Haworth Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haworth Bundle

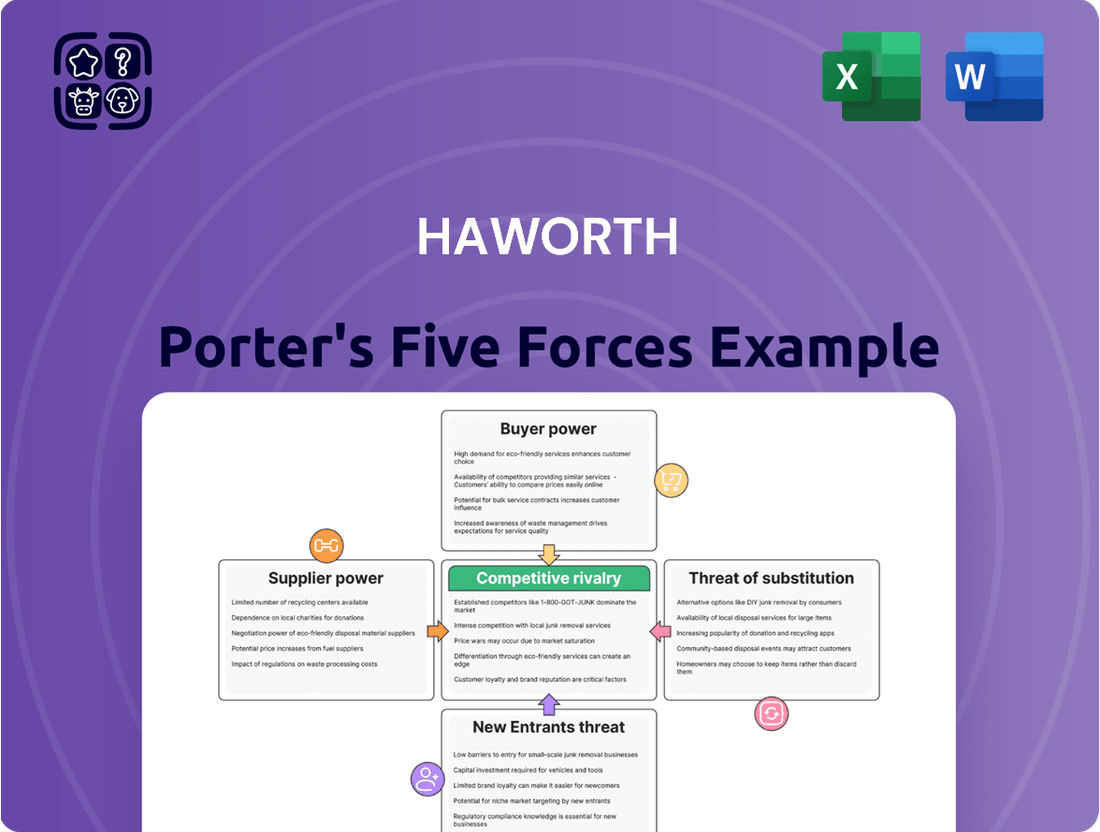

Haworth's competitive landscape is shaped by the interplay of five key forces, revealing the underlying pressures that influence profitability and strategy. Understanding these forces is crucial for navigating the furniture industry.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Haworth’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Raw material cost volatility is a key factor in supplier bargaining power. Fluctuations in prices for essential inputs like wood, metal, and plastics can directly impact Haworth's manufacturing expenses and profit margins. These price swings, coupled with the potential for scarcity, give suppliers leverage.

The furniture sector, including companies like Haworth, has been grappling with escalating raw material costs. For instance, lumber prices saw significant increases throughout 2024, with some benchmarks reporting year-over-year hikes of over 15%. This trend is projected to continue into early 2025, exacerbated by ongoing global supply chain disruptions.

For highly specialized components or unique finishes that differentiate Haworth's premium products, the number of alternative suppliers is often limited. This scarcity directly translates into increased bargaining power for these specialized providers. For instance, if Haworth relies on a single supplier for a proprietary ergonomic mechanism crucial to its high-end office chairs, that supplier can command higher prices or dictate terms.

