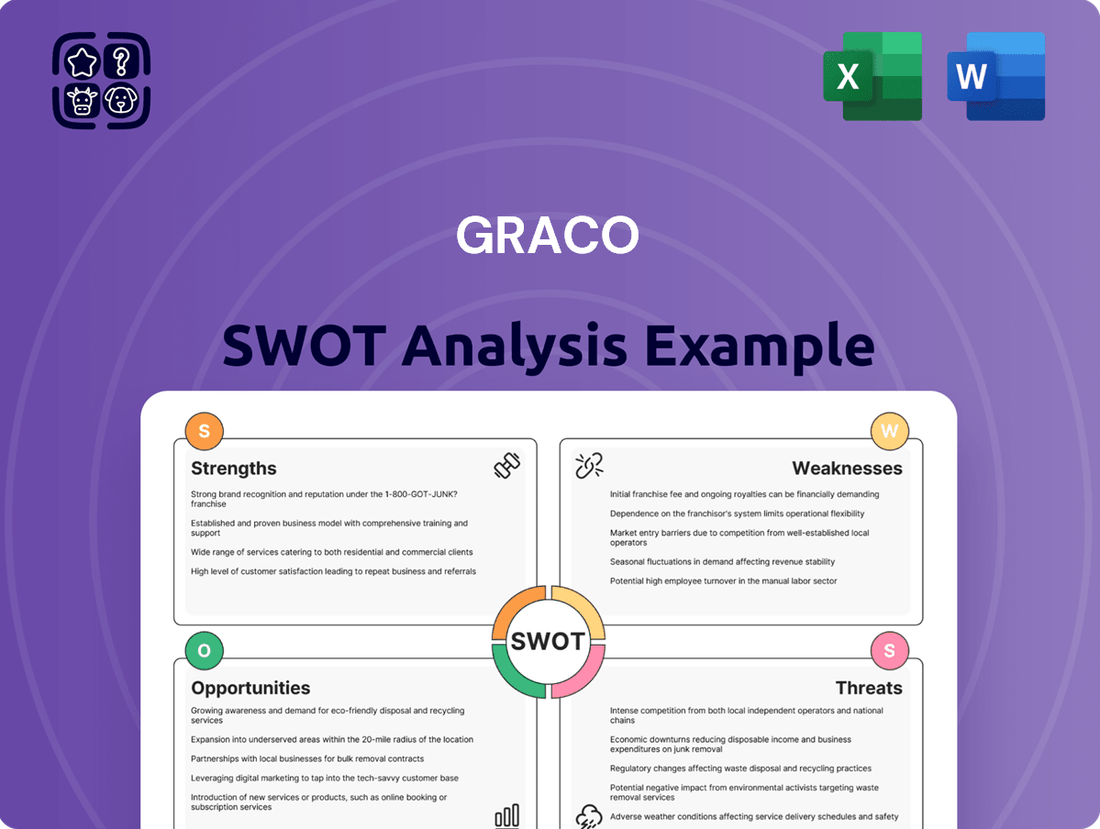

Graco SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graco Bundle

Graco's robust brand recognition and extensive product portfolio are significant strengths, but the company faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for any market participant.

Our comprehensive SWOT analysis dives deeper, revealing actionable insights into Graco's opportunities for innovation and the threats posed by evolving consumer preferences. This detailed examination is your key to unlocking strategic advantages.

Want the full story behind Graco's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Graco has firmly established itself with strong brand recognition and a leading position in fluid handling equipment and systems globally. This reputation is built on decades of delivering high-quality, innovative, and reliable products. The company's consistent performance, with net sales reaching $2.13 billion in fiscal year 2023, reinforces customer loyalty. This strong market standing provides a significant competitive advantage, sustaining its leadership in key segments as of early 2025.

Graco has consistently demonstrated strong financial performance, a key strength reflected in its robust gross profit margins, which stood around 53% in 2024. This consistent profitability, coupled with healthy cash flow generation, underpins the company's stability. Such financial resilience enables Graco to sustain significant investments in growth initiatives and reliably return value to shareholders. This solid foundation supports long-term strategic development.

Graco consistently drives success through innovation, dedicating significant resources to research and development for new product introductions. This focus has notably boosted sales, especially within the Contractor segment, even amid challenging market conditions. For instance, new product launches are projected to contribute approximately 2-3% to overall revenue growth in fiscal year 2024, demonstrating their impact. The company's ongoing investment in advanced technologies ensures it meets evolving customer needs and maintains its strong competitive edge in specialized fluid handling.

