Harmonic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harmonic Bundle

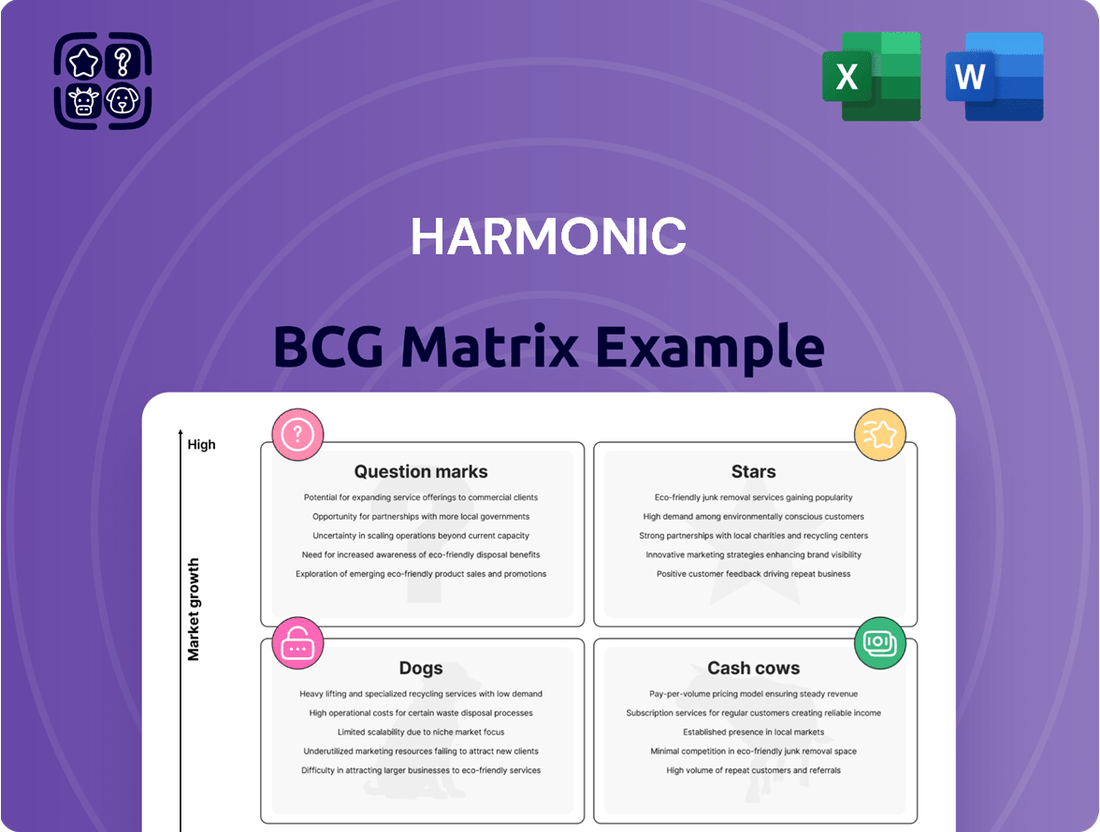

The Harmonic BCG Matrix offers a foundational understanding of a company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market share and growth. This glimpse into strategic positioning is crucial for informed decision-making. To truly leverage this powerful framework and unlock actionable insights for optimizing your product mix and resource allocation, dive deeper with the full BCG Matrix report. It's your essential guide to navigating market dynamics and driving profitable growth.

Stars

Harmonic is a clear leader in advanced cable access technologies, particularly its DOCSIS 4.0 offerings. The company has already achieved impressive, record-breaking speeds with this technology, setting the stage to secure a substantial portion of the market as the industry upgrades to the new standard.

The market is poised for significant growth in DOCSIS 4.0, with initial node shipments slated for late 2025. Harmonic's strategic positioning and technological prowess are expected to drive revenue growth starting in 2026, fueled by widespread customer adoption and successful implementation of their DOCSIS 4.0 solutions.

Harmonic's Video Streaming SaaS, spearheaded by its VOS360 platform, is a standout performer, demonstrating robust year-over-year revenue increases. This solution is instrumental in streamlining OTT video delivery through cutting-edge cloud and software innovations, enhancing revenue streams via sophisticated ad insertion and AI-driven processes.

