Haworth Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haworth Bundle

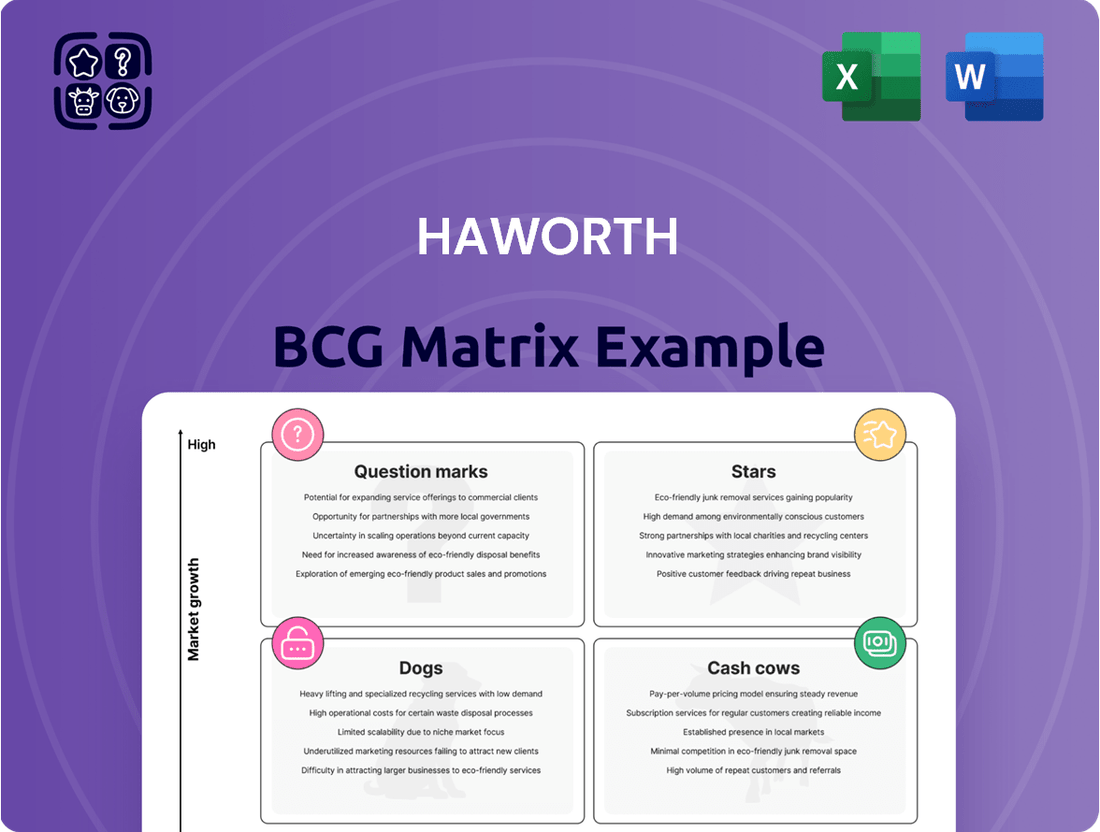

Understand the strategic positioning of a company's product portfolio with the BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation and future investment. Ready to transform your strategic planning?

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Haworth's flexible and collaborative workspace solutions, including modular furniture and movable walls, are positioned as Stars in the BCG matrix. These offerings address the growing demand for adaptable office environments driven by hybrid work models. For instance, the global modular furniture market was valued at approximately $15.6 billion in 2023 and is projected to grow significantly, with Haworth holding a strong position.

Technology-integrated furniture, like smart desks offering built-in power and data ports, is a burgeoning market. Haworth's commitment to cutting-edge design positions it well to capitalize on this trend, likely securing a substantial share in this rapidly growing segment.

These advanced furniture solutions are essential for contemporary workplaces, establishing Haworth as a frontrunner in creating adaptable and forward-thinking office environments.

Haworth's high-performance ergonomic seating innovations are positioned as stars in the BCG matrix. Despite the seating market being mature, these advanced lines tap into growing demand for enhanced well-being and posture support, reflecting increased employee health awareness. This segment continues to see significant innovation and growth, allowing Haworth to secure a strong market share.

