Casino Guichard-Perrachon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casino Guichard-Perrachon Bundle

Navigate the complex external landscape affecting Casino Guichard-Perrachon's operations with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the retail giant's future. Gain actionable intelligence to inform your strategic decisions and secure your competitive advantage. Download the full version now for a complete, expert-driven breakdown.

Political factors

As a prominent French retailer, Casino Guichard-Perrachon's operations are significantly influenced by the political landscape in France. Recent political events, such as the snap legislative elections called in June 2024 following the European Parliament elections, introduce a period of uncertainty that can affect consumer sentiment and spending patterns. This instability can directly impact the retail sector's performance.

Shifts in government policy, particularly concerning fiscal matters and economic regulations, are critical. Discussions around budget consolidation and potential tax reforms, for instance, can shape the broader economic outlook. Such changes can have a direct bearing on consumer purchasing power and the operational costs for large retail groups like Casino Guichard-Perrachon.

The French government's intensified focus on consumer protection, fair trade, and environmental sustainability significantly shapes Casino Guichard-Perrachon's operational landscape. New legislation, for instance, the AGEC law (Anti-Waste for a Circular Economy), mandates stricter rules on product labeling and waste management, impacting Casino's supply chain and product offerings. Failure to comply with these evolving regulations, such as those concerning plastic packaging reduction, could lead to substantial fines and damage the company's reputation.

Casino Guichard-Perrachon, as a major retailer, is significantly influenced by international trade policies. For instance, changes in the European Union's trade agreements or the imposition of tariffs on goods imported from outside the EU can directly impact the cost of merchandise Casino sources for its French and international markets. In 2024, ongoing discussions around global trade frameworks and potential adjustments to existing agreements could introduce volatility into supply chain costs.

Geopolitical tensions and trade disputes between major economic blocs, even if not directly involving France, can disrupt global supply chains. This disruption can lead to increased shipping costs and potential shortages of certain products, ultimately affecting Casino's inventory management and pricing strategies. For example, a trade dispute between Asia and North America might indirectly raise the cost of electronics or textiles that Casino imports.

Labor Laws and Social Dialogue

French labor laws are notably robust, offering significant protections for employees concerning working hours, minimum wages, and social benefits. These regulations directly impact Casino Guichard-Perrachon's operational costs and flexibility in managing its workforce. For instance, the French statutory work week is 35 hours, and any overtime is subject to premium pay, a factor that influences staffing models in Casino's retail operations.

Casino's ongoing transformation, which has involved restructuring and potential workforce adjustments, underscores the critical need to navigate these stringent labor laws. The company's commitment to employee support during these changes, including severance packages and retraining initiatives, is vital for maintaining industrial peace. Engaging in social dialogue with trade unions is a key component of this process, ensuring compliance and mitigating risks of labor disputes.

Compliance with these labor regulations is not merely a legal obligation but a strategic imperative for Casino. Failure to adhere to laws regarding working conditions, collective bargaining agreements, or dismissal procedures can lead to significant fines, legal challenges, and reputational damage. As of early 2024, France's unemployment rate hovered around 7.5%, making employment stability a sensitive issue that influences labor relations.

- Employee Protections: French law mandates strict rules on working hours, paid leave, and dismissal procedures, impacting Casino's staffing and HR policies.

- Social Dialogue: Casino must actively engage with trade unions, as demonstrated by ongoing negotiations concerning restructuring plans and their social impact.

- Labor Costs: The high level of social contributions and mandatory benefits in France contribute to Casino's overall labor expenses, affecting profitability.

- Transformation Impact: Recent workforce restructuring plans by Casino highlight the complexities of managing job reductions within the framework of protective labor legislation.

Public Investment and Infrastructure Development

Government investment in infrastructure, like roads and digital networks, directly influences Casino's operational efficiency. For instance, improved transportation links can reduce logistics costs for their extensive store network and e-commerce deliveries. While some public investment programs might be tightening due to budget constraints, attracting foreign investment remains a priority for many governments, aiming to stimulate economic growth. This can indirectly benefit Casino by fostering a healthier economic environment and boosting consumer spending power.

Government spending on infrastructure projects can create a more favorable operating landscape for retailers like Casino. Enhanced transportation networks, for example, can streamline supply chains and reduce delivery times. In 2024, many European governments are focusing on digital infrastructure upgrades, which could bolster Casino's online sales channels and omnichannel strategies. Although direct public investment in retail infrastructure might be limited, the resulting economic uplift from broader infrastructure development is a positive factor.

