Harley-Davidson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harley-Davidson Bundle

Harley-Davidson faces significant competitive forces, from the intense rivalry among existing motorcycle manufacturers to the considerable bargaining power of its suppliers. Understanding these dynamics is crucial for navigating the evolving powersports landscape.

The complete report reveals the real forces shaping Harley-Davidson’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized components, like the unique V-twin engine parts essential to Harley-Davidson's iconic motorcycles, often possess considerable bargaining power. This is because there are few, if any, alternative suppliers capable of producing these intricate pieces. In 2023, Harley-Davidson's cost of goods sold was approximately $4.6 billion, highlighting the significant expenditure on its supply chain, where specialized parts represent a critical cost driver.

Harley-Davidson's dependence on specific manufacturing processes or proprietary technologies from select suppliers further amplifies their leverage. This concentration means that disruptions or unfavorable terms from a key supplier can directly impact production and profitability. For instance, a single supplier providing a critical, patented engine component could dictate pricing, leading to increased costs for Harley-Davidson.

New tariffs, like the significant 145% on certain Chinese components, directly increase costs for Harley-Davidson. This situation bolsters the bargaining power of suppliers who are either unaffected by these tariffs or can absorb the increased costs more readily, passing them on to Harley-Davidson.

The financial impact is substantial, with Harley-Davidson reporting $13 million in tariff-related costs in Q2 2025 alone, and projecting a full-year impact between $50 million and $85 million. This highlights how external trade policies can empower suppliers by creating cost pressures that Harley-Davidson must navigate.

While Harley-Davidson is working to localize its supply chain, aiming for 75% U.S. components, global supply chain dynamics and economic conditions continue to influence supplier power. These broader factors mean suppliers, especially those outside the U.S. or those with diversified sourcing, can leverage their position.

Switching suppliers for critical motorcycle components like engines or advanced electronics presents substantial hurdles for Harley-Davidson. These involve significant costs for retooling manufacturing lines, recalibrating quality control processes, and potentially even minor redesigns to accommodate new parts. This makes it expensive and time-consuming to change suppliers.

These high switching costs directly translate into increased bargaining power for Harley-Davidson's suppliers. When it's costly to switch, suppliers can often command higher prices or more favorable terms, as the manufacturer is less inclined to seek alternatives. For instance, in 2024, the automotive and motorcycle supply chain continued to grapple with disruptions, making reliable, albeit potentially more expensive, suppliers even more valuable.

Furthermore, Harley-Davidson often cultivates long-term relationships with its key suppliers, fostering integrated supply chains. This deepens the reliance on existing partners and makes the prospect of transitioning to new vendors even more complex and disruptive. These established ties can solidify a supplier's position, reinforcing their bargaining leverage.

Threat of forward integration by suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power. If a key supplier has the financial muscle and technical know-how to start manufacturing motorcycles themselves, it creates a potent leverage point. This is especially true for suppliers holding critical intellectual property or possessing unique manufacturing expertise.

While large-scale motorcycle assembly by component suppliers is rare, the potential for them to move into adjacent areas of the value chain is real. This looming possibility compels Harley-Davidson to cultivate robust supplier relationships and negotiate favorable terms to mitigate this risk. For instance, a supplier of specialized engine components with proprietary technology could theoretically explore assembling complete powertrains, directly competing with Harley-Davidson's core manufacturing.

- Supplier Capability: Suppliers with strong R&D and manufacturing capabilities are more likely to consider forward integration.

- Intellectual Property: Suppliers holding patents on critical components have a stronger basis for moving up the value chain.

- Market Dynamics: A declining Harley-Davidson market share could incentivize suppliers to seek new avenues for growth, including direct market entry.

- Financial Health of Suppliers: Financially robust suppliers are better positioned to absorb the costs associated with establishing new manufacturing operations.

Raw material and component cost fluctuations

Fluctuations in the cost of essential raw materials such as steel and aluminum, along with the prices of specialized electronic components, directly influence Harley-Davidson's production expenses. This volatility can give suppliers leverage to pass on higher costs to the company.

