Hanwha Solutions Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Solutions Bundle

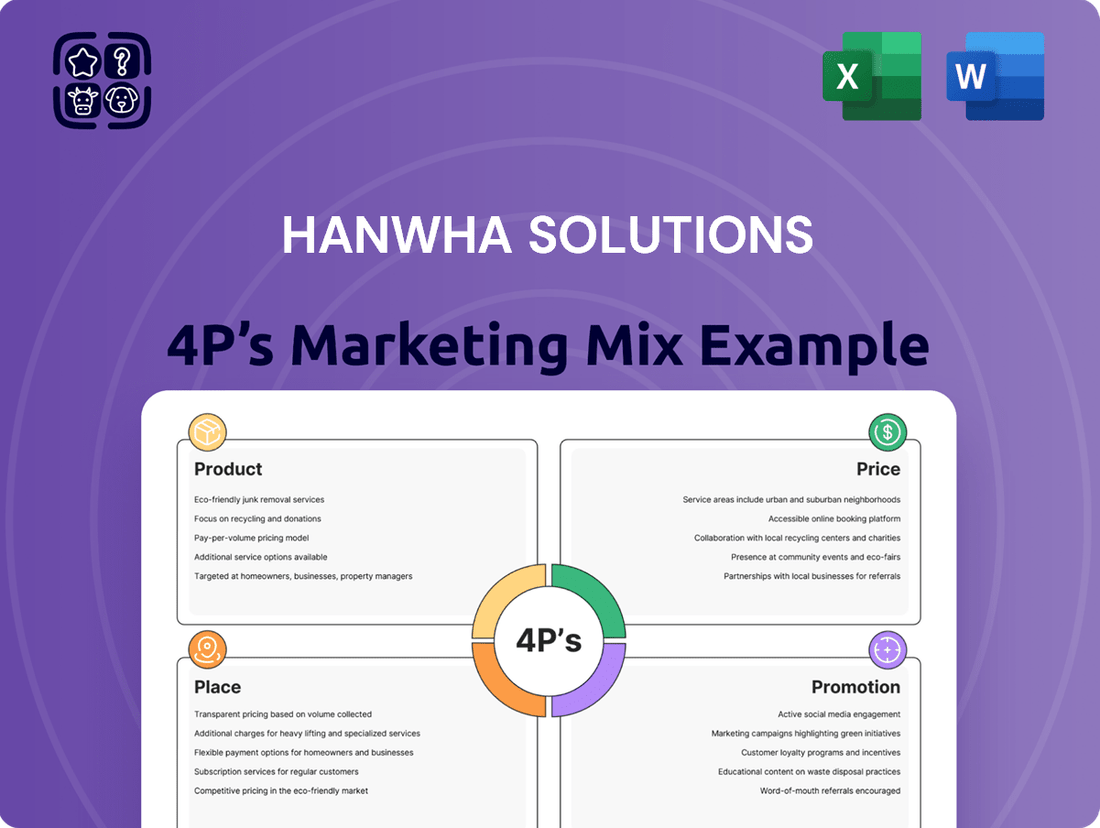

Hanwha Solutions masterfully navigates the market by integrating innovative products, competitive pricing, strategic distribution, and impactful promotions. Their product portfolio, spanning advanced materials and renewable energy solutions, addresses diverse global needs with a focus on sustainability. This comprehensive approach ensures they remain a leader in a dynamic industry.

Unlock a detailed understanding of how Hanwha Solutions leverages its Product, Price, Place, and Promotion strategies to achieve market dominance. This ready-to-use analysis is invaluable for business professionals, students, and consultants seeking actionable market insights.

Go beyond the surface with our complete 4Ps Marketing Mix Analysis for Hanwha Solutions. Discover their strategic product development, pricing architecture, distribution channels, and promotional campaigns in an editable, presentation-ready format.

Save hours of research and gain a competitive edge. Our pre-written analysis offers structured thinking, real-world examples, and actionable insights into Hanwha Solutions' marketing effectiveness, perfect for benchmarking or strategic planning.

Gain instant access to a professionally written, editable Marketing Mix report for Hanwha Solutions. This comprehensive analysis is tailored for both business and academic applications, providing a deep dive into their market success.

