Golden State Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden State Foods Bundle

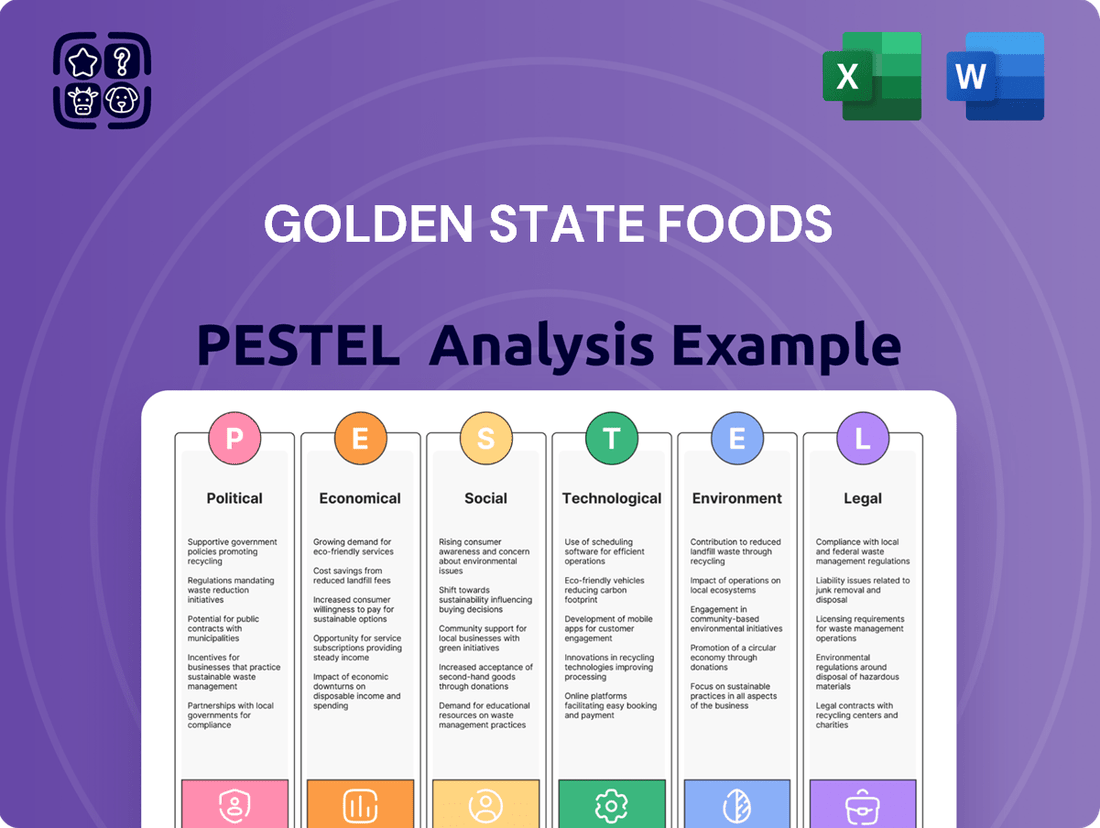

Navigate the complex external forces shaping Golden State Foods's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this industry leader. Equip yourself with actionable intelligence to refine your own strategic planning and gain a competitive advantage. Download the full PESTLE analysis now and unlock the insights you need to thrive.

Political factors

Governments worldwide, including the U.S., impose strict food safety regulations that directly affect Golden State Foods' operations. These rules cover every stage, from how ingredients are sourced to how finished products reach consumers.

The U.S. Food and Drug Administration (FDA) is enhancing its Food Safety Modernization Act (FSMA) rules for 2025, emphasizing better traceability and more robust sanitary transportation standards. A key deadline for enhanced traceability is January 20, 2026.

Adhering to these evolving governmental mandates is crucial for Golden State Foods to continue its global business and protect its brand image, especially as compliance costs can impact profitability.

Golden State Foods, as a global food supplier, is significantly influenced by international trade policies and tariffs. Changes in these regulations can directly affect the cost of sourcing ingredients and the ease of distributing finished products across borders. For instance, the World Trade Organization's (WTO) dispute settlement system, while aiming for stability, saw ongoing challenges in 2024, potentially impacting the predictability of trade flows.

Fluctuations in tariffs, such as those seen in trade disputes between major economies in late 2024, can increase the cost of raw materials like agricultural commodities or processed ingredients. This directly impacts Golden State Foods' cost of goods sold and potentially its pricing strategies in international markets. The company must remain agile to navigate these shifts, perhaps by diversifying sourcing or adjusting distribution networks.

Geopolitical tensions and ongoing trade negotiations in 2024-2025 present a dynamic landscape for global supply chains. For Golden State Foods, this could mean adapting sourcing strategies to mitigate risks associated with specific regions or trade blocs. For example, reliance on a single country for a key ingredient could become problematic if new tariffs or trade barriers are imposed, necessitating a proactive approach to supply chain resilience.

