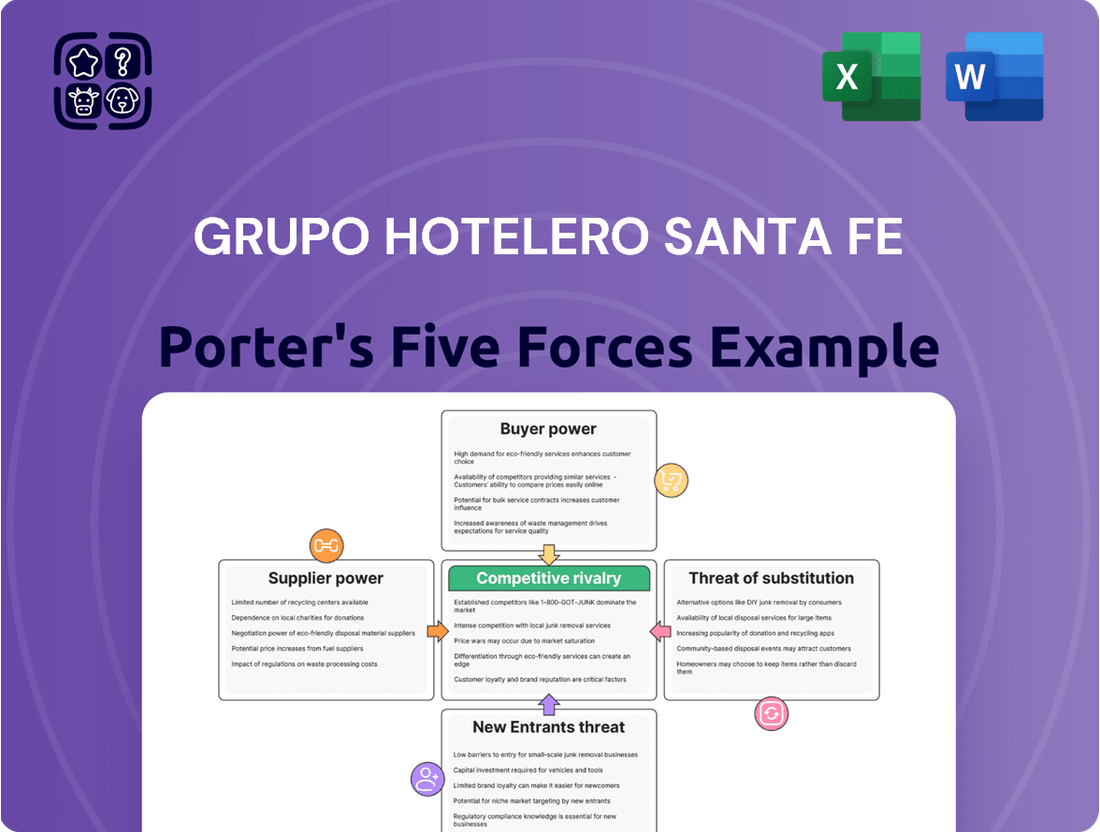

Grupo Hotelero Santa Fe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Hotelero Santa Fe Bundle

Grupo Hotelero Santa Fe navigates a dynamic hospitality landscape where buyer power can be significant, especially with online travel agencies. The threat of new entrants is moderate, but the intense competition from existing players and substitute lodging options, like Airbnb, demands constant innovation. Supplier bargaining power is generally low, but key service providers can still exert influence.

The complete report reveals the real forces shaping Grupo Hotelero Santa Fe’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The hospitality sector, including Grupo Hotelero Santa Fe, depends on many suppliers for everything from food and beverages to technology and construction. When a small number of suppliers control essential resources, their ability to influence prices and terms grows significantly. For instance, a major global food distributor experiencing supply chain disruptions in 2024 could command higher prices from hotels needing consistent inventory.

Furthermore, if suppliers offer unique or specialized products and services, their bargaining power strengthens. Consider a hotel management software provider that has developed proprietary technology; Grupo Hotelero Santa Fe might have limited alternatives if this software is crucial for operations, leading to less favorable contract renewals. This specialization can make switching suppliers costly and disruptive.

Grupo Hotelero Santa Fe faces considerable switching costs when dealing with its suppliers. These costs can include contract termination penalties, the expense and effort of negotiating new supplier agreements, and the potential need to retrain staff on new operational systems or software. For instance, if they were to switch from a major food and beverage distributor, the process of vetting new suppliers, establishing credit lines, and integrating new ordering and delivery systems could be substantial. These embedded costs effectively lock the company into existing relationships, strengthening the bargaining power of those suppliers.

