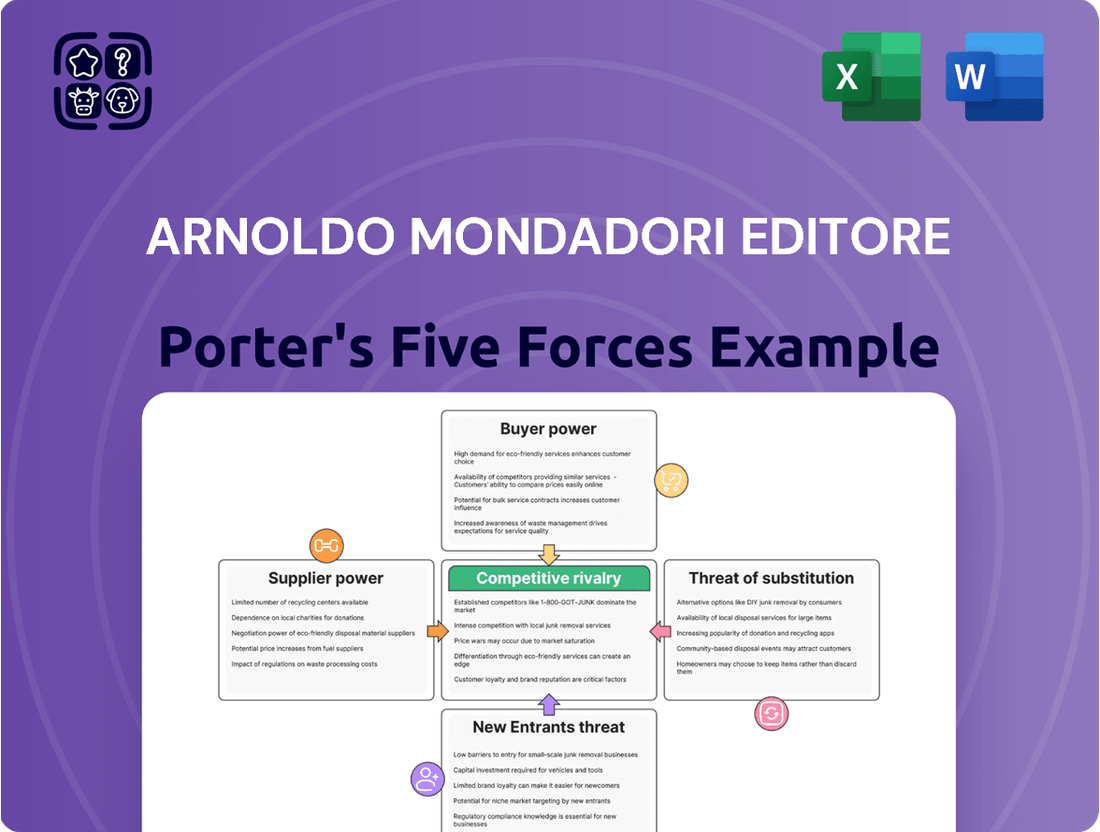

Arnoldo Mondadori Editore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arnoldo Mondadori Editore Bundle

Arnoldo Mondadori Editore navigates a complex media landscape where buyer power and the threat of substitutes significantly shape its strategic options. Understanding the intensity of these forces is crucial for any player in the publishing industry.

The complete report reveals the real forces shaping Arnoldo Mondadori Editore’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Authors, especially those with dedicated followings or distinctive content, are gaining substantial leverage. The growth of self-publishing and direct-to-consumer platforms empowers them with more creative autonomy and potentially better financial returns, lessening their reliance on traditional publishers such as Arnoldo Mondadori Editore.

This evolving landscape necessitates that publishers offer attractive terms and superior services to secure and keep talented authors. For instance, in 2024, the self-publishing market continued its upward trajectory, with many authors leveraging digital platforms to reach readers directly, often achieving significant sales without traditional publishing deals.

The publishing industry, including major players like Arnoldo Mondadori Editore, grapples with escalating production expenses, particularly concerning paper and printing. Global economic factors such as inflation and volatile raw material prices directly contribute to these increased supplier costs. For instance, in 2024, the price of pulp, a key component of paper, experienced significant fluctuations, impacting the cost of paper for publishers.

While Mondadori's substantial operational scale can offer some leverage, these persistent cost increases can still compress profit margins. This situation often compels publishers to investigate more cost-effective production methods or to pass on some of these increased costs to consumers, potentially affecting sales volume.