Labor laws and immigration policies significantly shape Golden State Foods' operating landscape. For instance, the projected federal minimum wage increase in the US, potentially reaching $15 per hour by 2025, directly impacts labor expenses. Worker safety regulations, while crucial, also add to compliance costs.

The foodservice sector, a primary market for GSF, is grappling with ongoing labor shortages. Data from the Bureau of Labor Statistics in late 2024 indicated job openings in the leisure and hospitality sector remained elevated, contributing to wage pressures. This trend is anticipated to persist, impacting GSF's ability to staff its operations affordably.

Furthermore, evolving immigration policies present a dual challenge. Stricter enforcement or changes in visa programs could reduce the pool of available workers for manufacturing and distribution, GSF's core functions. This necessitates increased investment in automation technologies and robust employee retention programs to mitigate potential workforce disruptions.

Government Support and Subsidies for Agriculture

Government support and subsidies for agriculture in key sourcing regions directly impact the stability and cost of raw materials for Golden State Foods. For instance, the U.S. Department of Agriculture's (USDA) farm bill, renewed periodically, provides billions in support, influencing crop prices and availability. In 2024, projected farm bill spending remains substantial, offering a degree of predictability for commodity markets.

Shifts in these policies, such as changes to farm subsidies or the allocation of disaster relief programs, can significantly affect the prices and consistent supply of crucial inputs like produce, dairy, and protein. For example, a reduction in crop insurance subsidies could lead to higher price volatility for fruits and vegetables sourced by GSF.

- Farm Bill Influence: The U.S. Farm Bill, a cornerstone of agricultural policy, continues to shape commodity markets, impacting GSF's raw material costs.

- Subsidies and Pricing: Government subsidies for specific crops or livestock can lower production costs for farmers, potentially translating to more stable pricing for Golden State Foods.

- Disaster Relief Impact: Federal disaster relief programs, like those administered by the USDA's Risk Management Agency, help mitigate losses from extreme weather, bolstering supply chain resilience for GSF.

- Trade Policy Alignment: Government trade agreements and tariffs also play a role, influencing the cost and accessibility of imported agricultural goods used by Golden State Foods.

Political Stability in Operating Regions

The political stability across the five continents where Golden State Foods operates is a cornerstone of its operational integrity. With 50 locations and service to 125,000 restaurants, any disruption due to political instability can have far-reaching consequences.

Regions experiencing political unrest or conflict, such as ongoing food crises in parts of Africa and Western Asia, directly impact food security and distribution networks. These situations can severely hinder supply chain operations and affect production, as seen in instances where political instability exacerbates existing hunger issues.

- Geopolitical Risk Exposure: Golden State Foods' global footprint necessitates constant monitoring of political climates in over 50 operating regions.

- Supply Chain Vulnerability: Political instability can lead to border closures, trade restrictions, and disruptions in logistics, impacting the flow of goods.

- Impact on Food Security: In 2024, the World Food Programme reported that over 780 million people faced chronic hunger, with political instability being a major driver in many affected regions, posing direct risks to food supply chains.

- Policy Shifts and Regulations: Sudden changes in government policies or regulatory frameworks in key operating countries can affect manufacturing, labor, and distribution, requiring agile adaptation.

Government regulations, particularly those concerning food safety and international trade, significantly shape Golden State Foods' operational environment. The U.S. FDA's ongoing enhancements to the Food Safety Modernization Act (FSMA) for 2025, focusing on traceability and sanitary transport, require continuous adaptation and investment. Trade policies and tariffs, as highlighted by ongoing WTO dispute settlement challenges in 2024, directly influence raw material costs and distribution efficiency, necessitating agile responses to potential price volatility and supply chain disruptions.

Labor laws and immigration policies present ongoing challenges, with projected federal minimum wage increases in the U.S. to $15 per hour by 2025 impacting labor expenses. Elevated job openings in the foodservice sector in late 2024, as reported by the Bureau of Labor Statistics, contribute to wage pressures and potential workforce shortages for Golden State Foods. Changes in immigration policies could further constrain the labor pool, driving increased investment in automation and retention strategies.

Government support, such as the U.S. Farm Bill's substantial projected spending in 2024, influences agricultural commodity prices and availability, offering a degree of stability for Golden State Foods' sourcing. However, shifts in subsidies or disaster relief programs can introduce price volatility for key inputs. Political stability across Golden State Foods' 50 operating locations is paramount, as geopolitical risks and regional conflicts, which contribute to global food insecurity as noted by the World Food Programme in 2024, can severely disrupt supply chains and production.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Golden State Foods, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying key opportunities and threats within the company's operating landscape.

A concise, actionable summary of Golden State Foods' PESTLE analysis, designed to quickly identify and address potential external challenges and opportunities, streamlining strategic decision-making.

