Hailiang Education Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hailiang Education Bundle

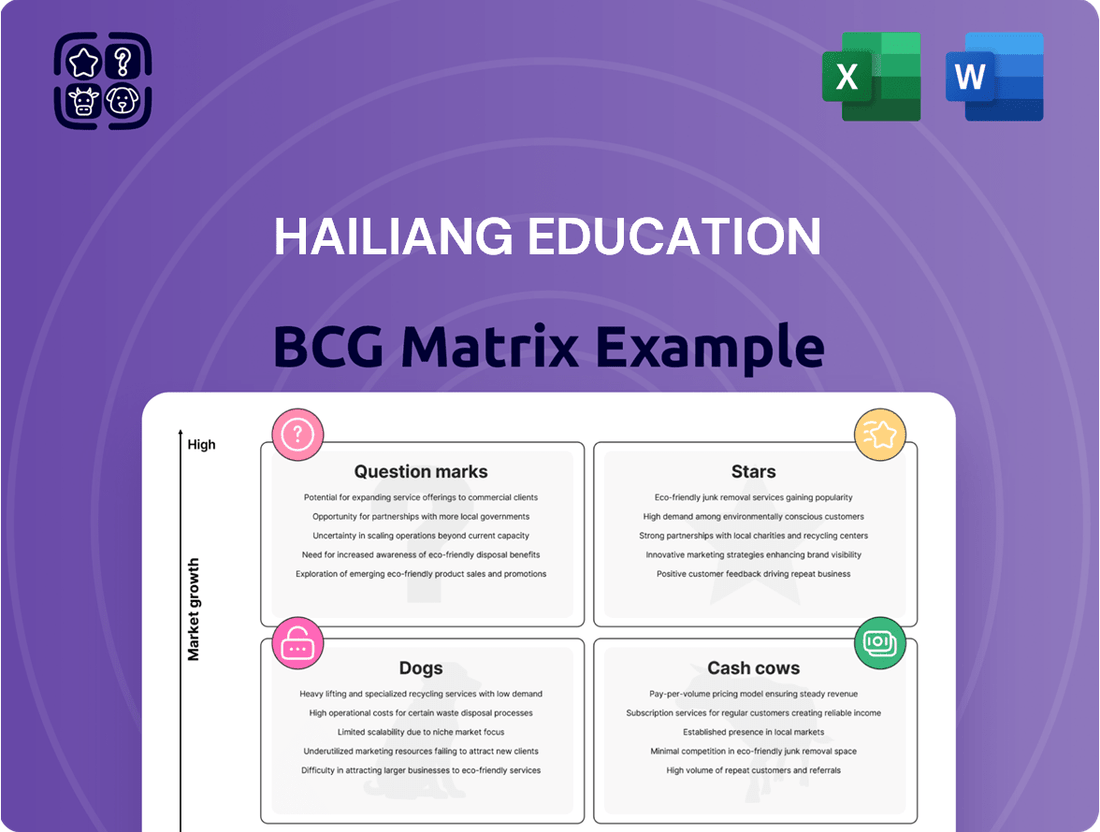

Curious about Hailiang Education's strategic positioning? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain a comprehensive understanding of their product portfolio's performance and identify key areas for growth and resource allocation.

Don't miss out on the actionable insights that will guide your investment decisions and empower your strategic planning for Hailiang Education.

Stars

Hailiang Education's international programs, such as A-levels and SAT preparation, are designed for students targeting universities abroad. This segment benefits from a robust demand and faces fewer regulatory hurdles than domestic compulsory education, positioning it for sustained expansion and market dominance.

The company's ambition to build a global educational presence by opening schools beyond China highlights the significant growth prospects within this high-demand international education sector.

Hailiang Education's high-end K-12 schools, encompassing primary, middle, and international programs, are strategically positioned to capture a premium segment of China's private education market. This focus on specialized, quality education appeals to families willing to invest more for advanced curricula and international standards.

The company's investment in these high-end offerings reflects a growing demand for differentiated educational experiences, particularly among affluent urban families. As of 2024, the private K-12 education market in China continues to expand, with premium segments showing robust growth driven by parental aspirations for their children's future success.

