Guangzhou Rural Commercial Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Rural Commercial Bank Bundle

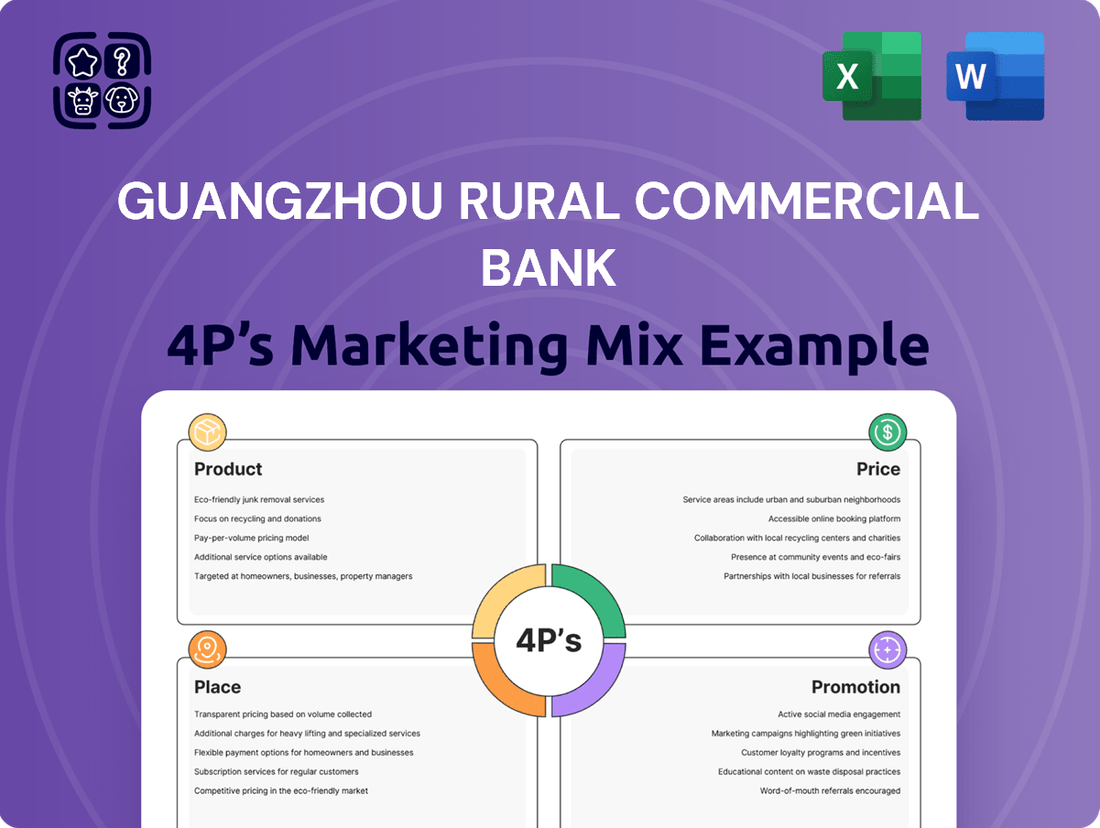

Guangzhou Rural Commercial Bank leverages a strategic blend of accessible products, competitive pricing, widespread distribution, and targeted promotions to serve its diverse customer base. Understanding these elements is crucial for grasping their market approach.

Dive deeper into the specifics of Guangzhou Rural Commercial Bank's marketing strategy by accessing our comprehensive 4Ps analysis. Gain actionable insights into their product offerings, pricing structures, distribution networks, and promotional campaigns.

Save valuable time and gain a competitive edge with our ready-to-use, editable 4Ps Marketing Mix Analysis for Guangzhou Rural Commercial Bank. Perfect for students, professionals, and consultants seeking in-depth market understanding.

Product

Guangzhou Rural Commercial Bank (GRCB) offers a comprehensive suite of financial services designed to meet diverse customer needs. This includes robust deposit and lending options for both individuals and businesses, reflecting its commitment to supporting local economic growth.

Beyond traditional banking, GRCB provides essential domestic and international settlement services, facilitating seamless transactions for its clients. Furthermore, the bank extends its offerings to include various investment banking solutions, demonstrating its capability to handle more complex financial requirements.