Haworth's commitment to innovative design and the increasing demand for sustainable materials often necessitate inputs from suppliers with niche expertise or advanced manufacturing capabilities. Companies providing these specialized materials or components, such as those offering advanced recycled polymers or unique acoustic dampening fabrics, can leverage their unique offerings to negotiate favorable terms, impacting Haworth's cost structure and product development timelines.

Haworth's commitment to sustainability, including its goal for 100% sustainably sourced wood, means suppliers must meet increasingly rigorous environmental and ethical standards. This can narrow the field of available suppliers, concentrating power with those who can readily comply.

Logistics and Geopolitical Instability

Global trade uncertainties, exacerbated by geopolitical tensions, significantly impact supply chain reliability. For instance, the ongoing conflicts and trade disputes in various regions throughout 2024 have led to increased shipping times and surcharges. Ocean freight bottlenecks, like those experienced in late 2023 and continuing into 2024, have further inflated logistics costs, with some routes seeing freight rates double compared to pre-pandemic levels.

This instability grants greater bargaining power to suppliers situated in regions less affected by these disruptions or those possessing exceptionally robust and resilient logistics networks. Companies that can ensure consistent and timely delivery, even amidst broader global challenges, can command higher prices or more favorable terms from their buyers. This was evident in 2024 as many industries scrambled to secure inventory, prioritizing reliability over cost savings.

- Increased Shipping Costs: Average ocean freight rates for major East-West trade lanes saw significant increases in early 2024, with some routes experiencing a 50-100% rise compared to the previous year due to congestion and geopolitical risks.

- Supply Chain Disruptions: Geopolitical events in 2024 led to an average increase of 15% in lead times for critical components sourced from volatile regions.

- Supplier Leverage: Suppliers with diversified logistics options and operations in stable geopolitical zones were able to negotiate an average 5-7% price premium for their goods in 2024.

Supplier Concentration

When a market for essential inputs is dominated by a small number of significant suppliers, those suppliers gain considerable power to set terms and prices. This concentration means buyers have fewer alternatives, amplifying the suppliers' ability to influence market conditions.

While Haworth's substantial size can provide some negotiating leverage, its reliance on specific suppliers for crucial materials or advanced components can still create vulnerabilities. For instance, if a key supplier for specialized ergonomic components experiences production issues, it could disrupt Haworth's manufacturing.

- Supplier Concentration: The office furniture industry, like many manufacturing sectors, can experience supplier concentration for specialized components such as advanced polymers, high-performance fabrics, or unique metal alloys.

- Leverage and Dependence: While Haworth's scale of operations, which saw revenues in the hundreds of millions of dollars annually in recent years, offers some bargaining power, dependence on a few suppliers for proprietary or technologically advanced inputs can shift power towards those suppliers.

- Impact on Pricing: High supplier concentration can lead to less competitive pricing for raw materials and components, potentially increasing Haworth's cost of goods sold and impacting its profit margins if these costs cannot be fully passed on to customers.

- Strategic Sourcing: To mitigate this risk, Haworth likely engages in strategic sourcing initiatives, potentially developing long-term partnerships with key suppliers or exploring dual-sourcing strategies for critical inputs where feasible.

The bargaining power of suppliers significantly influences Haworth's operational costs and strategic flexibility. When suppliers have substantial leverage, they can command higher prices, dictate terms, and potentially limit availability of critical inputs, directly impacting Haworth's profitability and production schedules. This power is amplified by factors like supplier concentration, the uniqueness of their offerings, and the overall stability of the supply chain.

The furniture industry, including manufacturers like Haworth, faces ongoing challenges from raw material price volatility. For example, lumber prices, a key input, saw year-over-year increases exceeding 15% in 2024, with projections indicating continued upward pressure into early 2025 due to persistent global supply chain disruptions.

