Harley-Davidson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harley-Davidson Bundle

Harley-Davidson's iconic motorcycles are often seen as Cash Cows, generating consistent revenue, but what about their newer ventures or less popular models? Understanding where each product line fits within the BCG Matrix is crucial for strategic growth.

This preview offers a glimpse into Harley-Davidson's product portfolio, highlighting potential Stars and Question Marks. Purchase the full BCG Matrix report to gain a comprehensive understanding of their market position, uncover actionable insights, and chart a course for future success.

Stars

Harley-Davidson's Touring and Trike motorcycles, featuring iconic models such as the Street Glide and Road Glide, consistently demonstrate robust performance. These segments are pivotal to the company's success, reflecting a strategic focus on core strengths.

In 2024, these popular models fueled nearly 5% growth within the U.S. Touring segment. This impressive expansion bolstered Harley-Davidson's market share in this category to a commanding 74.5%, underscoring the brand's dominance.

Harley-Davidson's explicit strategy involves continued investment to fortify and expand its leadership position in these highly profitable segments. The company views these areas as crucial for sustained revenue and market influence.

Harley-Davidson's CVO (Custom Vehicle Operations) models, like the CVO Street Glide and CVO Pan America 1250, are its premium, limited-edition offerings. These bikes command higher prices due to their exclusivity and advanced features, making them strong profit contributors for the company.

In 2024, Harley-Davidson continued to focus on its high-margin segments, with CVO models playing a key role in this strategy. The company aims to drive innovation and profitability through these top-tier motorcycles, appealing to a dedicated customer base.

Harley-Davidson's Parts & Accessories segment, while experiencing a 4% revenue dip in Q2 2025, continues to be a bedrock of the company's financial health. This segment consistently generates revenue, often with healthier profit margins than the core motorcycle business, underscoring its importance for overall profitability and customer retention.

Harley-Davidson Financial Services (HDFS)

Harley-Davidson Financial Services (HDFS) acts as a crucial profit center for the parent company, offering essential financing options to both dealerships and individual buyers. Its financial performance remains strong, even with minor revenue fluctuations.

In the first quarter of 2025, HDFS demonstrated impressive profitability. Despite a slight dip in revenue, operating income saw a significant jump of 19%, reaching $64 million. This translates to a healthy operating income margin of 26.1%, highlighting the unit's efficiency and strong financial management.

The strategic importance of HDFS is further underscored by recent developments. A newly announced partnership is poised to inject substantial capital into the financial services arm, with projections indicating a significant boost to its overall earnings capacity. This move is expected to unlock new avenues for growth and enhance its contribution to Harley-Davidson's bottom line.

- Profit Driver: HDFS provides vital financing for dealers and customers, contributing significantly to Harley-Davidson's overall profitability.

- Q1 2025 Performance: Operating income rose 19% to $64 million, with a robust 26.1% operating income margin, despite a slight revenue decline.

- Strategic Partnership: A recent partnership is anticipated to unlock substantial cash flow and enhance HDFS's earnings potential.

Global Market Share in Specific Regions (e.g., India, Europe)

Harley-Davidson's global market share is showing promising signs of recovery, particularly in key regions. Despite broader sales headwinds, the company experienced a notable upswing in worldwide registrations for 2024. This growth was significantly bolstered by strong performance in emerging and recovering markets.

India emerged as a standout performer, with Harley-Davidson registering a remarkable 135% increase in sales for 2024. Europe also demonstrated robust growth, achieving a 15.6% rise in registrations during the same period. These figures highlight the strategic importance of these regions for Harley-Davidson's future market expansion and share acquisition.

- India's 2024 Registration Growth: +135%

- Europe's 2024 Registration Growth: +15.6%

- Market Focus: Emerging and recovering markets are key to Harley-Davidson's strategy.

- Strategic Expansion: Harley-Davidson is actively increasing its presence and market share in these high-growth areas.

