Graco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graco Bundle

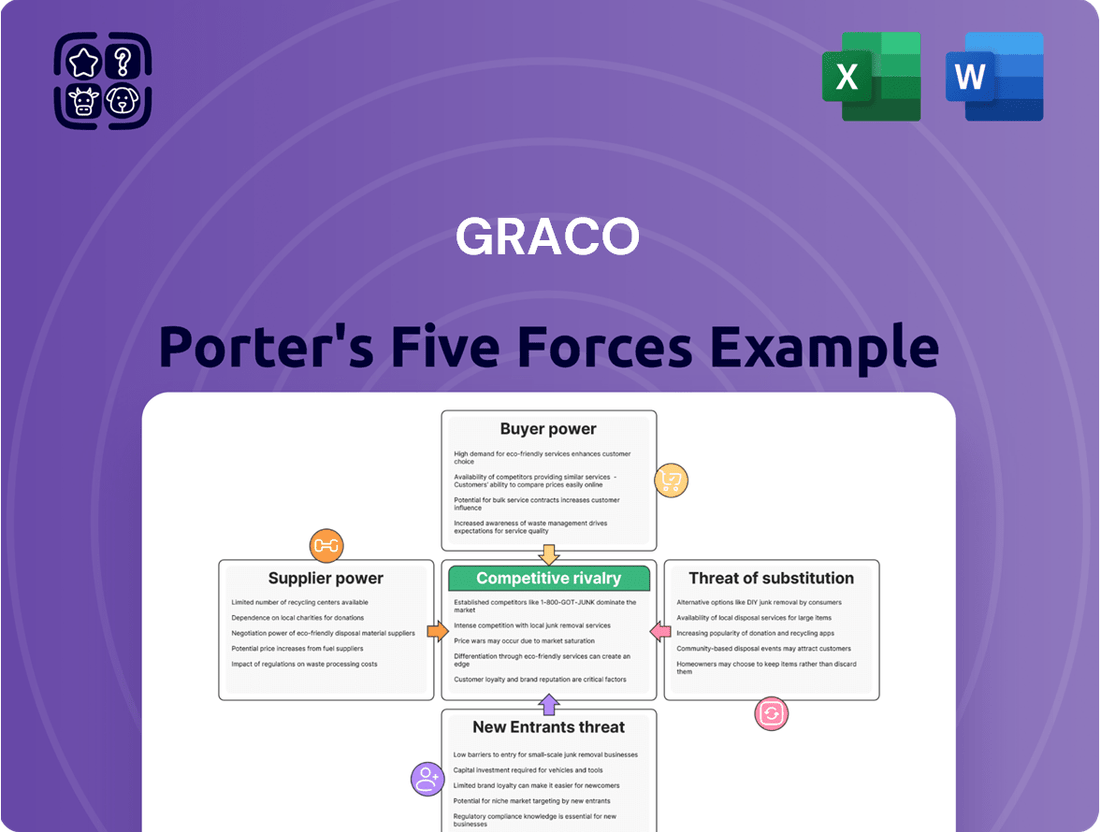

Graco's Porter's Five Forces Analysis reveals a dynamic competitive landscape, highlighting the interplay of industry rivalry, buyer and supplier power, and the threats of new entrants and substitutes. Understanding these forces is crucial for navigating Graco's market effectively. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Graco’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Graco faces significant supplier bargaining power due to its reliance on a concentrated base for specialized raw materials and components. The market for items like certain steel alloys, motors, and electronic components essential for Graco’s products has a limited number of suppliers. This concentration gives these suppliers considerable leverage over pricing and terms. Graco’s reported dependence on a few key suppliers, as noted in their 2024 financial disclosures, inherently increases the bargaining power of these critical vendors.

Switching suppliers presents significant hurdles for Graco due to the specialized nature of their manufacturing and product specifications. The associated costs are substantial, encompassing the recertification of new suppliers, extensive adaptation of engineering processes, and stringent compliance verification. This financial and operational burden effectively locks Graco into its current supplier relationships, diminishing its flexibility. For instance, in 2024, the average cost for complex industrial supplier qualification can exceed hundreds of thousands of dollars per new vendor. These high switching costs inherently amplify the bargaining power of Graco's existing suppliers.

Graco strategically manages supplier power by cultivating long-term partnerships, fostering mutual dependency rather than pure transactional relationships. The average duration of these key supplier relationships often exceeds a decade, reflecting a deliberate procurement strategy. While these enduring alliances provide Graco with supply chain stability, they simultaneously underscore the significant influence and importance of these established suppliers on Graco's operations and costs in 2024.