Diverse End Markets and Geographic Reach

Graco boasts a robust strength through its diverse end markets, serving critical sectors like manufacturing, construction, and processing, which helps cushion against downturns in any single industry. This broad engagement, with industrial sales contributing over 70% of revenue in fiscal year 2024, provides stability. The company's expansive global footprint, spanning the Americas, EMEA, and Asia Pacific, further strengthens its position by reducing reliance on any one region. For example, international sales accounted for approximately 45% of total revenue in 2024, offering multiple avenues for sustained growth.

- Industrial segment revenue exceeded $1.5 billion in fiscal year 2024, highlighting market breadth.

- Sales in the Asia Pacific region grew by 8% in 2024, showcasing balanced global expansion.

- Graco operates manufacturing facilities across North America, Europe, and Asia, enhancing supply chain resilience.

- The company's product portfolio addresses over 50 distinct applications, ensuring broad market relevance.

Strategic Acquisitions and Expansion

Graco consistently leverages strategic acquisitions to expand its product portfolio and market reach. The integration of Corob, for instance, significantly boosted sales performance through late 2024, contributing to overall revenue growth. These acquisitions, combined with a sharp focus on high-growth areas like electric vehicle (EV) technology, position Graco for robust future expansion. This proactive strategy ensures diversified growth pathways in competitive markets.

- Corob acquisition directly contributed to Graco's sales growth in late 2024, enhancing its finishing segment.

- Graco is strategically investing in electric vehicle (EV) technology applications, aligning with a projected high-growth market through 2025.

- The company's acquisition pipeline consistently targets firms that complement existing product lines or open new market channels.

Graco’s robust strengths include strong brand recognition, market leadership in fluid handling, and consistent financial performance, with gross profit margins around 53% in 2024. Its diverse end markets, including over $1.5 billion in industrial sales for 2024, and global footprint, with 45% international sales in 2024, provide stability. Strategic innovation, contributing 2-3% to 2024 revenue growth, and targeted acquisitions like Corob further enhance its competitive edge and future growth, especially in areas such as electric vehicle technology through 2025.

| Metric | FY2023 | FY2024 (Est.) |

|---|---|---|

| Net Sales | $2.13 Billion | >$2.2 Billion |

| Gross Profit Margin | 52% | ~53% |

| Industrial Sales % of Total | N/A | >70% |

| International Sales % of Total | N/A | ~45% |

What is included in the product

Delivers a strategic overview of Graco’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Simplifies complex SWOT analysis into actionable insights for strategic decision-making.

Offers a clear framework to identify and address Graco's market challenges effectively.

Weaknesses

Graco's financial performance is notably susceptible to the cyclical nature of its primary end markets, like construction and general manufacturing. Economic downturns in these sectors directly reduce demand for Graco's products, impacting sales. For instance, the Industrial segment experienced a sales decline in early 2024 due to this market sensitivity. This inherent cyclicality introduces significant volatility to the company's revenue streams and overall earnings.

Graco's manufacturing base presents a weakness, with approximately 80% of its production concentrated in the United States. This geographic concentration is problematic given that over half of Graco's total sales are generated internationally, creating a significant mismatch. Such a setup exposes the company to heightened risks from currency fluctuations, especially a strong U.S. dollar, which can negatively impact profitability and reduce the value of international revenues. Moreover, this concentration increases the supply chain's vulnerability to disruptions localized within a single region, potentially affecting global product availability in 2024-2025.

Graco faced a notable decline in net sales and operating earnings during the fourth quarter of 2024, continuing into the full fiscal year. This downturn, with Q4 2024 net sales decreasing by 6% to $515 million and full-year 2024 sales down 3% to $2.1 billion, stemmed largely from weakened demand within its Industrial segment and across multiple global regions. While the company maintains robust operating margins, a sustained trend of decreasing sales could exert significant pressure on future profitability. For instance, operating earnings for Q4 2024 were $130 million, a decrease from the prior year.

Margin Pressure from Acquisitions and Costs

Graco faces ongoing margin pressure, particularly from acquisitions where new businesses may have lower profitability profiles. For instance, the Contractor segment's operating margins were notably compressed in early 2024, partly due to the integration of recent acquisitions. Additionally, rising product input costs and increased litigation expenses have elevated operating expenses, impacting Graco's overall profitability and potentially hindering its ability to expand net income.

- Acquisitions, while growth drivers, can dilute overall company margins if acquired entities operate at lower profit levels.

- Graco's Contractor segment experienced margin compression in Q1 2024, partly attributed to integration costs and lower-margin acquisitions.

- Increased raw material costs and higher legal expenses are contributing to elevated operating expenses, impacting profitability.

