Grupo Hotelero Santa Fe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Hotelero Santa Fe Bundle

Grupo Hotelero Santa Fe operates within a dynamic environment, influenced by a complex interplay of political, economic, social, technological, legal, and environmental factors. Understanding these external forces is crucial for strategic decision-making and long-term success in the hospitality sector. Our comprehensive PESTLE analysis delves deep into these influences, offering you a clear roadmap to navigate challenges and seize opportunities. Gain the competitive edge you need to thrive in this evolving market. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Mexico's government is heavily invested in promoting tourism, a clear advantage for Grupo Hotelero Santa Fe. This support manifests in national marketing initiatives and crucial infrastructure upgrades. For instance, by late 2024, Mexico aims to attract over 40 million international tourists, a target directly boosted by government efforts that benefit hotel operators like Santa Fe.

Government policies directly shape the appeal of destinations where Grupo Hotelero Santa Fe operates. Favorable regulations and investment in areas like airport expansion or new attractions can significantly increase visitor flow. Understanding these evolving policies is vital for Santa Fe's long-term strategic planning, ensuring alignment with national tourism objectives.

Mexico's political stability is a critical factor for Grupo Hotelero Santa Fe. In 2024, the country continued to navigate its political landscape, with general elections scheduled for June 2024. Investor confidence is often tied to the predictability of policy and the rule of law, which directly influences tourism numbers and the willingness of businesses to invest in new ventures or expand existing ones.

Perceived security is equally vital. While specific crime statistics fluctuate, any significant increase in crime rates, particularly in popular tourist destinations like Cancun or Los Cabos where Santa Fe operates, could negatively impact occupancy. For instance, reports from early 2024 indicated ongoing security challenges in certain regions, which could deter international and domestic travelers, thereby affecting hotel revenues.

A stable political environment fosters greater traveler confidence. The hospitality sector thrives on predictability, and any perceived instability or abrupt policy changes can lead to cancellations or a general reluctance to travel. Grupo Hotelero Santa Fe's performance is therefore intrinsically linked to the government's ability to ensure public safety and maintain a consistent, business-friendly regulatory framework throughout 2024 and into 2025.

Changes in corporate tax rates, such as potential adjustments to Mexico's federal corporate income tax, can directly impact Grupo Hotelero Santa Fe's bottom line. For instance, if the corporate tax rate were to increase, the company's net profit margin would likely decrease, necessitating a review of its pricing strategies and cost management. Similarly, shifts in tourism taxes levied by various Mexican states could alter the attractiveness of destinations where Santa Fe operates, influencing demand and revenue streams. By the end of 2024, Mexico's corporate tax rate remained at 30%, a figure to monitor for any proposed changes in the upcoming legislative sessions impacting 2025.

The hotel industry is subject to a dynamic regulatory environment. New legislation concerning labor practices, such as minimum wage adjustments or employee benefits, could increase operational expenses for Grupo Hotelero Santa Fe. For example, an increase in the minimum wage in key operational regions could directly affect payroll costs. Furthermore, evolving environmental regulations, such as those promoting sustainable practices or waste management, may require capital investment in new technologies or operational adjustments. Staying compliant with these evolving standards is essential for maintaining operational continuity and avoiding potential penalties.

Continuous monitoring of policy shifts is paramount for Grupo Hotelero Santa Fe's financial stability and strategic planning. For example, upcoming legislative proposals in 2025 regarding digital services taxes or data privacy regulations could introduce new compliance burdens or impact revenue models. Understanding and adapting to these changes proactively allows the company to mitigate risks and identify potential opportunities within the evolving political landscape of Mexico and other relevant markets.

Infrastructure Development Plans

Government investment in transportation infrastructure directly impacts Grupo Hotelero Santa Fe's accessibility. For instance, Mexico's National Infrastructure Program 2020-2024 aims to boost connectivity. Enhanced airport capacity or new highway construction can significantly improve travel to the company's destinations, potentially increasing visitor numbers.

Improved connectivity translates to more tourism and business travel opportunities. As of early 2024, Mexico's tourism sector has shown robust recovery, with international arrivals nearing pre-pandemic levels. This trend, supported by infrastructure upgrades, directly benefits hotel occupancy rates and revenue streams for Grupo Hotelero Santa Fe.

Strategic location planning for new hotel developments by Grupo Hotelero Santa Fe critically considers future infrastructure projects. Understanding upcoming transportation enhancements allows the company to secure prime locations that will benefit from increased accessibility and demand in the coming years.

- Government investment in transportation infrastructure, such as Mexico's National Infrastructure Program 2020-2024, aims to improve connectivity.

- Enhanced airport and highway access can boost tourism and business travel, directly benefiting hotel occupancy.

- Mexico's tourism sector recovery, nearing pre-pandemic levels in early 2024, is supported by infrastructure development.

- Grupo Hotelero Santa Fe's location strategy incorporates future infrastructure projects to maximize accessibility and demand.

International Relations and Trade Agreements

Mexico's trade agreements and diplomatic ties significantly shape its tourism sector, a crucial element for Grupo Hotelero Santa Fe. Favorable relations with the USA and Canada, its primary source markets, directly impact cross-border travel and business tourism. For instance, in 2023, Mexico welcomed over 42 million international tourists, with a substantial portion originating from these North American neighbors, underscoring the importance of these relationships.

Changes in these diplomatic ties or the implementation of new trade policies can quickly alter visitor flows. Strained relations or the issuance of travel advisories, while not prevalent currently, could negatively affect occupancy rates. Conversely, continued strong diplomatic engagement and beneficial trade terms support robust demand for accommodations.

Geopolitical events occurring globally or in key source markets also introduce a layer of uncertainty. These events can influence travel sentiment and economic conditions, indirectly impacting the discretionary spending available for travel. For example, economic downturns in the US could lead to reduced travel to Mexico.