- Infrastructure Investment: Governments continue to prioritize investments in transportation and digital connectivity, aiming to boost economic activity.

- Foreign Investment Focus: With tighter public budgets, there's an increased reliance on foreign capital to drive growth in key sectors, potentially benefiting the retail environment.

- Economic Spillover: Improvements in infrastructure and economic conditions driven by investment can lead to increased consumer spending, directly impacting retailers like Casino.

Political stability is a cornerstone for Casino Guichard-Perrachon's predictable business environment. The French government's policies on taxation, consumer protection, and labor laws directly influence operational costs and strategic planning. For example, changes in VAT rates or minimum wage legislation can significantly impact the company's bottom line.

Regulatory frameworks, particularly those concerning food safety, competition, and environmental standards, are crucial. Casino must adhere to stringent EU and French regulations, such as those related to plastic packaging reduction under the AGEC law, which impacts its supply chain and product development. Non-compliance can result in substantial fines and reputational damage.

Trade policies and geopolitical stability play a vital role in Casino's international operations and sourcing. Tariffs, import/export regulations, and trade disputes can affect the cost of goods and supply chain reliability. For instance, in 2024, ongoing global trade tensions continue to pose risks to the cost and availability of imported products.

Government support for economic development, including infrastructure investment and incentives for job creation, indirectly benefits Casino by fostering consumer spending. While public budgets may be constrained, efforts to attract foreign investment can stimulate the broader economy, creating a more favorable retail landscape.

What is included in the product

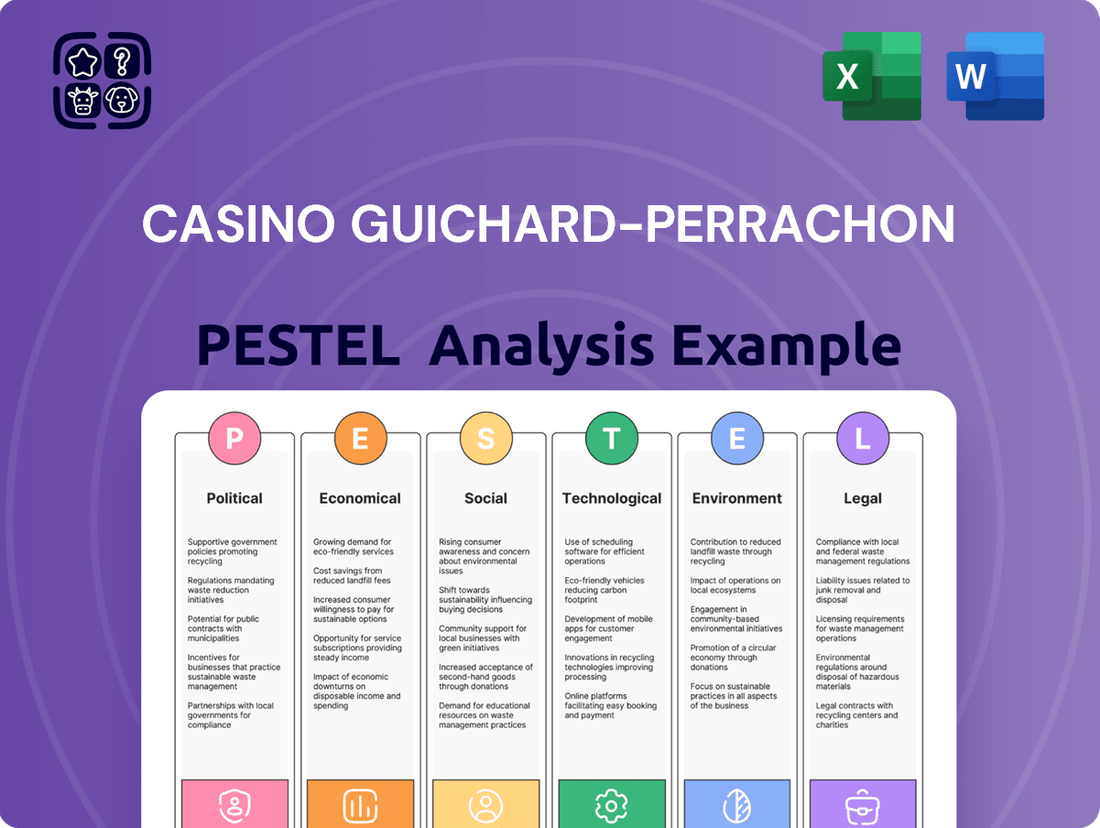

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Casino Guichard-Perrachon, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling stakeholders to identify opportunities and mitigate risks within the dynamic retail landscape.