Harley-Davidson's CVO models, positioned as premium, limited-edition offerings, represent a significant "Star" in the BCG matrix. Their exclusivity and advanced features drive higher prices and contribute strongly to profitability.

These high-margin products appeal to a dedicated customer base, reinforcing Harley-Davidson's strategy to drive innovation and profit through its top-tier motorcycles. The focus on CVO models is key to enhancing the company's overall financial performance.

The CVO segment, characterized by strong brand loyalty and premium pricing, demonstrates high market share and high growth potential. This strategic positioning allows Harley-Davidson to capitalize on demand for exclusive, high-performance motorcycles.

Harley-Davidson's CVO models, such as the CVO Street Glide and CVO Pan America 1250, are central to its "Stars" category due to their premium positioning and strong profitability. These limited-edition bikes command higher prices, reflecting their exclusivity and advanced features, making them significant profit contributors.

| BCG Category | Harley-Davidson Segment | Key Characteristics | 2024/2025 Data Points |

|---|---|---|---|

| Stars | CVO Models | Premium, limited-edition, high-margin, exclusive features | Focus on innovation and profitability; appeal to dedicated customer base. |

| Stars | Touring & Trike Motorcycles | Iconic models (Street Glide, Road Glide), robust performance, market dominance | Nearly 5% growth in U.S. Touring segment in 2024; 74.5% market share in this category. |

| Stars | Harley-Davidson Financial Services (HDFS) | Crucial profit center, financing for dealers and buyers, strong profitability | Q1 2025: Operating income up 19% to $64 million (26.1% margin); new partnership to boost earnings. |