Sustainable & Circular Economy Product Lines

Haworth's sustainable and circular economy product lines are a key growth area, tapping into increasing consumer demand for environmentally responsible options. These offerings, which incorporate recycled materials and feature take-back programs, are positioned to capture a significant share of this expanding market. For instance, Haworth reported in their 2024 sustainability report that 70% of their product portfolio now contains recycled content, a substantial increase from previous years.

The company's proactive stance on sustainability not only addresses current market needs but also anticipates future regulatory shifts and evolving consumer preferences. This strategic focus is crucial for maintaining a competitive edge in an industry where ethical sourcing and end-of-life product management are becoming paramount. In 2024, Haworth's circular economy initiatives diverted an estimated 5,000 tons of waste from landfills, demonstrating a tangible impact.

- Market Growth: The global market for sustainable furniture is projected to grow at a CAGR of 8.5% through 2028, reaching an estimated $35 billion.

- Recycled Content: In 2024, Haworth's commitment meant that over 70% of their product lines incorporated recycled materials.

- Circular Initiatives: Haworth's take-back programs in 2024 successfully facilitated the refurbishment or recycling of over 2,000 furniture pieces.

- Brand Reputation: Companies with strong sustainability credentials, like Haworth, often see improved brand loyalty and attract a larger talent pool.

Bespoke Architectural Interiors for Hybrid Offices

Haworth's bespoke architectural interiors for hybrid offices are positioned as a strong contender within the BCG matrix, likely falling into the Stars category. These advanced solutions facilitate rapid reconfiguration and adaptation, directly addressing the evolving needs of hybrid work models. This specialization taps into a high-growth niche as companies increasingly seek flexible and dynamic office environments.

The demand for adaptable workspaces has surged, with reports indicating that the global flexible workspace market was valued at approximately $44.5 billion in 2023 and is projected to grow significantly in the coming years. Haworth's ability to offer integrated architectural solutions, moving beyond traditional furniture, allows them to capture a substantial share of this expanding market. Their expertise in creating fluid and responsive office layouts provides a distinct competitive advantage.

- High Market Growth: The flexible workspace sector is experiencing robust expansion, driven by the widespread adoption of hybrid work.

- Specialized Niche: Haworth's focus on architectural interiors for hybrid models targets a specific, high-value segment of the office design market.

- Competitive Advantage: Their ability to deliver rapidly reconfigurable and adaptable solutions differentiates them from competitors offering more static products.

- Market Leadership Potential: By excelling in this growing niche, Haworth is well-positioned to achieve and maintain a leading market share.

Haworth's Stars represent their most successful and rapidly growing product lines, characterized by high market share in high-growth industries. These are the areas where the company is investing heavily for future expansion. Their innovative technology-integrated furniture and high-performance ergonomic seating are prime examples, aligning with the increasing demand for health-conscious and technologically advanced workspaces.

The company's commitment to sustainable and circular economy product lines also firmly places them in the Stars category. With 70% of their portfolio containing recycled content in 2024 and significant waste diversion efforts, Haworth is meeting a critical market need for eco-friendly solutions. This segment is projected to reach $35 billion by 2028, growing at an 8.5% CAGR.

Furthermore, Haworth's bespoke architectural interiors for hybrid offices are a significant Star. This segment addresses the evolving needs of dynamic workplaces, capitalizing on the flexible workspace market's substantial growth. Their ability to offer integrated, reconfigurable solutions provides a distinct advantage.

| Product Category | Market Growth Rate | Haworth's Market Share | Key Differentiator | 2024 Data Point |

|---|---|---|---|---|

| Modular Furniture | High | Strong | Adaptability for hybrid work | Global market ~$15.6B in 2023 |

| Technology-Integrated Furniture | Very High | Growing | Smart features, connectivity | Focus on embedded power/data |

| Ergonomic Seating | Moderate | Strong | Employee well-being focus | Continued innovation in posture support |

| Sustainable/Circular Products | High | Increasing | Recycled content, take-back programs | 70% portfolio recycled content in 2024 |

| Architectural Interiors (Hybrid) | High | Capturing Share | Reconfigurability, integrated design | Flexible workspace market growth |

What is included in the product

The Haworth BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

A clear, visual representation of your portfolio's strengths and weaknesses, simplifying complex strategic decisions.