A concise PESTLE analysis for Casino Guichard-Perrachon, presented in an easily digestible format, serves as a powerful pain point reliever by offering clear insights into external factors impacting the business, streamlining strategic decision-making.

This analysis, segmented by PESTEL categories, provides a quick and effective way to identify and address potential challenges and opportunities, relieving the pain of navigating complex market dynamics.

Economic factors

Inflation continues to impact French consumers, with 90% reporting no noticeable decrease in shelf prices despite broader economic easing. This sustained high cost of goods directly erodes consumer purchasing power, forcing shoppers to be more strategic with their spending.

Consumers are exhibiting cautious behavior, a trend likely to persist through 2024 and into 2025. They are prioritizing value, which translates to more frequent but smaller shopping trips and a clear preference for private-label brands over premium options.

French consumers are anticipated to maintain a cautious approach to spending throughout 2025, largely influenced by ongoing economic uncertainties. A notable trend indicates a prioritization of essential goods such as food and groceries, with consumers actively reducing expenditure on non-essential items.

Despite potential boosts from wage and pension increases, coupled with lower energy costs which might stimulate some spending, a significant portion of the population, around one-third of those surveyed, intends to increase their savings. This saving strategy is often achieved by opting for more budget-friendly products and exploring cheaper distribution channels.

The French retail landscape is highly competitive, with over 700 stores, including those operated by Casino and Cora, experiencing rebranding or ownership shifts. This dynamic environment, coupled with evolving consumer preferences for diverse shopping channels and specialized value, creates opportunities for independent retailers to gain market share.

Casino's strategic decisions to divest hypermarkets and supermarkets are direct responses to these intense market pressures and the need to adapt to changing consumer demands. For instance, in 2023, Casino announced the sale of its French hypermarkets and supermarkets to Intermarché and Auchan, a move aimed at strengthening its financial position and focusing on its core convenience and online businesses.

E-commerce Growth and Digitalization

E-commerce is a significant and expanding sector in France. In 2024, a notable 32% of consumers reported increasing their online shopping habits. This digital shift is particularly evident in the grocery sector, which is experiencing consistent growth.

Casino Guichard-Perrachon must actively enhance its digital presence and e-commerce capabilities to align with these changing consumer preferences. Staying competitive requires ongoing investment in online platforms and services.

- Growing Online Penetration: 32% of French consumers increased online purchases in 2024, highlighting a strong shift towards digital channels.

- Grocery E-commerce Expansion: The online grocery market is a key growth area, demanding dedicated strategies from retailers.

- Adaptation Imperative: Casino needs to continually invest in and refine its e-commerce strategies to meet evolving customer expectations and market demands.

Debt Restructuring and Financial Health

Casino Guichard-Perrachon successfully finalized a major financial restructuring in March 2024, a pivotal moment for its future. This operation significantly reduced its consolidated gross debt, which stood at €6.1 billion as of December 31, 2023, and also led to a change in control of the group. The successful completion of this debt restructuring is paramount for Casino's long-term financial health and its capacity to re-establish a growth trajectory.

The restructuring involved a substantial deleveraging, with the company aiming to shed a significant portion of its financial burden. This strategic move is designed to improve operational flexibility and restore investor confidence. The new ownership structure is expected to bring fresh capital and strategic direction, crucial for navigating the competitive retail landscape.

- Debt Reduction: Consolidated gross debt reduced significantly from €6.1 billion at the end of 2023.

- Change in Control: The restructuring resulted in a new controlling shareholder for Casino Guichard-Perrachon.

- Sustainability Focus: The primary goal is to ensure the group's long-term viability and return to profitable growth.

- Operational Impact: Improved financial health is expected to enable greater investment in core business operations.

Economic factors continue to shape consumer behavior in France, with persistent inflation impacting purchasing power. Despite some easing of broader economic conditions, 90% of consumers reported no noticeable decrease in shelf prices, leading to continued caution in spending through 2024 and into 2025.