Product

Hanwha Solutions' Chemical Division offers a diverse portfolio of essential petrochemicals like polyolefin (PO), polyvinyl chloride (PVC), chlor-alkali (CA), and toluene diisocyanate (TDI). These are building blocks for crucial sectors such as construction, automotive, textiles, and electronics, showcasing the company's deep manufacturing experience. Hanwha Solutions reported revenue of approximately ₩2.3 trillion for its Chemical Division in Q1 2024, highlighting its significant market presence.

The division is strategically focused on increasing the value and cost-effectiveness of its existing products. Furthermore, it's actively investing in the development of more sustainable, eco-friendly chemical alternatives to meet growing environmental demands. In 2023, the company announced plans to invest heavily in green hydrogen production, a move that will likely influence its chemical product development and supply chain strategies moving forward.

Hanwha Advanced Materials focuses on high-performance plastics and specialized materials, notably lightweight composites for the automotive sector. This aligns with the Product strategy by offering innovative solutions that meet evolving industry demands.

Key products like Glass Fiber Mat Reinforced Thermoplastics (GMT) and Expanded Polypropylene (EPP) directly support growth in future mobility and eco-friendly energy. For instance, GMT's use in automotive components can reduce vehicle weight, improving fuel efficiency, a critical factor in the 2024 market.

Furthermore, their advanced film materials, including encapsulants and backsheets, are essential for solar energy applications. The global solar energy market is projected for significant expansion, with continued growth expected through 2025, making these products strategically vital.

Hanwha Qcells, a key player within Hanwha Solutions, dominates the solar energy market with its advanced solar cells and modules. Products like the Q.PEAK DUO series are engineered for superior efficiency and resilience, performing exceptionally even in challenging conditions such as low light and high temperatures. This focus on performance ensures reliable energy generation for diverse applications.

The company's commitment to innovation is evident in its pioneering work with perovskite-silicon tandem cell technology. This next-generation approach promises to dramatically boost solar module efficiency while simultaneously driving down manufacturing costs. As of early 2024, Hanwha Qcells continues to invest heavily in R&D, aiming to set new benchmarks in solar energy conversion.

Hanwha Qcells' product strategy emphasizes not just high efficiency but also long-term durability, a critical factor for solar investments. Their modules are designed to withstand environmental stressors, offering customers a dependable and cost-effective solution for renewable energy generation. This robust product offering solidifies their position as a global leader.

Complete Energy Systems & Solutions

Hanwha Solutions' Complete Energy Systems & Solutions, primarily through its Hanwha Qcells division, offers more than just solar panels. They provide integrated energy solutions, encompassing everything from large-scale solar farms to financing options. This holistic approach includes comprehensive Engineering, Procurement, and Construction (EPC) services tailored for diverse sectors like utility, commercial, government, and residential projects.

This strategy is reinforced by Hanwha's commitment to building a robust, integrated solar value chain. By controlling processes from ingot and wafer production all the way through to module manufacturing and power plant development, Hanwha Qcells ensures quality and efficiency across its offerings. This vertical integration is a key differentiator in the competitive energy market.

- Integrated Solutions: Hanwha Qcells delivers complete energy systems, not just individual components, including utility-scale projects and solar financing.

- EPC Services: The company provides end-to-end EPC services for a wide range of markets, from residential to large commercial and governmental installations.

- Value Chain Integration: Hanwha is actively developing its solar value chain, covering ingot, wafer, module manufacturing, and power plant development.

- Market Reach: Their comprehensive approach allows them to serve diverse customer needs across various segments of the energy market.

Solar Panel Recycling (EcoRecycle)

EcoRecycle by Qcells, launched in 2025, represents Hanwha Solutions' strategic play in the Product aspect of its marketing mix, directly addressing the burgeoning issue of solar panel waste. This new business vertical focuses on creating value from end-of-life solar panels by recovering essential materials such as aluminum, glass, silver, and copper. This not only reduces environmental impact but also positions Hanwha as a leader in sustainable solar energy solutions.

The initiative is designed to offer cost-saving take-back services, making it easier for solar asset owners to manage their retired panels responsibly. Furthermore, EcoRecycle is investing in advanced high-purity resource separation technology. This technological advancement is crucial for maximizing the recovery of valuable materials, thereby enhancing the economic viability of the recycling process and contributing to a more circular economy for the solar industry.

- Product Innovation: EcoRecycle by Qcells offers a novel recycling service for solar panels, turning waste into valuable resources.

