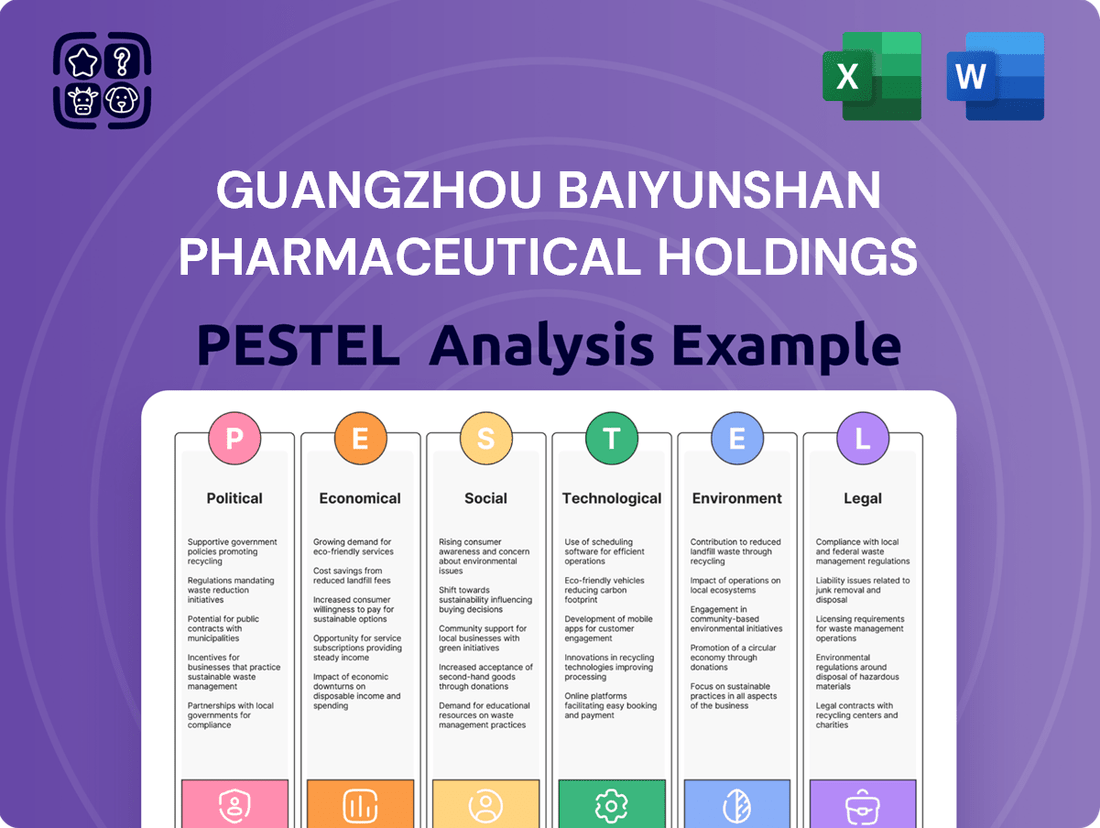

Guangzhou Baiyunshan Pharmaceutical Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Baiyunshan Pharmaceutical Holdings Bundle

Navigate the complex external forces shaping Guangzhou Baiyunshan Pharmaceutical Holdings with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this leading pharmaceutical company. Gain a strategic advantage by leveraging these critical insights to inform your market approach and investment decisions. Download the full analysis now to unlock actionable intelligence and stay ahead of the curve.

Political factors

The Chinese government's steadfast commitment to Traditional Chinese Medicine (TCM) is a significant political factor for Guangzhou Baiyunshan Pharmaceutical Holdings. This national priority translates into policy initiatives designed to elevate TCM's role within the broader healthcare landscape.

These supportive policies are expected to fuel substantial market expansion, with projections indicating the TCM market could reach $113 billion by 2025. As a leading entity in the TCM sector, Guangzhou Baiyunshan is well-positioned to capitalize on this government backing and the resulting market growth.

China's National Reimbursement Drug List (NRDL) updates annually, directly influencing how much pharmaceutical companies can charge and how easily patients can access their medicines. For Guangzhou Baiyunshan, inclusion on this list is a double-edged sword; it opens up a vast patient pool but often requires significant price reductions.

In 2023, for instance, the NRDL update saw the inclusion of over 120 new drugs, many of which are innovative therapies. This trend signals continued government efforts to expand access to advanced treatments. Guangzhou Baiyunshan's ability to secure favorable pricing during NRDL negotiations will be crucial for maintaining profitability while maximizing market share for its products.

China's National Medical Products Administration (NMPA) has significantly reformed drug approval processes, aiming to speed up the market entry for innovative medicines. For eligible groundbreaking drugs, the review timeline can now be as swift as 30 working days. This enhanced efficiency directly benefits Guangzhou Baiyunshan Pharmaceutical Holdings by enabling quicker commercialization of its research and development pipeline.