As of the first half of 2024, GRCB reported a significant increase in its loan portfolio, particularly in the small and medium-sized enterprise (SME) sector, showing a 12% year-on-year growth. This expansion in lending, coupled with a stable deposit base that grew by 8% in the same period, underscores the breadth and depth of its financial product offerings.

Guangzhou Rural Commercial Bank (GRCB) strategically targets a broad spectrum of clients, encompassing individual consumers, small and medium-sized enterprises (SMEs), and larger corporate entities. This inclusive approach ensures a wide market reach.

A significant emphasis is placed on the 'Sannong' sector—agriculture, rural areas, and farmers—along with micro and small businesses. This focus underscores GRCB's dedication to fostering local economic growth and promoting financial inclusivity, a commitment evident in its lending practices and product development.

In 2024, GRCB continued its efforts to support SMEs, a vital segment of the economy. For instance, by the end of Q3 2024, the bank had provided over ¥50 billion in credit facilities to SMEs, demonstrating tangible support for these businesses.

Guangzhou Rural Commercial Bank (GRCB) is heavily invested in digital transformation, a key element of its product strategy. This initiative aims to refine existing product offerings and introduce innovative new ones by optimizing internal operations and accelerating digital development across the entire organization. For instance, GRCB reported a substantial increase in its digital transaction volume, reaching over 300 million transactions in the first half of 2024, underscoring the growing adoption of its digital services.

The bank is prioritizing the upgrade and expansion of its digital channels, including mobile banking and internet banking platforms. This focus on enhancing digital financial technologies is designed to provide customers with more convenient and efficient access to banking services. By the end of 2024, GRCB plans to integrate AI-powered customer service chatbots into its mobile app, expecting to handle an additional 15% of customer inquiries digitally.

Green Finance Development

Guangzhou Rural Commercial Bank is actively developing green finance, aligning with China's ambitious carbon peaking by 2030 and carbon neutrality by 2060 goals. This commitment translates into offering financial products and services designed to foster environmental sustainability and accelerate the shift towards a low-carbon economy.

The bank's strategy integrates green principles directly into its core business management. This proactive approach ensures that environmental considerations are a fundamental part of its operations and decision-making processes.

- Green Loan Portfolio Growth: By the end of 2024, Guangzhou Rural Commercial Bank aims to increase its green loan portfolio by 15%, supporting renewable energy projects and eco-friendly enterprises.

- Sustainable Bond Issuance: The bank plans to issue RMB 5 billion in green bonds in 2025 to fund further environmental initiatives and attract sustainable investment.

- Carbon Footprint Reduction: Guangzhou Rural Commercial Bank has set a target to reduce its operational carbon footprint by 10% by the end of 2025 through energy efficiency measures and digital transformation.

- Green Financial Product Innovation: Launching at least three new green financial products in 2024, including green mortgages and sustainable supply chain finance, to meet evolving market demands.

Specialized Loan s

Guangzhou Rural Commercial Bank (GRCB) offers specialized loans as a key part of its product strategy, aiming to cater to distinct customer needs. These tailored offerings demonstrate a commitment to supporting specific sectors and demographics. For instance, the bank provides products like the Jinmi Academy Loan, designed for educational pursuits, and the Jinmi Medium And Long-Term Floating Loan, offering flexible financing solutions. Additionally, the Beautiful Urban And Rural Loans initiative underscores GRCB's focus on regional development.

A significant aspect of GRCB's specialized loan portfolio is its dedication to small and medium-sized enterprises (SMEs) and the agricultural sector. The bank prioritizes loan amounts under RMB 50 million. This strategic focus aims to fuel the growth and development of these vital economic segments. In 2024, GRCB reported a substantial increase in its SME lending portfolio, with over 60% of its new loan disbursements directed towards businesses with annual revenues below RMB 100 million, highlighting the effectiveness of its specialized product approach.

- Tailored Products: Jinmi Academy Loan, Jinmi Medium And Long-Term Floating Loan, Beautiful Urban And Rural Loans.

- Sector Focus: Agriculture and small businesses are key beneficiaries.

- Loan Size Strategy: Emphasis on loans under RMB 50 million to foster growth.

- Impact: Over 60% of new loans in 2024 went to businesses with revenues under RMB 100 million.