- Environmental Focus: The service recovers materials like aluminum, glass, silver, and copper, significantly reducing the solar industry's environmental footprint.

- Economic Advantage: EcoRecycle provides cost-saving take-back services, offering a financial incentive for responsible panel disposal.

- Technological Advancement: Investment in high-purity resource separation technology aims to optimize material recovery and enhance the circular economy model.

Hanwha Solutions' product strategy is multifaceted, spanning foundational chemicals, advanced materials, and cutting-edge solar technology. The Chemical Division provides essential petrochemicals like PO, PVC, and CA, vital for industries from construction to automotive, contributing to the division's ₩2.3 trillion revenue in Q1 2024. Hanwha Advanced Materials focuses on lightweight composites and films for automotive and solar applications, with products like GMT enhancing fuel efficiency in vehicles. Hanwha Qcells leads in solar energy, offering high-efficiency modules and investing in next-generation perovskite-silicon tandem cells, aiming to boost efficiency and lower costs by 2025.

The introduction of EcoRecycle by Qcells in 2025 marks a significant product development, addressing solar panel waste by recovering valuable materials like aluminum and silver, and offering cost-saving take-back services. This initiative underscores Hanwha's commitment to sustainability and a circular economy within the solar sector.

| Product Area | Key Products | Target Market | 2024/2025 Focus | Data Point |

|---|---|---|---|---|

| Chemicals | Polyolefin (PO), PVC, Chlor-Alkali (CA), TDI | Construction, Automotive, Textiles, Electronics | Value enhancement, Eco-friendly alternatives, Green hydrogen investment | ₩2.3 trillion Chemical Division revenue (Q1 2024) |

| Advanced Materials | Lightweight Composites (GMT, EPP), Advanced Films | Automotive (future mobility), Solar Energy | Reducing vehicle weight, Enhancing solar module performance | GMT aids fuel efficiency in vehicles |

| Solar Energy (Qcells) | Solar Cells & Modules (Q.PEAK DUO), Perovskite-Silicon Tandem Cells | Residential, Commercial, Utility-Scale Solar Projects | High efficiency, Long-term durability, Next-gen cell technology R&D | Projected significant expansion of global solar energy market through 2025 |

| Recycling Services | EcoRecycle by Qcells | Solar Asset Owners | Solar panel waste management, High-purity resource separation | Launched in 2025; recovers aluminum, glass, silver, copper |

What is included in the product

This analysis provides a comprehensive examination of Hanwha Solutions' marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Hanwha Solutions' 4P's Marketing Mix Analysis acts as a pain point reliever by streamlining complex strategic decisions into a clear, actionable framework.

This analysis simplifies the marketing strategy, easing the burden on teams and leadership by providing a digestible overview of key elements.

Place

Hanwha Solutions leverages a robust global manufacturing network to support its market presence. A prime example is its significant investment in the United States, with the 'Solar Hub' in Georgia representing a fully integrated solar production facility. This facility handles everything from ingot and wafer production to cell and module assembly, underscoring a commitment to localized supply chains and efficiency for products like Hanwha Qcells.

Beyond solar manufacturing, Hanwha Solutions maintains critical chemical production facilities in key international markets. These include operations in China, Thailand, and Saudi Arabia. This strategic distribution of chemical production bases allows the company to effectively serve diverse regional demands and optimize its operational footprint, ensuring competitive cost structures and reliable supply for its various business segments.

Hanwha Solutions leverages direct sales and B2B channels for its chemical and advanced materials divisions, fostering close relationships with industrial clients. This strategy enables personalized solutions, crucial for large-scale, ongoing supply agreements. In 2023, Hanwha Solutions reported total sales of KRW 23.35 trillion, with its Chemical Division being a significant contributor, underscoring the importance of these direct client interactions.

Hanwha Solutions' Qcells division boasts a robust global sales and support network that is crucial to its marketing strategy. This network reaches across key markets in Europe, North America, Asia, South America, Africa, and the Middle East, demonstrating a commitment to widespread customer engagement.

This extensive geographical footprint allows Qcells to provide superior service and cultivate enduring relationships with a diverse customer base. Their clients include major players in the utility sector, commercial enterprises, governmental bodies, and individual homeowners.

The support infrastructure is designed to handle a comprehensive range of photovoltaic products and advanced energy storage solutions. Furthermore, it underpins their renewable electricity contracting services, offering end-to-end support for clients transitioning to sustainable energy.