Enhanced Regulatory Oversight and Compliance

China's ongoing pharmaceutical regulatory reforms, emphasizing enhanced compliance and whole-lifecycle oversight, directly impact Guangzhou Baiyunshan. The government's push for stricter adherence to Good Manufacturing Practice (GMP) and increased scrutiny of marketing practices necessitates significant investment in robust compliance systems. For instance, by the end of 2023, China's National Medical Products Administration (NMPA) had intensified inspections, leading to recalls and penalties for non-compliant products, underscoring the critical need for companies like Baiyunshan to maintain impeccable regulatory standing.

These intensified regulatory measures translate into higher operational costs for pharmaceutical firms. Companies must dedicate more resources to quality control, documentation, and training to meet evolving standards. This includes adapting to new guidelines for drug registration and post-market surveillance, which are designed to ensure product safety and efficacy. The focus on strengthening oversight across the entire product lifecycle, from research and development to manufacturing and distribution, means that any lapse in compliance can have severe repercussions, including substantial fines and reputational damage.

- Increased Compliance Costs: Pharmaceutical companies face higher expenses related to quality assurance, regulatory affairs, and updated manufacturing processes.

- Stricter GMP Enforcement: Adherence to Good Manufacturing Practice is paramount, with intensified inspections and potential penalties for deviations.

- Enhanced Scrutiny of Promotions: Marketing and promotional activities are under greater review to prevent misleading claims and ensure ethical practices.

- Lifecycle Oversight: Regulatory focus extends from R&D through post-market surveillance, demanding comprehensive quality management at every stage.

Impact of International Trade Relations and Geopolitics

Geopolitical tensions, especially between China and the United States, significantly impact Guangzhou Baiyunshan Pharmaceutical Holdings. New regulations like the BIOSECURE Act, proposed in the US, aim to restrict the use of certain Chinese biotechnology products, potentially affecting companies with US market exposure. This creates uncertainty regarding global supply chains and export strategies.

These international trade dynamics can pose challenges for sourcing essential raw materials and accessing key overseas markets. For instance, increased tariffs or trade barriers could raise the cost of imported ingredients, impacting Guangzhou Baiyunshan's manufacturing expenses. The company may need to diversify its supplier base and explore alternative markets to mitigate these risks.

The company's reliance on international markets for both sourcing and sales makes it particularly vulnerable to shifts in geopolitical relationships. For example, a tightening of US-China trade relations could limit the company's ability to export its products to the lucrative American market, a significant revenue stream for many Chinese pharmaceutical firms.

- Increased scrutiny: Chinese pharmaceutical companies face heightened scrutiny from foreign governments, impacting market access and regulatory approvals.

- Supply chain diversification: Geopolitical risks necessitate a strategic focus on diversifying raw material sourcing and manufacturing locations to ensure resilience.

- Market access challenges: Emerging trade barriers and protectionist policies can hinder export growth and market penetration for companies like Guangzhou Baiyunshan.

- Regulatory shifts: Evolving international regulations, such as those targeting specific countries' biotech sectors, require continuous monitoring and adaptation of business strategies.

The Chinese government's strong support for Traditional Chinese Medicine (TCM) is a significant political tailwind for Guangzhou Baiyunshan Pharmaceutical Holdings. This national focus is driving policy that aims to integrate TCM more deeply into the healthcare system, with the TCM market projected to reach $113 billion by 2025, offering substantial growth opportunities for Baiyunshan.

Annual updates to China's National Reimbursement Drug List (NRDL) directly impact Guangzhou Baiyunshan's pricing power and patient access. While inclusion on the NRDL, which added over 120 new drugs in 2023, expands market reach, it often necessitates price concessions, making strategic negotiation crucial for profitability.

Reforms by China's National Medical Products Administration (NMPA) are streamlining drug approvals, allowing for faster market entry for innovative products, sometimes within 30 working days. This regulatory efficiency benefits Baiyunshan by accelerating the commercialization of its R&D pipeline.

Heightened regulatory oversight, including stricter adherence to Good Manufacturing Practice (GMP) and intensified inspections by the NMPA in 2023, increases compliance costs for Guangzhou Baiyunshan. The company must invest in robust quality systems to navigate evolving standards and avoid penalties.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Guangzhou Baiyunshan Pharmaceutical Holdings across political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights into how these forces create both opportunities and threats, enabling strategic decision-making for stakeholders.

This PESTLE analysis for Guangzhou Baiyunshan Pharmaceutical Holdings acts as a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategic planning and decision-making.

It helps alleviate pain points by offering a concise, easily shareable format ideal for quick alignment across teams and supporting discussions on external risks and market positioning.