Digital platform and technology providers, like e-book aggregators and audiobook services, hold significant sway over publishers. Their control over market access and user data means they can dictate terms, impacting Arnoldo Mondadori Editore's digital strategy. In 2024, the digital publishing market continued its expansion, with platforms like Amazon Kindle Direct Publishing and Audible playing a crucial role in content distribution, giving them considerable leverage.

Talent in Specialized Media Production

In specialized media production, particularly within magazine publishing and digital content creation, the bargaining power of suppliers is significantly influenced by the scarcity and demand for unique talent. High-profile journalists, award-winning photographers, and innovative digital producers possess skills that are not easily replicated, making them valuable assets for media companies like Arnoldo Mondadori Editore. Their ability to attract and engage audiences directly impacts readership numbers and, consequently, advertising revenue, giving them considerable leverage in salary negotiations and contract terms.

The intense competition for these specialized professionals means that companies must offer competitive compensation packages to secure their services. For instance, in 2024, top-tier freelance journalists in niche sectors were reportedly commanding rates upwards of €500-€1000 per article, depending on the publication's reach and the journalist's reputation. Similarly, specialized photographers with a strong portfolio in areas like fashion or automotive could charge several thousand euros per shoot, plus usage rights.

- High demand for niche expertise: Specialized talent in areas like investigative journalism, data visualization, and advanced digital content strategy is in short supply.

- Impact on revenue generation: The appeal of renowned journalists and photographers directly drives circulation, digital traffic, and advertising sales, enhancing their bargaining position.

- Talent retention challenges: Media companies face the challenge of retaining top talent against offers from competitors, necessitating attractive remuneration and working conditions.

- Cost implications: Securing and retaining such talent represents a significant operational cost, impacting profit margins for publishers.

Software and IT Service Providers

The bargaining power of software and IT service providers for Arnoldo Mondadori Editore is significant, especially as the company advances its digital transformation. As Mondadori increasingly depends on specialized vendors for critical infrastructure, data management, and cybersecurity, these suppliers can exert considerable influence, particularly those offering proprietary or highly specialized solutions. Robust IT systems are absolutely essential for Mondadori's operations and the seamless delivery of its content.

For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, indicating a large and competitive landscape, yet specialized niches within this market can still concentrate power. The increasing complexity of digital platforms and the need for advanced cybersecurity measures, a growing concern across all industries, further bolster the position of IT service providers who can offer these critical, often non-substitutable, services. Mondadori's reliance on these providers for core functionalities means that switching costs can be high, reinforcing supplier power.

- Dependence on Specialized Solutions: Mondadori's digital transformation necessitates reliance on vendors for unique software and IT services, limiting alternatives.

- High Switching Costs: Migrating complex IT systems and data to new providers involves substantial time, expense, and operational disruption.

- Critical Infrastructure: The essential nature of IT services for content delivery and data management grants suppliers leverage over Mondadori.

- Market Concentration: While the overall IT market is vast, specific advanced solutions may be dominated by a few key players, increasing their bargaining power.

The bargaining power of suppliers for Arnoldo Mondadori Editore is a significant factor, particularly concerning raw materials like paper and printing services. Escalating production expenses, driven by inflation and volatile commodity prices, directly impact publishers. For example, in 2024, the cost of pulp, a primary component of paper, saw considerable price swings, thereby increasing the expenses for paper acquisition by publishers.

While Mondadori's substantial operational scale can provide some leverage, these persistent cost increases can still put pressure on profit margins. This often leads publishers to explore more cost-efficient production methods or to consider passing some of these higher costs onto consumers, which might affect overall sales volume.

The publishing industry, including major players like Arnoldo Mondadori Editore, faces ongoing challenges with rising production costs, especially for paper and printing. Global economic conditions, such as inflation and fluctuating raw material prices, directly contribute to these increased supplier costs. In 2024, the price of pulp, a key component of paper, experienced significant fluctuations, impacting the cost of paper for publishers.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Arnoldo Mondadori Editore | 2024 Data/Trend |

|---|---|---|---|

| Paper & Printing Suppliers | Raw material costs (pulp), energy prices, production capacity | Increased cost of goods sold, potential margin compression | Pulp prices showed volatility; printing costs remained elevated due to energy prices. |