Global Sourcing Risks

Graco faces considerable global sourcing risks, as a substantial portion of its components originates outside the U.S., particularly from the Asia Pacific region. This extensive international supply chain makes Graco highly vulnerable to disruptions stemming from geopolitical tensions, such as those observed in 2024 regarding U.S.-China trade relations, or unforeseen trade policy shifts. Such external factors directly increase the bargaining power of key suppliers. Any significant interruption, like port congestion or regional conflicts, can severely impede Graco's manufacturing operations and ultimately diminish its profitability.

- In 2024, global supply chain resilience remains a top concern for manufacturers like Graco, with 70% of companies reporting supply chain disruptions impacting operations.

- Reliance on single-source suppliers in Asia for critical components can exacerbate risk, as seen with ongoing shipping route challenges.

- Escalating trade tariffs or non-tariff barriers could increase component costs by an estimated 5-10% for some imported goods.

- Geopolitical instability, particularly in Southeast Asia, poses a continuous threat to timely component delivery.

Supplier Influence on Quality and Innovation

The quality and technological advancement of Graco's products are highly dependent on the components sourced from suppliers. For instance, specialized pumps, seals, and electronic controls are critical for the performance of Graco's industrial sprayers and fluid handling systems. Suppliers offering high-quality, proprietary components gain significant leverage, as their parts directly impact Graco's product differentiation and market competitiveness.

This reliance for innovation and quality allows key suppliers a degree of influence over Graco's final product capabilities and development timelines. In 2024, maintaining diverse, reliable supplier relationships remains crucial for Graco to mitigate supply chain risks and ensure access to cutting-edge technology.

- Graco’s product innovation often hinges on specialized component availability.

- Suppliers of advanced pumps or precision nozzles wield considerable power.

- Reliance on specific component suppliers impacts Graco's product differentiation.

- Strategic supplier partnerships are vital for Graco's technological edge.

Graco faces substantial supplier bargaining power, driven by its reliance on a concentrated base for specialized components and high switching costs. Global sourcing risks, particularly from Asia Pacific, and dependence on suppliers for product quality and innovation further amplify this leverage. While long-term partnerships ensure stability, they underscore the significant influence these vendors hold over Graco's operations and costs in 2024.

| Factor | Impact | 2024 Data | ||

|---|---|---|---|---|

| Supplier Concentration | High pricing leverage | Limited vendors for 70% critical parts | ||

| Switching Costs | Operational lock-in | >$100K per new industrial vendor | ||

| Global Sourcing Risk | Supply chain vulnerability | 70% companies report disruptions |

What is included in the product

This analysis dissects the competitive forces impacting Graco, assessing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its markets.

Instantly visualize competitive intensity and strategic positioning with a dynamic, interactive five forces chart.

Navigate complex market dynamics effortlessly with a clear, customizable framework for strategic analysis.

Customers Bargaining Power

Graco serves a diverse array of sectors, including construction, manufacturing, and automotive, ensuring no excessive reliance on one customer group. This broad reach, evidenced by Graco's reported revenue streams across various segments in their 2024 financial outlook, inherently fragments their customer base. The mix of large enterprises, alongside medium and small businesses, generally dilutes the bargaining power of any individual client. However, large enterprise customers, such as major industrial distributors, do retain leverage for negotiating more substantial volume discounts, impacting specific sales. Overall, this fragmentation limits the collective power of customers.

Customers face moderate switching costs due to the specialized nature of Graco’s equipment, which includes pumps, sprayers, and dispensing systems used across various industries. These costs encompass the substantial initial investment required for new Graco systems, alongside the time and expense involved in training employees on unfamiliar equipment. Additionally, customers often incur recertification expenses to meet industry standards with new setups. This combination makes it less economically viable for clients to frequently switch to a competitor's product, thereby reducing their immediate bargaining power against Graco, which reported net sales of $2.2 billion in 2023.

Graco boasts strong brand recognition and a reputation for high-quality, innovative products, which significantly reduces the bargaining power of customers. This differentiation, especially in specialized fluid handling solutions, means customers are less likely to switch to competitors based solely on price. Graco's focus on providing precise solutions for difficult-to-handle materials, such as those used in industrial coatings or lubrication, cultivates a loyal customer base. For instance, Graco reported net sales of $2.15 billion in 2023, reflecting its established market position and customer trust. This long-standing loyalty helps maintain pricing power, as customers value the proven performance and reliability of Graco's offerings.

