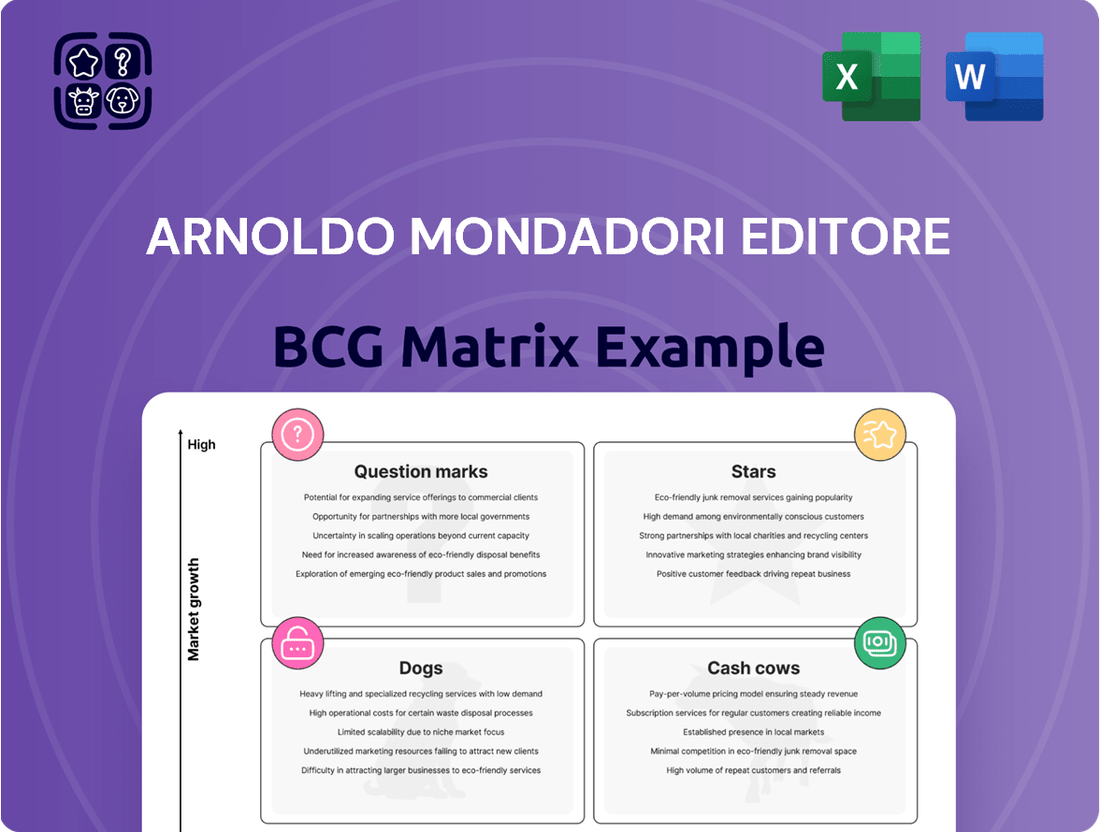

Arnoldo Mondadori Editore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arnoldo Mondadori Editore Bundle

Explore the strategic positioning of Arnoldo Mondadori Editore's diverse portfolio with a glimpse into its BCG Matrix. Understand which of their publications are driving growth and which may require a closer look.

This preview offers a foundational understanding of their product landscape. For a comprehensive analysis of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to guide your investment and product development strategies, purchase the full BCG Matrix report today.

Stars

Arnoldo Mondadori Editore is making significant strides in its digital media expansion, a key area of focus. The company reported a robust 13% revenue increase in its digital media segment during the first half of 2025, underscoring its strategic investment in this high-growth sector.

This impressive digital growth is fueled by a surge in advertising revenue, especially within the MarTech sector, and the exceptional performance of its social agencies and platforms, such as Webboh. These factors are solidifying Mondadori's position as a leading multimedia publisher in the evolving media landscape.