Economic factors

Golden State Foods (GSF) is navigating a challenging economic landscape marked by persistent inflation, significantly impacting ingredient and labor expenses. The foodservice sector saw a noticeable deceleration in 2024, largely attributed to elevated menu prices, prompting a critical need for operators to reassess their pricing strategies heading into 2025.

The ability to effectively manage these escalating input costs, while simultaneously ensuring competitive pricing for their quick-service restaurant (QSR) clients, presents a substantial hurdle for GSF's continued profitability. For instance, the US Consumer Price Index for food away from home rose by 5.5% in the year ending April 2024, illustrating the ongoing pressure on food costs.

Consumer spending power is a critical driver for quick-service restaurant (QSR) chains, Golden State Foods' (GSF) main clientele. As consumers increasingly prioritize value, GSF needs to ensure its offerings enable its QSR partners to provide affordable choices. This focus on value is essential for maintaining demand in a competitive market.

Looking ahead to 2025, a projected modest recovery in consumer confidence, fueled by anticipated lower inflation and interest rates, could lead to an uptick in dining out frequency. For instance, the U.S. Bureau of Labor Statistics reported a Consumer Price Index (CPI) increase of 3.4% in April 2024, a notable decrease from previous years, suggesting a potential easing of price pressures that could boost discretionary spending.

Golden State Foods' (GSF) performance is closely tied to the health of the global economy and the demand for food. While the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, significant regional disparities persist. This uneven recovery directly impacts GSF's market opportunities.

The food industry, while often resilient, is not immune to economic downturns. Reports from the UN in late 2024 highlighted that while food security has improved in some areas, the number of undernourished people increased in regions like Sub-Saharan Africa and Western Asia, reaching an estimated 282 million in 2023. This creates a complex demand landscape for GSF.

Consequently, GSF's strategic decisions regarding expansion and investment in new markets are heavily influenced by the projected economic outlook and growth potential in various international territories. Understanding these nuances is critical for successful global operations.

Currency Exchange Rate Fluctuations

Golden State Foods, as a global supplier, faces the challenge of currency exchange rate fluctuations. These shifts directly influence the cost of raw materials sourced internationally and the value of revenue generated from overseas markets. For instance, a stronger US dollar could make imported ingredients cheaper but reduce the profitability of sales in countries with weaker currencies.

Significant currency movements can impact Golden State Foods' overall financial performance and necessitate adjustments to pricing strategies across various international markets. The company must navigate these volatilities to maintain competitive pricing and profitability, especially considering that major trading partners like Mexico and Canada can experience notable currency shifts.

- Impact on Imported Costs: A 5% depreciation of the US dollar against the Euro could increase the cost of European dairy ingredients by 5%.

- Impact on International Revenue: A 3% appreciation of the US dollar against the Japanese Yen would decrease the Yen-denominated revenue when converted back to USD.

- Financial Stability: Effective foreign exchange risk management is crucial for GSF's financial stability, as demonstrated by companies that experienced significant earnings volatility due to unhedged currency exposures in previous years.

Supply Chain Resilience and Logistics Costs

The efficiency and cost of Golden State Foods' extensive supply chain and logistics operations are critical economic factors. Increased costs for transportation, warehousing, and the necessity of temperature-controlled shipping directly impact overall operational expenses.

For instance, global freight rates saw significant fluctuations in late 2023 and early 2024, with some routes experiencing double-digit percentage increases year-over-year, directly affecting companies like Golden State Foods.

Optimizing supply chains with automation and AI is a key strategy for reducing costs and enhancing efficiency, a trend expected to accelerate through 2025.

- Transportation Costs: Fuel price volatility and driver shortages continue to exert upward pressure on freight expenses.

- Warehousing Needs: Demand for specialized, temperature-controlled warehousing for food products remains high, increasing overhead.

- Automation Investment: Companies are increasingly investing in AI-driven route optimization and warehouse automation to mitigate rising logistics expenses.

- Supply Chain Visibility: Enhanced real-time tracking and data analytics are crucial for managing and reducing supply chain disruptions and costs in 2025.

Persistent inflation continues to pressure ingredient and labor costs for Golden State Foods (GSF), impacting its ability to offer competitive pricing to QSR clients. While the US CPI for food away from home rose 5.5% year-over-year through April 2024, a projected easing of inflation to 3.4% by April 2024 suggests potential relief for consumers and, by extension, GSF's partners.

Consumer spending power remains a key economic driver, with GSF needing to support its QSR clients in providing value-oriented options. A modest recovery in consumer confidence anticipated for 2025, potentially driven by lower inflation and interest rates, could boost dining-out frequency.