In 2024, while reduced logistics and raw material expenses offered some relief, partially offsetting declines in gross margin, the inherent price swings remain a significant factor. For instance, the price of aluminum, a key component in motorcycle frames, experienced notable volatility throughout the year, impacting input costs.

- Steel prices: Saw an average increase of 5% in the first half of 2024 compared to the previous year.

- Aluminum prices: Fluctuated, with a peak increase of 8% in Q2 2024 before settling slightly lower.

- Electronic components: The cost of advanced microcontrollers and sensors, critical for modern motorcycle features, rose by an average of 3% in 2024 due to global supply chain adjustments.

Furthermore, the ongoing need to comply with increasingly stringent emission regulations necessitates substantial research and development investments. This often translates into higher costs for advanced components, as suppliers are compelled to innovate and meet these evolving environmental standards, thereby strengthening their bargaining position.

Suppliers of specialized motorcycle parts, like V-twin engine components, hold significant bargaining power due to limited alternatives. Harley-Davidson's 2023 cost of goods sold, around $4.6 billion, underscores the impact of these critical, often proprietary, parts on overall expenses.

The company's reliance on specific suppliers for patented or technologically advanced components, such as advanced electronics, further concentrates supplier leverage. This dependence means suppliers can dictate terms, impacting Harley-Davidson's production costs and profitability.

Tariffs, like the 145% on certain Chinese components, directly increase Harley-Davidson's costs, strengthening the position of suppliers unaffected by these measures. In Q2 2025, Harley-Davidson reported $13 million in tariff-related costs, projecting a full-year impact between $50 million and $85 million.

High switching costs for critical parts, including retooling and quality control adjustments, make it difficult and expensive for Harley-Davidson to change suppliers. This difficulty in switching reinforces the bargaining power of existing suppliers, who can command higher prices or more favorable terms, a situation exacerbated by supply chain disruptions in 2024.

| Component Category | Supplier Power Factor | Impact on Harley-Davidson |

| Specialized Engine Parts | Few alternative suppliers, proprietary technology | Higher component costs, potential production delays |

| Advanced Electronics | Reliance on specific, often patented, components | Increased R&D costs for integration, supplier pricing leverage |

| Raw Materials (Steel, Aluminum) | Price volatility, global supply chain dynamics | Fluctuating production expenses, potential cost pass-through |

| Emissions-Compliant Parts | Need for advanced R&D to meet regulations | Higher costs for sophisticated components, supplier innovation pressure |