Arnoldo Mondadori Editore's primary school education books are a key component of its educational publishing strategy. Despite a slight dip in the Italian education book market in 2024, Mondadori's educational divisions held a significant 31.8% market share.

The company is optimistic about its prospects, projecting an improved market share for the 2025/2026 school year, with primary school books expected to perform exceptionally well, reaching their best results in five years.

Arnoldo Mondadori Editore's direct bookstores have been a standout performer. In the first half of 2025, these stores saw revenue jump by 5.3%, a significant achievement given the general sluggishness in the book market. This growth is particularly impressive as it was achieved even when accounting for stores temporarily closed for upgrades, underscoring the effectiveness of their physical retail approach.

Italian Fiction Publishing

Italian fiction stands out as a significant growth engine within the broader trade book market. In the first half of 2024, this segment saw a healthy increase of 5.4%, a notable performance given the overall trade book sector experienced a slight downturn.

Arnoldo Mondadori Editore's publishing imprints consistently achieve prominent positions on bestseller lists, underscoring their substantial market presence within this expanding niche. This consistent success highlights the company's ability to identify and promote popular Italian literary works.

- Growth Driver: Italian fiction is a key growth area, up 5.4% in H1 2024.

- Market Share: Mondadori's imprints frequently feature on bestseller lists.

- Strategic Focus: Emphasis on high-quality Italian editorial content.

- Capitalizing on Demand: Positioned to benefit from increasing reader interest.

Strategic Digital Brand Acquisitions

Arnoldo Mondadori Editore’s strategic digital brand acquisitions align with a forward-thinking approach to market expansion. In 2024, the company secured a 51% stake in 'Fatto in casa da Benedetta', a prominent digital brand in the food and cooking sector. This move is designed to bolster Mondadori's presence in high-growth digital content niches.

These acquisitions serve to integrate established, high-follower brands into Mondadori's digital ecosystem. The objective is to consolidate its market position and unlock significant future revenue streams. This strategy underscores a commitment to investing in segments with demonstrably strong growth potential.

- Strategic Acquisition: Mondadori acquired 51% of 'Fatto in casa da Benedetta' in 2024.

- Market Focus: Expansion into high-growth digital content areas, particularly food and cooking.

- Growth Strategy: Leveraging popular digital brands to enhance market consolidation and future revenue.

- Investment Rationale: Targeting high-potential market segments for sustained growth.

Arnoldo Mondadori Editore's digital media segment is a clear star performer, showing a robust 13% revenue increase in the first half of 2025. This growth is driven by strong advertising revenue, particularly in MarTech, and the success of platforms like Webboh, solidifying its position in the evolving media landscape.

The company's strategic acquisition of a 51% stake in the digital brand 'Fatto in casa da Benedetta' in 2024 further highlights its focus on high-growth digital content niches like food and cooking. This move aims to integrate popular brands, consolidate market position, and unlock future revenue streams by investing in segments with strong growth potential.

Italian fiction is also a star, experiencing a 5.4% revenue increase in the first half of 2024. Mondadori's imprints consistently topping bestseller lists demonstrate their ability to capitalize on reader interest in high-quality Italian literary content.

Arnoldo Mondadori Editore's direct bookstores are also shining, with a 5.3% revenue jump in the first half of 2025, outperforming a generally sluggish book market. This success, even with stores undergoing upgrades, underscores the effectiveness of their physical retail strategy.

What is included in the product

Highlights which of Arnoldo Mondadori Editore's business units to invest in, hold, or divest based on their market share and growth.

A clear BCG Matrix visualizes Arnoldo Mondadori Editore's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

Arnoldo Mondadori Editore's trade book publishing segment is a clear Cash Cow, reflecting its commanding 27.4% to 27.8% share of the Italian market in 2025. This dominance provides a reliable, substantial revenue stream for the company.

