market Trend Impact: Investment in energy-efficient and smart pool technologies by homeowners directly boosts sales for Hayward's relevant product lines within this segment.

DIY Enthusiasts and Tech-Savvy Consumers

DIY enthusiasts and tech-savvy consumers represent a significant customer segment for Hayward, particularly those keen on leveraging advanced technology for pool management and maintenance. These individuals actively seek out smart home integration and are motivated by potential energy savings. Hayward's Internet of Things (IoT)-enabled solutions, such as smart pumps and automation systems, directly appeal to this group's desire for control and efficiency.

This segment is actively engaged in pool upgrades and often performs their own maintenance. For instance, in 2024, the smart pool technology market saw continued growth, with a notable increase in consumer adoption of connected devices for home management. Hayward's OmniLogic® system, offering comprehensive pool and spa control via a smartphone app, directly caters to this trend, allowing users to manage everything from filtration cycles to heating remotely.

- Value Proposition: Smart pool management, energy efficiency, remote control, and self-sufficiency in maintenance.

- Key Motivations: Desire for advanced technology, cost savings through energy efficiency, and the satisfaction of managing their own pool systems.

- Engagement: Actively research and purchase IoT-enabled pool equipment, participate in online forums for DIY advice, and prioritize ease of use and connectivity.

Hayward's customer segments are diverse, ranging from individual homeowners to large commercial operators and industry professionals.

Residential pool owners seek innovation and ease of use, while commercial clients prioritize durability and advanced water treatment. Pool builders and servicers represent crucial channels for both new installations and aftermarket sales, with a growing demand for energy-efficient and smart pool technologies evident throughout 2024.

Cost Structure

Hayward's manufacturing and production costs represent a substantial segment of its overall expense. These costs encompass the procurement of raw materials like plastics, metals, and electronic components, as well as direct labor involved in assembly and quality control. In 2024, the company likely continued to focus on optimizing these expenditures through supply chain management and automation.

Factory overhead, including utilities, equipment maintenance, and depreciation, also contributes significantly to the cost of goods sold. Hayward's ability to maintain operational efficiencies and control these manufacturing expenses is paramount to its profitability and competitive pricing in the pool equipment market.

Hayward's commitment to innovation is reflected in its significant Research, Development, and Engineering (RD&E) expenses. These investments are vital for creating new pool and spa products, enhancing current offerings, and pushing technological boundaries in the industry. For instance, in 2023, Hayward reported RD&E expenses of $105.5 million, representing approximately 4.5% of its net sales. This focus ensures the company remains at the forefront of technological advancements, a key driver for maintaining its competitive edge.

Selling, General, and Administrative (SG&A) expenses for Hayward, a leader in pool and spa equipment, include significant investments in sales and marketing to drive market penetration and brand awareness. These costs also cover essential customer service operations and the administrative backbone supporting the company's expansive commercial relationships and product distribution networks.

In 2024, Hayward's commitment to expanding its commercial footprint and enhancing customer engagement translated into substantial SG&A investments. These expenditures are crucial for maintaining their competitive edge and supporting the normalized annual incentive compensation programs that motivate their sales and support teams, ultimately driving revenue growth and customer loyalty.

Tariffs and Supply Chain Costs

Hayward's cost structure is significantly influenced by tariffs, especially those impacting goods imported from China. These tariffs directly increase the cost of goods sold, affecting profitability. For instance, in 2024, the ongoing trade tensions and specific tariff rates on pool equipment components can add a notable percentage to the landed cost of inventory.

Managing the complexities of global supply chain logistics is another major cost driver. This includes transportation, warehousing, and the potential for disruptions. Furthermore, inflationary pressures observed throughout 2024 continue to push up the costs of raw materials, manufacturing, and labor, all of which contribute to Hayward's overall operating expenses.

- Tariff Impact: Increased import duties on key components from China in 2024 raise the cost of goods sold.

- Supply Chain Management: Expenses related to global logistics, including shipping and warehousing, are substantial.

- Inflationary Pressures: Rising costs for raw materials, labor, and manufacturing in 2024 directly impact operational expenses.

- Inventory Costs: Holding inventory, especially with fluctuating shipping times and costs, adds to financial commitments.

Acquisition and Integration Costs

Hayward incurs significant costs through strategic acquisitions, like the purchase of ChlorKing in 2023 for an undisclosed sum, and the subsequent integration of these acquired businesses. These are crucial investments designed to broaden Hayward's product offerings and enhance its market presence in the pool and spa industry.

These acquisition and integration expenses are vital for Hayward's growth strategy, enabling the company to expand its capabilities and capture a larger share of the market. For instance, the integration of ChlorKing's advanced water purification technologies is expected to bolster Hayward's competitive edge.

- Acquisition Expenses: Costs associated with identifying, negotiating, and completing the purchase of target companies.

- Integration Costs: Investments in merging systems, processes, and personnel post-acquisition.

- Strategic Value: These costs are weighed against the expected benefits of increased market share and expanded technological capabilities.

Hayward's cost structure is heavily influenced by its manufacturing operations, encompassing raw material procurement, direct labor, and factory overhead. In 2024, optimizing these production expenses through efficient supply chain management and automation remained a key focus to maintain competitive pricing.

Research, Development, and Engineering (RD&E) represent a significant investment, with $105.5 million spent in 2023, approximately 4.5% of net sales, to drive innovation in pool and spa technology. Selling, General, and Administrative (SG&A) costs, including marketing and customer service, were also substantial in 2024 to support market expansion and customer engagement.