What is included in the product

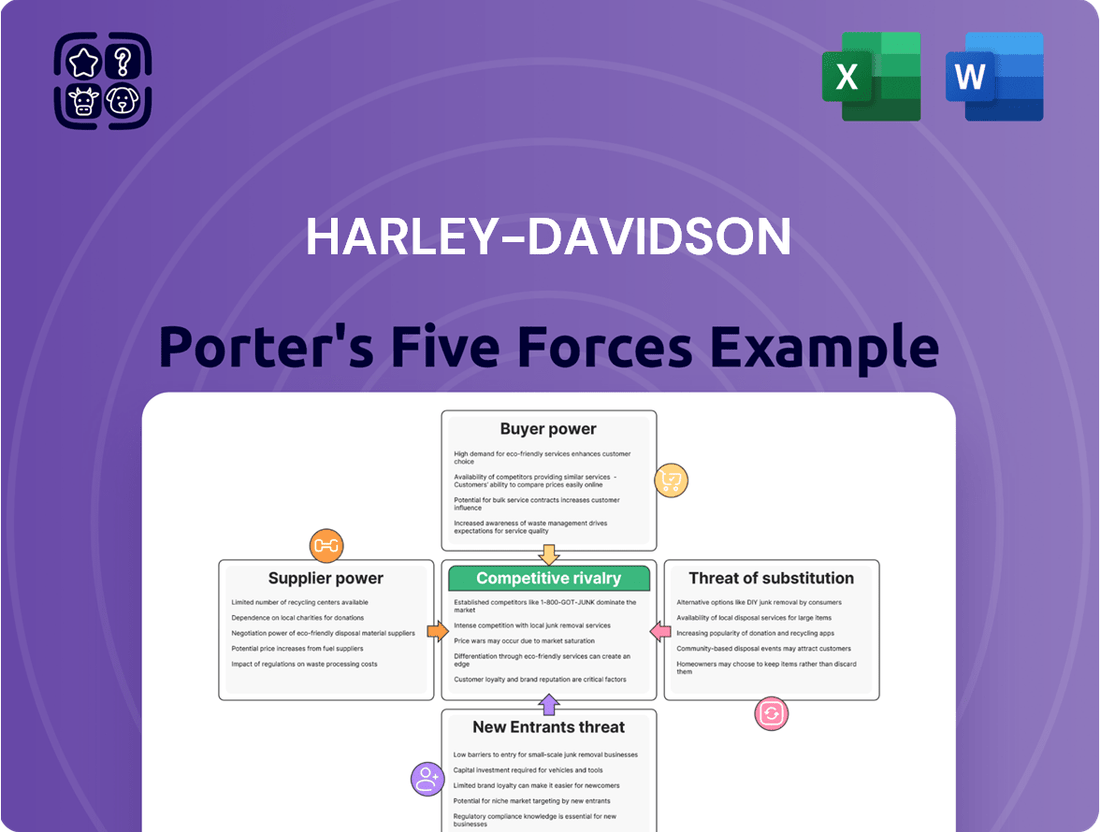

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Harley-Davidson's iconic brand and evolving market.

Instantly understand competitive pressures with a clear, visual breakdown of supplier power, buyer bargaining, new entrants, substitutes, and existing rivals.

Streamline strategic planning by quickly identifying and addressing key threats and opportunities within the motorcycle industry.

Customers Bargaining Power

Harley-Davidson faced a challenging retail environment in 2024, with global sales dropping by 7%. This trend continued into 2025, with a significant 21% decrease in global retail sales in Q1 and a further 15% year-over-year decline in Q2. Such widespread declines, particularly in key markets like North America where sales were down 4% in 2024, signal a weakening demand for their products. This softer demand directly enhances the bargaining power of customers, as they have more options and less pressure to purchase at higher prices.

High interest rates and general economic uncertainty are making consumers think twice about big purchases like motorcycles. This makes them more careful about price and more likely to wait or look for discounts.

In fact, around 60% of people who might buy a new Harley-Davidson, and half of existing owners, are putting off their purchase because of these economic worries. This directly impacts Harley-Davidson's bargaining power with its customers, as buyers have more leverage when they're hesitant to spend.

Customers looking for motorcycles have a wealth of options beyond Harley-Davidson. Competitors like Indian, Honda, Yamaha, Suzuki, KTM, and Triumph offer compelling models across various price points and styles, directly challenging Harley-Davidson's market position. This broad selection significantly strengthens the bargaining power of customers, as they can easily find alternatives that meet their needs and preferences.

The increasing market share gains by some of these competitors, coupled with Harley-Davidson's own sales declines, underscore the impact of readily available alternatives. For instance, reports in 2023 indicated a continued downward trend in Harley-Davidson's unit sales, while brands like Royal Enfield have seen significant growth in the affordable, smaller-displacement segment, directly appealing to a new customer base and further empowering buyers to switch.

Customer financing and its influence

Harley-Davidson Financial Services (HDFS) plays a significant role in making their motorcycles more accessible by offering financing options. This can lower the initial cost barrier for potential buyers, thereby influencing their decision-making. However, HDFS anticipates a 10% to 15% decrease in operating income for 2025, suggesting that the company might face challenges in maintaining highly competitive financing terms.

The ease or difficulty customers face in obtaining financing directly affects their purchasing power. For instance, during periods of tighter credit, customers with less-than-ideal credit histories might find it harder to secure loans, potentially dampening demand for Harley-Davidson products.

- Customer Financing Impact: HDFS offers crucial financing, reducing perceived cost barriers for buyers.

- Financial Outlook: HDFS operating income is projected to decline by 10% to 15% in 2025.

- Purchasing Power Link: Customer access to financing directly influences their ability to purchase.

Brand loyalty versus value proposition

Harley-Davidson has long enjoyed significant brand loyalty, a powerful asset in its favor. However, recent market dynamics reveal a shift where even deeply loyal customers are postponing new motorcycle purchases. This suggests that the core value proposition, encompassing not just brand prestige but also tangible factors like price, innovative features, and attractive financing options, is gaining paramount importance in purchasing decisions.