Hailiang's educational support services, encompassing study tours and consulting, are positioned to thrive. These offerings are relatively insulated from the direct impacts of recent compulsory education reforms, allowing them to tap into a growing demand for supplementary learning experiences. In 2023, the global educational tourism market was valued at approximately $180 billion, with projections indicating continued robust growth.

Public School Management Services

Hailiang Education's venture into providing management services to public high schools represents a strategic move into a high-growth market. This expansion leverages their established expertise, aiming to improve educational quality and operational efficiency in public institutions.

This initiative allows Hailiang to tap into new revenue streams by partnering with public schools, a sector actively seeking external support. For instance, in 2024, there was a notable increase in public-private partnerships within the education sector as districts looked for innovative solutions to budget constraints and performance improvement goals.

- Market Expansion: Hailiang Education is broadening its service offering by engaging with public high schools.

- Revenue Diversification: This strategy opens up new income channels beyond its existing private school operations.

- Growth Potential: The public education sector's demand for enhanced management and educational services presents significant growth opportunities.

- Expertise Leverage: Hailiang can capitalize on its proven success in school management to serve a wider client base.

Smart Campus Operation System

Hailiang Education's collaboration with Ruijie Networks to build a Smart Campus Operation System underscores its strategic focus on digitalizing education. This initiative aligns with the robust growth of technology integration in China's education sector, a trend expected to see significant expansion in the coming years.

The company's investment in this area positions it to capitalize on the increasing demand for advanced EdTech solutions. China's private education market is actively seeking digitalization and intellectualization, and Hailiang's Smart Campus Operation System is designed to be a key driver in this transformation.

- Digital Education Investment: Strategic partnerships like the one with Ruijie Networks for a Smart Campus Operation System highlight Hailiang's commitment to education digitalization.

- Market Growth Potential: Technology integration in education is a high-growth trend in China, with the EdTech market projected to reach substantial figures by 2025.

- Competitive Positioning: Hailiang's focus on innovation in digital campus solutions aims to capture market share in China's evolving private education landscape.

Hailiang Education's international programs and premium K-12 schools represent its "Stars" in the BCG matrix. These segments benefit from high demand and strong growth potential, particularly as affluent families increasingly seek specialized, globally-oriented education. The company's strategic investments in these areas, including expanding its international school footprint, underscore their position as key drivers of future revenue and market leadership.

| Segment | Market Growth | Competitive Position | Strategic Focus |

|---|---|---|---|

| International Programs (A-levels, SAT) | High | Strong, fewer regulatory hurdles | Expansion, market dominance |

| High-End K-12 Schools | High (premium segment) | Capturing affluent urban families | Premiumization, advanced curricula |

What is included in the product

This analysis categorizes Hailiang Education's business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic resource allocation.

The Hailiang Education BCG Matrix offers a clear, one-page overview, instantly identifying high-growth opportunities and underperforming assets to guide strategic resource allocation.

Cash Cows

Hailiang Education's Core K-12 Private Basic Education segment represents a significant Cash Cow. Historically, the company operated one of China's largest private K-12 school networks, ensuring a robust student base and consistent revenue streams.

Even with regulatory changes affecting for-profit compulsory education, these established schools maintain high enrollment and generate substantial, stable cash flow. This segment is characterized by mature operations and a strong market presence, serving as the bedrock of the company's foundational revenue.

The established school network in Zhejiang Province, operating under the 'Hailiang' brand in Zhuji city, represents a significant Cash Cow for Hailiang Education. These institutions, including the Zhuji Hailiang Foreign Language School and Tianma Experimental School, boast a long history and strong regional brand recognition.

These well-established schools benefit from consistent demand and high student capacity, leading to stable cash flow generation. For instance, Hailiang Education reported that its K-12 schools in China, which include these Zhejiang-based institutions, maintained high enrollment rates throughout the 2023-2024 academic year, underscoring their dependable revenue streams.

Hailiang Education's traditional primary and middle school programs are firmly established as cash cows. These programs hold a significant market share within a mature and stable educational sector.