The company achieved a record $15.4 million in Video SaaS revenue during the second quarter of 2025, with live sports broadcasts identified as a key driver of this growth. This segment is clearly positioned as a strong contender within the market.

Harmonic is solidifying its position in video delivery by highlighting advancements in hybrid cloud and on-premises streaming solutions. These offerings give customers the adaptability and efficiency needed to fine-tune their spending and operational processes. This strategic direction is designed to meet a wide range of customer needs by integrating the advantages of both cloud and on-premises infrastructure.

In 2024, Harmonic reported that a significant portion of its revenue comes from these flexible deployment models, demonstrating strong customer adoption. For instance, their cloud-native platform adoption grew by over 25% year-over-year, while on-premises deployments continued to be a robust segment for large broadcasters and content providers seeking direct control.

AI-Powered Video Workflows

Harmonic is making significant investments in AI to transform video workflows, aiming to boost viewer engagement and create new revenue streams. This strategic focus is designed to keep them ahead in the rapidly evolving video landscape.

The company is showcasing several AI-driven capabilities. These include speech-to-text for accurate captioning, AI-powered sports clipping for instant highlight generation, and automated translation. Additionally, AI is being used for the seamless insertion of in-stream ad formats.

- AI-Powered Captioning: Harmonic's speech-to-text AI can generate captions with high accuracy, improving accessibility and viewer experience.

- Real-Time Sports Highlights: AI-driven sports clipping enables the automatic creation of highlight reels during live events, capturing key moments instantly.

- Automated Translation: This feature expands content reach by providing automated translations, making videos accessible to a global audience.

- AI-Driven Ad Insertion: Harmonic is leveraging AI to automatically place in-stream ads, optimizing monetization without disrupting the viewer experience.

Fiber Deployment Solutions (cOS and SeaStar)

Harmonic's cOS platform stands out by enabling both DOCSIS and Fiber-to-the-Home (FTTH) services, a significant competitive edge. This unified approach simplifies network management and allows operators to offer a broader range of connectivity options.

The company has recently announced several new broadband wins specifically for fiber networks, underscoring its commitment to this growing segment. Furthermore, the introduction of the SeaStar Optical Node, designed for multi-dwelling units (MDUs), directly addresses the increasing demand for high-speed fiber connectivity in densely populated areas.

- Unified Platform: cOS supports both DOCSIS and FTTH, offering flexibility and a competitive advantage.

- Fiber Expansion: Harmonic is actively securing new fiber network wins.

- MDU Focus: The SeaStar Optical Node targets the lucrative MDU market for fiber deployment.

- Market Opportunity: These initiatives position Harmonic to capitalize on the strong global demand for enhanced broadband speeds.

Stars in the Harmonic BCG Matrix represent Harmonic's most promising growth areas, characterized by high market share and high market growth. These are the segments where Harmonic is a clear leader and the market itself is expanding rapidly. The company's investments in these areas are expected to yield significant future returns.

Harmonic's DOCSIS 4.0 technology is a prime example of a Star, given its record-breaking speeds and the anticipated industry-wide upgrade cycle. Similarly, their Video Streaming SaaS, particularly the VOS360 platform, is performing exceptionally well, driven by innovation in cloud, software, and AI for video delivery and monetization.

The company's strategic focus on AI-powered video workflows, including automated captioning, sports clipping, and ad insertion, also positions it as a Star. These advancements enhance viewer engagement and create new revenue opportunities in a rapidly evolving market.

Harmonic's cOS platform, supporting both DOCSIS and FTTH, and their recent fiber network wins, including the SeaStar Optical Node for MDUs, further solidify their Star status in the broadband connectivity sector.

| Segment | Market Position | Market Growth | Key Differentiator | 2024 Data Point |

|---|---|---|---|---|

| DOCSIS 4.0 | Leader | High | Record speeds, industry upgrade | Anticipated node shipments late 2025 |

| Video Streaming SaaS (VOS360) | Strong Performer | High | Cloud/Software innovation, AI monetization | Record $15.4M Video SaaS revenue Q2 2025 |

| AI in Video Workflows | Emerging Leader | High | Enhanced engagement, new revenue streams | Over 25% year-over-year cloud-native platform adoption |

| Fiber Connectivity (cOS, SeaStar) | Growing Leader | High | Unified platform, MDU focus | Multiple new broadband wins for fiber networks |

What is included in the product

The Harmonic BCG Matrix categorizes products/business units by market share and growth, guiding investment and divestment decisions.