In 2023, Qcells reported significant growth in its global operations, with a particular emphasis on expanding its presence in North America and Europe, markets that increasingly demand reliable solar and storage solutions. This expansion directly leverages their established sales and support network to capture market share.

Strategic Partnerships and EPC Services

Hanwha Solutions strategically utilizes partnerships, notably with Microsoft in 2024, to secure significant solar module supply agreements and Engineering, Procurement, and Construction (EPC) contracts. This collaboration enhances their global market presence for solar energy solutions by leveraging established networks and technological integration.

Through its dedicated subsidiary, Qcells Enable, Hanwha Qcells provides comprehensive, end-to-end EPC services. This allows them to directly manage and deliver complex solar projects for both commercial and utility-scale customers, streamlining project lifecycles.

- Strategic Alliance: Partnership with Microsoft for large-scale module supply and EPC contracts.

- Integrated EPC: Qcells Enable offers complete turnkey EPC services for direct project delivery.

- Market Penetration: This integrated approach enhances market access and project execution efficiency.

- Project Scale: Hanwha Qcells' total solar module shipments reached 9.9 GW in 2023, underscoring their capacity for large projects facilitated by these strategies.

Online Presence and Digital Platforms

Hanwha Solutions actively manages its online presence through comprehensive corporate websites and dedicated investor relations portals. These platforms serve as crucial channels for disseminating company news, financial reports, and strategic updates, fostering transparency and engagement with a broad range of stakeholders, including investors and business partners.

The Hanwha Vision segment, previously known as Hanwha Techwin, leverages digital platforms and an extensive network of online distributors to broaden its market reach. This digital strategy is essential for connecting with customers seeking advanced video surveillance solutions, facilitating sales and support in a competitive global market.

- Corporate Websites & IR Portals: Essential for B2B information dissemination and stakeholder engagement.

- Hanwha Vision's Digital Strategy: Utilizes online platforms and distributors to reach customers for video surveillance products.

- Global Reach: Digital channels are key to expanding market access for specialized solutions.

Hanwha Solutions' physical presence is anchored by its significant manufacturing hubs, notably the Georgia 'Solar Hub' in the US, which handles the entire solar production process. Complementing this, strategic chemical production facilities are located in China, Thailand, and Saudi Arabia, optimizing supply chains and regional market access.

The company’s distribution strategy involves direct sales and B2B channels for its chemical and advanced materials, fostering close ties with industrial clients. For its Qcells division, a vast global sales and support network spans continents, ensuring broad customer engagement and service for photovoltaic products and energy storage solutions.

Hanwha Solutions amplifies its reach through strategic digital platforms, including corporate websites and investor relations portals, crucial for information dissemination and stakeholder relations. Hanwha Vision further utilizes online distributors to expand its market for advanced surveillance solutions.

| Segment | Key Locations/Channels | 2023 Data/Relevance |

|---|---|---|

| Solar Manufacturing | Georgia, USA (Solar Hub) | Supports localized supply chains for Qcells products. |

| Chemical Production | China, Thailand, Saudi Arabia | Optimizes regional demand fulfillment and cost structures. |

| Chemical & Materials Sales | Direct Sales, B2B Channels | KRW 23.35 trillion total sales in 2023, with Chemical Division as significant contributor. |

| Qcells Sales & Support | Global Network (Europe, N. America, Asia, etc.) | 9.9 GW solar module shipments in 2023, emphasizing market penetration. |

| Digital Presence | Corporate Websites, Online Distributors | Facilitates information sharing and market access for all divisions. |

Preview the Actual Deliverable

Hanwha Solutions 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Hanwha Solutions 4P's Marketing Mix Analysis provides a comprehensive overview of their strategies. It delves into Product, Price, Place, and Promotion, offering valuable insights. You'll gain a clear understanding of how Hanwha Solutions positions itself in the market.

Promotion

Hanwha Solutions actively communicates its sustainability efforts through detailed annual sustainability reports and a robust corporate website presence. These platforms highlight their dedication to ESG principles, showcasing initiatives in areas like climate action and ethical business practices. In 2023, Hanwha Solutions reported a 13.6% increase in renewable energy use across its operations, underscoring its commitment to environmental stewardship.