Grupo Hotelero Santa Fe must remain attuned to these dynamics:

- Impact of USMCA: The United States-Mexico-Canada Agreement (USMCA) facilitates smoother trade and travel, indirectly benefiting the hospitality sector by fostering economic stability and business travel.

- Visa Policies: Changes in visa requirements or entry procedures for citizens of key source markets can directly influence inbound tourism numbers.

- Diplomatic Incidents: Any diplomatic friction or negative press concerning Mexico can lead to travel advisories, deterring tourists.

- Global Economic Health: The economic performance of the USA and Canada directly correlates with their citizens' propensity to travel internationally, impacting demand for Grupo Hotelero Santa Fe's services.

Government support for tourism is a significant boon for Grupo Hotelero Santa Fe, with Mexico targeting over 40 million international tourists by late 2024. This proactive governmental approach, including marketing and infrastructure enhancements, directly fuels demand for accommodations. Political stability, underscored by the June 2024 general elections, is crucial for investor confidence and sustained tourism growth, directly impacting Santa Fe's operational environment.

Policy decisions, such as potential adjustments to Mexico's 30% corporate tax rate by 2025, can directly affect Grupo Hotelero Santa Fe's profitability. Similarly, labor and environmental regulations require constant vigilance to ensure compliance and manage operational costs. Proactive adaptation to evolving legislation, including potential digital services taxes in 2025, is key to mitigating risks and capitalizing on opportunities.

Mexico's infrastructure development, highlighted by the National Infrastructure Program 2020-2024, is enhancing travel accessibility. Improved connectivity through airport and highway upgrades directly supports the tourism sector's recovery, which by early 2024 was nearing pre-pandemic levels. Grupo Hotelero Santa Fe strategically aligns its location planning with these projects to leverage future accessibility gains.

| Political Factor | Impact on Grupo Hotelero Santa Fe | Data/Context (2024-2025) |

|---|---|---|

| Government Tourism Promotion | Increased visitor numbers, higher occupancy rates | Target of over 40 million international tourists by late 2024. |

| Political Stability & Elections | Investor confidence, predictable business environment | General elections held in June 2024. |

| Taxation Policies | Impact on net profit margins | Federal corporate income tax rate at 30% as of end 2024. |

| Infrastructure Investment | Improved accessibility to destinations | National Infrastructure Program 2020-2024 focused on connectivity. |

| Regulatory Environment | Operational costs, compliance requirements | Ongoing monitoring of labor, environmental, and digital tax regulations. |

What is included in the product

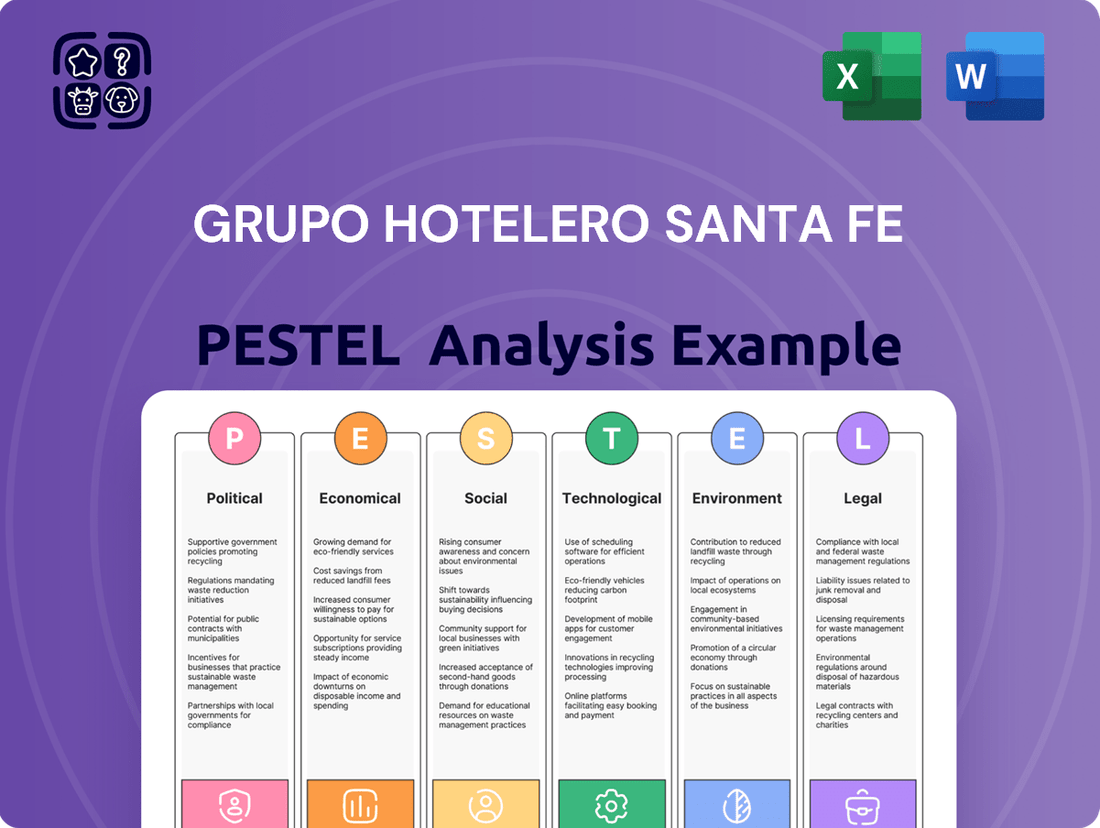

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Grupo Hotelero Santa Fe's operations and strategic planning.

It provides a comprehensive overview of how these external forces create both challenges and opportunities for the company's growth and market position.

This PESTLE analysis for Grupo Hotelero Santa Fe acts as a pain point reliever by providing a clear, summarized version of complex external factors, enabling faster decision-making and strategic adjustments.