External factors like tariffs on imported components, particularly from China, and ongoing inflationary pressures on materials and labor in 2024 directly impacted the cost of goods sold and overall operating expenses. Managing global logistics and inventory holding costs further contribute to the financial commitments within Hayward's cost structure.

Strategic acquisitions, such as ChlorKing in 2023, also incur significant upfront and integration costs, reflecting investments aimed at expanding product portfolios and market reach. These expenditures are weighed against the anticipated benefits of increased market share and enhanced technological capabilities.

| Cost Category | 2023 Data (Millions USD) | 2024 Considerations |

|---|---|---|

| RD&E Expenses | 105.5 | Continued investment for product innovation |

| SG&A Expenses | Significant investment for market expansion | Focus on sales, marketing, and customer engagement |

| Tariffs | Impact on imported components | Ongoing trade tensions influencing landed costs |

| Inflation | Pressures on raw materials, labor, and manufacturing | Continued upward trend in operating expenses |

| Acquisitions | ChlorKing acquisition (undisclosed sum) | Integration costs for expanded capabilities |

Revenue Streams

Hayward's primary revenue stream comes from selling equipment for residential pools. This includes essential items like pumps, filters, heaters, automatic cleaners, sanitization systems, and lighting. These products are the backbone of their sales.

In 2024, Hayward continued to see strong demand in this segment, reflecting the ongoing popularity of pool ownership. The company's extensive product line caters to various needs, from basic maintenance to advanced automation, driving significant sales volume.

Hayward's revenue streams are significantly bolstered by the sale of commercial pool equipment and sophisticated automation systems. This segment saw notable growth, further solidified by Hayward's strategic acquisition of ChlorKing, a move that expanded its product offerings and market reach in the commercial sector.

Aftermarket sales are a cornerstone for Hayward, accounting for a substantial 80% of their net sales. This robust revenue stream is fueled by the continuous need for repairs, replacements, and upgrades for existing pool equipment. This segment demonstrates consistent demand, providing significant financial stability.

New Construction and Remodel Sales

Hayward's revenue is significantly bolstered by sales directly linked to the construction of new swimming pools and substantial renovation projects. This stream, while robust, is notably sensitive to broader economic shifts and the health of the housing market. For instance, in 2024, the residential construction sector experienced varied performance across regions, directly impacting the demand for new pool installations and associated equipment.

The volume of business generated from these new construction and remodel activities is a critical driver for Hayward's overall sales figures. A strong housing market, characterized by increased home sales and new builds, typically translates into higher demand for pool-related products. Conversely, economic slowdowns or rising interest rates can temper this segment's growth. In 2024, industry reports indicated a moderate uptick in new home starts in certain Sun Belt states, a positive indicator for this revenue stream.

Key contributing factors to this revenue stream include:

- New Pool Construction: Sales of pumps, filters, heaters, and automation systems for newly built pools.

- Major Remodeling Projects: Revenue from upgrading existing pool systems, adding features like LED lighting or variable-speed pumps, and replacing older equipment.

- Seasonal Demand Fluctuations: Revenue peaks often align with construction seasons and homeowner renovation cycles.

- Geographic Market Performance: Sales are influenced by regional economic conditions and housing market vitality, with areas experiencing strong population growth often showing higher demand.

Technology Adoption and Smart Products

Hayward's revenue streams are significantly boosted by the increasing integration of smart technology in the pool industry. The company's focus on IoT-enabled products, like the OmniX product suite and SmartPad™ systems, directly translates into sales of these advanced, connected devices. This adoption reflects a broader market shift towards smart home features extending to outdoor living spaces.

These smart products represent a key growth area for Hayward. For instance, the OmniLogic platform, a foundational element of their smart pool control, saw continued expansion in its user base throughout 2023 and into early 2024. This increased adoption of connected pool management systems drives not only initial hardware sales but also potential for future software and service-based revenue streams as the ecosystem matures.

- Smart Product Sales: Direct revenue from the sale of IoT-enabled pool controllers, pumps, heaters, and lighting systems.

- Ecosystem Growth: Increased adoption of platforms like OmniLogic creates a sticky customer base, encouraging further purchases within the smart product ecosystem.

- Service and Software: Potential for recurring revenue through advanced app features, data analytics, or remote diagnostics offered as subscription services for smart product users.

Hayward's revenue is significantly diversified, with aftermarket sales constituting a substantial 80% of its net sales. This strong aftermarket performance is driven by the ongoing need for replacement parts, repairs, and upgrades for existing pool equipment, ensuring a consistent and stable revenue flow. This segment highlights the long-term value and serviceability of Hayward's product ecosystem.

In 2024, the company continued to capitalize on this by offering a comprehensive range of replacement components and service solutions. The emphasis on durability and readily available parts for their installed base solidifies this critical revenue stream, making it a cornerstone of Hayward's financial strategy and a testament to customer loyalty and product longevity.

Hayward's aftermarket revenue is further bolstered by its extensive distribution network and commitment to customer support. This ensures that consumers and service professionals have easy access to the necessary parts, driving repeat business and reinforcing Hayward's market position. The company's focus on providing reliable solutions for pool maintenance and repair directly translates into sustained sales in this high-margin segment.

Business Model Canvas Data Sources

The Hayward Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and operational performance metrics. These diverse sources ensure a holistic and accurate representation of the business's strategic framework.