Suppliers of specialized components, such as proprietary ergonomic mechanisms or advanced recycled polymers, hold significant power due to limited alternatives. Haworth's reliance on these niche providers means they can negotiate higher prices, especially when these components are crucial for differentiating premium products.

| Factor | Impact on Haworth | 2024 Data/Trend |

|---|---|---|

| Raw Material Price Volatility | Increased manufacturing costs, reduced profit margins | Lumber prices up >15% YoY; projected continued increases into early 2025 |

| Supplier Concentration | Limited alternatives, potential for price gouging | Concentration exists for specialized components like advanced polymers |

| Uniqueness of Inputs | Higher prices, dictated terms for specialized materials | Niche suppliers of ergonomic components or sustainable fabrics can command premiums |

| Supply Chain Disruptions | Increased lead times, higher logistics costs | Geopolitical tensions caused 15% increase in lead times for critical components; ocean freight rates doubled on some routes |

What is included in the product

Haworth's Porter's Five Forces Analysis meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the office furniture industry.

Effortlessly identify and prioritize competitive threats with a visual breakdown of each force, streamlining strategic planning.

Customers Bargaining Power

Haworth's diverse customer base, spanning corporate, healthcare, education, and government sectors, presents a varied landscape of bargaining power. Large corporate and government clients, in particular, wield considerable influence due to the sheer volume of their purchases, often involving extensive office fit-outs. For instance, a major corporation outfitting hundreds or thousands of workstations can negotiate more favorable terms and pricing than a smaller business.

Customers are increasingly seeking furniture that is not only comfortable and supportive but also tailored to their specific needs and integrated with technology. This trend towards customization and ergonomics significantly boosts their bargaining power.

For instance, a 2024 survey indicated that over 60% of office furniture purchasers prioritize ergonomic features and customization options when making buying decisions. This demand forces manufacturers like Haworth to invest in flexible production lines and offer a wider range of adaptable products.

As a result, buyers can negotiate more favorable terms, demanding specific materials, adjustable components, and even integrated tech solutions. This ability to influence product design and specifications gives customers a stronger hand in the negotiation process.

The widespread adoption of hybrid work models significantly bolsters customer bargaining power in the furniture industry. Customers now demand flexible, adaptable, and modular furniture that can be easily reconfigured to suit dynamic office and home environments. This shift means customers have more leverage to select vendors who can effectively meet these evolving workspace needs, pushing for greater customization and value.

Availability of Alternatives

The office furniture market is quite crowded, with many companies offering a variety of desks, chairs, and storage solutions. This means customers aren't limited to just one or two suppliers; they can easily find similar products from different manufacturers, whether they're looking for high-end ergonomic chairs or more budget-conscious workstations.

This abundance of choice directly translates to increased bargaining power for customers. They can leverage the availability of alternatives to negotiate better prices, demand specific features, or secure more favorable service agreements. For instance, a large corporation looking to furnish a new office can solicit bids from multiple suppliers, using the lowest offer as a benchmark.

- Market Saturation: The global office furniture market was valued at approximately $60 billion in 2023, with numerous manufacturers competing for market share.

- Product Homogeneity: Many standard office furniture items, like basic desks and chairs, are similar across brands, making it easier for customers to switch suppliers.

- Price Sensitivity: For many businesses, office furniture represents a significant capital expenditure, making them highly sensitive to pricing and discounts offered by competitors.

Transparency in Procurement

The rise of digital procurement platforms and e-commerce channels has significantly boosted price transparency for customers. These platforms allow buyers to quickly compare prices and configure product options, leading to shorter decision-making processes. This ease of comparison directly empowers customers, allowing them to leverage competitive pricing more effectively and thereby increasing their bargaining power.

This enhanced transparency means customers can readily identify the best deals available in the market. For instance, in 2024, B2B e-commerce sales were projected to reach over $3.7 trillion globally, underscoring the widespread adoption of digital channels that facilitate price discovery. Such market conditions inherently shift power towards the buyer.

- Increased Price Visibility: Digital tools provide immediate access to competitor pricing, making it harder for suppliers to maintain premium markups.

- Streamlined Comparison: Buyers can easily evaluate features, specifications, and pricing across multiple vendors simultaneously.

- Faster Decision Cycles: Reduced information asymmetry allows customers to make purchasing decisions more rapidly, often based on price and value.

- Leveraging Competitive Landscape: Transparency enables customers to use quotes from one supplier to negotiate better terms with another.