Consumers are prioritizing value, opting for smaller, more frequent shopping trips and favoring private-label brands. This trend is expected to persist, with a significant portion of the population intending to increase savings by choosing budget-friendly products and cheaper distribution channels.

The retail market remains highly competitive, with ongoing store rebranding and ownership shifts. Casino's strategic divestment of hypermarkets and supermarkets, such as the sale to Intermarché and Auchan in 2023, reflects an adaptation to these pressures and evolving consumer preferences for diverse shopping options.

Casino Guichard-Perrachon underwent a significant financial restructuring in March 2024, reducing its consolidated gross debt from €6.1 billion (as of December 31, 2023) and leading to a change in control. This deleveraging is crucial for the group's long-term financial health and its ability to invest in core operations and pursue growth.

| Economic Factor | Impact on Consumers | Retailer Response/Data |

|---|---|---|

| Inflation | 90% report no noticeable decrease in shelf prices; reduced purchasing power | Consumers prioritize value, private labels; Casino divests stores |

| Consumer Sentiment | Cautious spending expected through 2025; preference for essentials | Increased savings intention; shift to budget-friendly products |

| E-commerce Growth | 32% increased online shopping in 2024; growth in grocery sector | Casino must enhance digital presence and e-commerce capabilities |

| Financial Restructuring | €6.1 billion debt reduction (Dec 2023); change in control (March 2024) | Improved financial health to enable investment and growth |

Preview the Actual Deliverable

Casino Guichard-Perrachon PESTLE Analysis

The preview you see here is the exact Casino Guichard-Perrachon PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Casino Guichard-Perrachon, providing actionable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed examination of the company's operating landscape.

Sociological factors

Consumer habits in France have significantly shifted, with inflation driving a persistent trend of more frequent, smaller shopping trips. This value-seeking behavior, observed in 70% of shoppers being cautious about their spending, directly affects retailers like Casino Guichard-Perrachon.

The preference for private-label brands over national brands is a clear indicator of this value-consciousness. This trend necessitates a strategic focus on affordability and competitive pricing to resonate with a French consumer base prioritizing getting the most for their money.

The widening income gap in France significantly impacts consumer spending patterns. Wealthier households are boosting their expenditures, while middle-income and blue-collar segments are tightening their belts. This divergence necessitates a nuanced approach to product and service offerings.

This social stratification translates into shopper fragmentation across various retail channels. E-commerce, smaller convenience stores, and specialized retailers are experiencing growth as consumers seek tailored shopping experiences. Casino Guichard-Perrachon must therefore adapt its retail formats and product assortments to effectively serve these increasingly distinct consumer groups.

Consumer demand for sustainable and ethical products is showing signs of a gentle rebound, with spending in this area seeing an increase. Younger demographics are increasingly focused on adopting sustainable habits, including engaging with the circular economy and prioritizing repairs over replacements.

Casino Guichard-Perrachon's corporate social responsibility initiatives, such as promoting plant-based protein options and investing in sustainable delivery methods, directly address these growing consumer expectations. However, a significant segment of consumers still exhibits a reluctance to pay a premium for environmentally friendly products, presenting a challenge for widespread adoption.

Demographic Shifts and Urbanization

Demographic shifts, such as declining birth rates across many developed nations, present a long-term challenge to the overall consumer base size for retailers like Casino Guichard-Perrachon. For instance, France's birth rate hovered around 1.7 children per woman in 2023, a trend that can gradually shrink the potential market. This necessitates a strategic focus on market share and customer loyalty.

Urbanization continues to reshape consumer behavior, with a noticeable shift towards city centers. This trend impacts the viability of large suburban shopping centers versus the growing importance of convenience and local retail formats. Casino's strategic investment in its proximity store networks, such as Franprix and Monoprix, directly addresses this by catering to the increasing demand for easily accessible shopping options in densely populated urban areas.

- Declining Birth Rates: France's birth rate in 2023 was approximately 1.7 children per woman, impacting long-term consumer base growth.

- Urban Concentration: A growing proportion of the French population resides in urban centers, favoring convenience retail.

- Proximity Store Growth: Casino's network of convenience stores, like Franprix, is well-positioned to capitalize on urban living trends.