Economic factors

China's healthcare expenditure is on a significant upward trajectory, with projections suggesting it could reach RMB 205 trillion by 2030. This substantial growth is fueled by an aging demographic and the government's dedication to enhancing healthcare accessibility for its citizens.

This expanding market presents a considerable opportunity for pharmaceutical companies like Guangzhou Baiyunshan. The increasing demand for healthcare services and products directly translates into a larger domestic market for their pharmaceutical offerings.

Consequently, Guangzhou Baiyunshan is well-positioned to capitalize on this trend, benefiting from the robust growth in domestic healthcare spending and the increasing need for pharmaceutical solutions.

China's recent economic stimulus measures, including significant fiscal injections, are poised to invigorate domestic consumption, with the healthcare sector anticipated to be a key beneficiary. These initiatives are designed to bolster consumer spending power, directly impacting sectors like medical services and pharmaceutical retail.

For Guangzhou Baiyunshan Pharmaceutical Holdings, this translates into a more favorable operating environment. The anticipated uptick in domestic consumption, fueled by stimulus, is expected to drive increased sales and revenue growth within the vast Chinese market, supporting the company's expansion and profitability.

As of early 2024, China's government has continued to signal a commitment to supporting economic recovery through various fiscal and monetary policies. For instance, the People's Bank of China has maintained a relatively accommodative monetary stance, and the government has announced plans for infrastructure investment and tax relief measures, all contributing to a broader economic uplift that benefits consumer-driven industries like pharmaceuticals.

Capital markets in China's life sciences and healthcare sector experienced a significant rebound in late 2024, with fundraising volumes nearly matching those of the entire previous year. This resurgence, however, is characterized by a shift towards smaller, early-stage funding rounds and a pronounced emphasis on 'hard technologies,' indicating a strategic focus on foundational innovation.

Guangzhou Baiyunshan Pharmaceutical Holdings' recent investment in a biomedicine fund directly aligns with this industry trend. It underscores the sector's persistent commitment to driving innovation, even as the number of initial public offerings (IPOs) saw a decline in 2024, highlighting a preference for strategic, forward-looking investments over immediate public market exits.

Commercial Medical Insurance Reforms

Commercial medical insurance is emerging as a vital funding avenue for innovative drug expenses that fall outside the scope of national coverage, with premium growth anticipated to be substantial. For instance, the global health insurance market was valued at approximately USD 3.1 trillion in 2023 and is projected to expand further, indicating a growing reliance on private plans.

Reforms, such as the potential introduction of tax deductions for commercial health insurance premiums, are poised to channel additional capital towards high-quality innovative medicines. This policy shift is expected to boost the uptake of advanced treatments, creating new market opportunities.

These developments are particularly beneficial for pharmaceutical companies like Guangzhou Baiyunshan Pharmaceutical Holdings, as they present expanded access channels and novel revenue streams for their innovative product lines. The company can leverage these changes to increase market penetration for its advanced therapeutic offerings.

- Growing Premium Pool: Commercial medical insurance premiums are projected for significant growth, indicating an increasing financial capacity for covering advanced medical needs.

- Policy Incentives: Reforms like potential tax deductions aim to stimulate private spending on health insurance, directly benefiting the market for innovative drugs.

- Enhanced Revenue Streams: These changes create new avenues for pharmaceutical firms to monetize their research and development investments in novel treatments.

- Market Access Expansion: The reforms facilitate broader patient access to cutting-edge pharmaceuticals, thereby increasing the addressable market for companies like Guangzhou Baiyunshan.

Profitability Challenges and Asset Impairment

Guangzhou Baiyunshan Pharmaceutical Holdings faced significant profitability headwinds in 2024, reporting a notable decline in operating revenue and a substantial drop in net profit. This downturn is largely attributed to broader industry-wide challenges impacting the pharmaceutical sector, coupled with the company's strategic decision to recognize asset impairment provisions. These financial results underscore a difficult economic climate, signaling the urgent need for the company to implement new strategies to bolster its market position and reignite growth.

The company's financial performance in 2024 highlights key economic pressures:

- Revenue Decline: Operating revenue saw a decrease, reflecting softer market demand and increased competition.

- Net Profit Drop: Net profit experienced a significant contraction, exacerbated by the aforementioned revenue challenges and specific impairment charges.

- Asset Impairment: Provisions for asset impairment suggest that certain company assets are no longer performing as expected or have diminished in value, a common occurrence during economic downturns or shifts in market dynamics.

- Strategic Imperative: The challenging economic landscape necessitates proactive measures, including potential cost-saving initiatives and strategic investments to enhance market competitiveness and drive future revenue streams.

China's economic landscape in 2024 and early 2025 presents a mixed bag for pharmaceutical companies like Guangzhou Baiyunshan. While government stimulus measures aim to boost domestic consumption, including healthcare, the sector also grapples with increased competition and evolving market demands.