Visualize your portfolio's health with a clear, quadrant-based overview.

Cash Cows

Harmonic's established broadband access solutions, specifically its DOCSIS 3.1 offerings, function as a robust cash cow. This segment has consistently delivered substantial revenue and EBITDA, underpinning the company's financial stability.

Despite the industry's gradual shift towards DOCSIS 4.0, the extensive existing deployment of DOCSIS 3.1 guarantees sustained demand. Harmonic's strong market share in mature broadband markets ensures this segment remains a reliable and significant contributor to the company's financial performance through 2024 and beyond.

Harmonic's traditional broadcast video appliances, like the Software Spectrum X media server, represent a strong Cash Cow. These on-premises solutions, including the XOS Advanced Media Processor, have consistently delivered stable revenue and impressive profit margins for the company.

Despite the industry's move towards cloud, these legacy appliances remain vital for a substantial segment of broadcasters and service providers. Their established reliability and performance are key reasons for continued demand, allowing Harmonic to focus on maintaining profitability in this mature market.

Harmonic's existing customer base, featuring giants like Comcast and Charter, forms a bedrock of its financial strength. These relationships, built on years of service, contribute substantially to the company's revenue streams.

The ongoing service contracts are crucial, generating a predictable cash flow. This stability stems from the essential support and maintenance required for Harmonic's deployed solutions, ensuring consistent income.

In 2023, Harmonic reported that its top four customers accounted for approximately 50% of its total revenue, highlighting the importance of this established base and their continued reliance on Harmonic's services.

Content Preparation and Processing Solutions

Harmonic's solutions for content preparation and processing are critical, forming the bedrock of efficient video delivery. These offerings, while perhaps not experiencing explosive growth, are indispensable for media companies and service providers. Their foundational nature in the video workflow guarantees consistent demand, translating into stable and reliable revenue streams for Harmonic.

These mature solutions are vital for ensuring the quality and readiness of video content, a non-negotiable aspect for any broadcaster or streaming service. For instance, in 2024, the global digital video market continued its expansion, underscoring the persistent need for robust content processing tools. Harmonic's role here is akin to a utility, providing essential services that media organizations depend on daily.

- Foundational Role: Harmonic's content preparation and processing solutions are essential for media workflows, ensuring content is ready for distribution.

- Mature Market: While not a high-growth area, these solutions serve a stable and consistent market demand.

- Revenue Stability: Their integral nature in video delivery contributes to predictable and reliable revenue streams for Harmonic.

- Market Demand: In 2024, the continued growth of the digital video market highlights the ongoing necessity for these critical services.

Channel Density and Bandwidth Efficiency Solutions

Harmonic's commitment to boosting UHD channel density and bandwidth efficiency, particularly for 5G applications, directly benefits their existing clientele by enabling better utilization of current infrastructure.

These advancements provide tangible, incremental upgrades to established systems, ensuring a steady revenue stream and reinforcing the cash flow generated from their loyal customer base through enhanced efficiency and reduced operational costs for clients.

- Optimized Infrastructure: Harmonic's solutions allow broadcasters to transmit more high-quality content within existing bandwidth constraints.

- 5G Integration: The focus on bandwidth efficiency is crucial for supporting the increasing demands of 5G networks and new video services.

- Customer Retention: By offering solutions that improve existing systems, Harmonic fosters long-term customer relationships and predictable revenue.

- Cost Savings for Clients: Enhanced bandwidth efficiency translates to lower operational costs for broadcasters, making Harmonic's offerings highly attractive.

Harmonic's established broadband access solutions, particularly DOCSIS 3.1, are key cash cows, consistently generating substantial revenue and EBITDA. This segment benefits from a large installed base, ensuring sustained demand despite industry shifts towards DOCSIS 4.0.

The company's traditional broadcast video appliances, like the Software Spectrum X media server, also act as strong cash cows. These on-premises solutions offer stable revenue and high profit margins, remaining vital for a significant portion of broadcasters due to their proven reliability.