The bargaining power of customers in the office furniture sector is substantial, driven by market saturation and product homogeneity. With numerous competitors offering similar items, buyers can easily switch suppliers, demanding better pricing and terms. This leverage is amplified by increasing price transparency through digital platforms, allowing for quick comparisons and negotiation based on competitive offers.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Market Saturation | High | Global office furniture market valued at ~$60 billion in 2023, with many competing manufacturers. |

| Product Homogeneity | Moderate to High | Standard items like desks and chairs are often similar across brands, facilitating supplier switching. |

| Price Transparency (Digital) | High | B2B e-commerce projected to exceed $3.7 trillion globally in 2024, enabling easy price discovery. |

Preview Before You Purchase

Haworth Porter's Five Forces Analysis

This preview showcases the complete Haworth Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately upon purchase, ensuring you get exactly what you need without any alterations or placeholders.

Rivalry Among Competitors

The global office furniture market is a battleground for major players like Steelcase, MillerKnoll, and Teknion. These giants compete fiercely, leveraging their established brand names and wide-reaching distribution channels to capture market share. In 2024, the office furniture industry saw continued consolidation and strategic moves as these companies vied for dominance.

The office furniture market sees intense rivalry fueled by a constant push for innovation. Companies are locked in a race to differentiate through cutting-edge design, advanced ergonomics, seamless technology integration, and a growing emphasis on eco-friendly materials and production. This drive for uniqueness is crucial for capturing market share and building customer loyalty.

Haworth, for instance, demonstrates this commitment by channeling significant resources into research and development. Their focus on creating distinct products and tailored solutions positions them to stand out in a crowded field. In 2024, the global office furniture market was valued at approximately $75 billion, highlighting the substantial stakes involved in achieving product differentiation.

The US office furniture market, while anticipated to expand, operates within a mature industry. This maturity often fuels intense competitive rivalry as existing companies vie for even small, incremental market share gains. For instance, the US office furniture market was valued at approximately $11.7 billion in 2023 and is projected to grow at a CAGR of around 3.5% through 2028, indicating a steady but not explosive growth trajectory.

Globally, the office furniture market is also on an upward trend, with projections suggesting it could reach over $70 billion by 2028, growing at a CAGR of approximately 4.1%. However, this growth occurs in an environment with numerous established players, many with significant brand recognition and distribution networks. This high level of competition means that new entrants or smaller firms face considerable challenges in carving out their niche.

High Fixed Costs and Capacity

The office furniture industry is characterized by substantial fixed costs, primarily stemming from investments in manufacturing plants, advanced machinery, and extensive distribution infrastructure. These high upfront expenses create a significant barrier to entry and can intensify rivalry among existing players.

During economic downturns or periods of reduced demand, companies face pressure to keep their production lines running to cover these fixed costs. This often results in aggressive pricing strategies and increased promotional activities as firms compete fiercely for market share, aiming to optimize capacity utilization.

- High Capital Investment: Setting up a modern office furniture manufacturing facility can easily run into tens of millions of dollars, encompassing specialized machinery for woodworking, metal fabrication, and upholstery.

- Capacity Utilization Pressure: In 2024, many manufacturers reported operating below optimal capacity, leading to a greater need to secure orders to offset fixed overheads, driving competitive pricing.

- Distribution Network Costs: Establishing and maintaining a robust distribution network, including warehouses and logistics, adds another layer of significant fixed expenditure for office furniture producers.

Customer Loyalty and Switching Costs

Customer loyalty in the office furniture sector is often influenced by the significant switching costs associated with changing suppliers for large-scale projects. These costs can encompass not only financial outlays for new furniture but also the logistical challenges of installation and the potential disruption to business operations. For instance, a company like Steelcase, a major player, might offer integrated design, delivery, and installation services, creating a comprehensive package that is difficult for clients to replicate with a new vendor.

Despite these barriers, rivalry remains robust. Poor product quality, inadequate customer service, or a lack of flexibility in meeting evolving workplace needs can drive customers to explore alternatives. In 2024, the demand for adaptable and ergonomic office furniture surged, with companies prioritizing employee well-being and hybrid work models. This shift means that providers failing to innovate and respond to these trends risk losing market share, even from established clients.

- High Switching Costs: Businesses often face substantial financial and operational hurdles when changing office furniture suppliers, especially for large installations.