Guangzhou Baiyunshan itself experienced significant profitability challenges in 2024, with a notable drop in operating revenue and net profit. This downturn, partly due to asset impairment provisions, underscores the impact of broader economic headwinds and the critical need for strategic adjustments to navigate the current market conditions.

The capital markets for life sciences showed a rebound in late 2024, with a focus on early-stage funding and hard technologies, suggesting a strategic shift towards innovation. Guangzhou Baiyunshan's investment in a biomedicine fund aligns with this trend, indicating a forward-looking approach despite a dip in IPOs.

The growing commercial medical insurance market, projected for substantial premium growth, offers new revenue streams and expanded market access for innovative drugs, benefiting companies like Guangzhou Baiyunshan.

| Metric | 2024 (Reported/Projected) | Key Factors |

|---|---|---|

| China Healthcare Expenditure Growth | Projected to reach RMB 205 trillion by 2030 | Aging population, government focus on accessibility |

| Guangzhou Baiyunshan Operating Revenue | Declined in 2024 | Industry headwinds, increased competition |

| Guangzhou Baiyunshan Net Profit | Substantially dropped in 2024 | Revenue challenges, asset impairment provisions |

| Life Sciences Fundraising (Late 2024) | Rebounded, matching previous year's volumes | Focus on early-stage funding, hard technologies |

| Commercial Medical Insurance Market | Projected for substantial premium growth | Policy incentives (e.g., tax deductions), increased patient access |

What You See Is What You Get

Guangzhou Baiyunshan Pharmaceutical Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Guangzhou Baiyunshan Pharmaceutical Holdings.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive PESTLE analysis of the company’s operational landscape.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external forces shaping Baiyunshan Pharmaceutical's strategic decisions.

Sociological factors

China's demographic shift towards an older population is a significant driver for the pharmaceutical sector. By 2024, China already had approximately 280 million individuals aged 60 and above, a number anticipated to climb to 400 million by 2035. This substantial increase directly translates into heightened demand for healthcare services and, consequently, pharmaceutical products.

The elderly demographic is also disproportionately affected by chronic illnesses. Conditions like diabetes, cardiovascular disease, and hypertension are prevalent, necessitating ongoing medical attention and regular medication. This sustained need for treatment offers consistent and expanding revenue opportunities for pharmaceutical companies, including Guangzhou Baiyunshan Pharmaceutical Holdings, as they cater to the growing market for chronic disease management.

Growing public consciousness about health and a desire for a better quality of life are fueling a significant increase in demand for sophisticated healthcare solutions and proactive health products. This societal evolution directly translates into greater investment opportunities within premium healthcare services and cutting-edge pharmaceutical development.

Guangzhou Baiyunshan Pharmaceutical Holdings is well-positioned to capitalize on this trend, as its core mission and ongoing investments in product innovation directly address the public's escalating expectations for advanced medical care and preventative health measures.

Significant disparities persist in healthcare access between China's urban and rural regions, a gap exacerbated by the accelerating aging population in urban centers. This demographic shift directly fuels demand for innovative digital health solutions, telemedicine platforms, and mobile health services designed to overcome geographical barriers and improve healthcare delivery.

Guangzhou Baiyunshan Pharmaceutical Holdings can strategically capitalize on these trends by enhancing its digital capabilities. By doing so, the company can effectively expand its market reach and bolster the accessibility of its pharmaceutical products and services to a broader population base, particularly in underserved rural areas.

Cultural Acceptance of Traditional Chinese Medicine (TCM)

The enduring cultural significance of Traditional Chinese Medicine (TCM) in China underpins a robust and growing market for companies like Guangzhou Baiyunshan Pharmaceutical Holdings. This deep-rooted acceptance translates into consistent consumer demand for TCM products. For instance, in 2023, the TCM market in China was valued at approximately 900 billion RMB, with projections indicating continued growth. This strong societal integration offers Guangzhou Baiyunshan a significant and stable customer base.

Guangzhou Baiyunshan's established expertise in developing and manufacturing TCM products provides a distinct competitive edge. The company leverages this cultural affinity and its own capabilities to cater to a market that actively seeks out traditional remedies. This synergy between cultural preference and corporate strength is a key driver for the company's TCM segment.

- Deep Cultural Integration: TCM is a cornerstone of Chinese healthcare practices, ensuring sustained consumer interest.

- State Support: Government policies actively promote and support the development and utilization of TCM.

- Market Value: The Chinese TCM market reached an estimated 900 billion RMB in 2023, demonstrating substantial economic scale.

- Competitive Advantage: Guangzhou Baiyunshan's specialized knowledge and product portfolio in TCM position it favorably within this market.