Global economic growth, projected at 3.2% for 2024 by the IMF, presents uneven market opportunities for GSF, necessitating careful strategic expansion planning. Currency fluctuations also pose a significant challenge, directly impacting the cost of imported raw materials and the value of international revenue streams.

| Economic Factor | 2024 Data/Projection | 2025 Outlook | Impact on GSF |

|---|---|---|---|

| Inflation (Food Away From Home CPI) | +5.5% (Year ending April 2024) | Projected easing to ~3.4% (Year ending April 2025) | Higher input costs, pressure on pricing strategies |

| Global GDP Growth | 3.2% (IMF Projection 2024) | Varied regional growth, potential for market expansion | Influences demand and market opportunities |

| Currency Exchange Rates | Volatile, with notable shifts in major trading partners | Continued volatility expected | Impacts cost of goods and international revenue |

Full Version Awaits

Golden State Foods PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Golden State Foods' PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Golden State Foods.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Golden State Foods.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving a significant demand for foods that support these goals. This includes a notable rise in interest for plant-based alternatives and functional foods offering specific health benefits.

Golden State Foods is responding by focusing its innovation efforts on developing products with cleaner labels and more recognizable, simpler ingredients. This strategic move aims to directly address the growing consumer preference for transparency and naturalness in their food choices.

This evolving consumer landscape necessitates that GSF adapt its product offerings to align with shifting dietary preferences and health aspirations. For instance, there's a growing emphasis on foods that are high in protein and fiber, reflecting a broader health-conscious market.

The demand for plant-based and alternative proteins is surging, driven by health, environmental, and ethical concerns. For instance, the global plant-based food market was valued at approximately $29.4 billion in 2023 and is projected to reach $162 billion by 2030, demonstrating a compound annual growth rate of over 27%. This signifies a significant shift in consumer preferences, moving beyond niche veganism to embrace a broader spectrum of whole, unprocessed plant foods and innovative protein alternatives.

Golden State Foods, a key player in protein supply, must actively integrate these evolving consumer preferences into its product strategy. By exploring and offering a wider range of plant-based and alternative protein solutions, the company can tap into this expanding market segment. This trend presents a dual opportunity: fostering new product development while also addressing the potential impact on its traditional protein product lines.

A growing number of consumers are making purchasing decisions based on a company's environmental and social impact. In 2024, studies indicated that over 60% of consumers consider sustainability a key factor when buying food products. This trend directly influences food service providers like Golden State Foods (GSF).

GSF's proactive stance on sustainability, including its commitment to net-zero emissions and engagement with the Science Based Targets initiative (SBTi), directly addresses this consumer preference. By aligning its operations with these ambitious environmental goals, GSF is positioning itself favorably within a market that increasingly values corporate responsibility.

Communicating these efforts effectively is crucial for GSF. Highlighting sustainable practices and ethical sourcing in marketing and transparent reporting can significantly bolster brand reputation and foster deeper consumer trust, potentially leading to increased customer loyalty and market share by 2025.

Impact of Social Media and Digital Influencers on Food Trends

Social media platforms are powerful drivers of food trends, with platforms like TikTok and Instagram significantly influencing what consumers eat. In 2024, food content on TikTok alone garnered billions of views, demonstrating its reach. Digital influencers, often showcasing new ingredients or preparation methods, can rapidly shift consumer demand, creating both opportunities and challenges for food suppliers like Golden State Foods.

These evolving preferences, particularly among Gen Z and Millennials who are heavy social media users, necessitate constant monitoring by companies such as Golden State Foods. For instance, the rise of plant-based eating, heavily promoted by influencers, has reshaped the demand for certain ingredients. GSF must stay agile to adapt its product development and marketing to capitalize on these digitally-driven shifts.

- Social Media Food Content Reach: Billions of views for food-related content on platforms like TikTok in 2024.

- Influencer Impact: Digital influencers can create sudden, significant shifts in demand for specific ingredients or dishes.

- Demographic Influence: Younger generations (Gen Z, Millennials) are particularly susceptible to social media-driven food trends.

- Adaptation Need: Golden State Foods must monitor these trends to inform product innovation and marketing strategies.

Shifting Dining Experiences and Convenience Needs

The foodservice industry is undergoing a significant transformation, driven by evolving consumer preferences for convenience and personalized dining. This shift is evident in the rising popularity of virtual and hybrid dining models, which demand greater flexibility from suppliers. For Golden State Foods, a key player in supplying quick-service restaurants (QSRs), this means adapting its offerings and logistics to better support takeout and delivery services. For instance, the demand for off-premise dining solutions surged, with U.S. restaurant off-premise sales projected to reach $400 billion by 2025, highlighting the critical need for supply chain agility.

Consumers are increasingly prioritizing value and efficiency when dining out, influencing both menu development and operational strategies within the QSR sector. This trend directly impacts Golden State Foods, necessitating the creation of product formats and supply chain solutions that streamline operations for its restaurant partners. A McKinsey report from 2024 indicated that consumers are actively seeking value, with 70% of respondents stating they are more mindful of their spending, reinforcing the importance of cost-effective and efficient food solutions.

- Convenience is King: Consumers expect quick and easy meal solutions, driving demand for grab-and-go options and efficient delivery infrastructure.

