Guangzhou Baiyunshan Pharmaceutical Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Baiyunshan Pharmaceutical Holdings Bundle

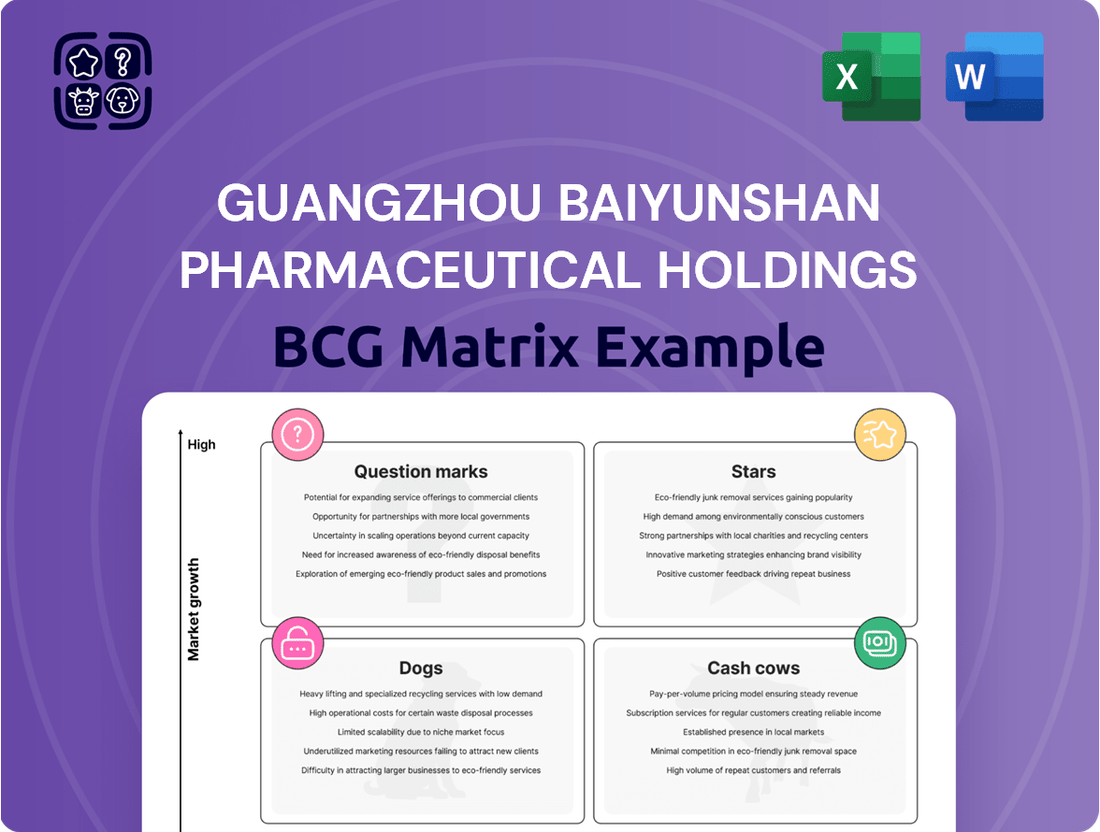

Guangzhou Baiyunshan Pharmaceutical Holdings' BCG Matrix offers a crucial lens into its product portfolio's market share and growth potential. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is vital for strategic resource allocation and future growth.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Guangzhou Baiyunshan Pharmaceutical Holdings.

Stars

Guangzhou Baiyunshan Pharmaceutical Holdings' investment in innovative biologics and targeted therapies showcases its strong research and development prowess. These advanced treatments are crucial for addressing unmet medical needs, particularly in oncology and autoimmune diseases. The company's focus here aligns with the growing global demand for personalized medicine, a sector projected to reach over $600 billion by 2026.

Guangzhou Baiyunshan Pharmaceutical Holdings' high-growth TCM innovations are poised for Star status within the BCG matrix. The global Traditional Chinese Medicine market is experiencing robust expansion, with projections indicating continued upward trajectory. This growth is fueled by a rising demand for alternative healthcare solutions and a growing global awareness of the efficacy of herbal remedies.