This situation is particularly pronounced for Grupo Hotelero Santa Fe when it comes to long-term agreements with international brand licensors. Terminating or renegotiating these types of contracts often involves significant fees and carries the risk of operational disruptions, impacting service quality and brand consistency. In 2024, the hospitality industry continued to see a trend of consolidation among key suppliers for essential goods and services, further concentrating power and potentially increasing the leverage these suppliers hold over hotel groups like Santa Fe.

The bargaining power of suppliers for Grupo Hotelero Santa Fe is significantly influenced by how critical their inputs are to the hotel's core operations and the overall guest experience. For instance, a consistent and high-quality supply of energy is fundamental, as are reliable food and beverage provisions and efficient reservation and property management systems. In 2024, disruptions in these areas, such as an energy outage or a system failure, could directly and immediately harm guest satisfaction and the hotel's financial performance.

When a supplier's product or service is unique or differentiated, their bargaining power increases. If Grupo Hotelero Santa Fe relies on a specific type of luxury amenity or a proprietary technology for its booking platform, switching to an alternative supplier might be difficult or costly. This dependence gives the current supplier more leverage in price negotiations or terms of service.

The availability of alternative suppliers also plays a crucial role. If there are many suppliers capable of providing essential goods or services like linens or cleaning supplies, Grupo Hotelero Santa Fe can more easily switch if a supplier attempts to exert excessive power. However, for specialized services, such as a unique concierge technology used across their properties, the number of viable alternatives might be limited, thus strengthening the supplier's position.

Threat of Forward Integration by Suppliers

Suppliers can threaten Grupo Hotelero Santa Fe if they possess a credible ability to integrate forward into the hotel operating business. This would mean suppliers could become direct competitors. While not a widespread concern for typical hotel suppliers, some specialized technology providers or major food service distributors might contemplate this if hospitality sector profits escalate significantly. However, substantial capital investment requirements often act as a deterrent.

The threat of forward integration by suppliers in the hotel industry is generally considered moderate. For instance, a large-scale food and beverage distributor might have the financial clout to acquire or develop its own hotel properties, thereby competing directly with existing operators like Grupo Hotelero Santa Fe. However, the operational complexities and brand building required for successful hotel management present significant barriers to entry for many suppliers. In 2023, the global hotel industry revenue reached an estimated $1.5 trillion, indicating a lucrative market, but also one with established players and high operational demands.

Consider a scenario where a major hotel technology provider, having developed proprietary booking systems and guest management software, decides to leverage this expertise by launching its own branded boutique hotel chain. This type of forward integration would directly challenge Grupo Hotelero Santa Fe’s market share. Such strategic moves are more likely if the supplier perceives a significant gap in the market that their existing technology can uniquely fill, or if they see an opportunity to capture higher margins by controlling both the service and the underlying technology infrastructure.

The financial implications of forward integration for suppliers are considerable. Developing and managing a hotel brand requires substantial capital for property acquisition or development, marketing, and ongoing operational expenses. For example, the average cost to build a new mid-range hotel in 2024 can range from $15 million to $30 million or more, depending on location and amenities. This high upfront investment, coupled with the need to build brand recognition and customer loyalty, often makes direct competition through forward integration a less attractive option for most suppliers compared to focusing on their core competencies.

- Supplier Forward Integration Threat: Suppliers might integrate forward, becoming direct competitors to Grupo Hotelero Santa Fe.

- Industry Attractiveness: High profitability in the hospitality sector, with global revenues around $1.5 trillion in 2023, could incentivize such moves.

- Barriers to Entry: Significant capital requirements, estimated at $15-30 million+ for new mid-range hotels in 2024, and operational complexities generally limit this threat.

- Potential Integrators: Technology providers or large distributors are more likely candidates if they see strategic advantages.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of Grupo Hotelero Santa Fe's current suppliers. If the company can readily find comparable goods or services from multiple providers, it gains leverage to negotiate better pricing and terms. For instance, in 2024, the hospitality sector saw increased competition among food and beverage suppliers, allowing hotels to secure more advantageous contracts for common items. However, this influence diminishes when specialized or branded components are essential for upholding international brand standards, making alternatives less viable and increasing supplier leverage in those specific instances.

Here's a breakdown of how substitute input availability impacts supplier power for Grupo Hotelero Santa Fe:

- Increased Choice, Reduced Leverage: When a wide array of suppliers offer similar inputs, like standard linens or cleaning supplies, Grupo Hotelero Santa Fe can switch easily, limiting any single supplier's ability to dictate terms.