- Personalization Matters: Diners are seeking customized meal experiences, pushing restaurants and their suppliers to offer more adaptable product lines.

- Digital Integration: The rise of online ordering and delivery platforms requires robust logistical support and product packaging suitable for off-premise consumption.

- Value-Driven Choices: Economic considerations remain paramount, compelling foodservice providers to offer high-quality products at competitive price points.

Societal shifts are profoundly reshaping food consumption patterns, with a growing emphasis on health, sustainability, and ethical sourcing. Consumers are actively seeking transparency in ingredients and are increasingly influenced by digital platforms and social media trends. This necessitates that Golden State Foods (GSF) remain agile in its product development and marketing strategies to align with these evolving consumer values and preferences.

Technological factors

Golden State Foods is actively integrating automation and robotics to boost efficiency and safety across its operations. Their Opelika, Alabama facility showcases this commitment with advanced robotics and a vision inspection system for automated patty production, notably enhancing quality control and lessening reliance on manual tasks.

This technological shift is projected to accelerate throughout the food manufacturing sector by 2025. Key drivers include ongoing labor shortages, estimated to impact the industry significantly, and the continuous pursuit of cost reductions, making automation a critical strategic imperative for companies like Golden State Foods.

Golden State Foods (GSF) is increasingly using artificial intelligence (AI) and machine learning (ML) to refine its operations. For instance, AI is instrumental in enhancing demand forecasting accuracy within the food sector, a critical element for managing inventory and minimizing waste. This predictive capability extends to optimizing warehouse management, ensuring efficient storage and retrieval of goods.

The application of AI across GSF's supply chain is designed to boost visibility and streamline complex logistics. By analyzing vast datasets, AI-powered systems help identify potential bottlenecks and inefficiencies, leading to reduced errors in order fulfillment and distribution. This data-driven approach allows GSF to make more informed and agile decisions, ultimately improving overall operational performance.

Golden State Foods (GSF) is actively leveraging blockchain and IoT technologies to bolster supply chain transparency and traceability. Their collaboration on initiatives like IBM's Food Trust, which integrates blockchain, AI, and IoT, aims to provide unprecedented visibility into their food products, enhancing food safety protocols.

The implementation of RFID technology, guided by GS1 Standards, is a key component of GSF's strategy. This allows for real-time tracking of product freshness and inventory, offering end-to-end visibility across the supply chain. This granular level of tracking is vital for ensuring quality and minimizing waste.

These technological advancements are not merely operational improvements; they are critical for GSF to navigate the increasingly stringent global food traceability regulations. By providing verifiable data, GSF can build and maintain consumer trust, a paramount factor in today's market, especially as consumers demand greater assurance about the origin and safety of their food.

Data Analytics and Business Intelligence

Golden State Foods (GSF) leverages data analytics to meticulously track production trends and enhance operational efficiency across its diverse business units. This focus on data allows for a granular understanding of performance, directly impacting cost management and quality control.

The broader food industry is increasingly prioritizing significant investments in big data and real-time analytics platforms. For instance, by the end of 2024, it's projected that over 70% of food and beverage companies will have implemented advanced analytics solutions to support data-driven decision-making, a trend GSF actively participates in.

For GSF, this translates to the continuous collection and analysis of vast datasets from its global operations. The objective is to optimize every stage of the supply chain, from sourcing raw materials to final product delivery, thereby identifying areas for improvement and enabling swift responses to evolving market dynamics.

- Production Trend Analysis: GSF uses data to pinpoint peak production times and identify bottlenecks, leading to smoother operations.

- Operational Efficiency Gains: Real-time data analysis helps in reducing waste and optimizing resource allocation, contributing to cost savings.

- Data-Driven Decision-Making: GSF's commitment to analytics ensures that strategic choices are informed by concrete performance metrics rather than assumptions.

- Market Responsiveness: By analyzing consumer behavior and market shifts through data, GSF can adapt its product offerings and distribution strategies more effectively.

Innovation in Product Development and Packaging

Golden State Foods (GSF) leverages its ten global Innovation Centers to drive technological progress, consistently developing hundreds of new products each year. This includes a strong focus on healthier options and cleaner labels, reflecting current consumer trends. For instance, their commitment to innovation is evident in the development of advanced patty mold plate technology and pioneering sustainable packaging solutions, which are crucial for meeting evolving market demands.

The company's dedication to continuous improvement in product formulation and eco-friendly packaging is paramount. This technological focus allows GSF to adapt to shifting consumer preferences and increasingly stringent regulatory landscapes, ensuring their offerings remain competitive and compliant.

- Global Innovation Network: Ten centers worldwide foster rapid product development and technological advancement.

- Product Pipeline: Hundreds of new products, emphasizing healthier and cleaner label options, are created annually.

- Key Innovations: Breakthroughs include patty mold plate technology and the development of sustainable packaging.