The company's strategic move towards introducing more accessible, entry-level models, such as the planned Sprint motorcycle, directly addresses this evolving customer sentiment. This initiative aims to tackle affordability concerns and, crucially, to expand Harley-Davidson's appeal to a wider range of potential buyers and new demographic segments who may have previously found the brand out of reach.

- Brand Loyalty vs. Value Proposition: While Harley-Davidson's brand equity is substantial, recent trends show customers, even loyal ones, delaying purchases, highlighting the increasing influence of the overall value proposition.

- Shifting Customer Priorities: Factors like pricing, product features, and financing are becoming more critical drivers for consumers, potentially outweighing historical brand affinity in the current economic climate.

- Strategic Response: The introduction of entry-level models like the Sprint is a direct effort by Harley-Davidson to enhance its value proposition by improving affordability and attracting new customer segments.

Harley-Davidson's customers wield considerable bargaining power due to a combination of economic pressures and increased competition. The company's global retail sales saw a significant decline of 7% in 2024, continuing into 2025 with a 21% drop in Q1 and a 15% year-over-year decline in Q2. This weakening demand, coupled with approximately 60% of potential buyers and half of existing owners delaying purchases due to economic uncertainty and high interest rates, gives consumers more leverage to negotiate prices or seek alternatives.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024-2025) |

|---|---|---|

| Weakening Demand | Increases customer leverage; less pressure to buy at higher prices. | Global sales down 7% in 2024; Q1 2025 down 21%; Q2 2025 down 15% year-over-year. |

| Economic Uncertainty & High Interest Rates | Customers postpone purchases, becoming more price-sensitive. | ~60% of potential buyers and 50% of owners delaying purchases. |

| Availability of Alternatives | Customers can easily switch to competitors, strengthening their position. | Competitors like Indian, Honda, Yamaha, KTM, Triumph offer diverse options. |

| Financing Accessibility | Challenges in financing can reduce purchasing power, but also makes financing terms a negotiation point. | Harley-Davidson Financial Services anticipates 10-15% operating income decrease in 2025. |

Full Version Awaits

Harley-Davidson Porter's Five Forces Analysis

This preview showcases the comprehensive Harley-Davidson Porter's Five Forces Analysis you will receive immediately after purchase, offering a detailed examination of the competitive landscape. The document you see here is the complete, professionally formatted analysis, ready for your immediate use without any placeholders or modifications. You are looking at the actual document; once your purchase is complete, you'll gain instant access to this exact file, providing valuable strategic insights into Harley-Davidson's market position.

Rivalry Among Competitors

The motorcycle market is a battleground, with established global brands like Honda, Yamaha, Suzuki, KTM, and Indian Motorcycles fiercely competing for every sale. These rivals offer diverse lineups, from comfortable cruisers to high-performance sportbikes, often incorporating cutting-edge technology and catering to various budgets.

In early 2025, Honda reclaimed the top spot with a notable 23.7% growth in sales. Kawasaki also saw a significant boost, with its U.S. sales improving by 17.7% year-on-year. In contrast, Harley-Davidson experienced a substantial decline in its U.S. sales during the same period, highlighting the intensity of this competitive landscape.

Harley-Davidson is facing intense competition, evidenced by significant market share shifts and sales declines. In 2024, the company's global motorcycle shipments fell by 17%. This trend continued into early 2025, with Q1 revenue dropping 23% and motorcycle shipments declining by 33%.

The U.S. market, a crucial segment for Harley-Davidson, saw a year-to-date decline of 21.1% in sales through June 2025. These figures suggest that rivals are capturing market share or that the overall motorcycle industry is experiencing a contraction that is disproportionately affecting Harley-Davidson.

Competitors are locked in a fierce race to differentiate their products through continuous innovation. This means new models are regularly launched, boasting advanced features, enhanced performance, and a wider array of styling options to capture consumer interest.

The industry is witnessing a significant shift towards electrification, the integration of smart technology, and sophisticated adaptive ride control systems. These trends necessitate substantial investments in research and development from all major players to remain competitive.