Harmonic's existing customer base, including major players like Comcast and Charter, provides a predictable and significant cash flow through ongoing service contracts. In 2023, these top customers represented about 50% of Harmonic's revenue, underscoring their importance.

The company's content preparation and processing solutions are indispensable for media workflows, guaranteeing consistent demand and stable revenue. The global digital video market's continued expansion in 2024 highlights the persistent need for these essential tools.

| Segment | Role in Harmonic's Portfolio | Revenue Driver | Key Characteristics |

|---|---|---|---|

| DOCSIS 3.1 Broadband Access | Cash Cow | Substantial revenue and EBITDA | Large installed base, sustained demand |

| Traditional Broadcast Video Appliances | Cash Cow | Stable revenue, high profit margins | Proven reliability, essential for broadcasters |

| Existing Customer Base (Service Contracts) | Cash Cow | Predictable and significant cash flow | Strong customer loyalty, essential support |

| Content Preparation & Processing | Cash Cow | Consistent demand, stable revenue | Indispensable for media workflows, vital for digital video |

Delivered as Shown

Harmonic BCG Matrix

The preview you're seeing is the complete Harmonic BCG Matrix report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just the fully formatted, professionally designed strategic tool ready for your immediate use. You can confidently preview this document knowing it accurately represents the final, editable, and actionable report you'll download, enabling you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

Older, non-virtualized hardware represents Harmonic's Dogs in the BCG matrix. These are legacy products that were developed before the company's strategic shift towards virtualization and cloud-native solutions. They often lack a clear upgrade path to newer technologies such as DOCSIS 4.0 or seamless integration with cloud platforms.

These products are characterized by declining market share and very limited growth prospects. The industry's rapid move towards software-defined networking and virtualized architectures makes these older systems increasingly obsolete. Consequently, any further investment in these "Dogs" would likely result in diminishing returns for Harmonic.

Discontinued product lines within Harmonic's portfolio, such as legacy broadcast equipment that has been superseded by IP-based solutions, would likely reside in the Dogs quadrant. These products generate minimal revenue while still requiring some level of support, draining resources that could be allocated to growth areas.

Products or solutions that have failed to gain significant traction beyond specific, limited geographic regions or niche markets, despite initial expectations, can be categorized as Dogs within the Harmonic BCG Matrix. These typically exhibit low market share and limited growth potential due to their narrow appeal or an inability to compete effectively on a broader scale. Harmonic's revenue, for instance, is predominantly generated from the Americas, suggesting a potential concentration of its offerings within this region.

Highly Customized, One-Off Projects

Projects that are highly customized for specific clients and cannot be easily scaled or productized for wider market adoption might be considered Question Marks in the Harmonic BCG Matrix. These one-off endeavors, while potentially lucrative in the short term, often struggle with long-term growth due to their inherent limitations in market reach. For instance, a bespoke software development project for a single enterprise, while generating significant initial revenue, offers little in the way of recurring income or expansion into new customer segments.

These highly specialized projects typically demand substantial upfront investment in terms of time and resources, with the potential for high costs and consequently, often lower returns when viewed against their limited scalability. In 2024, the average cost for custom software development projects can range from $30,000 to $150,000, with larger, more complex systems potentially exceeding $250,000, yet the market for such niche solutions remains confined.

- Limited Scalability: Custom solutions cater to unique client needs, restricting their applicability to a broader market.

- Resource Intensity: Development and maintenance of one-off projects can be demanding, consuming significant capital and personnel.

- Low Growth Potential: Without a scalable business model, these projects offer minimal opportunity for significant market expansion or recurring revenue streams.

- High Cost, Low Return: The specialized nature often translates to high development costs with a restricted revenue base, impacting overall profitability.

Products Facing Intense Price Competition with Commodity Alternatives

Products facing intense price competition with commodity alternatives, often referred to as Dogs in the Harmonic BCG Matrix, are those where Harmonic's offerings have become commoditized. This means numerous vendors, including those with lower-cost options, now offer similar products, leading to fierce price wars. For instance, if Harmonic's legacy software suite for basic data processing has seen competitors emerge offering similar functionality at significantly lower price points, it would fall into this category.