The company’s transparent disclosure of its progress on climate change, sustainable product development, and corporate governance directly targets and resonates with investors and partners prioritizing environmental and social responsibility. This focus on clear communication aims to build trust and attract stakeholders aligned with their ESG vision.

Hanwha Solutions leverages industry exhibitions and conferences, like MADEX for defense and wire/cable shows for chemicals, to directly showcase its technological advancements and new product lines. These events are crucial for demonstrating integrated solutions and fostering valuable connections with potential clients and industry leaders.

In 2023, Hanwha Aerospace, a key part of Hanwha Solutions' broader ecosystem, reported significant growth, with participation in major defense expos playing a role in securing new contracts. For instance, the company's presence at events like the Defense & Security Equipment International (DSEI) allowed for high-level discussions that contributed to its expanding global footprint.

The chemical division's engagement at wire and cable exhibitions in 2024 highlights its commitment to presenting advanced materials. These platforms are vital for networking and identifying emerging market needs, directly impacting sales pipelines and brand visibility within specialized sectors.

Hanwha Solutions leverages its digital channels, like its newsroom and corporate blog, to disseminate thought leadership content. This strategy aims to position the company as an authority in areas such as advanced solar technology, including their work on perovskite-silicon tandem cells, which are projected to reach efficiencies over 30% by 2025. By sharing insights into industry trends, they attract a discerning audience interested in innovation and future market directions.

Strategic Alliances & Public Relations

Hanwha Solutions actively cultivates strategic alliances and public relations to bolster its brand and market standing. A notable example is its global solar alliance with Microsoft, which garnered significant positive media attention, underscoring Hanwha's leadership in renewable energy. This partnership, announced in late 2023, aimed to accelerate the adoption of clean energy solutions globally.

The company consistently leverages news releases to communicate key achievements, such as securing major contracts and reaching critical technological advancements. For instance, in early 2024, Hanwha Solutions announced a substantial solar module supply agreement for a utility-scale project in the United States, valued at over $500 million. Such announcements are crucial for maintaining investor confidence and market visibility.

Hanwha Solutions' PR efforts also focus on showcasing its commitment to sustainability and innovation. This includes participation in major industry events and collaborations with research institutions. In 2024, Hanwha announced an investment of $100 million into advanced solar cell research, further cementing its position as an industry innovator.

- Global Solar Alliance with Microsoft: Enhances brand image and market position in renewable energy.

- High-Profile Partnerships: Generate positive media coverage and demonstrate leadership.

- News Releases: Highlight significant contracts, like a $500M+ US solar project in early 2024, and technological milestones.

- Sustainability Focus: Reinforced by a $100M investment in advanced solar cell research in 2024.

Brand-Specific Marketing (Hanwha Qcells)

Hanwha Qcells, the consumer-facing solar brand of Hanwha Solutions, actively engages homeowners and businesses with its marketing. Campaigns highlight key selling points like superior efficiency, long-term durability, and competitive pricing. A strong emphasis is placed on robust warranties to build customer confidence in the renewable energy sector.

In 2024, Qcells has continued to invest in brand building, aiming to solidify its position as a reliable provider in the increasingly competitive solar market. This includes digital marketing initiatives and partnerships to reach a wider audience. Their strategy centers on communicating value, not just price, by showcasing the long-term benefits of their solar solutions.

Key marketing messages often revolve around:

- Product Performance: Emphasizing high efficiency ratings and advanced technology in their solar panels.

- Reliability and Durability: Showcasing the long lifespan and resilience of Qcells products against various environmental conditions.

- Customer Support and Warranties: Promoting comprehensive warranties that offer peace of mind to consumers.

- Cost-Effectiveness: Highlighting the return on investment through energy savings and potential incentives.

Hanwha Solutions employs a multi-faceted promotional strategy. This includes detailed sustainability reports and a strong online presence, highlighting ESG commitments and achievements like a 13.6% increase in renewable energy use in 2023. The company also actively participates in industry exhibitions, showcasing advancements in chemicals and aerospace, with Hanwha Aerospace securing new contracts through participation in events like DSEI in 2023.

Digital channels and thought leadership content, particularly on advanced solar technology like perovskite-silicon tandem cells (targeting over 30% efficiency by 2025), position Hanwha as an innovator. Strategic alliances, such as the global solar alliance with Microsoft announced in late 2023, coupled with targeted news releases on major contracts like a $500 million+ US solar project in early 2024, bolster brand image and investor confidence.