It serves as a pain point reliever by offering a visually segmented breakdown of PESTLE categories, allowing stakeholders to quickly identify and address potential challenges or opportunities impacting the hospitality sector.

Economic factors

Mexico's economic performance, particularly its Gross Domestic Product (GDP) growth, significantly influences the hospitality sector. For instance, projections from agencies like Banxico (Bank of Mexico) for 2024 indicated a robust GDP growth, potentially around 2.5% to 3.5%, which generally translates to increased disposable income and a greater propensity for both leisure and business travel. This economic vitality is crucial for Grupo Hotelero Santa Fe's revenue streams.

Conversely, inflation presents a dual challenge. High inflation rates, which hovered around 4.5% to 5.5% for much of 2024 according to INEGI (National Institute of Statistics and Geography), directly escalate operational expenses for hotels, from energy and food to labor. Furthermore, it erodes consumer purchasing power, potentially leading to reduced spending on non-essential services like hotel stays or downgrades in room preferences, impacting profit margins for companies like Grupo Hotelero Santa Fe.

The interplay between GDP growth and inflation dictates the overall demand landscape. A healthy GDP expansion coupled with controlled inflation creates an environment conducive to higher hotel occupancy rates and average daily rates (ADRs). Economic forecasts from institutions like the IMF for Mexico in 2025 continue to suggest a stable, albeit moderate, growth trajectory, necessitating careful financial planning and budgeting for Grupo Hotelero Santa Fe to navigate cost pressures and capitalize on demand shifts.

As a Mexican company, Grupo Hotelero Santa Fe is significantly impacted by fluctuations in the MXN/USD exchange rate. A stronger peso, for instance, makes Mexico a more costly destination for American tourists, potentially dampening demand for hotel services. Conversely, a weaker peso can boost inbound tourism by making travel more affordable, though it simultaneously raises the cost of imported goods and services the company may rely on.

For example, in early 2024, the Mexican Peso showed relative strength against the US Dollar, trading around 16.50 MXN to 1 USD. This environment presents a double-edged sword for Grupo Hotelero Santa Fe, potentially attracting more international visitors while increasing the peso-denominated cost of any imported supplies or furnishings.

Effective management of this currency risk is therefore paramount for maintaining profitability and competitive pricing. Strategies to mitigate these fluctuations, such as hedging or diversifying revenue streams, are crucial for the company's financial stability in the face of global economic shifts.

Interest rate levels, as determined by the Bank of Mexico, directly affect Grupo Hotelero Santa Fe's borrowing costs. For instance, if the benchmark interest rate were to increase, the cost of securing loans for new hotel projects or renovations would rise, potentially making expansion less attractive. This directly impacts their capacity to finance crucial growth initiatives.

Access to affordable credit is a cornerstone of Grupo Hotelero Santa Fe's ambitious expansion strategy. Favorable credit terms allow them to undertake significant investments in acquiring new properties, converting existing ones, and developing new hospitality ventures. Without this access, their strategic growth trajectory could be significantly hindered.

The prevailing interest rate environment in Mexico plays a critical role in the company's investment decisions. During periods of higher interest rates, the financial feasibility of new capital-intensive projects, such as building a new resort or undertaking a major rebranding, becomes more challenging, potentially leading to a slowdown in development activities.

Disposable Income and Consumer Spending

Disposable income is a crucial driver for Grupo Hotelero Santa Fe's performance. When Mexican citizens and international visitors have more money left after essential expenses, they are more likely to spend on travel and hospitality services. For instance, an increase in real disposable income in Mexico, which saw a growth of approximately 3% in 2023 according to INEGI, directly supports higher hotel occupancy and average daily rates.

Economic downturns, however, pose a significant challenge. A contraction in consumer purchasing power, perhaps due to inflation or job losses, forces individuals to cut back on non-essential spending. This can lead to reduced demand for hotel stays, impacting Grupo Hotelero Santa Fe's revenue streams and potentially lowering occupancy rates and average daily rates (ADR).

Consumer confidence plays a vital role in this dynamic. High consumer confidence, often reflected in surveys like Mexico's National Consumer Confidence Index, indicates a positive outlook on the economy and personal finances, encouraging spending on travel. Conversely, low confidence signals caution, leading to decreased discretionary spending on hotel accommodations.

- Disposable Income Growth: Mexico's real disposable income grew by an estimated 3% in 2023, providing a positive backdrop for domestic tourism spending.

- Consumer Confidence Index: Monitoring the National Consumer Confidence Index in Mexico offers insights into potential shifts in travel spending by local consumers.

- Impact of Inflation: Rising inflation can erode disposable income, potentially leading to a decrease in leisure travel bookings for Grupo Hotelero Santa Fe.

- International Tourist Spending: The spending power of international tourists, influenced by their home country's economic conditions and exchange rates, directly impacts revenue from foreign visitors.

Tourism Sector Performance

The broader tourism sector's performance is a critical backdrop for Grupo Hotelero Santa Fe. For instance, Mexico saw a significant rebound in international tourist arrivals, reaching an estimated 42.1 million in 2023, a figure nearing pre-pandemic levels. This upward trend directly impacts demand for hotel accommodations, influencing occupancy rates and revenue potential for companies like Grupo Hotelero Santa Fe.

Global travel trends, such as the increasing preference for experiential travel and sustainable tourism, also shape the competitive landscape. Grupo Hotelero Santa Fe must adapt its offerings to align with these evolving consumer preferences to maintain and grow its market share. The overall demand for hotel rooms, influenced by economic conditions and travel confidence, directly affects the company's pricing power and profitability.

- International Tourist Arrivals to Mexico (2023 Estimate): 42.1 million, showing a strong recovery trend.

- Impact on Occupancy Rates: Higher arrivals generally translate to increased hotel occupancy, boosting revenue.

- Competitive Dynamics: Evolving travel preferences necessitate strategic adaptation to stay competitive.