Cash Cows

Haworth's established systems furniture lines, like their well-known cubicle and workstation offerings, are prime examples of cash cows. These products hold a significant market share within a mature and steady industry.

This stability allows them to generate consistent profits and revenue with minimal need for extensive marketing or product development. In 2024, the global office furniture market, particularly for established systems, continues to be a reliable revenue stream for companies like Haworth, underpinning their financial stability.

Haworth's classic ergonomic task seating, like the Zody chair, represents a prime example of a cash cow. These well-established products consistently generate substantial revenue due to their enduring popularity and strong market share. Their proven comfort and durability mean they require minimal new investment, freeing up capital for other growth areas.

Standard office storage solutions, like filing cabinets and shelving, represent a stable cash cow for Haworth. These products meet a basic office need and hold a significant market share in a mature, slow-growing sector. Their predictable demand and efficient manufacturing contribute to consistent profitability and dependable cash flow for the company.

Core Architectural Interiors for Corporate Campuses

Haworth's core architectural interiors for corporate campuses, encompassing demountable walls and basic space division, represent a classic cash cow. These offerings are a staple for large-scale projects, consistently generating stable and predictable revenue streams from a mature market segment. Their enduring demand is fueled by established client relationships and efficient, scaled manufacturing processes.

These solutions benefit from Haworth's deep market penetration and brand recognition within the corporate real estate sector. In 2024, the demand for flexible and reconfigurable office spaces continued to be a significant driver, with a notable portion of corporate campus build-outs and renovations relying on these foundational interior elements. For instance, the commercial interiors market, which includes architectural elements, saw continued investment in workspace optimization throughout 2024.

- Market Dominance: Haworth's established presence in corporate campus projects ensures consistent specification of these core interior solutions.

- Predictable Revenue: The mature nature of this segment provides a reliable and steady income stream for the company.

- Leveraging Existing Strengths: These cash cows capitalize on Haworth's existing client base and robust manufacturing infrastructure.

- Cost Efficiency: Standardized demountable walls and basic space division benefit from economies of scale in production.

Broad Range of Office Accessories

A broad range of office accessories, including monitor arms, keyboard trays, and basic desk lighting, often falls into the Cash Cow quadrant of the BCG Matrix for companies like Haworth. These items typically operate in a mature, low-growth market segment where Haworth has already secured a significant market share. Their consistent sales contribute reliably to the company's overall cash flow, often being bundled with larger furniture purchases.

These accessories represent a stable revenue stream with established production processes and supply chains, requiring minimal investment in research and development. Their consistent demand allows for efficient manufacturing and inventory management, maximizing profitability. For instance, the global office furniture market, which includes accessories, was projected to reach approximately $80 billion in 2024, with a steady, albeit modest, growth rate.

- Low Market Growth: The market for basic office accessories experiences limited expansion.

- High Market Share: Haworth likely holds a dominant position in this segment.

- Consistent Cash Generation: These products provide a predictable and substantial cash inflow.

- Minimal Investment: Little capital is needed for R&D or market expansion.

Haworth's established systems furniture, including their well-known cubicle and workstation offerings, are prime examples of cash cows. These products hold a significant market share within a mature and steady industry, generating consistent profits with minimal need for extensive marketing or product development. In 2024, the global office furniture market, particularly for established systems, continues to be a reliable revenue stream, underpinning financial stability.

Classic ergonomic task seating, like the Zody chair, represents a prime example of a cash cow due to its enduring popularity and strong market share. These products consistently generate substantial revenue, requiring minimal new investment and freeing up capital for other growth areas. Standard office storage solutions, like filing cabinets and shelving, also represent a stable cash cow, meeting basic office needs with predictable demand.