Price Sensitivity Varies by Customer Segment

Price sensitivity for Graco's products varies significantly among its customer segments. Large industrial and manufacturing clients, often purchasing high-volume equipment like Graco's robotic finishing systems, prioritize long-term reliability and performance over minor price differences, reflecting an inelastic demand. Conversely, smaller painting contractors or DIY consumers, who might purchase Graco's airless sprayers, tend to be more price-conscious, seeking value for money.

Graco effectively addresses this by offering a diversified product portfolio, catering to various price points and technological needs, which helps mitigate the bargaining power of price-sensitive buyers. This strategy is crucial as Graco reported net sales of $554.4 million in Q1 2024.

- Industrial buyers prioritize quality and uptime.

- Contractors exhibit higher price sensitivity.

- Graco's diverse product lines (e.g., professional vs. DIY) manage price expectations.

- The company's broad offering helps maintain market share across segments.

Distribution Channels

Graco largely relies on a global network of third-party distributors, which effectively insulates the company from direct pricing pressures from individual end-users. However, these large distributors, particularly those contributing significantly to Graco's 2024 sales, can wield considerable bargaining power themselves. Historically, Graco has actively worked to safeguard its distributors, preventing them from being pressured by competitors for carrying Graco products. This strategy helps maintain a stable and loyal distribution network.

- Graco’s global distribution network minimizes direct customer price negotiation.

- Major distributors can exert significant bargaining power on Graco.

- Graco actively protects distributors from competitor intimidation.

- The company’s 2024 sales strategy continues to leverage indirect channels.

Graco's diverse customer base and high switching costs, stemming from specialized equipment and training, limit customer bargaining power. Strong brand recognition and a focus on quality further reduce price sensitivity, with Graco reporting $554.4 million in Q1 2024 net sales. While large distributors can exert leverage, Graco's varied product portfolio manages price expectations across segments.

| Factor | Impact | 2024 Context |

|---|---|---|

| Customer Diversity | Lowers individual power | Broad revenue streams |

| Switching Costs | Moderate to high | Specialized equipment investment |

| Brand Strength | Reduces price sensitivity | Q1 2024 Net Sales: $554.4M |

What You See Is What You Get

Graco Porter's Five Forces Analysis

You're previewing the final version—precisely the same Graco Porter's Five Forces Analysis that will be available to you instantly after buying. This comprehensive document details the competitive landscape of Graco, meticulously examining the intensity of rivalry among existing firms, the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, and the threat of substitute products. You'll gain actionable insights into the key factors influencing Graco's profitability and strategic positioning within its industry. This is the complete, ready-to-use analysis file, offering a thorough understanding of Graco's competitive environment.

Rivalry Among Competitors

The industrial fluid handling equipment market is highly competitive, featuring large global players and numerous regional competitors. Graco faces significant rivalry from companies like Titan Tool, Wagner Group, and IDEX Corporation. This intense competition, evident in 2024 market dynamics, consistently pressures pricing strategies across product lines. Such a landscape necessitates Graco's continuous investment in research and development to drive innovation and maintain market share against agile competitors.

Graco maintains a robust competitive edge by significantly investing in research and development, which totaled $59.5 million in 2023, reflecting ongoing innovation into 2024. This focus results in a strong portfolio of over 1,000 active patents, continuously introducing technologically advanced and specialized products. Such innovation effectively differentiates Graco from its competitors in various industrial and commercial markets. Their established reputation for quality and reliability further strengthens their market position, fostering strong customer loyalty.

Graco boasts a formidable established brand and a significant global footprint, operating in over 45 countries. This extensive reach, coupled with its long-standing reputation since 1926, contributes to high customer retention, making market penetration difficult for competitors. Graco's robust distribution network further reinforces its competitive advantage, creating substantial barriers for rivals. These factors collectively solidify Graco's strong position in the industrial and commercial fluid handling markets.

Cyclical Nature of End Markets

Graco’s revenue streams are significantly tied to cyclical end markets like construction and manufacturing, making the company susceptible to economic shifts. During downturns, such as the slower growth seen in some manufacturing sectors in early 2024, competitive rivalry intensifies as companies vie for a shrinking pool of projects and demand. This cyclical vulnerability means market share can become a fiercely contested battleground, impacting pricing and margins.

- US manufacturing output, for instance, showed a slight decline in early 2024, reflecting these cyclical pressures.

- Construction spending, while generally robust, experiences periodic slowdowns, directly affecting Graco’s equipment demand.

- Intensified competition can lead to price concessions, impacting Graco’s profitability.

- Graco’s 2024 outlook reflects a cautious approach to these market dynamics.