- Pricing Power: Sustained demand allows for potentially stronger pricing strategies.

Mexico's economic outlook for 2024 and 2025 is a primary driver for Grupo Hotelero Santa Fe. Projections from institutions like Banxico indicated a solid GDP growth of around 2.5% to 3.5% for 2024, fostering increased consumer spending and travel. However, inflation, which averaged between 4.5% to 5.5% in 2024 according to INEGI, directly impacts operational costs and consumer purchasing power, creating a delicate balance for the hospitality sector.

The MXN/USD exchange rate is a critical factor, with the peso trading around 16.50 MXN to 1 USD in early 2024. While a stronger peso can attract more international visitors, it also increases the cost of imported goods for hotels. Interest rates set by the Bank of Mexico directly influence Grupo Hotelero Santa Fe's borrowing costs, impacting their ability to finance expansion and development projects.

Consumer confidence and disposable income are key demand indicators. Mexico's real disposable income saw an estimated 3% growth in 2023, supporting domestic travel. The tourism sector's performance is also vital, with Mexico attracting an estimated 42.1 million international tourist arrivals in 2023, nearing pre-pandemic levels and directly boosting hotel occupancy.

| Economic Factor | 2023/2024 Data Point | 2025 Outlook/Implication |

|---|---|---|

| GDP Growth (Mexico) | Projected 2.5%-3.5% for 2024 | Continued moderate growth expected, supporting travel demand. |

| Inflation Rate (Mexico) | 4.5%-5.5% average in 2024 | Potential pressure on operational costs and consumer spending. |

| MXN/USD Exchange Rate | Approx. 16.50 MXN/USD (early 2024) | Influences inbound tourism affordability and import costs. |

| Interest Rates (Bank of Mexico) | Key determinant of borrowing costs | Affects financing for new projects and expansion. |

| Real Disposable Income Growth (Mexico) | ~3% in 2023 | Positive indicator for domestic leisure travel spending. |

| International Tourist Arrivals to Mexico | 42.1 million (2023 estimate) | Strong recovery trend, directly impacting hotel occupancy. |

What You See Is What You Get

Grupo Hotelero Santa Fe PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for Grupo Hotelero Santa Fe's PESTLE Analysis. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain critical insights into market dynamics and strategic considerations. Everything displayed here is part of the final product; what you see is what you’ll be working with to understand Grupo Hotelero Santa Fe's operational landscape.

Sociological factors

Modern travelers are shifting their focus towards unique experiences and genuine local immersion, with sustainability also gaining significant traction. This is especially noticeable among millennials and Gen Z, who often seek authenticity over conventional opulence. For instance, a 2024 survey indicated that 65% of Gen Z travelers consider a hotel's sustainability practices when booking, a figure that has steadily climbed.

Grupo Hotelero Santa Fe must therefore tailor its portfolio to align with these changing traveler desires. This could involve integrating more eco-conscious initiatives, such as reducing single-use plastics and sourcing local produce for their restaurants, or developing distinct cultural programs that offer guests a taste of the region's heritage. The company's success hinges on its ability to reflect these evolving preferences in its branding and service delivery.

Furthermore, personalization is emerging as a key differentiator. Travelers now expect tailored recommendations and services that cater to their individual interests and past behaviors. By leveraging guest data, Grupo Hotelero Santa Fe can enhance the guest experience, making stays more memorable and fostering greater loyalty, which is crucial in a competitive market where personalized touches can significantly impact customer satisfaction and repeat business.

Demographic shifts are significantly reshaping the hospitality landscape for Grupo Hotelero Santa Fe. In Mexico, the median age has been steadily increasing, with a notable rise in the 65+ population, suggesting growing demand for accessible rooms and quieter, more relaxed environments. Conversely, international markets, particularly North America and Europe, continue to see a strong presence of Millennial and Gen Z travelers who prioritize digital integration, sustainable practices, and experiential stays, influencing the need for smart room technology and unique local activities.

Income distribution also plays a crucial role; a growing middle class in emerging economies presents opportunities for mid-tier hotel segments, while higher-income brackets often seek luxury amenities and personalized services. For instance, reports from 2024 indicate a rebound in luxury travel spending, with individuals increasingly willing to invest in premium experiences. This necessitates a flexible approach to hotel development and service provision, ensuring offerings cater to diverse economic capacities and evolving lifestyle preferences across different age groups.

Public awareness of health and safety, heightened by the lingering effects of the COVID-19 pandemic, remains a critical factor for travelers. Concerns about hygiene and personal security, especially in certain areas of Mexico, can directly impact booking decisions for Grupo Hotelero Santa Fe. For instance, as of early 2025, traveler confidence surveys continue to show a strong preference for destinations and accommodations with demonstrably high cleanliness standards and visible safety measures.

Grupo Hotelero Santa Fe's success hinges on its ability to not only implement but also effectively communicate these robust health and safety protocols. This transparency is key to rebuilding and maintaining guest trust. In 2024, hotels that actively promoted their enhanced cleaning procedures and safety certifications saw a notable uptick in occupancy rates compared to those that did not. Maintaining impeccable cleanliness is no longer just a service expectation; it's a fundamental requirement for guest satisfaction and loyalty.

Cultural and Social Trends

Broader societal shifts are significantly influencing the hospitality sector, presenting both challenges and opportunities for Grupo Hotelero Santa Fe. The increasing prevalence of remote work, for instance, has fueled the emergence of 'workation' trends, where individuals combine leisure travel with their professional responsibilities. This presents a direct opportunity for hotels to adapt their offerings, perhaps by incorporating dedicated co-working spaces or enhanced business facilities to attract this growing demographic. In 2024, a significant portion of the workforce continues to embrace flexible work arrangements, suggesting sustained demand for accommodations that cater to this blended lifestyle.