What is included in the product

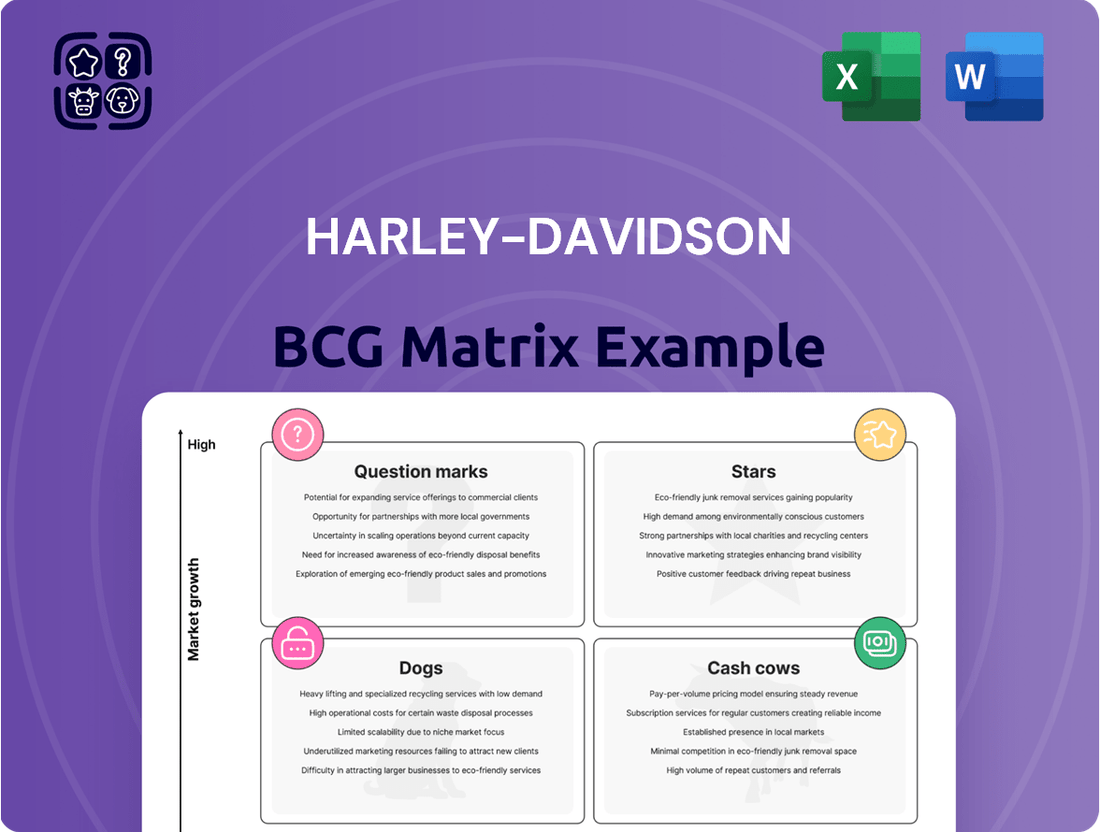

This BCG Matrix analysis categorizes Harley-Davidson's product lines into Stars, Cash Cows, Question Marks, and Dogs.

It guides strategic decisions on investment, divestment, and resource allocation for each product category.

Harley-Davidson's BCG Matrix analysis offers a clear, actionable roadmap for optimizing their product portfolio, acting as a pain point reliver by highlighting areas for investment or divestment.

Cash Cows

Harley-Davidson's traditional large cruiser motorcycles are firmly positioned as cash cows within its BCG matrix. The company commanded a substantial 37% share of the domestic heavyweight motorcycle market in 2024, a testament to the enduring appeal of its cruiser segment.

Despite a mature market with limited growth prospects, these models, such as the popular Softail series, generate reliable and substantial cash flow. This stability is largely due to Harley-Davidson's exceptionally strong brand loyalty and a deeply entrenched customer base that consistently drives sales.

Harley-Davidson's apparel and licensing segment, despite recent dips, functions as a classic Cash Cow. This division requires minimal new investment due to its established brand strength and high customer recognition, particularly for its iconic 'Bar and Shield' logo.

The enduring appeal of the Harley-Davidson lifestyle brand ensures consistent revenue generation beyond motorcycle sales. In 2023, Harley-Davidson reported that its Parts & Accessories and General Merchandise segments, which include apparel, contributed to a significant portion of its overall revenue, demonstrating the segment's ability to leverage brand heritage for steady income.

Harley-Davidson's established global dealership network acts as a significant cash cow. This extensive infrastructure, cultivated over many years, ensures a consistent and reliable channel for both motorcycle sales and crucial after-sales services and parts.

The maturity of this network means it requires minimal new capital investment for its core functions, allowing it to efficiently generate steady cash flow. In 2023, Harley-Davidson reported that its Parts & Accessories segment, heavily reliant on this network, generated $975 million in revenue, underscoring its role as a stable cash generator.

Brand Legacy and Customer Loyalty

Harley-Davidson's brand legacy is a significant asset, built over more than a century of motorcycle manufacturing. This heritage fosters a strong emotional connection with its customers, leading to exceptional brand loyalty.

This deep-seated loyalty translates into consistent sales for Harley-Davidson's core motorcycle models, even in a mature market. For instance, in 2023, Harley-Davidson reported approximately $6.0 billion in total revenue, underscoring the enduring demand for its established products.

- Brand Strength: Harley-Davidson's iconic status commands premium pricing and reduces marketing costs due to organic brand advocacy.

- Customer Loyalty: A dedicated rider community ensures repeat purchases and a stable revenue stream.

- Market Position: The brand is a recognized leader in the heavyweight cruiser segment, a segment it helped define.

- Revenue Contribution: Core motorcycle sales remain the primary revenue driver for the company.

Service and Maintenance Revenue

Harley-Davidson's service and maintenance revenue represents a classic Cash Cow. The company boasts a substantial installed base of motorcycles, estimated to be in the millions globally, which translates into a consistent demand for after-sales support. This segment is relatively insulated from the cyclical nature of new motorcycle sales, offering a predictable income stream. The enduring appeal and long operational life of Harley-Davidson bikes further solidify this ongoing revenue generation.

Key aspects of this Cash Cow include:

- Large Installed Base: Millions of Harley-Davidson motorcycles worldwide necessitate ongoing service and parts.