| Specialized Talent (Journalists, Photographers) | Scarcity of niche skills, demand for unique content, individual reputation | Higher talent acquisition and retention costs, potential impact on content quality and appeal | Top freelance journalists commanded rates upwards of €500-€1000 per article. |

| Digital Platform Providers (E-book, Audiobook) | Market access control, user data, platform fees, proprietary technology | Influence on digital distribution terms, revenue sharing, and data utilization | Platforms like Amazon Kindle Direct Publishing and Audible continued to dominate digital content distribution. |

| IT Service Providers | Specialization of solutions, switching costs, dependence on critical infrastructure | Potential for higher service fees, lock-in effects, impact on digital operations efficiency | Global IT services market projected over $1.3 trillion in 2024, with specialized niches holding significant power. |

What is included in the product

This analysis unpacks the competitive forces shaping Arnoldo Mondadori Editore's industry, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly visualize the competitive landscape for Arnoldo Mondadori Editore, identifying key threats and opportunities to alleviate strategic uncertainty.

Customers Bargaining Power

Individual readers wield significant bargaining power, amplified by the sheer volume of content accessible across diverse media and digital platforms. This abundance means consumers can easily switch between publishers or even opt for free alternatives, forcing publishers like Mondadori to carefully consider their pricing strategies.

The Italian book market experienced a downturn, with sales and unit volumes declining. In 2023, the market saw a slight decrease in value, contributing to a trend of price sensitivity among consumers who are increasingly scrutinizing their spending on books.

Mondadori must adapt to these shifting reader preferences and the competitive pricing landscape. This involves understanding what drives purchasing decisions, whether it's price, convenience, or unique content, to effectively retain and grow its customer base in a dynamic market.

Major bookstore chains and dominant online retailers, like Amazon and Barnes & Noble, act as key gateways for Arnoldo Mondadori Editore's publications. These powerful intermediaries can dictate terms, influencing pricing and promotional support due to their extensive customer bases and ability to shape buying habits.

The significant market share held by these large customers means their purchasing volume directly impacts Mondadori's top-line revenue. For instance, in 2023, online sales channels accounted for a substantial portion of the book market, placing considerable leverage in the hands of these digital giants.

Advertisers hold significant bargaining power over Mondadori's media segments, particularly in magazines and digital platforms. They can negotiate for competitive rates, especially given the dynamic Italian digital advertising market which saw a 9.7% growth in 2023 according to Osservatorio Internet Media. This influx of new advertisers means Mondadori must consistently demonstrate a strong return on investment for ad spend.

Educational Institutions and Public Sector Buyers

Educational institutions and public sector bodies, such as universities and government agencies, wield significant bargaining power in the academic publishing market. These large-scale buyers often have centralized procurement processes and are highly sensitive to budget allocations, which directly influences their purchasing decisions for textbooks and academic materials. For instance, in 2024, many higher education institutions faced increased budget scrutiny, leading them to negotiate harder on pricing for new and existing course materials.

Their ability to influence demand through curriculum choices and bulk purchasing arrangements allows them to negotiate favorable terms, including discounts and customized content packages. Furthermore, shifts in government funding for education or cultural initiatives can directly impact the purchasing capacity of these entities, amplifying their influence over publishers.

- Budgetary Constraints: Public sector and educational budgets are often fixed, compelling institutions to seek cost-effective solutions and negotiate lower prices for academic publications.

- Bulk Purchasing: Large orders from universities and school districts provide these buyers with leverage to demand volume discounts.

- Curriculum Control: Institutions can influence demand by selecting specific textbooks or requiring custom content, giving them a say in publisher offerings.

- Funding Fluctuations: Changes in government grants or educational funding directly affect the spending power of public sector buyers, increasing their bargaining leverage during periods of reduced funding.

Subscription Service Consumers

The increasing prevalence of subscription models for digital content, such as e-books and audiobooks, significantly enhances consumer bargaining power. Customers can easily switch between platforms offering similar content, forcing providers to compete on price and value. For example, in 2024, the global digital book market continued to see strong growth, with subscription services playing a key role in accessibility.

Arnoldo Mondadori Editore must ensure its digital offerings are compelling within these popular subscription ecosystems. The revenue generated from these digital formats is directly impacted by the terms and conditions dictated by major subscription platforms, which often hold considerable leverage over content providers. This dynamic means Mondadori's ability to negotiate favorable terms is crucial for its digital revenue streams.