- Shifting Retail Landscape: The preference for local, accessible shopping is influencing the decline of traditional large-format retail in favor of smaller urban formats.

Influence of Digital Media and Social Trends

Younger consumers in France, particularly Gen Z and Millennials, are increasingly swayed by digital media, with platforms like TikTok and Instagram significantly shaping their purchasing habits. This trend highlights the growing importance of social commerce, where brands with a robust social media presence can see a direct uplift in sales. For instance, a significant portion of French Gen Z consumers report discovering new products through social media influencers and brand content.

Casino Guichard-Perrachon must adapt its e-commerce strategies and marketing campaigns to effectively tap into these digital currents. By leveraging social listening and influencer collaborations, Casino can enhance engagement with younger demographics. In 2024, social commerce sales in France were projected to reach billions of euros, underscoring the financial imperative for retailers to embrace these platforms.

Key considerations for Casino include:

- Adapting content for TikTok and Instagram: Creating engaging, short-form video content that resonates with younger audiences.

- Investing in influencer marketing: Partnering with relevant influencers to promote products and build brand credibility.

- Developing social commerce features: Integrating seamless purchasing options directly within social media platforms.

- Utilizing user-generated content: Encouraging customers to share their experiences with Casino's products online.

Consumer behavior in France is increasingly shaped by digital trends, with younger demographics heavily influenced by social media platforms like TikTok and Instagram. This shift highlights the growing significance of social commerce, a market projected to generate billions of euros in France by 2024, making it crucial for retailers like Casino Guichard-Perrachon to integrate these platforms into their strategies. Adapting content for these channels and investing in influencer marketing are key actions for Casino to enhance engagement and drive sales among these valuable consumer segments.

Technological factors

The French e-commerce market continues its strong expansion, with projections indicating sustained double-digit growth through 2025. This trend highlights the critical need for Casino Guichard-Perrachon to maintain and enhance its digital footprint. A significant portion of French consumers, estimated to be over 80% by late 2024, are actively increasing their online shopping habits across various retail sectors.

Casino's ability to offer a seamless omnichannel experience, blending online convenience with physical store accessibility, is paramount. This includes optimizing click-and-collect services and ensuring user-friendly mobile applications, which are becoming the primary interface for many shoppers. By late 2024, mobile commerce was expected to account for over 60% of all e-commerce transactions in France, underscoring its strategic importance.

Casino Guichard-Perrachon's supply chain efficiency hinges on advanced technologies. Innovations in inventory management and last-mile delivery are crucial. For instance, real-time tracking and route optimization directly impact operational costs and customer satisfaction.

The company is investing in technologies to streamline logistics, including truck load optimization software. Modernizing vehicle fleets for transport is also a key focus, aiming for faster and more reliable delivery networks across its operations.

Casino Guichard-Perrachon is increasingly leveraging smart in-store technologies to elevate the customer experience. Interactive displays and AI-powered recommendation engines are key to personalizing shopping journeys, effectively merging the physical and digital retail spaces. For instance, by mid-2024, retailers globally saw a significant uplift in customer satisfaction scores when implementing personalized digital interfaces, with some reporting up to a 15% increase.

The company can further boost customer engagement and operational efficiency through technologies that streamline payment processes and offer real-time updates on inventory and order status. This focus on seamless transactions and transparent information is crucial in today's competitive market, where convenience drives loyalty. By the end of 2025, it's projected that 60% of retail transactions will incorporate some form of contactless or mobile payment, highlighting the importance of this technological shift.

Data Analytics and Artificial Intelligence (AI)

The retail landscape is increasingly shaped by data analytics and artificial intelligence (AI). Casino Guichard-Perrachon can leverage these technologies to enhance various operational facets, from product development and supply chain efficiency to targeted marketing and personalized customer journeys. Retailers effectively deploying AI have reported significant improvements in both cost reduction and revenue growth.

For Casino, harnessing data and AI is essential for gaining deeper insights into consumer behavior patterns, improving sales forecasting accuracy, and ultimately driving more informed strategic business decisions in the competitive retail environment.

- AI Integration: Pervasive AI adoption across retail enhances product R&D, supply chain, marketing, and customer experience.

- Operational Benefits: Retailers implementing AI at scale have seen operational cost reductions and revenue increases.

- Data-Driven Decisions: Leveraging data and AI is crucial for understanding consumer behavior and forecasting sales.