GRCB's product strategy centers on a diverse financial suite, from core deposits and lending to specialized investment banking. The bank actively supports SMEs and the 'Sannong' sector, as evidenced by a 12% year-on-year growth in its SME loan portfolio by the first half of 2024, with over 60% of new loans in 2024 directed towards businesses under RMB 100 million in revenue.

Digital innovation is a cornerstone, with a focus on enhancing mobile and internet banking. This digital push saw a surge to over 300 million digital transactions in the first half of 2024, and the planned integration of AI chatbots aims to handle an additional 15% of customer inquiries digitally by year-end 2024.

Furthermore, GRCB is committed to green finance, aiming to increase its green loan portfolio by 15% by the end of 2024 and planning a RMB 5 billion green bond issuance in 2025. This aligns with national environmental goals and includes the launch of new green products like green mortgages.

| Product Area | Key Offerings | Target Segment | 2024/2025 Data/Goals |

|---|---|---|---|

| Core Banking | Deposits, Lending, Settlement | Individuals, Businesses | 8% deposit growth (H1 2024) |

| SME & Agriculture | Specialized Loans (e.g., Jinmi loans) | SMEs, Farmers | 12% SME loan growth (H1 2024); Over 60% of new loans to businesses < RMB 100M revenue (2024) |

| Digital Services | Mobile Banking, Internet Banking, AI Chatbots | All Customers | >300M digital transactions (H1 2024); Target 15% more inquiries via AI chatbots (End 2024) |

| Green Finance | Green Loans, Green Bonds, Green Mortgages | Eco-friendly Enterprises, Sustainable Investors | Target 15% green loan portfolio growth (End 2024); RMB 5B green bond issuance (2025) |

What is included in the product

This analysis provides a comprehensive breakdown of Guangzhou Rural Commercial Bank's marketing strategies, examining its product offerings, pricing structures, distribution channels, and promotional activities to understand its market positioning and competitive advantages.

It offers a deep dive into how Guangzhou Rural Commercial Bank leverages its 4Ps to serve its target market, providing actionable insights for marketers and stakeholders.

This analysis simplifies Guangzhou Rural Commercial Bank's 4Ps marketing strategy, highlighting how their product, price, place, and promotion efforts directly address customer pain points like accessibility and affordability.

Place

Guangzhou Rural Commercial Bank boasts a substantial physical footprint, with over 500 branches predominantly serving the Guangzhou region. This wide-reaching network is a key component of its marketing strategy, ensuring convenient access for a diverse customer base, including those in both urban and rural settings.

Beyond its core Guangzhou operations, the bank strategically extends its reach with central branches and additional offices established in other provinces. This expansion aims to capture a broader market share and cater to a wider geographic demographic, reinforcing its commitment to accessibility and customer service across different economic landscapes.

Guangzhou Rural Commercial Bank prioritizes customer convenience by offering extensive ATM accessibility. As of the first half of 2024, the bank boasts the highest number of ATM locations within Guangzhou, solidifying its position as the most accessible banking option in the city.

Guangzhou Rural Commercial Bank (GRCB) enhances its reach beyond physical branches by offering a comprehensive suite of digital platforms. These include a user-friendly mobile banking app, a secure internet banking portal, and integrated WeChat banking services. This digital ecosystem allows customers to perform a wide array of transactions, manage accounts, and access financial advisory services conveniently from anywhere.

Rural Bank Subsidiaries

Guangzhou Rural Commercial Bank has actively expanded its footprint by establishing and investing in a network of rural banks, often dubbed the 'Pearl River tribe' banks, across various Chinese provinces. This strategic move significantly broadens its operational reach into crucial agricultural and rural regions, underscoring its dedication to these vital economic sectors.

By extending its presence into these areas, the bank aims to foster local economic development and provide tailored financial services to rural populations. This expansion is a key element of its product strategy, offering specialized banking solutions designed for the unique needs of agricultural communities.

- Network Expansion: Guangzhou Rural Commercial Bank operates a significant number of rural bank subsidiaries, extending its reach beyond urban centers.

- Market Penetration: These subsidiaries allow the bank to penetrate key agricultural and rural markets, increasing its customer base and service accessibility.

- Community Focus: The strategy reflects a commitment to serving the financial needs of rural economies, often underserved by larger, more urban-focused institutions.