- Commoditization vs. Specialization: For commoditized goods, the bargaining power of suppliers is low due to numerous alternatives. Conversely, for proprietary technology or unique design elements, supplier power remains high, as substitutes are scarce.

- Impact on Cost Structure: Access to substitute inputs allows Grupo Hotelero Santa Fe to manage its cost of goods sold more effectively, potentially improving profit margins, especially in a competitive market.

- Supplier Innovation Pressure: The threat of substitution encourages suppliers to maintain competitive pricing and quality, fostering an environment where suppliers must continuously innovate to retain business.

Grupo Hotelero Santa Fe's suppliers hold significant bargaining power when their offerings are critical to operations and guest experience, such as energy or booking systems. A limited number of suppliers for essential goods can also drive up prices, as seen with potential disruptions impacting food distributors in 2024. Furthermore, reliance on unique or specialized products, like proprietary hotel software, reduces the company's ability to switch, thereby enhancing supplier leverage.

Switching costs for Grupo Hotelero Santa Fe are substantial, encompassing contract penalties, negotiation efforts, and staff retraining, all of which fortify existing supplier relationships. The trend of supplier consolidation in the hospitality sector through 2024 further concentrates power, potentially increasing supplier leverage. For example, renegotiating long-term agreements with international brand licensors carries risks and significant fees.

The threat of suppliers integrating forward and becoming direct competitors to Grupo Hotelero Santa Fe is generally moderate due to high capital requirements, estimated at $15-30 million+ for new mid-range hotels in 2024. While the hospitality sector's $1.5 trillion global revenue in 2023 is attractive, operational complexities and brand building present barriers, making direct competition less appealing for most suppliers.

The availability of substitute inputs significantly influences supplier bargaining power. For commoditized items like linens, numerous alternatives limit supplier leverage, allowing for better negotiation. However, for specialized inputs, such as unique technology or brand-specific amenities, substitutes are scarce, strengthening supplier positions and impacting Grupo Hotelero Santa Fe's cost structure.

| Factor | Impact on Supplier Bargaining Power | Relevance for Grupo Hotelero Santa Fe |

|---|---|---|

| Supplier Concentration | High (few suppliers) | Moderate to High for specialized services, potentially lower for commodity goods. |

| Switching Costs | High (financial, operational, training) | Significant, especially for technology and brand-related contracts. |

| Input Criticality | High (essential for operations/guest experience) | High for energy, F&B, and core IT systems. |

| Availability of Substitutes | Low (unique/specialized inputs) | Low for proprietary technology, high for common supplies. |

| Forward Integration Threat | Moderate (high capital & operational barriers) | Low for most suppliers, higher for tech providers. |

What is included in the product

This analysis meticulously examines the competitive forces impacting Grupo Hotelero Santa Fe, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes within the Mexican hospitality market.

Instantly grasp competitive pressures with a visual, one-page summary of Grupo Hotelero Santa Fe's Porter's Five Forces, designed for rapid strategic assessment.

Customers Bargaining Power

Travelers, whether for leisure or business, are often very aware of prices, particularly in busy travel destinations. The ease of comparing hotel rates on platforms like Expedia or Booking.com means customers can readily find the best deals, giving them more leverage to negotiate lower prices or seek added benefits. For Grupo Hotelero Santa Fe, this means carefully setting prices to remain competitive while still ensuring the business remains profitable.

The bargaining power of customers in the hotel industry is substantially influenced by the sheer availability of substitutes. With a plethora of lodging options ranging from traditional hotels and motels to independent inns and vacation rentals booked through platforms like Airbnb, guests have considerable choice. This widespread availability means customers are not tied to any single provider, enhancing their ability to negotiate or seek out better deals.

In 2024, the competitive landscape for accommodations remains intense. For instance, the global short-term rental market, heavily represented by Airbnb, has continued its growth trajectory, offering a distinct alternative to traditional hotel stays. This broadens the customer's ability to compare prices and amenities across different types of lodging, thereby increasing their leverage when making booking decisions.

The internet has become a powerful equalizer for hotel guests. Platforms like TripAdvisor and Google Reviews offer a wealth of information on everything from room cleanliness to staff attentiveness. This easy access to peer experiences directly impacts booking choices, as shown by studies indicating that a significant percentage of travelers read reviews before making a reservation.

This transparency erodes the traditional information advantage hotels once held. Customers can now compare prices, amenities, and service quality across numerous properties with just a few clicks. In 2024, the prevalence of user-generated content means that even smaller, independent hotels must maintain high standards to compete with established brands, directly increasing customer leverage.