Furthermore, there's a palpable rise in consumer interest towards wellness tourism. Travelers are increasingly seeking experiences that promote physical and mental well-being, from spa treatments and healthy dining options to mindfulness activities. Grupo Hotelero Santa Fe can capitalize on this by expanding and promoting its spa facilities, offering specialized wellness packages, and ensuring healthier food choices are readily available. The global wellness tourism market was projected to reach over $7.0 trillion by the end of 2025, highlighting the substantial growth potential in this area.

Cultural sensitivity is paramount in a diverse and interconnected world. Understanding and respecting the cultural nuances of different guest segments allows Grupo Hotelero Santa Fe to tailor its services and marketing efforts effectively. This includes everything from language accessibility and localizing culinary offerings to appreciating diverse holiday traditions. For example, by offering culturally relevant experiences or services, the company can foster stronger guest loyalty and attract a wider international clientele. In 2024, international travel continues its recovery, making cultural adaptability a key differentiator.

- Workation Trend: Growing remote work adoption in 2024 encourages hotels to offer co-working spaces and extended stay packages.

- Wellness Tourism: The global wellness tourism market, expected to exceed $7.0 trillion by 2025, presents opportunities for enhanced spa and health-focused amenities.

- Cultural Adaptation: Tailoring services to diverse cultural backgrounds is crucial for attracting and retaining an international customer base in a recovering travel market.

Labor Force Dynamics and Talent Availability

The availability of skilled labor within Mexico's hospitality sector directly impacts Grupo Hotelero Santa Fe's ability to deliver consistent, high-quality service. Social attitudes toward service industry roles can influence the pool of available talent, making recruitment and retention a key operational challenge. For instance, as of early 2025, the hospitality sector in Mexico continued to face a shortage of experienced management and specialized roles, pushing up wage expectations.

Grupo Hotelero Santa Fe must invest significantly in attracting, training, and retaining its workforce to uphold its service standards while managing labor costs. In 2024, the average annual wage for hospitality workers in Mexico saw an increase, reflecting the competitive labor market. Effective training programs not only enhance service but also contribute to employee loyalty and reduced turnover.

Employee well-being is increasingly becoming a critical factor in talent management within the hospitality industry. Companies like Grupo Hotelero Santa Fe are recognizing that prioritizing staff welfare, including fair compensation, benefits, and a positive work environment, is essential for long-term success. This focus is particularly relevant as younger generations of workers often prioritize work-life balance and company culture.

- Labor Shortage: Mexico's hospitality sector, as of early 2025, experienced a deficit in skilled and experienced personnel, particularly in management and specialized operational roles.

- Rising Wages: The average annual wage for hospitality staff in Mexico saw an upward trend throughout 2024, driven by increased demand and competition for talent.

- Talent Retention: Companies are focusing on robust training and development programs, alongside competitive benefits, to improve employee retention rates and reduce the costs associated with high turnover.

- Employee Well-being: A growing emphasis is placed on employee well-being initiatives, recognizing their impact on service quality and the overall attractiveness of the company as an employer.

Societal trends are significantly shaping traveler expectations, with a pronounced shift towards experiential and sustainable tourism, particularly among younger demographics. These travelers increasingly value authenticity, local immersion, and eco-conscious practices. For instance, a 2024 survey revealed that over 60% of Gen Z travelers consider a hotel's sustainability efforts when making booking decisions.

Grupo Hotelero Santa Fe needs to adapt its offerings to resonate with these evolving preferences. This includes embracing eco-friendly initiatives and developing unique cultural programs that highlight regional heritage. Personalization is also emerging as a key differentiator, with guests expecting tailored services based on their individual interests and past interactions.

Demographic changes, such as an aging population in Mexico and the continued global influence of Millennials and Gen Z, necessitate varied service approaches. Income distribution further diversifies demand, with a growing middle class creating opportunities in mid-tier segments, while higher earners seek luxury and bespoke experiences. Reports from early 2025 indicate a strong rebound in luxury travel spending, underscoring this demand.

Public health and safety remain paramount, with travelers prioritizing destinations and accommodations demonstrating high cleanliness standards and visible security measures. This was evidenced in 2024, where hotels actively promoting enhanced hygiene protocols saw increased occupancy. The rise of remote work has also spurred the 'workation' trend, creating demand for hotels offering co-working spaces and flexible stay options.

| Societal Trend | Impact on Grupo Hotelero Santa Fe | 2024/2025 Data/Example |

|---|---|---|

| Experiential & Sustainable Travel | Demand for authentic local experiences and eco-friendly practices. | 60%+ of Gen Z travelers consider sustainability in bookings (2024 survey). |

| Demographic Shifts | Catering to an aging population alongside Millennial/Gen Z preferences for digital integration and sustainability. | Mexico's median age increasing; Millennials/Gen Z prioritize digital and sustainable stays. |

| Workation Trend | Opportunity to offer co-working spaces and extended stay packages. | Growing adoption of remote work fuels demand for blended leisure and work accommodations. |

| Wellness Tourism | Expansion of spa, health-focused amenities, and wellness packages. | Global wellness tourism market projected to exceed $7.0 trillion by 2025. |

Technological factors

The hotel industry is seeing a significant shift towards digitalizing the guest experience. This means guests increasingly expect smooth online interactions, from booking to check-in and even controlling room features via their phones. For Grupo Hotelero Santa Fe, this necessitates ongoing investment in technology to meet these evolving demands.

By enhancing the digital guest journey, hotels can boost guest satisfaction and make operations more efficient. For instance, streamlined mobile check-in processes can reduce wait times at the front desk. Furthermore, personalized digital services, like tailored recommendations or in-room controls, create a more engaging stay, as seen in the growing adoption of smart room technology across the sector.

Critical to this digital transformation are user-friendly interfaces. A report from Skift Research in early 2024 indicated that over 70% of travelers prefer mobile check-in options. This highlights the importance of intuitive design in apps and online platforms, ensuring guests can easily navigate services and enjoy a hassle-free experience.