Despite limited policy-driven growth potential in compulsory education, the substantial existing student base and established fee structures guarantee a steady and predictable stream of revenue for Hailiang. For instance, in the 2023 fiscal year, Hailiang Education reported total revenue of approximately $420 million, with a significant portion derived from its K-12 schools.

Given their strong market position and consistent performance, these foundational programs require minimal investment in aggressive marketing or expansion efforts, allowing them to generate substantial cash flow with relatively low operational costs.

Basic Educational Program Offerings

Hailiang Education's basic educational program offerings, encompassing their standard curriculum across various schools, are strong contenders for cash cows. These programs are the bedrock of their operations, consistently attracting a large student base due to their focus on comprehensive academic development.

The predictable demand and established operational efficiencies allow these programs to generate substantial and stable profits. For instance, in the 2023 fiscal year, Hailiang Education reported a significant portion of its revenue stemming from its core K-12 education segment, which includes these fundamental programs. This segment's consistent performance underscores its cash-generating capabilities.

Key characteristics supporting their cash cow status include:

- Proven Student Attraction: High enrollment numbers demonstrate consistent demand for the standard curriculum.

- Stable Revenue Streams: Predictable tuition fees and ancillary income contribute to reliable cash flow.

- Managed Operational Costs: Efficient management of school operations keeps expenses in check, maximizing profit margins.

- Established Market Position: A long-standing presence and reputation in the education sector solidify their market share.

Residential Boarding School Model

The residential boarding school model is a significant Cash Cow for Hailiang Education. These institutions typically charge higher tuition and fees due to the integrated living and learning experience they provide. In 2024, Hailiang's boarding schools demonstrated strong occupancy rates, contributing to a predictable and substantial revenue stream.

This established operational model benefits from existing infrastructure and well-honed student management systems, enhancing efficiency and profitability. The consistent demand for boarding education ensures these schools remain highly productive assets within the company's portfolio.

- High Revenue Generation: Boarding schools, with their comprehensive service offering, command premium pricing.

- Stable Cash Flow: Consistent demand and high occupancy rates ensure reliable revenue generation.

- Operational Efficiency: Existing infrastructure and management systems streamline operations, reducing costs.

- Market Dominance: Hailiang's established reputation in the boarding sector solidifies its position as a market leader.

Hailiang Education's core K-12 private basic education segment, particularly its established schools in Zhejiang Province, functions as a significant Cash Cow. These institutions, including the Zhuji Hailiang Foreign Language School, benefit from a long history and strong regional brand recognition, ensuring consistent student enrollment and predictable revenue streams.

The residential boarding school model is another key Cash Cow, commanding premium tuition and fees due to the integrated living and learning experience. In 2024, these schools demonstrated strong occupancy rates, contributing substantially to Hailiang's predictable revenue generation.

These segments require minimal investment for aggressive expansion, allowing them to generate substantial cash flow with managed operational costs and established market positions. For instance, in the 2023 fiscal year, Hailiang Education reported total revenue of approximately $420 million, with a significant portion derived from its stable K-12 education segment.

| Segment | Cash Flow Generation | Investment Needs | Market Position |

| K-12 Private Basic Education (Zhejiang) | High & Stable | Low | Strong Regional |

| Residential Boarding Schools | High & Predictable | Low | Market Leader |

| Overall K-12 Operations | Consistent | Low to Moderate | Dominant |

Full Transparency, Always

Hailiang Education BCG Matrix

The Hailiang Education BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis is ready for immediate strategic application, offering clear insights into Hailiang Education's market position. You can confidently expect the professional-grade report without any watermarks or demo content, ensuring it's perfectly suited for your business planning needs.

Dogs

Within Hailiang Education's vast network, schools experiencing persistent low enrollment or profitability due to intense local competition or shifts in community demographics would be categorized as dogs. These educational units consume valuable resources without making substantial contributions to the company's overall revenue or strategic expansion. For example, if a particular Hailiang school in a declining urban area saw its student numbers drop by 15% in 2024, falling below the breakeven point for operational costs, it would fit this description.