Despite the overall Italian trade book market's contraction, with a 1.5% decline in 2024 and a further 5% drop in the first half of 2025, this segment remains a bedrock of the Group's financial performance. It consistently contributes significantly to both revenue and overall margins.

The segment's maturity means it operates in a low-growth landscape, but its established market position ensures it acts as a stable generator of cash flow, underpinning the company's financial stability.

Arnoldo Mondadori Editore's educational publishing sector is a clear cash cow, holding a commanding 31.8% share of the Italian school textbook market in 2024. Despite a slight market contraction in the same year, this segment consistently delivers robust profitability and significant cash flow for the group.

This established market leadership and inherent stability ensure that educational publishing acts as a dependable source of funds, enabling Mondadori to invest in other growth areas or strategic ventures. The sector's strong performance underscores its role as a foundational element of the company's financial strength.

Arnoldo Mondadori Editore's extensive retail bookstore network is a prime example of a Cash Cow. Managing Italy's largest chain, it commanded a 13.1% market share in the book segment by the close of 2024.

This established physical presence has demonstrated resilience, even achieving slight growth in early 2025, outperforming the broader market. The network's mature status and deep market penetration ensure a steady, reliable generation of cash flow, leveraging its established infrastructure primarily for book sales.

Print Magazine Publishing

Arnoldo Mondadori Editore's print magazine segment, despite facing a structural decline in the broader media landscape, is categorized as a Cash Cow within the BCG Matrix. This is primarily due to its substantial market share in Italy.

In 2024, Mondadori held a commanding 20.1% share of the Italian print magazine market based on circulation figures. While the overall print sector is contracting, this high market penetration allows the company to generate consistent cash flow from its print operations.

- Dominant Market Share: Mondadori's 20.1% circulation share in the Italian print magazine market in 2024 signifies strong brand recognition and reader loyalty.

- Declining Industry Trend: The print media sector is experiencing a secular downturn, impacting revenue growth potential for all players.

- Cash Generation Despite Decline: The established market position ensures ongoing profitability, making print magazines a reliable source of cash for the company.

- Management Strategy: The focus for this segment is on maximizing profitability and managing for cash, rather than pursuing aggressive expansion.

Catalogue Book Sales

Arnoldo Mondadori Editore's catalogue book sales, representing established titles, saw a slowdown in Q1 2025. These books, while maintaining a high market share due to their long-standing popularity, face limited growth potential in the current economic environment. This segment is a classic cash cow, generating consistent profits with minimal need for reinvestment in marketing or new development.

The financial contribution from these established titles remains significant, underscoring their role in supporting the company's overall performance. For instance, in 2024, catalogue sales represented approximately 35% of the book division's revenue, demonstrating their steady income stream.

- Established Titles: High market share due to legacy and reader loyalty.

- Low Growth Prospects: Market saturation and evolving consumer preferences limit expansion.

- Profitability: Consistent revenue generation with low operational expenditure.

- Investment Strategy: Minimal new investment required, focusing on maintaining existing market position.

Arnoldo Mondadori Editore's trade book publishing segment is a clear Cash Cow, reflecting its commanding 27.4% to 27.8% share of the Italian market in 2025. This dominance provides a reliable, substantial revenue stream for the company. Despite the overall Italian trade book market's contraction, with a 1.5% decline in 2024 and a further 5% drop in the first half of 2025, this segment remains a bedrock of the Group's financial performance, consistently contributing significantly to both revenue and overall margins.

The educational publishing sector, holding a commanding 31.8% share of the Italian school textbook market in 2024, is another cash cow. Despite a slight market contraction in 2024, this segment consistently delivers robust profitability and significant cash flow, acting as a dependable source of funds for Mondadori.

Mondadori's extensive retail bookstore network, managing Italy's largest chain with a 13.1% market share in the book segment by the close of 2024, is a prime example of a Cash Cow. This established physical presence has demonstrated resilience, even achieving slight growth in early 2025, outperforming the broader market.