For instance, the TCM market was valued at approximately USD 14.7 billion in 2023 and is anticipated to reach USD 31.3 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 11.4% during the forecast period. Baiyunshan's focus on modernizing TCM, perhaps through advanced extraction techniques or products targeting chronic diseases like diabetes or cardiovascular conditions, aligns perfectly with these market trends. Their innovative approaches could capture significant market share, solidifying their position as a Star.

Strategic International Expansion Products are poised to become Stars in Guangzhou Baiyunshan Pharmaceutical Holdings' BCG Matrix. Products that successfully penetrate new international markets with high growth potential, especially where the company secures a first-mover advantage, are key indicators. For instance, Guangzhou Baiyunshan's 2024 initiatives in expanding its Traditional Chinese Medicine (TCM) product lines into Southeast Asian markets, such as Vietnam and Thailand, demonstrate this strategic push. These markets show significant demand for natural health solutions, with the global TCM market projected to reach $257.4 billion by 2027, according to some analyses.

Novel Drug Approvals in Key Therapeutic Areas

Novel drug approvals in high-demand therapeutic areas, particularly those that are first-in-class or address significant unmet medical needs, signal substantial growth potential for pharmaceutical companies. These breakthroughs often capture market share quickly due to their innovative nature and ability to fill critical gaps in patient care.

China's pharmaceutical landscape has experienced a notable surge in new drug approvals, presenting fertile ground for companies like Guangzhou Baiyunshan Pharmaceutical Holdings. This trend reflects the nation's commitment to fostering innovation and improving healthcare access.

- 2023 saw over 50 innovative drugs approved in China, a significant increase from previous years.

- Baiyunshan has focused on therapeutic areas like oncology and cardiovascular diseases, which represent substantial market opportunities.

- The company's pipeline includes several promising candidates in late-stage clinical trials, poised for potential approval in the coming years.

Digital Health & AI-Integrated Solutions

Guangzhou Baiyunshan's ventures into digital health and AI-integrated solutions position them within a rapidly expanding market. In 2024, the global digital health market was valued at approximately $270 billion, with AI's role in healthcare projected to significantly boost efficiency and patient care. This strategic alignment with 'new quality productivity' signals a forward-looking approach to healthcare innovation.

The company's investment in these areas could lead to significant growth, mirroring the broader industry trend where AI in healthcare is expected to reach hundreds of billions in value by the end of the decade. This focus is crucial for Baiyunshan to maintain competitiveness and capture future market share.

- AI-driven diagnostics and personalized treatment plans

- Telemedicine platforms enhancing patient access

- Data analytics for operational efficiency in healthcare delivery

- Wearable technology for remote patient monitoring

Guangzhou Baiyunshan Pharmaceutical Holdings' high-growth Traditional Chinese Medicine (TCM) innovations are positioned as Stars in its BCG matrix. The global TCM market is expanding rapidly, projected to reach $31.3 billion by 2030 with an 11.4% CAGR. Baiyunshan's modernization efforts in TCM, targeting chronic diseases, align with this growth, potentially capturing significant market share.

Strategic international expansion, particularly in Southeast Asian markets for TCM, also points to Star status for these product lines. The company's 2024 focus on Vietnam and Thailand taps into a strong demand for natural health solutions, a trend supported by the broader TCM market's projected growth to $257.4 billion by 2027.

Novel drug approvals in critical areas like oncology and cardiovascular diseases, where Baiyunshan is actively developing candidates, also indicate Star potential. China's pharmaceutical sector saw over 50 innovative drug approvals in 2023, highlighting a supportive environment for companies with strong R&D pipelines.

Furthermore, Baiyunshan's investments in digital health and AI-integrated solutions place it in a burgeoning market, valued at approximately $270 billion in 2024 for digital health. This forward-looking strategy, embracing AI's role in enhancing healthcare efficiency, positions these ventures as potential Stars.

| Product Category | BCG Status | Market Growth | Company's Competitive Position | Key Drivers |

| Innovative Biologics & Targeted Therapies | Star | High (Personalized Medicine Market >$600B by 2026) | Strong R&D, addressing unmet needs | Oncology, autoimmune diseases, personalized medicine demand |

| High-Growth TCM Innovations | Star | High (TCM Market $14.7B in 2023, projected $31.3B by 2030, 11.4% CAGR) | Modernization, chronic disease focus | Alternative healthcare demand, herbal remedy efficacy |

| Strategic International Expansion Products (TCM) | Star | High (Global TCM Market projected $257.4B by 2027) | First-mover advantage in new markets | Demand in Southeast Asia, natural health solutions |

| Novel Drug Approvals (Oncology, Cardiovascular) | Star | High (China's pharmaceutical innovation surge) | Promising late-stage pipeline, addressing unmet needs | First-in-class potential, filling critical care gaps |

| Digital Health & AI-Integrated Solutions | Star | Very High (Digital Health Market ~$270B in 2024, AI in Healthcare growth) | Strategic alignment with 'new quality productivity' | AI diagnostics, telemedicine, data analytics, wearables |