- Revenue Stability: Service and maintenance income is less volatile than new vehicle sales, providing financial predictability.

- Customer Loyalty: The strong brand loyalty encourages owners to return to authorized service centers.

- Long Product Lifespan: Harley-Davidson motorcycles are built for durability, ensuring continued demand for maintenance over many years.

Harley-Davidson's traditional cruiser motorcycles are its quintessential cash cows, commanding a significant market share and generating consistent profits. The company's substantial 37% share in the domestic heavyweight motorcycle market in 2024 highlights the enduring strength of this segment. These models, like the Softail series, benefit from immense brand loyalty, ensuring stable sales even with limited market growth.

The apparel and licensing division also operates as a cash cow, leveraging the iconic Harley-Davidson brand for minimal investment and high returns. This segment, which includes Parts & Accessories and General Merchandise, consistently contributes to overall revenue. In 2023, Parts & Accessories alone brought in $975 million, showcasing its reliable income generation.

Harley-Davidson's extensive global dealership network and its associated service and maintenance operations are also strong cash cows. The vast installed base of millions of motorcycles worldwide creates a steady demand for after-sales support, providing a predictable revenue stream. This segment is less susceptible to the fluctuations of new motorcycle sales, further solidifying its role as a stable profit generator.

| Segment | BCG Classification | 2023 Revenue (USD Millions) | Key Strengths |

| Cruiser Motorcycles | Cash Cow | ~$6,000 (Total Revenue) | High Brand Loyalty, Dominant Market Share |

| Apparel & Licensing | Cash Cow | ~$975 (Parts & Accessories) | Iconic Brand Recognition, Low Investment Needs |

| Service & Maintenance | Cash Cow | N/A (Included in Parts & Accessories) | Large Installed Base, Long Product Lifespan |

Preview = Final Product

Harley-Davidson BCG Matrix

The Harley-Davidson BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive immediately after purchase. This document is designed to provide comprehensive strategic insights into Harley-Davidson's product portfolio, categorizing its offerings into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate. You can confidently expect this analysis-ready file, free of watermarks or demo content, to be instantly downloadable for your business planning and competitive analysis needs.

Dogs

LiveWire, Harley-Davidson's electric motorcycle venture, is currently positioned as a 'Dog' within the BCG matrix, primarily due to its underperforming sales and persistent financial losses. In the first quarter of 2025, sales plummeted to just 33 units, representing a stark 72% decrease compared to the same period in the prior year. This performance directly contributed to an operating loss of $20 million for the electric segment.

Harley-Davidson's management has publicly expressed diminishing patience with LiveWire's trajectory, signaling a reluctance to inject additional capital beyond the existing loan arrangements. This stance underscores the brand's challenging market position and the significant hurdles it faces in achieving profitability and market share.

Within the large cruiser segment, certain older or less popular models might be classified as Dogs in Harley-Davidson's BCG matrix. These models, while part of a generally strong category, are not capturing current consumer interest, contributing to slower overall growth in this area.

For instance, while Harley-Davidson's overall large cruiser sales saw a slight dip in early 2024 compared to previous years, specific models that haven't been updated to meet evolving rider preferences are likely the main culprits. The company's reported focus on revitalizing its core offerings suggests that underperforming large cruisers could be candidates for discontinuation or significant redesign in the near future.

Harley-Davidson's past ventures into smaller displacement motorcycles, excluding the current 'Sprint' project, can be viewed as question marks within their portfolio. These models, if they struggled to capture substantial market share or achieve profitability, likely drew valuable resources away from more successful ventures. For instance, the lack of significant sales figures for earlier small-bike attempts highlights the challenge Harley faced in this segment before the 'Sprint' initiative.

Certain International Markets with Declining Sales

Certain international markets, like China and Japan, showed considerable weakness in their retail performance during 2024 and into Q2 2025. These regions, characterized by declining sales and limited growth prospects, represent areas where Harley-Davidson might need to re-evaluate its market focus and investment strategies.