Such products would struggle with thin profit margins and a declining market share. Customers, prioritizing cost savings, would gravitate towards cheaper alternatives, even if Harmonic's product historically offered superior features or brand recognition. This dynamic forces Harmonic to invest minimal resources, if any, into these products, as the return on investment is negligible, and the focus shifts to more promising areas of the business.

- Commoditization: Harmonic's basic cloud storage solutions, once a differentiator, now face intense competition from providers offering similar services at a fraction of the cost, with the global cloud storage market expected to reach $266.2 billion by 2027, growing at a CAGR of 15.8%.

- Price Sensitivity: Customers are increasingly choosing lower-cost, off-the-shelf hardware components for their IT infrastructure over Harmonic's integrated, but more expensive, solutions.

- Low Profitability: Products in this category typically operate with single-digit profit margins, making further investment unattractive and potentially draining resources from growth areas.

Dogs in Harmonic's BCG Matrix represent products with low market share and low growth potential. These are often legacy systems or offerings that have been outpaced by technological advancements or market shifts. For instance, older, non-virtualized hardware, or discontinued product lines like legacy broadcast equipment, fall into this category. These products typically generate minimal revenue while still requiring some support, thus consuming resources that could be better utilized elsewhere.

Products facing intense price competition and commoditization also reside in the Dogs quadrant. This occurs when multiple vendors offer similar functionalities at lower price points, leading to thin profit margins and declining market share for Harmonic. For example, basic cloud storage solutions might become commoditized as competitors offer similar services at lower costs. In 2024, the global cloud storage market continues to expand, but for commoditized offerings, the pressure on profitability remains high.

These products are characterized by their inability to scale or gain significant market traction beyond niche areas. Custom software projects for specific clients, while initially profitable, often lack the scalability for broader market adoption. The average cost for custom software development in 2024 can range significantly, but their limited market reach categorizes them as potential Dogs if growth prospects are dim.

Harmonic's strategy for its Dogs typically involves minimal investment, focusing on harvesting remaining value or phasing out support. The goal is to reallocate capital and resources towards more promising Stars and Question Marks to drive future growth and innovation.

Question Marks

Harmonic's leadership in Unified DOCSIS 4.0 places it in a strong position within a high-growth market. However, the industry's transition to this advanced technology is still in its nascent phases as of 2025, meaning widespread adoption and significant revenue generation from this segment are still on the horizon. This dynamic suggests a "Question Mark" classification, requiring strategic investment to capitalize on its future potential.

New fiber solutions, such as Harmonic's SeaStar Optical Node, are positioned as question marks in the BCG matrix. These innovative products target the expanding broadband connectivity market, particularly in multi-dwelling units (MDUs). While the market itself shows strong growth potential, these offerings are relatively new for Harmonic, meaning their current market share is likely modest as they work to gain traction and adoption.

The high growth potential of these new fiber solutions necessitates significant investment from Harmonic to build out infrastructure, marketing, and sales efforts. This investment is crucial for establishing a solid market position and capturing a larger share of the growing broadband expansion market. For instance, the global FTTH (Fiber to the Home) market was valued at approximately USD 115 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating a fertile ground for new solutions.

Harmonic's AI-driven programmatic ad buying for linear TV and automatic in-stream ad insertion are positioned as Stars within the Harmonic BCG Matrix. This segment showcases significant growth potential as the industry shifts towards more automated and data-driven advertising. The market for these advanced solutions is rapidly expanding, with projections indicating continued strong upward trends in programmatic TV advertising spend throughout 2024 and beyond.

While Harmonic's market share in this nascent area might currently be modest, the inherent growth trajectory of AI-powered media solutions suggests a high potential for future revenue generation. Significant investment in research and development is crucial for Harmonic to maintain its competitive edge and capture a larger portion of this evolving market. The demand for efficient, targeted advertising across all platforms, including traditional linear TV, is a key driver for this segment's success.

5G Application Integration for Video Delivery

Harmonic's integration of 5G for video delivery positions it within a high-growth market, leveraging its advanced video compression technology, including the Versatile Video Coding (VVC) codec and the DVB-NIP standard, to efficiently deliver high-definition content over 5G networks. This strategic focus targets the burgeoning 5G ecosystem, which is projected to see significant expansion in video consumption.