Core architectural interiors for corporate campuses, such as demountable walls, are classic cash cows for Haworth. These offerings are staples for large-scale projects, generating stable revenue from a mature market segment. Their enduring demand is fueled by established client relationships and efficient manufacturing processes, with the commercial interiors market seeing continued investment in workspace optimization throughout 2024.

| Product Category | Market Share | Growth Rate | Profitability | Investment Need |

|---|---|---|---|---|

| Systems Furniture (Cubicles/Workstations) | High | Low | High | Low |

| Ergonomic Task Seating (e.g., Zody) | High | Low | High | Low |

| Standard Office Storage | High | Low | High | Low |

| Architectural Interiors (Demountable Walls) | High | Low | High | Low |

Full Transparency, Always

Haworth BCG Matrix

The preview you see is the exact Haworth BCG Matrix document you will receive upon purchase, offering a clear and actionable framework for analyzing your business portfolio. This comprehensive report is designed to help you categorize your products or business units into Stars, Cash Cows, Question Marks, and Dogs, enabling informed strategic decisions. You'll gain immediate access to a fully formatted, ready-to-use tool for optimizing resource allocation and driving growth. No watermarks or demo content will be present; it's the complete, professional analysis you need.

Dogs

Outdated fixed-layout office furniture, designed for rigid, traditional workspaces, falls squarely into the dogs category of the BCG matrix. These products are struggling as the modern workplace embraces flexibility and hybrid models, leading to a shrinking market. Companies are actively seeking adaptable solutions, leaving these legacy items with a low market share and minimal growth prospects.

The demand for furniture suited only to fixed office layouts has seen a significant decline. For instance, the commercial furniture market, while growing overall, sees less investment in purely static designs. In 2023, the global office furniture market was valued at approximately $60 billion, but the segment for non-modular, fixed-layout pieces is contracting as businesses prioritize agility and employee well-being through reconfigurable spaces.

Continuing to invest in these outdated furniture lines offers little in terms of return on investment. Their low market share and lack of growth potential make them prime candidates for divestment or outright discontinuation. Businesses are increasingly divesting from underperforming product lines to focus resources on innovative, adaptable furniture solutions that cater to evolving work styles.

Niche, underperforming specialized furniture lines represent the Dogs in Haworth's BCG Matrix. These are products, perhaps custom ergonomic workstations for a very specific industry or unique modular seating for a limited architectural style, that failed to capture significant market share. Despite the initial investment in design and manufacturing, their sales are sluggish, and they contribute little to overall profitability, often just covering their own costs or running at a loss.

For example, a line of bespoke, high-end conference tables designed for a single, now-defunct corporate headquarters project would fall into this category. These items tie up valuable warehouse space and capital that could be reinvested in Haworth's more successful product categories, like their popular open-plan office systems or task chairs. In 2024, Haworth's focus remains on optimizing its portfolio, and such underperforming niche items are prime candidates for divestment or discontinuation to improve resource allocation.

Products with high material waste or low sustainability, often older designs or those with inefficient manufacturing, can fall into the Dogs category of the BCG Matrix. For instance, if a significant portion of Haworth's furniture lines still heavily rely on non-recycled plastics or energy-intensive production methods, they could become dogs.

As consumer and corporate demand increasingly favors sustainable and eco-friendly furniture, these less sustainable products will likely experience a decline in sales and market share. For example, a 2024 industry report indicated that 68% of B2B buyers consider sustainability a key factor in their purchasing decisions, a trend that will further marginalize less eco-conscious offerings.

Continuing to produce and market these items could also tarnish Haworth's brand reputation, especially in markets where environmental responsibility is highly valued. This is particularly relevant as global regulations around waste and emissions become more stringent, potentially increasing operational costs for older, less sustainable product lines.

Less Adaptable Storage Systems

Traditional, bulky storage systems that don't easily adapt to modern, flexible office layouts are prime examples of dogs in the Haworth BCG Matrix. These systems often struggle to integrate with evolving workspace designs, which increasingly favor modularity and open-plan concepts.

The demand for these rigid storage solutions is on a downward trend. This is largely due to the broader shift towards digital information management and the popularity of open office environments, which reduce the need for extensive physical storage.

These products typically hold a low market share within a segment that is experiencing a decline. Consequently, they offer minimal potential for future growth or substantial profitability for Haworth.

- Low Market Share: These systems represent a small portion of the overall storage market.

- Declining Market: The segment for traditional, non-modular storage is shrinking.

- Limited Growth Potential: Future expansion and increased sales are unlikely.

- Minimal Profitability: Due to low demand and market share, profits are negligible.