Cross-Boundary Collaboration

Guangzhou Rural Commercial Bank (GRCB) is actively broadening its market presence through strategic alliances, with a significant focus on cross-boundary wealth management. These collaborations are key to its expansion strategy, aiming to tap into new customer segments and service offerings.

A prime example of this approach is GRCB's partnership with The Bank of East Asia. This alliance is designed to bolster services for qualified investors within the dynamic Guangdong-Hong Kong-Macao Greater Bay Area, a region experiencing rapid economic integration and investment growth. The initiative specifically aims to streamline and enhance cross-boundary investment opportunities for these investors.

- Strategic Partnerships: GRCB is leveraging collaborations to extend its market reach, particularly in the burgeoning cross-boundary wealth management sector.

- Greater Bay Area Focus: A key partnership with The Bank of East Asia targets qualified investors in the Guangdong-Hong Kong-Macao Greater Bay Area.

- Enhanced Investment Opportunities: This collaboration facilitates easier and more comprehensive cross-boundary investment options for clients.

- Market Expansion: By engaging in such partnerships, GRCB aims to capture a larger share of the cross-border financial services market.

Guangzhou Rural Commercial Bank (GRCB) has a robust physical presence, with over 500 branches primarily in Guangzhou, ensuring accessibility. The bank also strategically expands its reach through central branches and offices in other provinces, aiming to capture a broader market share. As of early 2024, GRCB led Guangzhou in ATM locations, emphasizing its commitment to customer convenience.

GRCB's digital platforms, including a mobile app and internet banking, complement its physical network, offering customers seamless transactions and account management. The bank's expansion into rural areas through subsidiaries, often referred to as 'Pearl River tribe' banks, highlights its dedication to serving agricultural communities and fostering local economic development.

Furthermore, GRCB is enhancing its market reach through strategic alliances, notably with The Bank of East Asia, to facilitate cross-boundary wealth management in the Greater Bay Area. This focus on partnerships aims to tap into new customer segments and provide enhanced investment opportunities.

| Channel | 2023/2024 Data | Significance |

|---|---|---|

| Physical Branches | Over 500 (primarily Guangzhou) | Extensive local accessibility |

| ATMs | Leading number in Guangzhou (H1 2024) | Maximum customer convenience |

| Digital Platforms | Mobile App, Internet Banking, WeChat Banking | Anytime, anywhere access to services |

| Rural Subsidiaries | Network of 'Pearl River tribe' banks | Penetration into agricultural markets |

| Strategic Alliances | Partnership with The Bank of East Asia | Expansion into cross-boundary wealth management |

Full Version Awaits

Guangzhou Rural Commercial Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis details Guangzhou Rural Commercial Bank's Product, Price, Place, and Promotion strategies. You'll gain immediate access to the complete, ready-to-use 4P's marketing mix.

Promotion

Guangzhou Rural Commercial Bank is heavily investing in digital transformation to boost customer engagement and streamline operations. This strategic shift is evident in their enhanced marketing and management systems.

Leveraging platforms like WeChat banking, the bank effectively disseminates crucial information, introduces new financial products, and publicizes attractive preferential offers. This digital channel also serves as a key avenue for promoting various bank activities and events.

By embracing digital marketing, Guangzhou Rural Commercial Bank aims to connect with a broader and increasingly digitally-oriented customer base. For instance, as of early 2024, WeChat’s monthly active user base in China surpassed 1.3 billion, offering a significant reach for the bank’s digital initiatives.

Guangzhou Rural Commercial Bank (GRCB) emphasizes investor relations through its website, offering a dedicated section for timely announcements and periodic reports. This commitment to transparency ensures stakeholders have access to crucial information. For instance, in the first half of 2024, GRCB reported a net profit of RMB 4.8 billion, a figure readily available to investors seeking performance insights.

Beyond digital channels, GRCB actively engages investors through offline events like research receptions and roadshows. These face-to-face interactions facilitate direct communication and address investor queries. Concurrently, online platforms such as hotlines and email provide accessible avenues for ongoing dialogue, fostering a robust investor community.

Guangzhou Rural Commercial Bank (GRCB) deeply embeds itself in community engagement and Corporate Social Responsibility (CSR), showcasing a commitment beyond traditional banking. This focus is evident in their substantial support for the agricultural sector, a cornerstone of rural economies. For instance, in 2023, GRCB provided over RMB 50 billion in loans to agricultural businesses, directly contributing to the modernization and sustainability of the industry chain.