Grupo Hotelero Santa Fe leverages advanced Property Management Systems (PMS) and sophisticated revenue management software to fine-tune pricing strategies, optimize inventory across its various properties, and streamline day-to-day operations. This technological adoption significantly boosts operational efficiency, minimizes human error, and furnishes critical real-time data essential for making sound strategic decisions. For instance, by employing dynamic pricing algorithms, the company can adjust room rates based on demand, seasonality, and competitor pricing, aiming to maximize occupancy and revenue per available room (RevPAR).

The effective integration of these PMS platforms with other essential business systems, such as customer relationship management (CRM) and global distribution systems (GDS), is paramount. This interconnectedness ensures a seamless flow of information, providing a holistic view of guest interactions and booking channels. In 2024, the hospitality sector saw significant investment in AI-powered PMS solutions, with companies reporting an average RevPAR increase of 5-8% after implementation, underscoring the tangible financial benefits of such technological advancements for groups like Santa Fe.

Grupo Hotelero Santa Fe must prioritize robust cybersecurity to safeguard extensive guest data and financial transactions, a critical factor in maintaining guest trust. In 2024, the global cybersecurity market was valued at over $200 billion, underscoring the significant investment required. Failure to protect this sensitive information can lead to severe breaches and loss of customer confidence.

Compliance with evolving data privacy regulations, such as Mexico's Federal Law on the Protection of Personal Data Held by Private Parties, is paramount. Non-compliance in 2024 could result in substantial fines, with some global regulations imposing penalties up to 4% of annual turnover. This necessitates constant adaptation to legal frameworks to avoid legal repercussions and reputational harm.

Integration of AI and Automation

The integration of AI and automation is significantly reshaping the hospitality sector for Grupo Hotelero Santa Fe. This technological wave touches everything from how guests interact with the brand to the operational efficiency behind the scenes. For instance, AI-powered chatbots are increasingly handling routine guest inquiries, freeing up human staff for more complex needs. This not only improves response times but also allows for 24/7 customer support, a critical factor in guest satisfaction. The ability to offer personalized experiences through AI, such as tailored recommendations or dynamic pricing based on individual preferences, is becoming a key differentiator.

Furthermore, AI’s analytical capabilities are proving invaluable for optimizing business operations. Grupo Hotelero Santa Fe can leverage AI-driven insights to refine pricing strategies, predict demand more accurately, and identify emerging market trends. This data-driven approach helps maximize revenue and occupancy rates. In 2024, the global hospitality industry saw a significant uptick in AI adoption, with reports indicating that over 60% of hotels were exploring or implementing AI solutions for customer service and operations. This trend is expected to continue growing rapidly through 2025, presenting both opportunities and challenges for established players.

The practical applications extend to back-of-house operations as well. Automation in areas like energy management can lead to substantial cost savings, contributing to improved profitability and sustainability. Predictive maintenance, powered by AI, helps anticipate equipment failures, minimizing disruptions to guest services and reducing costly emergency repairs. By embracing these advancements, Grupo Hotelero Santa Fe can secure a competitive edge in a rapidly evolving market.

- Enhanced Guest Experience: AI chatbots and personalized marketing campaigns improve guest satisfaction and engagement.

- Operational Efficiency: Automation in energy management and predictive maintenance reduces costs and minimizes disruptions.

- Data-Driven Decision Making: AI analytics optimize pricing, forecast demand, and identify market trends for strategic advantage.

- Competitive Advantage: Early and effective adoption of AI and automation is crucial for staying ahead in the hospitality industry.

Emerging Hospitality Technologies

Grupo Hotelero Santa Fe must stay on top of new technologies to stay competitive. For example, virtual reality tours can give potential guests a realistic preview of hotel offerings, potentially boosting bookings. The global virtual reality market is projected to reach $22.7 billion by 2025, indicating significant consumer interest.

Integrating Internet of Things (IoT) devices in rooms, such as smart thermostats and lighting, can significantly improve guest comfort and operational efficiency by allowing for remote management and energy savings. Companies like Marriott are already piloting smart room technology, aiming to enhance guest satisfaction and streamline operations.

Exploring blockchain for secure and transparent payment systems could also provide a competitive edge, building trust with customers and reducing transaction costs. While still nascent in hospitality, blockchain adoption in payments globally is expected to grow substantially in the coming years.

Early adoption of these innovations is crucial. A recent study found that 65% of travelers are more likely to book with hotels that offer advanced technology. This focus on innovation directly impacts the guest experience and attracts a growing segment of tech-savvy travelers seeking modern amenities.

Grupo Hotelero Santa Fe must embrace technological advancements to maintain a competitive edge. The increasing demand for seamless digital guest experiences, from booking to in-room controls, necessitates continuous investment in user-friendly platforms and mobile integration. A significant portion of travelers, over 70% as of early 2024, now prefer mobile check-in options, highlighting the critical importance of intuitive design in hotel applications and websites.

Legal factors

Grupo Hotelero Santa Fe operates under Mexico's robust labor laws, which dictate minimum wage, overtime pay, and mandatory employee benefits like profit sharing and Christmas bonuses. For instance, the national minimum wage in Mexico saw an increase to MXN 248.93 per day for most of the country in 2024, directly affecting operational payroll expenses. The company must also adhere to regulations concerning working hours, vacation time, and employee social security contributions.

Compliance with these labor statutes is paramount for maintaining positive employee relations and avoiding legal penalties. Changes to these regulations, such as potential adjustments to the legal workday or new mandates for employee training, could significantly influence the company's human resource strategies and overall operational costs. Understanding and adapting to evolving employment standards, including those related to unionization rights, is key for sustainable business practices.