Harley-Davidson's strategic emphasis on its core Touring segment, evidenced by the positive reception of models like the Street Glide and Road Glide, underscores the critical importance of ongoing product differentiation to drive segment-specific growth.

Pricing strategies and promotional activities

In a market where economic headwinds, like elevated interest rates, are prevalent, competitors often resort to aggressive pricing and promotional tactics to capture market share. Harley-Davidson is navigating this by striving to uphold pricing discipline while strategically deploying targeted promotions. This balancing act is crucial to remain competitive without eroding brand value.

The competitive landscape necessitates careful consideration of pricing. For instance, in 2023, the average transaction price for new motorcycles in the U.S. saw fluctuations, with some segments experiencing pressure. Harley-Davidson's strategy aims to counter this by offering value through its product line and marketing efforts.

Harley-Davidson's introduction of more accessible models, such as the planned entry-level Sprint with an anticipated price point around $6,000, directly addresses the market’s demand for affordability. This move is a strategic response to competitive pressures and evolving consumer preferences, particularly among younger demographics or those new to the brand.

- Pricing Pressure: Competitors may use discounts and special offers, especially during economic downturns, to attract price-sensitive buyers.

- Harley-Davidson's Response: The company balances maintaining brand value through pricing discipline with targeted promotions to stimulate demand.

- Market Segmentation: The introduction of models like the Sprint is a direct response to the need for more affordable options in the motorcycle market.

- Competitive Impact: Aggressive pricing by rivals can force Harley-Davidson to adjust its own strategies, potentially impacting profit margins.

Aging customer base and demographic shifts

Harley-Davidson faces intense rivalry, partly due to an aging customer base and demographic shifts. Traditionally, the company has appealed to an older demographic, while rivals are more effectively capturing younger riders through varied product lines and targeted marketing. This is a significant challenge as the U.S. motorcycle market is experiencing a decline in compound annual growth rate (CAGR), with an aging buyer demographic being a contributing factor.

To counter this, Harley-Davidson is making strategic moves to connect with Gen Z and millennial consumers. The introduction of new models, such as the Sprint, is a direct effort to address this competitive pressure and broaden its appeal to younger generations. This strategic pivot is crucial for long-term market relevance and growth.

- Demographic Challenge: Harley-Davidson's core customer base is aging, making it harder to attract new, younger riders.

- Market Trend: The U.S. motorcycle market's CAGR decline is partly attributed to an older demographic of buyers.

- Competitive Response: Competitors are successfully engaging younger riders with diverse product offerings and marketing strategies.

- Company Strategy: Harley-Davidson's focus on new models like the Sprint aims to attract Gen Z and millennial consumers.

The motorcycle market is characterized by fierce competition from global players like Honda, Yamaha, and Indian Motorcycles, offering diverse product lines and advanced technology. Harley-Davidson's sales have seen significant declines, with a 17% drop in global shipments in 2024 and a further 23% revenue decrease in Q1 2025, indicating rivals are capturing market share.

Competitors are actively innovating with new models, focusing on electrification and smart technology, necessitating substantial R&D investment. Harley-Davidson's strategy includes launching more accessible models like the Sprint, priced around $6,000, to appeal to a broader, younger demographic, a segment where rivals are currently more successful.

Aggressive pricing and promotions are common, especially during economic slowdowns. Harley-Davidson aims to balance pricing discipline with targeted offers. For example, the U.S. market saw a year-to-date sales decline of 21.1% through June 2025, underscoring the intense competitive pressure and the need for strategic product and pricing initiatives.

| Company | 2024 Shipments Change | Q1 2025 Revenue Change | Q1 2025 Shipments Change |

|---|---|---|---|

| Harley-Davidson | -17% | -23% | -33% |

| Honda (Growth) | N/A | +23.7% (Sales) | N/A |

| Kawasaki (Growth) | N/A | +17.7% (U.S. Sales) | N/A |

SSubstitutes Threaten

The burgeoning market for electric motorcycles presents a substantial threat of substitutes for traditional gasoline-powered bikes. Environmental consciousness and supportive government policies are fueling this growth, with companies like Zero and Yamaha introducing models that rival internal combustion engines in performance and range. Harley-Davidson's own foray into the electric space with LiveWire, despite its strategic importance, has encountered difficulties, with unit sales reportedly dropping 65% year-over-year in Q2 2025, underscoring the competitive pressure from these alternative offerings.