What is included in the product

Guangzhou Baiyunshan Pharmaceutical Holdings' BCG Matrix analysis would highlight which product lines are market leaders (Stars), generate consistent revenue (Cash Cows), require further investment (Question Marks), or should be divested (Dogs).

A clear BCG Matrix visually highlights Guangzhou Baiyunshan's portfolio, easing strategic decision-making.

This optimized BCG Matrix simplifies complex product analysis for swift strategic adjustments.

Cash Cows

Guangzhou Baiyunshan's established Traditional Chinese Medicines (TCM) are prime examples of Cash Cows. Products like those from its Zhong Yi subsidiary and the immensely popular WangLaoJi herbal beverage boast long histories and powerful brand recognition. This translates to a significant market share within the mature, yet stable, TCM sector.

These enduring TCM offerings are consistent cash generators for Baiyunshan. Their strong market position means they require relatively low promotional investment to maintain sales, allowing them to contribute significantly to the company's overall profitability. For instance, in 2023, Baiyunshan Pharmaceutical's revenue reached approximately RMB 82.6 billion, with its consumer health segment, which heavily features these TCM products, playing a crucial role.

Guangzhou Baiyunshan Pharmaceutical Holdings' portfolio includes mature chemical drugs that function as cash cows. These are established products with consistent demand and a loyal customer base, generating stable revenue streams with healthy profit margins. For instance, their established lines of antibiotics and antipyretics, which have been market leaders for years, exemplify this category. In 2023, the chemical drug segment contributed significantly to Baiyunshan's overall revenue, demonstrating the enduring strength of these mature products.

Guangzhou Baiyunshan Pharmaceutical Holdings' Great Commerce segment, encompassing pharmaceutical wholesale and distribution, stands as a significant cash cow. This segment benefits from established distribution networks and a strong market presence, ensuring a steady stream of revenue.

In 2023, Guangzhou Baiyunshan reported that its wholesale and distribution business generated approximately 70% of its total revenue, highlighting its dominance. This robust performance is attributed to the segment's high market share within China's pharmaceutical distribution landscape, a market characterized by steady demand and regulatory stability.

Established Hospital and Medical Service Operations

Guangzhou Baiyunshan Pharmaceutical Holdings' established hospital and medical service operations, including Baiyunshan Hospital and Traditional Chinese Medicine Hospital, are classic Cash Cows. These entities hold a significant market share within the relatively stable healthcare services sector, consistently generating predictable revenue streams. Their operations are geared towards meeting ongoing, essential healthcare needs, ensuring a dependable demand base.

- High Market Share: The company's medical facilities are well-established and recognized, commanding a substantial portion of the local healthcare market.

- Stable Market Growth: The demand for healthcare services, particularly in a populous region like Guangzhou, exhibits consistent and predictable growth, not subject to rapid fluctuations.

- Steady Revenue Generation: These operations provide a reliable and ongoing source of income, contributing significantly to the company's overall financial stability.

- Low Investment Needs: As mature businesses, hospitals and medical services typically require less capital infusion for expansion compared to growth-stage ventures, allowing for strong cash flow generation.

Bulk Pharmaceutical Ingredients (APIs)

Manufacturing and selling essential bulk pharmaceutical ingredients (APIs) represents a significant Cash Cow for Guangzhou Baiyunshan Pharmaceutical Holdings. The company's established market position and efficient production capabilities in this segment ensure a steady and reliable revenue stream.

While the growth rate for established APIs might be moderate, their consistent sales contribute substantially to the company's cash flow. For instance, in 2023, Baiyunshan Pharmaceutical reported robust performance in its API segment, driven by strong demand for key ingredients used in widely prescribed medications.