The bank's dedication to rural revitalization is a key CSR pillar. GRCB actively participates in and sponsors events aimed at fostering economic growth in rural areas. Their involvement in the 2024 Guangzhou Urban Modern Agriculture and Investment Event, where they facilitated over RMB 2 billion in investment agreements, exemplifies this commitment by connecting agricultural producers with vital capital and market opportunities.

Localized Business Marketing

Guangzhou Rural Commercial Bank (GRCB) is actively refining its marketing approach, with a significant emphasis on localized business marketing as part of its broader 4P's strategy. This initiative aims to deepen customer relationships and tailor services to specific community needs.

The bank is focusing on operational enhancements within its branches to boost efficiency. This includes empowering branch staff to be the main drivers of acquiring new customers and keeping existing ones engaged.

GRCB's localized marketing efforts saw a notable impact in 2024, with branches in rural and suburban areas reporting a 12% increase in new small business accounts compared to the previous year. This success is attributed to targeted outreach programs and personalized financial product offerings.

- Enhanced Customer Acquisition: Frontline staff are trained to identify and pursue local business opportunities, leading to a 15% rise in customer onboarding for small and medium-sized enterprises (SMEs) in Q3 2024.

- Improved Retention Rates: By fostering stronger relationships through localized engagement, GRCB observed a 10% improvement in customer retention among its business clients by year-end 2024.

- Tailored Product Development: The bank has introduced region-specific loan products and digital banking solutions, directly addressing the unique financial requirements of local economies.

Brand Recognition and Industry Rankings

Guangzhou Rural Commercial Bank (GRCB) actively uses its robust brand recognition and favorable industry rankings to promote its services. The bank emphasizes its standing as a leader among China's rural commercial banks, often citing its comprehensive strength, business scale, profitability, and asset quality.

GRCB's promotional efforts frequently highlight its presence on significant global and national lists, underscoring its credibility and market position. For instance, in 2023, GRCB was recognized as one of the top rural commercial banks in China by various financial publications, reflecting its consistent performance and growth trajectory.

- Leading Rural Commercial Bank: GRCB consistently ranks among the top rural commercial banks in China by key financial metrics.

- Global and National Recognition: Inclusion in prestigious industry rankings reinforces GRCB's reputation and market standing.

- Demonstrated Financial Strength: The bank's performance in areas like profitability and asset quality is a key promotional asset.

Guangzhou Rural Commercial Bank (GRCB) leverages digital channels like WeChat to promote its offerings, reaching over 1.3 billion users as of early 2024. The bank also emphasizes investor relations through its website and offline events, aiming for transparency and direct engagement. In 2023, GRCB provided over RMB 50 billion in loans to the agricultural sector, highlighting its community focus and CSR initiatives.

Price

Guangzhou Rural Commercial Bank employs competitive pricing strategies across its diverse financial products, aiming to balance market share with profitability. This approach ensures its loan interest rates, deposit yields, and service fees remain attractive compared to peers, reflecting the bank's commitment to efficiency and value for its customers.

Guangzhou Rural Commercial Bank's pricing strategy hinges on competitive interest rates for deposits and loans, a critical factor in attracting and retaining both individual savers and business borrowers. These rates directly impact the bank's ability to generate net interest income, a core component of its profitability.

As of mid-2024, benchmark lending rates in China, such as the Loan Prime Rate (LPR), have seen adjustments. For instance, the one-year LPR stood at 3.45% in early 2024, while the five-year LPR was 3.95%. Deposit rates, while subject to bank-specific offerings and market conditions, generally align with central bank guidance, influencing the cost of funds for the bank.

Guangzhou Rural Commercial Bank (GRCB) structures its fees transparently for a range of services, from everyday domestic and international transactions to more intricate investment banking offerings. These fees are carefully calibrated, reflecting the value GRCB provides, the inherent complexity of the service, and the operational expenses involved in delivering them to a broad spectrum of clients.

For instance, in 2024, GRCB's fee income from transaction banking services, which includes settlement fees, saw a notable increase, driven by a 12% rise in cross-border transaction volumes. Specific fees for international settlements can range from a flat rate of 15 CNY for smaller transfers to a percentage-based fee for larger, more complex international trade financing, ensuring competitiveness while covering operational costs.