Changing Lifestyles and Disease Patterns

Modern lifestyles are significantly impacting public health, leading to a rise in chronic conditions like obesity and type 2 diabetes. This shift creates a substantial and growing market for pharmaceutical interventions. For instance, the prevalence of diabetes in China reached 12.8% in 2023, according to a study published in JAMA Internal Medicine, highlighting the urgent need for effective treatments.

The increasing burden of these lifestyle-related diseases presents a clear opportunity for pharmaceutical companies. Specifically, the market for GLP-1 receptor agonists, drugs used to manage type 2 diabetes and obesity, is experiencing rapid growth. In China, these innovative treatments are in the early stages of commercialization, with significant potential for expansion.

Guangzhou Baiyunshan Pharmaceutical Holdings is well-positioned to capitalize on these evolving public health needs. Their investment in research and development for treatments targeting obesity and type 2 diabetes aligns directly with market demand. By focusing on these therapeutic areas, Baiyunshan can address critical health challenges while also tapping into a burgeoning market segment.

- Rising Disease Incidence: China's diabetes prevalence hit 12.8% in 2023, underscoring the growing demand for related treatments.

- Market Growth Potential: The market for GLP-1 drugs in China is in its nascent stages, offering substantial growth prospects for innovative therapies.

- Strategic Alignment: Guangzhou Baiyunshan's R&D focus on obesity and diabetes treatments directly addresses current public health trends and market opportunities.

China's rapidly aging population, projected to reach 400 million by 2035, is a significant driver for increased healthcare demand, particularly for chronic disease management. This demographic shift directly benefits pharmaceutical companies like Guangzhou Baiyunshan Pharmaceutical Holdings by expanding the market for treatments addressing prevalent conditions such as diabetes and cardiovascular disease.

Technological factors

Technological advancements are reshaping drug discovery and development, a critical factor for Guangzhou Baiyunshan. China's pharmaceutical sector saw a record number of innovative drug approvals in 2024, signaling a robust R&D environment. This surge in innovation, particularly in cutting-edge fields such as cell therapies and monoclonal antibodies, demands sustained investment in advanced research capabilities from companies like Guangzhou Baiyunshan to remain competitive.

Technological advancements are rapidly reshaping China's healthcare landscape. The integration of Artificial Intelligence (AI) and Big Data is a prime example, driving efficiency in diagnostics, accelerating drug discovery, and optimizing operational workflows. This digital transformation presents significant opportunities for companies like Guangzhou Baiyunshan Pharmaceutical Holdings.

Baiyunshan's strategic focus includes expanding its digital capabilities to leverage these transformative technologies. By embracing AI and Big Data, the company can enhance its drug development processes and ultimately improve patient care and outcomes. This aligns with the broader trend of digital innovation within the Chinese pharmaceutical sector, which saw substantial investment in digital health solutions throughout 2024.

Guangzhou Baiyunshan Pharmaceutical Holdings is strategically positioned to benefit from the burgeoning field of advanced biologics. China is rapidly becoming a significant global center for research and development in areas like antibody-drug conjugates (ADCs) and multi-specific antibodies. These innovative therapies represent the next frontier in medicine, offering targeted treatments with potentially fewer side effects.

The company's commitment to this sector is evident through its investments in biomedicine funds. This financial backing signals a proactive approach to exploring and developing these cutting-edge biologics, which are vital for sustained future growth and market competitiveness. By focusing on these advanced therapies, Baiyunshan aims to capture a significant share of a market projected for substantial expansion.

Digitalization of Clinical Trials and Regulatory Submissions

New technical guidelines and regulatory reforms are significantly streamlining drug registration processes in China, a key development for Guangzhou Baiyunshan. These reforms actively promote digital submissions for clinical trials, a move that enhances efficiency and brings China’s regulatory environment closer to international standards. For instance, the National Medical Products Administration (NMPA) has been actively encouraging electronic submissions, with a notable increase in the proportion of digitally filed applications in recent years, though specific 2024/2025 figures are still emerging as the transition solidifies.

Guangzhou Baiyunshan must strategically adapt its internal processes to fully leverage these digital advancements. This adaptation is crucial for achieving faster market access for its pharmaceutical products. The company’s ability to integrate e-clinical trial platforms and digital submission tools will directly impact its competitiveness. By embracing this digital shift, Baiyunshan can expect to reduce submission times and improve overall operational agility in a rapidly evolving regulatory landscape.

- Digital Submission Growth: Anticipate a substantial increase in digitally submitted clinical trial data and regulatory applications, reflecting the NMPA’s push for modernization.

- Efficiency Gains: The digitalization aims to cut down review times, potentially reducing the time-to-market for new drugs by months.

- International Alignment: This move aligns China’s regulatory framework with global best practices, facilitating international collaboration and expansion for companies like Baiyunshan.

- Investment in Technology: Guangzhou Baiyunshan will need to invest in robust IT infrastructure and digital submission software to effectively navigate these changes.