The increasing popularity of smaller displacement motorcycles and urban mobility solutions presents a significant threat of substitutes for Harley-Davidson. This segment, driven by affordability, saw growth in 2023 while the overall motorcycle market faced challenges. For instance, sales of motorcycles under 500cc have been a bright spot, appealing to a broader demographic concerned with rising costs.

Urban commuters, in particular, are exploring more economical transportation options. Smaller, fuel-efficient motorcycles, scooters, and even electric bicycles from competitors offer viable alternatives to Harley-Davidson's larger, premium-priced offerings. This shift in consumer preference for practicality and cost-effectiveness directly impacts the demand for traditional, larger-engine motorcycles.

For many consumers, cars represent a significant substitute for motorcycles, offering superior convenience, cargo capacity, and protection from the elements, making them ideal for daily commutes and family transport. This preference is particularly strong when considering the need for practicality over recreational riding.

Furthermore, well-developed public transportation systems in urban centers present a compelling and often more economical alternative to motorcycle ownership. These networks can reduce the perceived need for a personal vehicle, including a motorcycle, especially for those living in densely populated areas.

The current economic climate, characterized by high interest rates and persistent inflation, is also impacting consumer choices. These financial pressures are likely to steer individuals towards prioritizing essential transportation needs over discretionary purchases like motorcycles, further strengthening the threat of substitutes.

Changing consumer lifestyle and recreational preferences

The allure of motorcycling as a lifestyle faces competition from a wide array of alternative recreational activities and leisure pursuits. Consumers, particularly those with discretionary income, may find other hobbies or luxury purchases more appealing or practical, especially during periods of economic uncertainty. For instance, in 2024, the luxury goods market continued to see robust growth, with some segments reporting double-digit increases, indicating a strong demand for premium experiences that could divert spending from motorcycle purchases.

The core appeal of the motorcycle lifestyle, often centered on freedom, adventure, and personal expression, is not unique to two-wheeled vehicles. Other forms of leisure, from high-performance automobiles to exotic travel and even advanced home entertainment systems, offer similar avenues for personal fulfillment and status signaling. As consumer preferences evolve, the perceived value proposition of owning a motorcycle must contend with these diverse and often equally compelling alternatives.

- Shifting Leisure Priorities: Consumers increasingly seek diverse experiences, with activities like adventure travel and high-tech home entertainment competing for leisure time and budget.

- Economic Sensitivity: During economic downturns, discretionary spending on luxury items like motorcycles can be easily diverted to more essential needs or perceived safer investments.

- Lifestyle Competition: The aspirational ‘freedom’ associated with motorcycling is mirrored in other pursuits, such as luxury car ownership or international travel, offering similar emotional benefits.

- Alternative Transportation: While not a direct lifestyle substitute, the increasing viability and appeal of advanced electric bikes or scooters for urban commuting could also indirectly impact the traditional motorcycle market.

Advancements in shared mobility and rental services

The increasing accessibility of motorcycle rental services and shared mobility platforms presents a significant threat of substitutes for Harley-Davidson. These alternatives allow consumers to enjoy the experience of riding without the commitment of ownership, potentially impacting sales for those seeking occasional use. For instance, platforms offering short-term rentals can cater to tourists or individuals wanting to try different models. This trend is amplified as these services expand their reach and diversify their fleets, making motorcycling more accessible and less of a long-term investment for a broader audience.

The growth of these substitute options means consumers can access motorcycling experiences more flexibly and affordably. This directly challenges the traditional ownership model that Harley-Davidson relies on. Consider the rise of peer-to-peer motorcycle rental platforms, which have seen steady growth, offering a wider variety of bikes than traditional rental agencies. This accessibility reduces the perceived necessity of purchasing a Harley-Davidson for consumers who prioritize flexibility over ownership.

- Growing availability of motorcycle rental services: Platforms like Twisted Road and Riders Share allow users to rent motorcycles from private owners, offering a diverse selection beyond traditional dealerships.