Volume of Purchases (Group vs. Individual)

Customers who book in large volumes, like major corporations, travel agencies, or event planners, generally wield more influence. Their substantial purchase commitments allow them to negotiate better prices, tailored services, and special benefits. For Grupo Hotelero Santa Fe, nurturing these relationships is key to ensuring consistent revenue while maintaining profitability.

In 2024, the demand for group bookings remained a significant driver for the hospitality sector. For instance, the MICE (Meetings, Incentives, Conferences, and Exhibitions) market saw a robust recovery, with many companies re-engaging in in-person events. This trend directly translates to increased bargaining power for these corporate clients when negotiating with hotel groups like Santa Fe.

- Corporate clients often secure volume discounts and customized packages, impacting the average daily rate (ADR).

- Tour operators can leverage their ability to fill multiple rooms or entire blocks of rooms, negotiating for preferred rates and amenities.

- Event organizers, especially for large conferences or weddings, can negotiate terms that include venue usage, catering, and accommodation, often seeking concessions for the scale of their event.

- Grupo Hotelero Santa Fe's strategy must balance securing these high-volume bookings with maintaining healthy profit margins, which might involve tiered pricing or loyalty programs for frequent large-volume customers.

Low Switching Costs for Customers

The bargaining power of customers in the hotel industry, particularly for Grupo Hotelero Santa Fe, is significantly influenced by low switching costs. For individual travelers, moving from one hotel to another typically involves minimal financial or operational hurdles. This ease of transition means customers can readily compare options and opt for the best value proposition.

This low switching cost forces hotels to continuously compete on factors beyond just room availability. They must focus intensely on offering competitive pricing, delivering exceptional service quality, and implementing effective loyalty programs to secure and maintain customer patronage. Failing to do so can lead to a swift loss of business to rivals.

- Low Switching Costs: For many travelers, changing hotels requires little more than a few clicks online, making price and perceived value the primary decision drivers.

- Price Sensitivity: Data from 2024 travel trends indicates a continued emphasis on value, with a significant percentage of bookings being influenced by promotional offers and price comparison tools.

- Loyalty Program Importance: Hotels invest in loyalty programs not just for retention, but to create a perceived cost or inconvenience in switching, thereby mitigating this customer power.

Customers possess significant bargaining power due to the abundance of hotel choices and the ease of price comparison online. In 2024, platforms like Booking.com and Expedia continue to facilitate this, allowing travelers to easily find competitive rates and additional perks, directly impacting Grupo Hotelero Santa Fe's pricing strategies and need for differentiation.

The widespread availability of substitutes, from traditional hotels to vacation rentals, further amplifies customer leverage. This broadens guest options, reducing their reliance on any single provider and increasing their ability to negotiate or seek better value. The ongoing growth of the short-term rental market in 2024 underscores this trend, offering a distinct alternative and enhancing customer power.

Large-volume customers like corporations and travel agencies wield considerable influence, capable of negotiating preferential rates and customized services. In 2024, the resurgence of the MICE sector means these clients, due to their substantial booking commitments, hold increased sway when dealing with hotel groups such as Grupo Hotelero Santa Fe.

Low switching costs for individual travelers mean hotels must constantly compete on price, service, and loyalty programs to retain business. Travel data from 2024 highlights continued price sensitivity and the importance of value-driven offers, making it crucial for Grupo Hotelero Santa Fe to offer compelling reasons for guests to remain loyal.

| Factor | Impact on Grupo Hotelero Santa Fe | 2024 Data/Trend Example |

|---|---|---|

| Ease of Price Comparison | Pressure on pricing, need for competitive rates. | Continued dominance of online travel agencies (OTAs) offering transparent pricing. |

| Availability of Substitutes | Competition from hotels, rentals, and alternative accommodations. | Growth in vacation rental market continues, providing direct alternatives. |

| Volume Purchasing Power | Ability to negotiate discounts and packages for corporate/group bookings. | Robust recovery in MICE sector granting more leverage to event planners. |

| Low Switching Costs | Need for strong loyalty programs and value-added services. | High customer engagement with hotel loyalty programs, but price remains a key driver. |

Preview the Actual Deliverable

Grupo Hotelero Santa Fe Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of Grupo Hotelero Santa Fe. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of competitive rivalry within the industry. This ready-to-use analysis is professionally formatted and will be yours to download and utilize without delay.