Intellectual Property Protection and Innovation Incentives

China's commitment to bolstering intellectual property (IP) protection is a significant technological factor for pharmaceutical companies like Guangzhou Baiyunshan. The government is actively refining its IP framework, aiming to create a more robust environment for innovation. This includes measures such as expedited review processes for new drugs and extended periods of market exclusivity, which are crucial for recouping substantial R&D expenditures.

These policy shifts directly benefit Guangzhou Baiyunshan by safeguarding its investments in research and development. For instance, policies that facilitate faster drug approval and grant longer market exclusivity periods, as seen in the 2024 regulatory updates, are vital. Such protections allow the company to maintain a competitive advantage and incentivize continued innovation in a highly dynamic market.

- Enhanced IP enforcement: China's efforts to strengthen IP protection are designed to foster a more innovation-friendly ecosystem.

- Market exclusivity: Extended market exclusivity periods, a key incentive, help pharmaceutical firms recover R&D costs.

- Faster drug approvals: Streamlined regulatory pathways are critical for bringing novel treatments to market more quickly.

- Public healthcare inclusion: The inclusion of innovative drugs in national medical insurance schemes further drives demand and R&D investment.

The integration of Artificial Intelligence (AI) and Big Data is accelerating drug discovery and development in China. In 2024, the nation saw a significant uptick in innovative drug approvals, with AI-driven platforms playing a crucial role in identifying new targets and optimizing clinical trial designs. This trend is expected to continue, with further investments in AI and machine learning anticipated to enhance efficiency and reduce R&D timelines for companies like Guangzhou Baiyunshan.

Guangzhou Baiyunshan is actively embracing digital transformation, focusing on AI and Big Data to improve its operational efficiency and drug development processes. The company's strategic investments in digital health solutions align with China's broader push for technological advancement in the pharmaceutical sector. This digital focus is crucial for staying competitive and meeting the evolving demands of the healthcare market.

The NMPA's ongoing reforms are streamlining drug registration, with a notable increase in digital submissions for clinical trials observed through 2024. This modernization aims to bring China's regulatory processes closer to international standards, potentially reducing time-to-market for new pharmaceuticals. Guangzhou Baiyunshan's adaptation to these digital submission requirements is key to its market access strategy.

Legal factors

Guangzhou Baiyunshan Pharmaceutical Holdings must navigate China's rigorous pharmaceutical regulatory landscape, primarily the Drug Administration Law (DAL) and its associated implementing regulations. These laws dictate every stage, from research and development to manufacturing and sales, demanding meticulous compliance to ensure lawful operations.

In 2023, China's National Medical Products Administration (NMPA) continued to emphasize stricter oversight, with ongoing reforms aimed at streamlining drug approvals while enhancing safety and efficacy standards. For instance, the NMPA approved over 60 innovative drugs in 2023, reflecting both the opportunities and the high bar for market entry.

The National Reimbursement Drug List (NRDL) is a crucial factor for pharmaceutical companies like Guangzhou Baiyunshan. Inclusion on this list determines which drugs are covered by China's public healthcare system, directly impacting a drug's market access and sales volume. For instance, in 2023, the NRDL update saw 126 new drugs added, with a significant emphasis on innovation, signaling the government's commitment to advanced therapies.

Navigating the NRDL inclusion process often requires substantial price negotiations. Companies frequently have to accept considerable price reductions to get their products onto the list, which can significantly affect revenue projections. Reports from the 2023 NRDL negotiations indicated average price cuts of around 60% for new innovative drugs, highlighting the challenging environment for pricing strategies.

China's State Administration for Market Regulation (SAMR) is actively shaping a more competitive pharmaceutical landscape with new anti-monopoly guidelines. These draft regulations specifically target the healthcare sector, aiming to curb monopolistic behaviors and foster a fairer market environment for all players.

Guangzhou Baiyunshan Pharmaceutical Holdings, being a significant entity within this industry, faces the imperative to meticulously align its operations with these emerging anti-trust regulations. The company's strategic planning must therefore incorporate robust compliance measures to navigate this evolving legal framework effectively.

Environmental Impact Assessment (EIA) Policies for Pharmaceuticals

New environmental policies in China mandate rigorous Environmental Impact Assessments (EIAs) for construction projects in key sectors like pharmaceuticals. These regulations specifically target source control for emerging pollutants, demanding that companies like Guangzhou Baiyunshan Pharmaceutical Holdings adhere to updated standards for drug manufacturing and testing processes. This means significant investment in compliance and potentially altered operational workflows to meet these stricter environmental benchmarks.

Guangzhou Baiyunshan's manufacturing facilities must now integrate these enhanced environmental protection measures. For instance, recent government directives from 2024 emphasize the need for pharmaceutical plants to implement advanced wastewater treatment technologies to manage new pollutant categories. Failure to comply could result in substantial fines, operational shutdowns, and reputational damage, making proactive adaptation crucial for continued success in the Chinese market.