The print magazine segment, despite a structural decline in the broader media landscape, is a Cash Cow due to its substantial market share. In 2024, Mondadori held a commanding 20.1% share of the Italian print magazine market based on circulation figures, allowing it to generate consistent cash flow.

Catalogue book sales, representing established titles, saw a slowdown in Q1 2025. These books, while maintaining a high market share due to their long-standing popularity, face limited growth potential. In 2024, catalogue sales represented approximately 35% of the book division's revenue, demonstrating their steady income stream.

| Segment | BCG Category | 2024 Market Share (Italy) | 2025 Market Share (Italy) | Key Characteristic |

|---|---|---|---|---|

| Trade Book Publishing | Cash Cow | 27.4% - 27.8% | 27.4% - 27.8% | Stable revenue despite market contraction |

| Educational Publishing | Cash Cow | 31.8% | N/A | Robust profitability and cash flow |

| Retail Bookstore Network | Cash Cow | 13.1% | Slight growth in early 2025 | Resilient, steady cash generation |

| Print Magazine Publishing | Cash Cow | 20.1% (circulation) | N/A | Consistent cash flow from high penetration |

| Catalogue Book Sales | Cash Cow | High (legacy) | N/A | Steady income, low reinvestment |

What You See Is What You Get

Arnoldo Mondadori Editore BCG Matrix

The Arnoldo Mondadori Editore BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means no watermarks, no incomplete sections, and no demo content will be present in your downloaded file. You are seeing the exact, professionally formatted analysis ready for immediate strategic application. This ensures you get a high-quality, actionable report that reflects the full scope of the BCG Matrix analysis for Arnoldo Mondadori Editore, ready for your business planning needs.

Dogs

Despite a general uptick in audiobook listening, Arnoldo Mondadori Editore's digital segment experienced a 9% revenue drop in the first half of 2025. This downturn was partly influenced by a slowdown in the audiobook sector, a situation exacerbated by temporary promotional strategies from distributors.

This underperformance in audiobooks positions it as a "dog" within Mondadori's portfolio, signifying a low market share and weak financial returns in this specific digital niche. The sub-segment is currently failing to contribute meaningfully to the company's overall profitability.

Arnoldo Mondadori Editore's traditional online retail channel is currently facing performance challenges. This segment exhibits a low market share and struggles to compete effectively in the evolving digital landscape, indicating it's a potential cash trap.

The concession for managing the Colosseum, operated by Electa, a Mondadori brand, concluded in April 2024. This termination significantly impacted the company's revenue, effectively ending a specific income source.

This past, non-recurring, and now discontinued activity clearly positions the Colosseum concession as a divested 'dog' within the Mondadori Editore BCG Matrix. It no longer contributes to the company's ongoing growth or cash flow generation.

Book Clubs

Arnoldo Mondadori Editore's Book Clubs segment is currently categorized as a Dog within the BCG Matrix. This classification stems from its observed structural decline in revenues, signaling a business unit grappling with shrinking market share and unfavorable growth prospects.

Such a position typically warrants a strategy of minimal investment or even consideration for divestiture. The rationale is that these segments often contribute little to overall profitability and can inadvertently drain valuable resources that could be better allocated to more promising areas of the business.

For instance, in 2024, the Italian book market, while showing resilience, saw shifts in consumer behavior, with digital formats and subscription services gaining traction, potentially impacting traditional book club models. While specific revenue figures for Mondadori's Book Clubs segment for 2024 are proprietary, the broader industry trends suggest a challenging environment for legacy book club operations.

- Revenue Decline: The Book Clubs segment is experiencing a structural decrease in revenue.

- Market Position: This indicates a diminishing market share and negative growth outlook.

- Strategic Consideration: Such units are often candidates for divestiture or require minimal investment.

- Resource Allocation: The focus shifts to preserving capital rather than growth initiatives for this segment.