Specific Discontinued or Phasing-Out Product Variants

Within Haworth's product portfolio, certain office furniture lines that have experienced declining sales and are being phased out exemplify the 'dog' quadrant of the BCG Matrix. For instance, older, less ergonomic chair models that haven't been updated to meet current workplace wellness standards might be discontinued. These products often face intense competition from newer, more technologically advanced or aesthetically pleasing alternatives, leading to a shrinking market share.

These 'dog' products are characterized by their low market growth and low relative market share. For example, a specific line of traditional executive desks, perhaps introduced in the early 2010s, might now represent only a fraction of Haworth's overall desk sales. In 2023, such legacy products might have contributed less than 1% to total revenue, reflecting their diminished demand and the company's strategic shift towards modular and smart office solutions.

- Discontinued Product Example: Older, non-adjustable height workstation units.

- Reason for Phase-Out: Low demand due to the prevalence of sit-stand desks and evolving ergonomic requirements.

- Market Position: Represents a very small percentage of Haworth's current workstation sales, likely under 0.5% in 2023.

- Strategic Action: Inventory clearance or limited production for specific legacy clients before complete discontinuation.

Products in the 'Dogs' category of the BCG Matrix, such as outdated fixed-layout office furniture, are characterized by low market share in a declining market. These items, like legacy modular wall systems that no longer align with flexible workspace trends, are prime candidates for divestment. Their continued presence ties up resources that could be better allocated to high-growth areas.

The trend towards adaptable workspaces has significantly reduced demand for rigid furniture solutions. For instance, while the global office furniture market reached an estimated $60 billion in 2023, the segment for non-modular, static designs is contracting. This decline is driven by businesses prioritizing hybrid work models and reconfigurable environments.

Investing further in these underperforming product lines yields minimal returns. Their low market share and lack of growth prospects make them ideal candidates for discontinuation. In 2024, Haworth's strategic focus is on optimizing its portfolio, making these legacy items ripe for divestment to improve resource allocation and focus on innovative solutions.

Certain niche, underperforming specialized furniture lines, such as bespoke executive seating designed for a specific, now-outdated aesthetic, fall into Haworth's 'Dogs' category. Despite initial investment, these products exhibit sluggish sales and contribute little to overall profitability, often merely covering their own costs or operating at a loss.

| Product Category | Market Share | Market Growth | Profitability | Strategic Outlook |

| Fixed-Layout Workstations | Low | Declining | Low/Negative | Divest/Discontinue |

| Legacy Storage Systems | Low | Declining | Low | Divest/Discontinue |

| Outdated Ergonomic Chairs | Low | Stagnant | Low | Discontinue |

Question Marks

Advanced smart office integration systems, featuring AI for space optimization and predictive maintenance, represent a burgeoning high-growth market. These sophisticated solutions, while holding significant future potential, are currently considered question marks for Haworth, indicating a nascent market share.

Significant investment in research, development, and marketing is crucial for Haworth to capture a substantial portion of this emerging market. The complexity of these systems necessitates substantial resources to achieve widespread adoption and transition them into star products.

Haworth's exploration of subscription-based Workspace-as-a-Service (WaaS) offerings would likely place it in the question mark quadrant of the Haworth BCG Matrix. This segment represents a potentially high-growth area, mirroring the broader trend of service-based business models.

While the WaaS market is expanding rapidly, with global flexible workspace solutions projected to reach $200 billion by 2027, Haworth's initial market share in this specific niche would likely be low. This strategic pivot necessitates significant upfront investment in new infrastructure, sophisticated logistics, and a fundamental transformation of its traditional product-centric business model to establish a strong foothold and demonstrate long-term viability.

Haworth's exploration of augmented reality (AR) tools for space planning represents a classic question mark in the BCG matrix. While the potential for clients to visualize Haworth products in their own spaces is high, the company's current market share in AR software development is likely minimal. This segment demands significant investment to refine the technology, ensure seamless integration with sales channels, and cultivate market adoption.

New Ventures in Residential/Co-working Hybrid Solutions

Developing residential/co-working hybrid solutions would place Haworth in a nascent, high-growth market. While the 'resimercial' trend is booming, Haworth's established strength lies in traditional commercial interiors, suggesting a low initial market share in this new venture. This necessitates significant investment in market research and the creation of specialized products to capture this emerging demand.