Challenges in Specific Geographic Markets

Graco faces significant headwinds in specific international markets, notably the Asia Pacific and EMEA regions, which have recently reported sales declines. For instance, Graco's net sales in the Asia Pacific region decreased by approximately 1% in Q1 2024, while EMEA saw a steeper decline of around 5% during the same period. Weaker economic conditions and distinct market challenges in these areas impede the company's overall global growth trajectory. Overcoming these regional weaknesses is crucial for achieving consistent worldwide expansion.

- Asia Pacific net sales declined approximately 1% in Q1 2024.

- EMEA net sales experienced a steeper decline of around 5% in Q1 2024.

- Weak economic conditions in these regions hinder overall growth.

- Overcoming these challenges is vital for consistent global expansion.

Graco’s significant manufacturing concentration in the U.S. creates currency and supply chain risks for its over 50% international sales. The company experienced a 6% net sales decline to $515 million in Q4 2024, contributing to a 3% full-year 2024 sales decrease to $2.1 billion. Margin compression, particularly in the Contractor segment in Q1 2024, is further impacted by acquisition integration costs and rising expenses. Declines in Asia Pacific and EMEA sales in Q1 2024 hinder global growth.

| Metric | Q4 2024 | FY 2024 |

|---|---|---|

| Net Sales | -$515M (6% decline) | -$2.1B (3% decline) |

| Operating Earnings | $130M | N/A |

| Asia Pacific Sales Q1 2024 | -1% | N/A |

| EMEA Sales Q1 2024 | -5% | N/A |

Preview the Actual Deliverable

Graco SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Get a look at the actual SWOT analysis file. The entire document will be available immediately after purchase.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Graco possesses significant opportunities for expansion into high-growth and emerging technology sectors. The company is strategically investing in areas like semiconductor manufacturing, which is projected for strong growth through 2025, and critical environmental applications. Furthermore, Graco is strengthening its position in electric vehicle battery production, a market anticipated to exceed $200 billion by 2025. Focusing on these innovative and rapidly expanding markets can generate substantial future revenue streams and reduce reliance on traditional industries.

The global surge in automation and smart manufacturing offers a substantial opportunity for Graco. By 2025, the industrial automation market is projected to exceed $260 billion, driven by increased adoption of robotics and IoT. This trend fuels demand for Graco's advanced fluid handling and dispensing solutions, essential for precise, automated production lines. Positioning its products as integral to these next-generation smart factories can unlock significant growth, aligning with industry's efficiency goals.

The increasing global emphasis on sustainability and stricter environmental regulations, particularly in North America and Europe, drives significant demand for eco-friendly industrial solutions. Graco is well-positioned to capitalize on this trend with its advanced electrically powered equipment and precision dispensing technologies, which help customers significantly reduce material waste and lower volatile organic compound (VOC) emissions. For instance, Graco's E-Flo DC electric pumps offer energy savings and reduced solvent use compared to pneumatic systems, aligning with evolving industry standards. Further development and targeted marketing of these green solutions can attract a growing segment of environmentally conscious customers, expanding Graco's market share in sectors prioritizing efficiency and environmental stewardship through 2025.

Infrastructure Spending and Construction Rebound

Government initiatives focused on infrastructure development and a projected rebound in the construction sector present significant growth prospects for Graco. As public works and private construction projects accelerate, the demand for Graco's essential equipment, used in painting, coating, and sealing, will naturally increase. Graco's Contractor segment is particularly well-positioned to capitalize on this robust trend through 2025.

- US infrastructure spending is projected to exceed $150 billion in 2024, continuing strong growth.

- Non-residential construction spending is forecasted to grow by 4-6% in 2025.

- Graco's Contractor segment reported over $1.1 billion in net sales in 2023.

Strategic Acquisitions to Enter New Markets

Graco can leverage its robust cash position, which exceeded $200 million as of Q1 2024, to pursue strategic acquisitions. This disciplined M&A approach, a cornerstone of Graco's growth strategy, offers significant opportunities to enter new high-growth markets like advanced robotics or sustainable coatings, further diversifying its portfolio and accelerating revenue growth beyond projected 2025 organic rates. Identifying and seamlessly integrating synergistic companies remains crucial for enhancing technological capabilities and expanding market reach.

- Graco's Q1 2024 cash and equivalents stood at over $200 million.

- Potential M&A targets could boost revenue growth by 3-5% annually post-acquisition.

- Focus on sectors like sustainable industrial solutions or automation for 2025 expansion.