- Market Responsiveness: Continuous innovation in formulations and packaging is vital for meeting consumer and regulatory demands.

Golden State Foods (GSF) is heavily investing in automation and AI to enhance efficiency and safety, with advanced robotics and vision systems already in place at facilities like Opelika, Alabama. This trend is accelerating across the food industry, driven by labor shortages and the need for cost reduction, making technological adoption a strategic necessity by 2025.

The company is also leveraging blockchain and IoT, participating in initiatives like IBM's Food Trust for enhanced supply chain transparency and traceability. RFID technology, aligned with GS1 Standards, provides real-time product tracking and inventory management, crucial for meeting stringent food safety regulations and building consumer trust.

GSF utilizes data analytics to track production trends and optimize operations, a practice mirrored by over 70% of food and beverage companies expected to implement advanced analytics by late 2024. This data-driven approach fuels continuous improvement, from raw material sourcing to final delivery, ensuring agility in a dynamic market.

Through its ten global Innovation Centers, GSF drives product development, creating hundreds of new items annually with a focus on healthier options and sustainable packaging. Innovations in patty mold technology and eco-friendly solutions are key to adapting to consumer preferences and regulatory demands.

| Technology Area | GSF Application | Industry Trend (by 2025) | Impact |

|---|---|---|---|

| Automation & Robotics | Patty production, quality control | Increased adoption due to labor shortages | Enhanced efficiency, reduced manual tasks |

| Artificial Intelligence (AI) & Machine Learning (ML) | Demand forecasting, warehouse optimization | Widespread use for data-driven decision-making | Improved inventory management, reduced waste |

| Blockchain & IoT | Supply chain transparency, traceability | Growing integration for food safety | Enhanced food safety protocols, consumer trust |

| Data Analytics | Production trend analysis, operational efficiency | Over 70% of companies using advanced analytics by late 2024 | Cost savings, market responsiveness |

Legal factors

Golden State Foods (GSF) faces increasing regulatory scrutiny under the Food Safety Modernization Act (FSMA), with significant rule updates expected in 2025. These changes will likely mandate more robust food traceability systems, requiring enhanced digital record-keeping for every step of the supply chain. For instance, the FDA's proposed rule on traceability of certain foods, expected to be finalized in late 2024 or early 2025, will expand the scope of foods requiring detailed tracking.

Furthermore, GSF must adapt to stricter sanitary transportation regulations, impacting logistics and cold chain management. Violations of FSMA, including these new mandates, can result in substantial financial penalties, with the FDA having the authority to levy significant fines for non-compliance, potentially impacting GSF's profitability and market standing.

The Foreign Supplier Verification Programs (FSVP) are also being refined, demanding more rigorous vetting of international suppliers to ensure imported ingredients meet U.S. safety standards. Failure to comply with these evolving FSMA requirements could trigger costly product recalls, estimated to cost the food industry billions annually, and severely damage GSF's brand reputation among consumers and business partners.

The inclusion of sesame as a major allergen in 2023 presents significant challenges for food producers like Golden State Foods (GSF). This necessitates meticulously accurate allergen labeling across GSF's product lines and the implementation of stringent allergen control measures within their manufacturing sites to prevent cross-contamination.

Navigating varying state-specific regulations, such as California's prohibition on certain chemicals, further complicates compliance efforts for GSF. Failure to adhere to these evolving legal frameworks can result in substantial fines and reputational damage, impacting market access and consumer trust.

Golden State Foods (GSF) navigates a complex web of environmental regulations, particularly concerning air emissions, water discharge, and waste management. These rules are critical for maintaining operational compliance and mitigating environmental impact.

California's recent legislative push, including the Climate Corporate Data Accountability Act (SB253) and the Climate-Related Financial Risk Act (SB261), mandates emissions audits for 2025 data, with reporting due in 2026. This directly affects GSF's operations within the state, requiring significant data collection and verification processes.

GSF's stated commitment to achieving net-zero emissions by 2050 underscores its proactive stance in addressing growing regulatory mandates and heightened stakeholder expectations for environmental accountability and transparent reporting.

Labor Laws and Employment Regulations

Golden State Foods operates within a dynamic legal framework governing labor and employment. Navigating diverse regulations across its international footprint, the company must adhere to varying minimum wage laws, standards for working conditions, and a spectrum of employee rights. For instance, in the United States, the federal minimum wage stands at $7.25 per hour, though many states and cities have established higher rates, impacting Golden State Foods' operational costs and hiring strategies.

The increasing cost of labor, projected to continue rising in 2024 and 2025 due to inflation and competitive market pressures, presents a significant challenge. This, coupled with ongoing difficulties in recruiting and retaining qualified personnel, underscores the critical need for Golden State Foods to meticulously comply with all employment regulations. Investing in employee well-being and ensuring fair labor practices are not only legal imperatives but also strategic necessities for operational stability.