- Customer Dissatisfaction as a Driver: Issues such as inferior product quality or a failure to adapt to new workplace trends can override loyalty and prompt a search for new vendors.

- Market Responsiveness is Key: In 2024, the emphasis on ergonomic and flexible furniture solutions means that providers who don't innovate risk customer attrition.

Competitive rivalry within the office furniture sector is intense, driven by the presence of numerous established players and significant barriers to entry. Companies like Steelcase and MillerKnoll are locked in a continuous battle for market share, often resorting to aggressive pricing and promotional activities, especially when facing pressure to utilize excess manufacturing capacity. This dynamic is further amplified by the substantial fixed costs associated with production and distribution, making it challenging for smaller firms to compete effectively.

The market's maturity, particularly in regions like the US, means that growth often comes at the expense of competitors. In 2024, the global office furniture market, valued at approximately $75 billion, continued to see companies invest heavily in R&D to differentiate through innovative design and ergonomic features. This focus on product uniqueness is a critical strategy for retaining customers and attracting new business amidst fierce competition.

Customer loyalty, while present due to high switching costs, is not absolute. Failures in product quality or a lack of adaptability to evolving workplace needs, such as the surge in demand for hybrid work solutions seen in 2024, can lead to customer attrition. Therefore, continuous innovation and responsiveness to market trends are paramount for survival and success in this highly competitive landscape.

| Key Competitive Factors | Impact on Rivalry | Examples/Data (2024/2025 Projections) |

| Number and Balance of Competitors | High rivalry due to many established players | Major players: Steelcase, MillerKnoll, Haworth, Teknion. Global market valued at ~$75 billion in 2024. |

| Industry Growth Rate | Intensifies rivalry in mature markets | US market projected CAGR ~3.5% (2023-2028); Global market projected CAGR ~4.1% (to 2028). |

| Product Differentiation & Switching Costs | Rivalry tempered by switching costs, but innovation drives differentiation | Demand for ergonomic and adaptable furniture surged in 2024. High switching costs for large corporate clients. |

| Fixed Costs & Capacity Utilization | Pressure to utilize capacity leads to aggressive pricing | High capital investment in manufacturing; pressure to offset fixed overheads in 2024. |

SSubstitutes Threaten

The rise of flexible and modular workspace solutions presents a significant threat of substitution for traditional office furniture manufacturers. Companies are increasingly opting for reconfigurable systems, movable walls, and adaptable workstations to accommodate evolving work styles and reduce long-term real estate commitments. This trend allows businesses to quickly adjust layouts, fostering collaboration or providing quiet zones as needed, thereby diminishing the reliance on fixed, often costly, furniture installations.

Technological advancements are blurring the lines between furniture and electronics. For instance, smart desks offering integrated wireless charging and adjustable height settings are becoming more prevalent, directly competing with traditional desks that require separate charging pads and manual adjustments. This trend means consumers might opt for a single, tech-enabled piece of furniture, reducing demand for standalone accessories and potentially impacting the market for companies that don't adapt.

The growing popularity of remote and hybrid work models presents a significant threat of substitutes for traditional corporate office furniture. Home office setups and furniture designed for co-working environments offer compelling alternatives, often at competitive price points and with a focus on adaptability and personal style.

These substitute offerings cater to a shifting demand, with consumers increasingly seeking furniture that can seamlessly transition between work and leisure. For instance, the global home office furniture market was valued at approximately $30 billion in 2023, a figure projected to grow, indicating a strong consumer preference for these alternatives.

Architectural Renovations and Space Utilization

Customers might choose permanent architectural renovations, like constructing fixed walls or integrating built-in furniture, as a substitute for flexible furniture systems such as movable partitions. This can reduce the need for adaptable office layouts, impacting demand for modular solutions. For instance, a significant portion of office build-outs in 2024 involved custom millwork and permanent structures, reflecting a preference for long-term space definition over temporary flexibility in certain sectors.

Conversely, modular and flexible furniture systems can serve as a more cost-effective alternative to undertaking extensive and expensive architectural changes. Businesses looking to reconfigure their spaces without major construction costs might find modular solutions appealing. The global modular furniture market was valued at approximately $65 billion in 2023 and is projected to grow steadily, indicating a strong trend towards these adaptable solutions as a substitute for traditional renovations.