Grupo Hotelero Santa Fe must strictly adhere to health and safety regulations. This includes rigorous standards for food safety, fire prevention, and sanitation to ensure guest well-being and prevent costly legal issues. For instance, in 2024, the hospitality sector saw increased scrutiny on hygiene protocols following global health events, with fines for non-compliance reaching significant amounts for major hotel chains.

Environmental regulations are also critical. Compliance with rules on waste management, water conservation, and energy efficiency is not only a legal obligation but also impacts operational costs and brand reputation. Many jurisdictions, including Mexico where Grupo Hotelero Santa Fe operates, are strengthening their environmental mandates; a 2025 forecast suggests a 10% increase in corporate environmental reporting requirements.

Regular audits are indispensable for maintaining compliance across both health, safety, and environmental domains. These audits help identify potential risks and ensure the company's practices align with evolving legal frameworks and guest expectations, minimizing the likelihood of penalties or reputational damage.

Grupo Hotelero Santa Fe's hotel development hinges on rigorous adherence to property and land use laws. This includes navigating intricate zoning regulations, which dictate where and how hotels can be built or expanded. For instance, in Mexico City, obtaining permits for new construction often involves multiple layers of approval and can significantly impact project timelines and costs.

Building codes, which ensure structural integrity and safety, are also paramount. Compliance with these codes, which are regularly updated, requires substantial investment in design and construction processes. Failure to meet these standards can lead to costly delays or even project cancellation.

Furthermore, environmental impact assessments are a critical component. These studies, often mandated by federal and state environmental agencies, evaluate the potential ecological effects of new developments. In 2023, the Mexican government continued to emphasize sustainable development practices, making thorough environmental due diligence a non-negotiable step for Grupo Hotelero Santa Fe.

The company's success in acquiring, converting, and developing new properties, such as their expansion into new tourist destinations, directly correlates with their ability to effectively manage these legal complexities. Diligent legal review and proactive engagement with regulatory bodies are therefore essential for safeguarding investments and enabling strategic growth.

Consumer Protection Laws

Grupo Hotelero Santa Fe operates under stringent consumer protection laws in Mexico, which mandate clear communication regarding pricing, booking conditions, and cancellation terms. For instance, Mexico's Federal Consumer Protection Law (Profeco) requires hotels to clearly display rates, services included, and any applicable taxes, preventing hidden charges. Failure to comply can result in fines and reputational damage, impacting guest acquisition and retention. In 2024, consumer complaints related to deceptive advertising and unfair booking practices saw a notable increase across the hospitality sector, underscoring the importance of strict adherence.

Ensuring fair and transparent practices is paramount for maintaining guest trust and mitigating legal risks. This includes having well-defined and accessible policies for handling guest complaints and resolving disputes promptly. A proactive approach to consumer rights can prevent costly litigation and safeguard the company's brand image. For example, a clear and customer-friendly cancellation policy can reduce chargebacks and negative reviews, directly impacting revenue and future bookings.

Reputation management is intrinsically linked to consumer satisfaction and compliance with these laws. Hotels that consistently uphold consumer rights are more likely to receive positive reviews and repeat business. In 2025, industry reports indicate that over 60% of travelers consider a hotel's commitment to fair practices and transparent policies when making booking decisions. Grupo Hotelero Santa Fe's commitment to these principles directly influences its competitive standing.

Key legal factors impacting Grupo Hotelero Santa Fe include:

- Pricing Transparency: Adherence to Profeco regulations on displaying all-inclusive pricing and avoiding hidden fees.

- Booking and Cancellation Policies: Ensuring terms are clear, accessible, and legally compliant to prevent disputes.

- Guest Complaint Resolution: Establishing efficient and fair mechanisms for addressing and resolving guest grievances.

- Data Privacy: Complying with regulations concerning the collection and protection of guest personal information.

Intellectual Property and Brand Licensing

Grupo Hotelero Santa Fe's reliance on international brand affiliations, such as those with Hyatt and Marriott, makes strict adherence to intellectual property and brand licensing agreements paramount. These agreements dictate operational standards, marketing collateral, and the very essence of the brand experience. Failure to comply, for instance, by deviating from mandated service protocols or misusing trademarks, could result in hefty penalties and termination of valuable partnerships.

In 2024, the global hospitality sector saw increased scrutiny on brand integrity. For Grupo Hotelero Santa Fe, this translates to ensuring all franchised and managed properties consistently meet the stringent quality and operational benchmarks set by licensors. For example, a breach in brand standards could lead to a loss of booking referrals from the parent brand's loyalty programs, impacting occupancy rates and revenue streams. Protecting the associated trademarks is also vital to prevent dilution and maintain brand equity.

The legal ramifications of intellectual property infringement or breaches in licensing terms can be severe. These can include substantial fines, legal fees, and the loss of the right to operate under a recognized and trusted brand name. In 2025, as the industry continues to evolve with digital platforms and evolving consumer expectations, maintaining robust legal frameworks around brand licensing will be a key differentiator for sustained success and investor confidence.

Key considerations for Grupo Hotelero Santa Fe in this domain include:

- Ensuring all marketing materials align with international brand guidelines to protect trademark integrity.

- Maintaining operational compliance with service standards stipulated in franchise and management agreements.

- Regularly reviewing and auditing property-level adherence to brand-specific intellectual property usage policies.

- Proactively addressing any potential violations to mitigate legal and financial risks.

Grupo Hotelero Santa Fe must navigate complex tax laws, including corporate income tax, value-added tax (VAT), and specific tourism-related taxes. Mexico's federal tax authority, SAT, actively enforces compliance, with potential fines for discrepancies. For instance, in 2024, tax reforms in Mexico aimed to increase revenue collection, potentially impacting corporate tax rates or introducing new levies on digital services offered by hotels.

The company must also comply with international tax treaties and transfer pricing regulations, especially given its potential foreign investments or affiliations. Staying updated on changes in tax legislation and ensuring accurate financial reporting are crucial for avoiding penalties and maintaining financial stability. For 2025, a focus on digital economy taxation is anticipated, which could affect online booking platforms and revenue streams.