- Competitive Advantage: AI-powered insights enable informed business decisions, crucial for staying competitive.

Cybersecurity and Data Privacy

Casino Guichard-Perrachon's increasing reliance on digital platforms for e-commerce and loyalty programs amplifies the importance of robust cybersecurity. With cyber-attacks becoming more sophisticated, safeguarding customer data against breaches is paramount. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational risks involved.

Maintaining consumer trust hinges on effective data privacy measures. Compliance with evolving data protection regulations, such as GDPR, is non-negotiable. Failure to protect sensitive customer information can lead to substantial fines and damage brand reputation, impacting future sales and customer retention.

- Data Breach Impact: A significant data breach could cost Casino millions in remediation, legal fees, and lost business.

- Regulatory Fines: Non-compliance with data privacy laws can result in penalties of up to 4% of global annual turnover, as stipulated by GDPR.

- Customer Trust: A strong cybersecurity posture is essential for maintaining customer confidence in Casino's digital services.

Casino Guichard-Perrachon must prioritize technological advancements to remain competitive. The company's digital transformation, including robust e-commerce platforms and mobile applications, is crucial given that mobile commerce is projected to exceed 60% of French e-commerce transactions by late 2024. Investing in AI and data analytics will enhance customer understanding and operational efficiency, with AI-driven retailers reporting significant revenue growth.

The integration of smart in-store technologies, like interactive displays, can personalize the shopping experience, potentially increasing customer satisfaction by up to 15% as seen globally by mid-2024. Furthermore, a strong cybersecurity infrastructure is essential, especially as the global cost of cybercrime is estimated to reach $10.5 trillion annually by 2025, to protect sensitive customer data and maintain trust.

Legal factors

Casino Guichard-Perrachon finalized its substantial financial restructuring in March 2024, a critical step approved via accelerated safeguard plans by the Paris Commercial Court. This legal maneuver significantly reduced its debt burden, estimated to be around €1.1 billion, and led to a change in majority ownership.

The company now operates under new legal obligations stemming from this complex restructuring process. These include potential future arbitration requests from various stakeholders, which could impact its operational and financial landscape moving forward.

Casino Guichard-Perrachon, as a dominant force in French retail, operates under stringent competition laws and antitrust regulations designed to prevent market monopolization. These rules heavily influence strategic decisions, particularly concerning divestitures and potential consolidations. For instance, the sale of Casino's hypermarkets and supermarkets to Intermarché (Les Mousquetaires) in 2023, a deal valued at €1.3 billion, required approval from competition authorities to ensure fair market practices and avoid undue concentration of power in specific regions.

Future transactions, whether mergers, acquisitions, or even significant changes in market share, will continue to face rigorous scrutiny. Regulatory bodies like the French Autorité de la concurrence will assess the impact on consumer choice and price levels. Failure to comply can result in substantial fines and forced restructuring, underscoring the critical need for Casino to navigate these legal frameworks meticulously as it restructures its business and ownership in 2024 and beyond.

French consumer protection laws, such as those concerning pricing transparency and advertising practices, directly influence how Casino Guichard-Perrachon communicates with its customers. For instance, the Loi Hamon (2014) and subsequent amendments have strengthened consumer rights regarding product information and warranties.

Recent regulatory shifts, like the legislation targeting ultra-fast fashion with advertising bans and mandatory sustainability disclosures, demonstrate a growing emphasis on consumer information and responsible marketing across the retail sector. While these specific measures may not directly apply to Casino's core grocery business, they highlight a broader trend towards increased scrutiny of retail practices.

This evolving regulatory landscape suggests a future where enhanced transparency and ethical marketing will become even more critical for maintaining consumer trust and brand reputation within the French market.

Labor and Employment Laws

French labor laws are stringent, governing everything from minimum wage and working hours to employee dismissal and collective bargaining agreements. Casino Guichard-Perrachon's significant restructuring efforts, including its transformation plan and associated employment protection measures, must navigate these complex regulations meticulously. Failure to comply with these laws, such as those concerning redundancy procedures or consultation with employee representatives, could lead to substantial fines and protracted legal disputes, impacting the company's financial stability and reputation. For instance, French labor law often mandates specific notice periods and severance pay, which can add considerable cost to workforce reductions.