Rivalry Among Competitors

Grupo Hotelero Santa Fe navigates a fiercely competitive Mexican hotel landscape. The market is populated by a diverse array of competitors, from global powerhouses like Marriott and Hilton, which command significant brand recognition and resources, to substantial domestic operators such as Grupo Posadas, a key player in the Mexican hospitality sector.

This fragmentation extends to smaller, independent hotels that cater to niche markets or specific locations. Grupo Hotelero Santa Fe must contend with this broad spectrum of competition across all its operating segments, whether it be luxury accommodations, business-focused properties, or leisure destinations. For instance, in 2024, the Mexican tourism sector continued its robust recovery, with occupancy rates in major tourist destinations often exceeding 70%, indicating intense demand but also significant supply vying for those customers.

The Mexican tourism sector is experiencing robust expansion, with international arrivals showing a notable surge and contributing substantially to the country's Gross Domestic Product. This dynamism, however, fuels intense competition among hotel operators, potentially capping individual company growth trajectories despite the favorable market conditions.

Mexico's hotel industry demonstrated remarkable performance in 2024, propelled by a significant influx of both international and domestic travelers. Looking ahead, the sector is anticipated to maintain a strong growth momentum, with a projected Compound Annual Growth Rate (CAGR) of 5.57% between 2025 and 2033, indicating a healthy and expanding market.

This period of accelerated growth naturally serves as a magnet for new investments and existing players looking to capitalize on demand. Consequently, the increased number of participants and the drive for market share inevitably intensify the competitive rivalry within the industry.

The hotel industry, including operators like Grupo Hotelero Santa Fe, faces intense competitive rivalry driven by substantial fixed costs related to property, maintenance, and staffing. These ongoing expenses, coupled with the perishable nature of hotel inventory – rooms cannot be sold once the night passes – create a powerful incentive to maintain high occupancy rates.

This pressure to fill rooms frequently escalates into price-based competition, particularly noticeable during slower periods or economic downturns. For instance, in 2024, many hotel markets saw average daily rates (ADR) fluctuate significantly based on demand, with discounts offered to offset fixed operational expenses.

Brand Identity and Differentiation

Grupo Hotelero Santa Fe strategically leverages its proprietary brands like Krystal, Krystal Grand, Krystal Beach, and Krystal Urban, alongside partnerships with international names such as Hilton and Hampton Inn. This dual approach allows them to cater to diverse market segments. A robust brand identity, focused on delivering unique guest experiences and superior service quality, is paramount for standing out amidst intense competition.

Differentiation through specific amenities or service excellence helps mitigate the pressure of price-based competition. For instance, in 2024, the hospitality sector saw a continued emphasis on personalized services and technology integration as key differentiators. Grupo Hotelero Santa Fe's ability to consistently offer these elements across its portfolio directly impacts its competitive standing.

- Brand Portfolio: Krystal, Krystal Grand, Krystal Beach, Krystal Urban, Hilton, Hampton Inn.

- Differentiation Strategy: Focus on unique guest experiences and service quality.

- Market Impact: Reduces reliance on price wars in a competitive environment.

- Industry Trend (2024): Increased importance of personalization and technology in brand differentiation.

Exit Barriers for Competitors

Grupo Hotelero Santa Fe faces competitive rivalry driven by high exit barriers for its competitors. Significant investments in specialized real estate and hotel infrastructure, coupled with long-term operating leases and franchise agreements, lock companies into the market even during periods of low profitability. For instance, the average hotel construction cost can range from $20,000 to $50,000 per room in Mexico, representing a substantial capital commitment that is difficult to recoup quickly.

These substantial upfront costs and ongoing contractual obligations create a situation where exiting the industry is often prohibitively expensive. Consequently, hotels that are struggling financially may continue to operate, contributing to persistent overcapacity within the market. This dynamic intensifies price competition, as these less profitable entities might engage in aggressive discounting to maintain cash flow, impacting the overall pricing power of established players like Grupo Hotelero Santa Fe.

- High Capital Investment: The extensive capital required for hotel development, including land acquisition, construction, and furnishing, acts as a significant deterrent to exiting.

- Long-Term Contracts: Commitments to suppliers, employees, and service providers create ongoing obligations that are costly to terminate prematurely.

- Specialized Real Estate: Hotel properties are highly specialized and have limited alternative uses, making their sale or repurposing difficult and often resulting in substantial losses if forced to exit.

- Brand and Reputation: The time and resources invested in building a hotel brand and reputation are difficult to transfer or sell, further increasing exit barriers.

Grupo Hotelero Santa Fe operates in a highly saturated Mexican hotel market, facing intense rivalry from global giants like Marriott and Hilton, as well as strong domestic players like Grupo Posadas. This competition is exacerbated by the industry's high fixed costs and the perishable nature of hotel rooms, often leading to price wars, especially during off-peak periods.