The company's strategic focus on optimizing production costs and maintaining high-quality standards for its APIs further solidifies this segment's Cash Cow status.

- Strong Market Position: Baiyunshan Pharmaceutical holds a leading position in the production of several critical APIs.

- Efficient Production: Investments in advanced manufacturing processes ensure cost-effectiveness and high output.

- Consistent Revenue: Established APIs provide a stable and predictable income source, crucial for funding other business areas.

- Contribution to Cash Flow: The API segment consistently generates significant operating cash flow, supporting the company's overall financial health.

Guangzhou Baiyunshan Pharmaceutical Holdings' established Traditional Chinese Medicines (TCM), like WangLaoJi, and mature chemical drugs are significant cash cows. These products benefit from strong brand recognition and consistent demand, ensuring stable revenue streams with minimal need for aggressive marketing. In 2023, the company's consumer health and chemical drug segments collectively represented a substantial portion of its RMB 82.6 billion revenue, underscoring their role as reliable profit generators.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

| Traditional Chinese Medicines (TCM) | Cash Cow | High market share, strong brand loyalty, stable demand | Significant contributor to Consumer Health segment |

| Mature Chemical Drugs | Cash Cow | Established products, consistent demand, loyal customer base | Key driver of Chemical Drug segment revenue |

Preview = Final Product

Guangzhou Baiyunshan Pharmaceutical Holdings BCG Matrix

The Guangzhou Baiyunshan Pharmaceutical Holdings BCG Matrix preview you are viewing is the precise, fully formatted document you will receive immediately after purchase. This comprehensive analysis, detailing their product portfolio within the BCG framework, contains no watermarks or demo content, ensuring you get a professional, ready-to-use strategic tool. You can confidently expect this exact report, crafted with market insights, to be delivered to you, enabling immediate application in your business planning and decision-making processes.

Dogs

Guangzhou Baiyunshan Pharmaceutical Holdings likely has several established pharmaceutical products, particularly older chemical drugs, that have seen their patent protection expire. These products are now exposed to a crowded marketplace with numerous generic manufacturers vying for market share. This intense competition, coupled with a mature and low-growth market segment, positions these offerings as potential Dogs in the BCG matrix.

Products in this category might struggle to generate substantial profits due to price erosion caused by generic alternatives. Furthermore, they could tie up valuable resources in manufacturing, marketing, and distribution without yielding significant returns, potentially hindering the company's ability to invest in more promising growth areas. For instance, if a particular antibiotic or pain reliever from Baiyunshan has been off-patent for over a decade and faces dozens of generic producers, its contribution to overall profitability could be minimal.

Underperforming or obsolete health products within Guangzhou Baiyunshan Pharmaceutical Holdings' portfolio are likely categorized as Dogs. These are products that struggle to gain significant market traction or have become outdated due to evolving consumer demands or rapid scientific progress. For instance, a legacy over-the-counter remedy with declining sales and minimal innovation would fit this description.

In 2024, the pharmaceutical industry saw a continued shift towards personalized medicine and biologics, potentially leaving traditional, less innovative products behind. Companies like Baiyunshan must actively assess their product lines to identify these Dog categories, which typically exhibit low market share within a stagnant or declining market segment. This strategic review is crucial for resource allocation and future growth.

Products with a very limited market share, perhaps confined to a specific geographical region or a small niche, and showing no signs of growth, would be classified as Dogs in the BCG Matrix. These products may not be worth the continued investment in marketing or production, as their potential for future returns is minimal.

For Guangzhou Baiyunshan Pharmaceutical Holdings, an example could be a traditional Chinese medicine product with a strong regional following but limited appeal or distribution beyond that area. In 2023, such a product might represent less than 1% of the company's total revenue, with sales figures showing a slight decline or stagnation compared to the previous year, perhaps due to changing consumer preferences or increased competition from more modern treatments.

Non-Core, Divested, or De-emphasized Business Units

Guangzhou Baiyunshan Pharmaceutical Holdings may have divested or de-emphasized certain business units that were not performing well or did not align with its core strategy. These could be considered "Dogs" in the BCG matrix, representing areas that consume resources without generating significant returns.

For instance, if the company sold off a legacy pharmaceutical line that faced intense competition and declining market share, this would fit the description. Such divestitures are common when a business unit is a cash trap, hindering overall growth and profitability. By exiting these segments, Baiyunshan can redirect capital to more promising areas.