The company's commitment to its employment protection plan, designed to mitigate the impact of job losses, is directly influenced by legal requirements. These laws ensure that employees facing redundancy are provided with adequate support, which might include outplacement services or retraining opportunities. In 2023, the French government continued to emphasize social dialogue and employee rights, meaning any significant workforce changes by Casino would be under close scrutiny to ensure adherence to established legal precedents and worker protections.

Compliance with labor and employment laws is not merely a legal obligation but a critical factor in maintaining industrial peace and employee morale during periods of change. Casino's ability to manage its workforce transition smoothly hinges on its capacity to operate within the legal framework, thereby avoiding disruptions that could further destabilize its operations. The legal landscape in France prioritizes worker consultation and fair treatment, making proactive legal counsel and strict adherence to procedures paramount for Casino's strategic execution.

Environmental Regulations and Eco-labeling

France's commitment to environmental transparency is intensifying. The AGEC law and the Climate and Resilience Law are pushing for mandatory environmental labeling and detailed product information, particularly in sectors like textiles, through an eco-score system. This regulatory push, initially focused on fashion, indicates a significant shift towards requiring businesses to openly disclose their environmental footprint across a wider range of products.

Casino Guichard-Perrachon must remain vigilant and adaptable as these disclosure requirements are likely to expand beyond fashion. The potential for these regulations to encompass food products and general merchandise necessitates proactive monitoring and strategic adjustments to ensure compliance and maintain consumer trust. For instance, the initial rollout of environmental labeling in France saw significant consumer interest, with studies indicating over 60% of consumers in 2024 are more likely to purchase products with clear environmental information.

- AGEC Law Impact: Mandates environmental labeling and transparency for various products.

- Climate and Resilience Law: Reinforces the push for eco-score systems and disclosure.

- Sectoral Expansion: Initial focus on fashion signals potential future requirements for food and general merchandise.

- Consumer Demand: Growing consumer preference for environmentally transparent products, influencing purchasing decisions.

Casino Guichard-Perrachon's legal framework is heavily shaped by its recent financial restructuring, finalized in March 2024, which involved accelerated safeguard plans and a significant debt reduction. This process has introduced new legal obligations, including potential future arbitration requests from stakeholders, impacting its operational landscape.

The company operates under strict French competition laws, necessitating careful navigation of antitrust regulations for any future mergers or acquisitions. For example, the €1.3 billion sale of its hypermarkets and supermarkets to Intermarché in 2023 required competition authority approval to ensure fair market practices.

Stringent French labor laws govern Casino's employment practices, particularly during its transformation plan. Adherence to regulations on redundancy procedures and employee consultation is crucial to avoid legal disputes and financial penalties, with specific notice periods and severance pay adding to workforce transition costs.

Environmental regulations, such as the AGEC and Climate and Resilience Laws, are increasingly mandating product transparency and eco-labeling. While initially focused on fashion, these laws signal a trend towards broader disclosure requirements, with over 60% of French consumers in 2024 showing a preference for products with clear environmental information.

Environmental factors

The retail industry, including Casino Guichard-Perrachon, faces growing scrutiny over its contribution to greenhouse gas emissions. Regulatory bodies and consumers alike are pushing for significant carbon footprint reduction. For instance, in 2023, the European Union continued to strengthen its climate policies, aiming for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, impacting supply chain operations.

Casino is actively exploring strategies to mitigate its environmental impact. This includes optimizing delivery routes and transitioning its logistics fleet towards cleaner alternatives. Investments in natural gas vehicles (NGV), biofuels, and electric vehicles are key components of this strategy. Furthermore, the company is investigating more sustainable last-mile delivery options, such as cargo bikes and pedestrian services, particularly in urban areas.

Casino Guichard-Perrachon is navigating growing consumer demand for sustainably sourced products, a trend amplified by concerns over environmental impact. In 2024, a significant portion of French consumers indicated a preference for retailers demonstrating strong environmental commitments.

The company's strategic focus on promoting plant-based proteins and a healthier plant-to-animal protein ratio directly addresses calls to lower the food sector's carbon footprint. This aligns with broader environmental goals, as research from 2025 highlights the substantial emissions reduction potential of dietary shifts.

Enhanced transparency in Casino's supply chain concerning environmental metrics is crucial. By 2024, a majority of shoppers surveyed expected detailed information on the ecological footprint of the products they purchase, influencing their loyalty and purchasing decisions.