Key tax considerations for Grupo Hotelero Santa Fe include:

- Corporate Income Tax: Adhering to federal and state corporate tax obligations.

- VAT Compliance: Correctly applying and remitting VAT on services rendered.

- Transfer Pricing: Ensuring intercompany transactions are conducted at arm's length.

- Tax Reporting: Maintaining accurate and timely tax filings to avoid penalties.

Environmental factors

Climate change poses significant long-term threats to tourism, the sector in which Grupo Hotelero Santa Fe operates. Extreme weather events, like hurricanes and prolonged droughts, can devastate popular destinations, impacting visitor numbers and disrupting operations. For instance, the Caribbean, a key region for many hotel groups, is highly vulnerable to increasingly intense hurricane seasons, as seen in recent years where storm damage led to significant revenue losses for coastal properties.

Rising sea levels present another critical challenge, potentially eroding beaches and damaging coastal infrastructure vital for tourism. This can directly affect property values and require substantial investment in protective measures. Altered natural landscapes, such as coral bleaching due to warming oceans, also diminish the appeal of destinations, directly impacting tourist experiences and, consequently, hotel occupancy rates.

These environmental shifts are likely to increase operational costs for Grupo Hotelero Santa Fe through higher insurance premiums and the necessity for climate-resilient infrastructure. Adapting to these evolving conditions, including investing in sustainable practices and diversifying offerings, is becoming an increasingly critical strategic imperative for the company's long-term viability and profitability in the face of a changing global climate.

Growing pressure from consumers and investors is pushing Grupo Hotelero Santa Fe to adopt more sustainable practices. This includes investing in energy-efficient technologies, conserving water, and improving waste management. For instance, many hotel chains are reporting significant reductions in utility costs after implementing LED lighting and smart thermostat systems, with some seeing savings of up to 15% on energy bills.

Adopting green building standards for new projects and renovations is also a key strategy. This not only improves the company's public image but also leads to lower operating expenses over time. Obtaining certifications like LEED (Leadership in Energy and Environmental Design) can further validate these efforts, potentially attracting environmentally conscious travelers and investors.

Water scarcity poses a significant environmental challenge, directly affecting hotel operations that are naturally high water consumers. Grupo Hotelero Santa Fe, like many in the hospitality sector, must prioritize robust water management. This includes investing in technologies like greywater recycling systems and implementing smart irrigation for landscaping. These measures are crucial not only for operational sustainability but also for adhering to increasingly stringent local water usage regulations. Reducing the company's overall water footprint will be a key focus for responsible growth.

Energy Consumption and Renewable Sources

Hotels are inherently energy-intensive operations, making energy consumption a critical environmental factor for Grupo Hotelero Santa Fe. The company's operational efficiency and environmental impact are directly tied to its energy usage patterns.

To address this, Grupo Hotelero Santa Fe can significantly reduce its environmental footprint and operational costs by strategically investing in renewable energy sources. This includes exploring options like solar power installations at their properties. For instance, in 2023, the global hospitality sector saw increased investment in solar, with some hotel chains reporting up to a 30% reduction in energy bills after implementing solar solutions.

Furthermore, upgrading to energy-efficient appliances and implementing smart building management systems are crucial steps. These technologies help optimize energy usage in real-time, from lighting and HVAC to water heating. By adopting these measures, Grupo Hotelero Santa Fe can align with growing consumer demand for sustainable travel and meet evolving regulatory requirements, making the shift towards cleaner energy a strategic imperative for long-term success.

- Energy-intensive operations: Hotels require significant energy for lighting, climate control, and amenities.

- Renewable energy investment: Solar and wind power offer cost savings and reduced carbon emissions.

- Energy efficiency: Upgrading to efficient appliances and smart systems lowers consumption.

- Strategic imperative: Shifting to cleaner energy addresses environmental concerns and enhances brand reputation.

Waste Management and Circular Economy

Grupo Hotelero Santa Fe must prioritize effective waste management, implementing robust reduction, recycling, and composting programs to meet environmental regulations and demonstrate corporate responsibility. For instance, in 2023, the hotel industry globally generated an estimated 1.2 million metric tons of waste, highlighting the scale of the challenge and the opportunity for improvement.

Embracing circular economy principles is key to enhancing environmental stewardship. This involves actively sourcing local and sustainable products, which not only minimizes waste but also supports regional economies. A 2024 report indicated that hotels adopting circular sourcing models saw a reduction in waste disposal costs by an average of 15%.

Reducing single-use plastics is a significant and achievable goal for the company. Many hotels are now phasing out items like plastic water bottles, straws, and miniature toiletries. By late 2024, over 70% of major hotel chains had committed to eliminating or significantly reducing their reliance on single-use plastics across their operations.

- Waste Reduction Targets: Implementing measurable goals for reducing landfill waste by 25% by 2026.

- Recycling and Composting Infrastructure: Investing in enhanced on-site facilities and partnerships for effective material diversion.

- Sustainable Sourcing: Prioritizing suppliers who adhere to circular economy practices and offer reusable or compostable alternatives.

- Single-Use Plastic Elimination: Developing and executing a phased plan to remove non-essential single-use plastic items from guest rooms and public areas.

Grupo Hotelero Santa Fe faces significant environmental challenges stemming from climate change, including extreme weather events and rising sea levels impacting tourism destinations. The company must invest in climate-resilient infrastructure and sustainable practices to mitigate risks and adapt to changing natural landscapes, which can diminish destination appeal. These environmental shifts are projected to increase operational costs through higher insurance premiums and necessitate greater investment in protective measures for coastal properties.

PESTLE Analysis Data Sources

Our PESTLE analysis for Grupo Hotelero Santa Fe is informed by data from governmental bodies, international financial institutions, and reputable market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the hospitality sector.