The challenges in these specific markets place them in a position that aligns with the concept of 'Dogs' within the BCG Matrix. This classification suggests that these markets are not currently contributing significantly to the company's growth and may require a strategic decision regarding divestment or minimal resource allocation.

- China's retail sales experienced a notable downturn in 2024.

- Japan also reported significant weakness in its motorcycle market performance during the same period.

- These markets exhibit low growth potential, impacting overall sales figures.

- Harley-Davidson's strategic approach to these regions may need adjustment due to declining sales.

Specific Apparel Lines with Low Demand

Within Harley-Davidson's broader apparel offerings, specific product lines are currently experiencing low demand, positioning them as potential 'Dogs' in the BCG matrix. These underperforming segments contribute to higher inventory holding costs without generating sufficient sales. For instance, apparel revenue saw a notable decline of 13% in the second quarter of 2025, signaling that certain apparel categories are not resonating with consumers.

These specific apparel lines, characterized by slow sales and accumulating inventory, require careful management. The overall dip in apparel revenue highlights the need to reassess the product mix and marketing strategies for these less popular items. Addressing these 'Dog' segments is crucial for optimizing inventory levels and improving the profitability of the apparel division.

- Underperforming Product Lines: Specific apparel items with low sales velocity.

- High Inventory Costs: Products that tie up capital and incur storage expenses.

- Q2 2025 Revenue Decline: A 13% drop in apparel revenue indicates challenges in specific segments.

- Strategic Reassessment: The need to evaluate and potentially discontinue or rebrand low-demand apparel.

LiveWire, Harley-Davidson's electric motorcycle division, currently represents a 'Dog' in the BCG matrix. Its performance in Q1 2025 was particularly weak, with sales of only 33 units, a significant 72% drop year-over-year, resulting in a $20 million operating loss for the segment. This underperformance, coupled with management's expressed hesitation to invest further capital, highlights LiveWire's challenging market position and its struggle to achieve profitability.

| Segment | BCG Classification | Key Performance Indicators (Q1 2025/Early 2024 Data) | Strategic Implications |

|---|---|---|---|

| LiveWire (Electric) | Dog | Sales: 33 units (down 72% YoY) Operating Loss: $20 million |

Limited further investment, potential divestment or restructuring. |

| Underperforming Cruiser Models | Dog | Slower growth within a strong segment; models not meeting evolving preferences. | Discontinuation or significant redesign to align with market trends. |

| Certain International Markets (e.g., China, Japan) | Dog | Declining retail performance in 2024; limited growth prospects. | Re-evaluation of market focus and investment strategies; potential exit. |

| Specific Apparel Lines | Dog | 13% revenue decline in Q2 2025; low sales velocity, high inventory costs. | Product mix reassessment, potential discontinuation or rebranding of low-demand items. |

Question Marks

Harley-Davidson's planned introduction of new small cruisers (601cc-1200cc) in 2026 positions them as question marks within the BCG matrix. These models are entering a segment with growth potential, but their future market share is yet to be determined. For context, the global motorcycle market, including cruisers, was projected to reach over $100 billion by 2025, indicating a substantial opportunity.

Harley-Davidson's 'Sprint' model, entering the market around $6,000, represents a calculated effort to capture a younger demographic and tap into the burgeoning small-displacement motorcycle segment. This strategic positioning places it firmly in the Question Mark category of the BCG Matrix.

The 'Sprint' is designed to appeal to new riders and those seeking more accessible, urban-friendly motorcycles, a departure from Harley's traditional larger-displacement offerings. In 2024, the small-displacement motorcycle market, particularly in North America, has seen steady growth, with brands like Kawasaki and Honda already holding significant market share in this price point. Harley-Davidson's investment in the 'Sprint' aims to carve out a niche, but success hinges on overcoming established competition and building brand loyalty among a new customer base.