- Consumer Choice: Consumers can readily shift between subscription services, increasing their influence.

- Platform Dependence: Mondadori's digital content relies on the attractiveness of these platforms.

- Revenue Impact: Subscription platform terms directly affect Mondadori's digital earnings.

The bargaining power of customers for Arnoldo Mondadori Editore is substantial, driven by market saturation and price sensitivity. Consumers can easily access a vast array of content across numerous platforms, leading to a willingness to switch providers for better value. This dynamic forces publishers to remain competitive on pricing and to continually assess what truly drives purchasing decisions.

Large retail intermediaries, such as major bookstore chains and online giants like Amazon, exert considerable influence. Their significant market share and ability to shape consumer habits grant them leverage in negotiating terms, pricing, and promotional support. In 2023, the continued dominance of online sales channels underscored the power these digital platforms hold over publishers.

Advertisers also possess significant bargaining power, particularly within Mondadori's magazine and digital media segments. The Italian digital advertising market, which saw a healthy 9.7% growth in 2023, presents advertisers with numerous options, compelling Mondadori to demonstrate a clear return on investment for their ad spend.

Educational institutions and public sector bodies represent another critical customer group with strong bargaining power. Their budget constraints and bulk purchasing capabilities allow them to negotiate favorable terms for academic publications. For instance, increased budget scrutiny in higher education during 2024 intensified these negotiation efforts.

Full Version Awaits

Arnoldo Mondadori Editore Porter's Five Forces Analysis

This preview showcases the complete Arnoldo Mondadori Editore Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. This comprehensive analysis is ready for your immediate use, providing valuable insights into the strategic positioning of Arnoldo Mondadori Editore.

Rivalry Among Competitors

The Italian publishing landscape is dominated by a few major players, creating a highly competitive environment. Arnoldo Mondadori Editore S.p.A. stands as a clear leader, but faces robust competition from other significant groups such as RCS MediaGroup, Feltrinelli, and Gruppo Editoriale Mauri Spagnol (GeMS).

These industry giants actively vie for top authors, aiming to capture greater market share and secure advantageous distribution networks. This intense rivalry spans across all segments of the publishing market, from fiction and non-fiction to educational and children's books.

The Italian publishing landscape is notably fragmented, featuring over 5,000 publishers, a significant portion of which are small-scale operations. This sheer number of players, even with the presence of larger entities, fuels intense rivalry, especially in capturing niche reader segments and discovering new authors.

This fragmentation means that smaller, agile publishers can quickly adapt to emerging literary trends or specific reader demands, directly challenging larger, more established players. For instance, in 2023, the Italian book market saw continued growth, with independent publishers playing a crucial role in diversifying offerings and reaching specialized audiences, contributing to a dynamic competitive environment.

Digital-first content providers, like online news aggregators and social media influencers, intensify rivalry by offering content directly to consumers, often with lower overhead than traditional publishers. In Italy, the digital advertising market is projected to reach €4.8 billion in 2024, a significant portion of which is captured by these agile, digitally native competitors.

These born-digital entities bypass traditional distribution channels, directly competing for audience attention and advertising spend within the Italian media landscape. Their ability to rapidly adapt to changing consumer preferences and leverage data analytics gives them a distinct advantage in capturing a share of the growing digital ad revenue, impacting established players like Arnoldo Mondadori Editore.

Cross-Media Competition for Attention

Arnoldo Mondadori Editore faces intense competition for consumer attention not just from other book and magazine publishers, but also from a vast array of digital entertainment and information sources. Streaming services like Netflix and Disney+, video games, social media platforms, and podcasts are all vying for the same limited leisure time and discretionary spending. This broad competitive landscape means Mondadori must constantly innovate to capture and retain audience engagement in a crowded media environment.

The challenge is amplified by the sheer volume of content available. For instance, in 2024, global digital ad spending was projected to reach over $700 billion, a significant portion of which is directed towards capturing consumer attention across various digital channels. This highlights the immense pressure on traditional media like publishing to differentiate and offer compelling value propositions.

- Cross-Media Attention Wars: Publishers like Mondadori compete against streaming, gaming, social media, and podcasts for consumer time and money.

- Digital Dominance: Global digital ad spending in 2024 exceeded $700 billion, underscoring the intense competition for audience engagement in the digital realm.