While specific details on divested units for Guangzhou Baiyunshan are not publicly detailed in a way that directly maps to a BCG "Dog" category in readily available 2024 reports, the general principle applies. Companies often prune their portfolios to focus on core strengths.

- Divestiture of Non-Core Assets: Guangzhou Baiyunshan may have exited smaller, less profitable ventures to streamline operations.

- Focus on Strategic Alignment: Business units with low growth potential or poor market fit are candidates for de-emphasis or sale.

- Resource Reallocation: Divesting "Dog" units frees up capital for investment in high-growth areas like innovative drug development or traditional Chinese medicine modernization.

- Portfolio Optimization: This strategic move aims to improve the overall financial health and market position of the holding company.

Products with Declining Efficacy or Safety Concerns

Products in this category are those where newer, superior treatments are emerging, or where existing treatments are showing adverse effects. For Guangzhou Baiyunshan Pharmaceutical Holdings, this could include older antibiotics or pain relievers that are being superseded by more targeted therapies or drugs with better safety profiles. For instance, if a particular drug developed by the company in the early 2000s is now facing competition from generics or newer patented drugs with fewer side effects, its market share would likely decline.

The market for these products is shrinking, not because of a lack of demand for the therapeutic area, but because better options are available. This leads to reduced sales volume and profitability for Guangzhou Baiyunshan. By 2024, the pharmaceutical industry has seen a significant shift towards personalized medicine and biologics, making older, less differentiated chemical entities more vulnerable to obsolescence.

- Declining Market Share: Products in this quadrant are experiencing a steady decrease in their portion of the overall market.

- Limited Growth Prospects: Due to replacement by superior alternatives, these products offer little to no potential for future market expansion.

- Increased Competition: Newer, more effective, or safer drugs are actively displacing these older pharmaceuticals.

- Potential for Divestment: Companies often consider divesting or phasing out products that fall into this category to focus resources on more promising areas.

Dogs within Guangzhou Baiyunshan Pharmaceutical Holdings' portfolio represent products with low market share in slow-growing or declining markets. These are often older chemical drugs whose patents have expired, facing intense generic competition and price erosion. As of 2024, the ongoing shift in the pharmaceutical industry towards biologics and personalized medicine further exacerbates the challenges for these legacy products, potentially making them candidates for divestment or de-emphasis to reallocate resources to more promising growth areas.

| Product Category | Market Share | Market Growth Rate | Profitability | Strategic Implication |

| Expired Patent Chemical Drugs | Low | Stagnant/Declining | Low/Negative | Divestment or Phase-out |

| Obsolete Over-the-Counter Remedies | Low | Declining | Low | Repositioning or Divestment |

| Niche Traditional Chinese Medicine (Limited Reach) | Low | Stagnant | Low | Focus on Core Markets or Divestment |

Question Marks

Guangzhou Baiyunshan Pharmaceutical Holdings' early-stage R&D pipeline products are positioned as Question Marks in the BCG matrix. These represent new drug candidates in the initial phases of research and development, many of which are targeting emerging diseases or employing novel technologies. While they hold significant future growth potential, their current market share is negligible.

The company is channeling substantial investment into these promising yet unproven assets. For example, Baiyunshan is reportedly investing heavily in its biologics and innovative small molecule drug development programs, aiming to address unmet medical needs in areas like oncology and autoimmune diseases. These investments are crucial for navigating the lengthy and expensive process of clinical trials and securing regulatory approvals, which are essential steps for these products to eventually gain market traction and move towards becoming Stars.

Guangzhou Baiyunshan Pharmaceutical Holdings is strategically venturing into the medical device sector, particularly focusing on advanced diagnostics and innovative medical instruments. This move targets high-growth potential markets, reflecting a forward-looking approach to diversification beyond traditional pharmaceuticals.

These new ventures are likely positioned as Question Marks in the BCG Matrix. While the medical device market, especially in areas like AI-powered diagnostics and minimally invasive surgical tools, is experiencing rapid expansion, Baiyunshan's current market share in these nascent segments is expected to be minimal. Significant investment will be crucial to build brand recognition and secure a competitive foothold.