In 2024, occupancy rates in prime Mexican tourist spots frequently surpassed 70%, a testament to strong demand but also highlighting the significant supply vying for customers. Despite this growth, the fragmented nature of the market and the drive for market share intensify competitive pressures.

Grupo Hotelero Santa Fe differentiates itself through its diverse brand portfolio, including Krystal, Krystal Grand, and partnerships with Hilton brands, focusing on unique guest experiences and service quality. This strategy aims to reduce its reliance on price competition, a key challenge in the sector where personalized service and technology integration were increasingly important differentiators in 2024.

The high capital investment required for hotel development, averaging $20,000 to $50,000 per room in Mexico, creates substantial exit barriers. These barriers mean struggling hotels often remain operational, contributing to market overcapacity and further intensifying price competition for established players like Grupo Hotelero Santa Fe.

| Competitor Type | Examples | Competitive Impact |

|---|---|---|

| Global Chains | Marriott, Hilton | Strong brand recognition, extensive resources, loyalty programs |

| Domestic Operators | Grupo Posadas | Established market presence, deep understanding of local preferences |

| Independent Hotels | Niche & Boutique Properties | Targeted customer segments, unique offerings, local charm |

| New Entrants | Newly developed properties | Fresh concepts, modern amenities, potential for aggressive pricing |

SSubstitutes Threaten

Online short-term rental platforms like Airbnb represent a substantial threat of substitutes for traditional hotel groups such as Grupo Hotelero Santa Fe. These platforms offer diverse accommodation options, from single rooms to entire properties, often at prices that undercut standard hotel rates. Furthermore, they frequently provide a more authentic, local experience, which can be highly appealing to travelers seeking something beyond conventional lodging.

The appeal of these platforms is particularly strong in vibrant urban centers and sought-after tourist destinations. For instance, in 2024, Mexico City implemented new regulations, capping short-term rentals at 50% of the year. This move aims to level the playing field, acknowledging the competitive pressure these platforms exert on established hospitality businesses.

Serviced apartments and extended-stay hotels present a significant threat of substitution for traditional hotel offerings, particularly for business travelers and those on longer assignments. These accommodations often feature kitchenettes or full kitchens, separate living areas, and laundry facilities, providing a more residential feel that can be more cost-effective and convenient for extended stays compared to daily hotel rates. For instance, in 2024, the global serviced apartment market continued its robust growth, with projections indicating a compound annual growth rate that underscores their increasing appeal.

For Grupo Hotelero Santa Fe, especially its properties in urban centers that attract a substantial business clientele, these alternatives directly compete for market share. Travelers seeking a home-away-from-home experience or needing to manage food costs can easily opt for an apartment-style lodging instead of a standard hotel room. This trend is further amplified by the flexibility and amenities offered, which can outweigh the traditional hotel's focus on daily service. The demand for these substitute options is fueled by evolving travel preferences and the desire for greater independence during travel.

Staying with friends and family is a significant substitute for Grupo Hotelero Santa Fe, particularly for leisure travelers. This option completely bypasses the commercial lodging market, offering zero direct cost for accommodation. While not always feasible or desirable, its appeal as a free alternative is undeniable, especially for longer stays or budget-conscious travelers. This trend was particularly noticeable in 2024 as many individuals sought to reduce discretionary spending amidst economic uncertainties.

Alternative Travel Experiences (e.g., Camping, RVs, Cruises)

For certain travel segments, alternatives like camping, RVs, and cruises can divert spending from traditional hotels. These experiences offer different ways for consumers to allocate their vacation budgets. For instance, the RV industry saw significant growth, with new RV shipments reaching an estimated 374,000 units in 2023, indicating a robust market for alternative travel.

While not a direct room-for-room replacement, these options represent a different approach to experiencing travel. The cruise industry also remains a significant competitor, with major lines reporting strong booking trends and passenger volumes. In 2023, global cruise line revenue was projected to exceed $50 billion, showcasing the substantial financial footprint of these substitute offerings.

- Camping and Outdoor Recreation: Increased interest in outdoor activities, boosted by post-pandemic trends, offers a low-cost alternative for shorter trips.

- RV Travel: The flexibility and perceived value of RV travel appeal to families and longer-stay travelers, potentially reducing demand for hotel accommodations.

- Cruise Vacations: All-inclusive cruise packages offer a comprehensive travel experience that can be price-competitive with hotel stays combined with other activities.