Legacy for-profit compulsory education assets in China, particularly those focused on primary and middle school education, are now in a challenging position following significant regulatory shifts. These segments are characterized by low growth potential and a shrinking market share due to the government's emphasis on public education and restrictions on for-profit operations.

Hailiang Education's older supplementary educational services and teaching methods, if they haven't kept pace with current trends and technology, would likely be classified as Dogs in the BCG Matrix. These offerings would struggle with low market share and declining student interest, failing to contribute meaningfully to revenue or growth.

For instance, if Hailiang continued to rely heavily on traditional, lecture-based tutoring for subjects where interactive, online platforms are now preferred, these services would be prime examples of Dogs. In 2024, the global EdTech market was projected to reach over $300 billion, highlighting the significant shift towards digital learning solutions that older methods might not address.

Less Differentiated Basic Programs

In the current educational landscape, K-12 programs that fail to offer distinct advantages or demonstrate superior academic results compared to competitors often fall into the "dog" category within a BCG matrix. These offerings struggle to capture and maintain student enrollment, leading to a diminished market share and minimal growth prospects.

Such programs do not enhance the company's competitive standing. For instance, if a large education provider like Hailiang Education Group (NASDAQ: HIL) were to offer generic K-12 curricula without specialized enrichment or advanced placement options, these would likely underperform.

Consider the competitive pressures: In 2024, the global K-12 education market is valued at hundreds of billions of dollars and is characterized by rigorous regulation and intense competition. Programs lacking a unique selling proposition, such as innovative teaching methodologies or strong alumni placement rates, would find it difficult to stand out.

- Low Market Share: Programs that are not differentiated will struggle to attract students, resulting in a small percentage of the overall student population.

- Stagnant Growth: Without unique appeal or proven outcomes, these programs will see little to no increase in enrollment over time.

- Limited Strategic Value: They do not contribute to the company's competitive edge or future growth potential.

- Resource Drain: Continued investment in underperforming programs can divert resources from more promising initiatives.

Divested or Non-Core Operations

Divested or non-core operations within Hailiang Education, prior to its going-private transaction, would likely be categorized as Dogs in the BCG Matrix. These were operations that demonstrated low growth potential and held a minimal market share, making them candidates for divestment or consolidation. For instance, if Hailiang Education had previously offloaded smaller, less profitable tutoring centers or educational technology ventures, these would fit this description.

These "Dogs" typically represent business units that were not contributing significantly to overall revenue or strategic growth. Their low market share meant limited competitive advantage, and the low growth environment suggested minimal prospects for future expansion. The decision to divest or absorb these segments into the parent company was a strategic move to streamline operations and focus resources on more promising areas.

- Divestment of Underperforming Assets: Operations with low market share and low growth prospects were divested.

- Consolidation into Parent Company: Non-core segments were merged to improve efficiency and focus.

- Strategic Resource Allocation: Divesting "Dogs" allowed Hailiang Education to reallocate capital to core, high-growth areas.

Educational programs within Hailiang Education that exhibit low student enrollment and minimal revenue generation, often due to intense competition or outdated offerings, are classified as Dogs. These units consume resources without contributing significantly to the company's growth or market position. For example, a K-12 program with a 5% market share in a saturated region and no discernible competitive advantage would be a prime candidate for this classification.

These "Dogs" represent a drain on resources, offering little return on investment. Their low market share and stagnant growth prospects limit their strategic value. By identifying and addressing these underperforming segments, Hailiang Education can optimize its portfolio and reallocate capital to more promising ventures.

| Category | Characteristics | Hailiang Education Example |

|---|---|---|

| Dogs | Low Market Share, Low Growth | Underperforming legacy tutoring centers in declining urban areas; K-12 programs lacking unique selling propositions. |

Question Marks

Hailiang Education's overseas school expansion initiative, targeting 10 new schools internationally by 2025, positions it as a potential "Question Mark" in the BCG matrix. This strategy targets a high-growth sector with aspirations of global brand leadership, but the ventures are in their early stages, implying a low current market share.