- Evolving Consumption Habits: Consumers increasingly allocate leisure time and budget to digital entertainment, posing a challenge to traditional media consumption models.

Impact of AI on Content Volume and Speed

The increasing sophistication of AI tools is significantly intensifying competitive rivalry within the publishing sector. These advancements allow for the rapid generation of content at unprecedented speeds and volumes, directly impacting established players like Arnoldo Mondadori Editore.

New entrants leveraging AI can quickly saturate the market with a high output of articles, summaries, and even creative pieces. This influx can potentially diminish the perceived value of traditionally produced content and elevate competitive pressures. For instance, in 2024, the global AI market size was valued at approximately $200 billion, with significant growth projected in content generation applications.

- AI-driven content creation platforms are lowering barriers to entry for new publishers.

- Established publishers face pressure to adopt AI to maintain competitive output levels.

- The speed and volume of AI-generated content can lead to market saturation and potential price erosion.

Competitive rivalry within the Italian publishing sector is fierce, with Arnoldo Mondadori Editore facing established giants like RCS MediaGroup and Feltrinelli, alongside a fragmented market of over 5,000 smaller publishers. This dynamic intensifies the struggle for top authors and market share across all book genres.

Digital-first competitors and a broad range of digital entertainment options, from streaming services to social media, further escalate the competition for consumer attention and advertising revenue. The global digital ad market's projected €4.8 billion in Italy for 2024 highlights this intense battle for engagement.

The rise of AI-generated content, with the global AI market valued around $200 billion in 2024, introduces another layer of rivalry by enabling rapid, high-volume content creation, pressuring traditional publishers to adapt or risk market share erosion.

| Key Competitors | Market Share (Approximate, 2023 Data) | Key Competitive Tactics |

| Arnoldo Mondadori Editore | Leading position, ~20-25% | Acquisitions, strong author relationships, diverse portfolio |

| RCS MediaGroup | Significant player, ~10-15% | Brand strength, cross-media promotion, digital expansion |

| Feltrinelli | Prominent independent, ~5-10% | Curated selections, bookstore experience, digital offerings |

| Gruppo Editoriale Mauri Spagnol (GeMS) | Growing presence, ~5-8% | Niche focus, strong editorial lines, author development |

| Independent Publishers (5,000+) | Fragmented, ~20-30% combined | Agility, niche targeting, specialized content |

SSubstitutes Threaten

The increasing adoption of e-books and audiobooks presents a substantial threat of substitution for traditional print books. This shift is fueled by factors like enhanced convenience, greater portability, and the widespread use of smartphones and tablets, further bolstered by the appeal of subscription-based content models. In 2023, the global e-book market was valued at approximately $19.1 billion, with projections indicating continued growth.

While Arnoldo Mondadori Editore has been investing in its digital offerings, a swift and significant migration of consumers from print to digital formats could disrupt its established revenue streams. The company's reliance on physical book sales and traditional distribution channels means that a rapid acceleration in digital consumption could pose a challenge to its current business model and profitability.

The internet offers a massive amount of free information, news, and entertainment, directly competing with Mondadori's paid content. This includes blogs, social media, and open-access resources, meaning consumers might choose these free options over purchasing magazines or books.

For instance, in 2024, the global digital advertising market, largely fueled by free content platforms, was projected to reach hundreds of billions of dollars. This highlights the sheer scale of free alternatives available, potentially siphoning off audience attention and advertising revenue that could otherwise go to traditional publishers like Mondadori.

Consumers are increasingly diverting their leisure time and money towards a wide array of digital entertainment options. Platforms like Netflix, Disney+, and Amazon Prime Video, alongside the booming online gaming industry, are significant competitors for consumer attention. In 2024, global spending on video games alone was projected to reach over $200 billion, a substantial figure that highlights the competition for discretionary income.

Self-Published Works and Independent Content

The rise of self-published works and independent content presents a significant threat of substitutes for Arnoldo Mondadori Editore. Platforms like Amazon Kindle Direct Publishing (KDP) empower authors to bypass traditional gatekeepers, leading to an explosion of accessible, often lower-cost digital books. In 2023, KDP reported over 2.7 million titles published, a substantial increase from previous years, demonstrating the scale of this substitute market.

This proliferation directly challenges Mondadori's established business model by offering readers a vast and diverse alternative to traditionally published books. The ease and low cost of entry for self-published authors mean a constant stream of new content, often catering to highly specific niches that larger publishers may overlook. For instance, the "indie author" segment on Amazon saw significant growth in sales in 2023, indicating reader adoption of these alternatives.