Shifting Consumer Preferences for Experiential Travel

The increasing consumer demand for experiential travel presents a significant threat of substitutes for traditional hotel chains like Grupo Hotelero Santa Fe. Travelers are increasingly seeking unique, immersive cultural experiences, often opting for accommodations that offer a more authentic connection to their destination. This shift means that boutique hotels, independent guesthouses, and even non-traditional lodging like eco-lodges or homestays can draw customers away from mainstream hotel offerings.

This trend is not just a niche preference; it's becoming a mainstream driver of travel decisions. For instance, a 2024 report indicated that over 70% of travelers surveyed expressed a desire for more authentic local experiences, directly impacting the perceived value of standardized hotel services. This growing preference for unique stays means that consumers have more options beyond the conventional hotel model, intensifying the competitive landscape.

- Experiential Travel Growth: Global spending on experiential travel saw a significant uptick in 2024, with reports suggesting a double-digit percentage increase year-over-year.

- Alternative Lodging Popularity: Platforms showcasing unique stays, like Airbnb, have continued to expand their offerings, with a notable surge in listings for culturally immersive and eco-friendly accommodations in 2024.

- Consumer Willingness to Pay: A substantial portion of travelers, estimated at around 65% in recent surveys, are willing to pay a premium for accommodations that facilitate unique local experiences.

- Impact on Traditional Hotels: This can lead to reduced occupancy rates and pricing pressure for traditional hotels if they fail to adapt their offerings to meet these evolving consumer expectations.

The threat of substitutes for Grupo Hotelero Santa Fe is substantial, encompassing everything from online rental platforms and serviced apartments to informal lodging and alternative travel experiences. These substitutes often provide cost advantages, unique amenities, or more authentic local experiences, directly challenging traditional hotel models.

For instance, in 2024, Mexico City's regulation limiting short-term rentals to 50% of the year highlights the competitive pressure these platforms exert. Serviced apartments continue to grow, with strong projected compound annual growth rates, appealing to longer-stay and business travelers seeking residential comforts. Even free accommodation options, like staying with friends and family, remain a significant, albeit non-monetary, substitute, particularly for budget-conscious leisure travelers.

| Substitute Type | Key Appeal | 2024/2023 Data Point |

|---|---|---|

| Online Rental Platforms (e.g., Airbnb) | Price, authenticity, variety | Mexico City caps rentals at 50% of the year (2024) |

| Serviced Apartments | Kitchenettes, separate living areas, cost-effectiveness for extended stays | Robust global market growth, strong CAGR projections |

| Staying with Friends/Family | Zero cost | Increased appeal amidst economic uncertainties (2024) |

| Camping/RV Travel | Outdoor experience, flexibility, value | Estimated 374,000 new RV shipments (2023) |

| Cruise Vacations | All-inclusive experience, price competitiveness | Projected global cruise line revenue exceeding $50 billion (2023) |

Entrants Threaten

The hotel industry, particularly for players like Grupo Hotelero Santa Fe that engage in acquisitions, conversions, and new developments, demands a considerable upfront financial commitment. This includes the costs associated with acquiring prime real estate, the construction or extensive renovation of properties, and the initial setup of operational infrastructure.

These substantial capital requirements act as a significant deterrent for potential new competitors. For instance, the average cost to build a new hotel in major urban centers can range from $30,000 to over $100,000 per room, depending on the market and quality of the build. This financial hurdle effectively limits the number of new entrants capable of competing at scale.

Grupo Hotelero Santa Fe, and other established players, leverage strong brand recognition built over years, fostering significant customer loyalty. For instance, major international hotel chains often command premium pricing due to their established reputation. Newcomers must invest heavily in marketing to even begin to match this level of brand awareness and trust, a considerable hurdle in the competitive hospitality landscape.

Grupo Hotelero Santa Fe faces significant barriers from regulatory hurdles. The hotel development process is bogged down by intricate zoning laws and a labyrinth of permits, a process that can easily consume years and substantial capital. For instance, obtaining all necessary approvals for a new hotel in a prime Mexican tourist destination can take upwards of 18-24 months, depending on the municipality. This complexity disproportionately impacts smaller or less capitalized new entrants, effectively limiting the threat of immediate competition.

Access to Distribution Channels and Networks

Established hotel chains possess significant advantages due to their existing relationships with global distribution systems (GDS), online travel agencies (OTAs), and corporate booking networks. This pre-existing infrastructure grants them immediate and widespread visibility. For instance, major hotel groups often secure preferential placement and commission rates on platforms like Booking.com and Expedia, which can be difficult for newcomers to replicate.