- Architectural Renovations as Substitutes: Permanent walls and built-in fixtures offer a fixed solution that can replace the need for movable partitions, impacting the demand for flexible furniture.

- Modular Furniture as a Substitute: Modular furniture provides a cost-effective alternative to significant architectural changes, allowing for space reconfiguration without major construction.

- Market Data: The global modular furniture market's growth, projected to reach over $90 billion by 2028, underscores its role as a viable substitute for traditional office build-outs.

- Customer Preference Shift: In 2024, a notable trend in commercial real estate involved companies opting for modular fit-outs to achieve agility, thereby substituting more permanent, costly renovations.

DIY and Custom-Built Solutions

For smaller businesses or individual users, the threat of substitutes in the office furniture market is significant, particularly from DIY and custom-built solutions. These alternatives can offer compelling price points or tailored designs that appeal to budget-conscious or niche-seeking customers. For instance, the global DIY furniture market was valued at approximately USD 20.5 billion in 2023, with projections indicating continued growth as consumers increasingly seek personalized and cost-effective options.

These DIY and custom solutions can directly compete with established manufacturers like Haworth by providing lower-cost alternatives. While they might not always match the ergonomic standards or integrated design of professionally manufactured furniture, their accessibility and affordability present a viable substitute for many. A 2024 survey found that over 40% of small businesses consider cost savings as a primary driver when selecting office furnishings, making these accessible substitutes a considerable competitive force.

- DIY Furniture Market Growth: The DIY furniture market is expanding, driven by consumer demand for personalization and cost savings.

- Cost as a Key Factor: For many small businesses, the lower price point of DIY or custom-built furniture is a major deciding factor.

- Compromise on Quality: While often cheaper, these substitutes may sometimes lack the ergonomic quality and integrated design found in premium office furniture.

- Targeting Specific Niches: Custom-built solutions cater to unique needs, offering a level of specialization that mass-produced furniture cannot always match.

The threat of substitutes for traditional office furniture is substantial, driven by evolving work arrangements and the rise of alternative solutions. These substitutes range from home office setups to architectural modifications, each offering distinct advantages that can reduce reliance on conventional office furniture providers.

The increasing adoption of remote and hybrid work models has fueled demand for home office furniture, presenting a direct substitute for corporate office environments. Furthermore, advancements in flexible and modular workspace systems allow businesses to reconfigure spaces without extensive renovations, acting as a substitute for fixed furniture installations.

DIY and custom-built furniture options also pose a significant threat, particularly for smaller businesses, due to their cost-effectiveness and potential for personalization. These alternatives can offer a compelling value proposition, challenging the market share of established manufacturers.

| Substitute Category | Key Characteristics | Market Relevance (2023-2024 Data) |

|---|---|---|

| Home Office Furniture | Adaptability, personal style, competitive pricing | Global home office furniture market valued at ~$30 billion in 2023; continued growth projected. |

| Modular/Flexible Systems | Space reconfiguration, reduced real estate commitment, cost-effectiveness vs. renovations | Global modular furniture market valued at ~$65 billion in 2023; projected steady growth. Over 40% of small businesses prioritize cost savings in furniture selection (2024 survey). |

| DIY/Custom Solutions | Lower cost, personalization, niche appeal | Global DIY furniture market valued at ~$20.5 billion in 2023; strong consumer demand for tailored, affordable options. |

Entrants Threaten

Entering the office furniture manufacturing sector, particularly at the scale required to compete with established players like Haworth, demands a significant financial outlay. This includes acquiring or leasing advanced manufacturing plants, purchasing specialized machinery for wood, metal, and upholstery work, and investing in sophisticated design and engineering software and talent. For instance, setting up a modern, automated production line can easily cost millions of dollars.

Beyond production, new entrants must also allocate substantial capital towards building robust distribution channels and marketing efforts to reach a broad customer base. Establishing warehousing, logistics, and sales teams requires considerable investment, further increasing the barrier to entry. In 2024, the average cost to launch a new manufacturing facility of moderate size can range from $10 million to $50 million, depending on the level of automation and product complexity.