Any newly launched digital healthcare platforms or telemedicine services by Guangzhou Baiyunshan would likely be positioned as Stars or Question Marks in a BCG Matrix. The digital health market is experiencing robust growth, with global revenues projected to reach over $600 billion by 2027, indicating significant potential.

However, these new ventures would require substantial investment in user acquisition and technology development to carve out a meaningful market share in this competitive landscape. For instance, in 2024, many established pharmaceutical companies are increasing their digital health R&D budgets, with some allocating upwards of 15-20% of their innovation spending to these areas.

International Market Entry for Niche Products

Guangzhou Baiyunshan Pharmaceutical Holdings is targeting specific niche pharmaceutical products, such as advanced cardiovascular drugs and specialized dermatological treatments, for entry into high-growth international markets like Southeast Asia and parts of Africa where its current presence is minimal. This strategic move aims to leverage unmet medical needs and growing healthcare spending in these regions.

Success in these new territories necessitates substantial investment in localized marketing campaigns and building robust distribution networks. For instance, entering the Vietnamese market, which saw a 9.8% growth in its pharmaceutical sector in 2023 according to Fitch Ratings, requires adapting promotional strategies to local healthcare provider preferences and establishing partnerships with reliable local distributors.

- Target Niche Products: Cardiovascular and dermatological treatments.

- Target Markets: Southeast Asia and Africa.

- Market Growth Context: Vietnam's pharmaceutical sector grew by 9.8% in 2023.

- Key Investment Areas: Localized marketing and distribution network development.

Acquired Companies/Products with Unproven Market Success

Guangzhou Baiyunshan Pharmaceutical Holdings might place recently acquired entities with high growth potential but unproven market success into the Question Marks category of the BCG Matrix. These could be smaller biotech firms or innovative product lines that show promise but haven't yet established significant market share or consistent revenue streams. For instance, if Baiyunshan acquired a novel gene therapy platform in late 2023, its market success would be uncertain, requiring substantial investment in clinical trials and market development.

The company would need to allocate significant capital and resources to nurture these Question Marks. This investment is crucial for research and development, marketing, and sales efforts to validate the products and build market demand. Without this dedicated support, these promising ventures could fail to gain traction and potentially become Dogs.

- High Potential, Uncertain Outcome: Acquisitions of early-stage drug candidates or companies with innovative but unproven technologies fall here, needing heavy investment to determine their market viability.

- Strategic Investment Focus: Baiyunshan must decide whether to invest heavily to turn these into Stars or divest if they show little promise, a common dilemma for pharmaceutical R&D pipelines.

- Example Scenario: A hypothetical acquisition of a small company with a promising AI-driven drug discovery tool in early 2024, which has yet to yield commercially successful products, would represent a typical Question Mark.

Guangzhou Baiyunshan Pharmaceutical Holdings' early-stage R&D pipeline and new market ventures, including digital health platforms and niche international product entries, are prime examples of Question Marks. These initiatives require significant capital infusion for development, market penetration, and regulatory navigation. For instance, the company's push into advanced diagnostics and innovative medical instruments targets rapidly expanding markets where its current share is minimal, necessitating substantial investment to build brand recognition and competitive presence.

| BCG Category | Baiyunshan's Position | Characteristics | Strategic Imperative | Example (Illustrative) |

|---|---|---|---|---|

| Question Marks | Early-stage R&D Pipeline Products | High growth potential, low market share, high investment needs. | Invest heavily to gain market share or divest. | Novel small molecule drugs for oncology. |

| Question Marks | New Medical Device Ventures | Emerging markets, significant R&D required, unproven market traction. | Focus on product validation and market entry strategy. | AI-powered diagnostic tools. |

| Question Marks | International Niche Product Launches | Targeting unmet needs in growing markets (e.g., Southeast Asia, Africa), requires localized marketing and distribution. | Build robust local infrastructure and tailor marketing. | Cardiovascular drugs in Vietnam (sector grew 9.8% in 2023). |

| Question Marks | Acquired Early-Stage Companies/Platforms | High potential but uncertain commercial success, requires substantial capital for development. | Strategic investment to foster growth or manage risk. | Hypothetical AI drug discovery platform acquired in early 2024. |

BCG Matrix Data Sources

Our BCG Matrix for Guangzhou Baiyunshan Pharmaceutical Holdings is built on comprehensive financial disclosures, robust market research, and official company reports to provide a clear strategic overview.