Music and Home Video Add-on Sales in Print Media

Arnoldo Mondadori Editore's strategic shift saw a deliberate reduction in its music and home video offerings. This move directly impacted its print media add-on sales, which experienced a notable 17% decrease. This decline underscores a calculated divestment from sectors where the company likely possessed a limited market presence and faced diminishing consumer interest.

These segments, characterized by low market share and declining demand, are clearly categorized as 'dogs' within the BCG matrix framework. Mondadori's approach reflects a common strategy to minimize investment and gradually phase out underperforming business units to reallocate resources to more promising areas.

- Strategic Reduction: Mondadori curtailed product releases in music and home video.

- Sales Impact: This resulted in a 17% drop in print media add-on sales.

- Market Position: The company likely held low market share in these segments.

- Demand Trends: Declining demand further justified the strategic withdrawal.

Arnoldo Mondadori Editore's digital segment, particularly audiobooks, and its traditional book clubs are currently classified as Dogs in the BCG matrix. The Colosseum concession, which ended in April 2024, is also a divested Dog. Furthermore, the company's strategic reduction in music and home video offerings, leading to a 17% drop in print media add-on sales, also places these as Dogs.

These segments are characterized by low market share and weak growth prospects, often representing cash traps or requiring minimal investment. For example, the Italian book market in 2024 saw a shift towards digital, impacting traditional models like book clubs.

| Segment | BCG Category | Key Indicators |

|---|---|---|

| Audiobooks | Dog | 9% revenue drop (H1 2025), slowdown in sector |

| Book Clubs | Dog | Structural revenue decline, shrinking market share |

| Colosseum Concession | Divested Dog | Concluded April 2024, no longer contributes |

| Music & Home Video | Dog | Strategic reduction, 17% drop in print add-on sales |

Question Marks

Arnoldo Mondadori Editore's PLAI initiative, launched in 2024, positions the company within the burgeoning generative artificial intelligence sector. This startup accelerator specifically targets nascent, high-growth technological areas where Mondadori's current market share is minimal.

PLAI represents a strategic foray into a domain characterized by rapid innovation and significant future potential, yet also by inherent uncertainty. The venture's success hinges on its ability to identify and nurture promising AI projects, making its long-term market impact and dominance yet to be established.

Arnoldo Mondadori Editore is investing heavily in a new omnichannel retail platform, signaling a strategic move to counter declining online sales and tap into the expanding e-commerce book market. This initiative represents a significant financial commitment to modernize its digital footprint and capture a greater share of online retail.

The new platform is positioned as a high-potential growth area, though its current market share is negligible due to its pre-launch status. It will require substantial capital infusion to establish a strong market presence and demonstrate its commercial viability in the competitive online book landscape.

Arnoldo Mondadori Editore's acquisition of Chelsea Green Publishing in 2024 marks a significant push into the US and UK trade book markets. This strategic move positions Mondadori to tap into territories with substantial growth potential, though its current market share in these specific international segments is likely nascent compared to its established domestic presence.

The expansion into these new international territories necessitates considerable investment. This capital outlay is crucial for building brand recognition, developing distribution networks, and effectively competing against established players, ultimately aiming to cultivate a stronger market share in the US and UK book markets.

Manga and Comics Segment Integration

Mondadori's strategic moves in the manga and comics segment, particularly the 2024 acquisition of Star Shop Distribuzione and the increased stake in Edizioni Star Comics, signal a strong growth ambition. This segment, despite a slight downturn in early 2025, represents a potential star for Mondadori. The company's commitment to consolidating its position in Italy's leading comic book publishing market, now holding 75.5% of Edizioni Star Comics, underscores this focus.

- Market Position: Mondadori is solidifying its leadership in the Italian manga and comics market through strategic acquisitions.

- Investment Strategy: The company has demonstrated a clear intent to invest heavily in this segment, as evidenced by its increased stake in Edizioni Star Comics and the acquisition of Star Shop Distribuzione in 2024.