Established brand recognition and reputation present a significant barrier to new entrants. Companies like Haworth have cultivated decades of trust and a strong reputation for quality among architects, designers, and major corporate clients. For instance, Haworth's brand equity, built over 75 years, translates into a perceived reliability that newcomers struggle to replicate quickly.

Haworth's extensive global reach, with 400 dealers and operations in over 150 countries, presents a significant barrier to new entrants. Establishing a comparable distribution network requires immense capital investment and considerable time to build relationships and infrastructure worldwide.

Intellectual Property and Design Innovation

The office furniture industry highly values innovative design, ergonomic research, and product patents. Established players like Steelcase and Herman Miller have invested heavily in R&D, holding numerous patents for their ergonomic advancements and unique design features. For instance, Steelcase's extensive patent portfolio provides a significant barrier to entry, as replicating their patented technologies would require substantial upfront investment in research and development. In 2023, major office furniture manufacturers continued to emphasize sustainability and user well-being in their product development, further raising the bar for new entrants seeking to compete on innovation.

Existing companies possess substantial intellectual property, including design patents and utility patents, and maintain a continuous pipeline of new product introductions. This makes it challenging for new entrants to differentiate themselves without considerable R&D expenditure. For example, Herman Miller’s ongoing commitment to design leadership, evidenced by collaborations with renowned designers, creates a strong brand identity and customer loyalty that is difficult for newcomers to replicate quickly. The ability to secure and leverage intellectual property is a critical factor in deterring new competition.

- High R&D Investment Required: New entrants must commit significant capital to research and development to match the innovative capabilities of established firms.

- Patent Protection as a Barrier: Existing companies' patent portfolios protect their unique designs and technologies, making it difficult for new entrants to offer comparable products without infringement.

- Continuous Innovation Pipeline: Established manufacturers consistently introduce new products, requiring new entrants to maintain a rapid pace of innovation to remain competitive.

- Brand Reputation Tied to Design: A strong reputation for design innovation, built over years, acts as a significant deterrent to new market entrants.

Sustainability and Certification Requirements

The increasing demand for sustainability and the associated certification requirements present a significant hurdle for new entrants. Companies looking to enter the market must now factor in the costs and complexities of sourcing eco-friendly materials and implementing environmentally conscious manufacturing processes from day one. For instance, achieving certifications like LEED (Leadership in Energy and Environmental Design) or Cradle to Cradle Certified® requires substantial upfront investment in research, development, and material validation, directly impacting the capital needed to establish a competitive presence.

These stringent standards mean that newcomers face higher initial capital outlays compared to established players who may have already adapted their operations. The need to demonstrate compliance with environmental, social, and governance (ESG) criteria, which often underpins these certifications, adds another layer of complexity. For example, in 2024, the global green building market was valued at over $1.5 trillion, highlighting the scale of investment required to meet these evolving industry expectations.

- Higher Capital Investment: New entrants need significant capital for sustainable materials and processes.

- Certification Costs: Obtaining certifications like LEED or Cradle to Cradle Certified® adds substantial expense.

- Operational Complexity: Implementing eco-friendly practices requires specialized knowledge and supply chain adjustments.

- Market Expectations: Demonstrating ESG compliance is becoming a prerequisite for market acceptance.

The threat of new entrants in the office furniture industry is moderate, primarily due to high capital requirements for manufacturing, distribution, and R&D. Established brands also hold significant sway, making it tough for newcomers to gain traction. Furthermore, increasing emphasis on sustainability and certifications adds another layer of investment for potential market entrants.

| Barrier to Entry | Description | Estimated Cost/Impact (2024 Data) |

|---|---|---|

| Capital Requirements | Setting up manufacturing, distribution, and sales infrastructure. | $10 million - $50 million for a moderate-sized facility. |

| Brand Recognition & Reputation | Building trust and a strong market presence against established players. | Decades of investment; difficult to quantify but substantial. |

| R&D and Intellectual Property | Developing innovative designs and securing patents. | Significant ongoing investment; patent portfolios can be extensive. |

| Sustainability & Certifications | Meeting eco-friendly material sourcing and process standards. | Increased upfront investment for certifications like LEED. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive approach, drawing data from industry-specific market research reports, company financial statements, and expert interviews to capture the nuances of competitive dynamics.