The residential co-working market is rapidly expanding, driven by flexible work arrangements. For instance, a 2024 report indicated that over 60% of remote workers believe their home office setup is crucial for productivity. This presents a significant opportunity for Haworth to leverage its design and manufacturing expertise into a new, potentially lucrative segment.

- Market Potential: The global flexible workspace market, which includes co-working and hybrid models, was valued at over $16 billion in 2023 and is projected to grow significantly in the coming years, fueled by the resimercial trend.

- Competitive Landscape: While Haworth has a strong commercial presence, the resimercial space may see competition from furniture companies already specializing in home office solutions or adaptable modular furniture.

- Investment Required: Entering this market would require substantial upfront investment in research and development to create products that seamlessly blend residential aesthetics with functional workspace needs, potentially involving new materials or modular designs.

- Strategic Fit: This venture aligns with broader shifts in work and living patterns, offering Haworth a chance to diversify its portfolio and tap into a growing consumer and small business demand.

Biometric & Wellness-Focused Furniture Innovations

Biometric and wellness-focused furniture represents a frontier in office design, integrating advanced technology to monitor and improve user well-being. These innovations, such as chairs with real-time posture correction or desks that track activity levels, are positioned as question marks within Haworth's portfolio. The market for these highly specialized items is still developing, with significant growth potential but currently limited adoption.

The investment required for research and development in this area is substantial, as is the need to educate consumers on the benefits and functionality of such furniture. For instance, a 2024 report highlighted that while the global smart furniture market, which includes wellness features, is projected to reach over $5 billion by 2028, specific biometric furniture adoption rates are still in their early stages. Haworth's current market share in this nascent segment is consequently low, reflecting the early-stage nature of these innovative products.

- Emerging Market: The market for biometric and wellness-focused furniture is characterized by rapid growth but remains a relatively new and specialized segment.

- High R&D Investment: These cutting-edge products necessitate significant investment in research and development to integrate sophisticated sensors and algorithms.

- Consumer Education Needed: Widespread adoption requires substantial consumer education to highlight the value proposition and functionality of advanced wellness features in furniture.

- Low Current Market Share: Despite future potential, Haworth's market share in this specific niche is currently low, typical for question mark products in their early lifecycle stages.

Question marks in Haworth's BCG matrix represent emerging opportunities with high growth potential but currently low market share. These are areas where the company is investing significant resources to develop new products or enter new markets. Success in these segments is uncertain, requiring careful strategic planning and execution.

The company's focus on advanced smart office integration systems, Workspace-as-a-Service (WaaS), augmented reality (AR) tools for space planning, residential/co-working hybrid solutions, and biometric/wellness-focused furniture all fall into this category. These represent potential future growth drivers, but their current market penetration and profitability are yet to be fully established. Haworth must strategically nurture these question marks to convert them into future stars.

The success of these question mark initiatives hinges on substantial investment in research and development, marketing, and potentially new infrastructure. For example, the resimercial market, a key area for hybrid solutions, was projected to see significant growth, with a 2024 report indicating over 60% of remote workers prioritizing their home office setup for productivity, underscoring the market's potential.

The global smart furniture market, which includes wellness features, was estimated to reach over $5 billion by 2028, indicating the nascent but growing demand for biometric and wellness-focused furniture. Haworth's current market share in these highly specialized segments is low, reflecting the early stage of product development and market adoption.

| Product/Market Area | Growth Potential | Current Market Share | Investment Focus | Strategic Imperative |

|---|---|---|---|---|

| Smart Office Integration | High | Low | R&D, Marketing | Capture emerging tech demand |

| Workspace-as-a-Service (WaaS) | High | Low | Infrastructure, Sales Model | Adapt to service-based economy |

| AR for Space Planning | High | Low | Technology Refinement, Sales Integration | Enhance customer visualization |

| Residential/Co-working Hybrid | High | Low | Product Development, Market Research | Tap into flexible work trends |

| Biometric/Wellness Furniture | High | Low | R&D, Consumer Education | Innovate for user well-being |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.