- Minimum Wage Compliance: Adherence to federal, state, and local minimum wage laws, which may exceed the U.S. federal $7.25/hour, is crucial.

- Working Condition Standards: Ensuring safe and fair working environments that meet all regulatory requirements is paramount.

- Employee Rights Protection: Upholding employee rights related to fair treatment, non-discrimination, and benefits is essential.

- Legal Dispute Avoidance: Strict compliance mitigates the risk of costly lawsuits and reputational damage.

Product Labeling and Marketing Claims

Regulations surrounding product labeling and marketing claims significantly influence how Golden State Foods (GSF) communicates with consumers. The U.S. Food and Drug Administration's (FDA) revised definition of 'healthy' for food labeling, effective April 28, 2025, introduces new criteria that GSF must adhere to for any 'healthy' claims. This means GSF's packaging and promotional materials must be scrupulously truthful and avoid any misleading information. Compliance with these evolving national and regional labeling standards is paramount to maintaining consumer trust and avoiding regulatory penalties.

GSF must navigate a complex web of legal requirements to ensure its marketing is both effective and compliant. For instance, claims about nutritional content, health benefits, or ingredient sourcing are subject to strict oversight. The company needs to ensure that all marketing collateral, from product packaging to digital advertisements, accurately reflects the product's composition and adheres to guidelines set by bodies like the FDA and the Federal Trade Commission (FTC). This meticulous attention to detail is crucial, especially as consumer awareness and regulatory scrutiny of food marketing continue to grow.

- FDA's Revised 'Healthy' Definition: The new rule, effective April 28, 2025, sets specific criteria for using the term 'healthy' on food labels, impacting product positioning.

- Truthful and Non-Misleading Claims: GSF must ensure all marketing statements are accurate and do not deceive consumers regarding product attributes or benefits.

- Regional and National Standards: Adherence to a patchwork of federal, state, and potentially international labeling laws is essential for market access and brand reputation.

- Consumer Protection Laws: Beyond food-specific regulations, GSF must comply with broader consumer protection statutes that govern advertising and sales practices.

Golden State Foods (GSF) must navigate evolving food safety regulations, including the FDA's Food Safety Modernization Act (FSMA). Updates expected in 2025 will likely mandate more robust traceability systems and stricter sanitary transportation rules, with non-compliance potentially leading to significant fines.

The company also faces challenges with allergen labeling, particularly with sesame now recognized as a major allergen, requiring meticulous control measures. Furthermore, varying state-specific regulations, such as California's restrictions on certain chemicals, add layers of complexity to GSF's compliance efforts.

Environmental factors

Climate change presents substantial risks to Golden State Foods' supply chain. Extreme weather events, such as prolonged droughts or intense storms, can severely impact agricultural yields, disrupt transportation networks, and damage critical infrastructure, directly affecting raw material availability and product delivery.

Golden State Foods has proactively addressed these challenges by setting a target to achieve net-zero greenhouse gas emissions by 2050, signaling a commitment to reducing its environmental impact and building a more sustainable operational model.

Building resilience against climate-related disruptions is paramount for GSF to guarantee a consistent supply of essential ingredients and maintain reliable distribution channels, especially as global weather patterns become more unpredictable.

Golden State Foods, as a major player in the food supply chain, faces significant environmental challenges, particularly concerning water. Its operations, especially those involving produce and liquid products, are inherently dependent on reliable access to clean water. This reliance makes the company vulnerable to the growing issue of water scarcity, a trend that is becoming more pronounced in many agricultural regions.

The increasing frequency and intensity of droughts, as seen in California where GSF has a significant presence, directly impact the availability and cost of water. For instance, California experienced severe drought conditions in recent years, leading to stricter water usage regulations and increased competition for this vital resource. This necessitates proactive water management strategies within GSF's own facilities to minimize consumption and explore water recycling opportunities.

Beyond its direct operations, GSF must also address water management within its agricultural supply chain. Sourcing raw materials from regions experiencing water stress requires collaboration with suppliers to promote sustainable farming practices that conserve water. Failure to do so could lead to supply chain disruptions and increased input costs, impacting the company's profitability and operational resilience in the face of climate change.

Golden State Foods (GSF) is navigating growing expectations to reduce waste, especially food waste, throughout its operations. Globally, an estimated 1.3 billion tonnes of food are lost or wasted annually, a staggering figure that highlights the environmental and economic imperative for companies like GSF to address this issue.

GSF's commitment to circular economy principles, coupled with robust recycling and reuse initiatives, directly tackles this challenge. By optimizing resource use and minimizing waste streams, GSF not only lessens its environmental footprint but also enhances operational efficiency and potentially reduces costs associated with waste disposal.

Sustainable Packaging Initiatives

Golden State Foods faces increasing pressure from consumers and regulators to adopt more sustainable packaging. This trend is particularly strong in the food industry, pushing companies to find eco-friendly alternatives. Meeting these evolving market expectations requires continuous innovation in packaging materials and design to reduce environmental impact.