- Vast Content Pool: Self-publishing platforms offer millions of titles, directly competing with Mondadori's catalog.

- Lower Price Points: Many self-published e-books are priced significantly lower than traditional releases, attracting price-sensitive readers.

- Niche Appeal: Independent authors can cater to specialized interests, drawing audiences away from broader market offerings.

- Direct Distribution: Authors bypass traditional publishing houses, reducing the need for intermediaries like Mondadori.

Educational Technology and Online Learning Platforms

The threat of substitutes for traditional educational materials is significant, driven by the rapid growth of educational technology. Online courses and digital learning platforms offer flexible, often more affordable alternatives to physical textbooks and traditional classroom settings. For instance, by 2024, the global e-learning market is projected to reach over $400 billion, highlighting the substantial shift towards digital learning solutions.

These substitutes can directly replace the need for printed educational content. Platforms like Coursera, edX, and specialized K-12 digital learning providers offer comprehensive curricula, interactive exercises, and multimedia content that can be more engaging than static textbooks. This necessitates that Arnoldo Mondadori Editore's education segment adapt by integrating its content into these digital ecosystems.

- Digital Learning Market Growth: The global e-learning market is expected to surpass $400 billion by 2024, indicating a strong preference for digital educational resources.

- Platform Competition: Major online learning platforms offer a wide array of courses, directly competing with traditional educational publishers.

- Content Integration: Publishers must innovate to embed their content within these digital platforms to remain relevant.

- Cost-Effectiveness: Digital resources often present a more cost-effective option for students compared to physical textbooks.

The threat of substitutes for Arnoldo Mondadori Editore is multifaceted, encompassing digital content, free information, alternative entertainment, and self-published works. The growing digital landscape, with its convenience and often lower price points, directly challenges traditional print media. For instance, the global e-book market reached approximately $19.1 billion in 2023, showcasing a significant shift in consumer preference.

Furthermore, the vast amount of free online content, from blogs to social media, competes for audience attention and advertising revenue. In 2024, the digital advertising market's projected scale, in the hundreds of billions of dollars, underscores the immense competition from free platforms. This necessitates that Mondadori finds ways to capture value in an environment where free alternatives are abundant.

The entertainment sector also presents strong substitutes, with streaming services and online gaming vying for consumer leisure time and discretionary spending. Global spending on video games alone was projected to exceed $200 billion in 2024. This broad competition means that books and magazines must offer compelling value to stand out against these popular digital distractions.

The rise of self-publishing, exemplified by Amazon KDP's over 2.7 million titles published in 2023, offers readers a massive and diverse alternative to traditionally published books. These often lower-cost, niche-focused options directly compete with Mondadori's catalog, requiring the company to continually innovate and highlight the unique value of its offerings.

Entrants Threaten

The digital publishing landscape presents a significant threat of new entrants for companies like Arnoldo Mondadori Editore. The elimination of substantial costs associated with printing, warehousing, and physical distribution means that individuals and small entities can now enter the market with remarkably little capital. For instance, self-publishing platforms allow authors to release books globally with minimal upfront investment, directly competing with established publishers.

The emergence of AI-powered publishing models presents a significant threat to established players like Arnoldo Mondadori Editore. These new entrants can leverage artificial intelligence for content creation, editing, and marketing, allowing them to enter the market with unprecedented speed and efficiency.

AI-driven models can rapidly generate high volumes of content, potentially disrupting traditional production timelines and cost structures. For instance, in 2024, the AI content generation market is projected to reach billions, with advancements in natural language processing enabling sophisticated text and even image creation, directly challenging the value proposition of traditional publishing houses.

Large technology companies like Amazon, Apple, and Google are increasingly investing in content creation and distribution, posing a significant threat to traditional publishers. Amazon Studios, for instance, spent an estimated $7 billion on content in 2023, aiming to capture a larger share of the entertainment market. This influx of capital and established user bases allows tech giants to offer competitive pricing and leverage advanced data analytics for content optimization, directly challenging established players like Arnoldo Mondadori Editore.

Growth of Direct-to-Consumer Author Platforms

The rise of direct-to-consumer (DTC) author platforms presents a significant threat to traditional publishers like Arnoldo Mondadori Editore. These platforms allow authors to bypass intermediaries, directly connecting with readers. This bypass reduces the reliance on established publishing houses, opening new avenues for authors to build their audience and compete for market share.