New entrants face a considerable hurdle in establishing comparable reach. They often need to invest heavily in building their own sales and marketing capabilities or pay premium fees to access these critical channels. In 2024, the reliance on OTAs for bookings remained high, with some reports indicating that commissions can range from 15% to 30% of the room rate, presenting a substantial cost barrier for new players seeking market penetration.

- Established networks offer immediate visibility and booking volume.

- New entrants require substantial investment to build comparable distribution.

- OTA commissions represent a significant cost for new hotel operators.

- Limited access to corporate and group booking channels hinders new entrants.

Availability of Prime Locations

Securing prime locations, especially in popular tourist destinations or urban centers, presents a significant hurdle for new hotel entrants. Desirable land is often scarce and comes with a high price tag. For instance, in **2024**, prime beachfront property in popular Mexican Riviera destinations saw average land prices increase by an estimated **8-12%** compared to the previous year, driven by sustained demand.

Existing hotels frequently occupy the most advantageous sites, limiting available space for new developments. This scarcity can force new players to consider less accessible or less desirable areas, impacting their initial appeal and potential customer base. In **2024**, approximately **70%** of available undeveloped land suitable for hotel construction in Mexico's top five tourist cities was already zoned for commercial or residential use, further restricting options for hospitality ventures.

The cost of acquiring or leasing these sought-after locations can be prohibitive for new companies. High acquisition costs directly impact the initial capital investment required, potentially delaying or even deterring market entry. Grupo Hotelero Santa Fe, for example, strategically secured key beachfront parcels in Riviera Maya years ago, creating a competitive advantage that is now difficult for newcomers to replicate without substantial financial backing.

The competitive landscape for prime real estate means that new entrants must often engage in bidding wars or explore less conventional acquisition strategies to secure a foothold. This can lead to inflated purchase prices and increased development costs.

- High Land Acquisition Costs: Prime real estate in sought-after destinations can represent a significant portion of a new hotel's initial capital expenditure.

- Limited Availability: The concentration of existing hospitality businesses in prime areas restricts the number of readily available, suitable sites for new construction.

- Occupied Market: Many of the most attractive locations are already developed, meaning new entrants must either acquire existing properties (often at a premium) or find alternative, potentially less advantageous, sites.

- Increased Development Expenses: Competition for limited prime locations can drive up costs, impacting the profitability and viability of new hotel projects.

The threat of new entrants for Grupo Hotelero Santa Fe is moderated by substantial capital requirements and regulatory complexities. High upfront costs for property acquisition and development, coupled with lengthy permit processes, create significant barriers. For example, in 2024, the average cost to build a new mid-range hotel room in Mexico City was estimated to be between $40,000 and $70,000, a substantial hurdle for many potential competitors. Furthermore, navigating zoning laws and obtaining necessary licenses can extend project timelines by 18-24 months, disproportionately affecting smaller, less capitalized entrants.

Established brands and distribution networks also limit new entrants. Grupo Hotelero Santa Fe benefits from brand recognition and existing relationships with online travel agencies (OTAs) and corporate clients, which new players struggle to replicate. In 2024, OTA commissions remained a significant cost, often ranging from 15% to 30% of room revenue, making it harder for newcomers to achieve competitive pricing and visibility. Limited access to established corporate booking channels further exacerbates this challenge.

The scarcity and cost of prime real estate are considerable deterrents. In 2024, desirable beachfront or city-center locations saw land price increases of 8-12% in popular Mexican tourist areas. Existing hotels often occupy the most advantageous sites, forcing new entrants to consider less ideal locations or pay premium prices, impacting their initial appeal and profitability. Approximately 70% of suitable land in top Mexican tourist cities was already zoned for other purposes in 2024, highlighting this scarcity.

| Factor | Impact on New Entrants | Grupo Hotelero Santa Fe Advantage |

| Capital Requirements | High (e.g., $40k-$70k per room in 2024) | Established financial capacity and access to capital |

| Regulatory Hurdles | Time-consuming (18-24 months for permits) | Experience navigating complex legal and zoning processes |

| Brand & Distribution | Difficult to build awareness and reach | Existing brand loyalty and strong OTA/corporate relationships |

| Real Estate Access | Scarce and expensive (8-12% price increase in 2024) | Strategic acquisition of prime locations over time |

Porter's Five Forces Analysis Data Sources

Our analysis of Grupo Hotelero Santa Fe's competitive landscape is built upon a foundation of official company filings, including annual reports and investor presentations, supplemented by industry-specific market research and economic data from reputable sources.