State-level regulations are accelerating this shift. For instance, California and Virginia have implemented bans on specific packaging materials like expanded polystyrene (EPS). These legislative actions underscore the growing imperative for companies like Golden State Foods to actively seek and implement alternative, more sustainable packaging solutions to ensure compliance and maintain market relevance.

- Consumer Demand: A 2024 NielsenIQ report indicated that 73% of consumers are willing to pay more for sustainable products, including those with eco-friendly packaging.

- Regulatory Landscape: As of early 2025, over 20 U.S. states have introduced or passed legislation targeting single-use plastics and promoting recyclable or compostable packaging.

- Industry Response: Major food service providers, including those partnered with Golden State Foods, are setting ambitious targets for reducing plastic waste, with many aiming for 100% recyclable, compostable, or renewable packaging by 2030.

Energy Consumption and Renewable Energy Adoption

Golden State Foods' extensive manufacturing and distribution network inherently makes it a substantial energy consumer. The company's commitment to reaching net-zero emissions by 2050 underscores a strategic imperative to significantly curb energy usage and accelerate the adoption of renewable energy sources across its operations. This transition is not merely an environmental goal but a financial necessity, with investments in energy-efficient technologies and renewable energy solutions directly impacting operational costs and long-term profitability.

The global push towards decarbonization, coupled with evolving energy regulations and market dynamics, presents both challenges and opportunities for Golden State Foods. For instance, as of early 2024, the average cost of electricity in California, a key operational state for GSF, has seen fluctuations, making energy efficiency a critical cost-management lever. Furthermore, the increasing availability and decreasing costs of solar and wind power present viable avenues for GSF to reduce its reliance on fossil fuels.

- Energy Efficiency Investments: GSF's focus on upgrading to more efficient machinery and optimizing logistics can lead to substantial energy savings.

- Renewable Energy Sourcing: Exploring power purchase agreements (PPAs) for solar or wind energy can stabilize energy costs and reduce Scope 2 emissions.

- Operational Cost Reduction: By reducing energy consumption and shifting to renewables, GSF can lower its utility bills, improving the bottom line.

- Carbon Footprint Reduction: Adopting cleaner energy practices directly contributes to GSF's net-zero targets and enhances its corporate sustainability profile.

Golden State Foods faces increasing scrutiny regarding its environmental impact, particularly concerning water usage and waste management. The company's reliance on agricultural inputs makes it susceptible to water scarcity issues, exacerbated by climate change, with California's drought conditions serving as a prime example. Addressing these environmental factors is crucial for maintaining supply chain stability and operational efficiency.

GSF is actively pursuing sustainability initiatives, including a net-zero emissions target by 2050 and a focus on circular economy principles to reduce waste. The company is also responding to market and regulatory pressures for more sustainable packaging, with several U.S. states implementing bans on certain materials. These efforts are vital for GSF to align with evolving consumer expectations and environmental regulations.

Energy consumption is another significant environmental consideration for Golden State Foods. The company is investing in energy efficiency and exploring renewable energy sources to meet its decarbonization goals and manage operational costs effectively. The fluctuating energy costs, particularly in California, underscore the financial benefits of these sustainable energy strategies.

| Environmental Factor | Impact on GSF | GSF's Response/Initiatives | Relevant Data/Trends (2024-2025) |

|---|---|---|---|

| Climate Change & Extreme Weather | Supply chain disruption, raw material availability, infrastructure damage | Net-zero emissions target by 2050, building supply chain resilience | Increased frequency of droughts and storms impacting agricultural regions. |

| Water Scarcity | Impact on agricultural yields, increased operational costs, regulatory restrictions | Promoting sustainable farming practices with suppliers, water management in facilities | California's ongoing water challenges; stricter water usage regulations. |

| Waste Management & Food Waste | Environmental impact, operational inefficiencies, cost of disposal | Circular economy principles, recycling and reuse initiatives | Global food waste estimated at 1.3 billion tonnes annually; 73% of consumers willing to pay more for sustainable products (NielsenIQ, 2024). |

| Sustainable Packaging | Consumer demand, regulatory compliance, brand reputation | Seeking eco-friendly packaging alternatives, innovation in materials | Over 20 U.S. states with legislation on single-use plastics (early 2025); industry targets for 100% recyclable packaging by 2030. |

| Energy Consumption & Renewables | Operational costs, carbon footprint, regulatory compliance | Energy efficiency investments, adoption of renewable energy sources | Fluctuating electricity costs in key operational states (e.g., California); decreasing costs of solar and wind power. |

PESTLE Analysis Data Sources

Our Golden State Foods PESTLE Analysis is informed by a robust blend of public and proprietary data. We draw from industry-specific market research, government economic indicators, and legislative updates, ensuring a comprehensive understanding of the macro-environment.