The Pan America, Harley-Davidson's bold foray into the lucrative adventure touring market, is currently positioned as a Question Mark in the BCG Matrix. This classification reflects its status as an expansion into a high-growth segment, but one where its market share and sales trajectory are still being established.

While the adventure touring segment offers significant potential, the Pan America's performance has been somewhat uneven. For instance, Q4 2024 shipments for the model were noted as being on the lower side, indicating that it hasn't yet achieved the dominant sales figures needed to move it into a stronger position.

To elevate the Pan America from a Question Mark to a Star, Harley-Davidson must continue to invest strategically in its development, marketing, and distribution. This includes refining the product based on rider feedback and effectively communicating its capabilities to capture a larger share of this competitive market.

Future Electric Motorcycle Models (beyond LiveWire's current struggles)

Despite LiveWire's current market position, Harley-Davidson's commitment to electric motorcycles is unwavering. Future electric models, potentially leveraging new technologies or strategic alliances, are positioned as question marks within the BCG matrix. The electric motorcycle market is experiencing rapid expansion, with projections indicating significant growth, but these ventures demand considerable capital and flawless execution to capture substantial market share.

- Market Growth: The global electric motorcycle market was valued at approximately $20.5 billion in 2023 and is projected to reach over $80 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 21.5%.

- Investment Needs: Developing new electric platforms, battery technology, and charging infrastructure requires substantial R&D and capital expenditure, placing these future models in a high-investment quadrant.

- Competitive Landscape: Intense competition from established players and new entrants necessitates innovation and effective go-to-market strategies to differentiate and gain traction.

- Brand Potential: Harley-Davidson's iconic brand could be a significant asset in attracting riders to its electric offerings, provided the new models deliver on performance and desirability.

Selective Expansion into New Geographies/Segments

Harley-Davidson's strategic plan, Hardwire, emphasizes a measured approach to entering new markets and customer segments. This selective expansion is crucial for identifying future growth opportunities that can transition from question marks to stars or cash cows in the BCG matrix. The company is focusing on regions and demographics where they believe they can achieve market leadership, rather than broad, unfocused growth.

These new ventures are inherently uncertain, requiring diligent analysis and resource allocation. For instance, Harley-Davidson has been exploring markets in Asia and focusing on younger demographics with models like the Pan America adventure bike. The success of these initiatives will determine their future placement within the BCG matrix.

- Selective Expansion: Targeting specific, profitable new geographies and customer segments for growth.

- Unproven Ventures: These new market entries are considered question marks, needing careful evaluation.

- Path to Leadership: Focus on segments where Harley-Davidson can realistically achieve a leading market position.

- Strategic Monitoring: Continuous assessment of performance to guide future investment decisions.

Harley-Davidson's new small-displacement cruisers and the Pan America adventure bike are currently classified as question marks. These ventures are in high-growth markets but have uncertain future market shares, requiring significant investment and strategic focus to succeed. The company's electric motorcycle initiatives also fall into this category, demanding substantial capital and innovation to gain traction against competitors.

These question mark products represent Harley-Davidson's strategic bets on future growth. Success in these areas, like the burgeoning small-displacement segment where brands like Honda and Kawasaki already hold strong positions, will depend on effective product development, marketing, and capturing new customer demographics. For example, the global motorcycle market is expected to continue its upward trajectory, offering fertile ground for these new offerings.

| Product/Segment | BCG Classification | Market Growth | Market Share Potential | Key Considerations |

|---|---|---|---|---|

| New Small Cruisers (e.g., 'Sprint') | Question Mark | High (growing segment) | Uncertain (new entrant) | Brand appeal to younger riders, competition, pricing strategy. |

| Pan America (Adventure Touring) | Question Mark | High (lucrative segment) | Developing (uneven initial performance) | Product refinement, marketing effectiveness, overcoming established rivals. |

| Future Electric Models | Question Mark | Very High (rapid expansion) | Uncertain (high investment, competition) | Technology, battery development, infrastructure, brand perception in EVs. |

BCG Matrix Data Sources

Our Harley-Davidson BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.