The significant capital investment and strategic focus required for these nascent international operations, coupled with the inherent uncertainty of success in new markets, further solidify their classification as Question Marks. For instance, in 2024, the company was reportedly exploring opportunities in Southeast Asia and Europe, markets characterized by robust educational demand but also intense competition and regulatory complexities.

Hailiang Education's strategy to develop specialized high school modules, including science and technology, humanities, arts, and sports, aims to capture niche but high-growth educational markets. These diverse offerings, while potentially starting with a low market share, are positioned to attract specific student groups and evolve into Stars within the BCG matrix.

The Integrated Education Center for Autism, as part of Hailiang Education's strategic initiatives, positions itself as a potential 'Question Mark' in the BCG Matrix. This venture targets a specialized and socially critical niche, addressing the significant unmet needs in autism education and employment pathways for disabled youth.

While the social impact and growth potential are considerable, this segment likely represents a new market entry for Hailiang Education. Consequently, it can be assumed to have a low current market share, necessitating substantial investment to build capacity, establish brand recognition, and scale operations effectively to capture a larger portion of this growing demand.

Educational R&D Center Initiatives

The Hailiang Education R&D Center is actively investing in initiatives aimed at establishing itself as a leading think tank and fostering innovation within the private education landscape. These forward-thinking projects, while vital for long-term expansion, are currently in an investment-heavy phase, demanding substantial capital without immediate guaranteed returns or market dominance.

The center's strategic focus on R&D positions these initiatives as potential future stars, but their current market share and growth rate are low, characteristic of a question mark in the BCG matrix. For instance, in 2024, Hailiang Education allocated a significant portion of its budget to these nascent R&D projects, aiming to develop cutting-edge educational technologies and pedagogical approaches.

- Focus on Innovation: The R&D Center is exploring AI-driven personalized learning platforms and advanced vocational training modules.

- Investment Phase: Significant capital expenditures were made in 2024 for research personnel, technology infrastructure, and pilot program development.

- Future Potential: The success of these initiatives hinges on their ability to translate novel educational concepts into commercially viable products and services.

- Market Uncertainty: While promising, the immediate market impact and revenue generation from these R&D efforts remain uncertain, reflecting their question mark status.

Expansion into Underdeveloped Regions

Hailiang Education's expansion into underdeveloped regions is a classic example of a company pursuing a "question mark" strategy within the BCG matrix. This initiative aims to serve 2.5 million students and teachers and support 500 schools in these areas by 2025. While these markets hold significant potential due to large student populations, they also present challenges.

The strategy involves high investment to establish a presence and build infrastructure in these underserved markets. Initially, Hailiang Education is expected to have a low market share in these regions, reflecting the nascent stage of its operations and the need to overcome existing barriers to entry. This high investment coupled with low market share is characteristic of a question mark, where future success is uncertain but the potential for growth is substantial.

- High Growth Potential: Targeting underdeveloped regions offers access to a large, untapped student base, projected to reach 2.5 million students and teachers by 2025.

- Initial Low Market Share: The strategy begins with a low market share in these new territories, requiring significant effort to gain traction.

- High Investment Requirements: Establishing operations and infrastructure in underdeveloped areas necessitates substantial upfront capital expenditure.

- Uncertain Future Success: The ultimate profitability and market dominance in these regions remain uncertain, classifying the venture as a question mark.

Hailiang Education's ventures into new international markets and specialized educational niches, such as autism education and advanced R&D, are prime examples of "Question Marks" in the BCG matrix. These initiatives, while holding significant future growth potential, currently operate with low market share and require substantial investment. The company's 2024 strategic focus on global expansion and innovation underscores its commitment to these high-risk, high-reward opportunities.

| Initiative | Market Growth | Market Share | Investment Level | BCG Classification |

| International School Expansion | High | Low | High | Question Mark |

| Specialized High School Modules | High | Low | Medium | Question Mark (potential Star) |

| Integrated Education Center for Autism | High | Low | High | Question Mark |

| R&D Center Initiatives | High | Low | High | Question Mark |

| Expansion into Underdeveloped Regions | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Hailiang Education BCG Matrix is built upon comprehensive financial disclosures, detailed market research reports, and official government education statistics to provide a robust strategic overview.