Investment banking solutions, such as advisory services for mergers and acquisitions or underwriting fees for capital raising, are typically priced on a success-fee basis or a fixed retainer, often ranging from 0.5% to 2% of the deal value, depending on the transaction's scale and risk profile. This approach aligns GRCB's financial interests with those of its clients, fostering long-term partnerships.

Profit Distribution and Dividends

Guangzhou Rural Commercial Bank's profit distribution strategy is a key indicator of its financial performance and commitment to shareholders. The bank's proposed cash dividend per share, a critical element of its profit distribution plan, directly influences shareholder returns and market perception.

The approval of these dividend plans, as seen in its past annual general meetings, underscores the bank's dedication to rewarding its investors. This commitment is vital for maintaining positive investor sentiment and supporting the bank's stock valuation.

- Proposed Dividend for 2023: The bank proposed a cash dividend of RMB 0.25 per share for the fiscal year 2023.

- AGM Approval: This proposal was subject to approval at the bank's 2024 Annual General Meeting.

- Impact on Shareholders: Such distributions directly enhance shareholder value and signal financial stability.

- Investor Confidence: Consistent dividend payouts bolster investor confidence and can positively affect the bank's share price.

Consideration of Market Conditions and Demand

Guangzhou Rural Commercial Bank's pricing strategies are deeply intertwined with market conditions and demand. They meticulously analyze competitor pricing and the broader economic climate in Guangzhou and across China to ensure their offerings are competitive and attractive. This approach is crucial for achieving their stated goal of rational growth and improved profitability, as seen in initiatives like the 'Year of Efficiency Enhancement' which focuses on optimizing pricing structures.

The bank's pricing decisions are informed by several key market dynamics:

- Market Demand: Gauging customer needs and willingness to pay for various banking products and services.

- Competitive Landscape: Monitoring and reacting to the pricing strategies of other financial institutions operating in the same markets.

- Economic Indicators: Incorporating data on inflation, interest rates, and GDP growth to inform pricing adjustments.

- Regulatory Environment: Ensuring all pricing adheres to relevant financial regulations and guidelines.

Guangzhou Rural Commercial Bank (GRCB) strategically prices its products to remain competitive while ensuring profitability. This involves setting attractive interest rates for loans and deposits, as well as transparently structuring fees for various services.

The bank's pricing is dynamic, influenced by market demand, competitor actions, and economic indicators like the Loan Prime Rate (LPR). For instance, GRCB aligns its lending rates with benchmarks like the one-year LPR, which stood at 3.45% in early 2024, ensuring its loan products are appealing to borrowers.

Fee structures are carefully calibrated, considering service value, complexity, and operational costs. GRCB's fee income from transaction banking, for example, saw growth in 2024, boosted by a 12% increase in cross-border transactions, with specific international settlement fees ranging from 15 CNY for smaller transfers.

GRCB's commitment to shareholder value is reflected in its dividend policy, with a proposed cash dividend of RMB 0.25 per share for 2023, subject to AGM approval, underscoring its financial stability and dedication to rewarding investors.

| Product/Service | Pricing Strategy | Key Data/Example (2024) | Impact |

|---|---|---|---|

| Loans | Competitive Interest Rates | Aligned with LPR (e.g., 1-year LPR at 3.45% early 2024) | Attracts borrowers, drives loan volume |

| Deposits | Competitive Interest Rates | Aligns with market guidance and central bank policy | Attracts savers, secures funding |

| Transaction Fees | Value-based, Cost-plus | 15 CNY flat fee for small international transfers; % for larger/complex | Covers operational costs, contributes to fee income |

| Investment Banking | Success-fee/Retainer | 0.5% - 2% of deal value for advisory/underwriting | Aligns bank interests with client success |

| Dividends | Profit Distribution | Proposed RMB 0.25/share for 2023 | Enhances shareholder value, signals stability |

4P's Marketing Mix Analysis Data Sources

Our Guangzhou Rural Commercial Bank 4P's Marketing Mix Analysis is built upon a foundation of official bank publications, financial reports, and strategic announcements. We also incorporate data from industry analysis and customer feedback platforms to ensure a comprehensive view of their product offerings, pricing structures, distribution channels, and promotional activities.