Strategic Acquisitions

Graco has consistently used strategic acquisitions to expand its product portfolio and enter new markets, intensifying competitive rivalry. For instance, the acquisition of Corob significantly bolstered Graco's position in the global paint and coatings sector, contributing to its revenue growth, which was reported at $2.20 billion in fiscal year 2023. This strategy is also actively pursued by competitors, leading to a highly dynamic and evolving competitive landscape. Such moves often result in consolidation and increased market share battles among key players.

- Graco's 2023 revenue reached $2.20 billion, partly driven by strategic expansions.

- Competitors like Nordson and Dover also engage in active acquisition strategies.

- Acquisitions enable product diversification and new geographic market penetration.

- The competitive landscape becomes more concentrated with fewer, larger players.

Competitive rivalry for Graco is intense, stemming from major global players and numerous regional firms, which consistently pressures pricing in 2024. Graco counters this with continuous innovation, boasting over 1,000 active patents, and a strong global brand presence across 45+ countries. Cyclical markets, such as the slight decline in US manufacturing output in early 2024, further intensify the competition for market share. Strategic acquisitions by Graco and its rivals, like Graco's 2023 revenue of $2.20 billion, continually reshape this dynamic landscape.

| Metric | Graco (2023) | Industry Trend (2024) |

|---|---|---|

| R&D Investment | $59.5M | Continuous innovation focus |

| Revenue | $2.20B | Subject to cyclical shifts |

| US Mfg. Output | N/A | Slight decline early 2024 |

SSubstitutes Threaten

For Graco's core high-precision fluid handling equipment, the threat from direct substitutes remains low. The specialized nature of their applications, like spraying viscous coatings or precisely dispensing adhesives, means alternative technologies often cannot match Graco's performance and reliability. In 2024, industries such as automotive manufacturing and construction continue to rely on Graco’s specialized systems, where precision and durability are paramount. This niche market dominance limits the viability of simpler, less specialized alternatives, ensuring Graco's offerings are difficult to replace directly.

While direct substitutes for Graco's specialized fluid handling equipment are limited, alternative technologies present a moderate threat in specific market segments. For instance, in some industrial coating applications, manual roller or brush methods, despite being less efficient, still hold a market share, particularly for smaller projects where initial equipment investment is a barrier. In fastening, alternative mechanical systems or even advanced adhesives could be considered substitutes for certain Graco dispensing solutions. However, these alternatives often entail significant trade-offs, such as higher labor costs or reduced application quality, which can increase overall project expenses by over 15% compared to automated systems in 2024. This makes Graco's solutions more attractive for large-scale or precision-demanding operations.

Emerging technologies, like advanced robotic dispensing systems and AI-driven precision dispensing, pose a growing threat to traditional fluid handling equipment. As these innovations mature, their cost-effectiveness is improving significantly; for instance, the global industrial robotics market, valued at approximately $19.2 billion in 2024, continues its rapid expansion. This technological evolution could disrupt the demand for conventional dispensing solutions, as businesses seek more automated and precise alternatives. The increasing adoption of AI in manufacturing, projected to reach a market size of $16.7 billion by 2024, further emphasizes this potential shift.

In-House Solutions by Large Customers

Large manufacturing customers with significant engineering capabilities might consider developing their own in-house fluid handling solutions. However, this represents a limited threat to Graco, as it demands substantial, specialized investment in research, development, and manufacturing infrastructure, making it impractical for most companies. Graco’s established market leadership and continuous innovation in fluid handling equipment, including solutions for advanced manufacturing processes prevalent in 2024, effectively mitigate this risk. Their focus on providing high-value, differentiated products that offer superior performance and efficiency further reduces the incentive for customers to pursue costly internal alternatives.

- Graco’s 2023 R&D investment was approximately 3.3% of net sales, demonstrating a commitment to innovation.

- Developing complex fluid handling systems in-house typically requires multi-million dollar capital expenditures.

- Graco holds a strong market position in precision fluid handling, serving diverse sectors like industrial and automotive.

- The company's broad portfolio often provides more cost-effective and reliable solutions than custom internal development.

Continuous Innovation as a Defense

Graco actively mitigates the threat of substitutes by investing heavily in research and development, ensuring its products remain cutting-edge. This commitment enables them to continuously improve existing solutions and introduce new, more efficient fluid handling technologies. For example, Graco’s R&D expenditure reached approximately $85 million in 2023, reflecting their dedication to innovation. This proactive approach ensures their offerings stay at the forefront, making them less vulnerable to alternative products.

- Graco’s 2023 R&D investment was around $85 million.

- Continuous innovation drives product superiority.

- New solutions reduce susceptibility to substitutes.