While the 5G market presents a substantial opportunity, Harmonic's specific market share within these emerging 5G video applications is still in its formative stages, indicating room for growth and development. The company's commitment to innovation in video delivery over next-generation networks is a key differentiator.

To capitalize on this expanding market, Harmonic's strategy likely involves crucial investments in research and development, alongside strategic partnerships. These efforts are vital for solidifying its position and capturing a significant share of the 5G video delivery landscape, which is expected to grow substantially in the coming years, with global 5G subscriptions predicted to surpass 1.5 billion by the end of 2024.

- Market Opportunity: The global 5G market is experiencing rapid expansion, with an increasing demand for high-quality video content delivery.

- Technological Edge: Harmonic's advanced video compression, including VVC and DVB-NIP, offers efficient HD video streaming over 5G, a critical advantage.

- Market Share Development: While the segment is high-growth, Harmonic's current market share in specific 5G video applications is still developing, presenting an opportunity for strategic gains.

- Strategic Imperatives: Continued investment and strategic partnerships are essential for Harmonic to effectively capture and expand its market share in this dynamic sector.

Expansion into New Geographic Markets (e.g., EMEA and APAC Broadband)

Harmonic's strategic push into EMEA and APAC broadband markets is a key element of its customer diversification strategy. This expansion aims to broaden its subscriber base beyond North America, tapping into regions with significant growth potential. For instance, in 2024, Harmonic reported continued progress in its international customer acquisition, with a notable uptick in revenue from the EMEA and APAC segments, though specific market share figures for these newer territories are still developing.

While Harmonic has experienced growth in its 'rest-of-world' customer base, penetrating new geographic markets like EMEA and APAC requires substantial and ongoing investment. The company's 2024 financial reports indicate increased R&D and sales expenditures directed towards these regions to build brand awareness and establish robust distribution channels. This investment is crucial for gaining traction against established competitors and capturing a larger market share.

- Geographic Focus: Harmonic is actively expanding its broadband customer base in EMEA and APAC.

- Growth Opportunity: These regions represent significant high-growth potential for Harmonic's broadband solutions.

- Market Share Dynamics: Market share in EMEA and APAC is likely lower than in the Americas, necessitating continued investment.

- Investment Strategy: Sustained investment is required for market penetration and customer acquisition in these new territories.

Harmonic's Unified DOCSIS 4.0 technology represents a significant opportunity in a rapidly evolving broadband landscape. As the industry transitions to this advanced standard, Harmonic's early positioning places it in a favorable spot, though widespread adoption and substantial revenue realization are still developing. This makes it a classic "Question Mark," demanding strategic investment to secure future market leadership.

New fiber solutions, such as Harmonic's SeaStar Optical Node, are being introduced to a growing broadband connectivity market, particularly within multi-dwelling units. While the overall market shows robust growth, these specific offerings are relatively new for Harmonic. Consequently, their current market share is likely modest as they work to establish a stronger foothold and gain broader customer acceptance.

The high growth potential of these new fiber solutions necessitates considerable investment from Harmonic. This includes building out infrastructure, enhancing marketing efforts, and expanding sales channels to effectively compete and capture a larger slice of the expanding broadband market. The global FTTH market's significant growth, projected at over 15% CAGR through 2030, underscores the strategic importance of these investments.

| Category | Market Growth | Harmonic's Position | Strategic Implication |

|---|---|---|---|

| Unified DOCSIS 4.0 | High (Emerging) | Early Mover, Developing Market Share | Invest to capture future leadership |

| New Fiber Solutions (e.g., SeaStar) | High (Broadband Expansion) | New Entrant, Modest Market Share | Invest for market penetration and growth |

| 5G Video Delivery | High (5G Ecosystem Growth) | Developing Market Share, Tech Advantage | Invest in R&D and partnerships |

| EMEA/APAC Broadband Expansion | High (Geographic Growth) | Developing Market Share, New Markets | Sustain investment for market capture |

BCG Matrix Data Sources

Our Harmonic BCG Matrix is built on comprehensive market data, integrating financial reports, industry growth rates, competitor analysis, and consumer trend insights for strategic clarity.