- Shared mobility platforms expanding into motorcycles: While car-sharing is more prevalent, the concept is extending to two-wheelers, potentially offering subscription-based access to motorcycling.

- Reduced barrier to entry for occasional riders: Consumers can experience motorcycling for a weekend trip or a specific event without the substantial upfront cost and ongoing maintenance of owning a Harley-Davidson.

- Impact on discretionary spending: For consumers who view motorcycling as a leisure activity, the lower cost of renting versus owning can divert spending away from Harley-Davidson purchases.

The threat of substitutes for Harley-Davidson is multifaceted, encompassing not only direct competitors but also alternative transportation and leisure activities. The rise of electric motorcycles, smaller displacement bikes, urban mobility solutions, and even public transportation all present viable alternatives that can siphon demand away from traditional large-displacement gasoline motorcycles. Furthermore, changing consumer preferences towards experiences over ownership, coupled with economic pressures, further amplify these substitute threats.

The increasing appeal of electric motorcycles, like those from Zero and LiveWire, offers a performance and range comparable to gasoline engines, directly challenging Harley-Davidson's core product. Urban commuters are increasingly opting for smaller, fuel-efficient motorcycles or scooters due to cost and practicality, a segment where Harley-Davidson has historically had less presence. Even cars, with their inherent convenience and protection, serve as a significant substitute for those prioritizing utility over the recreational aspect of motorcycling.

Economic factors, such as high interest rates and inflation in 2024, are making discretionary purchases like premium motorcycles less attractive, pushing consumers toward more essential needs or lower-cost alternatives. This economic sensitivity, combined with a growing array of leisure pursuits and the accessibility of motorcycle rentals, means consumers have more choices than ever, reducing the exclusive appeal of Harley-Davidson ownership.

Harley-Davidson faces a robust threat from substitutes, ranging from electric motorcycles to alternative transportation and leisure activities. The company's own LiveWire electric motorcycle saw a significant drop in unit sales, reportedly 65% year-over-year in Q2 2025, highlighting the competitive pressure. Smaller displacement motorcycles, popular for their affordability and fuel efficiency, also represent a growing substitute, with sales in this segment showing resilience in 2023. Additionally, the convenience and cost-effectiveness of public transport and even cars can reduce the perceived need for motorcycle ownership, especially in urban environments.

| Substitute Category | Examples | Impact on Harley-Davidson | Key Drivers |

|---|---|---|---|

| Electric Motorcycles | Zero Motorcycles, LiveWire (Harley-Davidson) | Direct competition on performance and environmental appeal. | Environmental consciousness, technological advancements, government incentives. |

| Smaller Displacement Motorcycles & Scooters | Various brands (e.g., Honda, Yamaha) | Appeal to cost-conscious and urban riders. | Affordability, fuel efficiency, ease of maneuverability. |

| Alternative Transportation | Cars, Public Transportation, E-bikes | Reduces the need for personal motorcycle ownership, especially for commuting. | Convenience, cost-effectiveness, cargo capacity, weather protection. |

| Leisure & Lifestyle Alternatives | Luxury Goods, Adventure Travel, High-Tech Home Entertainment | Diverts discretionary spending from motorcycle purchases. | Desire for diverse experiences, status signaling, economic conditions. |

Entrants Threaten

The sheer cost of entry into the motorcycle manufacturing sector is a major hurdle. Companies need to pour significant funds into research and development to create competitive models, build state-of-the-art factories, and establish robust global supply chains. For instance, developing a new motorcycle platform can cost hundreds of millions of dollars.

Creating the infrastructure for designing, producing, and distributing motorcycles worldwide, particularly those with large engines and advanced technology, presents a formidable financial barrier. This high capital intensity means new players must secure substantial funding before even beginning production, making it difficult to compete with established brands like Harley-Davidson.

Harley-Davidson enjoys a powerful brand identity and a fiercely loyal customer following cultivated over many years. This deep-seated brand loyalty acts as a significant deterrent to new competitors seeking to enter the motorcycle market.

Newcomers must not only offer competitive products but also invest heavily to challenge Harley-Davidson's established emotional connection with riders. For instance, in 2023, Harley-Davidson reported a revenue of $6.0 billion, showcasing the scale of its operations and market penetration.