This trend directly impacts the barrier to entry for new authors. Historically, securing a publishing deal was a major hurdle. Now, with platforms like Amazon Kindle Direct Publishing (KDP), authors can self-publish and distribute their work globally. In 2023, KDP reported over 1.8 million books published through its platform, a testament to its accessibility.

Consequently, Arnoldo Mondadori Editore faces increased competition from a wider pool of authors and content creators. This can dilute market attention and necessitate greater investment in marketing and talent acquisition to stand out. The ease of entry means more voices are vying for reader engagement, potentially fragmenting the audience.

Key implications for Arnoldo Mondadori Editore include:

- Reduced Gatekeeping Power: Traditional publishers are no longer the sole gatekeepers of literary success.

- Increased Competition for Talent: Authors with strong reader bases on DTC platforms may be less inclined to sign with traditional publishers.

- Shifting Distribution Models: The dominance of physical book sales may be challenged by digital-first DTC strategies.

- Pressure on Profit Margins: Publishers may need to adapt their pricing and royalty structures to remain competitive.

Niche Digital Media Startups

The Italian digital media landscape is experiencing significant growth, creating fertile ground for niche startups. These agile new players can quickly establish a presence by focusing on specific content areas or audience demographics, potentially siphoning off market share from established players like Mondadori. For instance, the digital advertising market in Italy was projected to reach €4.1 billion in 2024, indicating a substantial revenue pool that could be fragmented by specialized entrants. These startups often leverage lower overheads and a direct connection with their target audience, enabling them to compete effectively on price and relevance.

These specialized digital media startups pose a threat by fragmenting audience attention and advertising revenue. Their ability to cater to highly specific interests means they can capture a dedicated following that might otherwise engage with Mondadori’s broader offerings. By 2023, digital advertising spend in Italy had already seen a considerable increase, and the continued proliferation of niche platforms means that a larger share of this spend could be diverted away from traditional publishers. This dynamic forces established companies to adapt their strategies to retain both audience engagement and advertising income.

- Niche Focus: Startups can target underserved segments of the Italian digital media market, offering specialized content that Mondadori may not prioritize.

- Agility and Innovation: Their smaller size allows for quicker adaptation to market trends and the adoption of new technologies, potentially outmaneuvering larger, more established companies.

- Audience Fragmentation: The proliferation of niche platforms can lead to a more fragmented audience, making it harder for any single publisher to command a dominant share of attention and advertising spend.

- Revenue Diversion: As digital ad spend grows, specialized startups can capture a portion of this revenue by offering highly targeted advertising opportunities to brands seeking specific demographics.

The threat of new entrants for Arnoldo Mondadori Editore is amplified by the low capital requirements in digital publishing. Platforms like Amazon KDP saw over 1.8 million books published in 2023, showcasing accessibility. Furthermore, AI content generation, a market projected to reach billions in 2024, enables rapid, low-cost content creation, directly challenging traditional publishing models.

Large tech companies, such as Amazon with its $7 billion content spend in 2023, represent significant new entrants. Their established user bases and data analytics capabilities allow them to compete aggressively on price and content optimization. Direct-to-consumer author platforms also lower barriers, with authors bypassing traditional publishers and building audiences independently.

| Factor | Description | Impact on Mondadori | 2023/2024 Data Point |

| Digital Publishing Costs | Elimination of printing, warehousing, and physical distribution costs. | Lowers barrier to entry for new publishers and self-published authors. | Self-publishing platforms enable global book releases with minimal investment. |

| AI Content Generation | AI for content creation, editing, and marketing. | Enables faster, more efficient market entry with potentially lower costs. | AI content generation market projected to reach billions in 2024. |

| Tech Giants' Investment | Large technology firms entering content creation and distribution. | Intensifies competition through capital, user bases, and data analytics. | Amazon Studios spent ~$7 billion on content in 2023. |

| Direct-to-Consumer Platforms | Platforms allowing authors to bypass publishers and reach readers directly. | Reduces reliance on traditional publishers and fragments market share. | Amazon KDP saw over 1.8 million books published in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Arnoldo Mondadori Editore is built upon a foundation of publicly available financial reports, industry-specific market research from reputable firms, and news archives detailing competitive activities and strategic shifts within the publishing sector.