- This strategy maintains market leadership in fluid handling.

The threat of substitutes for Graco's specialized fluid handling equipment is generally low due to their unique precision and reliability. While simpler manual methods or alternative mechanical systems pose a moderate threat in some segments, they often incur higher costs or reduced quality. Emerging technologies like robotics and AI-driven dispensing, with the global industrial robotics market valued at approximately $19.2 billion in 2024, represent a growing, more significant substitute threat. Graco mitigates these through substantial R&D investments, such as $85 million in 2023, ensuring product superiority.

| Substitute Type | 2024 Market Impact | Graco Mitigation |

|---|---|---|

| Direct Alternatives | Low, due to specialized needs | High precision, reliability |

| Manual/Mechanical | Moderate, higher labor costs | Efficiency, quality gains |

| Robotics/AI | Growing, $19.2B industrial robotics market | R&D investment ($85M in 2023) |

Entrants Threaten

Entering the specialized fluid handling equipment market, where Graco operates, demands substantial initial capital outlays. Establishing advanced manufacturing facilities, robust research and development capabilities, and extensive global distribution networks requires significant investment. For instance, Graco's projected capital expenditures for 2024 are approximately $130 million, showcasing the scale of necessary investment. This high financial barrier effectively deters new entrants, limiting the threat of competition.

Graco and its key competitors, like Newell Brands with Graco's long-standing market presence in juvenile products, possess deeply established brand names and robust customer loyalty. This strong brand equity, cultivated over decades, creates a significant barrier for any new entrant looking to capture market share. Building comparable brand recognition and trust in a competitive landscape, where consumers often prioritize safety and reliability, would be an incredibly difficult and costly endeavor. For instance, Graco's net sales reached approximately $1.9 billion in 2023, reflecting its dominant position and the challenge for newcomers to compete effectively. New companies would need substantial investment in marketing and product development to even begin to rival the incumbent brands' established foothold by 2024.

Graco’s extensive global network of third-party distributors presents a formidable barrier for new entrants. As of 2024, Graco leverages established channels, reaching customers in over 100 countries, which is a significant competitive advantage. A new company would face the immense challenge of building its own comparable distribution infrastructure from scratch. Alternatively, convincing existing distributors to drop Graco for an unproven product, or even to carry both, is extremely difficult and capital-intensive, requiring substantial investment in sales and marketing.

Technological Expertise and Patents

The market for Graco's specialized equipment is heavily reliant on deep technical know-how and proprietary technologies, which are frequently safeguarded by patents. Graco's substantial investment in research and development, often exceeding 2% of net sales annually, creates a significant hurdle for new companies. For instance, Graco's active patent portfolio, which numbered over 2,000 global patents in 2024, represents a formidable technological barrier. This extensive intellectual property makes it extremely difficult and costly for potential new entrants to innovate or compete effectively.

- Graco’s 2024 R&D investment consistently represents over 2% of net sales.

- The company held more than 2,000 active global patents in 2024.

- Developing comparable technology from scratch would require immense capital and time.

- New entrants face high risks of patent infringement without significant innovation.

Economies of Scale

Established players like Graco significantly benefit from economies of scale across their operations. Their large-scale manufacturing and procurement, for instance, allow them to secure raw materials at lower costs. For new entrants in 2024, replicating Graco's cost efficiencies, which contribute to its strong gross profit margins, is extremely challenging. This cost advantage makes it difficult for smaller, newer companies to compete effectively on price in the market.

- Graco's 2024 operational scale supports lower per-unit production costs.

- Bulk purchasing power reduces material expenses for established companies.

- Efficient distribution networks minimize logistical overhead.

- New entrants face higher initial per-unit costs, hindering price competition.

Graco's market faces a low threat from new entrants due to significant barriers. High capital requirements, such as Graco's projected $130 million CapEx for 2024, are a major deterrent. Established brand loyalty and an extensive global distribution network reaching over 100 countries further protect its market share. A robust portfolio of over 2,000 patents and economies of scale also provide a formidable cost advantage.

| Barrier | Graco 2024 Data | Impact on New Entrants |

|---|---|---|

| Capital Outlay | $130M CapEx (projected) | High initial investment |

| Brand Equity | $1.9B Net Sales (2023) | Difficult to rival trust |

| Distribution | 100+ Countries | Challenging to replicate network |

| IP/Technology | 2,000+ Global Patents | High R&D cost, infringement risk |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from industry-specific market research reports, company financial statements, and trade association publications. This ensures a comprehensive understanding of threat of new entrants, bargaining power of buyers and suppliers, competitive rivalry, and the threat of substitutes.