France is implementing stricter regulations on waste management, particularly impacting the retail sector. New eco-taxes and a strong emphasis on recyclability and reusability are becoming standard, pushing companies to rethink their product lifecycles and packaging strategies.

While Casino Guichard-Perrachon's primary focus is food retail, these environmental shifts are broadly applicable. The growing societal demand for a circular economy means Casino must consider reducing waste and enhancing recycling across all its operations, from store packaging to product sourcing.

For instance, the push against textile waste, a significant concern in the fashion segment of retail, highlights a broader trend. This societal pressure encourages businesses like Casino to explore more sustainable materials and implement robust recycling programs, potentially impacting their supply chain and operational costs.

Resource Consumption (Water, Energy)

Casino Guichard-Perrachon's extensive retail footprint, encompassing numerous supermarkets, hypermarkets, and logistics facilities, inherently leads to substantial water and energy consumption. For instance, in 2023, the energy expenditure across its French operations alone represented a significant portion of its overheads, with electricity costs seeing a notable increase due to market volatility.

To mitigate its environmental footprint and operational expenses, Casino is actively pursuing enhanced resource management strategies. This involves a multi-pronged approach, including the phased implementation of energy-efficient lighting systems and refrigeration units across its store network. The company has also been exploring the integration of renewable energy solutions, such as solar panel installations at select distribution centers, aiming to reduce reliance on conventional energy sources.

Key initiatives and data points include:

- Energy Efficiency Investments: Casino has committed to a €50 million investment program by the end of 2024 to upgrade refrigeration systems and lighting in its stores, targeting a 15% reduction in energy consumption for those facilities.

- Water Management: Efforts are underway to optimize water usage in store operations and logistics, with pilot programs in 2023 showing a potential 10% reduction in water consumption through improved fixture efficiency and staff training.

- Renewable Energy Adoption: By mid-2025, Casino aims to power 20% of its logistics operations through renewable energy sources, with a focus on solar and potentially wind energy partnerships.

Environmental Labeling and Consumer Information

France's commitment to environmental transparency is escalating with new legislation like the AGEC law and the Climate and Resilience Law. These acts are paving the way for mandatory eco-score labeling on a growing range of products, offering consumers clear insights into a product's environmental footprint across its entire lifecycle. This shift directly influences purchasing decisions, pushing for more sustainable consumption patterns.

For Casino Guichard-Perrachon, adapting to these evolving regulations is crucial, particularly if eco-labeling expands to encompass food and general merchandise. The company must proactively prepare for and implement these labeling requirements, ensuring robust transparency and accountability in its product offerings. This includes meticulous data collection and clear communication to consumers about environmental impacts.

- AGEC Law (Anti-Waste for a Circular Economy): This French law aims to accelerate the societal transition to a circular economy by reducing waste and promoting reuse and recycling.

- Climate and Resilience Law: Enacted in 2021, this law seeks to integrate climate change considerations into all aspects of French policy, including consumer product information.

- Eco-labeling Expansion: While initial focus might be on specific sectors, the trend suggests a broader application of environmental labeling across retail categories, impacting Casino's supply chain and product management.

- Consumer Demand: Studies in 2024 indicate a significant portion of French consumers actively seek out products with clear environmental certifications, influencing over 60% of their purchasing decisions.

Casino Guichard-Perrachon faces increasing pressure from evolving environmental regulations in France, such as the AGEC and Climate and Resilience Laws, pushing for greater waste reduction and circular economy principles. Consumer demand for sustainable products, with over 60% of French shoppers in 2024 influenced by environmental certifications, is a significant driver for the company to enhance its transparency and eco-friendly practices.

The company is investing in energy efficiency, targeting a 15% reduction in energy consumption by upgrading store systems by the end of 2024, and aims to power 20% of its logistics with renewables by mid-2025. These initiatives are crucial for meeting climate goals and addressing the substantial energy and water consumption inherent in its large retail footprint.

| Initiative | Target/Metric | Timeline |

|---|---|---|

| Energy Efficiency Upgrades | 15% energy consumption reduction | End of 2024 |

| Renewable Energy in Logistics | 20% powered by renewables | Mid-2025 |

| Water Consumption Reduction (Pilot) | 10% reduction | 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Casino Guichard-Perrachon is underpinned by data from official government publications, reputable financial news outlets, and comprehensive market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.