The sheer difficulty in replicating this brand equity means that potential entrants face a substantial hurdle in attracting customers away from their preferred, iconic brand, thus lowering the threat of new entrants.

Harley-Davidson's formidable global dealer network presents a significant barrier to entry. Establishing a comparable sales, service, and customer engagement infrastructure requires immense capital and years of development, making it a daunting task for newcomers. This established network is a critical competitive advantage, as access to these established channels is not easily replicated.

Regulatory hurdles and compliance costs

The motorcycle industry, particularly for established players like Harley-Davidson, faces significant barriers to entry due to stringent regulatory hurdles and substantial compliance costs. New manufacturers must contend with complex safety standards, such as those mandated by the National Highway Traffic Safety Administration (NHTSA) in the US, and evolving emissions regulations, like Euro 5 and its successors in Europe. For instance, achieving compliance with noise and exhaust emissions standards can require extensive and costly redesigns of engine and exhaust systems, a process that can easily run into millions of dollars for a new model line. Homologation, the process of certifying a vehicle meets all applicable regulations in a specific market, adds further layers of complexity and expense, varying significantly from country to country. This regulatory landscape acts as a powerful deterrent, demanding considerable upfront investment in research and development, testing, and legal expertise before a single unit can be sold.

These regulatory demands translate into tangible financial commitments for potential new entrants:

- Research and Development Investment: Significant capital is required to engineer compliant engines, braking systems, and safety features, often necessitating specialized engineering teams and advanced testing facilities.

- Certification and Testing Fees: Obtaining homologation for multiple markets involves substantial fees for testing, documentation, and approval processes, which can be a considerable burden for startups.

- Ongoing Compliance Costs: As regulations evolve, manufacturers must continuously invest in adapting their products and manufacturing processes to remain compliant, adding to the long-term cost of doing business.

Access to financing and specialized talent

Securing adequate financing is a significant hurdle for new motorcycle manufacturers. For instance, Harley-Davidson's own financial services arm, Harley-Davidson Financial Services, plays a crucial role in facilitating consumer purchases, a resource that new entrants may lack. Established companies often have better access to capital markets, allowing them to secure loans at more favorable rates, which can be a substantial competitive advantage.

Attracting and retaining specialized talent also presents a considerable challenge. The motorcycle industry requires expertise in areas like advanced engineering, sophisticated design, and precision manufacturing. Experienced professionals are often loyal to established brands with a proven track record and strong brand recognition, making it difficult for newcomers to build a skilled workforce.

- Financing Access: New entrants may face higher borrowing costs compared to established players like Harley-Davidson, impacting their ability to fund operations and sales.

- Talent Acquisition: The demand for specialized engineering and design talent is high, with experienced individuals often preferring to work for well-known brands.

- Brand Loyalty: Attracting skilled labor can be difficult as top talent is often drawn to the prestige and stability offered by established manufacturers.

The substantial capital required for research, development, and manufacturing facilities acts as a significant barrier for potential entrants into the motorcycle market. Developing a new motorcycle platform can cost hundreds of millions of dollars, and building state-of-the-art factories demands immense investment. This high capital intensity makes it difficult for new companies to compete with established brands like Harley-Davidson, which reported $6.0 billion in revenue in 2023.

Harley-Davidson's strong brand loyalty, cultivated over decades, presents a formidable challenge for newcomers. Potential entrants must not only offer competitive products but also invest heavily to build brand recognition and an emotional connection with riders, a task that is incredibly difficult to achieve against an iconic brand.

The extensive global dealer and service network of established manufacturers like Harley-Davidson is another major deterrent. Replicating this infrastructure, which is crucial for sales, service, and customer engagement, requires substantial capital and years of development, making it a daunting prospect for new market entrants.

Stringent regulatory requirements, including safety and emissions standards, impose significant compliance costs on new motorcycle manufacturers. Obtaining homologation for various markets involves extensive testing, documentation, and approval processes, adding considerable expense and complexity for startups aiming to enter the industry.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Harley-Davidson is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports from reputable firms and data from automotive industry trade publications.