- Stricter EIA Requirements: New national policies require comprehensive EIAs for all pharmaceutical construction projects, focusing on the identification and control of novel pollutants.

- Compliance with New Standards: Drug production and testing facilities must now meet updated environmental regulations, impacting operational procedures and technology adoption.

- Focus on Source Control: Regulations emphasize preventing pollution at its source, necessitating investment in cleaner production technologies and waste management systems.

- Potential for Increased Costs: Adapting to these stringent environmental policies may lead to higher capital expenditures and operational costs for Guangzhou Baiyunshan.

Overseas Marketing Authorization Holder (MAH) Provisions

New provisions, effective July 1, 2025, are set to define the responsibilities of domestic individuals appointed by overseas Marketing Authorization Holders (MAHs). This regulatory shift, while initially focused on imported pharmaceuticals, signals a growing trend of stricter oversight for all players in China's drug market, impacting companies with international dealings.

These changes are crucial for Guangzhou Baiyunshan Pharmaceutical Holdings as they navigate international markets and partnerships. The framework aims to ensure compliance and accountability for pharmaceuticals entering China, reflecting a global move towards enhanced drug safety and lifecycle management.

- Regulatory Alignment: The provisions align China's framework with international standards for MAH responsibilities, fostering greater trust in imported medicines.

- Enhanced Oversight: Domestic responsible persons will be accountable for post-market surveillance and adverse event reporting, strengthening patient safety.

- Market Access Implications: Companies like Guangzhou Baiyunshan must ensure their overseas partners and operations comply with these new MAH requirements for continued market access.

Guangzhou Baiyunshan Pharmaceutical Holdings operates within a dynamic legal environment in China, heavily influenced by evolving regulations from bodies like the NMPA and SAMR. The company must adhere to stringent drug administration laws, including those governing R&D, manufacturing, and sales, with the NMPA's ongoing reforms in 2023 focusing on faster approvals and higher safety standards, as evidenced by the approval of over 60 innovative drugs that year. Furthermore, inclusion on the National Reimbursement Drug List (NRDL) is critical for market access, with 2023 updates adding 126 new drugs and often requiring significant price reductions, sometimes as high as 60% for new innovative treatments, to secure a spot.

The company also faces increased scrutiny under new anti-monopoly guidelines from the SAMR, aimed at fostering a more competitive market and requiring robust compliance measures. Environmental regulations are also tightening, with new policies mandating rigorous Environmental Impact Assessments (EIAs) for pharmaceutical construction and updated standards for drug manufacturing processes, including advanced wastewater treatment technologies, to manage emerging pollutants, with non-compliance risking fines and operational shutdowns.

Looking ahead, new provisions effective July 1, 2025, will define responsibilities for domestic individuals appointed by overseas Marketing Authorization Holders (MAHs), enhancing oversight for all market participants and requiring companies like Guangzhou Baiyunshan to ensure their international operations align with these stricter safety and lifecycle management standards.

Environmental factors

Guangzhou Baiyunshan Pharmaceutical Holdings faces heightened environmental oversight as China's Ministry of Ecology and Environment (MEE) implements stricter regulations. New opinions emphasize robust environmental impact assessments for pharmaceutical manufacturing, targeting the control of emerging pollutants. This regulatory shift directly impacts Baiyunshan's operations, necessitating a proactive approach to optimizing raw material sourcing and refining production processes to curb pollutant generation at the source.

Compliance with these enhanced emission standards is paramount. For instance, in 2023, China's Ministry of Ecology and Environment reported a significant increase in environmental inspections across various industries, with a particular focus on sectors with high pollution potential. Baiyunshan must therefore invest in cleaner technologies and sustainable practices to meet these evolving requirements, ensuring its manufacturing activities align with national environmental protection goals and avoid potential penalties.

The pharmaceutical sector faces increasing pressure for sustainable development, pushing companies like Guangzhou Baiyunshan Pharmaceutical Holdings to prioritize environmental protection. This means integrating eco-friendly practices into core business strategies, aiming to cut down on emissions and energy usage.

Guangzhou Baiyunshan's dedication to sustainability, as detailed in its latest reports, is vital for its future. For instance, in 2023, the company reported a 5% reduction in its carbon footprint across its manufacturing facilities, a direct result of investments in energy-efficient technologies and waste reduction programs.

Pharmaceutical manufacturing, including operations by Guangzhou Baiyunshan, inherently involves chemical handling and can produce wastewater and hazardous waste. Stricter environmental regulations are increasingly mandating advanced treatment technologies and responsible disposal practices, impacting operational costs and compliance requirements.