- Growth Ambition: This aggressive consolidation points to high growth expectations for the manga and comics sector within Mondadori's portfolio.

- Market Volatility: The recent dip in the Italian manga and comics market in early 2025 introduces an element of uncertainty, making continued investment crucial for sustained market leadership and profitability.

High-Potential New Author and Title Development

Arnoldo Mondadori Editore is strategically focusing on developing new authors and titles, with a robust pipeline of significant releases planned for the latter half of 2025. These emerging works are categorized as 'Stars' in their early stages, possessing high growth potential but currently holding a low market share.

Significant marketing and promotional investment is crucial for these new ventures to gain traction and ascend to bestseller status. For instance, a successful new fiction title launch in 2024 required an initial marketing budget of €150,000, which contributed to a 20% increase in pre-orders compared to similar launches in previous years.

- Potential Growth: New authors and titles represent untapped market opportunities.

- Initial Market Share: These are considered low-market share products at inception.

- Investment Needs: Substantial marketing and promotional funding is required.

- Future Outlook: The goal is to cultivate these into future bestsellers and revenue drivers.

The PLAI initiative, launched in 2024, positions Arnoldo Mondadori Editore within the generative artificial intelligence sector, targeting nascent, high-growth technological areas where its current market share is minimal. This venture into AI represents a strategic move into a domain with rapid innovation and future potential, but also inherent uncertainty, with its success dependent on identifying and nurturing promising AI projects.

The company's investment in a new omnichannel retail platform, also initiated in 2024, aims to counter declining online sales and capture a greater share of the expanding e-commerce book market. This platform is positioned as a high-potential growth area, though its negligible current market share necessitates substantial capital infusion to establish a strong presence in the competitive online book landscape.

Mondadori's 2024 acquisition of Chelsea Green Publishing signifies a strategic push into the US and UK trade book markets, territories with substantial growth potential where its current market share is likely nascent. This expansion requires considerable investment to build brand recognition and distribution networks, aiming to effectively compete and cultivate a stronger market share.

The manga and comics segment, bolstered by the 2024 acquisition of Star Shop Distribuzione and an increased stake in Edizioni Star Comics (now holding 75.5%), represents a potential star for Mondadori. Despite a slight downturn in early 2025, the company's commitment to consolidating its position in Italy's leading comic book publishing market underscores high growth expectations for this sector.

New authors and titles, with a robust pipeline planned for late 2025, are categorized as early-stage stars with high growth potential but low initial market share. A successful fiction title launch in 2024, for example, required a €150,000 marketing budget, contributing to a 20% increase in pre-orders, highlighting the need for significant promotional investment to cultivate these into future bestsellers.

| Business Area | BCG Category | Key Initiatives/Data (2024-2025) | Investment Focus | Market Outlook |

| Generative AI | Question Mark | PLAI initiative (launched 2024), targeting nascent tech areas. | High capital infusion for identification and nurturing of AI projects. | High growth potential, high uncertainty. |

| E-commerce Retail | Question Mark | New omnichannel platform (2024), counteracting declining online sales. | Substantial capital for market presence and commercial viability. | Expanding e-commerce book market, negligible current share. |

| International Trade Books (US/UK) | Question Mark | Acquisition of Chelsea Green Publishing (2024). | Considerable outlay for brand recognition and distribution networks. | Substantial growth potential, nascent market share. |

| Manga & Comics (Italy) | Star | Acquisition of Star Shop Distribuzione (2024), increased stake in Edizioni Star Comics (75.5%). | Aggressive consolidation and investment in leading market position. | Potential star, slight downturn early 2025, high growth ambition. |

| New Authors & Titles | Question Mark | Robust pipeline of releases (late 2025), e.g., €150k marketing for 2024 fiction launch (20% pre-order increase). | Significant marketing and promotional funding required. | High growth potential, low initial market share, goal to become bestsellers. |

BCG Matrix Data Sources

Our Arnoldo Mondadori Editore BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.