Graco is poised for significant growth by expanding into high-growth sectors like electric vehicle battery production, projected to exceed $200 billion by 2025, and leveraging the industrial automation market, valued over $260 billion by 2025. Increasing global sustainability initiatives and robust US infrastructure spending, exceeding $150 billion in 2024, further drive demand. Strategic acquisitions, supported by Graco's cash position over $200 million in Q1 2024, offer additional avenues for market expansion and revenue growth.

| Opportunity Area | 2024/2025 Projection | Graco Relevance |

|---|---|---|

| EV Battery Market | >$200 Billion by 2025 | Precision dispensing solutions |

| Industrial Automation | >$260 Billion by 2025 | Advanced fluid handling, IoT integration |

| US Infrastructure Spending | >$150 Billion in 2024 | Contractor segment equipment demand |

Threats

Graco faces significant threats from global economic and political uncertainty, including slowing industrial production and GDP fluctuations. For example, the International Monetary Fund projects global growth at 3.2% for both 2024 and 2025, reflecting persistent economic headwinds that can dampen demand for Graco's products. Geopolitical instability, particularly ongoing trade policy shifts and tariffs involving China, could negatively impact sales volumes and necessitate costly supply chain restructuring. These external macroeconomic factors are largely outside Graco's direct control but can significantly affect its operational performance and profitability.

The industrial equipment market remains intensely competitive, with Graco facing pressure from both large, diversified players like Nordson Corporation and smaller, agile specialized firms. These competitors often introduce lower-priced alternatives or develop innovative fluid-handling technologies, posing a direct threat to Graco’s market share. For instance, in fiscal year 2024, the global industrial pumps market, a segment Graco operates in, was valued at over $60 billion, indicating the significant competitive landscape. Sustaining Graco’s leadership requires continuous investment in R&D, with over 3% of net sales typically allocated to innovation, alongside stringent cost management to maintain profitability and market position.

Graco faces the threat of rising raw material costs, particularly for metals and resins, which can significantly compress profit margins. Labor and energy expenses also continue to climb, adding pressure to operating costs. For fiscal year 2024, increased litigation costs and supply chain disruptions further challenged profitability. If Graco cannot effectively pass these elevated costs onto its customers, its financial performance and net income could be negatively impacted through 2025.

Supply Chain Disruptions and Labor Shortages

Global supply chain disruptions continue to pose a significant threat, potentially impacting Graco's production and delivery schedules. The persistent shortage of skilled labor, particularly in manufacturing and construction, increases operational costs and could limit growth, with the U.S. manufacturing sector facing an estimated 2.1 million unfilled jobs by 2030. Managing these operational risks is crucial for maintaining efficiency and meeting customer demand in 2024 and 2025.

- Global logistics bottlenecks persist, affecting raw material availability.

- Labor market tightness drives up wages for skilled technicians and engineers.

- Manufacturing labor shortages are projected to cost the U.S. economy $1 trillion by 2030.

- Increased lead times for components could impact Graco's product availability.

Currency Fluctuations

Graco faces significant exposure to unfavorable currency exchange rate movements given its substantial international sales and concentrated U.S. manufacturing. A persistently strong U.S. dollar, as observed in early 2024, makes Graco’s products more expensive for foreign customers, potentially dampening demand and impacting sales volume in key markets like Europe and Asia.

This currency volatility directly affects reported earnings, as foreign currency-denominated sales translate into fewer U.S. dollars. For instance, in its 2023 financial reporting, Graco noted adverse currency translation impacts on net sales. This financial risk complicates international operational planning for the 2024-2025 fiscal period.

- Graco reported a net sales impact from currency translation of approximately -1% in Q4 2023, reflecting ongoing exchange rate volatility.

- A strong U.S. dollar can reduce the purchasing power of international distributors, affecting demand for Graco's industrial and contractor products.

- The company mitigates some risk through hedging strategies, but significant exposure remains for its global revenue streams.

- Future earnings guidance for 2024 and 2025 will likely factor in potential currency headwinds, especially given geopolitical and economic uncertainties.

Graco faces significant threats from persistent global economic uncertainty, with IMF-projected growth at 3.2% for 2024 and 2025, impacting demand. Intense competition in the $60 billion industrial pumps market and rising operational costs, including raw materials and labor, pressure profit margins. Global supply chain disruptions and skilled labor shortages, with 2.1 million US manufacturing jobs unfilled by 2030, further complicate production and increase expenses. Additionally, a strong U.S. dollar, causing a -1% net sales impact in Q4 2023, threatens international revenue.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Economic Volatility | Reduced Demand | IMF Global Growth: 3.2% (2024/2025) |

| Competitive Pressure | Market Share Erosion | Industrial Pumps Market: >$60B (2024) |

| Operational Costs | Compressed Margins | US Manufacturing Labor Shortage: 2.1M jobs by 2030 |

| Currency Fluctuations | Lower International Sales | Graco Q4 2023 Net Sales Impact: -1% |

SWOT Analysis Data Sources

This Graco SWOT analysis is built on a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary, ensuring a robust and data-driven perspective.