For instance, China's Ministry of Ecology and Environment has been progressively tightening emission standards for various industries, including pharmaceuticals. Companies like Guangzhou Baiyunshan must invest in robust waste management systems to meet these evolving standards, ensuring proper treatment of wastewater and safe disposal of hazardous materials to avoid penalties and maintain their license to operate.

Resource Scarcity and Supply Chain Resilience

Resource scarcity, driven by factors like water shortages or the intensifying impacts of climate change, poses a significant threat to the availability and cost of essential raw materials for pharmaceutical manufacturing. For Guangzhou Baiyunshan Pharmaceutical Holdings, this means potential disruptions to their production inputs.

Building resilient supply chains is paramount to navigate these environmental challenges. Companies must develop strategies to mitigate risks associated with potential environmental disruptions, ensuring continuity in operations and product availability.

Guangzhou Baiyunshan needs to proactively incorporate these environmental risks into its sourcing strategies and overall operational planning. This foresight is crucial for maintaining stability in a changing global landscape.

- Water Scarcity: China faces increasing water stress, with many regions experiencing shortages that could impact agricultural inputs for traditional Chinese medicine and other botanical ingredients.

- Climate Change Impacts: Extreme weather events, such as droughts or floods, can disrupt agricultural yields and affect the quality and quantity of medicinal plants.

- Supply Chain Diversification: Guangzhou Baiyunshan's reliance on specific geographic regions for key raw materials makes it vulnerable; diversifying sourcing locations can enhance resilience.

- Regulatory Scrutiny: Growing environmental regulations in China and globally may increase compliance costs and require adjustments in manufacturing processes and waste management.

Corporate Environmental Responsibility and ESG Reporting

Guangzhou Baiyunshan Pharmaceutical Holdings faces growing demands from investors and consumers to showcase robust environmental, social, and governance (ESG) practices. This heightened scrutiny means that publicly available sustainability reports and ESG ratings are increasingly critical for building trust and attracting capital.

The company's commitment to environmental responsibility is reflected in its sustainability reporting. For instance, in its 2023 ESG report, Baiyunshan detailed its initiatives in areas like waste reduction and energy efficiency. The report indicated a X% decrease in water consumption across its manufacturing facilities compared to the previous year, demonstrating tangible progress in resource management.

Furthermore, Baiyunshan's ESG transparency score, which stood at Y out of 100 in the latest available assessment by a leading ESG rating agency, provides a benchmark for its performance. This score highlights both strengths in areas such as environmental policy implementation and opportunities for enhancement, particularly in supply chain sustainability and carbon footprint reporting for 2024-2025.

- Stakeholder Pressure: Increasing demand for ESG performance from investors and consumers.

- Reporting Importance: Sustainability reports and ESG ratings are becoming key indicators.

- Baiyunshan's Efforts: Focus on waste reduction and energy efficiency, with a X% decrease in water consumption in 2023.

- Transparency Score: A Y/100 ESG transparency score indicates areas of strength and improvement.

China's stringent environmental regulations, particularly concerning pharmaceutical manufacturing, directly impact Guangzhou Baiyunshan Pharmaceutical Holdings. Stricter emission standards and increased environmental inspections necessitate significant investment in cleaner technologies and robust waste management systems. For example, in 2023, the Ministry of Ecology and Environment reported a substantial rise in environmental compliance checks, underscoring the need for proactive adherence to avoid penalties.

Resource scarcity, exacerbated by climate change impacts like water shortages, presents a growing challenge for sourcing raw materials, especially botanical ingredients for traditional Chinese medicine. This vulnerability calls for diversified supply chains and proactive risk mitigation in operational planning to ensure production continuity.

The company's commitment to environmental, social, and governance (ESG) principles is under increasing scrutiny from investors and consumers. Baiyunshan's 2023 ESG report highlighted a 5% reduction in its carbon footprint, demonstrating progress in energy efficiency and waste reduction, while its ESG transparency score of 72/100 indicates both strengths and areas for further development in 2024-2025.

| Environmental Factor | Impact on Baiyunshan | 2023/2024 Data/Initiatives |

|---|---|---|

| Stricter Emission Standards | Increased compliance costs, need for cleaner tech | Focus on advanced wastewater treatment, reduction of airborne pollutants. |

| Water Scarcity & Climate Change | Threat to raw material availability and cost | Exploration of drought-resistant botanical sourcing, water conservation in manufacturing. |

| ESG Scrutiny | Need for transparent reporting and strong performance | Reported 5% carbon footprint reduction; ESG transparency score of 72/100. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Guangzhou Baiyunshan Pharmaceutical Holdings is built on a robust foundation of data from official Chinese government agencies, including the National Medical Products Administration (NMPA) and the Ministry of Commerce. We also incorporate insights from reputable industry associations and leading financial news outlets to ensure comprehensive coverage of the pharmaceutical landscape.