The consumer-facing brand, Hanwha Qcells, focuses on product performance, reliability, and customer support through marketing campaigns and robust warranties, aiming to build trust in the competitive solar market.

| Promotional Activity | Key Highlights | Data/Fact |

| Sustainability Communication | ESG Focus, Renewable Energy Use | 13.6% increase in renewable energy use (2023) |

| Industry Exhibitions | Showcasing Tech, Securing Contracts | Hanwha Aerospace presence at DSEI (2023) |

| Digital Content & Thought Leadership | Advanced Solar Tech (Perovskite-Silicon) | Targeting >30% efficiency by 2025 |

| Strategic Alliances & PR | Brand Enhancement, Media Coverage | Global solar alliance with Microsoft (late 2023) |

| News Releases | Contract Announcements, Milestones | $500M+ US solar project deal (early 2024) |

| Consumer Marketing (Qcells) | Product Value, Reliability | Emphasis on warranties and long-term benefits |

Price

Hanwha Solutions likely adopts a value-based pricing approach for its cutting-edge materials and specialized chemicals. This strategy is rooted in the superior performance, innovative nature, and customized applications these products offer to industrial customers.

The pricing directly reflects the tangible benefits these advanced materials deliver to clients' final products. For instance, in the automotive sector, this could translate to significant weight reduction, leading to improved fuel efficiency. In the solar industry, it means enhanced energy conversion rates for solar modules.

For example, Hanwha's advanced composites used in electric vehicle battery casings provide both structural integrity and thermal management, justifying a premium price. Similarly, their high-purity polysilicon for solar panels, crucial for maximizing photovoltaic efficiency, commands a price commensurate with its contribution to energy output.

This pricing model ensures that Hanwha Solutions captures the inherent worth of its technological advancements. By focusing on the value delivered, the company aligns its pricing with the economic advantages its materials provide to its diverse B2B clientele.

Hanwha Qcells positions its solar panels with competitive pricing, frequently using a price-per-watt metric to stay relevant in the dynamic global solar sector. This strategy ensures accessibility for a broad customer base.

For instance, in early 2024, the average price for solar panels hovered around $0.25 to $0.35 per watt, with premium brands like Qcells typically falling within the mid to upper end of this range, reflecting their advanced technology and performance metrics.

Qcells strives to strike a balance, offering high efficiency and robust durability without exorbitant costs, thereby delivering significant value to both residential and commercial clients looking for long-term energy solutions.

This approach to competitive pricing is crucial for market penetration, especially as the solar industry continues to expand and attract new consumers seeking cost-effective renewable energy options.

Pricing for Hanwha Solutions' large-scale energy projects, particularly solar power plants and EPC (Engineering, Procurement, and Construction) services, is highly customized. It's not a one-size-fits-all approach; instead, each project's price is a result of direct negotiation. This negotiation hinges on the unique scope of work, the intricate details of its complexity, and the sheer scale of the installation planned.

These arrangements frequently involve long-term agreements, reflecting the significant investment and operational lifespan of such projects. Key considerations influencing these prices include the projected levelized cost of electricity (LCOE), which estimates the total cost of building and operating a power plant over its lifetime. Additionally, government incentives play a crucial role; for instance, the U.S. Inflation Reduction Act offers benefits like the Advanced Manufacturing Production Credit (AMPC), directly impacting the final project cost for developers.

Dynamic Pricing based on Market Conditions

Hanwha Solutions employs dynamic pricing for its core petrochemical products, directly reflecting shifts in global supply and demand. This strategy is crucial for staying competitive, especially when raw material costs fluctuate significantly. For instance, in early 2024, the price of naphtha, a key feedstock, saw volatility, impacting production costs for Hanwha's polyethylene (PE) and polyvinyl chloride (PVC) products. The company actively adjusts its pricing to capitalize on favorable market conditions or mitigate losses during downturns.

The company's pricing strategy is a direct response to market dynamics, aiming for cost competitiveness across its product portfolio. This is evident in how Hanwha Solutions manages the price spreads for its key materials like PE and PVC. When these spreads weaken, indicating lower profitability, the company adapts its pricing to maintain its market position. Conversely, strong spreads allow for more robust pricing power.

- Global Naphtha Price (Jan-July 2024): Averaged around $600-$700 per ton, with notable spikes in Q2 2024 due to geopolitical tensions impacting supply chains.

- PE vs. Naphtha Spread (Q2 2024): Widened to approximately $400-$450 per ton, indicating improved profitability for polyethylene producers.

- PVC vs. Ethylene Spread (Q2 2024): Remained relatively stable, averaging around $250-$300 per ton, reflecting balanced market conditions for PVC.

- Regional Demand Impact: Strong automotive and construction sector recovery in Southeast Asia in late 2023 and early 2024 boosted demand for Hanwha's PVC products in those regions.

Impact of Regulatory Policies and Tariffs

Hanwha Solutions' pricing, especially for its solar products under the Qcells brand, is directly shaped by government regulations and international trade policies. For instance, the U.S. Section 201 tariffs on imported solar cells and modules have historically increased costs for manufacturers relying on overseas supply chains, impacting the final price consumers pay.

Hanwha Qcells' strategic decision to invest heavily in U.S. manufacturing facilities, including its Georgia plant, is a direct response to this regulatory landscape. By producing more components domestically, the company aims to capitalize on incentives like the Inflation Reduction Act's manufacturing tax credits, which can significantly lower production costs. This move also helps buffer against the financial impact of tariffs on imported materials, allowing for more stable and competitive pricing for its solar solutions in the U.S. market. For example, the Inflation Reduction Act of 2022 introduced production tax credits (PTCs) and investment tax credits (ITCs) designed to boost domestic clean energy manufacturing, with Hanwha Qcells being a major beneficiary, aiming to produce a significant portion of its solar module needs domestically by 2024.

- Tariff Mitigation: Section 201 tariffs on imported solar products can add substantial costs, influencing U.S. pricing strategies.

- Domestic Production Incentives: The Inflation Reduction Act (IRA) provides tax credits for U.S.-based manufacturing, lowering production expenses for companies like Hanwha Qcells.

- Investment in U.S. Manufacturing: Hanwha Qcells' Georgia facility, a multi-billion dollar investment, is designed to leverage these credits and reduce reliance on imported components.

- Price Competitiveness: Domestic production and credits enable more stable and potentially lower pricing for Qcells solar products in the competitive U.S. market.

Hanwha Solutions utilizes a tiered pricing strategy across its diverse product lines. For high-performance materials like advanced composites, value-based pricing reflects superior functionality, with premiums justified by benefits such as enhanced durability or efficiency, as seen in EV battery components.

In the solar sector, Hanwha Qcells employs competitive pricing, often benchmarked by price-per-watt, to ensure market accessibility. For instance, in early 2024, the average solar panel price was around $0.25-$0.35 per watt, with Qcells positioned competitively within this range.

Large-scale projects and EPC services feature highly customized, negotiated pricing based on project scope, complexity, and scale, often incorporating long-term agreements and considering factors like the projected Levelized Cost of Electricity (LCOE).

Petrochemical products are subject to dynamic pricing, directly influenced by global supply and demand for feedstocks like naphtha. This strategy ensures cost competitiveness, with pricing adjustments made to optimize profitability based on market spreads, such as the PE vs. Naphtha spread which averaged $400-$450 per ton in Q2 2024.

| Product Segment | Pricing Strategy | Key Influences | Example Data Point (2024) |

|---|---|---|---|

| Advanced Materials (e.g., EV Composites) | Value-Based Pricing | Performance, Innovation, Customization | Premium pricing for structural integrity and thermal management in EV battery casings. |

| Solar Products (Qcells) | Competitive Pricing | Price-per-watt, Market Share, Efficiency | Average solar panel price: $0.25-$0.35/watt; Qcells positioned mid-to-high end. |

| Energy Projects (EPC) | Customized/Negotiated | Project Scope, Complexity, LCOE, Government Incentives | Long-term agreements influenced by IRA tax credits for U.S. projects. |

| Petrochemicals (PE, PVC) | Dynamic Pricing | Global Supply/Demand, Feedstock Costs (Naphtha), Market Spreads | PE vs. Naphtha spread: $400-$450/ton (Q2 2024); PVC vs. Ethylene spread: $250-$300/ton (Q2 2024). |

4P's Marketing Mix Analysis Data Sources

Our Hanwha Solutions 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also leverage industry-specific market research and competitive intelligence to capture current product offerings, pricing strategies, distribution channels, and promotional activities.